TopFX forex broker offers over 600 CFDs to trade from 6 markets. Minimum deposit to trade in this broker is 50 EUR and because of FSA Seychelles and FSC BVI licenses, it provides the maximum leverage of 1:2000. All of the orders in this broker are executed with NDD model.

The broker also holds a valid CySEC regulation for providing services to European clients and the maximum trading leverage under the EU branch is limited to 1:30.

Company Information & Regulation

TopFX has been in the forex industry since 2010, primarily serving as a liquidity provider for other brokers and investment firms.

However, they've expanded their services to cater to retail traders as well, offering a comprehensive suite of trading instruments and tools. Key Points About TopFX Company:

Entity Parameters / Branches | TopFX Markets Ltd | TopFX Ltd | TopFX Global Ltd |

Regulation | FSC BVI | CySEC | FSA Seychelles |

Regulation Tier | 4 | 1 | 4 |

Country | British Virgin Islands | Cyprus | Seychelles |

Investor Protection Fund / Compensation | None | ICF (€20,000) | None |

Segregated Funds | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes |

Maximum Leverage | 1:2000 | 1:30 | 1:2000 |

Client Eligibility | Non-EEA / global (except restricted) | EEA | Non-EEA / global (except restricted) |

The broker partners with Tier-1 liquidity providers and uses its own proprietary CRM and integration system for MT4 and cTrader platforms.

Execution speeds average between 2.3 and 3 milliseconds, making TopFX technically competitive with industry leaders. Its transparent operations, regulatory oversight, and stable infrastructure contribute to its growing reputation among traders in Europe and beyond.

Summary of Key Specifics

To give you a quick overview of what TopFX offers, here's a summary table of the forex broker's key features:

Broker | TopFX |

Account Types | Raw, Zero |

Regulating Authorities | CySEC, FSA Seychelles, FSC BVI |

Based Currencies | USD, EUR |

Minimum Deposit | 50 EUR |

Deposit Methods | Credit/Debit Cards, Bank Wire Transfers, E-wallets, and Other Local Payment Methods |

Withdrawal Methods | Credit/Debit Cards, Bank Wire Transfers, E-wallets, and Other Local Payment Methods |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:2000 |

Investment Options | None |

Trading Platforms & Apps | cTrader, MetaTrader 4 |

Markets | Forex, Indices, Shares, Metals, Energies, ETFs |

Spread | From 0 Pips |

Commission | From 0 on ZERO Account |

Orders Execution | No Dealing Desk (NDD) |

Margin Call/Stop Out | 30/50% |

Trading Features | Use of Expert Advisors/Bots |

Affiliate Program | No |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | None |

Customer Support Ways | Email, Phone Call, Ticket, Live Chat |

Customer Support Hours | 24/7 |

Account Types + Comparison

TopFX forex broker offers two main account types, in addition to a demo one, to cater to different trading styles and preferences:

- RAW: Ideal for high-volume traders and scalpers, available on both cTrader and MT4 platforms

- ZERO: Suitable for beginners and traders who prefer all-inclusive pricing, also available on cTrader and MT4

In the table below, we will review these two accounts in more detail:

Account Type | RAW | ZERO |

Currency | USD, EUR | |

Leverage | Up to 1:2000 | |

Liquidity | TopFX | |

Min./Max. Trade Size | 0.01/100 Lots | |

Stop Out Level | 50% | |

Minimum Deposit | Depends on Payment Method | |

EAs/Bots | Allowed | |

Both accounts support MT4 and cTrader, offer a minimum trade size of 0.01 lots, a stop-out level of 50%, and a minimum deposit of just €50. There are no strategy limitations, allowing the use of scalping, EAs, bots, or hedging.

You can convert either of these accounts into an Islamic one, in case you are a Muslim trader. The choice between RAW and ZERO accounts ultimately depends on your trading strategy and volume.

Advantages and Disadvantages

There are strengths and weaknesses in working with any financial company. Let's break down the pros and cons of TopFX:

Disadvantages | Advantages |

No Social/Copy Trading Features | Competitive Pricing |

Lack of Cryptocurrency Trading | Choice Of Popular Trading Platforms |

Very Limited Educational Content | Wide Range Of Tradable Instruments |

- | Regulated By CySEC, Ensuring Client Fund Protection |

- | Fast Execution Speeds With No Dealing Desk (NDD) Model |

How to Sign Up & Verify Your Account on TopFX

The TopFX registration is a quick, structured process. In just a few minutes, users can enter their personal details, define their trading preferences, and activate their live trading account.

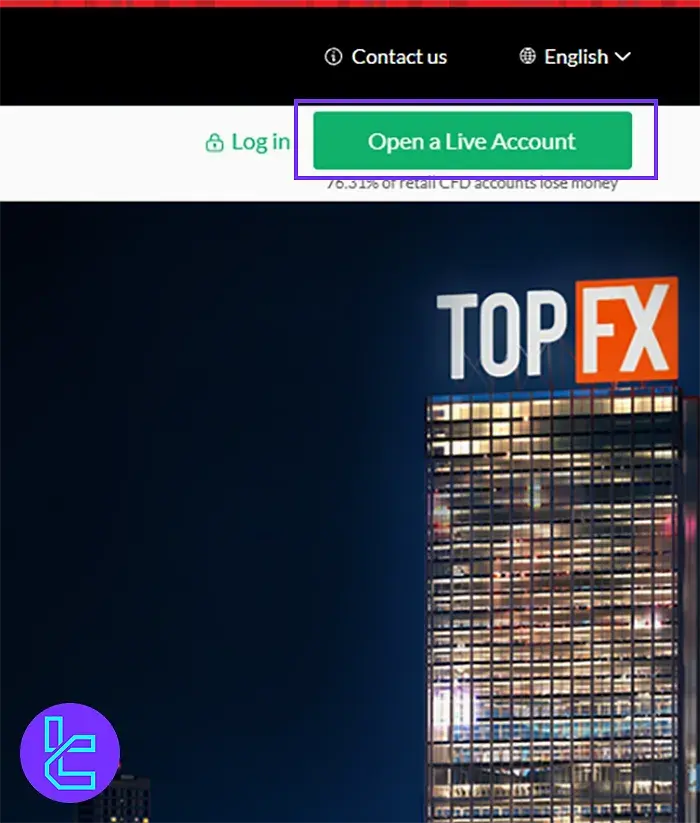

#1 Navigate to the TopFX Registration Page

Go to the official TopFX website and click on “Open Live Account” to begin the registration process.

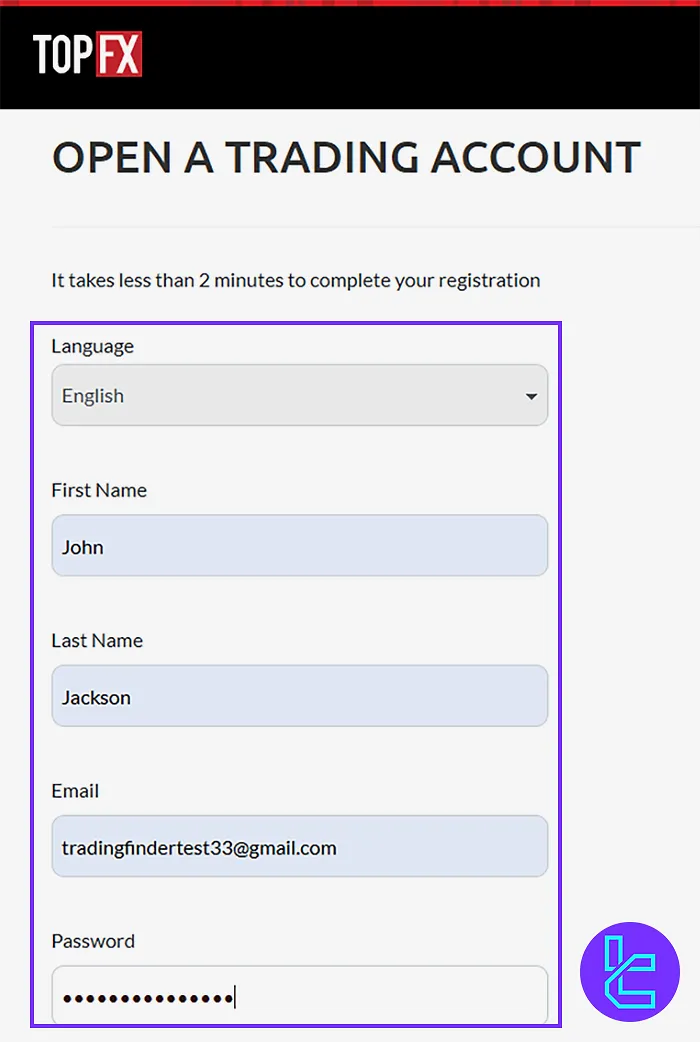

#2 Enter Personal Information

Select your language and provide the following information:

- First name

- Last name

- Email address

- Password (8–15 characters with uppercase, lowercase, numbers, and symbols)

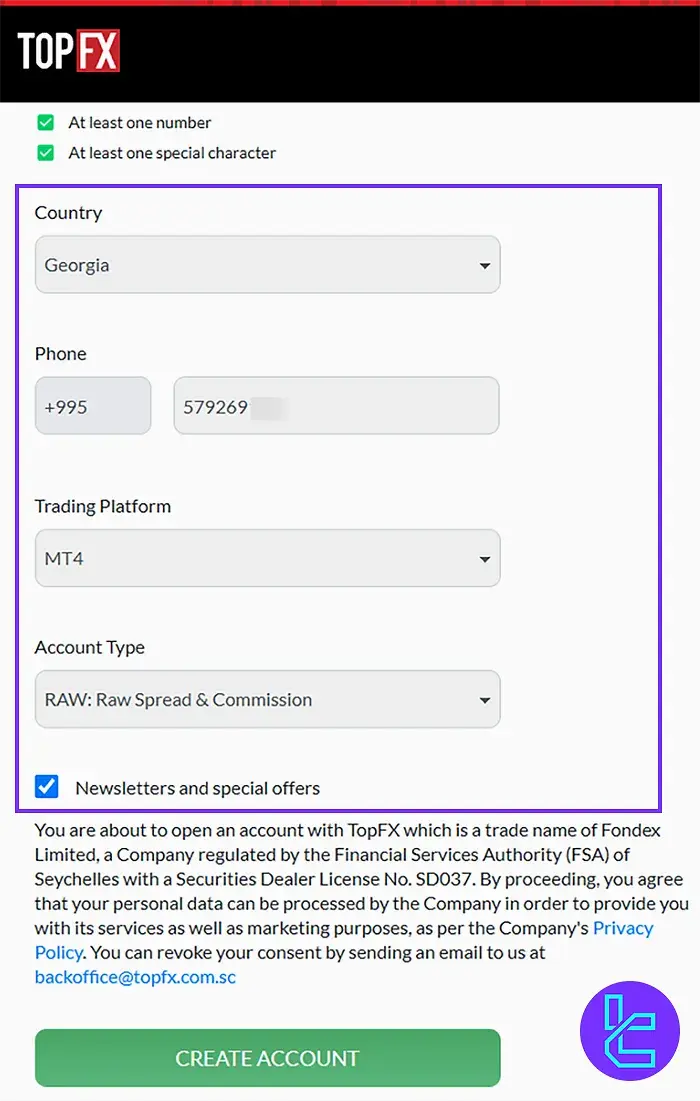

#3 Provide Additional Information & Trading Preferences

Fill in the application form with the following information:

- Country of residence

- Mobile number

- Account type

- Trading platform

Optionally, subscribe to TopFX news and updates. Click “Create Account” to complete the process.

#4 Proceed with the KYC Procedure

Upload supporting documents to comply with the company's AML and KYC policies:

- Proof of Identity: Passport or National ID

- Proof of Residence: Utility bill or Bank statement

Which Trading Platforms Are Used With TopFX?

Trading platforms are the environments for trading in financial markets. TopFX offers two popular platforms to its clients. We will take a look at each in the next sections.

MT4 offers a familiar interface and a large ecosystem of EAs and custom indicators, while cTrader delivers advanced charting, one-click trading, and is integrated with Autochartist for automated pattern recognition.

cTrader

This one is a trading platform with a modern interface and attractive skin. Features:

- Modern, intuitive interface

- Advanced charting capabilities with 60+ built-in trading indicators

- One-click trading and market execution

- Customizable layout and workspaces

- Trading based on signals

- Automated trade with the help of robots

Download this platform for your mobile devices through these links:

MetaTrader 4

MetaTrader 4 is a very popular trading platform used by many traders for almost 2 decades now. Key Specifics:

- Industry-standard platform with a wide user base

- Extensive library of custom indicators and Expert Advisors (EAs)

- MQL4 programming language for creating custom tools

- Multi-chart setup for monitoring multiple instruments

You can get the platform for your smartphones through the links below:

TradingFinder has developed a wide range of MT4 indicators that you can use for free.

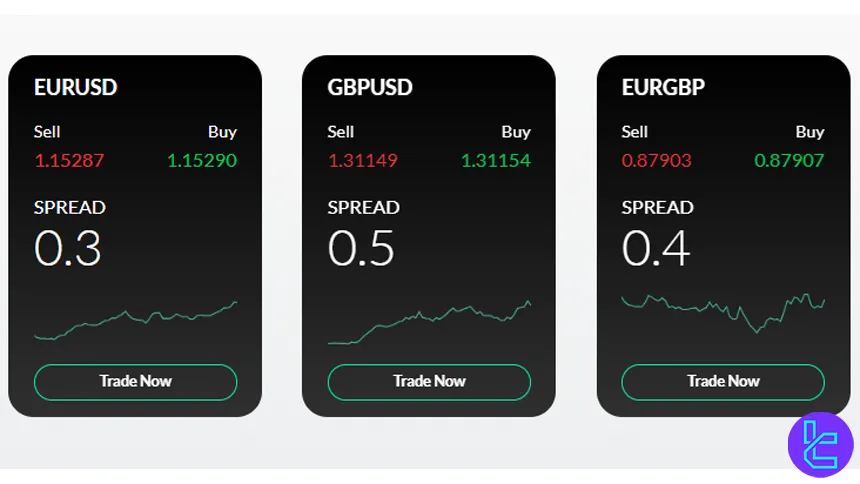

Spreads and Commissions in Trading and Other Operations

TopFX takes a fair approach in this regard, having lower-than-average commissions. Here's a breakdown of the spreads and fees for each account type:

Account Type | Spread | Commission |

RAW | From 0.0 Pips | 2.75 EUR Per Side Per Lot |

ZERO | From 0.5 Pips | Zero |

For deposits and withdrawals, no fees are charged by the broker. Also, you will be charged with no inactivity costs. Overall, TopFX is doing a solid job with commissions and fees for clients.

This transparent and cost-efficient setup is especially beneficial for active traders seeking tight spreads with predictable costs.

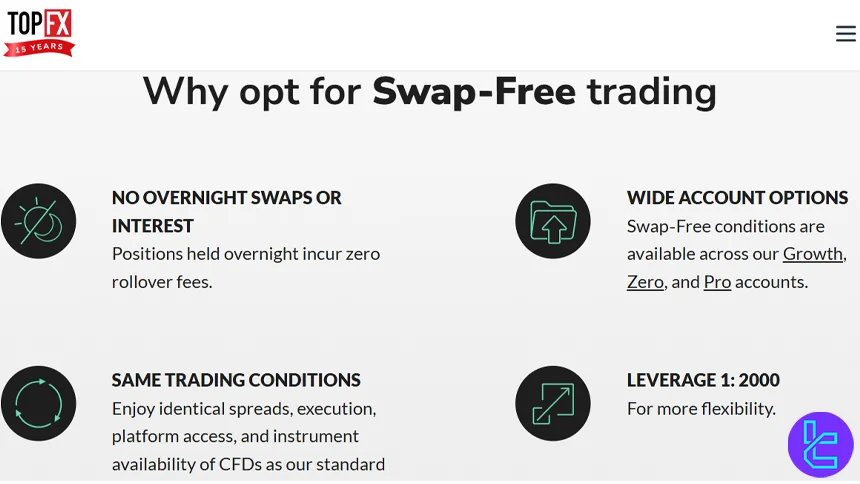

Swap Fee at TopFX

TopFX applies overnight (swap) interest for standard accounts based on interest rate differentials, and these swaps are calculated in the quote currency.

Furthermore, a triple swap is charged on a specific day to account for weekend rollover.

Here are some key details:

- Swaps are calculated daily based on prevailing interest rates and credited/debited in quote currency;

- For clients who qualify, TopFX offers a swap-free / Islamic account where overnight rollover fees are zero.

Non-Trading Fees at TopFX

TopFX may charge fixed account fees even if you don’t trade, particularly if your account is inactive or remains idle for a long time.

These are real costs that affect all clients holding funds without active trading.

Here are some core non-trading cost points:

- Inactivity fee: USD 5 (or currency equivalent) per month after 90 calendar days of no trading activity;

- Administrative fee: If there’s no activity (funding or trading) for one year, a fixed USD 25 annual fee is charged (if funds are available);

- Although the broker charges no withdrawal fee, deposits may incur costs depending on the payment method and the fees set by the provider.

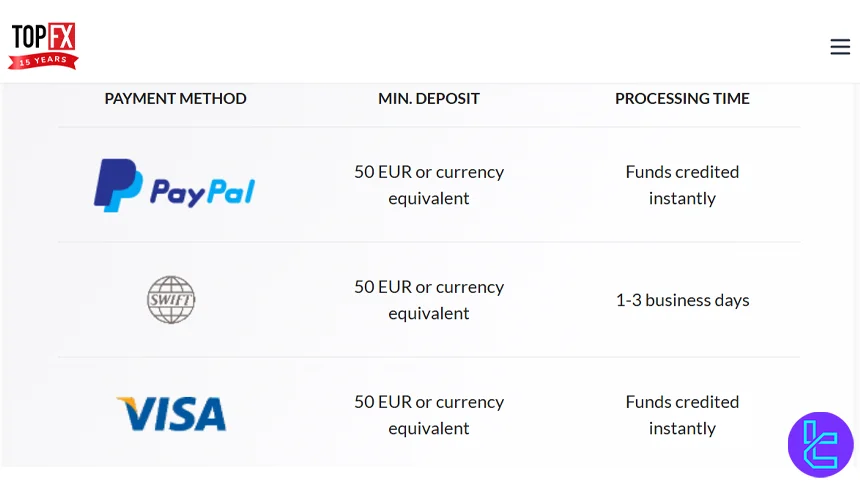

Deposit & Withdrawal Methods

TopFX offers a vast range of payment methods and tools to meet the needs of traders. Payment Options in TopFX:

- Credit/Debit cards: Visa and Mastercard

- E-wallets: PayPal, Neteller, Skrill, and more

- Bank wire transfer

- Other local payment methods (varies by country)

There are no deposit or withdrawal fees on most methods, with the exception of possible charges for wire transfers.

Electronic payment methods provide near-instant funding, while withdrawals are processed within one business day.

The minimum deposit requirement is €50, and withdrawals start from €100. TopFX supports more than 20 base account currencies, minimizing conversion fees.

Deposit Methods at TopFX

TopFX BVI offers a comprehensive selection of deposit methods to accommodate both international and local clients. Processing times are mostly instant, though some bank transfers may take a few business days depending on the method and bank.

Deposits are free of charge from TopFX’s side, while some payment providers may impose fees.

Here are the main deposit options:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Visa / MasterCard | EUR, USD, GBP | 50 | None | Instant |

Apple Pay / Google Pay | EUR, USD, GBP | 50 | None | Instant |

Bank Wire Transfer (SEPA, SWIFT) | EUR, USD | 100 | None | 3–5 business days |

e-Wallet (e.g. Skrill, Neteller, FasaPay, Sticpay) | EUR, USD, GBP, JPY | USD 50 (or equivalent) | None | Instant |

Local Transfer (e.g. M-Pesa, Airtel, Orange Money, Zamtel) | USD, THB, IDR, VND, CNY, TZS, KES, BRL, MXN, RWF, UGX, ZMW, etc. | Country-dependent | None | Instant |

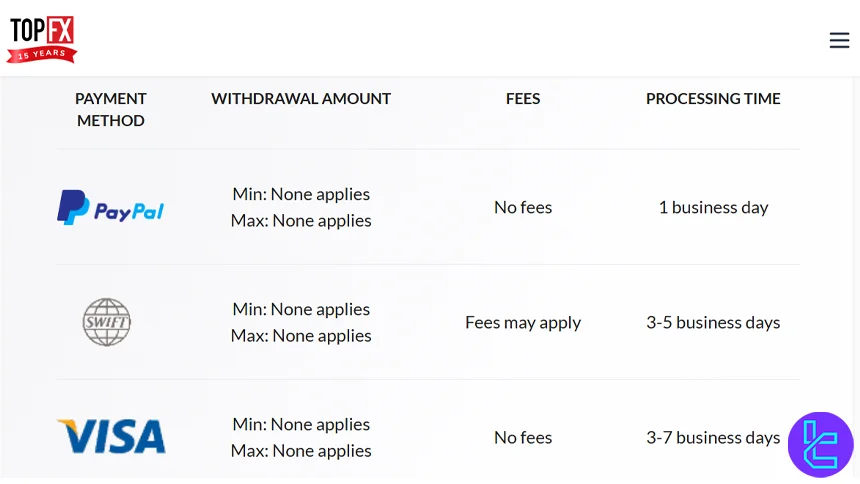

Withdrawal Methods at TopFX

TopFX BVI provides a wide variety of withdrawal methods to cater to both international and local clients. Processing times differ depending on the method, ranging from instant transfers to several business days for bank withdrawals.

Withdrawals are free of charge from TopFX’s side, although some providers may impose fees.

The main withdrawal methods are as follows:

Withdrawal Method | Currency | Minimum Amount | Withdrawal Fee | Funding Time |

Visa / MasterCard | EUR, USD, GBP | 50 | No fees | 3–7 business days |

Apple Pay / Google Pay | EUR, USD, GBP | 50 | No fees | Instant |

Bank Wire Transfer (SEPA, SWIFT) | EUR, USD | 50 )No minimum for SWIFT) | No fees | 3–5 business days |

e-Wallet (e.g. Skrill, Neteller, FasaPay, Sticpay) | EUR, USD, GBP, JPY | USD 50 (or equivalent) | No fees | From instant to 1 business day |

Local Transfer (e.g. Plus Debit, M-Pesa, Airtel, Orange Money, Zamtel) | USD, THB, IDR, VND, CNY, TZS, KES, BRL, MXN, RWF, UGX, ZMW, etc. | Country-dependent | No fees | From instant to 72 hours |

Copy Trading & Investment Options Offered on TopFX

Per our latest investigations, the broker offers no copy trading or social tradingfeatures on its platforms. This means that traders cannot automatically copy the trades of other successful investors or earn passive income through other methods.

For those interested in copy trading, it may be necessary to look for alternative brokers that offer such features or use third-party copy trading platforms in conjunction with their TopFX account.

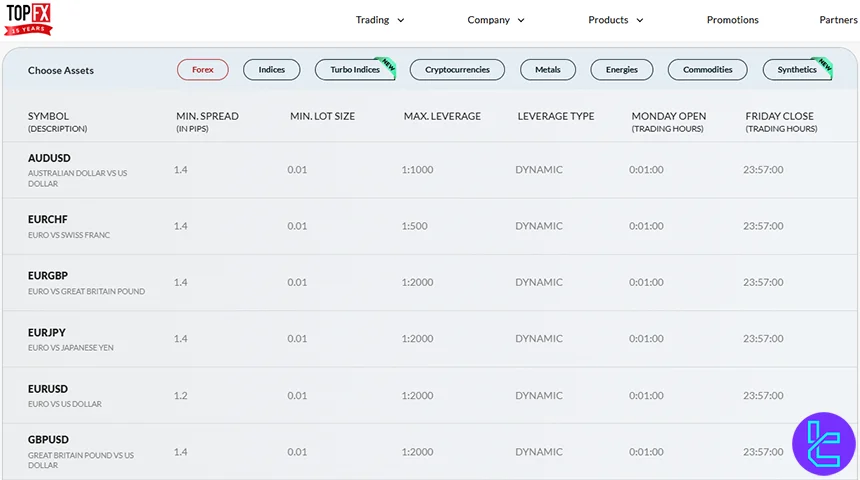

Which Markets & Symbols Can I Trade on TopFX?

There are many markets and instruments available for trading in the industry. TopFX offers a decent range of 600+ symbols across various asset classes, from the Forex market to Commodities.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex | Major, Minor & Exotic FX pairs | 40+ | 60–70 | 1:2000 |

Indices | Global Stock Indices | 15+ | 10–20 | 1:200 |

Turbo Indices | Short-term, high-volatility index CFDs | 5 | N/A | 1:200 |

Crypto CFDs (BTC, ETH, LTC, XRP, etc.) | 2 | 5–15 | 1:10 | |

Metals | Spot Gold & Silver | 5 | 2–5 | 1:1000 |

Energies | Oil & Natural Gas CFDs | 3 | 2–4 | 1:10 |

Commodities | Soft Commodities | 5 | 3–10 | 1:50 |

Synthetics | Volatility synthetic instruments | 8 | N/A | 1:500 |

All instruments are offered as CFDs, allowing for long and short trading with leverage.

Are There Any Bonuses and Promotions?

Based on the official resources, TopFX does not offer any specific bonuses or promotional offers to new or existing clients. This approach aligns with stricter regulatory guidelines, particularly from CySEC, which has placed limitations on bonus offerings in the forex and CFD industry.

It's worth noting that promotional offers in the forex industry can change frequently. Traders interested in potential future promotions should keep an eye on TopFX's official website or contact customer support for the most up-to-date information.

TopFX Broker Awards

TopFX has secured multiple industry awards over the years, demonstrating its standing in areas such as trading conditions, client services and overall brokerage performance.

These recognitions appear across the broker’s official communications and highlight its progress in both regional and international markets.

Here are some of the awards:

- Best Forex Trading Support – MENA 2022 by WikiEXPO

- Best Retail Forex Broker – 2023 by Fintech & Crypto Summit

- Best Copy Trading Platform – 2022 by WikiEXPO

- Best Client Trading Experience Broker – 2022 by Global Forex Awards

Support Contact Methods and Working Hours

TopFX provides customer support through multiple channels:

- Live Chat: Accessible directly from the website

- Email: support@topfx.com

- Phone: +357 25 352244

- Online Contact Form: Available on the official website

The support team at the broker is ready to answer your inquiries 24/7. While response times are generally quick, delays may occur during peak periods. The broker also maintains active social media pages for announcements and updates.

List of Restricted Countries

TopFX, being regulated by CySEC, adheres to strict guidelines regarding the countries it can serve. While the broker accepts clients from many countries worldwide, there are certain restrictions in place. Countries where the broker's services are not available include:

- United States of America

- Myanmar

- Japan

- New Zealand

- Iran

- North Korea

- Belgium

- Syria

- Cuba

- Sudan

It's important to note that the list of restricted countries can change based on regulatory updates or company policies.

Trust Scores & Reviews

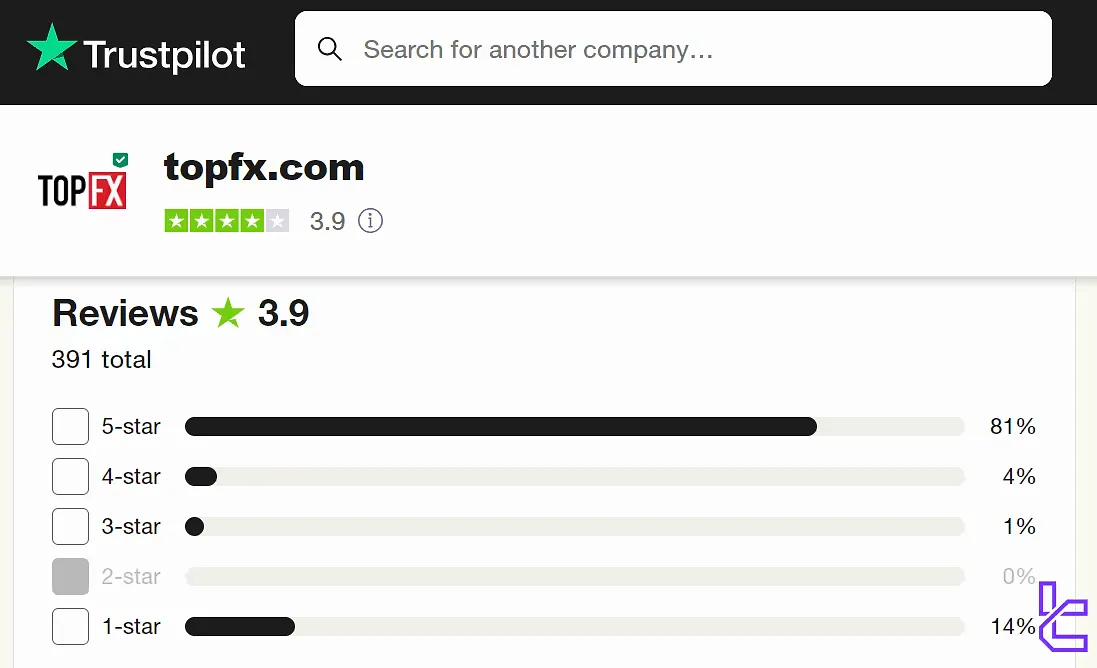

The brokerage has received mixed reviews from traders, as reflected in its ratings on popular review platforms. TopFX Trust Scores:

- TopFX Trustpilot: 3.9/5 stars, based on more than 390 reviews

- ForexPeaceArmy: 3.7 out of 5 with 30+ ratings

Overall, the company has achieved acceptable scores. However, it's important to approach these reviews with a balanced perspective. While they provide valuable insights into user experiences, individual experiences can vary.

Education Content on TopFX Broker

We examined the broker's website and official resources for any educational sections, and the only lead we found was the YouTube channel. It contains some tutorial videos on the platform, trading, etc., but hasn't been updated in almost a year.

Aside from that, there areno educational resources available from the brokerage. Therefore, if you want to learn at the same time as trading, you should look elsewhere.

You can check TradingFinder's Forex education for a comprehensive range of learning materials.

TopFX Comparison Table

Let's compare TopFX's services with other brokers:

Parameter | TopFX Broker | Exness Broker | HFM Broker | FxPro Broker |

Regulation | CySEC, FSA Seychelles, FSC BVI | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA | CySEC, DFSA, FCA, FSCA, FSA | FCA, FSCA, CySEC, SCB |

Minimum Spread | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | From $0.0 | From $0.2 to USD 3.5 | From $0 | From $0 |

Minimum Deposit | €50 | $10 | From $0 | $100 |

Maximum Leverage | 1:2000 | Unlimited | 1:2000 | 1:500 |

Trading Platforms | cTrader, MetaTrader 4 | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App |

Account Types | Raw, Zero | Standard, Standard Cent, Pro, Raw Spread, Zero | Cent, Zero, Pro, Premium | Standard, Pro, Raw+, Elite |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 600+ | 200+ | 1,000+ | 2100+ |

Trade Execution | Market | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Pending |

Conclusion and final words

Spreads from 0.0 pips, zero commission and0.01 lots minimum trade size are the features of TopFX 2 account types [RAW, ZERO]. TopFX rating in Trustpilot is 3.9/5 and that's because of advantages like NDD [fast execution speeds] and good range of instruments [600.]