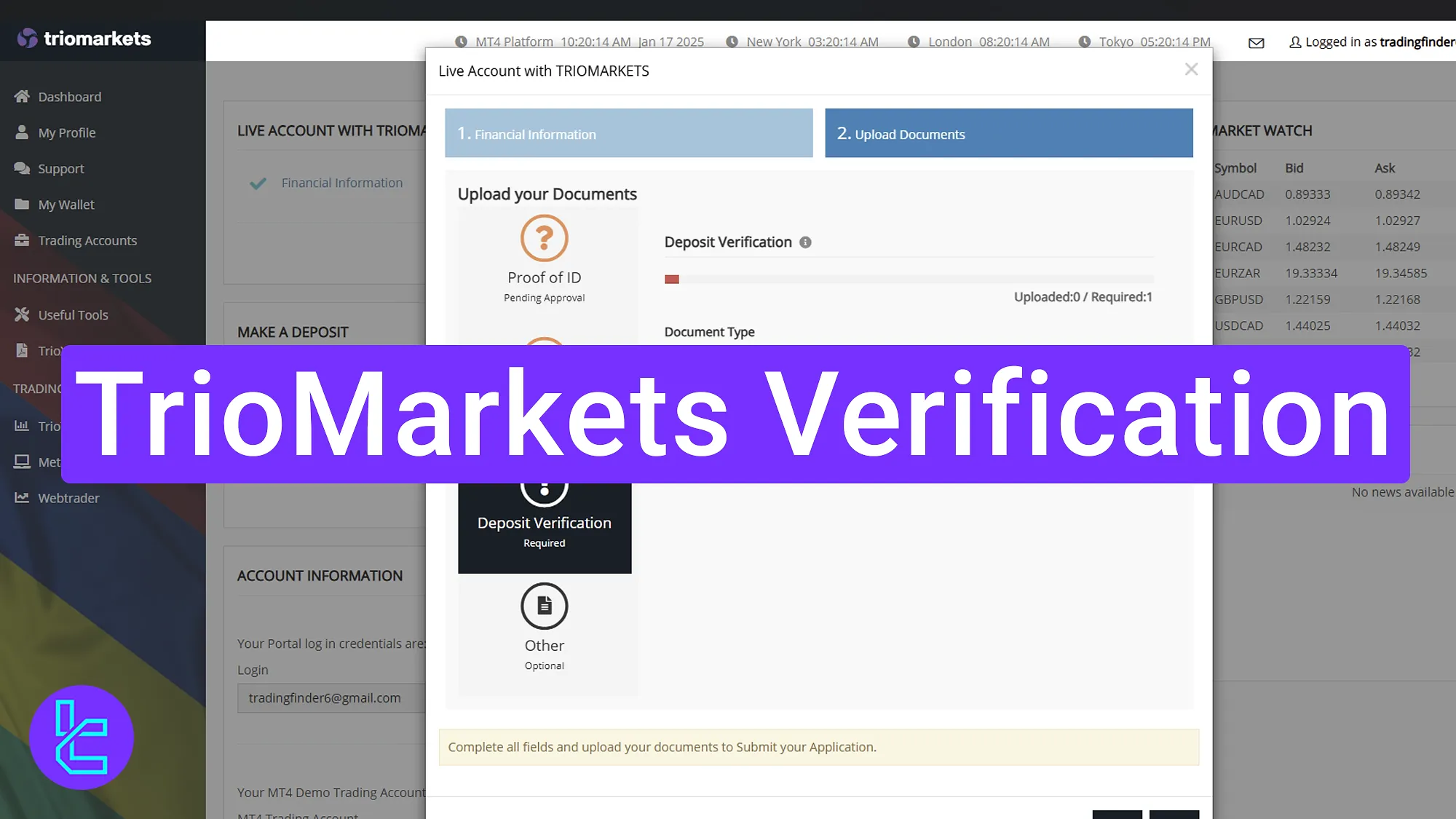

TrioMarkets verification can be completed in just 10 minutes. The process involves POI and POA document upload, and deposit verification.

Overview of TrioMarkets Verification Steps

Traders must complete various forms and upload the necessary documents to complete the TrioMarkets broker KYC.

TrioMarkets verification:

- Click on “Start live account with triomarkets”;

- Answer financial and experience-related questions;

- Upload your ID (front and back);

- Submit proof of residence (bank statement or utility bill);

- Complete deposit validation with transaction history;

- Upload additional documents if necessary;

- Check your approval status in “My Profile”.

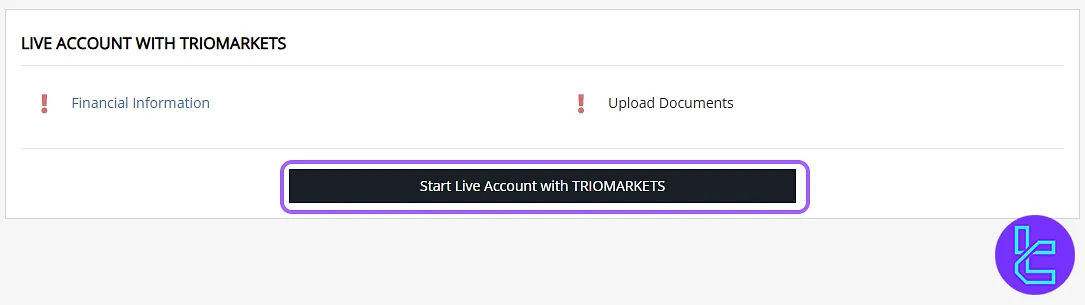

#1 Click on “Start live account with Triomarkets”

To start verifying your account, click on the "Start live account with Triomarkets" button on yourTrioMarkets dashboard.

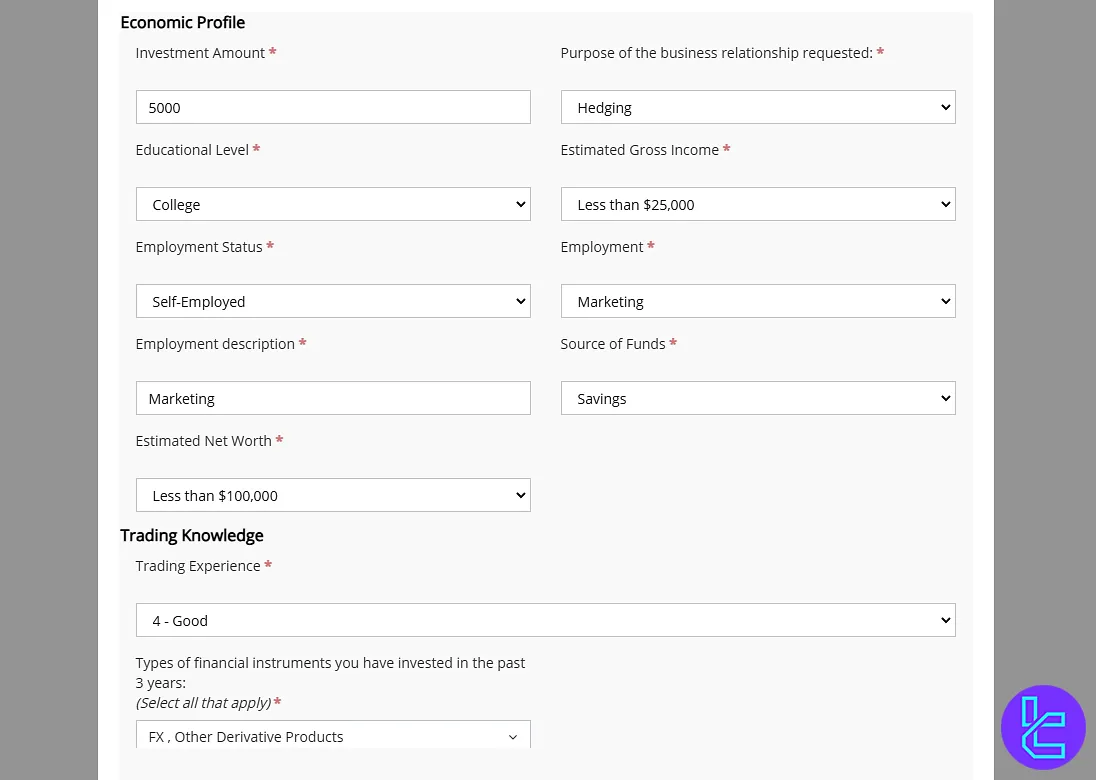

#2 Answer Financial and Trading Experience Questions

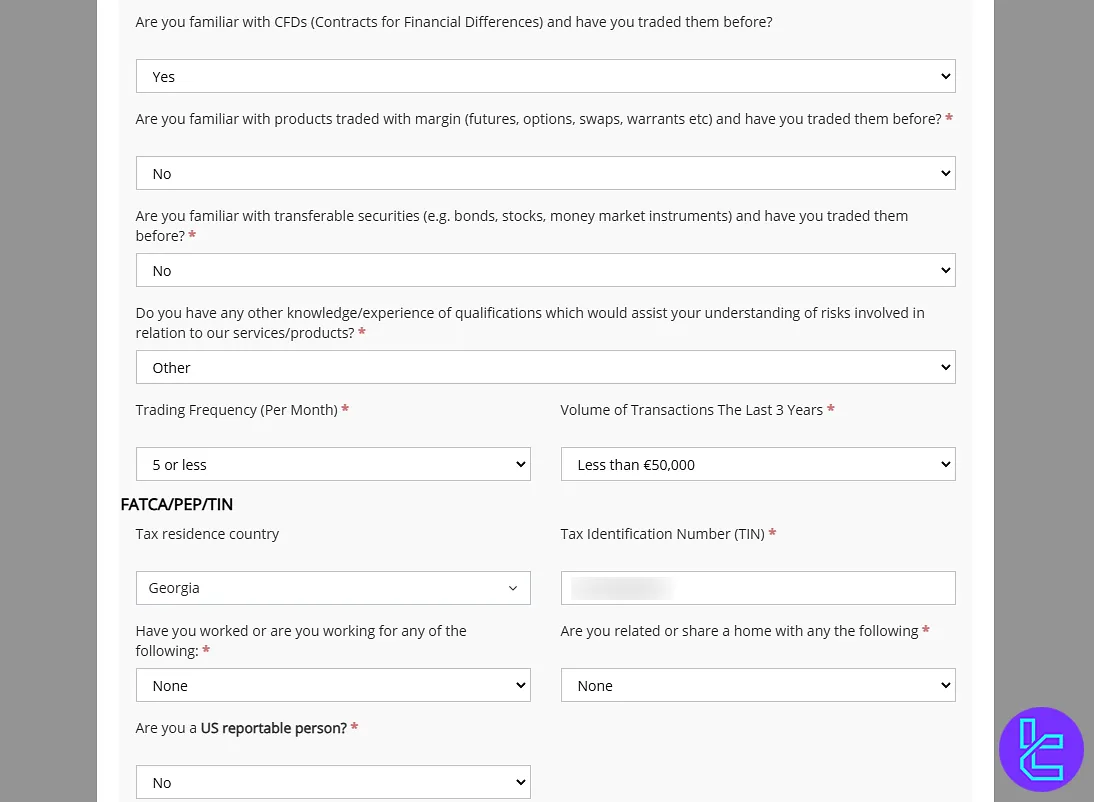

You will be required to provide information about your:

- Financial status

- Employment details

- Trading experience

- Tax information

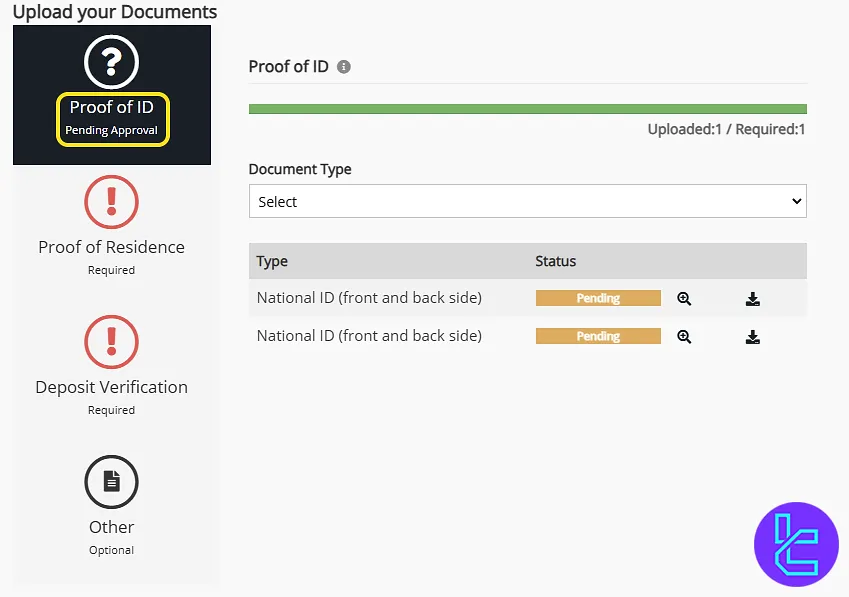

#2 Upload Your ID Card

To verify your identity, upload a clear photo of both the front and back of your government-issued ID card.

- Passport

- ID Card

- Driving licence

- Resident permit

Then, click "Browse", and then select your file.

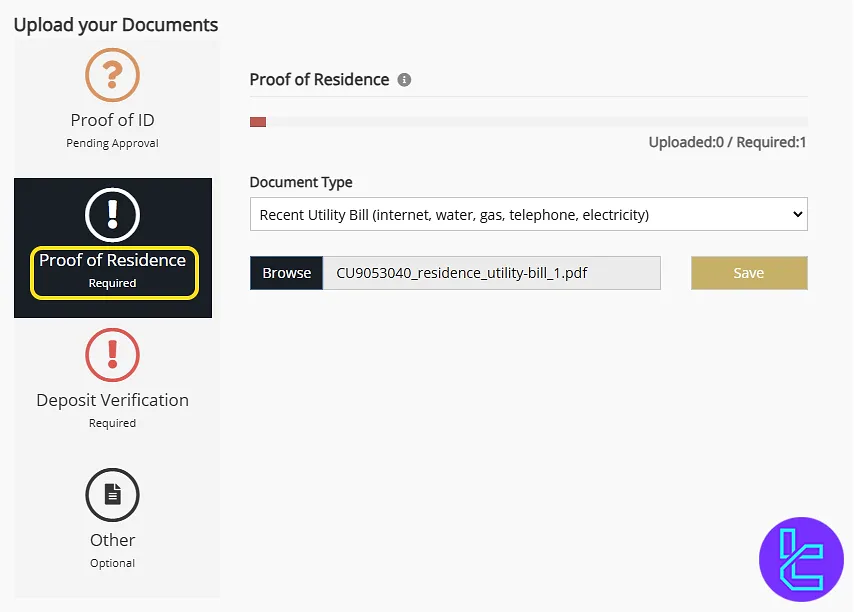

#3 Submit Proof of Residence

Upload a recent bank statement or utility bill (dated within the last 3 months) as proof of residence. Click "Proof of Residence", and select your document.

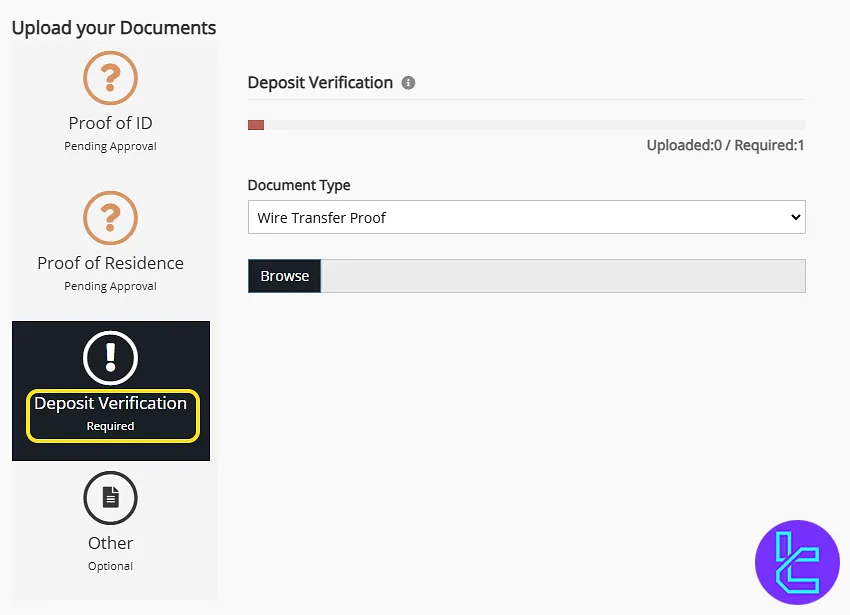

#4 Complete Deposit Verification

For deposit validation, upload a copy of your transaction history, such as a bank wire statement. Choose "Deposit Verification", click "Browse", and select your file before saving.

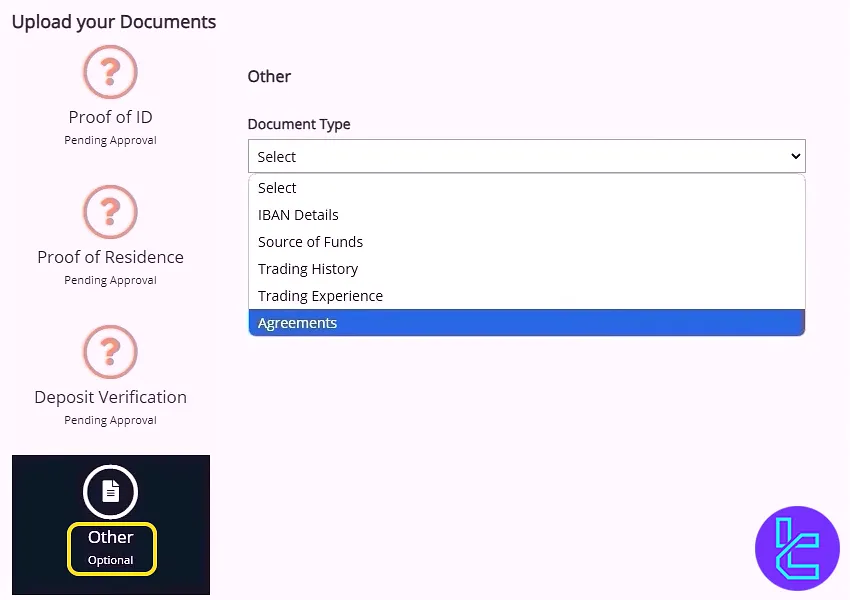

#5 Upload Additional Documents (If Required)

If further document is needed:

- Navigate to the "Other" section

- Select the document type

- Upload the file

Now, click "save" to finalize the TrioMarkets KYC process.

#6 Check Your Approval Status

To check if your TrioMarkets account is fully verified, navigate to the "My Profile" section. If everything is approved, your account will be fully verified.

TF Expert Suggestion

The TrioMarkets KYC process can be completed in 7 steps by uploading your ID card, passport, residence permit, and driver’s license as proof of identity.

Now, fund your account using the TrioMarkets deposit and withdrawal methods, by following out guides on the TrioMarkets tutorial page.