The Trust Capital verification process is an essential 4-step procedure required to activate deposit and withdrawals.

The process involves submitting proof of identity (POI), proof of address (POA), and completing financial and trading knowledge profiles.

How to Complete the Trust Capital Verification Process in 4 Simple Steps

Once Trust Capital registration is complete, traders must follow a 4-step process to gain access to deposits and withdrawals. Trust Capital Broker verification steps:

- Access the verification section;

- Provide personal, address, financial, and trading experience information;

- Upload POI and POA documents;

- Monitor verification status.

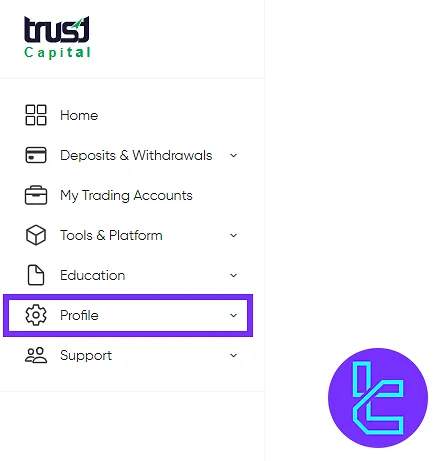

#1 Accessing the Verification Section

Log in to the Trust Capital dashboard and go to the "Profile" section.

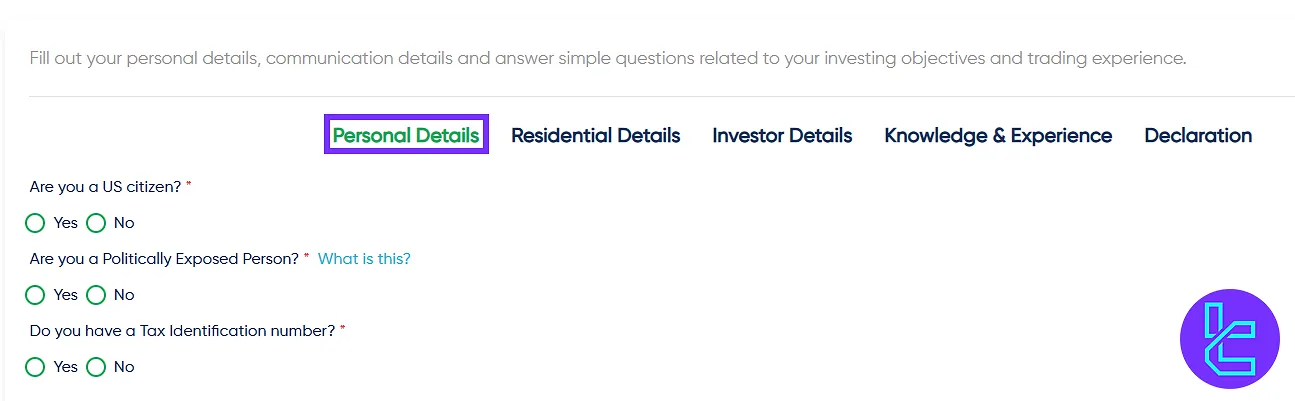

#2 Filling Out Personal, Address, Financial, and Trading Experience Information

Start by filling in your personal details, including US citizenship status, whether you are a politically exposed person (PEP), and your tax identification number (TIN).

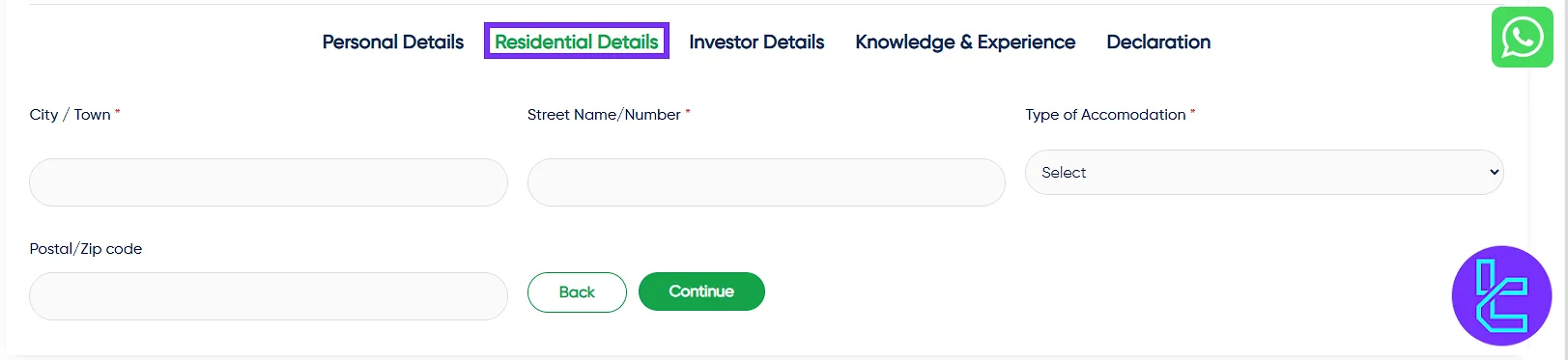

Next, provide your residential address such as:

- City/town

- Street number

- Type of accommodation

- Postal code

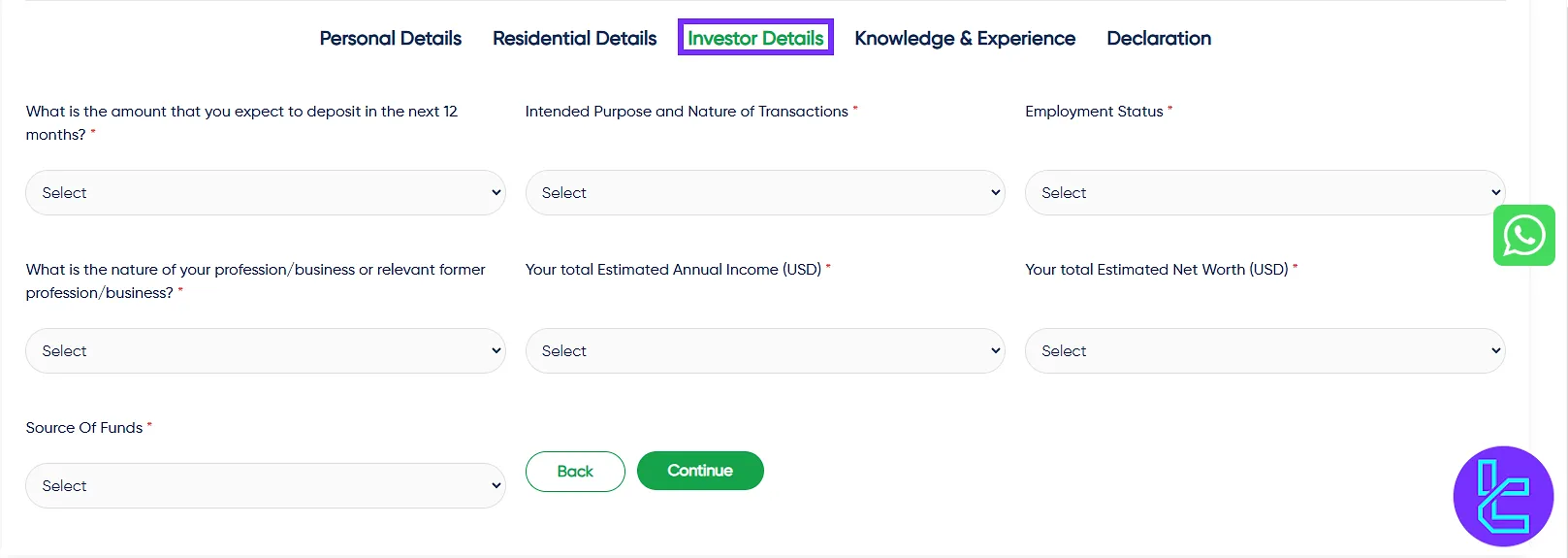

Next, move on to your financial profile, including your source of income, investment objectives, and annual income range. Click "Continue" once all fields are complete.

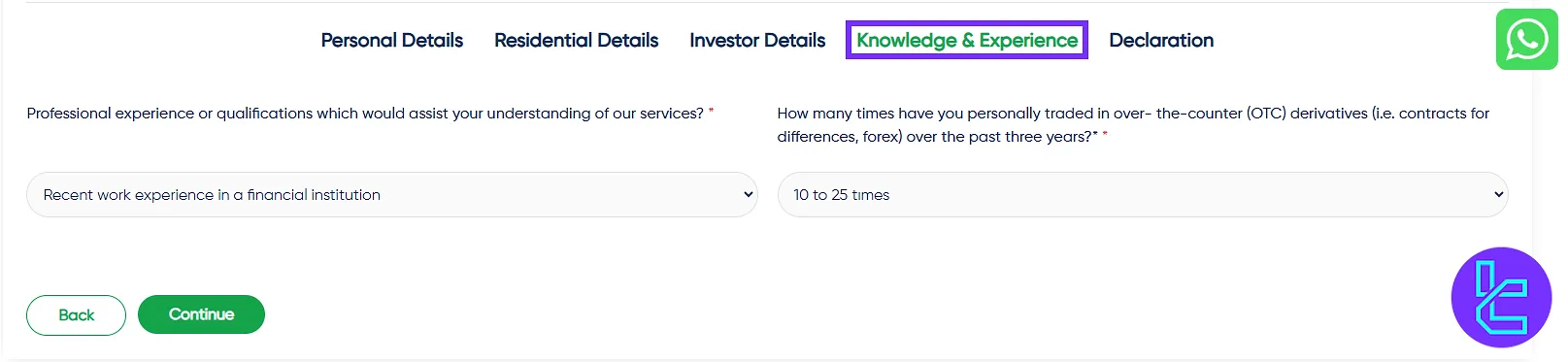

Finally, complete the trading knowledge section by answering questions about your trading experience and financial knowledge. Confirm the information and proceed by clicking "Continue".

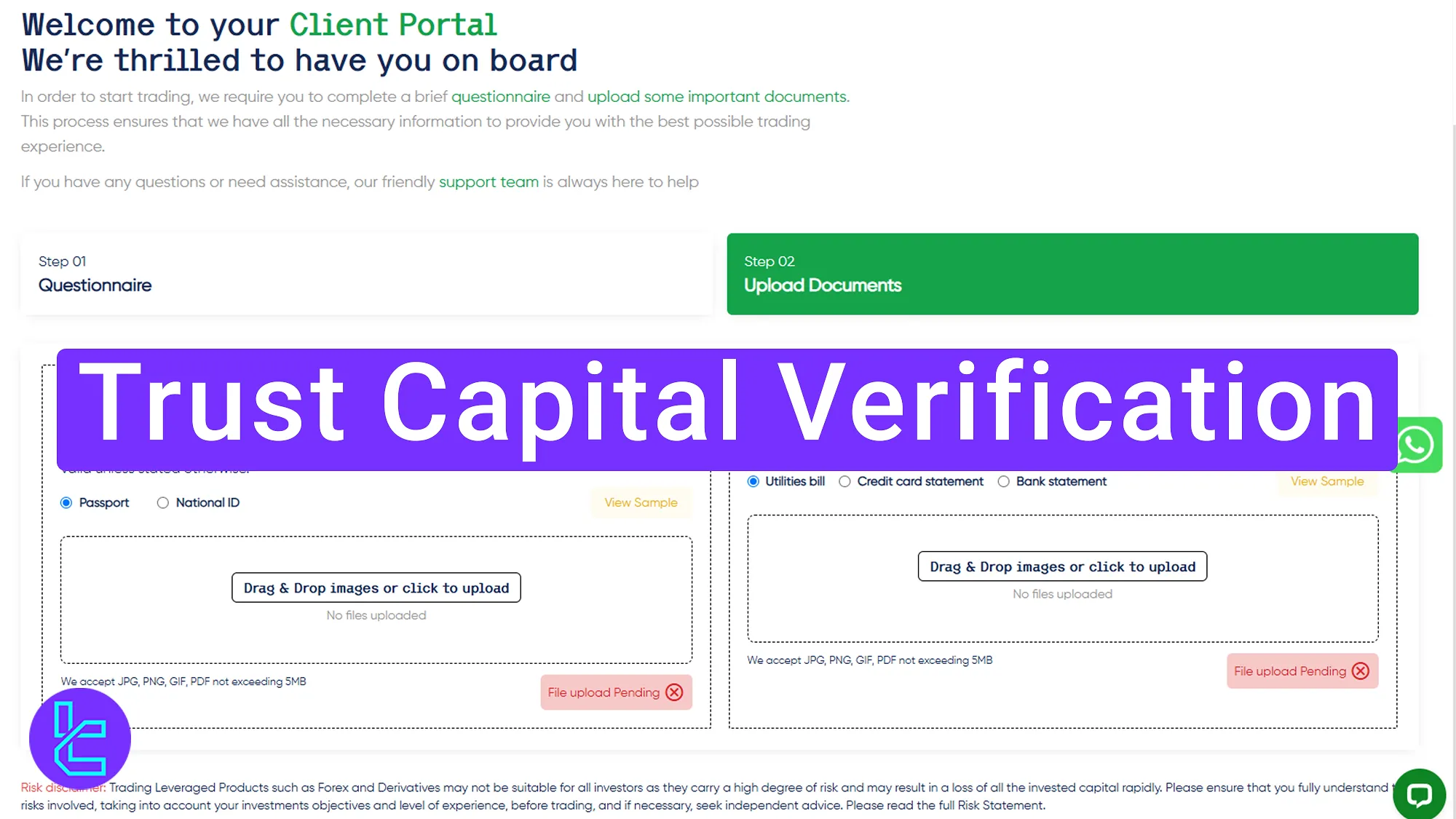

#3 Uploading POI and POA Documents

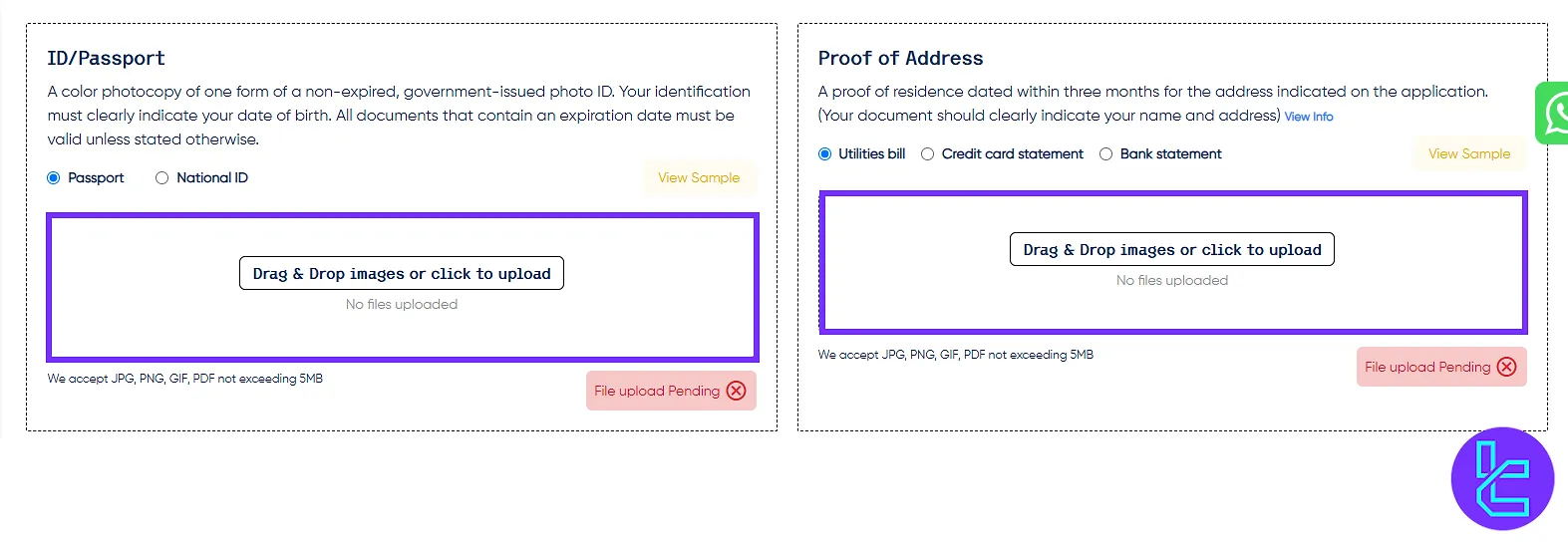

Note that in the "declaration" section you should agree with all terms and conditions related to your activities in Trust Capital.

Now you must provide one of the following documents for POI:

- Passport

- National ID

For proof of address (POA), you can upload a utility bill, bank statement, or credit card statement issued within the last 6 months.

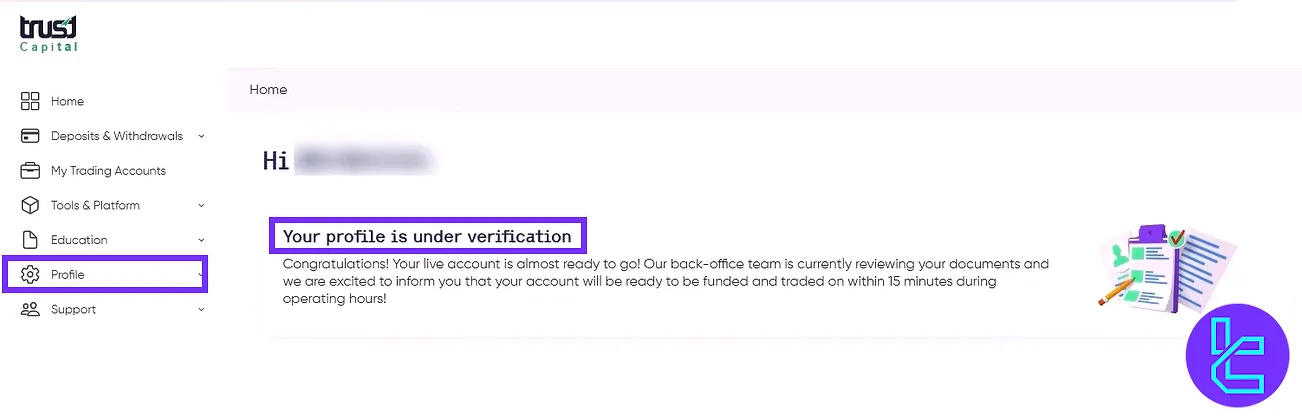

#4 Monitoring Verification Status

Return to the "Profile" section to monitor the status of your authentication.

TF Expert Suggestion

The Trust Capital verification process takes around 8 minutes to complete, with approval often finalized in around 15 minutes.

After completing the KYC process, explore the available Trust Capital Deposit and Withdrawal options by visiting the Trust Capital tutorialpage and manage your funds with ease.