Ultima Markets, offering Standard and ECN accounts in normal and Cent variations, requires an initial deposit of at least $50 and provides over 250+ tradable instruments in 4 asset classes.

The broker has an economic calendar and Trading Central as additional features.

Ultima Markets Company Information & Regulation

Ultima Markets was founded in 2016 and is registered at 2nd Floor, The Catalyst, 40 Silicon Avenue, Ebene Cybercity, 72201, Mauritius.

Ultima Markets operates under dual regulation:

- Cyprus Securities and Exchange Commission (CySEC) with CIF license number 426/23

- Financial Services Commission (FSC) of Mauritius with license number GB 23201593

The broker uses segregated bank accounts to safeguard client funds, ensuring they remain separated from operational capital. This regulatory framework enhances transparency and legal protection for global clients.

Ultima Markets Broker Key Specifications

As is the case with the reviews of other Forex brokers, this section of the Ultima Markets review consists of a table covering key parameters of UM:

Broker | Ultima Markets |

Account Types | Demo, Standard, ECN, Standard Cent, ECN Cent |

Regulating Authority | FSC, CySEC |

Based Currencies | USD, AUD, EUR, JPY, HKD, NZD, SGD, GBP, CAD |

Minimum Deposit | $50 |

Deposit Methods | Credit/Debit Cards, E-Payment Systems, Crypto, Bank Transfer |

Withdrawal Methods | Credit/Debit Cards, E-Payment Systems, Crypto, Bank Transfer |

Minimum Order | 0.01 |

Maximum Leverage | 1:2000 |

Investment Options | PAMM/MAM |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5, Proprietary |

Markets | Forex, Stocks, Commodities, Indices |

Spread | From Zero on ECN Accounts |

Commission | Zero on Standard Accounts |

Orders Execution | Market |

Margin Call / Stop Out | N/A |

Trading Features | Trading Central, Economic Calendar, Trading Calculator, VPS |

Affiliate Program | Yes |

Bonus & Promotions | Egg-citing Easter Welcome Bonus, Extra 1% Profit, 20% Deposit Bonus, 50% Deposit Bonus, Ultimate Mid-Year Bonanza |

Islamic Account | Yes |

PAMM Account | Yes |

Customer Support Ways | Email, Ticket, Live Chat |

Customer Support Hours | 24/7 |

Trading Accounts + Details

Ultima Markets offers a range of account types tailored to various trader profiles, including Standard, Raw Spread, and Islamic accounts. Key characteristics include:

- Minimum Deposit: $50 (suitable for beginners)

- Leverage: Up to 1:2000 (allows amplified exposure with minimal capital)

- Spread: Starting from 0.0 pips on Raw accounts, making it ideal for scalpers

- Commission: Zero commission on Standard accounts; Raw accounts may involve fixed commissions per trade

- Islamic Account: Swap-free option available for traders complying with Sharia law

These options enable traders to select a cost structure and trading environment that fits their strategy and risk appetite.

Here's a comparison table portraying the broker's account features and characteristics:

Account Type | Standard | ECN | Standard Cent | ECN Cent |

Platform | MT4/MT5, Proprietary | MT5, Proprietary | ||

Order Execution | Market | |||

Products | Forex, Indices, Commodities, Shares (250+) | Forex and Gold (60+) | ||

Max. Leverage | 1:2000 | |||

Min. Deposit | 50 USD | |||

Furthermore, a demo account with virtual funds of up to $100,000 is available for all traders.

Ultima Markets Benefits and Drawbacks

The table below discusses the pros and cons of trading with the discussed brokerage:

Benefits | Drawbacks |

Affordable $50 Minimum Deposit | No Top-Tier Regulation |

Up to 1:2000 Leverage | - |

Relatively Wide Range of Assets | - |

Various Account Types | - |

Ultima Markets Account Registration and Verification Guide

The first step to trading with a broker is the registration phase. Here's a step-by-step tutorial:

#1 Visit the Broker's Official Website

Navigate to Ultima Markets website and click "Open Account" to reach the sign up application.

#2 Registration Form

Fill out the sign up form with the following details:

- Email address

- Password

- Country of residence

Click on the "Request Code" button to receive the verification code. Enter the OTC emailed to you in the designated box.

#3 Ultima Markets Verification

After your account is opened with the broker, verify it by completing your profile with additional information and uploading the required documents as proof of ID and address.

Available Trading Platforms

Ultima Markets broker offers 3 choices in terms of trading terminals, with two of them being the most popular options among traders in the industry: MetaTrader 4 and MetaTrader 5.

These platforms offer trading tools, time frames, and additional features, including an economic calendar and one-click trading. Download Links:

Also, the brokerage offers a proprietary platform, available on mobile devices:

TradingFinder has developed various MT4 indicators and MT5 indicators that you can use for free.

What are the Spreads and Commissions in Ultima Markets?

Ultima Markets features a low barrier to entry with a $50 minimum deposit. Spread and commission policies vary by account type:

Account Type | Standard | ECN | Standard Cent | ECN Cent |

Min. Spread | 1 Pip | 0 Pips | 1 Pip | 0 Pips |

Commission | $0 | $5 | 0 USC | 5 USC |

According to the data available on the official website, Ultima Markets does not charge any fees on most of its payment methods; however, bank transfer withdrawals incur a $20 fee per request (except for the first transaction).

This pricing structure makes Ultima Markets suitable for both cost-sensitive traders and high-volume professionals.

Deposit & Withdrawal Methods

Ultima Markets provides a variety of 4 payment methods for deposits and withdrawals:

- Credit/Debit Cards: MasterCard, VISA, and UnionPay

- Bank Transfers: Wire transactions, etc.

- E-wallets: Alipay

- Cryptocurrencies: Bitcoin and Tether

Copy Trading & Other Investment Options Offered On Ultima Markets Broker

The broker offers 3 social trading features to help traders earn passive income in addition to profits from regular activities in financial markets.

- PAMM: Percentage Allocation Management Module

- MAM: Multi-Account Manager

- Copy Trading: Provided on UMSocial and Myfxbook platforms

Available Trading Instruments

Ultima Markets offers a good range of over 250 tradable instruments selected from 4 asset classes:

- Forex: 60+ currency pairs

- Stocks: AAPL, META, NFLX, GOOG, and more

- Commodities: Gold, silver, and oil

- Indices: DJ30, SP500, GER40, etc.

This wide selection allows for both diversification and strategic sectoral focus.

Bonuses and Promotional Offers

Ultima Markets offers several bonuses and promotions to attract and motivate clients:

- Egg-citing Easter Welcome Bonus: Up to $200 for new and existing users from April 7 to May 7

- Ultimate Mid-Year Bonanza: Prizes worth up to $3,000 for a minimum deposit of $500 and trading the required lots from May 1 to June 30

- Extra 1% Profit: Additional 1% of profit for every closed position from July 1, 2024, to July 1, 2025

- 20%/50% Deposit Bonus: Additional credits on deposits

Ultima Markets Support Department

This financial company provides 24/7 customer support through 3 channels:

- Email: info@ultimamarkets.com

- Live Chat: Available on the website

- Ticket: Through the Contact Us section of the site

However, the "Live Chat" button on the website was not working when we tried to reach support at the time of writing.

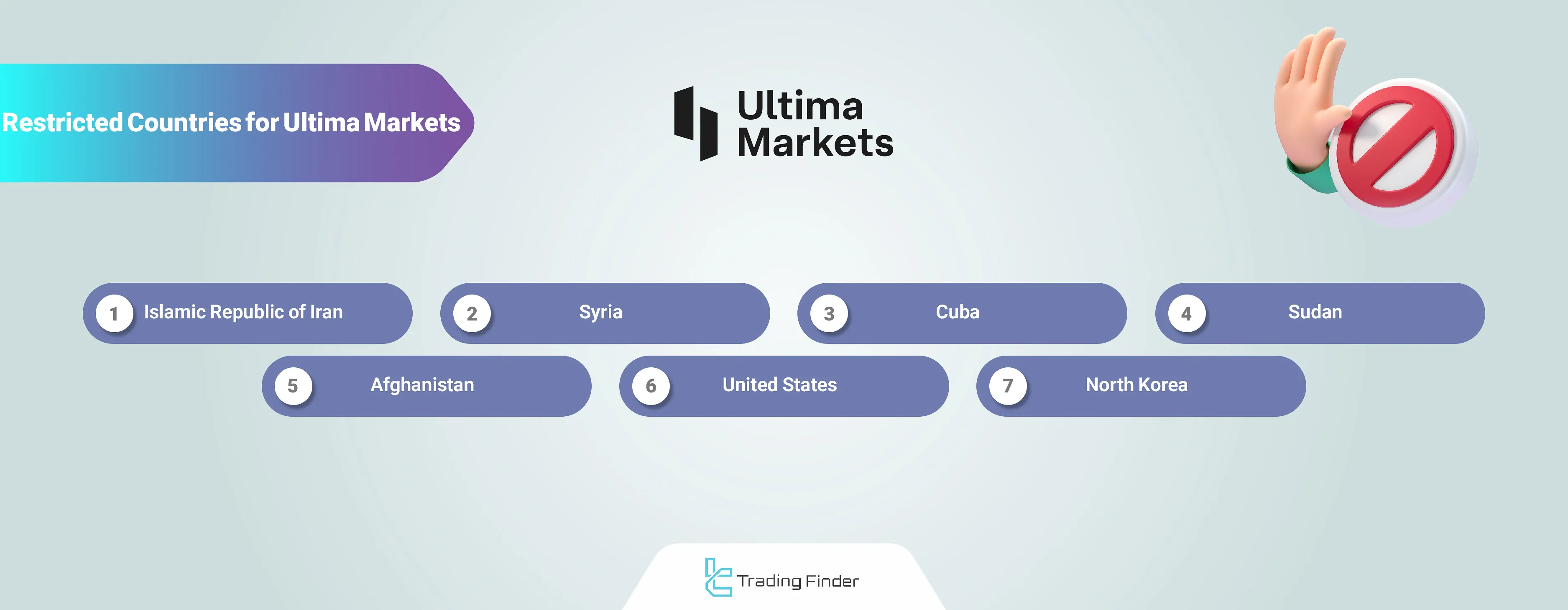

Restricted Countries

Ultima Markets does not outline the full list of restricted countries, only mentioning the US and North Korea. Based on our knowledge and observation of other companies, the other banned regions likely include:

- Iran

- Syria

- Cuba

- Sudan

- Afghanistan

- And more

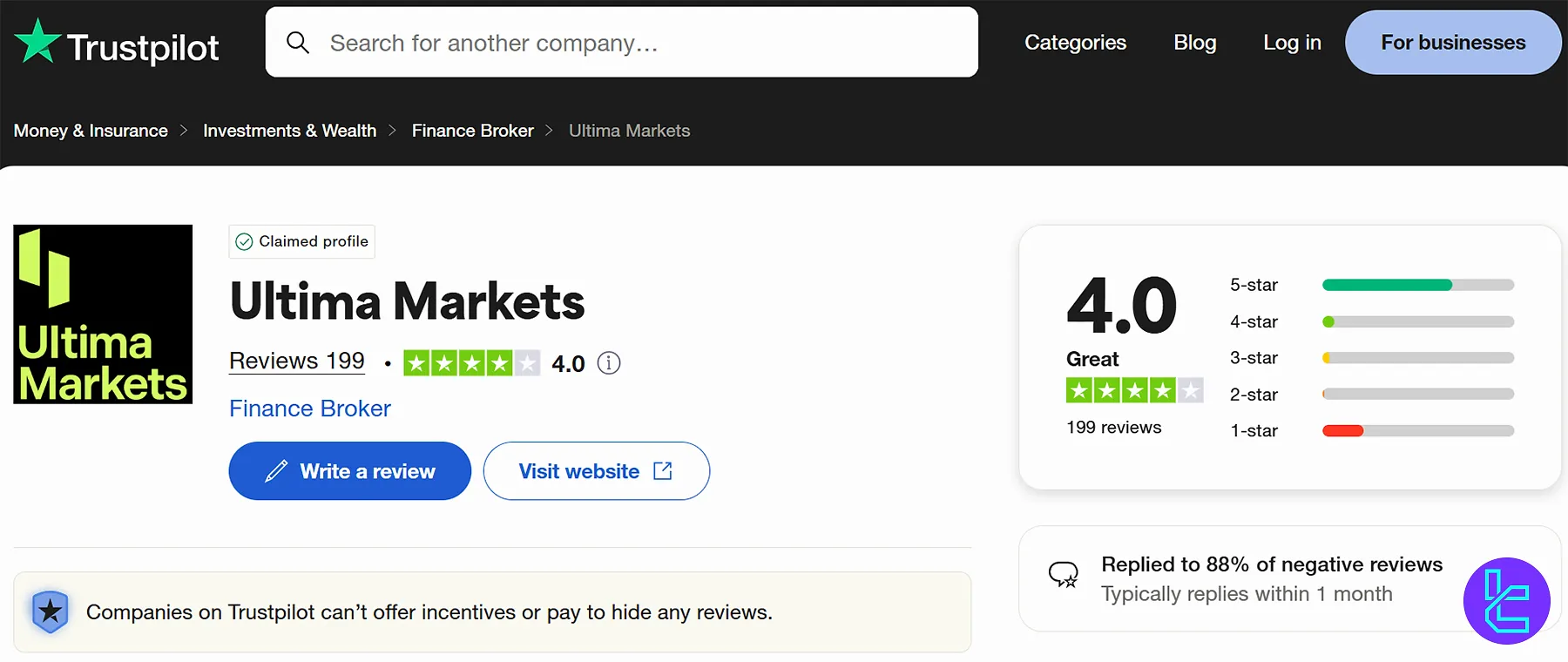

Trust Evaluations, Scores & User Reviews

Ultima Markets' page on Trustpilot and its other scores show mixed reviews from traders and industry watchdogs:

- Ultima Markets Trustpilot: 4.0/5 based on 190+ user ratings

- ScamAdviser: 46/100 Trustscore given by the site

Educational Resources

Ultima Markets provides a decent level and scale of educational materials to users and clients:

- Trading Courses: Divided into 3 skill levels [Beginner, Intermediate, and Advanced"

- News: Articles on events and happening effective on the financial markets

- Market analysis: On various symbols

- Investor's Magazine: Quarterly magazines on "market trends and insights"

Ultima Markets Comparison Table

The table below compares Ultima Markets with some of the most popular Forex brokers in terms of features and services.

Parameter | Ultima Markets Broker | |||

Regulation | FSC, CySEC | FSA, CySEC, ASIC | FCA, FSCA, CySEC, SCB | ASIC, FSC, DFSA, CySEC |

Minimum Spread | From 0.0 pips | 0.0 Pips | From 0.0 pips | From 0.6 Pips |

Commission | From $0 | Average $1.5 | From $0 | From Zero |

Minimum Deposit | $50 | $200 | $100 | $5 |

Maximum Leverage | 1:2000 | 1:500 | 1:500 | 1:1000 |

Trading Platforms | MetaTrader 4, MetaTrader 5, Proprietary App | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, cTrader, Web Trader, Mobile App | MT4, MT5, Mobile App |

Account Types | Demo, Standard, ECN, Standard Cent, ECN Cent | Standard, Raw Spread, Islamic | Standard, Pro, Raw+, Elite | Micro, Standard, Ultra Low, Shares |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 250+ | 2,250+ | 2,100+ | 1,400+ |

| Trade Execution | Market | Market | Market, Instant | Market, Instant |

Conclusion and Final Words

Ultima Markets enables the trading of Forex currency pairs and Gold on its Cent accounts, a total of 60 symbols. The company, having a 4/5 score on "Trustpilot" with 190+ user reviews, offers 24/7 support services through email, live chat, and ticket.