Our latest examination of the company's official website at the time of writing this paragraph shows that the site is unavailable. We couldn't reach USGFX's domain and received the "ERR_TIMED_OUT" error. Be warned; this could indicate that the company was shut down.

60 Assets to trade from 3 markets, $100 minimum deposit, 1:500 maximum leverage, and $0 deposit fees are some of the features of USGFX broker. All of these features are available in USGFX 4 accounts [Mini, Standard, VIP, Pro ECN].

USGFX Company Background and Regulatory Status

USGFX[United Strategic Group], founded by “Hien Min Soe”in 2006, is a CFD and forex broker available in 20+ languages.

USGFX previously operated under a license from the FCA in the UK, but this was revoked in December 2022 and has not been reinstated.

The company’s headquarters are in Sydney and are regulated bytwo offshore regulators:

- Financial Services Authority of Saint Vincent and the Grenadines (SVGFSA) with license number 648LLC2020

- Mwali International Services Authority (MISA)

Note: Offshore authorities like the SVGFSA may not provide the same level of protection as top-tier regulators such as the FCA or ASIC.

While the broker still enforces practices like negative balance protection, clients are no longer protected by top-tier regulatory frameworks or compensation schemes.

As such, traders should proceed with caution and be fully aware of the associated risks when trading under offshore regulatory umbrellas.

USGFX facilitates CFD trading in forex, commodities, and indices with leverage options. It accepts clients from most countries, with the exception of jurisdictions like the United States and Japan due to regulatory restrictions.

Table of Specifications

The table below provides a glance at what USGFX Broker brings to the table:

Broker | USGFX |

Account Types | Mini, Standard, VIP, Pro ECN |

Regulating Authorities | SVGFSA Saint Vincent & Grenadines and MISA Mwali |

Based Currencies | USD |

Minimum Deposit | $100 |

Deposit Methods | Bank Wire, VISA, MasterCard, Perfect Money, FasaPay, VoguePay, CoinPayments, GCPAY, AstroPay |

Withdrawal Methods | Bank Wire, VISA, MasterCard, Perfect Money, FasaPay, VoguePay, CoinPayments, GCPAY, AstroPay |

Minimum Order | 0.01 Lot |

Maximum Leverage | 1:500 |

Investment Options | Copy Trading, Social Trading |

Trading Platforms & Apps | MetaTrader 4, MetaTrader 5 |

Markets | Currencies, Indices, Commodities |

Spread | Starts From 1.3 |

Commission | $0 |

Orders Execution | ECN, Market |

Margin Call/Stop Out | N/A |

Trading Features | 1:500 Maximum Leverage, Personal Account Manager, Negative Balance Protection, $100 Minimum Deposit, 60 Tradable Assets |

Affiliate Program | Yes |

Bonus & Promotions | None |

Islamic Account | No |

Pamm Account | No |

Customer Support Ways | Email, Phone Call, Live Chat |

Customer Support Hours | 24/7 |

What are USGFX Account Types?

USGFX offers four distinct account types [Mini, Standard, VIP, Pro ECN] to cover all trading styles and experience levels.

USGFX Account Types Comparison:

Specifics | Mini | Standard | VIP | Pro ECN |

Minimum Deposit | $100 | $10000 | $50000 | $50000 |

Maximum Balance | None | None | None | None |

Spreads | Starts From 2.8 Pips | Starts From 2.2 Pips | Starts From 1.3 Pips | Starts From 1.5 Pips |

Minimum Lot Size | 0.01 | 0.01 | 0.01 | 0.01 |

Maximum Leverage | 1:500 | 1:500 | 1:500 | 1:100 |

Standard Lot Size | 100,000 | 100,000 | 100,000 | 100,000 |

Negative Balance Protection | Available | Available | Available | Available |

Hedging | Allowed | Allowed | Allowed | Allowed |

Scalping | Allowed | Allowed | Allowed | Allowed |

All account types offer access to over 60 currency pairs, indices, and commodities. A free demo account with £100,000 virtual funds is offered for 30-day access, ideal for strategy testing.

How to Register and Verify in USGFX? Complete Guide

USGFX offers a streamlined account setup process that allows you to start trading global markets after completing a few essential steps.

The registration includes identity verification and account funding to meet compliance and security standards.

#1 Begin Your Application

Visit the official USGFX website and click on “Open Account”. Fill out the registration form with the following details:

- Name

- Nationality

- Phone number

- Country of residence

#2 Define Account Type and Verify Identity

Choose your desired account type and create a secure password. Then, complete KYC by submitting ID documentation, address details, and national identification numbers.

- Proof of ID: Passport or Driver's license

- Proof of Address: Utility bill or Bank statement

#3 Submit Financial Info and Fund Your Account

Enter your banking details and other financial information. Once your documents are verified, deposit funds into your account to begin trading on USGFX platforms.

Advantages and Disadvantages

When considering USGFX as your broker, it's essential to weigh the advantages and disadvantages:

Pros | Cons |

Wide range of payment options for deposits and withdrawals | High spreads, especially on the Mini and Standard accounts |

Negative balance protection | Slow and difficult withdrawal process, with many customer complaints |

Personal account manager | Limited range of trading instruments [60] |

Comprehensive educational resources and market analysis | No PAMM or MAM account options for managed accounts |

High maximum leverage [1:500] | - |

Given the mixed reviews and reported difficulties with withdrawals, traders should approach USGFX with caution and thoroughly research their options before opening an account.

Trading Platforms

United Strategic Group provides access to MetaTrader 4 and MetaTrader 5 as industry-standard trading platforms.

MetaTrader 4 (MT4)

- Industry-leading platform

- Advanced charting tools

- Customizable indicators

- Expert Advisors (EAs) for automated trading

MetaTrader 5 (MT5)

- Next-generation platform

- Enhanced features compared to MT4

- Additional timeframes and analytical tools

- Integrated MetaTrader Market

Both platforms are available for desktop, web, and mobile devices, ensuring traders can access their accounts from anywhere at any time.

TradingFinder has developed a wide range of MT4 and MT5 indicators that you can use for free.

Traders also benefit from the Autochartist plug-in for real-time pattern recognition and signal alerts.

Fees, Spreads, and Costs

USGFX applies a spread-based pricing model with no direct trading commissions. However, trading costs are embedded in relatively wide spreads for lower-tier accounts:

Account | Mini | Standard | VIP | Pro ECN |

Spreads | From 2.8 Pips | From 2.2 Pips | From 1.3 Pips | From 1.5 Pips |

Note: Besides spreads, there are other fees, including withdrawal/deposit fees and currency conversion fees.

The broker also charges swap fees for overnight positions. While commission-free trading can appeal to some users, the high spreads on smaller accounts may not be suitable for active trading strategies such as scalping or day trading.

USGFX charges a monthly $10 inactivity fee after 90 days of no trading or withdrawals.

Here's a detailed list of USGFX withdrawal costs based on the method:

Withdrawal Method | Withdrawal Commission |

Bank Wire | $40 |

Credit/Debit Card | €0.8 |

Skrill/Netellar | 1% |

What Payment Methods are Available?

USGFX offers 9 payment options for deposits and withdrawals:

- Bank Wire Transfer

- Credit/Debit Cards: VISA, MasterCard

- E-Payment: Perfect Money, FasaPay, VoguePay, CoinPayments, GCPAY, AstroPay

Withdrawals take 1–5 business days and incur variable fees based on the selected payment method. The platform does not support PayPal or Wise.

The diverse range of payment methods provides flexibility for traders from different regions.

What Investment Plans are Available in USGFX?

USGFX does offer social trading and copy trading options for its clients, specifically through the Myfxbook platform.

This feature allows traders, especially beginners, to copy the trades of verified professional forex traders.

Key Points of USGFX Forex Copy Trade and Social Trade:

- Clients can select and follow one or multiple signal providers;

- The copy trading feature is highly customizable;

- Traders can easily add or remove signal providers from their portfolio.

How Many Assets are Tradable in USGFX?

USGFX offers over 60 tradable assets across different markets:

- Forex: majors, minors, and exotic pairs

- Indices: Popular global indices such as S&P 500, NASDAQ, FTSE 100, and regional indices

- Commodities: Precious metals (e.g., gold, silver), Energy (e.g., crude oil, natural gas), and Agricultural commodities

However, the broker does not offer equities, ETFs, or spot cryptocurrency trading. This limited offering may be suitable for forex-focused traders, but less appealing for portfolio diversification.

Does USGFX Offer Any Bonuses?

Currently, USGFX does not offer any active bonuses or promotions. However, in the past, they have provided bonuses that you can see below:

- Weekly bonuses

- Losable bonus offers

Support

USGFX provides multilingual 24/7 support through 3 channels, including:

- Email: clientsupport@usgfx.global

- Phone: +61291890223

- Live Chat: Accessible throughout their website for quick queries

Response times via live chat are quick, while email replies may be slower. VIP clients receive priority access to account managers.

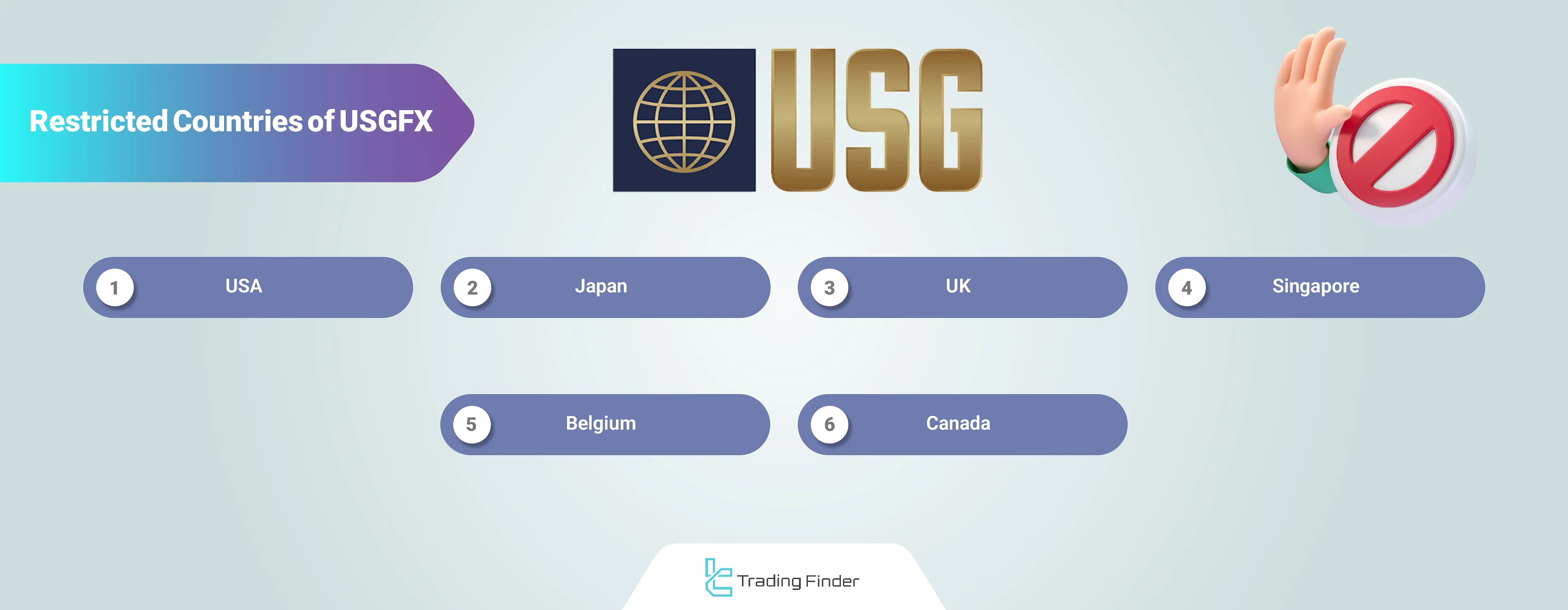

Geo-Restrictions: Which countries Are Banned from Using USGFX?

Like other Forex brokers, USGFX is unable to provide its services in some countries:

- USA

- Japan

- UK

- Singapore

- Belgium

- Canada

Following regulatory laws in some countries, including the United States, these restrictions have occurred.

Trust Score

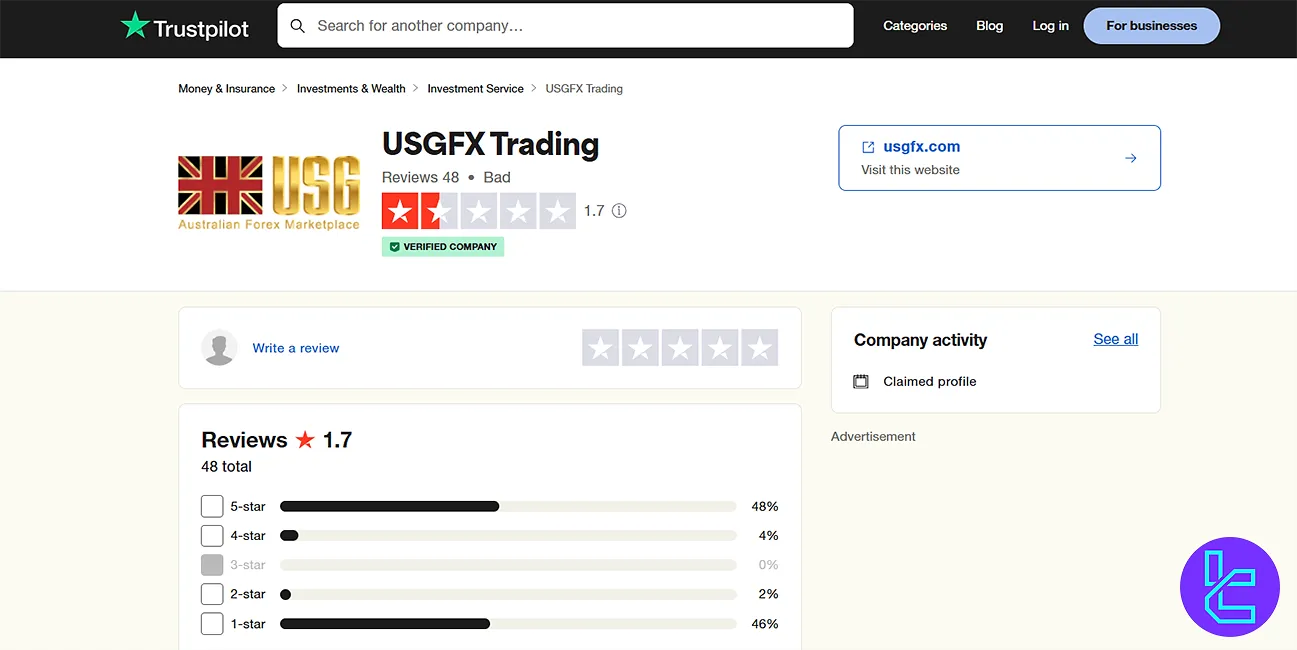

USGFX's trust scores from popular review platforms such as Trustpilot are alarmingly low:

- USGFX Trustpilot: 1.7/5 from over 45 reviews

- ForexPeaceArmy: 1/5 from 6 reviews

These poor ratings stem from numerous customer complaints, including:

- Difficulties withdrawing funds

- Poor customer service

USGFX Broker Educational Resources

USGFX offers a range of educational resources to traders:

- Blog: Regular posts and FX education

- Trading Guide: Covers forex basics, including trading strategies

- Webinars & Seminars: Introductory sessions for beginners, advanced topics for experienced traders

- FX TV: Provides analysis and market news

You can also check TradingFinder's Forex education section for additional resources.

USGFX vs Other Brokers

The table below compares USGFX features and services with other popular brokers:

Parameter | USGFX Broker | XM Broker | LiteForex Broker | Exness Broker |

Regulation | SVGFSA, Mwali | ASIC, FSC, DFSA, CySEC | CySEC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA |

Minimum Spread | From 1.3 pips | From 0.6 Pips | 0.0 Pips | 0.0 Pips |

Commission | $0 | None Except On Shares Account No Withdrawal & Deposit Commissions | From Zero | From $0.2 to USD 3.5 |

Minimum Deposit | $100 | $5 | $50 | $10 |

Maximum Leverage | 1:500 | 1:1000 | 1:30 | Unlimited |

Trading Platforms | MetaTrader 4, MetaTrader 5 | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5, Mobile Proprietary App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Account Types | Mini, Standard, VIP, Pro ECN | Micro, Standard, Ultra Low, Shares | Classic, ECN, Demo | Standard, Standard Cent, Pro, Raw Spread, Zero |

Islamic Account | No | Yes | No | Yes |

Number of Tradable Assets | 60+ | 1400+ | N/A | 200+ |

| Trade Execution | ECN, Market | Market, Instant | Market | Market, Instant |

Conclusion and Final Words

USGFX offers advantages such as Negative Balance Protection, scalping, news trading, and a personal account manager, along with features such as nine payment methods.

However, spreads at this broker start from 1.3 pips, and only 60 assets are available to trade.