ViTrade offers traders access to over 140,000 instruments across 13+ global exchanges and 33+ countries, combining CFDs and real equities. With spreads from 0.01 pips, €1 minimum deposit, and up to 1:30 leverage, it's built for cost-efficient, regulated trading.

ViTrade; Company Information and Regulation

Founded in 2010, ViTrade is a BaFin-regulated German broker under flatexDEGIRO Bank AG, complying with ECB and ESMA rules.

It ensures MiFID II protection and segregated client funds. Here are the key points about ViTrade:

- Regulator: Federal Financial Supervisory Authority BaFin (Tier 1)

- Supervision: European Central Bank (ECB) and European Securities and Markets Authority (ESMA)

- Investor Protection: €100,000 deposit insurance (bank), €20,000 BaFin-funded compensation

- Negative-Balance Protection

ViTrade Specific Features

ViTrade offers pro-level features like the HTX FIX API, smart orders, and RTD Excel feeds, tailored for algorithmic and high-frequency traders. The Forex broker merges CFD and securities trading in one regulated interface.

Broker | ViTrade |

Account Types | CFD, Demo |

Regulating Authorities | BaFin |

Based Currencies | EUR |

Minimum Deposit | €1 |

Deposit Methods | Bank Transfer |

Withdrawal Methods | Bank Transfer |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:30 |

Investment Options | Real Stocks and Securities |

Trading Platforms & Apps | CFD WebTrader, HTX |

Markets | Shares, Indices, Raw Materials, Currencies, Interest Rate Futures, Precious Metals, Index Futures |

Spread | From 0.01 pips |

Commission | Variable based on the asset |

Orders Execution | Market, Instant |

Margin Call / Stop Out | 80% / 50% |

Trading Features | Commission-free Forex trading, API trading, Individual training |

Affiliate Program | N/A |

Bonus & Promotions | No |

Islamic Account | No |

PAMM Account | No |

Customer Support Ways | Call Center, Email |

Customer Support Hours | 8:00 am to 10:00 pm CET |

ViTrade Account Types

ViTrade provides access to real stocks, ETFs, bonds, and CFDs via demo, CFD, and securities accounts. All accounts are unified under BaFin-regulated flatexDEGIRO Bank AG for seamless trading. ViTrade Trading Accounts:

- CFD: Trade forex, indices, commodities, metals, futures, volatility with spreads from 01 pips and leverage options of up to 1:30

- Demo: Simulated real-market environment and risk‑free

- Securities: Access to real stocks, ETFs, ETCs, and bonds via flatexDEGIRO

All accounts link into a unified platform with KYC, and cross-border securities trading across 33+ markets.

ViTrade Broker Upsides and Downsides

The advantages in this ViTrade review include institutional APIs and €5.95 flat securities trades, but it lacks live chat and bonus offers. Full BaFin/ESMA oversight ensures a secure, compliant environment for active traders. Let’s weigh the broker’s advantages against its disadvantages:

Pros | Cons |

Tier‑1 BaFin regulation, ECB/ESMA oversight | No ECN account option |

Robust HTX API & smart orders | Limited educational resources |

Unified CFD & securities trading | No live chat support |

Direct exchange and one‑click trading | Complex interface |

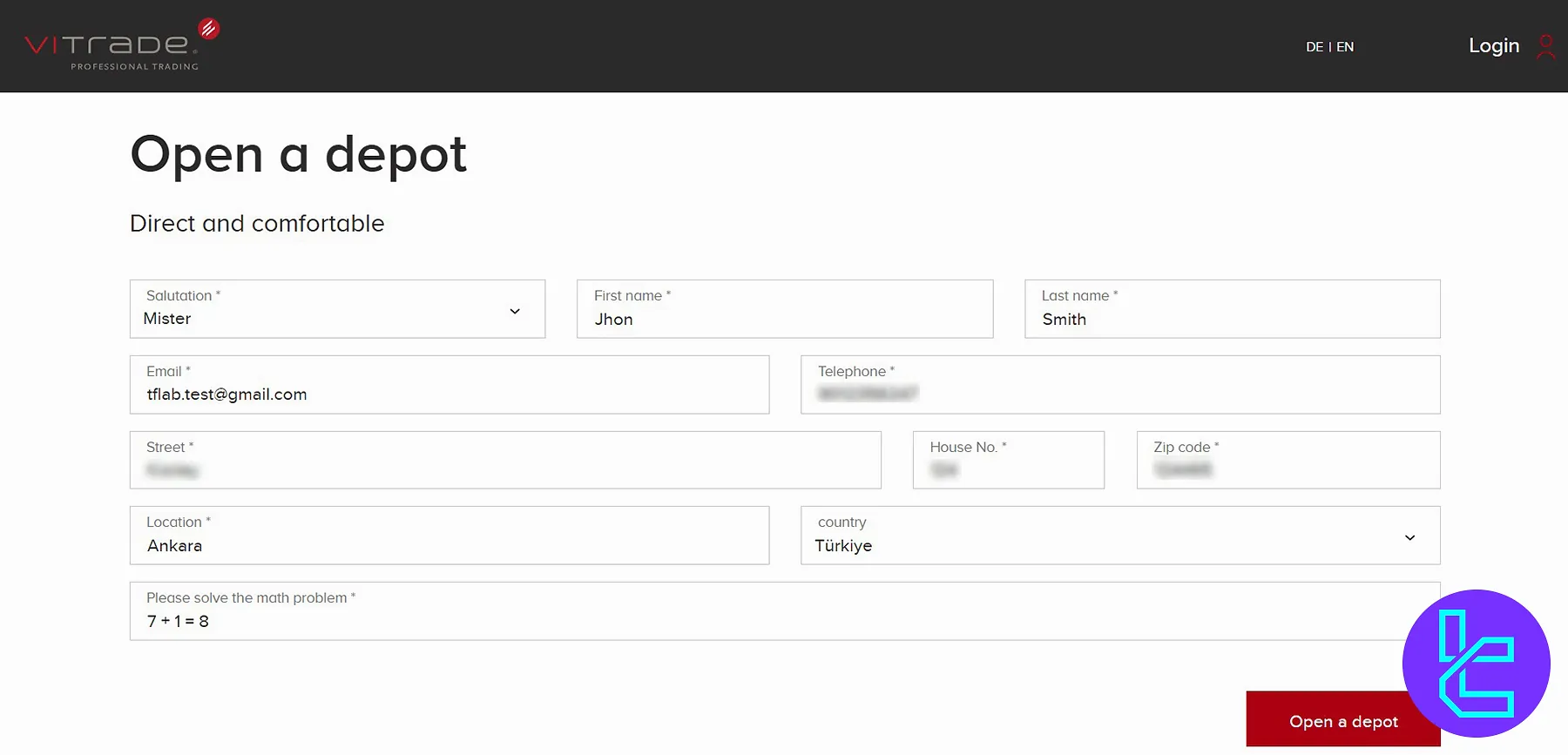

ViTrade Sign Up and KYC Guide

Opening a ViTrade account requires identity verification and proof of residence. German and EU traders can onboard digitally within 1–3 business days with bank-level security via flatexDEGIRO. Steps to ViTrade registration:

#1 Visit the Broker’s Official Website

Navigate to the ViTrade website and click “Open a Depot” to reach the application form.

#2 Fill out the Registration Form

Provide your personal details, including:

- Gender

- First name

- Last name

- Phone number

- Residential address

- Country

#3 Complete the KYC Procedure

Upload supporting documents, including:

- Proof of ID: Passport or Driving license

- Proof of Residence: Utility bill or Bank statement

ViTrade typically takes 1-3 business days to review your application and contact you with account credentials.

ViTrade Trading Platforms

ViTrade provides CFD WebTrader, HTX desktop/mobile apps, and Flatex Next for real equities. The HTX platform supports FIX API, RTD, and one-click trading for professionals.

- WebTrader (CFD): Browser-based execution with smart order tools

- HTX Desktop & API: Advanced platform with FIX / restful APIs for algo trading

- HTX Mobile App: One‑click trading on iOS (iPad and iPhone) and Android

- Flatex Next: For securities trading, via flatexDEGIRO bank

ViTrade Trading and Non-Trading Costs

ViTrade charges €5.95 per stock trade and offers tight spreads from 0.01 pips on CFDs. It imposes no deposit or inactivity fees. The broker imposes a 3-layer cost structure covering Order Fees, Spreads, and Financing Costs.

ViTrade Order Fees

CFDs | Order Fee | Minimum Fee |

Forex, Indices, Metals, Interest Rate Futures, Commodities | 0% | - |

Shares | 0.05% | €5.00 |

DAX Futures | 0.01% | €5.00 |

Other Index Futures | 0.02% | €5.00 |

Validity Indices | 0.02% | €5.00 |

ViTrade Spreads

The table below provides spread data on most important indices, commodities, currencies and interest rate futures:

Trading Asset | Spreads (pips) |

EURUSD | 1 |

EURO STOXX 50 | 1.5 |

DOW JONES INDUSTRIAL AVERAGE 30 | 3.5 |

NASDAQ 100 | 2 |

VEU50 | 0.1 |

Gold US | 0.5 |

Light US crude oil | 0.06 |

ViTrade Financing Costs (Swap Rate)

The broker charges swap rates on overnight positions:

CFDs | Long positions | Short positions |

Shares | 3.5% + currency interest | 3.5% - currency interest |

Indices | 3.5% + currency interest | 3.5% - currency interest |

Raw materials | 3.5% | 3.5% |

Currencies | 3.5% + currency interest | 3.5% - currency interest |

Metals | 3.5% + currency interest | 3.5% - currency interest |

ViTrade Payment Methods

ViTrade supports only SEPA and foreign currency bank transfers. Deposits are free and secure via flatexDEGIRO Bank AG; card or wallet options are not available. Note that deposits are all converted to EUR, so traders should consider the conversion rate. ViTrade deposit & withdrawal options:

- Deposit: Bank Transfer (SEPA, foreign currencies)

- Withdrawal: Bank Transfer (to the same account used for deposit)

Accounts are held with flatexDEGIRO Bank AG and support multi-currency deposits. One of the main letdowns in this ViTrade review is the lack of support for cards or wallets.

ViTrade Automated Trading

ViTrade’s HTX API enables professional algorithmic trading via FIX, REST, and Excel RTD.

It offers low-latency execution and access to all asset classes.

- FIX‑based HTX API: Access all asset classes for automated algo/trading robots;

- RTD Excel Interface: Pull live market data into spreadsheets for modelling.

Traders can utilize pre-built strategies on HTX desktop with support for custom trading tools.

ViTrade Trading Instruments

ViTrade supports over 140,000 securities and CFDs on shares, indices, forex market, metals, Futures markets, and more. It covers 13+ global exchanges for cross-border real equity trading.

- CFDs: Forex, commodity, index, precious metals, interest-rate futures, volatility indices

- Securities: Real stocks, bonds, ETFs, and ETCs

The broker provides cross-border equity trading in 33+ countries on 13+ international exchanges.

ViTrade Bonus and Promotions

ViTrade does not offer welcome bonuses or promotions. Instead, it focuses on tight pricing and institutional-grade trading infrastructure under BaFin supervision. There is no VIP program or loyalty system.

ViTrade Customer Support

ViTrade provides phone support in English and German during trading hours (8:00 am to 10:00 pm CET). Dedicated account managers are available for professional and B2B clients.

- Customer Service Phone Number: 0800 387 23 31 (from aboard: +49 30 233 66666)

- Interested Parties Phone Number: 0800 333 20 01 (from aboard: +49 30 233 66633)

- Email: info@vitrade.de

ViTrade Geo-Restrictions

The broker’s services are limited to EU/EEA residents. U.S., Canadian, and certain offshore jurisdictions are restricted from opening accounts due to regulatory constraints. ViTrade has strong presence in Germany, Austria, Netherlands.

ViTrade Trust Scores

There are no ViTrade reviews on platforms like Trustpilot and ForexPeaceArmy. So, the connection with flatexDEGIRO Bank AG is the sole credibility factor of this broker.

Does ViTrade Offer Learning Materials?

The broker offers one‑on‑one training sessions via dedicated account managers. Traders will be practicing HTX and API use. While it’s suitable for experienced traders, the session is limited for beginners seeking structured courses.

You can check TradingFinder’s Forex education section for additional learning materials.

ViTrade Comparison Table

Let’s compare the broker’s services and features with top brokerage companies:

Parameter | ViTrade Broker | |||

Regulation | BaFin | CySEC, DFSA, FCA, FSCA, FSA | FCA, FSCA, CySEC, SCB | No |

Min Spread | From 0.01 pips | From 0.0 Pips | From 0.0 Pips | From 0.1 Pips |

Commission | %0 | From $0 | From $0 | $0 |

Min Deposit | €1 | From $0 | $100 | $1 |

Max Leverage | 1:30 | 1:2000 | 1:500 | 1:3000 |

Trading Platforms | CFD WebTrader, HTX | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App | MetaTrader 4, MetaTrader 5 |

Account Types | CFD, Demo | Cent, Zero, Pro, Premium | Standard, Pro, Raw+, Elite | Standard, Premium, VIP, CIP |

Islamic Account | No | Yes | Yes | Yes |

Number of Tradable Instruments | 600+ | 1,000+ | 2100+ | 45 |

Trade Execution | Market, Instant | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Pending | Market, Instant |

Conclusion and Final Words

Backed by €100,000 deposit insurance and an extra €20,000 compensation scheme, ViTrade delivers secure, BaFin-supervised trading. While it doesn’t support e-wallets, bonuses, or live chat, its one-click HTX trading, SEPA funding, and 8:00–22:00 CET support appeal to advanced EU traders.