The broker offers 3 account types, with a minimum deposit of €500 for the CFD and Forex Mini account. Theforex commission is €2.20 per lot per side, while futures and options charge $2.20 per contract.

In addition, WH SelfInvest provides tools like copy trading, VPS, and trading signals to enhance the trading experience.

Company Information & Regulation Status

WH SelfInvest has established itself as a reputable and well-regulated forex and CFD broker in the European market. Founded in 1998 and headquartered in Luxembourg, the company has expanded its operations to serve clients from over 28 countries.

WH SelfInvest's commitment to regulatory compliance is evident in its licensing by several esteemed financial authorities:

Entity Parameters / Branches | Luxembourg (WH SelfInvest S.A.) | France (branch) | Germany (branch) | Switzerland (rep.) | Belgium (rep.) | Netherlands (rep.) |

Regulation | CSSF | ACPR / Banque de France | BaFin | FINMA (representation) | FSMA (representation) | AFM (representation) |

Regulation Tier | 1 | 1 | 1 | 1 | 1 | 1 |

Country | Luxembourg | France | Germany | Switzerland | Belgium | Netherlands |

Investor Protection Fund / Compensation | SIIL €20k · FGDL €100k | FGDR €100k | EdB / €100k | CHF 100k | FG €100k | Not specified |

Segregated Funds | Yes | Yes | Yes | Yes | Yes | Yes |

Negative Balance Protection | Yes | Yes | Yes | Yes | Yes | Yes |

Maximum Leverage | 1:30 | 1:30 | 1:30 | 1:30 | 1:30 | 1:30 |

Client Eligibility | EU & international | France residents | Germany residents | Switzerland residents | Belgium residents | Netherlands residents |

This multi-jurisdictional regulatory framework ensures that the broker operates transparently and adheres to strict financial standards, providing clients with a secure trading environment.

The broker adheres to strict compliance standards, with client funds kept in segregated accounts and protected by the Luxembourg Investor Compensation Scheme (SIIL), offering up to €20,000 coverage per trader in case of bankruptcy.

Summary of Specifics

WH SelfInvest offers a comprehensive trading solution catering to new and pro traders. Here's a breakdown of the key specifics of the Forex broker:

Broker | WH SelfInvest |

Account Types | Multi-Market, Zero Commission, CFD & Forex Mini, CFD & Forex Standard, Futures, Demo |

Regulating Authorities | BaFin, FINMA, CSSF, ACPR, FSMA, AFM |

Based Currencies | EUR, USD |

Minimum Deposit | € 500 |

Deposit/Withdrawal Methods | Bank Transfer |

Minimum Order | 0.01 |

Maximum Leverage | 1:30 |

Investment Options | No |

Trading Platforms & Apps | MT4, TradingView, NanoTrader |

Markets | Forex, CFDs, Futures, Stocks, Options |

Spread | Variable |

Commission | €2.20 for Forex |

Orders Execution | STP |

Margin Call/Stop Out | 100%/50% |

Trading Features | Copy Trading, VPS, Trading Signals |

Affiliate Program | No |

Bonus & Promotions | No |

Islamic Account | N/A |

PAMM Account | No |

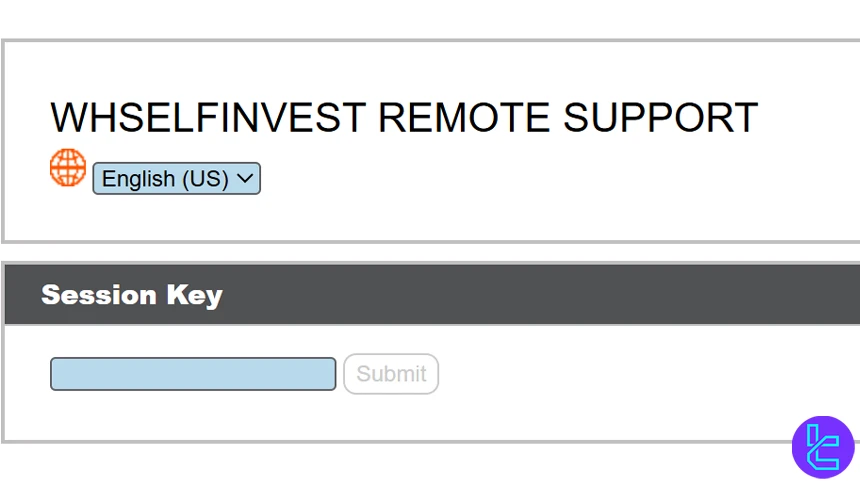

Customer Support Ways | Phone, Email, Callback, Remote desktop |

Customer Support Hours | 8:00 AM to 10:00 PM CET |

WH SelfInvest provides direct access to over 120 market centers in 26 countries, allowing traders to engage with various financial instruments.

Types of Accounts on the WH SelfInvest Broker

The broker introduces several account types to suit different trading needs:

Account | Min. Deposit | Instruments |

Multi-Market (Stock & Options) | €2,000 | Stocks and options, ETFs, Bonds, Forex, and more |

Zero Commission (Stock & Options) | N/A | Stocks and options |

CFD & Forex Mini | €500 | Indices, Metals, Energy, Bonds, Stock, ETF, FX Pairs |

CFD & Forex Standard | €2,500 | Indices, Metals, Energy, Bonds, Stock, ETF, FX Pairs |

Futures | €5,000 | E-mini |

Demo | €0 | Almost all covered |

Each account type can access multiple trading platforms.

Advantages and Disadvantages of WH SelfInvest

Like any broker, WH SelfInvest has its strengths and weaknesses. Here's an overview:

Advantages | Disadvantages |

Wide range of markets and instruments | Relatively high minimum deposit (€500) |

Regulated by multiple respected authorities | Monthly fee for premium NanoTrader platform (€29) |

Excellent customer support | No Crypto Trading |

Competitive commissions and spreads | Not available to clients from certain countries (e.g., US, Australia) |

Copy trading functionality | - |

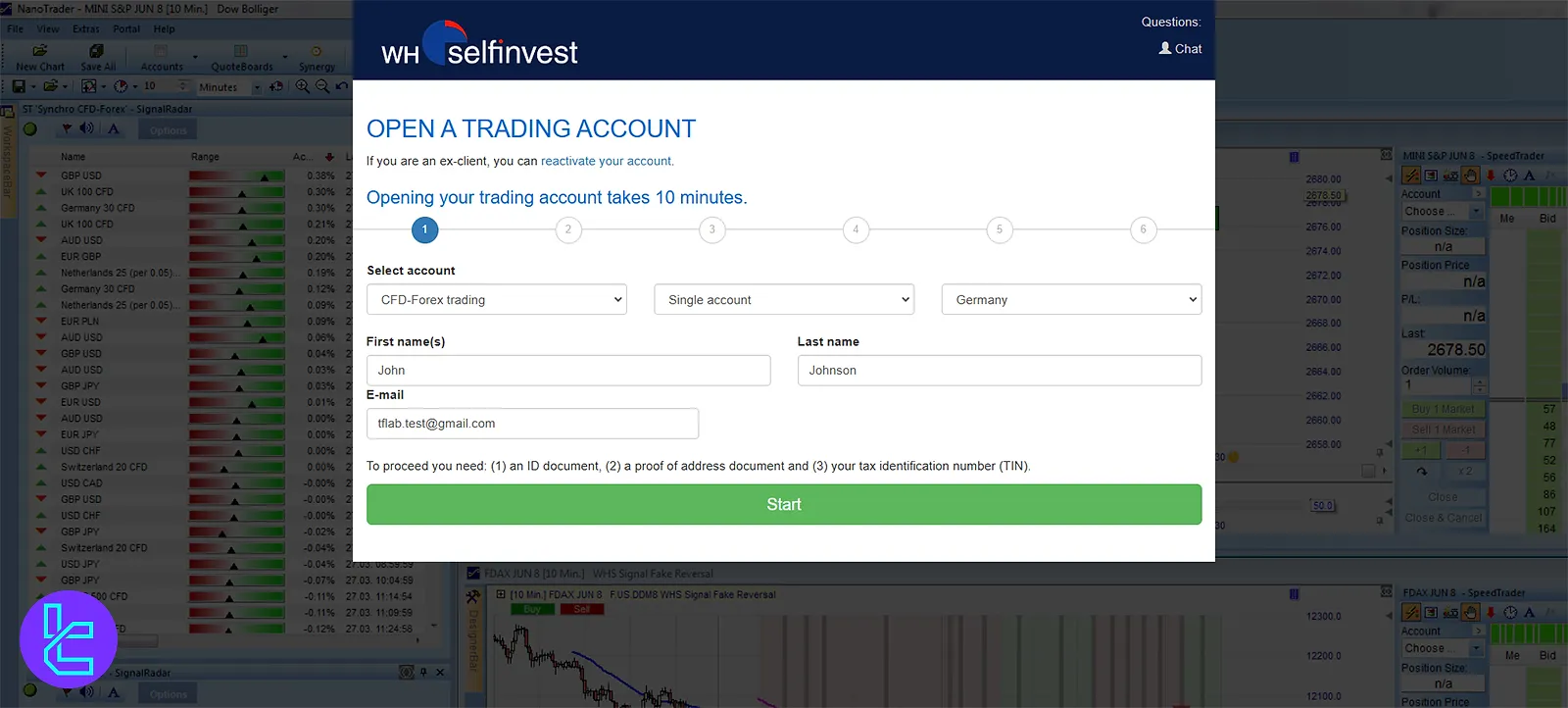

Signing Up & Verification Process

Opening an account with the broker is simple and easy. Users must select their account type, define a base currency, and provide essential KYC documents.

#1 Choose Account Type and Begin Registration

Access the official site, select “Fasttrack online account opening”, and pick your preferred trading account type.

#2 Provide Personal and Contact Information

Enter the required data in the online forms, such as:

- Full name

- Email address

- Date of birth

- Residency details

- A valid phone number

#3 Specify Base Currency and Tax Details

Define your desired account currency and submit required tax-related information, including country of tax residency and identification number.

#4 Upload KYC Documents

Submit valid proof of identity (passport or national ID) and proof of residence (utility bill or bank statement).

#5 Fund Your Account and Await Verification

Deposit funds through supported methods commonly bank transfers. Account verification is usually completed within 1–2 business days.

WH SelfInvest’s Trading Platforms

The broker offers several trading platforms to cater to different trader preferences:

- NanoTrader: This highly customizable proprietary platform has advanced features, including automated trading capabilities and extensive charting tools;

- MetaTrader 4 (MT4): The industry-standard platform is known for its robust Expert Advisor (EA) functionality and extensive technical analysis tools;

- TradingView: It's an advanced charting platform integrated with WH SelfInvest's execution capabilities.

Furhtermore, a VPS hosting service is available at €60/month, reduced to as low as €10/month with consistent trading activity.

While MT4 is famous for its EA capabilities, some traders may find it less suitable for discretionary trading due to limited functionalities compared to NanoTrader.

TradingFinder provides a comprehensive list of MT4 indicators and TradingView indicators for free. Check them for additional analytical tools.

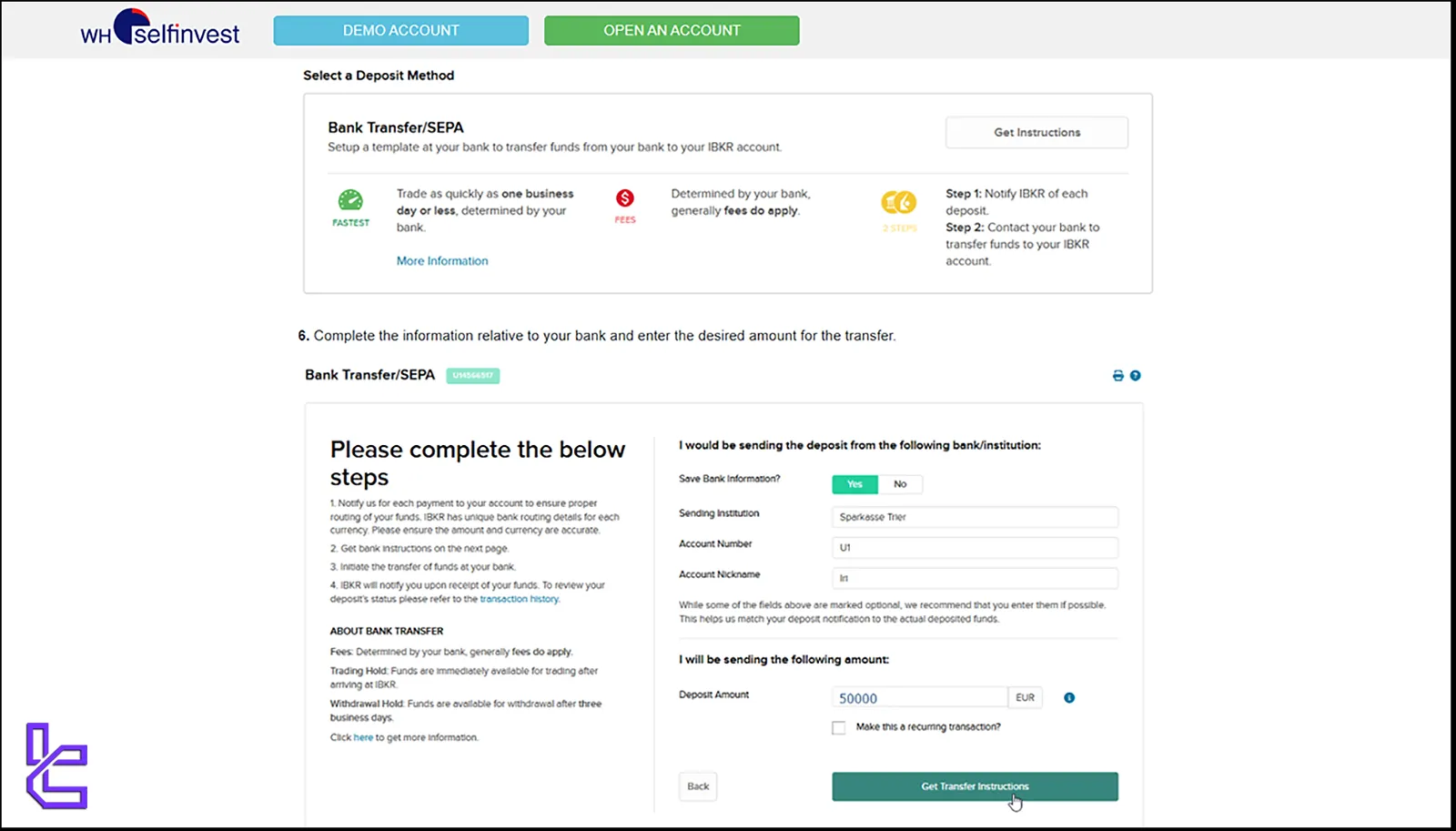

Spreads and Commission Structure

The broker offers competitive pricing across its various instruments:

- Forex and CFDs: Commission of €2,20 per lot per side

- Futures and options: Commission of $2,20 per contract

- Stocks and ETFs (USD): Commissions starting with a minimum of €1,90

The broker provides a transparent fee structure with no hidden costs. Volume-based discounts are available for high-volume traders.

Swap Fee at WH SelfInvest

WH SelfInvest applies a daily holding cost for CFDs; every night you keep a CFD position open, a fee is charged, based on the specific underlying asset and interest-rate differential.

For instance, their FX CFD Key Information Document explicitly states that the longer you hold, the more this cost accumulates.

Here are some key practical insights from their official cost disclosures:

- The overnight (swap) cost is part of the “daily holding cost” applied to all CFD types (equity, FX, commodity), not just FX;

- For FX CFDs, swap depends on the interest-rate differential of the currency pair, and is billed per night held;

- For commodity CFDs (futures), the rollover cost is calculated as half of the applicable spread when moving to the next expiry.

Non-Trading Fees at WH SelfInvest

WH SelfInvest applies non-trading fees such as an administrative charge and a quarterly custody fee for dormant or low-activity accounts. For example, a quarterly custody / account maintenance fee of €39 is levied on all accounts.

These fees reflect the cost of account maintenance rather than any trading.

To break down the main non-trading costs:

- A €5 administrative fee is charged for outgoing transfers below €30,000; above that, it’s 0.10% (up to €50);

- If the client has not executed any order over 12 months, an administrative charge of €15 per quarter may apply;

- Market-data subscriptions (real-time data) are billed at cost; as declared by the broker, data feeds are not subsidized by WH SelfInvest.

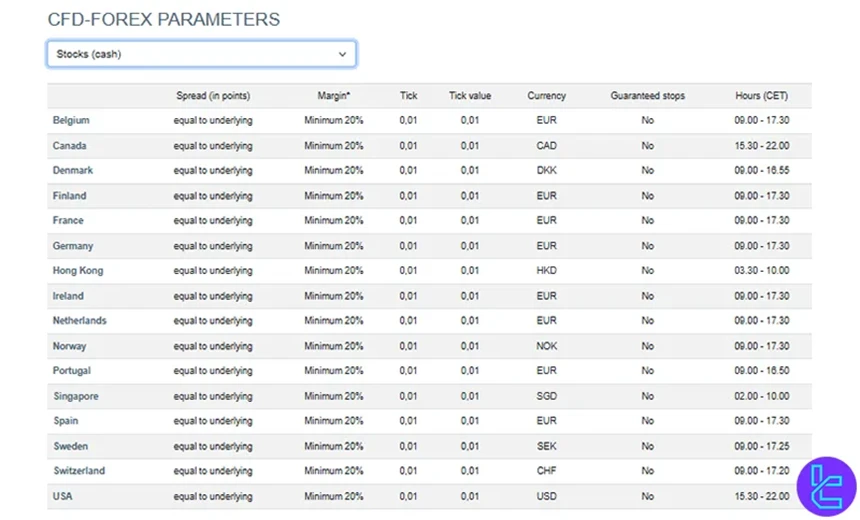

Deposit & Withdrawal Methods

WH SelfInvest, like some forex brokers, primarily uses bank wire transfers for deposits and withdrawals. Here's what you need to know:

- Minimum deposit: €500 (or equivalent)

- Deposit processing time: 1-3 business days

- Withdrawal processing time: 1-5 business days

- One free withdrawal per month; additional withdrawals may incur a fee of €8

All client funds are held in segregated accounts to enhance security.

Deposit Methods at WH SelfInvest

WH SelfInvest offers funding of client accounts primarily via bank wire transfers to their segregated client assets accounts held at their depository banks.

They require that the transfer originate from a bank account in the client’s own name, which helps ensure regulatory compliance and account security.

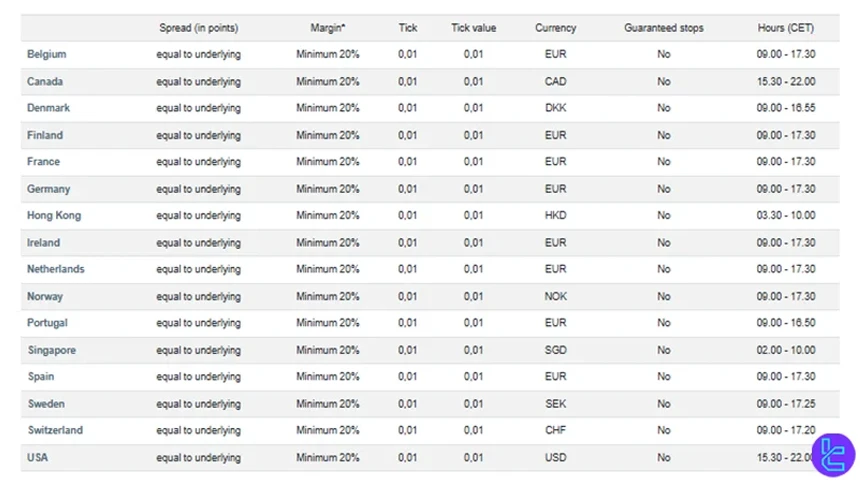

To make it concrete, here is a breakdown of the main deposit method and its parameters:

Deposit Method | Currency | Minimum Amount | Deposit Fee | Funding Time |

Bank Wire Transfer | EUR, CHF, USD | € 500 (or equivalent) according to account-type | €5 | N/A |

Withdrawal Methods at WH SelfInvest

WH SelfInvest allows withdrawals only via bank transfer to a bank account in the client’s own name. This ensures both regulatory compliance and account security.

Withdrawals are processed from the segregated client assets account, and clients must submit a completed withdrawal form specifying the amount and destination account.

Key Points (from official documents):

- Administrative fees apply: €5 for withdrawals below € 30,000; 0.10% of the amount for larger withdrawals, capped at €50;

- There are no alternative withdrawal methods; credit cards, e-wallets, or cash withdrawals are not supported.

Copy Trading & Investment Options

WH SelfInvest has a copy trading feature, allowing clients to replicate the trades of successful traders automatically. This can be particularly useful for newbie traders or those with limited time for market analysis.

However, it's worth noting that WH SelfInvest broker does not offer PAMM (Percentage Allocation Management Module) accounts, which other brokers sometimes provide for managed investments.

Tradable Markets & Symbols Overview

WH SelfInvest provides access to a wide range of markets, from the Forex market to Futures and Options.

Category | Type of Instruments | Number of Symbols | Competitor Average | Max. Leverage |

Forex CFD | CFD on forex (Currency pairs) | 80+ | 50-80 | 1:30 |

Market indices, commodities, forex futures, options on futures | N/A | 5000+ | N/A | |

CFD – Non ‑ FX | Stock CFDs, index CFDs, commodity CFDs | N/A | 5000+ | N/A |

Multi ‑ Market | Equities, options, bonds, ETFs | 1,200,000 | 10000+ | N/A |

This diverse offering allows traders to create well-diversified portfolios and exploit opportunities across asset classes.

Bonus offerings and Promotions

It's important to note that WH SelfInvest does not offer trading bonuses or run an affiliate program. This aligns with their focus on providing a transparent and professional trading environment rather than relying on promotional offers to attract clients.

Instead, the broker emphasizes the quality of its services, platforms, and educational resources as its main selling points.

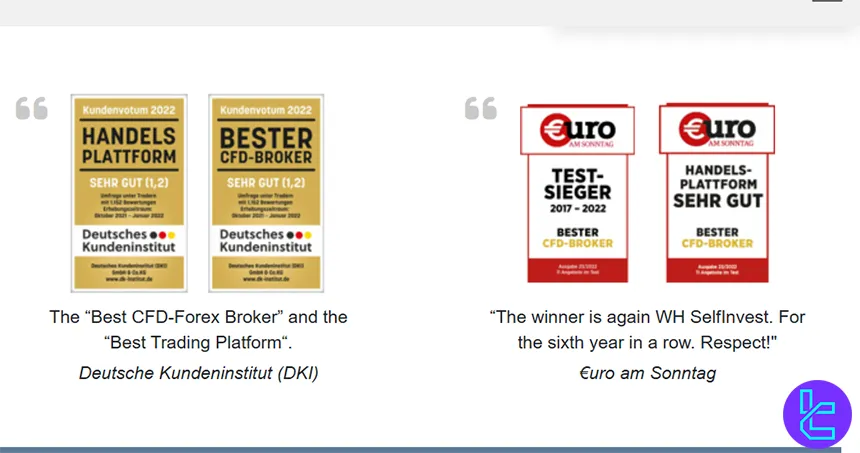

WH SelfInvest Awards

WH SelfInvest has received multiple prestigious awards over the years, reflecting its strong reputation in the brokerage industry.

According to WH SelfInvest’s awards, the broker combines low costs, excellent execution and a trading platform that continues to be recognized by independent institutions.

Here are some of the most notable recognitions:

- Best CFD-Forex Broker 2022 – Deutsche Kundeninstitut (DKI)

- Best Trading Platform 2022 – Deutsche Kundeninstitut (DKI)

- Best CFD-Broker 2017-2022 – €uro am Sonntag

Support Team and Response Hours

WH SelfInvest is known for its excellent customer support, offering assistance through multiple channels:

- Email support: info@whselfinvest.com (Luxembourg)

- Callback service

- Direct phone support: +352 42 80 42 80

- Remote desktop support (Desk)

The support team is multilingual and known for its quick response times and professionalism. Support is available during extended business hours, typically from 8:00 AM to 10:00 PM CET, Monday to Friday.

List of Restricted Countries

While WH SelfInvest accepts clients from over 28 countries, some notable restrictions exist.

Clients from the following countries cannot open live trading accounts:

- United States

- Australia

- Belgium

These restrictions are likely due to regulatory requirements in these jurisdictions.

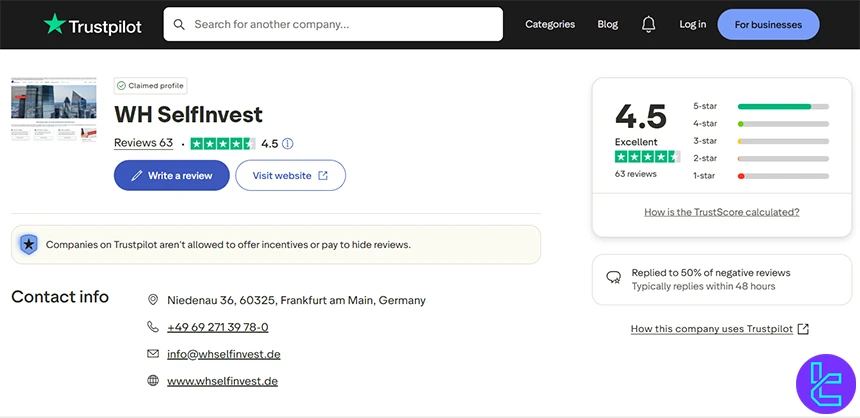

WH SelfInvest Broker Trust Scores & Reviews

The WH SelfInvest Trustpilot profile has garnered generally positive client reviews, with a Trust Score of 4.5 out of 5.

Critical points from client feedback include:

- 78% of reviews are 5-star

- Praised for professionalism and responsive customer service

- Some negative reviews (13% 1-star) indicate room for improvement in certain areas like hidden fees and withdrawal timing (Though all were answered by the broker)

Education on WH SelfInvest

The broker places a strong emphasis on trader education, offering a variety of resources:

- Regular webinars covering topics like technical analysis, options trading, and market outlook

- E-books on various trading strategies

- In-person seminars and events (subject to location)

Check TradingFinder's Forex education section for additional resources.

WH SelfInvest Compared to Other Forex Players

The table in this section compares the specifics and features found in SelfInvest to those of other brokers:

Parameter | WH SelfInvest Broker | HFM Broker | FxPro Broker | FXGlory Broker |

Regulation | BaFin, FINMA, CSSF, ACPR, FSMA, AFM | CySEC, DFSA, FCA, FSCA, FSA | FCA, FSCA, CySEC, SCB | No |

Minimum Spread | Variable | From 0.0 Pips | From 0.0 Pips | From 0.1 Pips |

Commission | €2.20 for Forex | From $0 | From $0 | $0 |

Minimum Deposit | €500 | From $0 | $100 | $1 |

Maximum Leverage | 1:30 | 1:2000 | 1:500 | 1:3000 |

Trading Platforms | MT4, TradingView, NanoTrader | MT4, MT5, Mobile App | MT4, MT5, cTrader, Web Trader, Mobile App | MetaTrader 4, MetaTrader 5 |

Account Types | Multi-Market, Zero Commission, CFD & Forex Mini, CFD & Forex Standard, Futures, Demo | Cent, Zero, Pro, Premium | Standard, Pro, Raw+, Elite | Standard, Premium, VIP, CIP |

Islamic Account | N/A | Yes | Yes | Yes |

Number of Tradable Assets | 100,000+ | 1,000+ | 2100+ | 45 |

| Trade Execution | STP | Market, Buy Stop, Stop Loss, Limit, Take Profit | Market, Pending | Market, Instant |

Conclusion and final words

WH SelfInvest supports STP (Straight Through Processing) for order execution, ensuring a direct and efficient trading experience.

With its diverse account types, such as Multi-Market, CFD & Forex Mini, and Futures, account holders can trade in EUR and USD.

However, potential clients should consider the higher minimum deposit of €5,000 for Futures accounts and the monthly fee for NanoTrader.