Based on our recent checkup on the company's website, we found out that Woxa has apparently gone through a restructure and rebrand procedure; as the website suggests, the company does not operate as a broker anymore, but, now, it provides brokerage solutions to other businesses.

Woxa is a multi-asset brokerage with 3 account types [Real, Demo, Credit]. This broker, founded in 2019, provides benefits such as a wide range of +1,200 tradable symbols across 6 categories.

The company enables trading with a leverage of up to 1:800. Also, it offers a $50 deposit bonus to its clients.

Company Details and Regulating Authorities

Woxa started its work in 2019. Headquartered inSaint Vincent and the Grenadines, this broker has been able to attract more than 100,000 users from around the world. Key Specifics About the Company:

- Legal Name: WOXA LIMITED

- Registered Number: 26740 BC 2022

- Registered Address: Beachmont Business Centre, 329, Kingstown, St. Vincent and the Grenadines

- Regulation: Financial Services Commission (FSC) in Mauritius

This classification places it under a Tier-3 regulatory framework, which lacks the stringent investor safeguards seen with top-tier bodies like the FCA or ASIC. As such, Woxa does not offer compensation schemes to protect client funds in the event of broker insolvency.

Despite these limitations, Woxa does implement two crucial safety features: it uses segregated accounts to protect client deposits from company liabilities and provides negative balance protection to ensure that users cannot lose more than their account balance, a vital safeguard when trading with high leverage.

Table of Key Specifics and Details

Every Forex broker comes with a set of features that define it. Let's have an overview of these features for Woxa in the table below:

Broker | Woxa |

Account Types | Real, Demo, Credit |

Regulating Authority | FSC |

Based Currencies | USD |

Minimum Deposit | $25 |

Deposit Methods | Not Specified |

Withdrawal Methods | Not Specified |

Minimum Order | Not Specified |

Maximum Leverage | 1:800 |

Investment Options | Social Trading |

Trading Platforms & Apps | Proprietary Platform |

Markets | Forex, Indices, Stocks, Commodities, Crypto |

Spread | Not Specified |

Commission | Above Average in Trading No Non-Trading Fees |

Orders Execution | Not Specified |

Margin Call/Stop Out | Not Specified |

Trading Features | Stocks Calendars, Calculator |

Affiliate Program | Yes |

Bonus & Promotions | $50 No-Deposit Bonus |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Live Chat, Email |

Customer Support Hours | Every Day from 03:00 to 19:00 (UTC) |

Woxa Account Types

When it comes to account types, the broker keeps it simple and offers only one real account for trading. Here are the details:

- Minimum Deposit: $25

- Leverage: 1:800

- Account Currency: USD

Also, Woxa provides a demo account for trading with virtual funds in order to eliminate the risk of losing money. However, once a withdrawal is made from the live account, the demo account is permanently deactivated.

Besides, a Credit account is offered for a specific type of bonus.

Important Benefits and Critical Drawbacks

Trading with any brokerage has a positive and a negative side, and Woxa is no exception. This part of the article will investigate the pros and cons:

Benefits | Drawbacks |

Low $25 Minimum Deposit | No High-Tier Regulation |

User-Friendly Platform | Higher Than Average Trading Fees |

Copy Trading Feature | No Variety in Trading Accounts |

Wide Range of Trading Symbols | Fake Reviews on Trustpilot |

Account Opening and Verification: Quick Guide

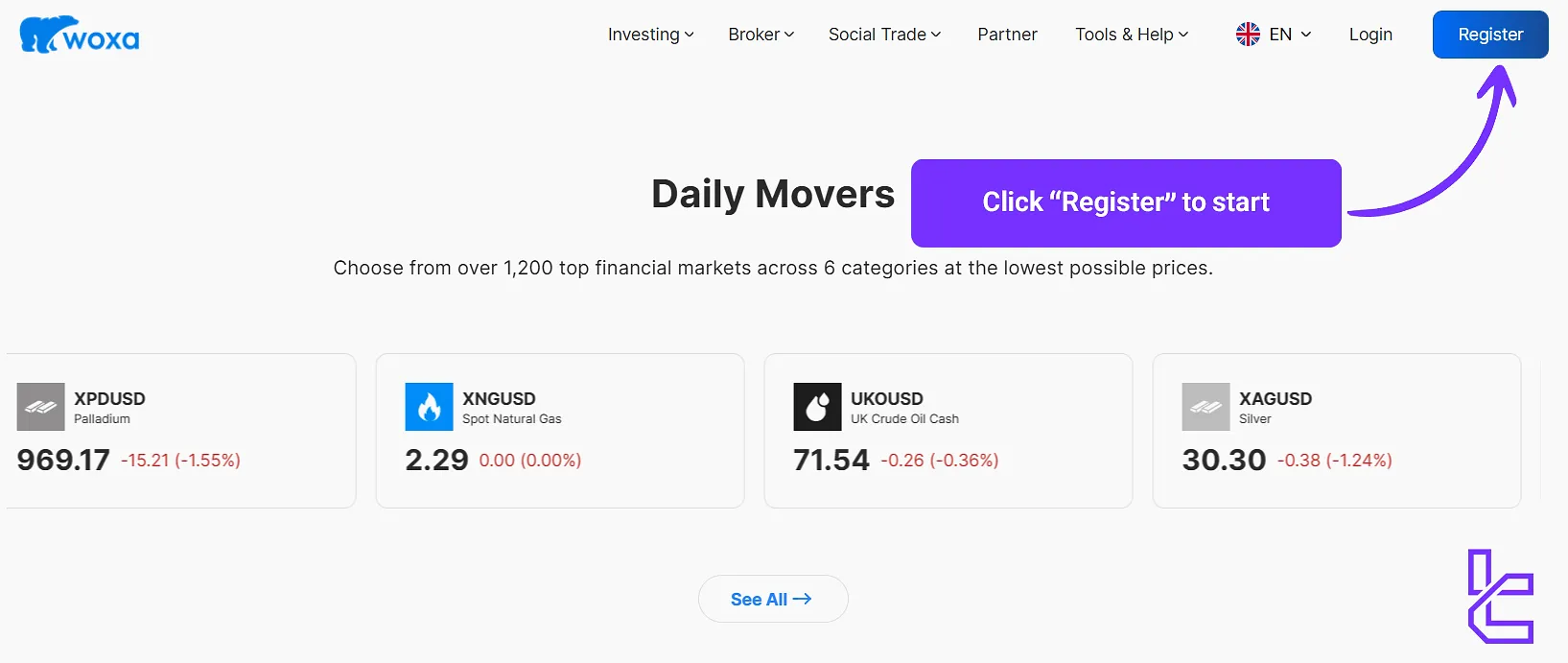

Creating an account with Woxa is a simple process and does not take much of your time. Here's how to do it:

- Head to woxa.com and click "Register" at the top of the page;

- Select your country, enter your name, and create a password. Alternatively, use your Google account to continue;

- Create a username and choose an avatar;

- Check your inbox and click the verification link if required.

Now, you have registered and created your account on Woxa. Upload the necessary documents and provide proof of your identity, including a valid ID and proof of address.

However, during our attempt, we found out that new clients currently cannot register with the broker.

In the July 2025 update, it appears that the broker still refuses to accept new clients, as the registration form does not function properly.

What Trading Platforms Are Offered on Woxa?

This broker does not offer any third-party platforms or popular options such as MetaTrader 5 to its clients. Instead, it employs proprietary software with essential features, trading tools, and additional benefits, such as a 3-portfolio system, visual statistics of the trader's performance, and TradingView chart integration.

While the interface is intuitive and minimalist, featuring clean chart layouts and logical navigation, it lacks the advanced capabilities of third-party platforms like MetaTrader 4 or 5.

You can download and install the platform's app on your mobile devices or access it through the web.

Spreads and Commissions; Trading and Non-Trading Fees

Commissions and spread structure are among the most critical factors in trading with a broker. We investigated Woxa's official website and other relevant sources for useful data about this matter. Unfortunately, the website does not provide much detail about the trading fees.

However, we can say that the commissions on the broker are above average. On the other hand, there are no fees or costs for non-trading activities (Such as Deposits and withdrawals) or inactivity periods.

Funding and Withdrawal Options

Unfortunately, the website does not provide useful information about this matter, either. However, these are the most common methods that are likely supported on Woxa:

- Credit/Debit Cards: Typically VISA or MasterCard

- Bank Transfers: Various types of transfers between bank accounts

Does Woxa Provide Social Trading Features?

One of the benefits of this brokerage is its copy trading or social trading service. You have the option to earn passive profits besides trading with it. Key Points of Social Trading in Woxa:

- Browse and follow top-performing traders

- Automatically copy trades in real time

- Adjust risk levels and investment amounts

- View detailed performance metrics of traders

There's an option to use your demo account for copy trading on this brokerage to try without risking your capital.

Copy trading isn't just about mimicking others – it's a learning opportunity, too. By watching successful traders in action, you can pick up valuable insights and strategies.

Number and Variety of Tradable Instruments

As it appears, another strength of Woxa is in this part of the services. The broker prides itself on providing access to more than 1,200 trading assets across these categories:

- Forex Market: 29 trading pairs of 7 major currencies

- Cryptocurrencies: 9 popular coins (Bitcoin, Ethereum, and so on)

- Indices: 8 global indices

- Stocks: +320 individual stocks, including AAPL, MSFT, INTC, and more

- Commodities: 8 options (Gold, silver, oil, gas, and others)

The sum of the numbers mentioned above is less than 1,000, while the company claims that there are +1,200 assets offered in total!

Are There Any Bonuses Offered by Woxa?

The brokerage offers one promotion to new users, and it's a $50 bonus. This offer is attractive to many traders since it does not require any deposits and is given to the client upon opening an account, but you should read the terms and conditions before trading with it.

Also, the bonus itself is not withdrawable; you can only withdraw the profits, and it's available on a separate account from your real one.

Support Channels and Working Schedules

When it comes to customer support, Woxa provides a typical level of such services to its clients. Let's investigate its channels:

- Live Chat: Available through the website

- Email: support@woxa.com

The lack of phone support might be a dealbreaker for some, especially those who prefer a more personal touch. Also, there's no 24/7 support; The team is available every day from 03:00 to 19:00 (UTC).

Does Woxa Provide Services to Clients from All Regions?

Almost all brokerages have limitations in offering their services to some regions and countries, and Woxa is no exception. Based on the available data, clients from the FATF blacklist and the EU are not eligible to register and trade with the broker. Banned regions include, but are not limited to:

- United Kingdom

- United States

- Canada

- Poland

- Japan

- Singapore

- New Zealand

- Turkey

- Iran

- North Korea

- Cuba

- Myanmar

Always check the most up-to-date list on Woxa's website, as restrictions can change.

Trust Scores & User Ratings

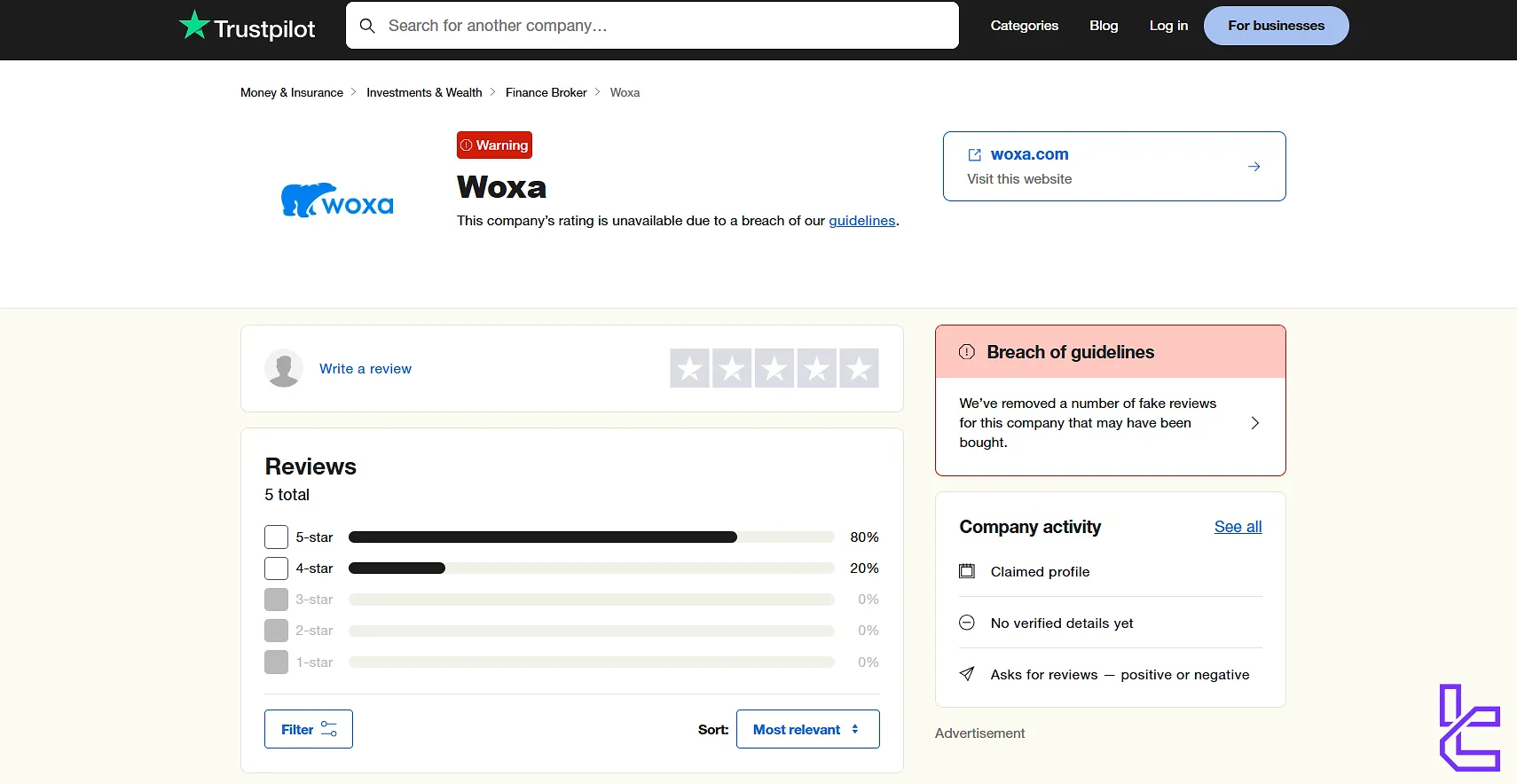

Trust is crucial in the world of online trading, and platforms such as Trustpilot are helpful sources for evaluating a broker's reliability. Woxa's Trustpilot page is controversial.

As stated by trustpilot.com, the company has received fake reviews on its website page; therefore, a breach of guidelines has occurred, and the rating is unavailable now.

This incident is concerning, and we consider it a severe drawback for Woxa. Also, there are no reviews on other reputable platforms like REVIEWS.io and ForexPeaceArmy.

Educational Content and Materials

For those looking to learn while they earn, Woxa is not the best choice in the industry. It offers these limited options, which are not completely accessible:

- Tools: Stocks Calendars and Calculators

- Help Center: Questions about the broker and its services with answers

- Academy: Currently not available

- Seminar: Coming soon

We attempted to visit the "Academy" page of the website and examine its structure, but the page didn't open. Instead, we faced this error:

Woxa Compared to the Competition

Here's a table comparing the broker against some of the best in the industry:

Parameter | Woxa Broker | IC Markets Broker | XM Broker | LiteForex Broker |

Regulation | FSC | FSA, CySEC, ASIC | ASIC, FSC, DFSA, CySEC | CySEC |

Minimum Spread | N/A | From 0.0 Pips | From 0.6 Pips | From 0.0 Pips |

Commission | Above Average in Trading No Non-Trading Fees | From $3 | $0 (except on Shares account) | From $0.0 |

Minimum Deposit | $25 | $200 | $5 | $50 |

Maximum Leverage | 1:800 | 1:500 | 1:1000 | 1:30 |

Trading Platforms | Proprietary Platform | Metatrader 4, Metatrader 5, cTrader, cTrader Web, IC Markets Mobile | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5, Mobile Proprietary App |

Account Types | Real, Demo, Credit | Standard, Raw Spread, Islamic | Micro, Standard, Ultra Low, Shares | Classic, ECN, Demo |

Islamic Account | Yes | Yes | Yes | No |

Number of Tradable Assets | 1,200+ (Advertised) | 2,250+ | 1400+ | N/A |

| Trade Execution | N/A | Market | Market, Instant | Market |

Conclusion and Final Words

Woxa is a brokerage with a minimum deposit of $25 and a maximum leverage of 1:800. The broker does not charge any fees for inactive accounts, deposits, or withdrawals.

The company serves over 100,000 clients worldwide. It is registered as WOXA LIMITED under the number 26740 BC 2022.