XLibre Verification takes 5 minutes. You must provide personal information and upload proof of identification and address documents to get verified and start trading.

Step-by-Step XLibre KYC Process

Traders need to verify their account in the XLibre broker in just 4 steps to access all the available features on the platform.

XLiber verification:

- Access the “Profile” section and complete the personal information;

- Upload and submit identity documents;

- Verify your address with the correct proof;

- Check the account user approval status.

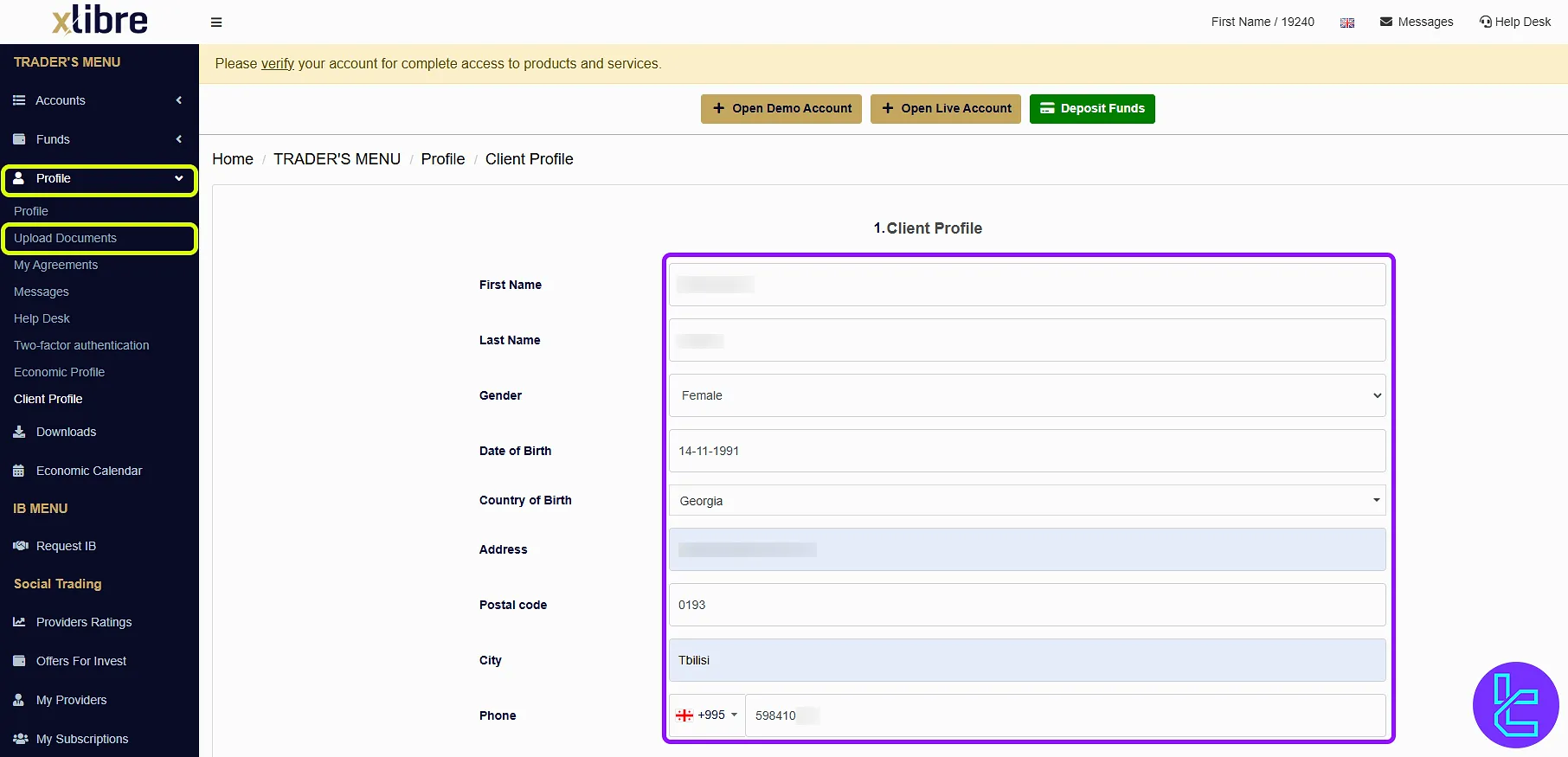

#1 Fill Out Your Personal Information in the “Profile” section

To verify your account, you must first enter the XLiber dashboard, navigate to the “Upload Documents” section under the “Profile” menu. Then provide the following information:

- First Name

- Last Name

- Gender

- Date of Birth

- Country of Birth

- Address

- Postal Code

- City

- Phone

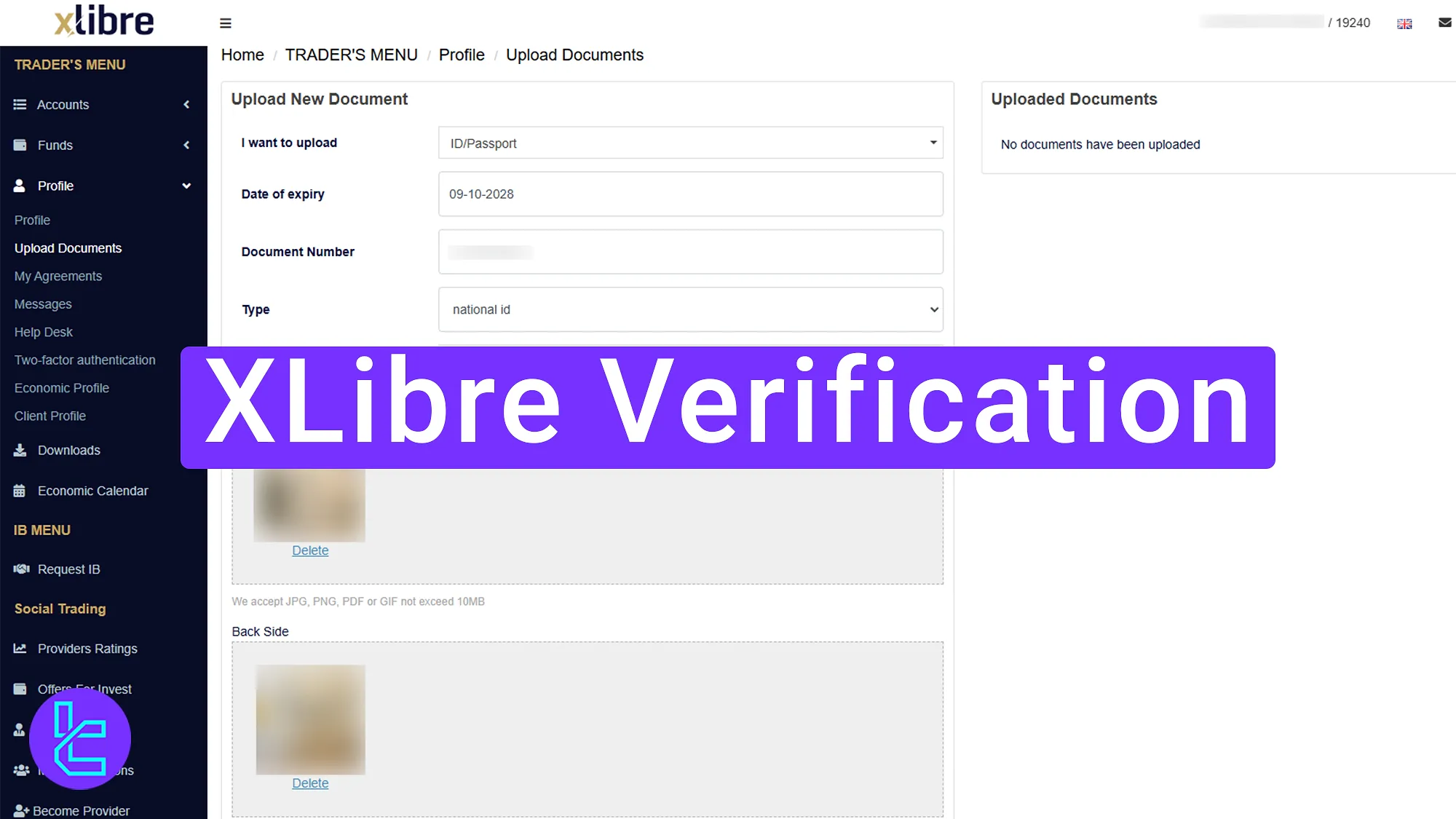

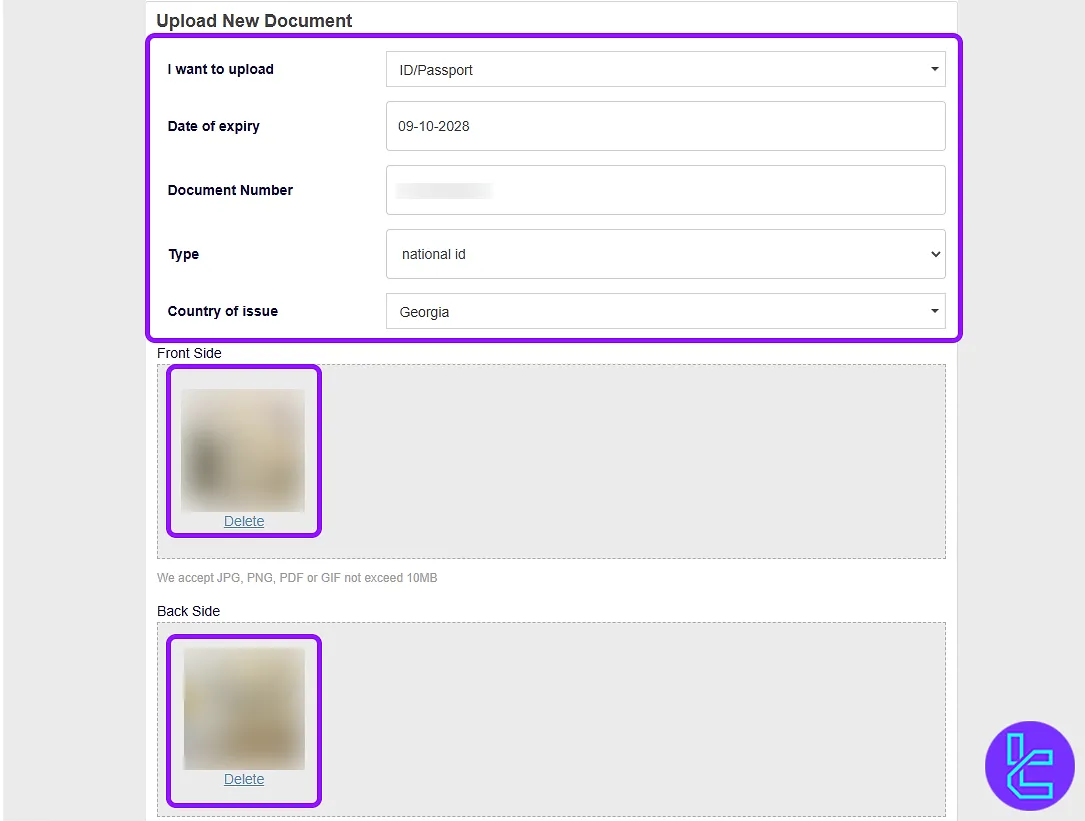

#2 Verify Your Identity

Next, access the KYC section from the top menu and select "Verify".

- Choose the Type of document (passport, ID card, etc.);

- Enter your ID number, issue date, Type, and country of residence;

- Upload a clear photo of the back side of your ID;

- Click "Submit".

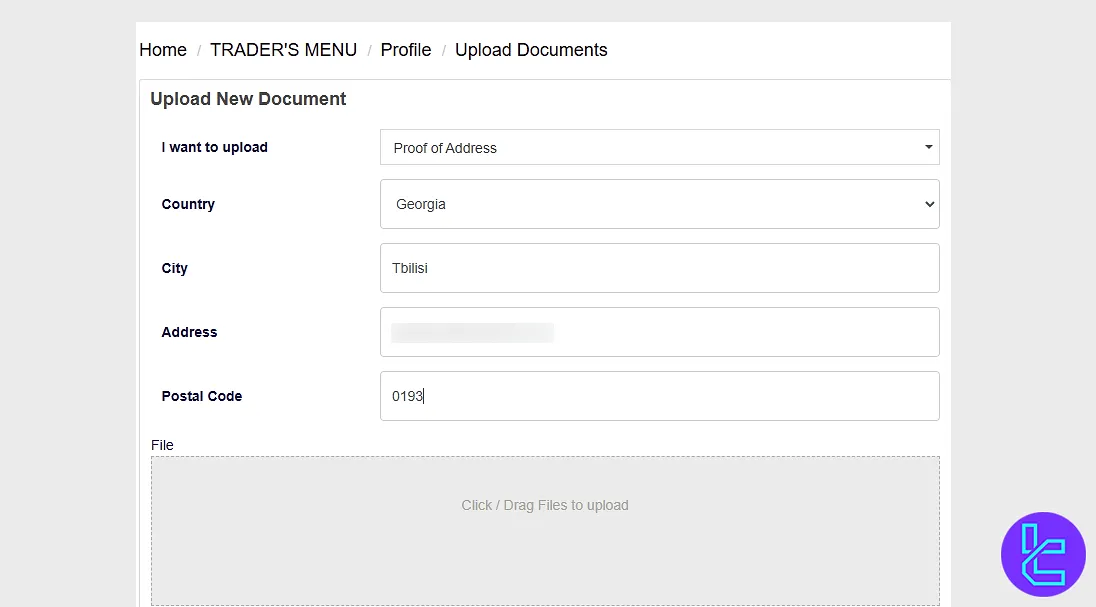

#3 Confirm Your Address

Now, move to the "Proof of Address" section and follow the steps below:

- Select the appropriate proof of address document (utility bill, bank statement, etc.);

- Confirm your country, city, complete address, and postal code;

- Upload the document dated within the last 3 months;

- Click "Submit".

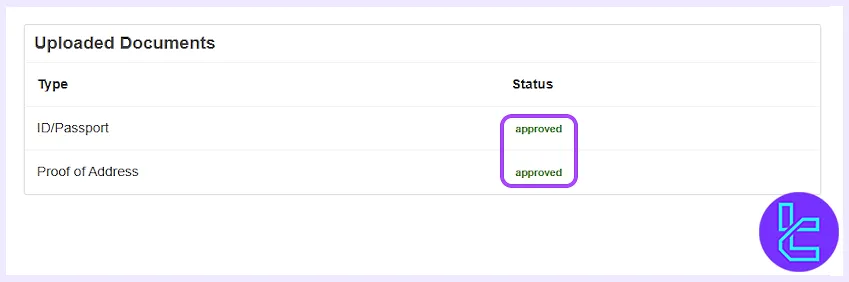

#4 Check The User approval Status

Once submitted, your document enters the review stage. Your account will be verified quickly if all data is valid and legible.

TF Expert Suggestion

XLibre verification is a 4-step process that require traders to complete upload thier passport, driving license, or ID card as proof of identity (POI) and a utility bill or bank statement as proof of address (POA).

Now that you have verified your account, you can seamlessly transfer funds using XLibre deposit and withdrawal methods, mentioned in the XLibre tutorial guides and articles.