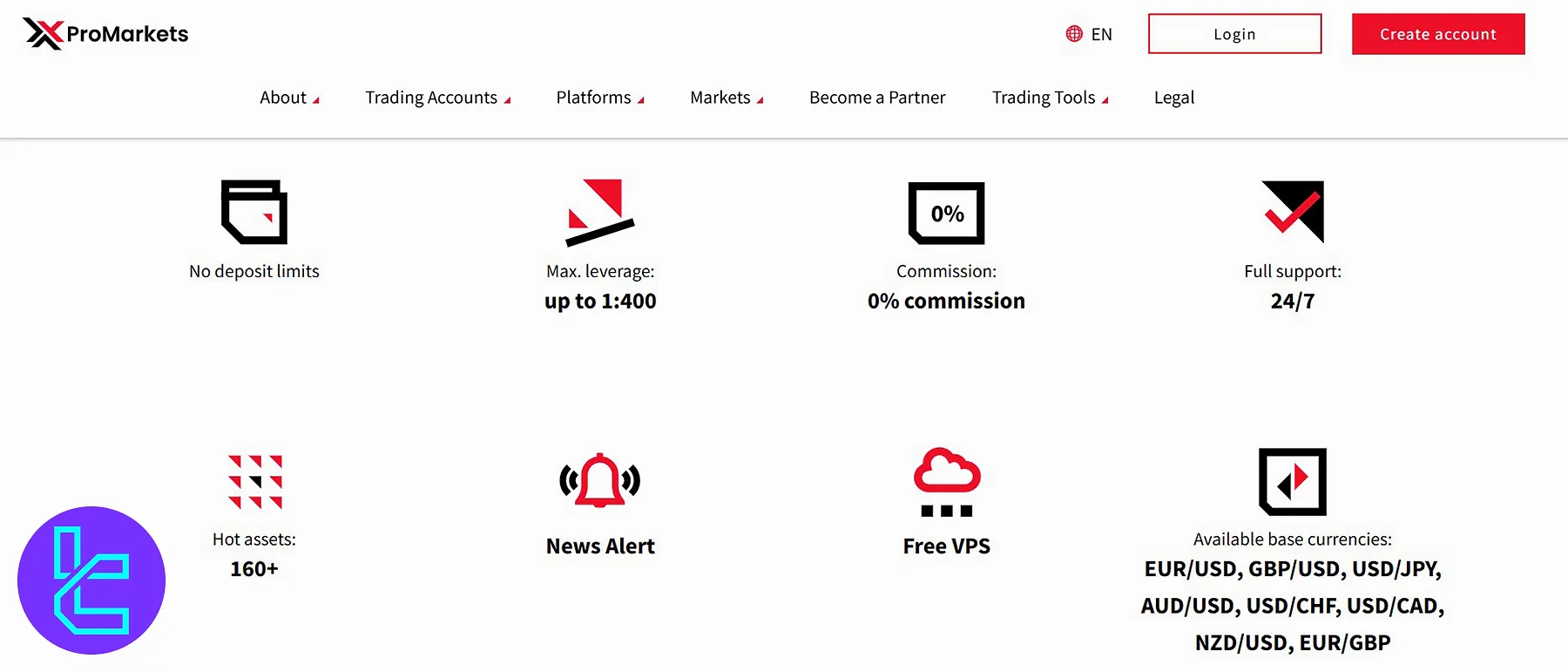

XPro Markets offers commission-free trading across 6 asset classes, including Forex and Crypto. Note that all instruments are CFDs with spreads from 0.03 pips and leverage options of up to 1:400.

XPro Markets; An Introduction to the Broker and Its Regulatory Status

Operated by UKUCHUMA FINANCIAL SERVICES (PTY) LTD, XPro Markets is a brokerage company based in South Africa.

The company was incorporated in 2020 under registration number 2020/735868/07. The Forex broker operates under supervision of the Financial Sector Conduct Authority (FSCA) of South Africa under license number 32535. Key features of XPro Markets:

- Flexible spreads from 0.03 pips

- Leverage options of up to 1:400

- CFD instruments

- Zero-commission trading

XPro Markets Table of Specifications

In addition to providing 90+ trading tools, such as Trading Central and economic calendar, the broker provides access to the MT4 WebTrader and 5 distinct trading accounts. Let’s take a quick look at XPro Markets broker’s offerings:

Broker | XPro Markets |

Account Types | Classic, Silver, Gold, Platinum, VIP |

Regulating Authorities | FSCA |

Based Currencies | USD, CHF, GBP, EUR |

Minimum Deposit | $250 |

Deposit Methods | Credit/Debit Cards, Wire Transfer, APMs |

Withdrawal Methods | Credit/Debit Cards, Wire Transfer, E-Wallets |

Minimum Order | 0.01 lots |

Maximum Leverage | 1:400 |

Investment Options | No |

Trading Platforms & Apps | MetaTrader 4 |

Markets | Forex, Indices, Commodities, Cryptocurrencies, Metals, Shares |

Spread | From 0.03 pips |

Commission | $0 |

Orders Execution | Market |

Margin Call / Stop Out | 100% / 20% |

Trading Features | Commission-free accounts, Crypto CFDs, Trading Central Access |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Call Center, Ticket, Email, Live Chat |

Customer Support Hours | 24/7 |

XPro Markets Broker Trading Accounts

The broker offers commission-free trading and leverage options of up to 1:400 across all of its trading account offerings.

Here are the key shared features between all XPro Markets trading accounts:

- Margin Call: 100%

- Stop Out: 20%

- Minimum Order Size: 0.01 lots

- Maximum Volume Per Trade: 50 lots

- Negative Balance Protection: Yes

- Base Currency: USD, EUR, CHF, GBP

- Commission: $0

- Execution Model: NDD

Despite the similarities, the account types differ in various aspects, including:

Account Type | Average Execution Speed | EUR/USD Spreads |

Classic | N/A | 2.5 pips |

Silver | 0.08s | 2.5 pips |

Gold | 0.05s | 1.8 pips |

Platinum | 0.05s | 1.4 pips |

VIP | 0.08s | 0.9 pips |

XPro Markets Upsides and Downsides

While the broker offers 5 trading accounts, it lacks transparency regarding trading fees. However, its license from FSCA creates a layer of comfort for potential clients.

Pros | Cons |

FSCA regulated | Limited trading instrument offerings (160+) |

Commission-free trading | High entry barrier ($250) |

24/7 support | No support for MT5 or TradingView |

Various trading tools | Lack of tier-1 licensing |

Registration and Verification

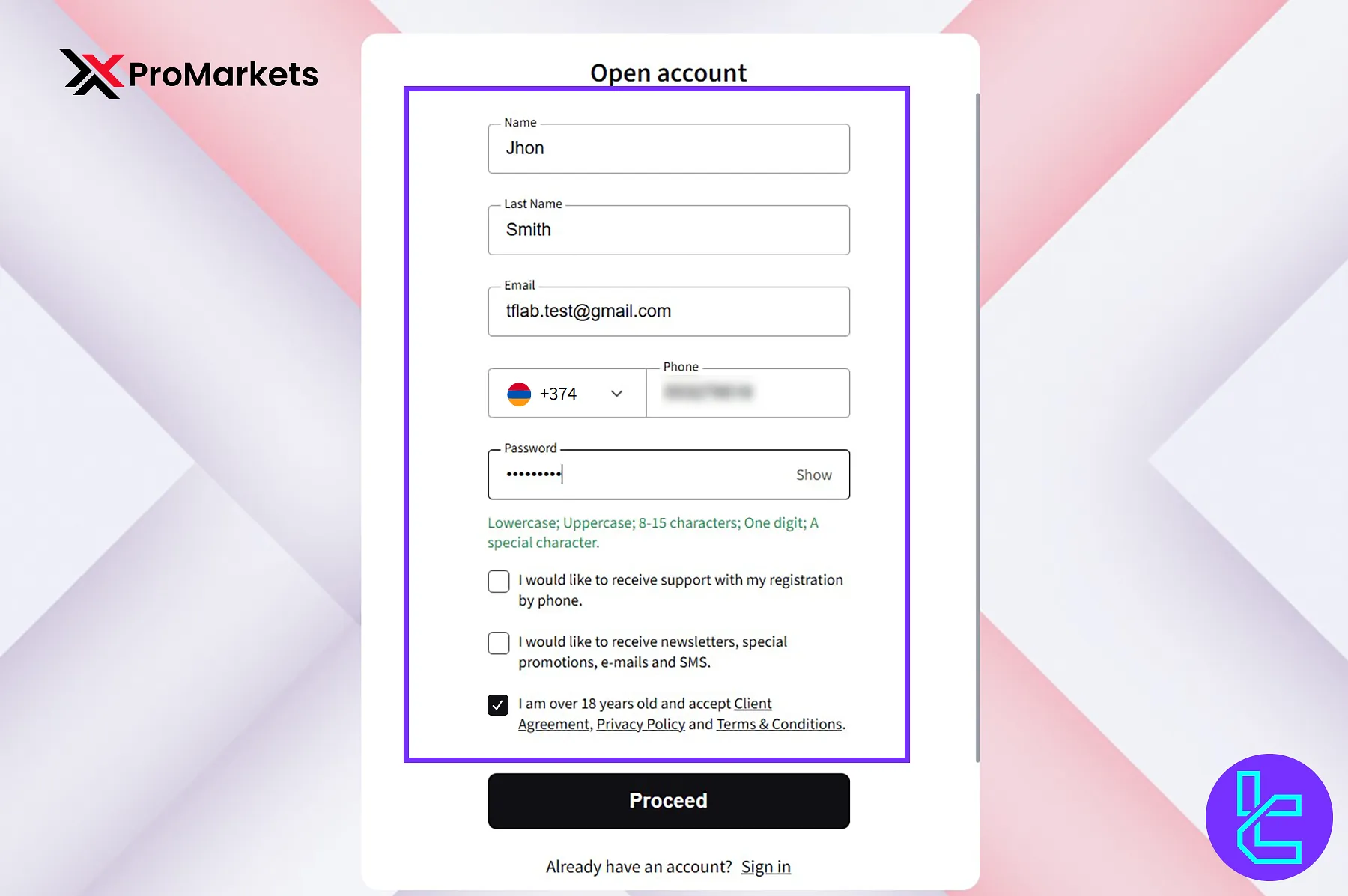

To open a trading account on XPro Markets, you’ll be required to complete the Know Your Customer (KYC) procedure.

#1 Visit the Official Website

Head to XPro Markets official website and click “Create Account” to reach the application form.

#2 Complete the Registration Form

Fill out the sign up application with the following details:

- Name

- Last Name

- Phone Number

- Password

Declare that you’re above 18 and that you have accepted the platform’s terms and policies.

Click the verification link sent to your email to activate your new account.

#3 Verify Your Account

Log in to the XPro Markets client dashboard, navigate to the profile menu, and click verification to initiate the KYC procedure. In addition to personal information, you’ll be required to provide the following documents:

- Proof of Identity: Passport, ID card, or Driver’s license

- Proof of Residence: Bank statement or Utility bill

- Proof of Payment Method: A color picture of both sides of your credit/debit card or a Screenshot of your E-Wallet

Trading Platforms

One of the biggest letdowns in this XPro Markets review is the lack of support for mobile trading or advanced platforms like MetaTrader 5 and TradingView.

However, the broker provides access to the industry-standard MT4 WebTrader with the following features:

- One-click trading

- Advanced order types and tools like TP and SL

- Multiple chart layout

- Instant market updates

- Mobile-friendly

TradingFinder has developed various MT4 indicators that you can use for free.

XPro Markets Trading Costs

While the broker charges no trading commissions, its fee structure evolves around swap rates and spreads.

While spreads vary by account type and trading instrument, here are the spread data for some of the most popular trading pairs:

Trading Asset | Classic | Silver | Gold | Platinum | VIP |

EUR/USD | 2.5 | 2.5 | 1.8 | 1.4 | 0.9 |

Gold | 2.8 | 2.8 | 2.3 | 2 | 1.4 |

Crude Oil | 2.8 | 2.8 | 2.3 | 2 | 1.4 |

Dax | $0.14 | $0.4 | $0.13 | $0.12 | $0.10 |

The broker charges no commissions on deposits and withdrawals, with one exception: $30 on Wire Transfer withdrawals.

XPro Market Inactivity Fee

The broker charges variable dormant fees based on the client’s inactivity period.

Inactivity Period | Monthly inactivity Fee |

0 to1 month | 0 |

After 30 days | $100 |

After 60 days | $250 |

After 180 days | $500 |

XPro Markets Deposit and Withdrawal

The company provides a wide range of payment options to cater to various traders’ needs, including:

- Credit/Debit Cards

- Wire Transfer

- APMs (Deposit only)

- E-wallets

Does XPro Markets Offer Investment or Growth Plans?

At the time of writing this XPro Markets review, the broker doesn’t provide any copy trading services, PAMM, or MAM solutions for investors or strategy providers.

This can be a serious letdown for those seeking creative options to reach passive income.

XPro Markets Broker Trading Products

The broker’s trading instrument offerings are quite limited in comparison to other competitors.

XPro Markets provides access to 160+ instruments across 6 asset classes, from the Forex market to stocks, with different leverage options:

- Forex: 45+ major, minor, and exotic currency pairs with maximum leverage of up to 1:400

- Indices: CFDs on 17 global indices, such as ASX100 and DOW30 with leverage up to 1:200

- Cryptocurrencies: CFDs on 30+ digital assets, such as BTC, ETH, XRP, and TRX with a max leverage of 1:5

- Metals: CFDs on Gold, Silver, Palladium, and Platinum with leverage options of up to 1:200

- Commodities: Energies (e.g., WTI, Brent, and NGAS) and agricultural products (e.g., Coffee, Corn, and Cotton) with a 1:200 maximum leverage

- Stocks: CFDs on shares of Apple, Tesla, and dozens of other companies with leverage options of up to 1:5

XPro Markets Promotional Offerings

While the broker doesn’t provide traditional bonuses like welcome gifts or double deposits, it features a partnership program with the following details:

- Three revenue plans: Conversion (commission per referred client), Rebate (cashback on traded lot), and Custom plan for high-performance partners

- Free marketing materials

- Precise traffic tracking

- Increasable conversion rate

You can use TradingFinder Forex Rebate Calculator to get a rough estimate on your earnings through the cashback plan.

How to Contact XPro Markets Support?

The broker provides 24/7 support via 4 main channels, including email, live chat, call center, and ticket system.

- Email: support@xpromarkets.com

- Phone Number 1: +27870948672

- Phone Number 2: +27101573383

- Live Chat: Available on the official website

- Ticket: Through the Contact Us page

XPro Markets also features a comprehensive FAQ section providing answers to the most frequent questions.

XPro Markets Broker Restricted Jurisdictions

Being a regulated entity in South Africa, the broker is prohibited to provide services to residents of the following jurisdictions:

- South Africa

- Japan

- European Union

- United States

- North Korea

- Iran

Client Satisfaction

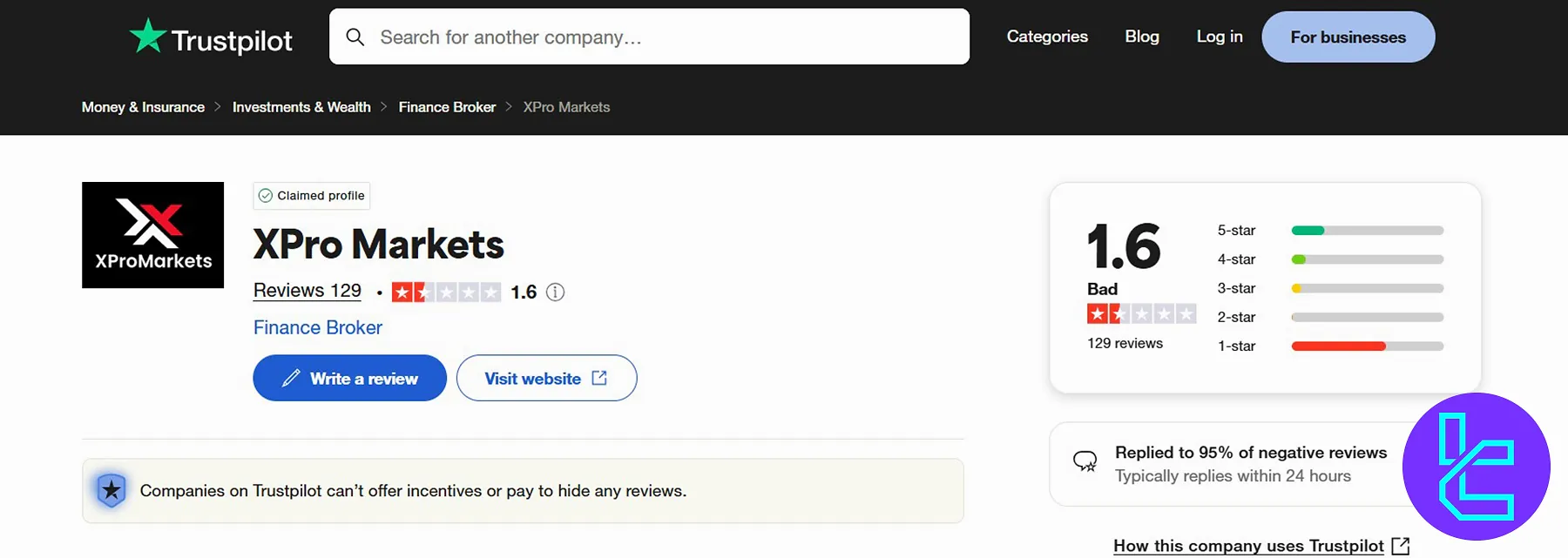

The XPro Markets Trustpilot profile has received numerous negative comments, resulting in a bad trust score. It’s the same story on other platforms, including:

- Trustpilot: 1.6 out of 5 based on 129 ratings

- io: 1.5 out of 5 based on 174 comments

- ForexPeaceArmy: 1.395 out of 5 based on 22 scores

Almost 63% of XPro Markets reviews on Trustpilot are 1-Star and 2-Star, while only 31% are positive (4-Star and 5-Star). Key subjects in the complaints are withdrawal refusals, poor quality support, and illegal usage of personal details.

Educational Resources

While XPro Markets doesn’t offer any learning materials, it provides access to 90+ trading tools, including:

- Trading Central: Independent research and leading analysis data integrated with MT4

- Economic Calendar: Records of high-impact financial events and news available to the broker’s clients

- Chart Analysis: A widget providing updates on every price movement

You can check TradingFinder’s Forex education section for free learning materials.

XPro Markets Comparison Table

Let’s check the company’s standing in the trading world in comparison with other competitors:

Parameter | XPro Markets Broker | |||

Regulation | FSCA | ASIC, FSC, DFSA, CySEC | CySEC | FSA, CySEC, FCA, FSCA, CBCS, FSC, CMA |

Min Spread | From 0.03 pips | From 0.6 Pips | From 0.0 Pips | From 0.0 Pips |

Commission | $0 | $0 (except on Shares account) | From $0.0 | From $0.2 to USD 3.5 |

Min Deposit | $250 | $5 | $50 | $10 |

Max Leverage | 1:400 | 1:1000 | 1:30 | Unlimited |

Trading Platforms | MT4 WebTrader | MT4, MT5, Mobile App | MetaTrader 4, MetaTrader 5, Mobile Proprietary App | Exness Trade (mobile), Exness Terminal (web), MT4, MT5 |

Account Types | Classic, Silver, Gold, Platinum, VIP | Micro, Standard, Ultra Low, Shares | Classic, ECN, Demo | Standard, Standard Cent, Pro, Raw Spread, Zero |

Islamic Account | Yes | Yes | No | Yes |

Number of Tradable Instruments | 160+ | 1400+ | N/A | 200+ |

Trade Execution | Market | Market, Instant | Market | Market, Instant |

Conclusion and Final Words

XPro Markets provides access to 160+ trading instruments through MT4 WebTrader across 5 account types [e.g., Platinum, and VIP], utilizing a NDD execution model.

The broker has low trust scores, including a 1.6 rating on Trustpilot and 1.395 on ForexPeaceArmy.