XTB is a famous broker that offers trading services for 2000+ instruments on MT4 and xStation trading platforms to over 1 million clients. This broker's maximum leverage is 1:500, allowing traders to perform high-risk, high-reward strategies on trading pairs in 6 markets.

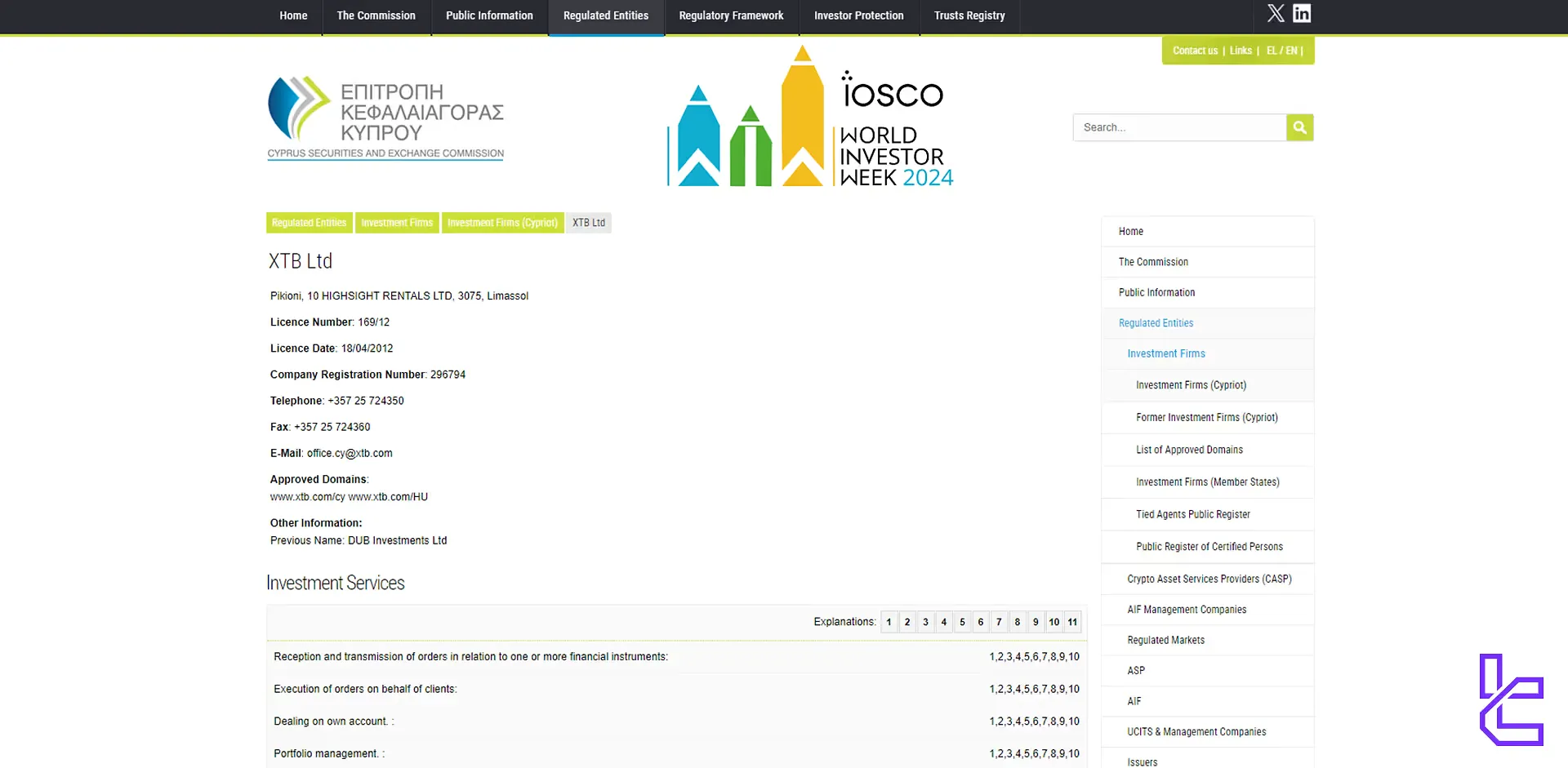

XTB Broker Company Information and Regulation Overview

XTB has established itself as an excellent choice in the online trading world, boasting a client base of over 1 million traders and managing client assets exceeding €7.2 billion. Founded in 2002 as X-Trade Brokers, the company has grown exponentially, operating in more than 13 countries worldwide. XTB's commitment to transparency is evident in its regular disclosures of earnings and cash reserves, which instill confidence in its traders.

Key points about XTB's company information and regulation include:

- Listed on the Warsaw Stock Exchange since 2016

- Regulated by top-tier authorities including the FCA, CySEC, FSC, and KNF

- Offers access to hundreds of global markets

- Provides 24/5 customer support in multiple languages

- Core values centered around trust and trader empowerment

XTB Broker Summary of Specifications

XTB stands out in the crowded forex broker space with its comprehensive offering and trader-friendly policies. Here's a concise summary of XTB's key features:

Broker | XTB |

Account Types | Standard, Islamic |

Regulating Authorities | FCA, CySEC, FSC, KNF, DFSA |

Based Currencies | USD |

Minimum Deposit | $0 |

Deposit Methods | Visa/Master Card, Bank transfer, Neteller, Skrill |

Withdrawal Methods | Bank transfer |

Minimum Order | 0.01 lot |

Maximum Leverage | 1:500 |

Investment Options | No |

Trading Platforms & Apps | xStation 5, MT4, Mobile app |

Markets | Forex, ETFs, stocks, indices, commodities, cryptocurrencies |

Spread | Floating starting from 0.5 |

Commission | No |

Orders Execution | Market |

Margin Call/Stop Out | 30%/30% |

Trading Features | Demo account |

Affiliate Program | Yes |

Bonus & Promotions | No |

Islamic Account | Yes |

PAMM Account | No |

Customer Support Ways | Email, live chat |

Customer Support Hours | 24/5 |

Restricted Countries | USA, North Korea, Iraq, Iran |

XTB Account Types Overview

XTB simplifies its account structure by offering a single Standard account type for most traders. This approach ensures clarity and ease of use for clients. Here are the key features of XTB's account offering:

- Standard Account: No commission on CFD markets (except Equity CFDs and ETFs)

- Trading Spreads: Costs built into slightly wider market spreads

- Stock and ETF Investments: 0% commission up to €100,000 nominal investment per month

- Leverage: up to 1:500

- Demo Account: Available for practice and strategy testing

XTB's straightforward account structure eliminates confusion and allows traders to focus on their trading activities rather than navigating complex account tiers.

The broker provides detailed information tailored to different regions (UK, EU, non-EU/UK, and MENA) on their website, ensuring clients have access to relevant account details based on their location.

XTB Broker Advantages and Disadvantages

When considering XTB as your broker, it's important to weigh the pros and cons. Here's a balanced overview:

Advantages | Disadvantages |

Wide range of tradable assets | Doesn’t offer MT5 trading platform |

Commission-free trading on stocks and ETFs | Limited account types |

Regulated by top-tier authorities | Charges an inactivity fee |

Proprietary xStation 5 platform with advanced features | - |

XTB Sign Up and Verification Guide

XTB registration is a streamlined process designed to get you trading quickly. Here's a step-by-step guide in 7 stages.

#1 Enter the Broker’s Website

Visit the official XTB homepage and click “Create Account” to begin the process.

#2 Provide Basic Info

Submit your email address and select your country of residence. Agree to the terms and proceed.

#3 Set a Secure Password

Create a password using a mix of upper and lowercase letters, symbols, and numbers (minimum 8 characters).

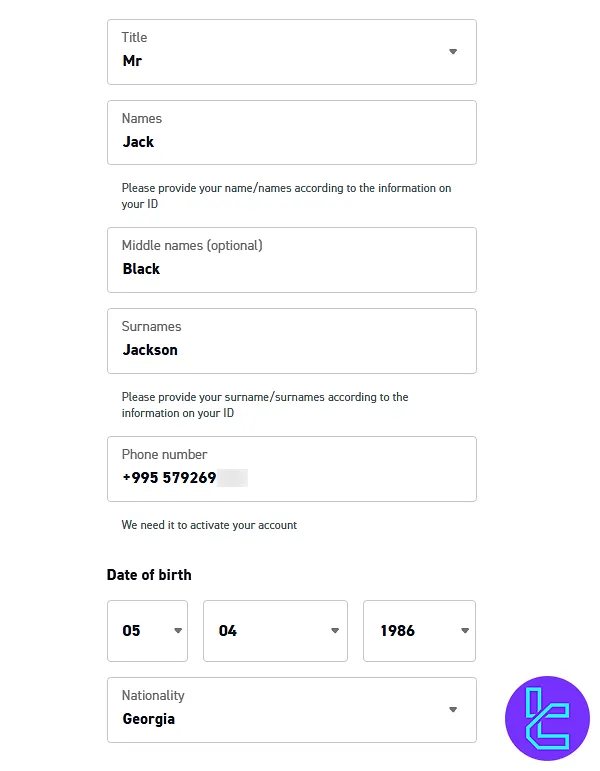

#4 Fill in Personal & Financial Details

Provide these details:

- Full name

- Date of birth

- Mobile number

- Income/employment info

Non-U.S. citizens must confirm their status here.

#5 Submit Residential Address

Provide your full address, including city and postal code.

#6 Choose Base Currency & Language

Select your account currency and preferred language, then agree to the final terms to complete the registration.

#7 Go Through KYC

Verify your phone number and upload verification documents (ID, proof of address, and bank statement) for complete authorization of your account.

XTB Broker Trading Platforms

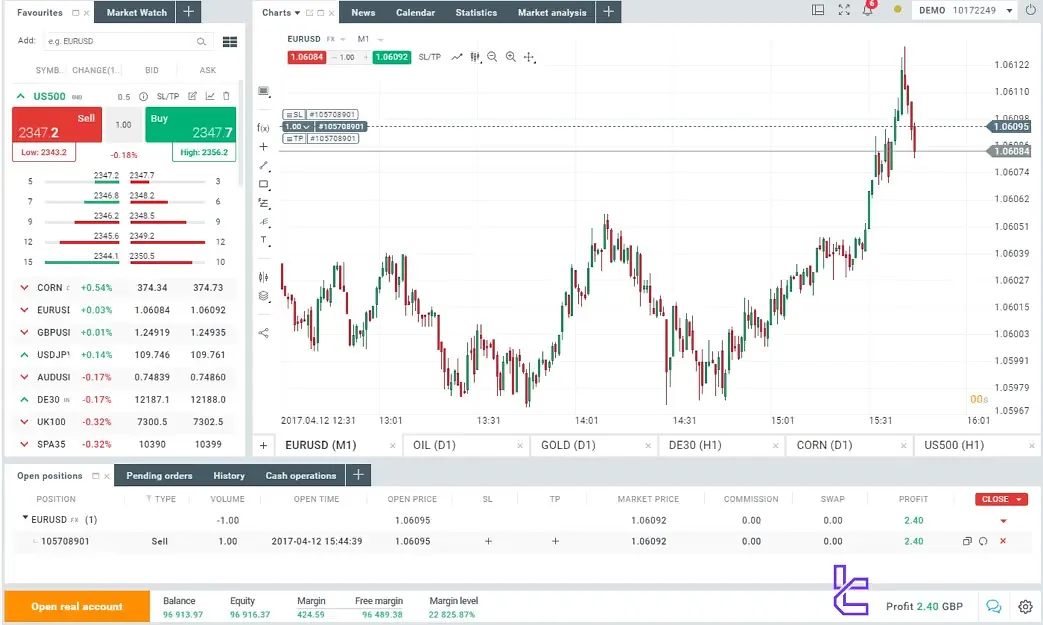

XTB's trading platform offers MetaTrader 4 and their proprietary xStation 5 platform, which is available on the web, desktop, and mobile versions.

XTB MetaTrader 4

MetaTrader 4 (MT4) is a popular trading platform widely used by traders for forex market, stocks, and commodities trading. It offers advanced charting tools and automated trading features through expert advisors. Key features of MetaTrader 4:

- Customizable charts with multiple timeframes

- Support for Expert Advisors (EAs) for automated trading

- Real-time price feeds and in-depth market analysis

- Secure and reliable with encryption for data protection

Links:

You can get access to MT4 indicators via this website.

xStation 5

xStation 5 is a user-friendly yet powerful platform with advanced charting tools available on desktop and mobile. Here are some of the reasons that make this platform standout:

- Real-time market data and news feeds

- Advanced risk management tools

- Heat map

- Customizable interface and watchlists

- Integrated economic calendar

- Sentiment analysis tools

XTB Broker Fees

XTB's pricing structure is competitive and transparent compared to other Forex brokers, with different models for CFD instruments and ETFs

Tradable instruments | STC & ETFs | CFD instruments |

Commission | 0 | 0% |

Spread | N/A | Floating starts from 0.5 pips |

Deposit fee | No | No |

Withdrawal fee | No (above %50) | No (above %50) |

Inactivity fee | Yes | Yes |

Currency conversion fee | 0.5% | 0.5% |

It's important to note that spreads can widen during volatile market conditions. XTB's pricing structure caters to different trading styles, allowing clients to choose between spread-based or commission-based trading.

Commission-free trading is offered on both stocks and ETFs up to a monthly volume of €100,000. Once that threshold is exceeded, a fee of 0.2% applies on the excess volume, with a minimum commission of €10 per trade.

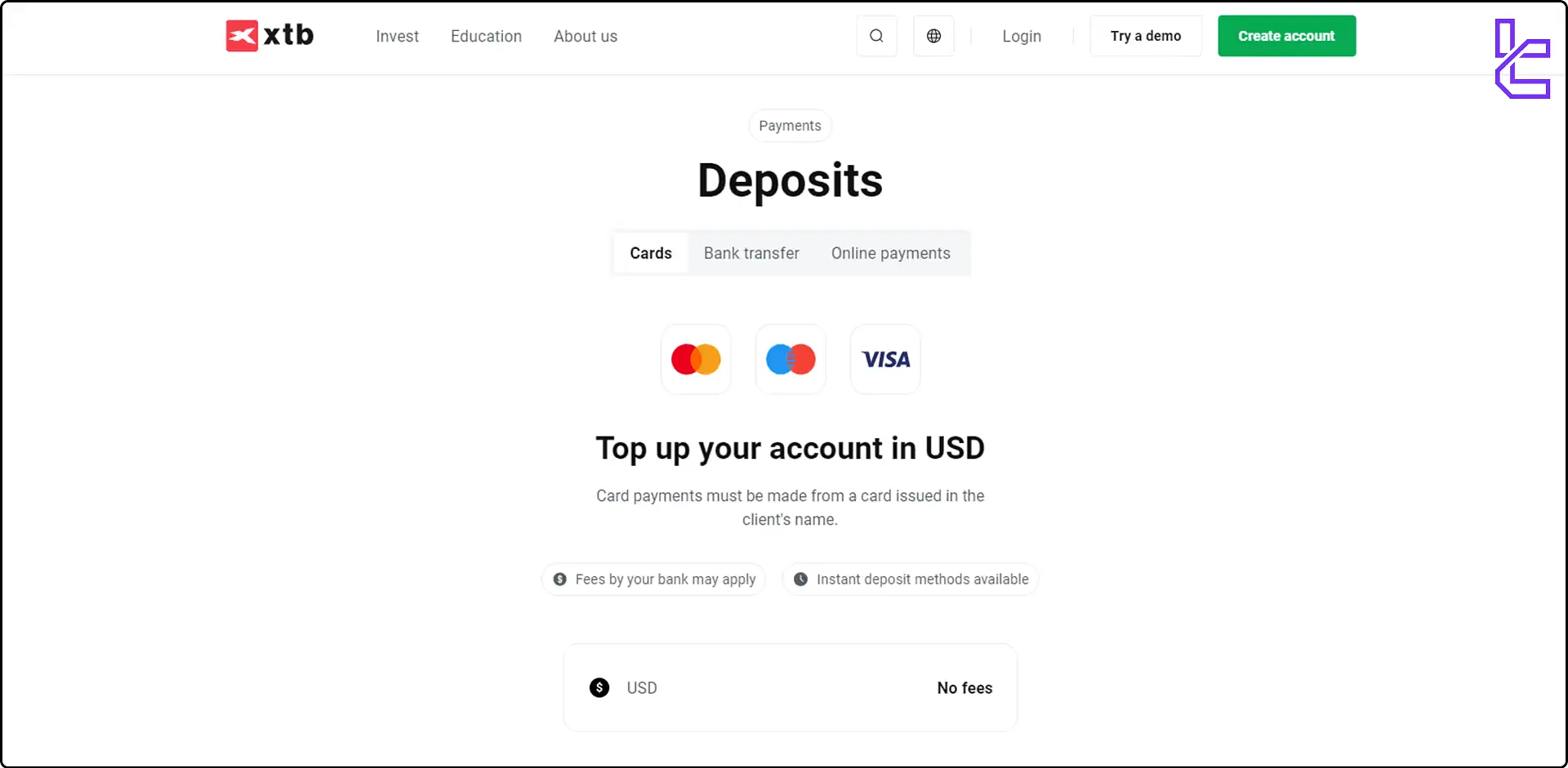

Deposit & Withdrawal methods in the XTB broker

It’s time to explore deposits and withdrawals in our XTB review. This broker offers a variety of deposit and withdrawal options to suit different client needs:

- Bank Transfer

- Credit/Debit Cards

- E-wallets (Skrill, Neteller)

Key points about XTB broker:

- Free deposits and withdrawals for most methods

- 2% fee for Skrill and 1% for Neteller deposits (non-EU/UK clients only)

- Easy deposit process through the xStation platform or Client Office

- Verification required before the first withdrawal

Here's a quick guide to deposit funds to XTB broker:

- Login to your client office;

- Choose the deposit method;

- Choose the trading account you wish to deposit funds to;

- Enter the deposit amount and enter the neccessary inforamtion to complete the process.

XTB's flexible and cost-effective deposit and withdrawal options make it easy for traders to manage their funds efficiently.

Investment Options Offered by XTB Broker

XTB is mainly focused on traders who invest or trade on their own and don’t use passive investment options. This could be a major downside for traders who seek copy trading or social trading since XTB doesn't offer them. If you are interested in investment options, we suggest checking out AVA Trade, eToro, and Pepperstone.

XTB Tradable Instruments & Symbols

XTB offers an impressive array of tradable instruments:

- Stocks: 36,000 stocks from the EU and the US market

- ETFs: 350+ ETFs from major fund managers

- Forex: over 70 currency pairs

- Commodities: 25 commodities, including gold, silver, and oil

- Indices: 30+ indices

XTB's wide range of markets and symbols caters to diverse trading strategies and preferences. It’s also worth mentioning that the broker claims to have cryptocurrencies, but there is no accurate data on the website about this.

XTB Bonuses and Promotion plans

XTB doesn’t offer deposit and welcome bonuses for traders in financial markets. Instead, they have an affiliate program that allows traders to set up a marketing campaign to promote XTB products and receive high commissions.

XTB Support

XTB provides excellent customer support with its 24/5 customer service availability and various contact channels, including:

- Live chat: available on the website

- Email: sales_int@xtb.com

- Phone support: +48 222 739 976

XTB's commitment to customer support extends beyond just problem-solving, with a focus on educating and empowering traders.

XTB Restricted Countries

While XTB accepts clients from most countries globally, there are some restrictions:

- Europe: Belgium, Albania, Bosnia and Herzegovina,

- Africa: Venezuela, Laos, Libya, Congo, Mozambique, Venezuela

- Australia: Australia, New Zealand

- Asia: Iran, Iraq, Indonesia, Syria, Pakistan, Hong Kong, Afghanistan, Singapore, South Korea, Japan, Yemen, Turkey

- South America: Panama, Macao

- North America: USA

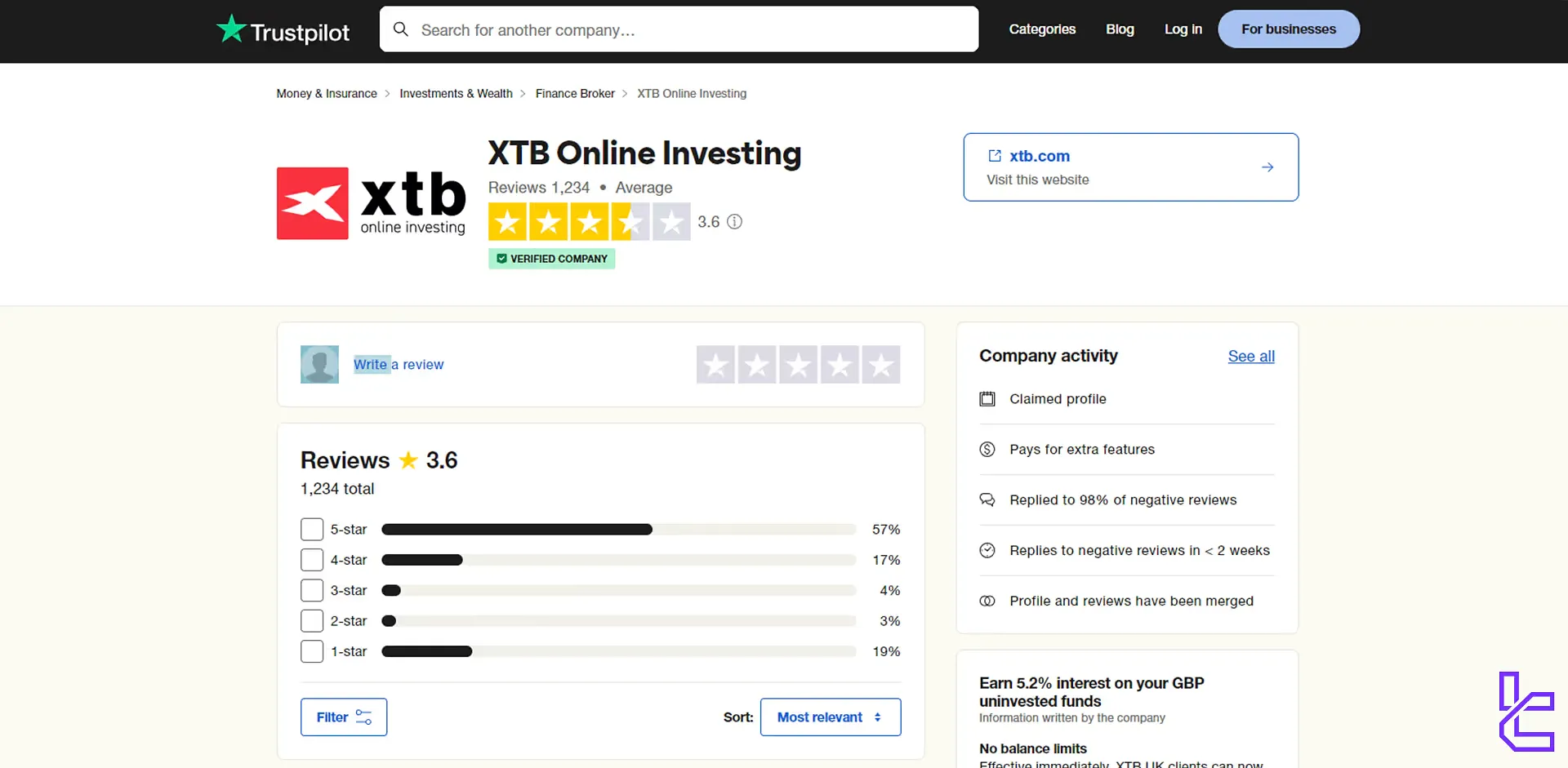

XTB Trust Scores in Customer Review Websites

Sources across the web have mixed reviews and trust scores for the broker, including a 2.9 out of 5 score on the XTB ForexPeaceArmy profile.

Many traders criticized the strict account opening policies and withdrawal delays at the XTB broker.

XTB Education

XTB values proper education and offers precious knowledge about various markets and its trading platform through the education tab on the main website.

In its comprehensive knowledge base, XTB offers various articles and guides regarding Forex trading and using the XTB platform. But it doesn’t end there.

XTB broker also has a complete section for detailed market news, from stock changes to the effect of financial policies on different markets. XTB's commitment to education helps traders develop their skills and make informed trading decisions.

Comparison Against The Best Brokers

This section is dedicated to a side-by-side comparison between XTB and some of its peers:

Parameter | XTB Broker | Alpari Broker | FXGT Broker | Pepperstone Broker |

Regulation | FCA, CySEC, FSC, KNF, DFSA | MISA | VFSC, CySEC, FSA, FSCA | ASIC, SCB, FCA, DFSA, CMA, BaFin, CySEC |

Minimum Spread | Floating starting from 0.5 | From 0.0 Pips | From 0.0 Pips | From 0.0 pips |

Commission | None | From $0.0 | From $0.0 | From $0.0 |

Minimum Deposit | $0 | $50 | $5 | $1 |

Maximum Leverage | 1:500 | 1:3000 | 1:5000 | 1:500 |

Trading Platforms | xStation 5, MT4, Mobile app | MetaTrade 4, MetaTrade 5, Mobile App, Web Trader | MT4, MT5 | Proprietary Platform, cTrader, Trading View, MetaTrader 4&5 |

Account Types | Standard, Islamic | Standard, ECN, Pro ECN, Demo | Standard+, ECN Zero, Mini Optimus, Pro | Standard, Razor |

Islamic Account | Yes | Yes | Yes | Yes |

Number of Tradable Assets | 36,400+ | 120+ | N/A | 1200+ |

Trade Execution | Market | Market | Market | Instant |

TF Expert Suggestion

XTB’s top-tier regulation by CySEC, FCA, KNF, and DFSA increases traders’ confidence in the legitimacy of this trading platform.

However, the $10 inactivity fee, a 3.6/5 Trustpilot score, and the unavailability of the broker’s services in various regions, such as the US, Singapore, Australia, and Turkey, are key points to consider before joining this broker.