Bitcoin Price

Bitcoin Chart

Bitcoin Current Price & Market Statistics

Bitcoin currently trades at $68.06K and holds the #1 position with a market cap of $1360.86B. The price has moved +3.85% in the last 24 hours, +1.32% over the past week, and +0.26% in the last hour.

Bitcoin Trading Volume & Market Capitalization

Bitcoin's 24-hour trading volume stands at $52.22B, with a market cap of $1360.86B and holding the #1 position, reflecting strong market activity.

Bitcoin Price History & All-Time Highs/Lows

Currently trading at $68.06K with a +1.32% change over the past week, Bitcoin has experienced remarkable growth throughout its history. Bitcoin's journey from essentially worthless in 2009 to becoming a globally recognized store of value represents one of the most significant financial phenomena of the 21st century.

The early years saw Bitcoin trading for mere cents, with the famous "Bitcoin Pizza Day" transaction on May 22, 2010, when 10,000 bitcoins were used to purchase two pizzas. Over the years, Bitcoin has experienced several major bull and bear cycles, each bringing increased mainstream attention and institutional adoption.

Bitcoin has weathered numerous challenges throughout its history, from exchange hacks and regulatory uncertainty to scaling debates and environmental concerns. Each crisis has ultimately strengthened the network and increased confidence in its resilience and long-term viability.

What is Bitcoin?

Bitcoin is the first decentralized cryptocurrency, invented in 2008 when an unknown entity published a white paper under the pseudonym of Satoshi Nakamoto, with use of bitcoin as a currency beginning in 2009, with the release of its open-source implementation. The nine-page thesis paper titled "Bitcoin: A Peer-to-Peer Electronic Cash System" established the basic structure for the Bitcoin network and presented the idea of decentralized cryptocurrency, or an electronic currency that can make transactions with low costs while using no financial institutions or third parties.

The inventor of Bitcoin, Satoshi Nakamoto, believed that scarcity could create value where there was none before, making Bitcoin revolutionary in that it could, for the first time, make a digital product scarce, there will only ever be 21 million Bitcoin. The idea of limiting Bitcoin's supply stands in marked opposition to how fiat currencies such as the U.S. dollar work, as Satoshi Nakamoto believed that devaluation of fiat money could have disastrous effects, and so, with code, prevented any single party from being able to create more Bitcoin.

Bitcoin accomplished its breakthrough by utilizing "blockchain," an electronic ledger that is signed and distributed to everyone in the Bitcoin network, making false spending or ledger tampering nearly impossible. The paper's major breakthrough was convincing Bitcoin users to trust each other, and the Bitcoin network, without the presence of gatekeepers like a centralized bank or government.

Bitcoin's launch marked the beginning of the cryptocurrency era, introducing concepts that would later influence thousands of other digital assets. The creation story is particularly fascinating because Nakamoto's identity remains unknown despite extensive investigations by journalists, mathematicians, and internet detectives. This mystery has only added to Bitcoin's mystique and decentralized ethos.

The timing of Bitcoin's creation was not coincidental. Embedded in the coinbase transaction of the genesis block is the text: "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks," citing a headline in the UK newspaper The Times published on that date, which has been interpreted as both a timestamp and a derisive comment on the alleged instability caused by fractional-reserve banking.

Key Features & Technology Behind Bitcoin

Cryptocurrencies are rooted in blockchain technology, which is an open-source database, essentially a public ledger, that is distributed across a decentralized computer network and forms a permanent record of transactions between parties. Each transaction represents a "block" of data about who owns what at a given time, along with the hash (unique identifier) of the previous block, and together these blocks form a "chain" that can't be altered or counterfeited.

Bitcoin is powered by open-source code known as blockchain, which creates a shared public history of transactions organized into "blocks" that are "chained" together to prevent tampering, creating a permanent record of each transaction and providing a way for every Bitcoin user to operate with the same understanding of who owns what.

The proof-of-work consensus mechanism is Bitcoin's most distinctive technological feature. Proof of work was popularized by Bitcoin as a foundation for consensus in a permissionless decentralized network, in which miners compete to append blocks and mine new currency, each miner experiencing a success probability proportional to the computational effort expended. The Proof of Work consensus algorithm involves solving a computationally challenging puzzle in order to create new blocks in the Bitcoin blockchain, with the process known as 'mining', and the nodes in the network that engage in mining known as 'miners'.

The reason proof of work in cryptocurrency works well is because finding the target hash is difficult but verifying it isn't, with the process being difficult enough to prevent the manipulation of transaction records, yet once a target hash is found, it's easy for other miners to check it.

Bitcoin's cryptographic security relies on sophisticated mathematical principles. A Bitcoin wallet contains a public key and a private key, which work together to allow the owner to initiate and digitally sign transactions. This public-private key cryptography ensures that only the rightful owner of bitcoins can spend them, while still allowing the network to verify that transactions are legitimate.

The network's decentralized nature means there's no central point of failure. Bitcoin works through the collaboration of computers, each of which acts as a node in the peer-to-peer bitcoin network, with each node maintaining an independent copy of a public distributed ledger of transactions, called a blockchain, without central oversight, and transactions are validated through the use of cryptography.

Who's Behind Bitcoin?

Satoshi Nakamoto is the name used by the presumed pseudonymous person or persons who developed bitcoin, authored the bitcoin white paper, and created and deployed bitcoin's original reference implementation. As part of the implementation, Nakamoto also devised the first blockchain database and was active in the development of bitcoin until December 2010.

Nakamoto's true identity is unknown, although various people have been posited as the person or group of people behind his name, with his name being Japanese, and his persona suggesting a man living in Japan, but many have speculated that he is a software and cryptography expert from the United States or Europe. Nakamoto has remained anonymous, despite several attempts or claims to have figured out his identity, by everyone from internet sleuths and mathematicians to The New Yorker, the Financial Times, and Fast Company and HBO, but no consensus has ever been reached, and Nakamoto to this day remains a mystery.

The mystery surrounding Satoshi Nakamoto has spawned countless theories and investigations. In October 2011, investigative journalist Adam Penenberg cited circumstantial evidence suggesting Neal King, Vladimir Oksman, and Charles Bry could be Nakamoto, as they jointly filed a patent application that contained the phrase "computationally impractical to reverse" in 2008, which was also used in the bitcoin white paper, and the domain name bitcoin.org was registered three days after the patent was filed, though all three men denied being Nakamoto when contacted.

Assuming he is an individual person, Nakamoto's bitcoin holdings make him one of the world's wealthiest people, with his wallet, which has been untouched since 2010, holding an estimated 1.1 million bitcoins. Blockchain analysts estimate that Nakamoto had mined about one million bitcoins before disappearing in 2010 when he handed the network alert key and control of the code repository over to Gavin Andresen.

Today, Bitcoin development continues through a global community of developers and contributors. Andresen later became lead developer at the Bitcoin Foundation, an organization founded in September 2012 to promote bitcoin. The current Bitcoin ecosystem involves hundreds of developers, researchers, and organizations working to improve and maintain the protocol, with changes requiring broad consensus from the community.

Notable early contributors included Hal Finney, who received the first Bitcoin transaction, and various cryptographers and computer scientists who helped refine the protocol in its early days. The decentralized nature of Bitcoin development means that no single person or organization controls its future direction, instead, improvements are proposed, discussed, and implemented through a consensus process involving the entire community.

Bitcoin Tokenomics & Supply Mechanics

Embedded in the Bitcoin code is a hard cap of 21 million coins, with new Bitcoin released through mining as block rewards, as miners do the work of maintaining and securing the Bitcoin ledger and are rewarded with newly minted Bitcoin, however, approximately every four years, the reward for mining is halved, and each halving reduces the rate at which new Bitcoin enters the supply, a process that likely will last until 2140.

Bitcoin's controlled supply is a key factor contributing to its value proposition, with the total supply of Bitcoin limited to 21 million coins, and the halving mechanism gradually reducing the rate at which new BTC are produced until the maximum supply is reached. At its core, the Bitcoin halving is an event designed to gradually reduce the rate at which new BTC is created, ultimately leading to a maximum supply of 21 million coins, which is unlike other layer-1 blockchains, which must address inflationary aspects within their economic models.

The halving mechanism is central to Bitcoin's economic model. A Bitcoin halving, also known as a "halvening," refers to the predetermined reduction in the rate at which new BTC are created, programmed into the Bitcoin protocol and occurring every 210,000 blocks, which is roughly every four years, with the halving event halving the block reward, reducing the number of newly minted Bitcoin awarded to miners.

Bitcoin network completed its fourth halving event on April 19th, 2024, slashing the miners' reward in half to 3.125 BTC (from the previous 6.25 BTC), reducing the rate at which new BTC enters circulation. This systematic reduction in new supply creates deflationary pressure over time.

The logic behind the process dictates that when the block subsidy runs out, when all of the 21 million Bitcoin are out there, the network will be mature enough to rely on transaction fees alone to pay for the security and processing capacity that the miners bring, with one of Nakamoto's most famous quotes being, "In a few decades when the reward gets too small, the transaction fee will become the main compensation for [mining] nodes."

At present, transaction fees make up only a small proportion of a miner's revenues, following the 2024 halving, miners mint around 428 BTC (about $28.3 million) a day, but earn between 60 and 100 BTC ($3.9 million to $6.6 million) in daily transaction fees, meaning transaction fees currently make up as little as 14% of a miner's revenue, but in 2140, that'll shoot up to 100%.

The economic design creates scarcity similar to precious metals. This decreasing-supply algorithm was chosen because it approximates the rate at which commodities like gold are mined. However, unlike gold, Bitcoin's maximum supply is precisely known and cannot be increased, creating what economists call "absolute scarcity."

As Saifedean Ammous wrote in "The Bitcoin Standard," "scarcity is the fundamental starting point of all economics," and we can't understate the importance of Bitcoin achieving absolute scarcity from the get-go, as neither gold, nor real estate, nor anything in the real world can be perfectly scarce, but Bitcoin can and is, with there only being 21 million Bitcoin.

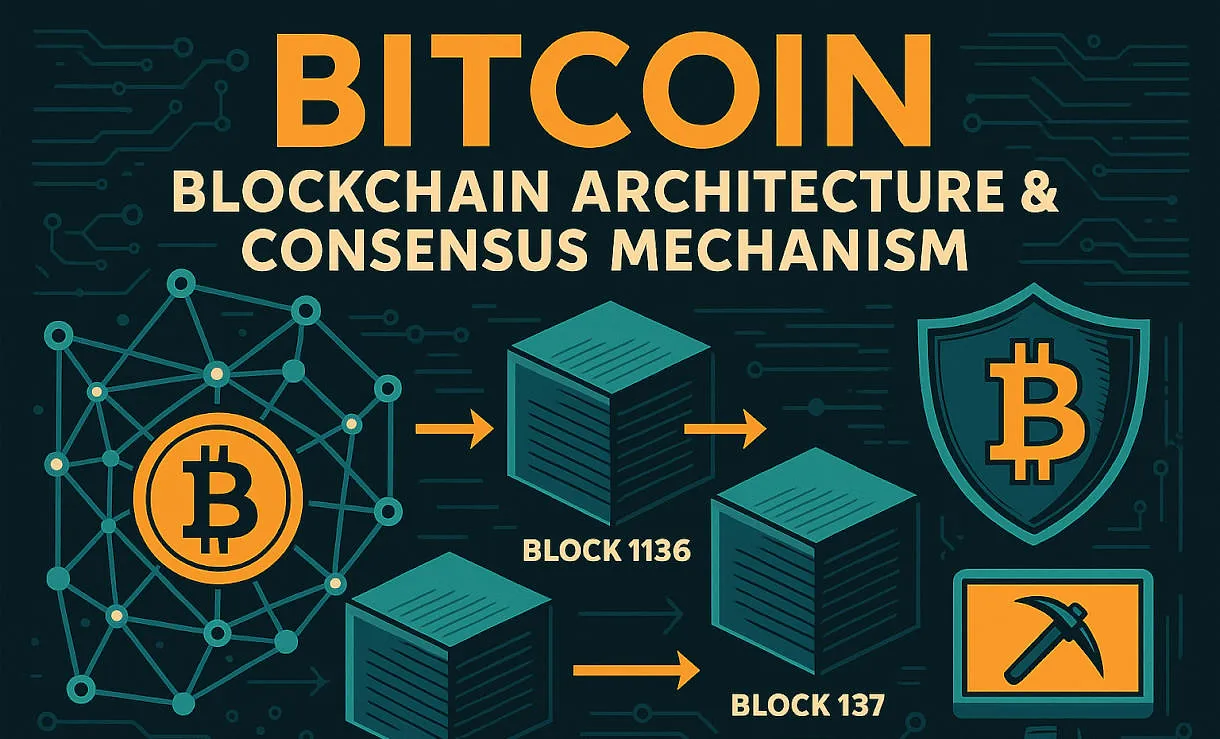

Bitcoin Blockchain Architecture & Consensus Mechanism

Bitcoin is a first digital cryptocurrency, a decentralized system that records transactions in a DLT called a blockchain, and Bitcoin gave us the first glimpse of the blockchain, and it is the first decentralized digital currency whose ledger is maintained by blockchain. Nakamoto's innovation was their complex interplay resulting in the first decentralized, Sybil resistant, Byzantine fault tolerant digital cash system, that would eventually be referred to as the first blockchain.

The Bitcoin blockchain operates through a sophisticated consensus mechanism. Proof of Work is a consensus mechanism that requires participants (miners) to solve complex mathematical problems to validate transactions and create new blocks, first introduced by Bitcoin in 2009, designed to secure the network against attacks and ensure that all transactions are legitimate.

The functioning of Proof of Work involves transaction broadcasting where users initiate transactions, which are broadcasted to the network, transaction validation where miners collect these transactions and validate them to ensure they are legitimate and not double-spent, problem-solving where miners compete to solve a cryptographic puzzle involving finding a hash that meets specific criteria, block creation where the first miner to solve the puzzle gets to add a new block to the blockchain and is rewarded with newly minted coins and transaction fees, and difficulty adjustment where the network adjusts the difficulty of the puzzles approximately every two weeks to ensure that blocks are added at a consistent rate.

The proof-of-work algorithm used by Bitcoin aims to add a new block every 10 minutes, and to do that, it adjusts the difficulty of mining Bitcoin depending on how quickly miners are adding blocks, with mining happening too quickly causing the hash computations to get harder.

The security of Bitcoin's blockchain comes from its decentralized nature and computational requirements. PoW is highly secure due to the computational power required to solve cryptographic puzzles, with an attacker needing to control more than 50% of the network's hashing power to alter the blockchain, making it extremely difficult and costly.

PoW consensus algorithms are resistant to tampering and fraud because changing a block's contents would require redoing the proof-of-work for that block and all subsequent blocks, making it difficult for a single entity to control or alter the blockchain. This creates an immutable record where past transactions become increasingly difficult to alter as more blocks are added on top.

The network automatically adjusts the difficulty level of these puzzles based on mining activity, using the SHA-256 hashing algorithm in Bitcoin. This self-regulating mechanism ensures consistent block times regardless of how much computational power joins or leaves the network.

The distributed nature means thousands of nodes worldwide maintain copies of the blockchain. The Bitcoin network runs on a distributed system of computers, with all computer processes in the network running simultaneously on hundreds and thousands of computers - i.e. nodes - located in different countries distributed all over the world, and all these computers are connected to each other and anyone with the suitable equipment can set up a computer to join in, with the more computers in the network creating more copies of the records, making the system even more secure.

Bitcoin Market Performance vs. Competitors

Bitcoin maintains its position as the dominant cryptocurrency, often referred to as "digital gold" due to its store of value properties and first-mover advantage. While newer cryptocurrencies like Ethereum offer smart contract functionality and faster transaction speeds, Bitcoin's simplicity and security-focused design continue to attract institutional investors and individuals seeking a reliable digital asset.

Compared to traditional assets, Bitcoin exhibits higher volatility but has also delivered exceptional long-term returns for early adopters. Its correlation with traditional markets has increased over time as institutional adoption has grown, though it still offers portfolio diversification benefits.

Bitcoin's transaction throughput is intentionally limited to prioritize security and decentralization, processing approximately 7 transactions per second compared to Ethereum's 15 and traditional payment networks like Visa's thousands. However, layer-2 solutions like the Lightning Network aim to address scalability while maintaining Bitcoin's security guarantees.

How to Buy Bitcoin

Purchasing Bitcoin has become increasingly accessible through multiple channels. For beginners, the process typically involves choosing a reputable exchange, completing identity verification, funding your account, and making your first purchase.

Start by selecting a cryptocurrency exchange that operates in your jurisdiction and has a strong security track record. Popular options include established platforms like Coinbase, Kraken, and Binance, each offering different features and fee structures. Consider factors like ease of use, security measures, available payment methods, and customer support quality.

Complete the registration process by providing required personal information and identity verification documents. This Know Your Customer (KYC) process is standard across regulated exchanges and helps prevent fraud and money laundering. Verification typically takes a few hours to several days depending on the platform.

Fund your account using bank transfers, credit cards, or other supported payment methods. Bank transfers usually offer lower fees but take longer to process, while credit card purchases are faster but more expensive. Some exchanges also accept PayPal, wire transfers, or other cryptocurrencies.

Execute your Bitcoin purchase by placing a market order for immediate execution or a limit order to buy at a specific price. Start with smaller amounts while learning the process, and consider dollar-cost averaging to reduce the impact of price volatility.

For those preferring traditional brokerages, many now offer Bitcoin exposure through their platforms, including Fidelity, Charles Schwab, and Robinhood. Bitcoin ETFs also provide indirect exposure through traditional investment accounts.

Best Bitcoin Exchanges & Trading Platforms

Exchanges come in two primary forms: centralized and decentralized, with centralized exchanges, such as Binance or Coinbase, operating as intermediaries, matching buyers and sellers while holding custody of users' funds.

Coinbase stands out for beginners due to its user-friendly interface, extensive educational resources, and strong regulatory compliance. From Bitcoin to Dogecoin, Coinbase makes it easy to buy and sell cryptocurrency and protects crypto with best in class cold storage. The platform offers both basic and advanced trading interfaces, making it suitable for new and experienced traders alike.

Kraken appeals to more experienced traders with advanced features, lower fees for high-volume trading, and extensive cryptocurrency selection. The platform provides sophisticated trading tools, futures trading, and margin trading options for qualified users.

Binance offers the largest selection of cryptocurrencies and some of the lowest trading fees in the industry. However, regulatory challenges in some jurisdictions have limited its availability. The platform provides extensive trading options including spot, futures, and options trading.

Interactive Brokers offers investors a solid entry-level crypto trading platform, letting investors buy and sell Bitcoin, Ethereum, Litecoin and Bitcoin Cash in fiat currency, with fees capped at 1% of trade value.

Traditional financial institutions are increasingly offering Bitcoin services. Investors who already use Fidelity and want to gain some exposure to three cryptocurrencies , Bitcoin, Ethereum and Litecoin , will find Fidelity Crypto to be a good choice.

When choosing an exchange, consider security features like two-factor authentication, cold storage for funds, insurance coverage, and regulatory compliance. Also evaluate trading fees, available cryptocurrencies, user interface quality, customer support responsiveness, and educational resources.

Bitcoin Wallet Options & Storage Solutions

If you decide to buy Bitcoin, you'll need a place to store it , like a "hot" (online) or "cold" (offline) wallet, with each Bitcoin being a digital asset that can be stored at a cryptocurrency exchange or in a digital wallet, and each individual coin representing the value of Bitcoin's current price, but you can also own partial shares of each coin.

Hot Wallets remain connected to the internet and offer convenience for frequent transactions. Exodus offers a solid set of software tools, including a mobile app, a desktop app and a browser extension, with its products allowing users to buy, trade or stake cryptocurrency directly from their wallets, and it has an integration with the Trezor cold wallet intended to help people easily move crypto from hot to cold storage, and Exodus, which is free to use, also has a solid library of explanatory content for people who are learning about crypto.

MetaMask is often considered a top Ethereum wallet because it focuses solely on ERC-20 tokens, while Electrum is among the top Bitcoin wallets because it's built specifically for Bitcoin power users, but if you're planning to protect multiple kinds of cryptocurrencies in one place, it's a good idea to shop around.

Cold Wallets provide maximum security by keeping private keys offline. A cold wallet is an encrypted portable device much like a thumb drive that allows you to download and carry your Bitcoins. Cold wallets, most of which are hardware devices, come with a one-time purchase cost ranging from as low as $49 for an entry-level wallet to as high as $500 for high-end models.

Popular hardware wallet brands include Ledger and Trezor, both offering military-grade security features and support for multiple cryptocurrencies. These devices require physical confirmation for transactions, making them nearly immune to online attacks.

You can have more than a single crypto wallet , in fact, some people have several of them, for example, you might use a hot wallet for everyday transactions or short-term trading and a cold wallet for storing larger amounts of crypto long-term, with hot wallets being better for active traders due to their speed and practicality, while cold storage is recommended for holding your crypto in the long-term.

Mobile Wallets like Trust Wallet and Zengo offer smartphone convenience with varying security levels. Zengo removes much of the complexity that typically comes with crypto wallets by eliminating complex seed phrases and private keys, replacing them with multi-party computational (MPC) cryptography, a keyless security model, with the platform's appealing design further adding to its beginner-friendly appeal, as does its 24/7 live customer support and streamlined setup process.

Bitcoin Security Best Practices & Risk Management

Bitcoin security starts with understanding that cryptocurrency transactions are irreversible and you are your own bank. Unlike traditional bank transfers, crypto transactions can't be reversed, so it's crucial for users to verify they are sending the correct asset to the correct address, for example, users must send Bitcoin (BTC) to a Bitcoin wallet address and Ethereum (ETH) to an Ethereum wallet address, as just one incorrect alphanumeric character in the receiving address will lead to a loss of funds.

Private Key Management is the foundation of Bitcoin security. Your private keys control access to your bitcoins, and losing them means losing your funds permanently. Losing a private key means losing access to the bitcoins, with no other proof of ownership accepted by the protocol, for instance, in 2013, a user lost ₿7,500, valued at US$7.5 million, by accidentally discarding a hard drive with the private key.

Store backup phrases (seed phrases) securely in multiple physical locations, never digitally. Consider using metal backup devices that resist fire and water damage. Never share your private keys or seed phrases with anyone, and be suspicious of anyone asking for this information.

Exchange Security requires careful consideration of custodial risks. Storing crypto in an exchange's wallet can leave you vulnerable to losses if an exchange fails or suffers a cyberattack, so some users prefer not to store assets on exchanges unless they're actively trading. This has happened to many people, and the purpose is to make you aware of the danger of centralized exchanges - use them for what they are best, to convert Fiat into Crypto and vice versa, but never trust them to guard your crypto.

Multi-Factor Authentication should be enabled on all accounts related to your Bitcoin holdings. Use authenticator apps rather than SMS when possible, as SIM swapping attacks can compromise SMS-based authentication.

Regular Security Audits of your setup help identify vulnerabilities. Review your wallet software versions, check for security updates, and periodically test your backup and recovery procedures. Consider using different wallets for different purposes: hot wallets for spending and cold storage for long-term holdings.

Social Engineering Awareness is crucial as attackers often target the human element rather than technical vulnerabilities. Be skeptical of unsolicited offers, phishing emails, fake support representatives, and "investment opportunities" promising guaranteed returns.

How Does Bitcoin Work? - Technical Explanation

Bitcoin operates as a peer-to-peer electronic cash system that eliminates the need for trusted third parties. At its core, Bitcoin solves the "double-spending problem" that plagued previous digital currency attempts by creating a distributed timestamp server that establishes a chronological order of transactions.

The Blockchain Structure consists of blocks containing transaction data, each linked to the previous block through cryptographic hashes. In a proof-of-work (PoW) consensus algorithm, each block of transactions is linked to the previous block using a cryptographic hash value, with the process of mining performed by "miners" who must select a random value (called a "nonce") and calculate the hash value of the block header, which includes the nonce and other information such as previous block hash and transaction data, and if the hash value is less than a predetermined target value, the block is added to the blockchain, with this process verified by other miners in the network.

Transaction Processing begins when users broadcast transactions to the network. Bitcoin transactions use a Forth-like scripting language, involving one or more inputs and outputs, and when sending bitcoins, a user specifies the recipients' addresses and the amount for each output, allowing sending bitcoins to several recipients in a single transaction, and to prevent double-spending, each input must refer to a previous unspent output in the blockchain, with using multiple inputs being similar to using multiple coins in a cash transaction, and as in a cash transaction, the sum of inputs can exceed the intended sum of payments, so an additional output can return the change back to the payer, with unallocated input satoshis in the transaction becoming the transaction fee.

Mining and Validation secure the network through computational work. Miners collect pending transactions, verify their validity, and compete to solve a cryptographic puzzle. The first miner to solve the puzzle broadcasts their solution, and other nodes verify and accept the new block if it's valid.

Network Consensus emerges from the longest valid chain rule. When multiple miners find blocks simultaneously, the network eventually converges on the chain with the most accumulated proof-of-work. This mechanism ensures all participants agree on the same transaction history without central coordination.

Digital Signatures ensure transaction authenticity. Each transaction is signed with the sender's private key and verified using their public key, proving ownership without revealing the private key. This cryptographic proof prevents unauthorized spending while maintaining transaction verification.

The system's elegance lies in its simplicity: miners are incentivized to follow the rules because attempting to cheat requires more computational resources than honest participation, while the open-source nature allows anyone to verify the system's integrity.

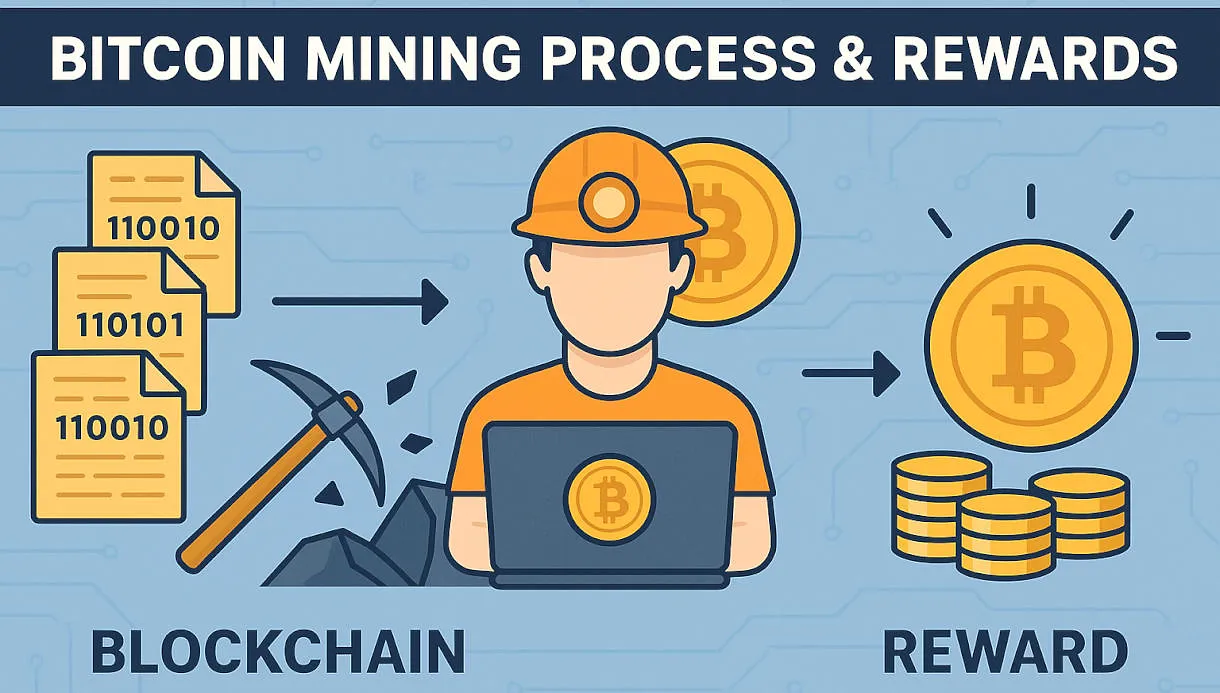

Bitcoin Mining Process & Rewards

Mining is the process through which new BTC are introduced into circulation and involves solving complex mathematical puzzles to validate and secure transactions on the blockchain, with miners investing in specialized hardware and competing to solve these puzzles, with successful miners rewarded with newly minted Bitcoin and transaction fees.

Mining Hardware Evolution has progressed from CPUs to GPUs to specialized ASIC (Application-Specific Integrated Circuit) miners. Modern Bitcoin mining requires substantial capital investment in equipment and electricity costs. The need for specialized hardware (ASICs) can create barriers to entry for new miners, which can lead to a concentration of mining power among those who can afford the latest technology.

Energy Consumption is a significant aspect of Bitcoin mining. The Bitcoin-style mining process is very energy intensive because the proof of work is shaped like a lottery mechanism, with the underlying computational work having no other use but to provide security to the network that provides open access and has to work in adversarial conditions, and miners have to use a lot of energy to add a new block containing a transaction to the blockchain, with the energy used in this competition being what fundamentally gives Bitcoin its level of security and resistance to attacks.

Mining requires the use of a computer, which burns a lot of electricity, which is expensive, and all of this mining power is applied to solving math problems that are totally useless to humanity, except that they make it possible to form new blocks and confirm transactions on the ledger, with one reason for the use of proof-of-work being to slow things down, so that block generation occurs at a manageable pace.

Geographic Distribution of mining operations often correlates with electricity costs. Because proof-of-work mining requires so much computing power, it tends to consolidate miners down to the few people who can afford the equipment, and it also tends to pull computing resources into locations where electricity is cheap, resulting in a consolidation of miners and a geographic consolidation.

Mining Pool Participation allows smaller miners to combine resources and share rewards proportionally to their contributed hash power. This system provides more predictable income compared to solo mining, where individual miners might wait months or years to find a block.

Difficulty Adjustment ensures consistent block times regardless of total network hash power. Every 2,016 blocks (approximately two weeks), the network recalculates the mining difficulty based on the time it took to mine the previous 2,016 blocks, maintaining the target of one block every 10 minutes.

Future Sustainability concerns drive innovation in renewable energy use and mining efficiency. Many mining operations now utilize stranded energy sources, renewable power, and waste heat recovery to improve their environmental footprint and profitability.

Bitcoin Network Upgrades & Development Roadmap

Bitcoin development follows a conservative approach prioritizing security and stability over rapid feature addition. In August 2017, the SegWit software upgrade was activated, intended to support the Lightning Network as well as improve scalability, with SegWit opponents, who supported larger blocks as a scalability solution, forking to create Bitcoin Cash, one of many forks of bitcoin.

Segregated Witness (SegWit) was one of Bitcoin's most significant upgrades, increasing transaction capacity and enabling advanced features. By separating signature data from transaction data, SegWit reduced transaction sizes and eliminated transaction malleability, paving the way for second-layer solutions.

Taproot Activation marked another major milestone. In November 2021, the Taproot soft-fork upgrade was activated, adding support for Schnorr signatures, improved functionality of smart contracts and Lightning Network. This upgrade enhanced privacy, efficiency, and smart contract capabilities while maintaining backward compatibility.

Lightning Network Development continues to expand Bitcoin's payment capabilities. This second-layer solution enables near-instantaneous, low-cost transactions while maintaining Bitcoin's security guarantees. Lightning Network adoption has grown significantly among merchants and payment processors.

Ordinals and NFTs represent a new use case. In 2023, ordinals, non-fungible tokens (NFTs), on bitcoin, went live. This development sparked debate about Bitcoin's intended use case while demonstrating the network's flexibility for new applications.

Future Developments focus on privacy enhancements, scalability improvements, and user experience refinements. Proposed upgrades include covenant opcodes, additional signature schemes, and protocol optimizations that maintain Bitcoin's core principles while expanding functionality.

The development process emphasizes consensus-building through Bitcoin Improvement Proposals (BIPs), extensive testing, and gradual deployment. This cautious approach has maintained Bitcoin's stability and security throughout its evolution.

Bitcoin Smart Contract Capabilities & DeFi Integration

While Bitcoin wasn't initially designed with smart contracts as a primary focus, its scripting language enables various programmable money functions. Bitcoin's script is intentionally limited compared to other blockchains, prioritizing security and predictability over Turing completeness.

Basic Smart Contract Features include time-locked transactions, multi-signature wallets, and hash time-locked contracts (HTLCs). These capabilities enable escrow services, payment channels, and cross-chain atomic swaps without requiring complex programming environments.

Lightning Network Smart Contracts expand Bitcoin's programmable capabilities through payment channels. The Lightning Network enables conditional payments, routing through intermediate nodes, and sophisticated payment contracts while maintaining Bitcoin's security model.

Taproot Smart Contracts introduced more advanced scripting capabilities while maintaining privacy. Complex spending conditions can be hidden until they're used, making advanced smart contracts indistinguishable from regular transactions on the blockchain.

DeFi Integration typically occurs through wrapped Bitcoin (WBTC) and other tokenized representations on smart contract platforms like Ethereum. These solutions allow Bitcoin holders to participate in decentralized finance while maintaining exposure to Bitcoin's price movements.

Cross-Chain Protocols enable Bitcoin integration with other blockchain ecosystems. Solutions like atomic swaps, bridge protocols, and sidechains allow Bitcoin to interact with smart contract platforms while preserving its security properties.

Limitations and Trade-offs include Bitcoin's intentionally constrained scripting language, which prevents certain complex smart contract functionalities but reduces attack vectors and maintains network stability. This design philosophy prioritizes security and decentralization over programmability.

The Bitcoin community continues exploring ways to expand smart contract capabilities while preserving the network's core security and decentralization properties.

Bitcoin Real-World Use Cases & Applications

Bitcoin serves multiple real-world functions that demonstrate its utility beyond speculative investment. Over the years, Bitcoin would rise from fringe idea to global popularity, as investors began to see it as a place to park wealth or hedge against inflation, and as institutions found ways to create crypto-focused financial instruments.

Store of Value represents Bitcoin's most recognized use case. Like physical gold, bitcoin's value stems from supply and demand dynamics, and the perception that it can be a store of value, an anonymous means of payment, or a hedge against inflation. Many individuals and institutions view Bitcoin as "digital gold" due to its scarcity and durability.

Cross-Border Payments benefit from Bitcoin's borderless nature. International remittances, especially to regions with limited banking infrastructure, can be faster and cheaper using Bitcoin compared to traditional money transfer services.

Financial Inclusion extends to unbanked populations worldwide. Research produced by the University of Cambridge estimated that in 2017, there were 2.9 to 5.8 million unique users using a cryptocurrency wallet, most of them using bitcoin. People without access to traditional banking can participate in the global economy through Bitcoin.

Merchant Acceptance continues growing among businesses seeking lower payment processing fees or access to global markets. Premier Shield Insurance, which sells home and auto insurance policies in the US, accepts Bitcoin for premium payments, and if you want to spend cryptocurrency at a retailer that doesn't accept it directly, you can use a cryptocurrency debit card, such as BitPay in the US.

Legal Tender Status was pioneered by El Salvador. In 2021, El Salvador adopted it as legal tender. This historic decision demonstrated Bitcoin's potential role in national monetary systems.

Crisis Response and Fundraising highlighted Bitcoin's utility during emergencies. In early 2022, during the Canadian trucker protests opposing COVID-19 vaccine mandates, organizers turned to bitcoin to receive donations after traditional financial platforms restricted access to funding, with proponents highlighting bitcoin's use as a tool for fundraising in situations where access to conventional financial systems may be restricted.

Institutional Treasury Management has emerged as major corporations add Bitcoin to their balance sheets as a hedge against currency debasement and inflation.

Bitcoin Institutional Adoption & Corporate Holdings

Institutional adoption has transformed Bitcoin from a niche digital currency to a mainstream financial asset. In 2020, some major companies and institutions started to acquire bitcoin: MicroStrategy invested $250 million in bitcoin as a treasury reserve asset, Square, Inc., $50 million, and MassMutual, $100 million, and in November 2020, PayPal added support for bitcoin in the US.

Corporate Treasury Adoption began with forward-thinking companies recognizing Bitcoin's potential as a treasury reserve asset. MicroStrategy led this trend by converting significant portions of their cash reserves to Bitcoin, citing currency debasement concerns and Bitcoin's superior long-term value retention properties.

Payment Platform Integration brought Bitcoin to mainstream users. PayPal's adoption allowed millions of users to buy, sell, and hold Bitcoin through a familiar interface. This development significantly increased Bitcoin's accessibility and legitimacy among traditional consumers.

Traditional Financial Services increasingly offer Bitcoin-related products. Major banks now provide custody services, investment products, and trading platforms for institutional clients. Firms like Fidelity, BlackRock, and JPMorgan have developed Bitcoin-focused services.

ETF Approval and Trading marked a significant milestone. In January 2024, the first 11 US spot bitcoin ETFs began trading, offering direct exposure to bitcoin for the first time on American stock exchanges. These ETFs democratized Bitcoin access for traditional investors and retirement accounts.

Insurance and Custody Solutions have matured to institutional standards. Professional custody services now offer insurance coverage, regulatory compliance, and institutional-grade security for large Bitcoin holdings.

Regulatory Clarity continues improving in major jurisdictions, encouraging further institutional participation. Clear regulatory frameworks reduce uncertainty and enable institutions to develop compliant Bitcoin-related products and services.

Future Institutional Trends point toward deeper integration of Bitcoin into traditional financial systems, with central banks exploring Bitcoin reserves and more corporations adopting Bitcoin treasury strategies.

Bitcoin Partnership Network & Integrations

Bitcoin's ecosystem thrives through a vast network of partnerships spanning technology companies, financial institutions, payment processors, and infrastructure providers. These collaborations expand Bitcoin's utility and accessibility while maintaining its decentralized nature.

Exchange Partnerships connect Bitcoin to global liquidity markets. Major cryptocurrency exchanges collaborate with traditional financial institutions to provide fiat on-ramps, regulatory compliance, and professional trading infrastructure. These partnerships enable seamless conversion between Bitcoin and traditional currencies.

Payment Processor Integrations allow merchants to accept Bitcoin payments while receiving settlement in their preferred currency. Companies like BitPay, CoinGate, and Strike provide merchant services that handle Bitcoin transactions, currency conversion, and compliance requirements.

Wallet Integrations create seamless user experiences across platforms. Popular wallets integrate with exchanges, DeFi protocols, and payment services to provide comprehensive Bitcoin management solutions. These partnerships reduce friction and improve user adoption.

Lightning Network Ecosystem continues expanding through partnerships between wallet providers, exchanges, and payment processors. This second-layer network enables instant, low-cost Bitcoin transactions for everyday payments and micro-transactions.

Financial Services Partnerships bring Bitcoin to traditional banking customers. Partnerships between fintech companies and established banks enable Bitcoin trading, custody, and investment services through familiar interfaces and trusted brands.

Infrastructure Partnerships support Bitcoin network security and accessibility. Mining pool collaborations, node hosting services, and blockchain data providers work together to maintain network health and provide reliable access to Bitcoin services.

Cross-Chain Partnerships enable Bitcoin interaction with other blockchain ecosystems. Bridge protocols, wrapped Bitcoin services, and inter-chain communication tools expand Bitcoin's utility beyond its native blockchain.

These partnerships demonstrate Bitcoin's growing integration into the broader financial ecosystem while preserving its core decentralized principles.

Bitcoin Developer Activity & Community Growth

Bitcoin's development ecosystem represents one of the most active and diverse open-source projects in the world. The community includes core protocol developers, application builders, researchers, educators, and users who collectively drive Bitcoin's evolution.

Core Development Activity remains robust with hundreds of contributors working on Bitcoin Core, the primary Bitcoin software implementation. Development follows a rigorous peer review process with extensive testing and consensus-building before implementing changes.

Bitcoin Improvement Proposals (BIPs) provide a formal process for proposing and discussing protocol improvements. This system ensures changes are thoroughly evaluated and achieve broad consensus before implementation, maintaining Bitcoin's stability and security.

Research Community actively explores Bitcoin's economics, security, privacy, and scalability. Academic institutions, research organizations, and independent researchers publish papers and analysis that inform Bitcoin's development direction.

Educational Initiatives have expanded significantly, with organizations like Bitcoin.org, Bitcoin Magazine, and numerous educational platforms providing resources for developers, users, and institutions. These efforts improve Bitcoin literacy and adoption.

Developer Funding has evolved through various mechanisms including corporate sponsorship, grant programs, and donation-based funding. Organizations like Chaincode Labs, Square Crypto (now Spiral), and the Human Rights Foundation support Bitcoin development.

Global Community Growth spans all continents with local Bitcoin communities organizing meetups, conferences, and educational events. As of June 2023, River Financial estimated that bitcoin had 81.7 million users, about 1% of the global population.

Open Source Ecosystem includes not just Bitcoin Core but hundreds of related projects including wallets, explorers, analytical tools, and infrastructure software. This diverse ecosystem strengthens Bitcoin's overall resilience and utility.

The community's commitment to decentralization, open development, and consensus-driven change continues attracting talented developers and researchers worldwide.

Bitcoin Cross-Chain Compatibility & Interoperability

Bitcoin's interoperability with other blockchain networks has expanded significantly through various technological solutions that maintain Bitcoin's security properties while enabling cross-chain functionality.

Wrapped Bitcoin (WBTC) represents one of the most successful cross-chain solutions, allowing Bitcoin holders to participate in Ethereum's DeFi ecosystem. WBTC maintains a 1:1 peg with Bitcoin through a custodial model involving trusted institutions and smart contracts.

Atomic Swaps enable trustless exchanges between Bitcoin and other cryptocurrencies without intermediaries. These cryptographic protocols allow users to trade directly between different blockchains using hash time-locked contracts (HTLCs) that ensure either both parties receive their funds or both transactions are cancelled.

Lightning Network Interoperability extends beyond Bitcoin to other compatible networks. The Lightning Network protocol can theoretically support multiple assets and cross-chain payments, enabling instant value transfer between different cryptocurrency networks.

Sidechains and Pegged Systems allow Bitcoin to interact with specialized blockchain networks while maintaining connection to the main Bitcoin blockchain. Solutions like Liquid Network provide faster settlement times and additional features while using Bitcoin as the underlying asset.

Bridge Protocols facilitate Bitcoin movement between different blockchain ecosystems. These solutions range from centralized bridges operated by trusted entities to more decentralized protocols using multi-signature schemes and smart contracts.

Cross-Chain Lending and DeFi platforms enable Bitcoin holders to earn yield without selling their Bitcoin. These services allow users to collateralize their Bitcoin holdings to access liquidity or earn interest while maintaining Bitcoin exposure.

Future Interoperability Developments include more advanced cross-chain protocols, improved decentralized bridges, and enhanced Lightning Network functionality that could further expand Bitcoin's utility across multiple blockchain ecosystems.

These interoperability solutions expand Bitcoin's utility while users can maintain exposure to Bitcoin's unique monetary properties and security characteristics.

Bitcoin Environmental Impact & Sustainability

Bitcoin's environmental impact has become a significant discussion point as the network's energy consumption has grown alongside its adoption and value. Understanding both the challenges and ongoing solutions provides a balanced perspective on Bitcoin's sustainability.

Energy Consumption Reality shows Bitcoin mining currently consumes substantial electricity. Studies show that Bitcoin mining alone consumes an estimated 0.1 to 10 GW of energy, exceeding the average electricity consumption of Ireland, which stands at 3 GW. Some estimates suggest that Bitcoin mining consumes more energy than entire countries.

Renewable Energy Adoption in Bitcoin mining has increased significantly. Mining companies are exploring renewable energy sources such as solar and hydroelectric power to reduce PoW's environmental impact. Many mining operations now utilize stranded energy sources that would otherwise be wasted, such as excess renewable energy or natural gas that would be flared.

Energy Efficiency Improvements continue through technological advancement. Newer ASIC miners provide more computational power per unit of energy consumed, while mining operations optimize their infrastructure and cooling systems to reduce overall energy usage.

Incentive Structure for Clean Energy emerges from miners seeking the lowest-cost electricity sources. This economic pressure often leads mining operations to renewable energy sources and helps finance renewable energy infrastructure development in remote locations.

Comparative Analysis with traditional financial systems reveals Bitcoin's energy use must be considered in context. Traditional banking systems, including branches, ATMs, data centers, and payment processing infrastructure, also consume significant energy, though precise comparisons remain challenging due to different accounting methodologies.

Innovation in Mining Technology includes development of more efficient hardware, improved cooling systems, and integration with renewable energy sources. Some operations use waste heat for other purposes, such as heating buildings or industrial processes.

Future Sustainability Trends point toward continued improvement in energy efficiency, increased renewable energy adoption, and potential development of alternative consensus mechanisms for Bitcoin-based applications while maintaining the main network's proof-of-work security.

The Bitcoin community increasingly recognizes environmental responsibility while balancing security, decentralization, and sustainability considerations.

Bitcoin Governance Model & Decision Making

Bitcoin's governance operates through a unique decentralized consensus model that differs fundamentally from traditional corporate or governmental decision-making structures. This system prioritizes stability, security, and broad consensus over rapid change.

Decentralized Development Process involves multiple stakeholders including developers, miners, node operators, exchanges, and users. Bitcoin's decentralized nature means no single entity controls its issuance or governance, with decisions made through a consensus mechanism involving the global community of miners and nodes. No single party can unilaterally impose changes on the network.

Bitcoin Improvement Proposals (BIPs) provide the formal process for proposing protocol changes. Anyone can submit a BIP, but implementation requires extensive peer review, testing, and community consensus. This process ensures changes are thoroughly vetted and broadly supported before activation.

Consensus Mechanisms for protocol upgrades often use signaling methods where miners indicate support for proposed changes. Soft forks activate when they achieve predetermined support thresholds, while hard forks require near-universal adoption to avoid network splits.

Node Operator Influence plays a crucial role in governance since full nodes validate transactions and enforce protocol rules. While changing protocol rules is possible in theory, it would require the majority of the community to accept these changes, and this is where the nodes come into play, as it's their job to enforce the 21 million limit and it's in their best interest to do so.

Economic Incentives align stakeholder interests with network health. Miners, validators, and users all benefit from a secure, functional network, creating natural resistance to harmful changes. If the miners are only motivated by profit, would they be willing to kill the golden goose, as there is a lack of an incentive to increase the bitcoin supply because it would result in inflation and destroy the core investment thesis for Bitcoin – its scarcity.

Community Discussions occur through various channels including mailing lists, forums, conferences, and social media. These discussions help build consensus and identify potential issues before formal proposal submission.

Conservative Change Philosophy prioritizes backward compatibility and network stability over feature addition. This approach has maintained Bitcoin's reliability and security throughout its evolution, though it sometimes frustrates those seeking faster innovation.

This governance model has successfully maintained Bitcoin's core properties while enabling careful evolution over more than a decade of operation.

Price

+3.85%

(1d)

Popularity

Market Cap

FDV

24h Trading Vol

Circulating Supply

Total Supply

Max Supply

All-Time High

-46.02%

All-Time Low

+100265.41%

Daily Range

What is Bitcoin?

Bitcoin is the first decentralized cryptocurrency, invented in 2008 by the pseudonymous Satoshi Nakamoto. It's a peer-to-peer electronic cash system that allows transactions without financial institutions or third parties. Bitcoin operates on blockchain technology - a distributed public ledger that records all transactions and prevents double-spending.

Who created Bitcoin and why is their identity unknown?

Bitcoin was created by someone using the pseudonym "Satoshi Nakamoto." Their true identity remains one of the biggest mysteries in the cryptocurrency world. Nakamoto was active in Bitcoin's development until December 2010, then disappeared completely. Despite extensive investigations by journalists and researchers, no consensus has been reached about Nakamoto's real identity. Their wallet contains an estimated 1.1 million bitcoins, untouched since 2010.

How do I buy Bitcoin?

You can buy Bitcoin through cryptocurrency exchanges like Coinbase, Kraken, or Binance. The process involves: choosing a reputable exchange, completing identity verification (KYC), funding your account via bank transfer or credit card, and executing your purchase. Traditional brokerages like Fidelity and ETFs also now offer Bitcoin exposure for those preferring familiar platforms.

How do I store Bitcoin safely?

Bitcoin can be stored in "hot" wallets (online, convenient for frequent use) or "cold" wallets (offline, more secure for long-term storage). Popular options include software wallets like Exodus, hardware wallets like Ledger or Trezor, and mobile wallets. Never share your private keys or seed phrases with anyone - losing them means losing access to your Bitcoin permanently.

Why is Bitcoin valuable and limited to 21 million coins?

Bitcoin's value comes from its programmed scarcity and utility. There will only ever be 21 million Bitcoin, creating "absolute scarcity" unlike any physical commodity. New Bitcoin are released through mining, but approximately every four years, the reward for mining is halved. This deflationary mechanism, combined with growing demand, contributes to Bitcoin's value proposition as "digital gold."

What is Bitcoin mining and how does it work?

Mining is the process through which new Bitcoin are created and transactions are validated. Miners use specialized computer hardware (ASICs) to solve complex mathematical puzzles, competing to add new blocks to the blockchain. The first to solve the puzzle receives newly minted Bitcoin plus transaction fees. This process secures the network and maintains the decentralized ledger.

Is Bitcoin secure and can transactions be reversed?

Bitcoin is highly secure due to its cryptographic design and decentralized network. However, transactions are irreversible - once confirmed, they cannot be undone. This means you must verify recipient addresses carefully. The network has never been successfully attacked, though individual wallets and exchanges can be compromised if not properly secured.

How does Bitcoin work technically?

Bitcoin operates on a peer-to-peer network using blockchain technology. When you send Bitcoin, the transaction is broadcast to the network, verified by miners, and recorded in a block. Each block is linked to the previous one through cryptographic hashes, creating an immutable chain. The proof-of-work consensus mechanism ensures all participants agree on transaction history without central authority.

Is Bitcoin legal and how is it regulated?

Bitcoin's legal status varies by country. It's legal in most major economies including the US, Europe, and Japan, though some countries have banned or restricted it. Regulation is evolving, with many jurisdictions developing frameworks for cryptocurrency taxation and compliance. In 2021, El Salvador became the first country to adopt Bitcoin as legal tender, while other nations are exploring similar possibilities.

What happens when Bitcoin mining ends in 2140?

When all 21 million Bitcoin are mined around 2140, miners will only earn transaction fees instead of block rewards. Currently, transaction fees represent about 14% of miner revenue, but this percentage will need to increase to 100% to maintain network security. Higher Bitcoin adoption and transaction volume should theoretically increase fee revenue, but this transition remains one of Bitcoin's long-term uncertainties that the community continues to monitor and plan for.

How do I recover lost Bitcoin or access old wallets?

If you've lost access to Bitcoin, recovery depends on what information you still have. With seed phrases (12-24 words), you can restore access using any compatible wallet. For old wallet files, you need the wallet.dat file and password. Professional recovery services exist for corrupted files or forgotten passwords, though success isn't guaranteed and costs can be high. Unfortunately, if you've completely lost all backup information, Bitcoin recovery is impossible - this affects an estimated 20% of all Bitcoin.

Can I buy just a piece of Bitcoin, or do I need to buy a whole one?

You absolutely don't need to buy a whole Bitcoin! You can buy as little as $1 worth of Bitcoin. One Bitcoin can be divided into 100 million smaller pieces called "satoshis" (like how a dollar has 100 cents). Most people start by buying $20, $50, or $100 worth of Bitcoin. Think of it like buying a slice of pizza instead of the whole pizza - you can own just a tiny fraction and that's perfectly normal.

Is Bitcoin real money that I can actually spend?

Bitcoin is digital money, but it works differently than the cash in your wallet. Some stores and websites accept Bitcoin payments, and you can use special Bitcoin debit cards to spend it anywhere regular cards work. However, most people treat Bitcoin more like digital gold - they buy it hoping it will be worth more later, rather than spending it on daily purchases. It's real value, but not as convenient as regular money for everyday shopping.