AI trading bots, powered by machine learning, data mining, and natural language processing technologies, represent a new generation of trading tools that bring speed, accuracy, and intelligence to financial markets.

These bots can outperform human traders in volatile markets. Some of the top AI Trading Bots include Trade Ideas, Tickeron, Crypto Hopper, Pionex, and others.

Introducing and Comparing the Best AI Trading Robots

Below, we will introduce, analyze, and compare 11 of the best AI Trading Robots:

- Trade Ideas

- Tickeron

- TrendSpider

- CryptoHopper

- Pionex

- Kavout

- Stoic by Cindicator

- Bitsgap

- Quadency

- Algosmith

- Capitalise.ai

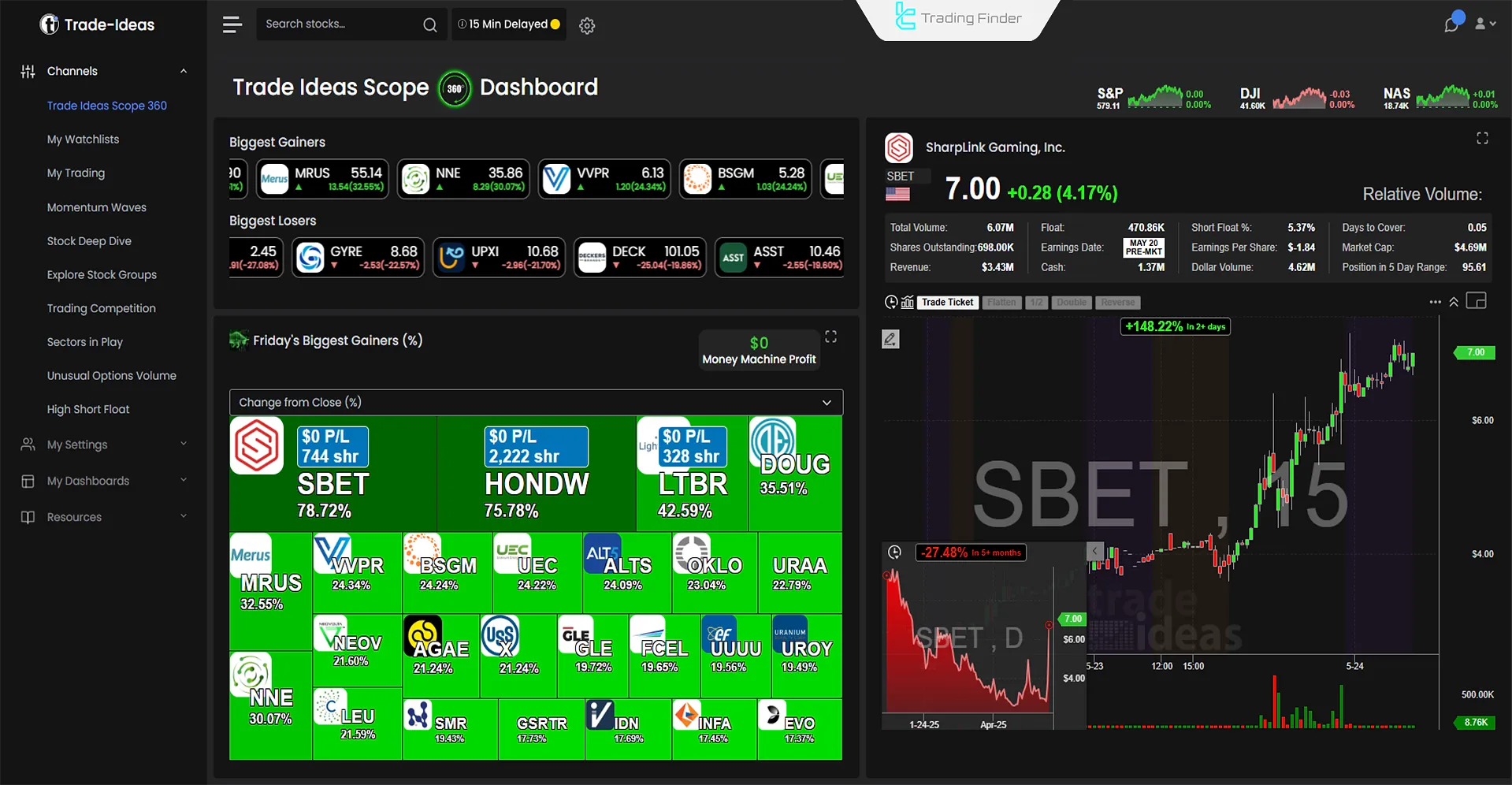

Trade Ideas (Professional AI Trading Bot for U.S. Stock Market)

The Trade Ideas AI Trading Bot is a platform based on machine learning tailored for the U.S. stockmarket.

It tests, filters, and optimizes thousands of trading strategies daily togenerate outputs with defined profit margins and risk.

For a complete review and more detailed information about the Trade Ideas AI trading bot platform, you can refer to the review video of this bot on the Modest Money YouTube channel.

Backtesting capabilities and support for paper trading have made Trade Ideas a suitable tool for traders.

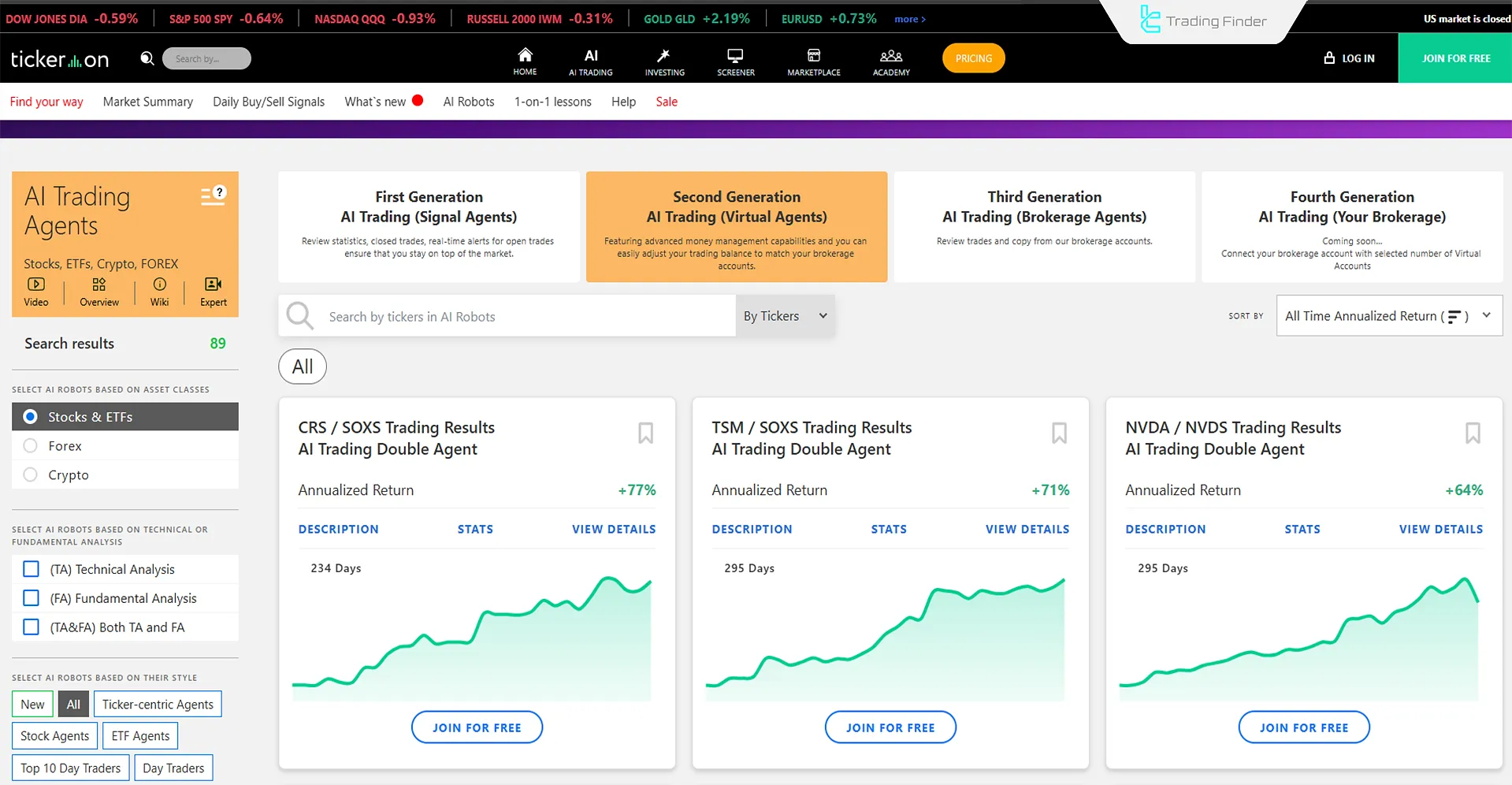

Tickeron (High-Accuracy Predictive AI Bot)

The Tickeron AI Trading Robot generates trading signals with a defined success rate using advanced Technical analysis and deep market prediction models.

It is designed for stock, cryptocurrency, and ETF markets and is ideal for traders who prioritize statistical metrics.

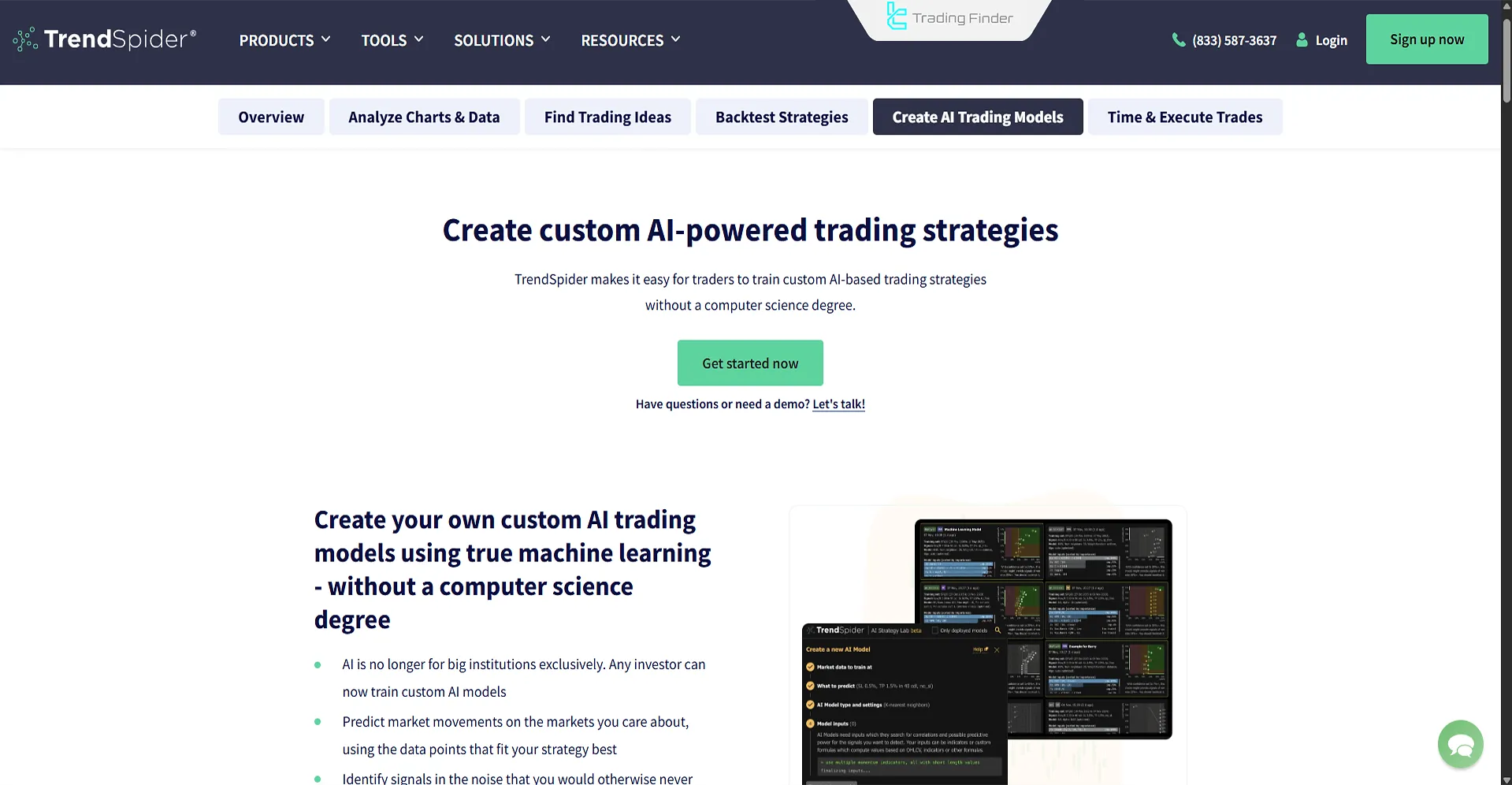

TrendSpider (Advanced Technical Analysis)

The TrendSpider AI Trading Bot offers automated technical analysis using pattern recognition algorithms, trendline drawing, key level detection, and tools like Fibonacci retracement.

With multi-timeframe analysis and real-time alerts, this bot virtually eliminates the need for manual analysis.

CryptoHopper (Cloud-Based AI Trading Robot for Crypto)

As a cloud-based AI Trading Bot, CryptoHopper allows users to connect with multiple exchanges, create custom strategies, and access various signal provider platforms.

Its flexibility in combining indicators and risk management tools makes it a highly effective AI Trading Robot for cryptocurrency traders.

Pionex (Built-in Bot with 16 Free Strategies)

The Pionex AI trading platform offers 16 built-in bots (including Grid, DCA, and Arbitrage), that allow users to run strategies directly within the exchange without requiring an API.

Simple interface, fast execution, and lowfees are key advantages of Pionex.

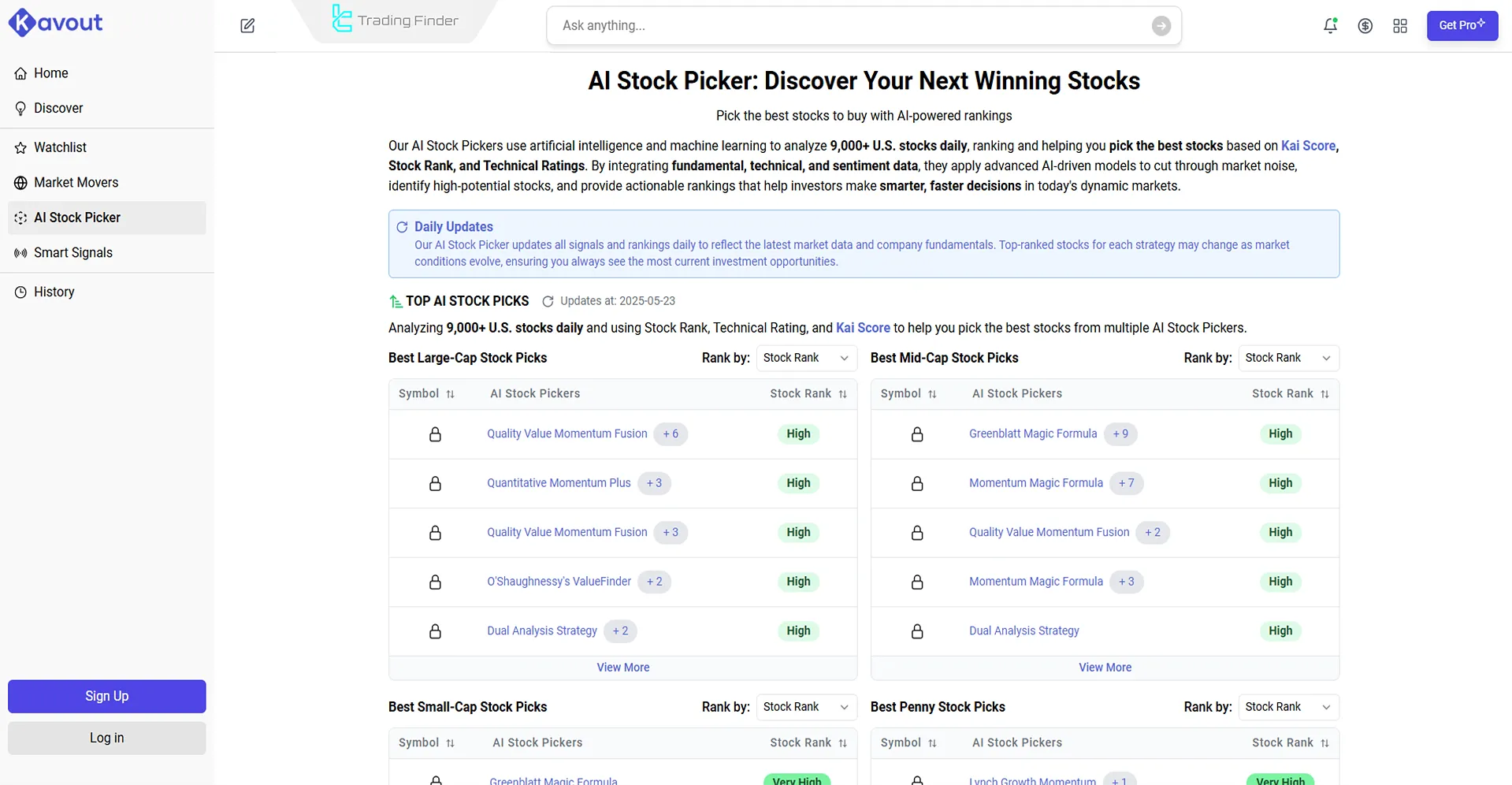

Kavout (AI-Powered Stock Ranking with K-Score)

The Kavout AI Trading Bot merges fundamental, technical, and behavioral data to provide intelligent stock rankings for long-term investors.

Its structure is ideal for portfolio managers and investment funds.

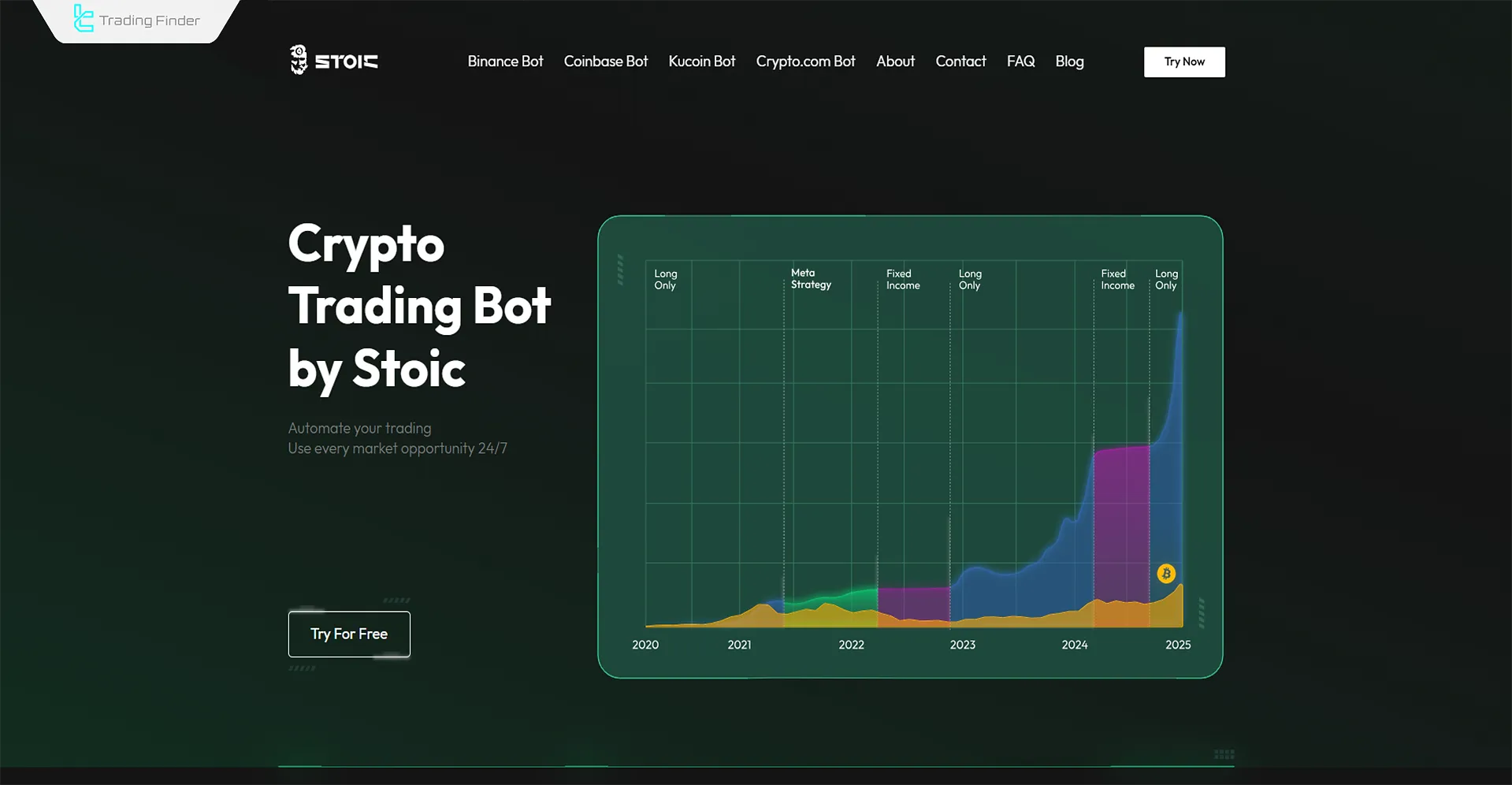

Stoic by Cindicator (Automated Crypto Portfolio Management)

Stoic by Cindicator is an investment tool based on hybrid intelligence (AI + Crowd Intelligence), that automatically manages users’ crypto portfolios on Binance.

It uses a DCA strategy algorithmically to handle daily volatility with minimal risk.

Bitsgap (AI Bot for Simultaneous Spot & Futures Execution)

The Bitsgap AI Trading Bot allows simultaneous execution of spot and futures trades using Grid and DCA strategies.

It supports over 25 exchanges and features a demo mode to test strategies effectively.

Quadency (No-Code Strategy Builder)

The Quadency AI Trading Robot features a user-friendly interface allowing users to create trading strategies without coding.

Besides strategy creation, it offers a range of analytical tools for trading.

Algosmith (Custom AI Bot Builder Platform)

The Algosmith AI Trading Bot enables users to design, test, and run their custom trading systems using AI modules in a cloud environment.

It’s specifically built for algorithmic trading teams and investment firms.

Capitalise.ai (Natural Language Trade Execution)

With Capitalise.ai, traders can define trading commands using natural language without coding. This AI Trading Robot combines NLP and a trading execution engine, ideal for users seeking to simplify complex strategies.

It supports financial markets like forex, stocks, and cryptocurrencies, and allows backtesting based on price action.

Comparison of AI Trading Bots

The table below compares 11 of the best AI Trading Bots across key features:

Bot Name | Free Version | Target Market | Type of AI | Key Feature | Ideal For |

Trade Ideas | No | U.S. Stocks | Machine Learning + Pattern Analysis | Daily signals powered by Holly AI engine | Professional traders |

Tickeron | Yes | Stocks, ETFs, Crypto | Deep Learning + Forecast Models | Success-rate-based signals, AI Robots | Data-driven traders |

TrendSpider | Yes | Stocks, Forex, Crypto | Visual Algorithms + Automated Pattern Detection | Automatic trendlines and dynamic alerts | Technical analysts |

CryptoHopper | Yes | Cryptocurrencies | Rule-Based AI + Strategy Designer | Multi-exchange integration, strategy design, mirror trading | Semi-pro to professional users |

Pionex | Yes | Cryptocurrencies | Grid Strategy AI | 16 built-in free bots, no API required | Beginners to intermediate users |

Kavout | Yes | Global Stocks | Quantitative + Multi-Source Analysis | Stock ranking with data-driven K-Score | Long-term investors |

Stoic | No | Crypto (Binance) | Hybrid Intelligence (AI + Crowd Insights) | DCA-based portfolio management using hybrid intelligence | Passive traders & HODLers |

Bitsgap | Yes | Crypto (Spot+Futures) | Grid + AI Optimization | 25+ exchange integration, simultaneous spot & futures trading | Professional crypto traders |

Quadency | Yes | Cryptocurrencies | Visual Strategy Builder | Strategy creation without coding, portfolio dashboard | New to intermediate users |

Algosmith | Yes | Stocks, Forex, Crypto | Modular AI Engine | Full control over design, testing & execution in the cloud | Algo traders & developers |

Capitalise.ai | Yes | Stocks, Forex, Crypto | NLP + Rule Engine | Natural language trade execution without coding | Beginner traders |

Difference Between AI Trading Bots and Traditional Robots

In today’s fast-paced financial markets with high volatility, massive data flow, and algorithmic competition only trading bots with learning, adaptability, and predictive capabilities can provide a competitive edge.

Based on this, AI Trading Bots clearly outperform traditional bots. The table below highlights the core differences between AI-powered trading robots and traditional systems:

Feature | Traditional Bot | AI Trading Bot |

Logic Engine | Rule-Based | Adaptive Learning (Machine Learning) |

Input Data | Price and indicators | Price, volume, news, sentiment, on-chain data |

Strategy Updates | Manual and developer-dependent | Automated |

Predictive Power | Limited and past-dependent | Future prediction with advanced statistical models |

Pattern Recognition | Only basic patterns and rules | Deep analysis of price and economic patterns |

Performance in Volatile Markets | Vulnerable and often ineffective | Adaptive |

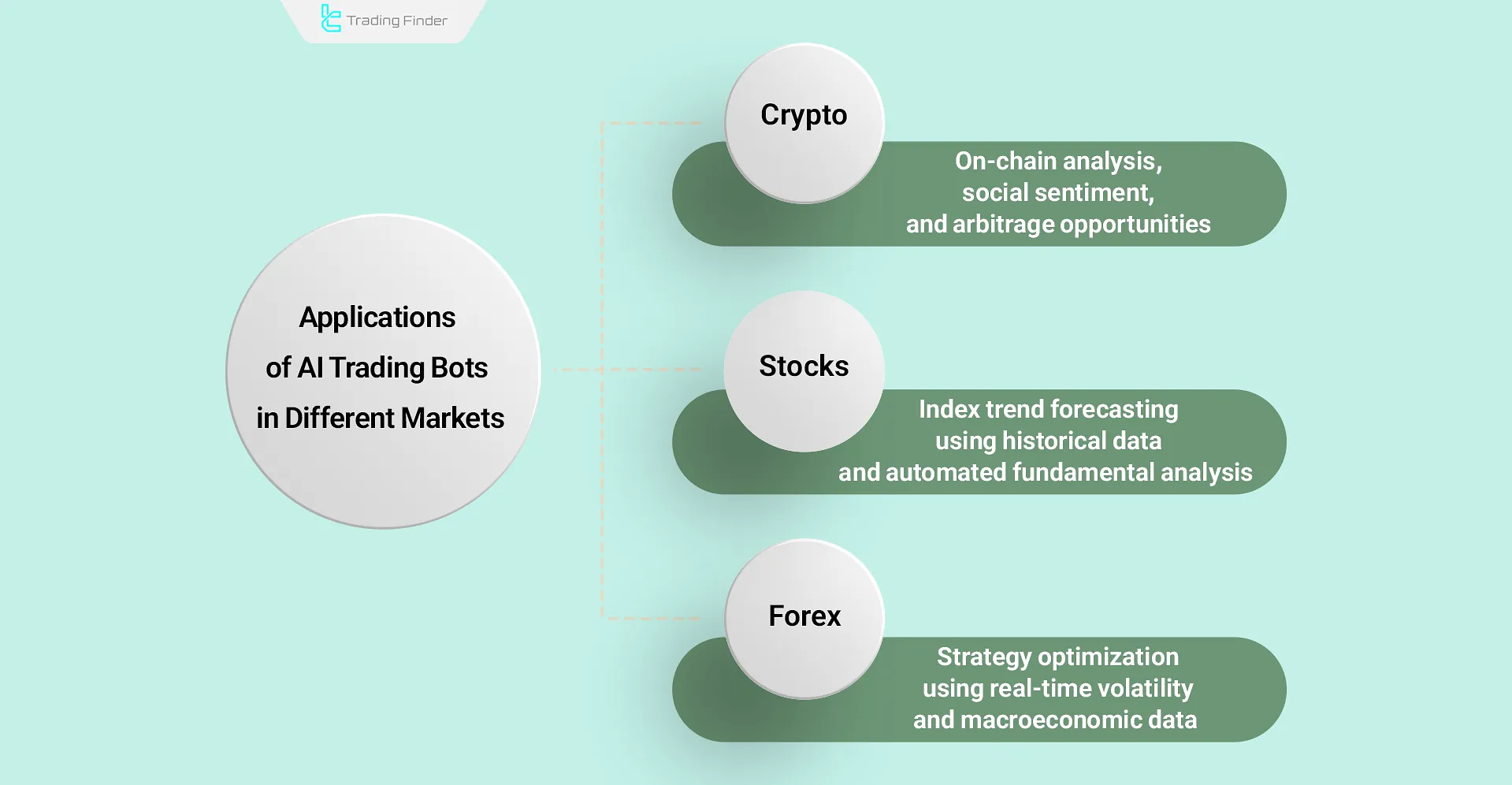

Applications of AI Trading Bots in Different Markets

AI trading bots are no longer limited to the crypto market and provide accurate and compatible performance in the fields of stocks, forex, and commodities as well.

- Crypto Market: On-Chain Analysis, Social Sentiment Evaluation, and Identification of Arbitrage Opportunities;

- Stock Market: Index trend forecasting using Historical Data and Automated Fundamental Analysis;

- Forex Market: Strategy optimization based on Real-Time Volatility and Macro Data.

This cross-market adaptability has made AI bots one of the main engines of transformation in the structure of modern trading.

Examples and Real Cases of AI Trading Bot Performance

To accurately assess the capability of AI trading bots, reviewing documented examples of their performance provides a clearer picture of this technology’s effectiveness.

- Trade Ideas Bot in 2024 recorded an average monthly return of 8.5% for its professional users and, through real-time market data analysis, significantly improved the success rate of trades;

- Pionex Bot, by executing an AI Arbitrage Strategy, generated an average monthly return of 3–5% without the need for manual intervention or adjustments.

Such examples demonstrate that AI bots, when supported by precise data and intelligent risk management frameworks, can become an effective and realistic tool within the modern trading portfolio.

Advantages and Disadvantages of Using Smart Trading Bots in Financial Markets

Speed, accuracy, data analysis, risk management, and strategy optimization are key advantages of using AI Trading Bots, making them suitable for both beginners and professional traders. Below is a detailed list of pros and cons:

Advantages | Challenges |

Faster execution than humans | Potential API errors in various conditions |

Continuous, multi-source data utilization | Heavily dependent on data quality |

Self-adaptive to market conditions | Possibility of Incorrect Learning |

Immune to fear and greed | Possibility of trade execution errors |

Lower long-term human resource costs | High subscription fees |

Risks and Limitations of AI Trading Bots

Despite their high accuracy and impressive execution speed, AI trading bots are not without risks and require careful evaluation:

- High dependence on data: If the input data is incomplete or manipulated, the model may make incorrect decisions, leading to analytical distortion;

- Risk of Overfitting: When a model is overtrained on historical data, its performance in real market conditions declines;

- API Security Risks: Incorrect configuration or weak protection of API keys can expose accounts to intrusion or misuse;

- Fraud and fake projects: It is essential to verify a platform’s credibility, licenses, and developer background before using it.

Awareness-based risk management defines the boundary between professional use of technology and exposure to the high-risk space of automated trading.

AI Trading Connection Expert for MetaTrader

The AI Trading Connection Expert in MetaTrader is a specialized tool for analyzing financial markets using artificial intelligence.

This expert advisor establishes a direct connection between the trading platform and advanced language models such as ChatGPT by OpenAI and Claude by Anthropic, providing real-time analysis of technical and fundamental data with precise text-based feedback.

- Download AI Trading Connection Expert for MetaTrader 5

- Download AI Trading Connection Expert for MetaTrader 4

This system acts as an intelligent analytical assistant, capable of interpreting forex, crypto, and stock market trends, identifying key price levels, and explaining the impact of economic news. Its function is purely analytical and does not execute any trading orders automatically.

The expert connects to AI model APIs via the HTTP protocol and WebRequest function in MetaTrader. By entering an analytical prompt, the user sends their request to the selected model and receives a text response from ChatGPT or Claude in the output window.

To establish the connection between the expert and AI models, the WebRequest feature must be enabled.

From the Tools menu, select Options, then Expert Advisors, and finally activate Allow WebRequest for listed URL.

Then enter the following URLs:

Click OK to save changes. Also, to use ChatGPT or Claude, enter the corresponding API key in the Inputs section:

Select the desired model (such as gpt-4 or claude-opus), input the token, and save the settings.

After running the expert on the chart, activate Allow DLL Imports and Allow WebRequest.

Type your analytical prompt and click Send to receive the model’s response in the Output section.

The output may include technical analysis of currency pairs, crypto market structure evaluations, or fundamental analysis. The technical specifications of this tool include:

- Platform: MetaTrader 4 and 5

- Tool Type: Expert Advisor (EA)

- Category: Artificial Intelligence and Machine Learning Indicators

- Skill Level: From beginner to professional

- Markets: Forex, Cryptocurrency, Stocks

- Timeframes: Supports multi-timeframe analysis

The AI Trading Connection Expert bridges AI analysis and human decision-making within MetaTrader.

By leveraging the power of ChatGPT and Claude, this tool provides a modern method for interpreting market data and making informed trading decisions.

Risk Management in AI Trading Bots

One of the main advantages of AI trading bots is their ability to perform multidimensional risk analysis.

These bots dynamically adjust Stop Loss and Take Profit levels by simultaneously processing price data, trading volume, and historical volatility to maintain a balance between risk and reward.

For detailed guidance on configuring AI trading bots for risk management, refer to the article “AI Trading Bot Risk Management Settings Tutorial” on the 3commas.io website.

Additionally, platforms such as Stoic and Bitsgap use Hybrid AI Algorithms to manage extreme market volatility and minimize capital drawdown in high-risk conditions.

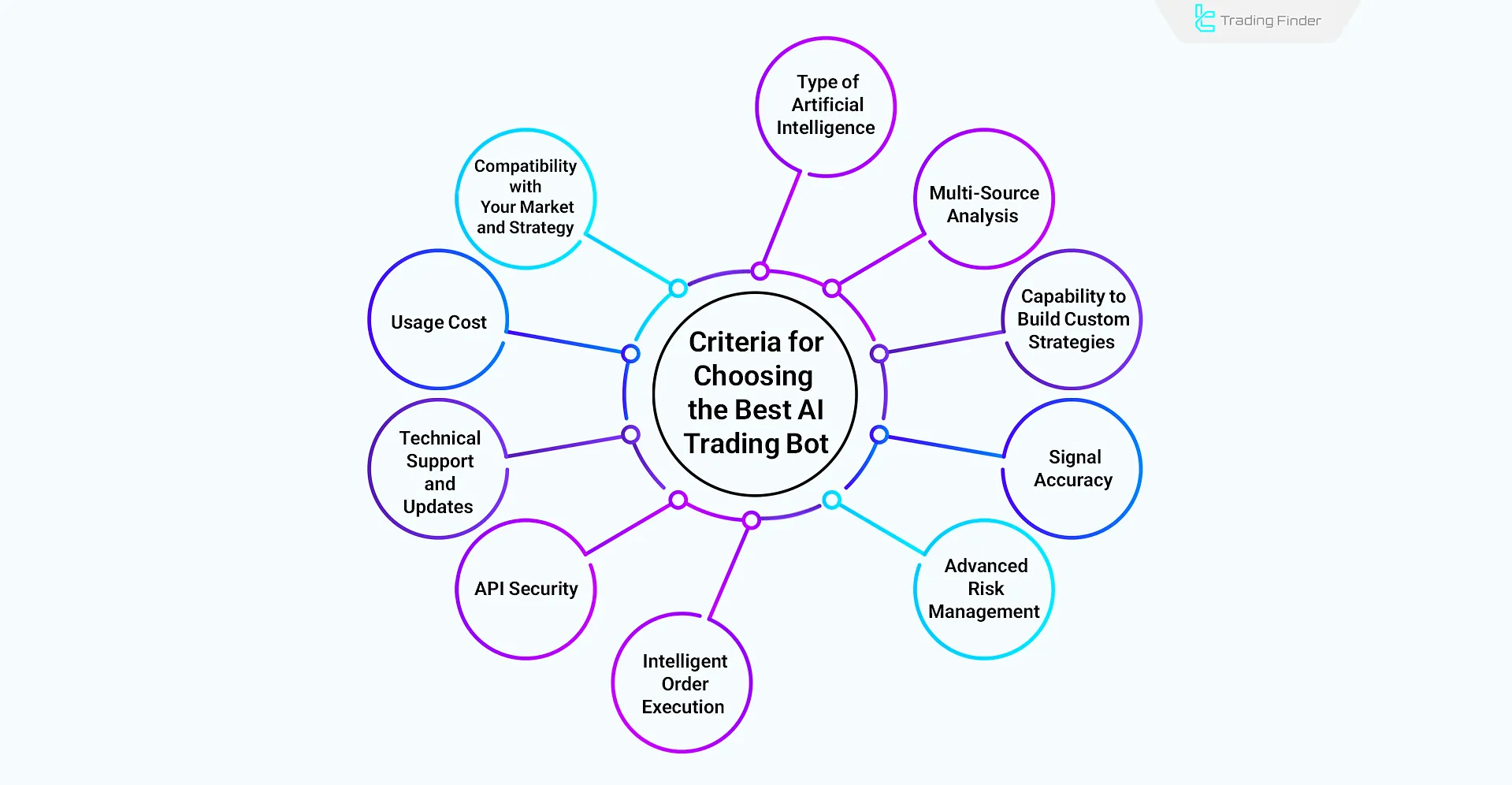

Criteria for Choosing the Best AI Trading Bot

Selecting the best AI Trading Bot requires careful evaluation of a range of technicalparameters, outlined below:

- Type of AI: Use of Machine Learning or advanced models like LSTM and GPT

- Multi-source Analysis: Ability to process news, market sentiment, and on-chain data

- Custom Strategy Builder: Option to create personal strategies without coding or with visual tools

- Signal Accuracy: Availability of real profit/loss ratios and verified performance reports

- Professional Risk Management: Support for trailing stop-loss, position sizing, and loss limits

- Smart Order Execution: High-speed and low-slippage order fulfillment

- API Security: Secure exchange connection and restricted bot permissions.

- Technical Support & Updates: Access to active development teams and responsive support

- Cost Efficiency: Fair subscription pricing or profit-sharing models aligned with bot features

- Market & Strategy Compatibility: Must align with your target market (crypto, forex, stocks) and trading style

Legal Framework and Considerations for Using AI Trading Bots

The use of AI trading bots is legal in most countries, provided that their operation is transparent, auditable, and compliant with regulatory requirements.

Users must ensure that the bot adheres to the brokerage or exchange’s guidelines and that personal data is protected with secure encryption such as SSL or AES-256.

International regulatory bodies emphasize the importance of transparency in algorithmic decision-making, the use of reliable data, and the prevention of market manipulation.

Using unlicensed or anonymous bots may lead to data exposure, capital loss, and violations of financial laws.

Table of Legal Considerations and Security Requirements for AI Trading Bots:

Parameters | Legal Considerations | Security Requirements | Professional Recommendation |

Algorithmic Transparency | Mandatory auditability and prevention of market manipulation | Logging of decisions and transactions | Use of Explainable AI models |

Compliance with AML/KYC | Adherence to Anti-Money Laundering and Know Your Customer regulations | User identity verification and transaction monitoring | Connection to officially licensed exchanges |

Data Protection | Compliance with GDPR and domestic privacy regulations | Strong encryption (AES-256/SSL) | Local storage and API access restriction |

Licensing and Legal Supervision | Activity license required from financial authorities | Performance reporting and ongoing monitoring | Operate under a regulated broker or licensed exchange |

Systemic Risk Control | Compliance with volatility limits and prevention of market distortion | Stress testing and trade volume limitation | Define Stop Loss and maintain human oversight |

Key and Access Management | Full responsibility for maintaining API keys | Encryption and two-factor authentication (2FA) | Use of hardware wallets or secure environments |

Data Quality and Information Sources | Use of reliable and verified data sources | Validation and monitoring of inputs | Connect only to official exchange APIs |

The Future of AI Trading Bots

The next generation of trading bots will be built upon Reinforcement Learning and Generative Models such as GPT.

These bots will not be limited to decision-making but will possess the ability to create new strategies and continuously retrain based on global market developments.

Combining these technologies with Sentiment Analysis and Macro Data will pave a new path in the evolution of automated trading aiming to create systems that simultaneously embody intelligence, adaptability, and a true understanding of market behavior.

Conclusion

AI Trading Bots combine Machine Learning, financial data analysis, and automated execution to deliver performance that surpasses human capabilities.

Based on target markets, algorithms, and specialized features, each Trading robot with AI offers unique value.

This article reviewed the essential criteria such as security, accuracy, and strategy customization for selecting the most suitable AI Trading Robot.