The crypto market operates 24 hours a day, 7 days a week. However, price volatility varies depending on trader activity during different hours and days.

Several factors, such as overlapping sessions of global markets or the daily candle close time, influence trading volume in the cryptocurrency hours.

Difference Between Crypto Market Hours and Other Markets

Traditional markets such as Forex market are only active during business days. In contrast, crypto hours are continuous, with trading possible at any time.

Despite its uninterrupted nature, the crypto market hours show varying levels of activity depending on factors such as liquidity, market sentiment, and major news events.

In the educational article on cryptocurrency market hours published by Forex.com, the reason behind the market’s 24-hour activity is explained. This feature makes the crypto market hours practically continuous, allowing traders to buy and sell at any time of the day or night.

What is the zero hour of the cryptocurrency market?

Unlike Forex or stocks, the closing time of the cryptocurrency market is automatically adjusted based on Coordinated Universal Time (UTC).

The zero hour, or the moment when a new daily candle begins, usually falls between 12:00 and 01:00 a.m. UTC. During this period, which corresponds to the crypto trading timing, many daily trading strategies are reactivated.

At this point, which technically represents both the crypto market close time and its reopening, the previous candle closes and a new one opens. Sudden price fluctuations and high spreads are common during this phase.

Most professional traders avoid entering the market at this time to stay away from random price movements at the start of the new trading day.

If your strategy is based on daily candle analysis, paying attention to the zero hour or the crypto trading time of your chosen exchange is highly important.

Peak Trading Hours in the Crypto Market

Cryptocurrency trading volume tends to surge in parallel with global market hours. Most of crypto transactions take place between Monday and Friday, aligning with the business days of other global markets.

During the day, trading volume typically increases during major trading sessions.

This increase often begins with the opening of the London session and peaks during the overlap between the London and New York sessions.

Time Zone Differences Between Exchanges in Crypto Trading

Each digital exchange operates based on its own time zone. For example, Binance follows Coordinated Universal Time (UTC), while exchanges such as KuCoin or Bybit may set their server time to a different region.

If you use multiple platforms simultaneously for market analysis, it is recommended to set all their time zones to UTC so that the candles close at the same moment. This ensures that crypto trading times remain synchronized across analyses, minimizing analytical errors.

Differences in time settings among exchanges can cause discrepancies in candle analysis, trading volume, and technical signals. Synchronizing the time zone prevents such analytical mistakes and enhances the overall accuracy of cryptocurrency market timing.

Best Time to Trade Cryptocurrencies

To determine the best time for crypto trading, it’s essential to first define your trade duration.

The importance of choosing the right cryptocurrency hours depends on whether the trade is short-term or long-term.

On the CoinDesk YouTube channel, the best time to trade crypto has been visually explained in detail:

Best Time for Short-Term Crypto Trading

For short-term trades, factors like volatility and liquidity play a critical role. It’s preferable to trade during hours when the market is at peak liquidity and volatility.

Usually, this happens during the overlap of the London and New York sessions, which marks the most active period for crypto trading.

However, if you lack experience, it’s better to trade during hours with lower volatility, when price movements are more rational.

After the New York session ends, the crypto market hours typically calm down, offering a better environment for beginners.

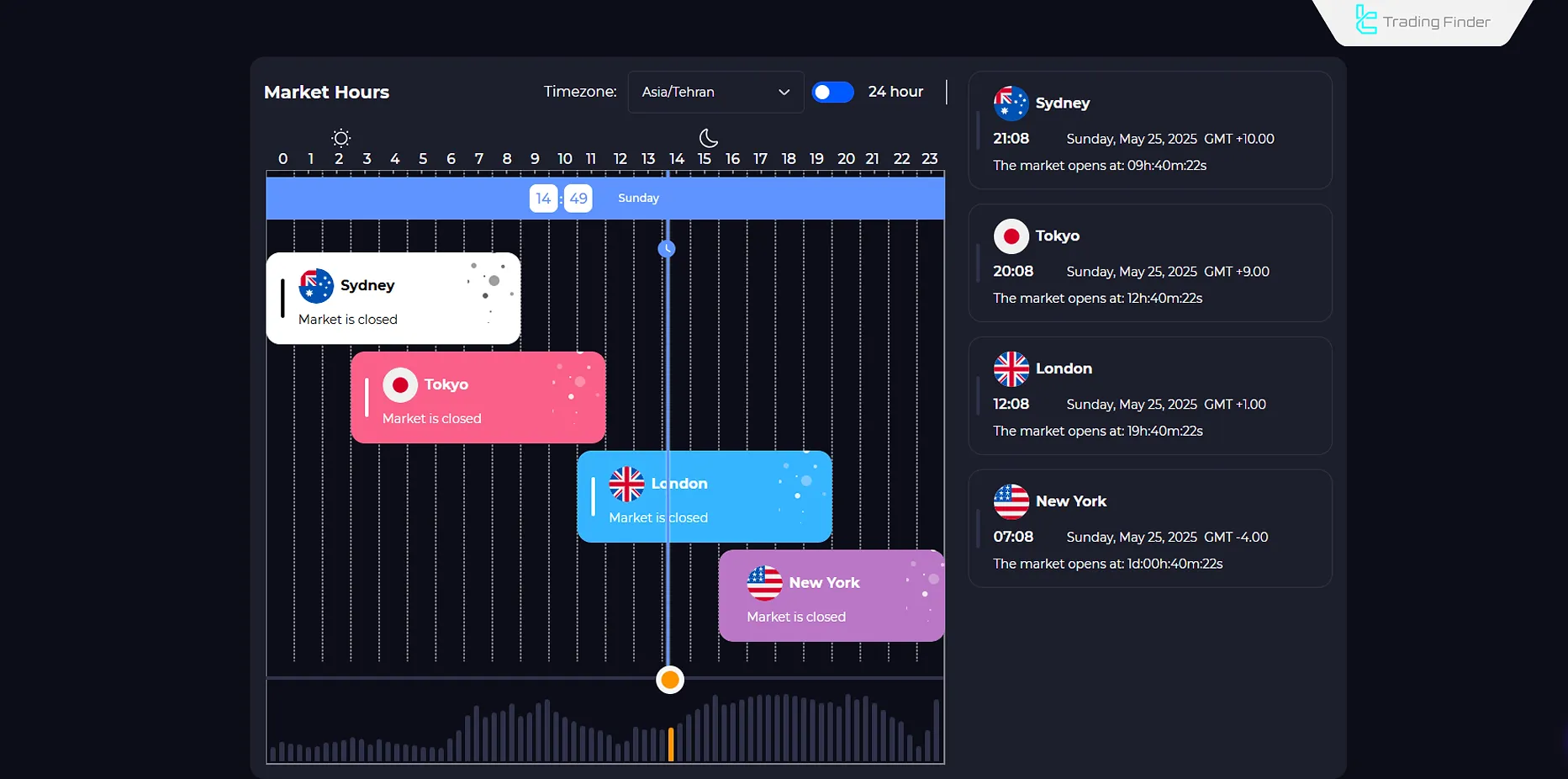

Note: You can track trading sessions using a Trading sessions tool.

.

On weekends (Saturday and Sunday), when global markets are closed, volatility decreases, providing a calmer environment for novice traders.

Best Time for Long-Term Crypto Trading

In long-term strategies, timing analysis is less critical compared to short-term trades. Instead, fundamental analysis and technical analysis become more significant.

Still, due to the cyclical nature of crypto market hours, it’s possible to identify patterns such as Classic Patterns for long-term entries.

For instance, as Bitcoin’s halving approaches, the market often trends downward, followed by bullish sentiment closer to the halving date.

Also, nearing the end of each calendar month, the trend of the previous month often ends or reverses.

Best Days of the Week to Trade Cryptocurrencies

In general, identifying the best crypto market hours involves analyzing volume, volatility, and liquidity. Typically, Mondays and Tuesdays see higher trading volume than other days.

For example, on Fridays, a significant economic report like Non-Farm Payrolls (NFP) may be released, directly impacting volatility and volume.

Best Time to Trade Altcoins

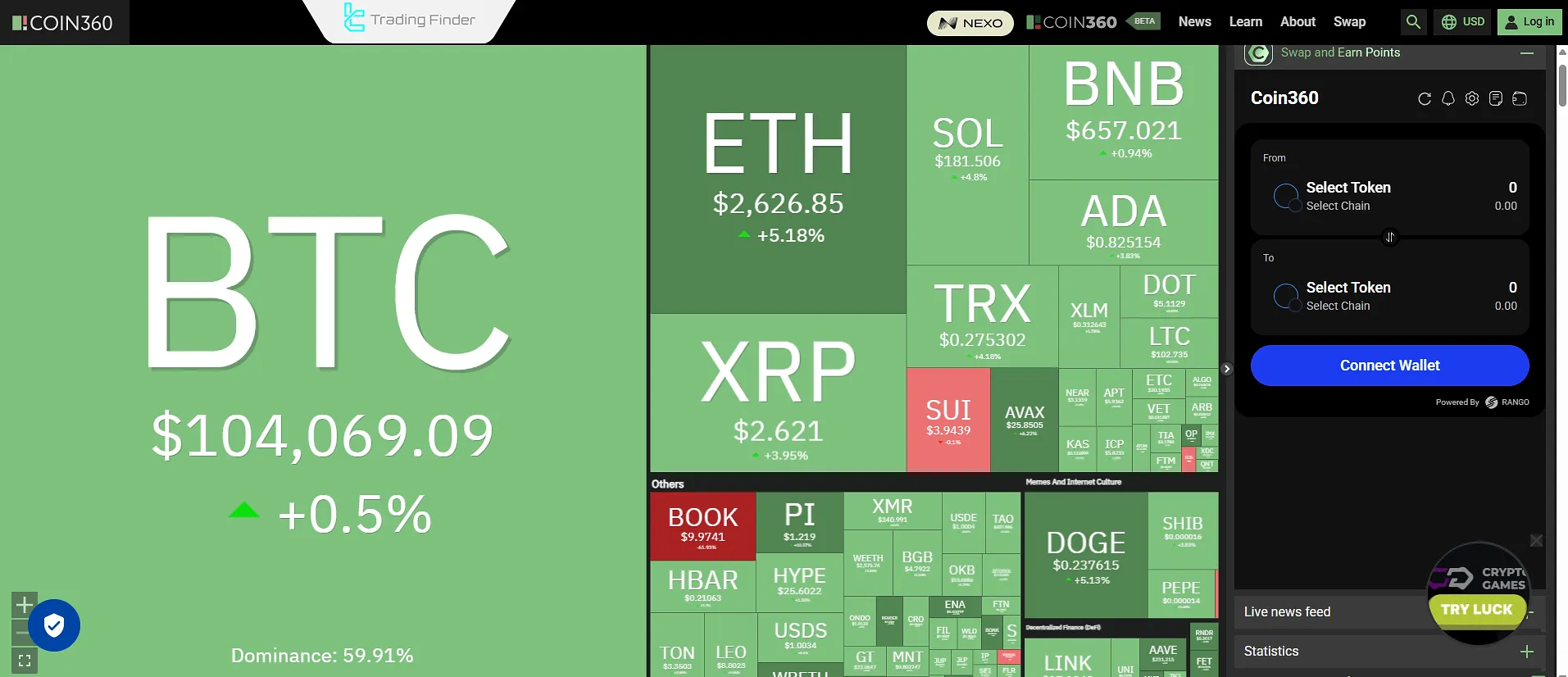

Since Bitcoin (BTC) dominates the crypto market, its trading volume usually surpasses the altcoins.

However, during Altseason, this changes. Traders shift focus to altcoins, significantly increasing their trading volume.

This increase in volume and volatility during Altseason, creates favorable conditions for trading altcoins.

Best Time to Trade Spot and Futures

In the crypto market, trader activity peaks during the overlap of the London and New York sessions. Between approximately 4:00 p.m. and 1:00 a.m. UTC, trading volume reaches its highest level and market liquidity increases.

These hours are generally recognized as the best times to trade crypto.

- Ideal time for futures trading: This period is highly suitable for futures, scalping, and high-volatility strategies, as price slippage is lower and market reactions are faster. This directly enhances the overall timing of the crypto market;

- Ideal time for spot trading: In contrast, for spot trades, timing plays a smaller role, and the main focus should be on technical analysis and maintaining stop-loss discipline.

Understanding these differences helps traders stay active during the hours considered the best time of day to trade crypto and use the quieter periods for analysis or capital management.

Using Fear and Greed Index to Find the Best Time to Trade

Trader sentiment, especially fear and greed, greatly influences market volume. Higher greed typically leads to increased trading volume and more active markets.

Interestingly, during periods of intensified fear, volume may also increase.

Reviewing the Fear and Greed Index on CoinMarketCap provides the opportunity to analyze the overall sentiment and condition of the market.

Why Choosing the Right Time Matters in Crypto Trading

Trading volume directly affects how analyzable a price chart is. By choosing the optimal crypto hours, you can reduce trading risks and improve your win rate.

Although the crypto market hours are always open, analytical methods don’t work equally well at all times. Poor timing in analysis can lead to inaccurate predictions and unsuccessful trades.

Real Example of Market Volatility at Different Hours of the Day

To better understand the impact of trading hours on market volatility, consider trading the BTC/USDT pair on a Monday:

- Asian session opening: The market is relatively calm, trading volume is low, and price changes are limited. During this period, the market usually lacks a clear trend, and most analysts wait for the European session to open. This interval is known in many sources as one of the crypto market times with the least activity;

- London session start: Trading volume increases, liquidity rises, and technical signals become more reliable. Many short-term traders open positions during these hours, which are often considered the best time for crypto trading;

- London and New York overlap: This is the peak of market volatility. U.S. economic data is released, and the market reacts quickly. There are great opportunities for scalping or short-term trades, but the risk level is high. This period is ideal for reviewing performance and adjusting strategies for the next day and reflects the changes in crypto market timings;

- New York close and Asia open: The market enters a resting phase with reduced volatility. This period is usually suitable for reviewing performance and adjusting next-day strategies, as crypto market trading hours reach their transitional phase.

Due to the lack of weekends or specific opening hours in the cryptocurrency market, identifying peak trading times is essential. Understanding cryptocurrency trading times helps traders operate during periods of higher liquidity and more predictable price movements.

Table: Comparison of Cryptocurrency Market Volatility in Different Trading Sessions

Trading Session | Start Time (UTC) | End Time (UTC) | Main Market Feature | Volatility Level |

Asia Session (Tokyo) | 00:00 | 09:00 | Calm movements, suitable for analysis | Low |

Europe Session (London) | 08:00 | 17:00 | Rising trading volume and range breakouts | Medium to High |

U.S. Session (New York) | 13:00 | 22:00 | Highest volatility and liquidity | High |

London & New York Overlap | 13:00 | 17:00 | Peak trading volume and scalping opportunities | Very High |

These data are highly useful for precise analysis of cryptocurrency market time and for deciding when to enter the market.

Fear and Greed Index in TradingFinder

The TradingFinder Crypto Fear and Greed Index measures the overall sentiment of cryptocurrency traders from 0 to 100, combining various data to illustrate the market’s psychological condition.

In addition to displaying the current Fear and Greed level for Bitcoin and other cryptocurrencies, it provides details about total market capitalization, 24-hour changes, and the dominance of Bitcoin and Ethereum.

This index helps users identify high-risk or low-risk market moments based on crypto market hours and trading volume fluctuations.

The Fear and Greed Index is divided into five ranges: 0–19 indicates extreme fear, 20–39 shows normal fear, 40–59 reflects neutrality, 60–79 represents increasing greed, and 80–100 signals extreme market FOMO.

This index serves as an effective tool for determining optimal entry or exit times because when the market shows extreme fear, it often creates good buying opportunities, while high greed levels usually precede price corrections.

In fact, knowing the best time to trade Bitcoin along with the Fear and Greed Index gives traders a clearer market perspective.

The final value of the Fear and Greed Index for Ethereum or other cryptocurrencies is calculated using these weightings: market volatility (25%), trading volume and momentum (25%), Google search trends (10%), social media activity (15%), online surveys (15%), and Bitcoin dominance (10%).

Using this index alongside other analytical tools in TradingFinder helps traders understand market sentiment, refine strategies, and avoid emotional decisions.

Regularly monitoring the Fear and Greed Index allows better risk management, more logical stop-loss placement, and avoidance of premature entries or exits during emotional market phases.

This index is one of the key behavioral tools for analyzing crypto market sentiment, and when combined with technical analysis, it provides a comprehensive view of price movements.

It also serves as a reliable indicator for identifying the best days to trade cryptocurrency, as extreme fear often signals buying opportunities while excessive greed increases correction risks.

Comparison Between Crypto and Forex Market Hours

In the Forex market, trading occurs within four defined sessions (Sydney, Tokyo, London, and New York), and the market closes on weekends. In contrast, the cryptocurrency market operates continuously, 24 hours a day, without breaks.

However, there is a time correlation between the two markets particularly during the overlap of the London and New York sessions where liquidity and price movement intensity both increase.

Therefore, understanding crypto market trading hours is essential for analyzing how price movements in the two markets interact.

This correlation helps traders use Forex data to predict cryptocurrency volatility, especially during the release of major macroeconomic indicators such as CPI or Federal Reserve interest rate decisions.

Paying attention to this relationship can help analysts determine when is the best time to trade crypto.

Laguerre Volume Index Indicator for Observing Crypto Market Hours and Trading Activity

The Laguerre Volume Index is an advanced technical analysis tool based on the combination of the Laguerre Filter and Volume Analysis, widely used in crypto trading. Its purpose is to identify overbought and oversold zones and help traders better understand buying and selling power.

Understanding this indicator’s behavior across different crypto market times can enhance the optimization of trading strategies.

The Laguerre Volume Index oscillates between 0 and 1 with three main levels: 0.25, 0.5, and 0.75. When the indicator’s value is above 0.5, buyer dominance increases and the likelihood of a price rise grows.

Conversely, a drop below 0.5 signals seller control and potential price decline. A breakout of 0.25 from below is considered a buy entry signal, while a downward break of 0.75 is treated as a sell or exit signal.

This indicator can be very effective for evaluating cryptocurrency market time.

It belongs to the group of Volume Oscillators & Reversal Indicators. Intermediate-level traders can use it in multi-timeframe analyses across Forex, cryptocurrency, and stock markets. In practice, it assists in understanding crypto markets trading hours more accurately.

In the second version of this indicator, released in August 2025, notification and alert-signal capabilities were added, enabling users to track price movements more quickly. The settings include three key parameters:

- Gamma: defines the indicator’s sensitivity to price changes;

- Shift: adjusts the time position relative to chart data;

- Theme: selects the visual theme of the indicator.

In summary, the Laguerre Volume Index is an efficient tool for identifying trend-phase changes and analyzing trading volume. Combining it with ICT-style indicators can enhance signal accuracy and provide more precise trading opportunities.

Conclusion

Thecrypto market is open 24/7, including weekends. Finding the best cryptocurrency hours to trade depends on various factors like trading volume and global market activity.

The higher the volume, the better the price chart reflects market behavior, making analysis more accurate.