To achieve profitability from copy trading, users can link their accounts to a selected trader’s account without directly executing any trades themselves. All transactions performed by the trader are automatically mirrored in the user's account.

Brokers and exchanges provide advanced platforms offering features such as risk management tools, performance tracking, and access to experienced traders to enhance the Copy Trading Profitability.

Copy trading, by diversifying the portfolio of traders, providing performance transparency, and utilizing risk management tools on reputable platforms, enhances profitability potential.

however, sustainable success is only achievable through informed selection and continuous monitoring.

Accurate trader selection in copy trading is the key factor for success. Evaluating indicators such as the Risk/Reward Ratio, average monthly profit, win rate, and Maximum Drawdown helps determine a strategy aligned with the risk tolerance level.

Capital management, through setting a cap on copied capital, defining overall stop-loss and take-profit levels, and applying diversification across multiple traders, controls account fluctuations and risk.

Evaluating the Profitability from Copy Trading

Profitability in Copy Trading depends on selecting the right trader, precise risk management settings, and capital control. Before entering live trades, it's essential to conduct a trial phase on a demo account.

For further review and insights into the profitability of copy trading in the cryptocurrency market, you can also refer to the YouTube video Profitability of Copy Trading in 7 Days on the Ksaveras channel:

Once the system proves reasonably effective, beginners are advised to start copy trading with a small and managed investment. Key tips to enhance profitability from copy trading:

- Selecting traders with transparent and reliable trading histories;

- Defining a maximum allowable loss and setting detailed capital management parameters;

- Using reputable platforms with a large user base;

- Choosing platforms equipped with advanced tools for in-depth trading account analysis;

- Continuously monitoring the trader’s performance and the overall status of the copy account.

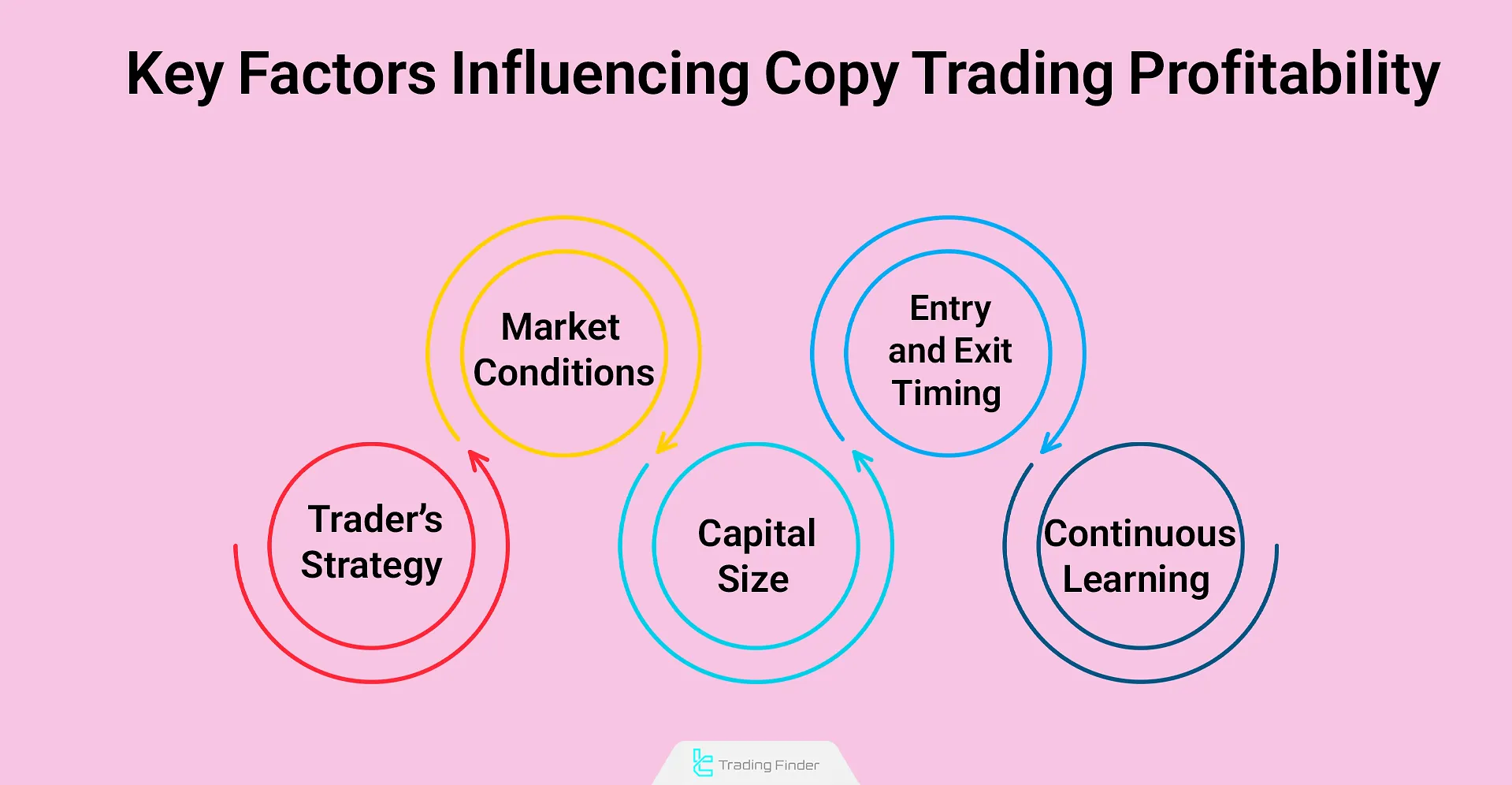

Key Factors Influencing Copy Trading Profitability

Profitability in copy trading is not solely dependent on selecting a successful trader but is shaped by a combination of multilayered factors.

These factors are linked both to external market conditions and to the investor’s individual characteristics and decisions.

The dynamic interaction among these variables determines the final outcome, and ignoring any factor can reduce efficiency or increase investment risk.

For more information on copy trading profitability, you can also refer to the educational article Profitability Copy Trading Training on fx2funding.com.

Below are the key factors influencing copy trading profitability:

- Market conditions: Returns increase during boom periods, while in downturns or high volatility, the risk of losses rises;

- Trader’s strategy: High-risk strategies generate higher returns but come with greater volatility;

- Capital size: A low balance prevents the full execution of copied trades;

- Entry and exit timing: Starting to copy at the peak of past performance increases the likelihood of future underperformance;

- Continuous learning: Staying updated with market analysis and modern methods produces more favorable results.

Copy Trading Costs

Some copy trading platforms offer their services for free, but many include commissions or additional fees depending on the platform and the trader:

- Some platforms have no subscription fee but may charge trade commissions or performance-based fees;

- Others may require a monthly subscription or a profit percentage to follow certain traders.

Before choosing a platform, carefully review its fee structure. Free platforms may be a good starting point but must also be evaluated for tools, security, and reliability.

Table of Copy Trading Costs:

Type of Cost | Description | Typical Amount/Percentage |

Platform Fee | Subscription or fee for using the platform | $10–$100 per month or 0.1–0.5% of capital |

Lead Trader’s Share | Percentage of profit paid to the trader | 10–30% of realized profit |

Broker Fee | Spread or trading commission | 0.01–0.5% of trade volume |

Fund Transfer Fee | Deposit or withdrawal | $0–$50 per transaction |

Legal Tax | Investment profit tax | Variable |

Additional Software Cost | Analysis tools or robots | $5–$50 per month |

Important Note: Lower costs don’t always mean better quality. What truly matters is the trader's performance, transparency, and the platform’s security.

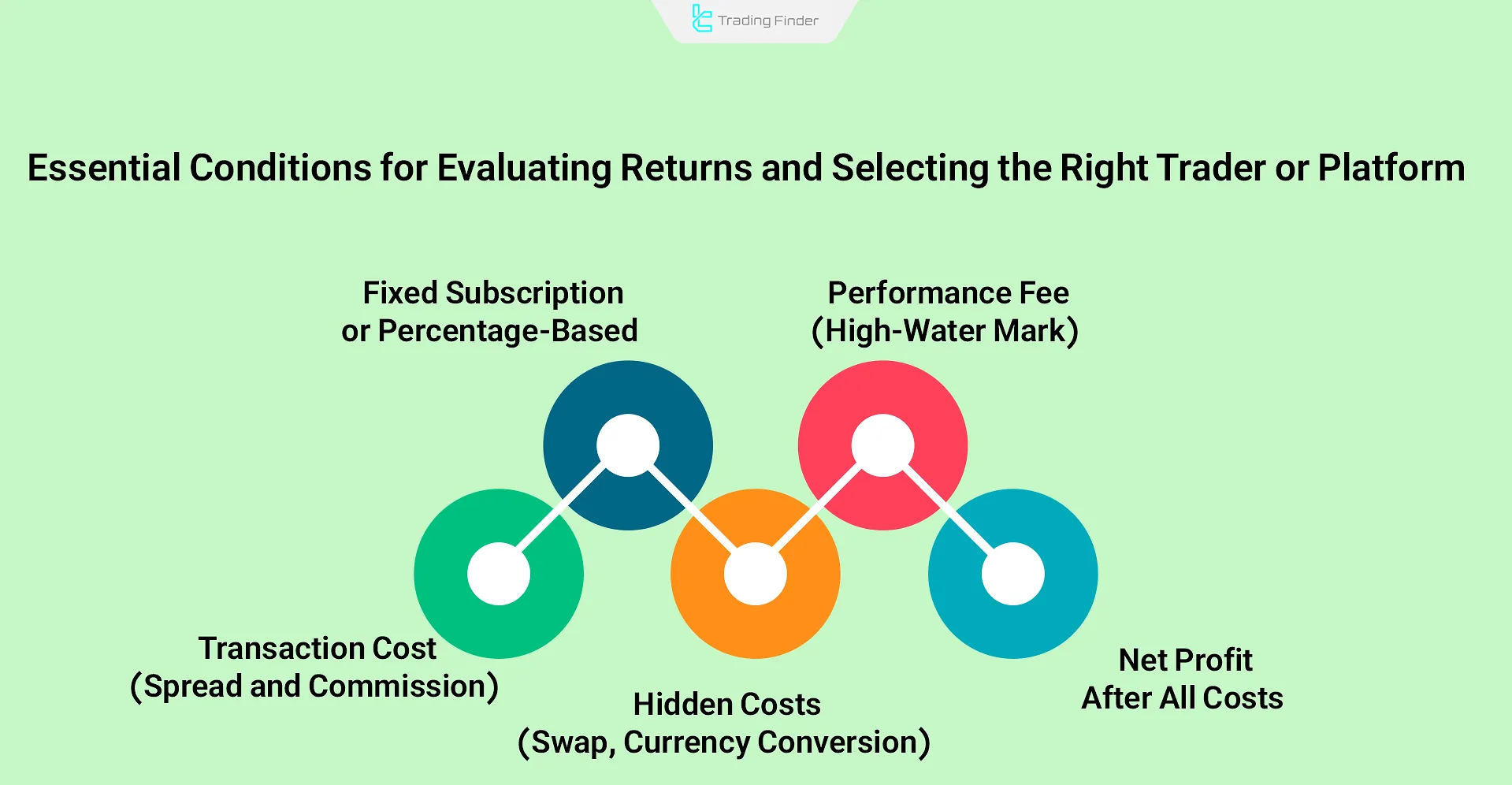

Cost Structure and Fee Models in Copy Trading

The cost structure and fee models in copy trading play a decisive role in an investor’s net profit.

A clear understanding of the types of fees and their calculation methods is essential for evaluating returns and selecting the right trader or platform. The main elements include:

- Performance-based fees with a transparent High-Water Mark structure;

- Fixed subscription fees or profit-percentage models, along with comparison of their effectiveness;

- Trade execution costs including Spread and Commission and their direct impact on returns;

- Hidden expenses such as Swap and currency conversion rates;

- The necessity of calculating net profit after deducting all costs.

Note: The High-Water Mark structure is a mechanism in performance-based fees that prevents double charging of investors. If the account incurs a loss, no performance fee is charged until the equity rises above the previous peak level again.

How to Choose the Right Trader for Maximum Copy Trading Profitability?

To succeed in Copy Trading, selecting a reliable and professional trader is the most critical step. A detailed evaluation involves the following factors:

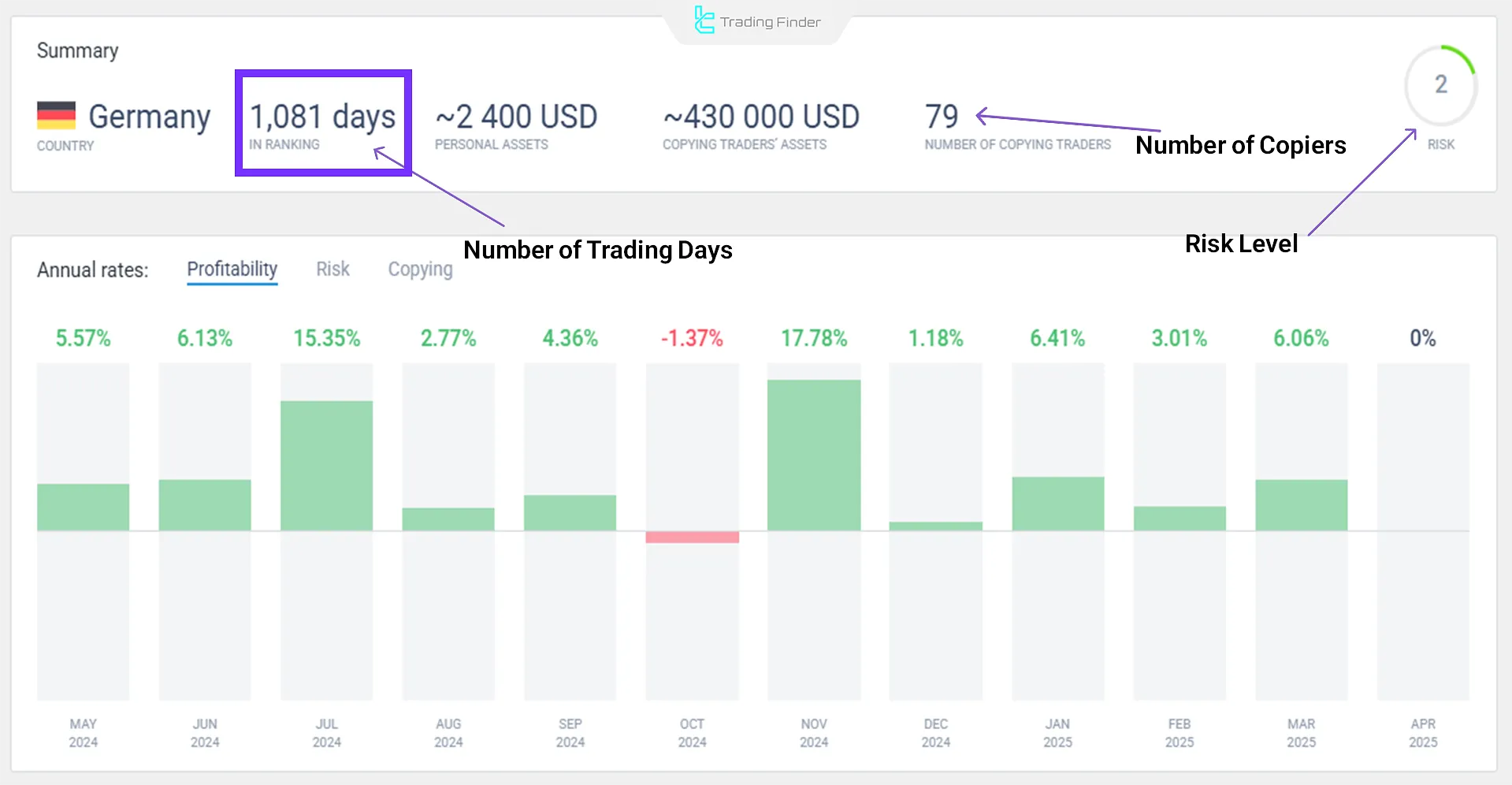

- High ranking on the copy trading platform with a traceable track record among top traders;

- A clearly defined and transparent trading strategy with a well-outlined risk level and no erratic behavior;

- Consistent returns over both short and long-term periods;

- A high volume of successful trades and stable performance in varying market conditions;

- Avoiding repetitive trades in the same price zone, which may signal misleading behavior;

- A highProfit Factor, reflecting strategy efficiency and execution accuracy;

- Reviewing the profit history of users connected to the trader to ensure the trader’s account data is accurate;

- Ensuring the trader's account belongs to a real person and is not operated by a trading bot.

Note: Considering the market’s volatility and variable risks over time, analyzing a trader’s short-term (e.g., monthly) performance is a smarter choice. It provides better insight into their current behavior, stability, and risk control.

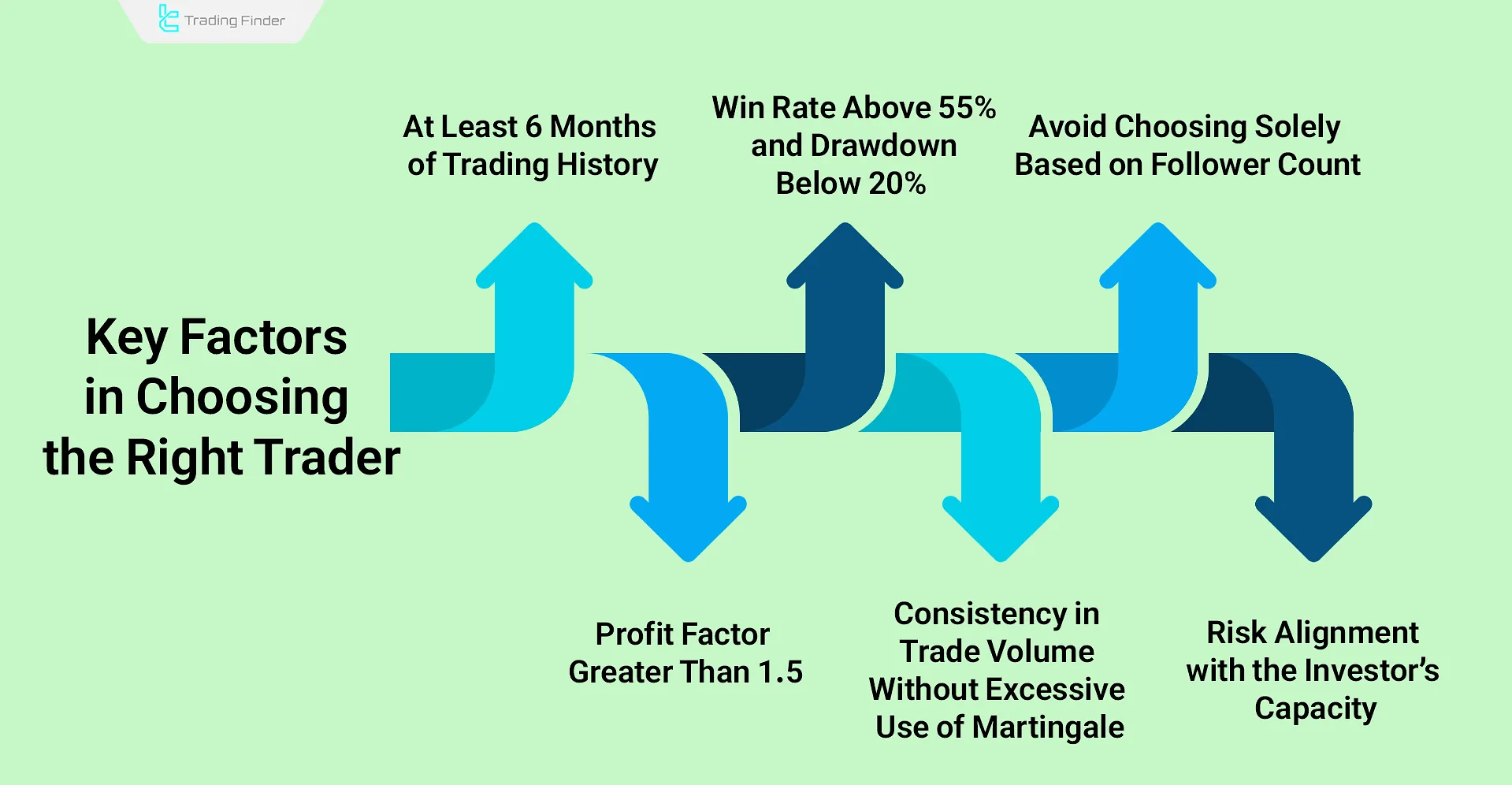

Checklist for Choosing the Right Trader

Selecting the right trader in copy trading requires analyzing performance data and evaluating risk and return metrics.

Focusing on both quantitative and qualitative criteria helps investors avoid making decisions solely based on popularity or follower count.

Key points include:

- A trading history of at least 6 months;

- Win rate above 55% and Drawdown below 20%;

- Profit Factor greater than 1.5;

- Consistency in trade volume without excessive use of Martingale;

- Alignment of risk level with the investor’s capacity;

- Avoiding choices based solely on a large number of followers.

Risks of Copy Trading

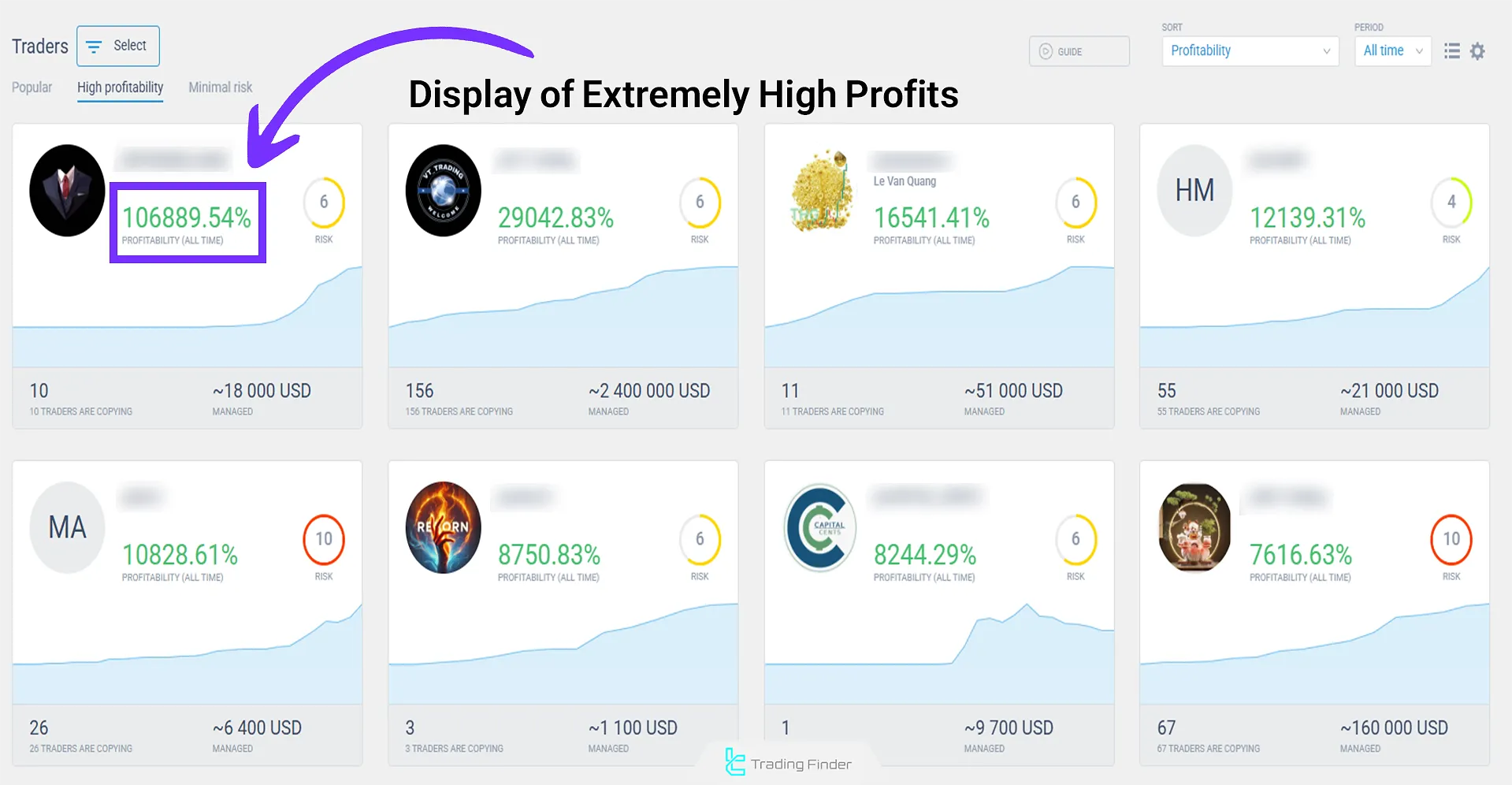

A common misconception is that Copy Trading guarantees profits without risk if one chooses a professional trader.

In reality, copy trading, like all trading strategies, involves inherent and structural risks that can lead to losses if ignored:

- Even the best traders can make human errors in decision-making;

- Unreliable or opaque platforms may manipulate performance reports or result in fund loss;

- Differences in risk tolerance between trader and investor may cause misalignment; some traders use high-risk strategies that may not suit everyone;

- Commissions, profit-sharing fees, or execution costs on some platforms can reduce actual returns over time;

- Displaying extremely high returns on a trader’s account doesn't guarantee similar results for you after linking.

Thus, smart entry into this field requires careful trader analysis, review of actual performance, selection of a trusted platform, and setting risk limitations.

Hidden Risks and Operational Limitations

Alongside attractive opportunities, copy trading also carries hidden risks and operational constraints.

Overlooking these factors creates a significant gap between expected returns and actual outcomes, posing challenges to capital management.

A thorough understanding of these risks is essential for maintaining capital stability. Hidden risks and operational limitations in copy trading profitability:

- Liquidity risk: Assets with low trading volume make exiting positions difficult;

- Price slippage and execution delay: A few pips’ difference in high-volume trades reduces profitability;

- Strategy correlation: Copying similar traders simultaneously increases risk;

- News risk: Fundamental events can cause substantial losses;

- Platform transparency: Misleading reporting can distort decision-making.

Advantages of Copy Trading

Copy Trading is an investment method that doesn’t require direct trade execution. Copy Trading Advantages:

- Ideal for beginners: Entering the market without prior experience or expertise;

- Low capital requirement: No need for large investments to get started;

- Learning while investing: Observing professional traders’ real strategies while copying them;

- Automated execution: Trades are carried out and settings applied automatically without user intervention;

- Diverse strategies and trader choices: Select from various traders with different approaches and strategies;

- Access to multiple markets and instruments: Trade in markets like forex, crypto, stocks, etc;

- Passive investment: No need for constant monitoring or real-time analysis;

- Diversification: Distributing capital among different traders to reduce risk;

- Reduced psychological stress: No pressure from real-time decisions and volatile markets;

- Simplified risk management: Tools like stop loss, capital limits, and emergency stops.

Numerical Example and Practical Scenarios in Copy Trading Profitability

To better understand the relationship between profitability and risk in copy trading, let’s review the following scenario:

Assume the account balance is $2000, and you intend to follow a professional trader’s positions with a Copy Ratio of 70%. This trader recorded 8% net profit and a Maximum Drawdown of 12% in the past month.

Copy Trading Profit Calculation:

$2000 × 70% × 8% = $112

With a Performance Fee of 20%, the net profit is:

112 × (1 − 20%) = $89.6 net profit

The overall stop-loss is set at 15% of capital; Therefore, if the balance falls from $2000 to $1700, all trades will be closed, keeping the loss limited.

If the trader suffers a 10% decline in the following month, your loss will be as follows, which still remains above the overall stop-loss threshold:

2000 × 70% × 10% = $140

This example shows that combining the copy ratio, overall stop-loss, and awareness of fees makes it possible to anticipate potential profit and manage risk.

Such calculations provide a realistic view for designing a financial strategy before starting copy trading and make decision-making more structured.

Fast Trade Copier Expert Advisor (Trade Copier)

The Fast Trade Copier Expert Advisor, developed by the Trading Finder team, is a professional tool for multi-account synchronization on the MetaTrader platform.

Using a floating panel, this EA instantly transfers trading commands between accounts and completely eliminates the risks of manually managing multiple accounts.

- Download Fast Trade Copier Expert Advisor for MetaTrader 5

- Download Fast Trade Copier Expert Advisor for MetaTrader 4

In addition to transferring open and closed trades, it also synchronizes key parameters such as Stop Loss (SL) and Take Profit (TP).

As a result, Slave accounts operate exactly in line with the Master account’s strategy and risk management, ensuring no detail is missed.

Main features and capabilities include:

- Instant and error-free transfer: all buy and sell trades along with SL and TP levels are copied in real time to the destination account;

- Compatibility with various trading styles: from Scalping and Day Trading to Swing Trading, this tool ensures high speed and accuracy;

- Support for multiple markets: Forex, international stocks, indices, commodities, and cryptocurrencies are all covered;

- Advanced management options: ability to set trading days, synchronize with Market Watch, define multiple Masters, and use Symbol Converter for symbol standardization, providing high flexibility in management.

For example, opening a buy position on NZD/USD in the one-hour timeframe with SL and TP is instantly copied to the Slave account without delay.

imilarly, a sell trade on AUD/USD in the 30-minute timeframe is immediately applied to the second account, maintaining full synchronization.

The Fast Trade Copier Expert Advisor is a reliable and powerful solution for traders managing multiple accounts simultaneously.

By combining speed, accuracy, and customization options, it transforms the copy trading process in financial markets including Forex and cryptocurrencies—into a seamless and professional experience.

Conclusion

To profit from copy trading, selecting experienced traders and applying precise risk management is essential.

Continuous monitoring of trader performance and choosing platforms with transparent cost structures significantly impact Copy Trading Profitability.

Also, to improve the chances of success, consider the trader’s strategy, return rates, and the number of successful trades when making your selection.