Crypto arbitrage bots use trading algorithms to execute arbitrage strategies rapidly, enabling the execution of more trades compared to manual methods.

Among the most notable arbitrage bots, we can mention Cryptohopper, Pionex, and Coinrule.

What Are Cryptocurrency Arbitrage Bots?

Cryptocurrency arbitrage bots use various algorithms and mathematical formulas to analyze factors like trading volume, orders, and price, identifying arbitrage opportunities at a rapid pace.

These arbitrage bots can monitor multiple exchanges simultaneously, which is a key advantage given the critical role of speed in such strategies.

Guide to Choosing Crypto Arbitrage Bots

There are many crypto arbitrage bots in the Cryptocurrency market. Choosing the right one depends on evaluating factors such as ease of use, speed, transfer networks, and more.

Key Factors for Selecting a Crypto Arbitrage Bot:

- Bot Credibility: Evaluate based on user reviews, project history, development team, free trial period, etc;

- Usage Costs: Compare arbitrage profits against the bot’s operating fees to assess strategy performance;

- Speed: Each stage of arbitrage trading must be executed as quickly as possible to fully utilize its potential;

- Capabilities: Features like risk management, custom strategies, and automation vary across platforms;

- Programming: Understanding the bot’s coding language helps with long-term usage and customization;

- Exchange Policies: Exchange limitations significantly impact arbitrage bots’ performance.

Best Crypto Arbitrage Bots

Several arbitrage bots exist in the crypto market. They offer features such as customization, futures trading support, and indicator integration. The best include:

- Cryptohopper

- Pionex

- Bitsgap

- HaasOnline

- Coinrule

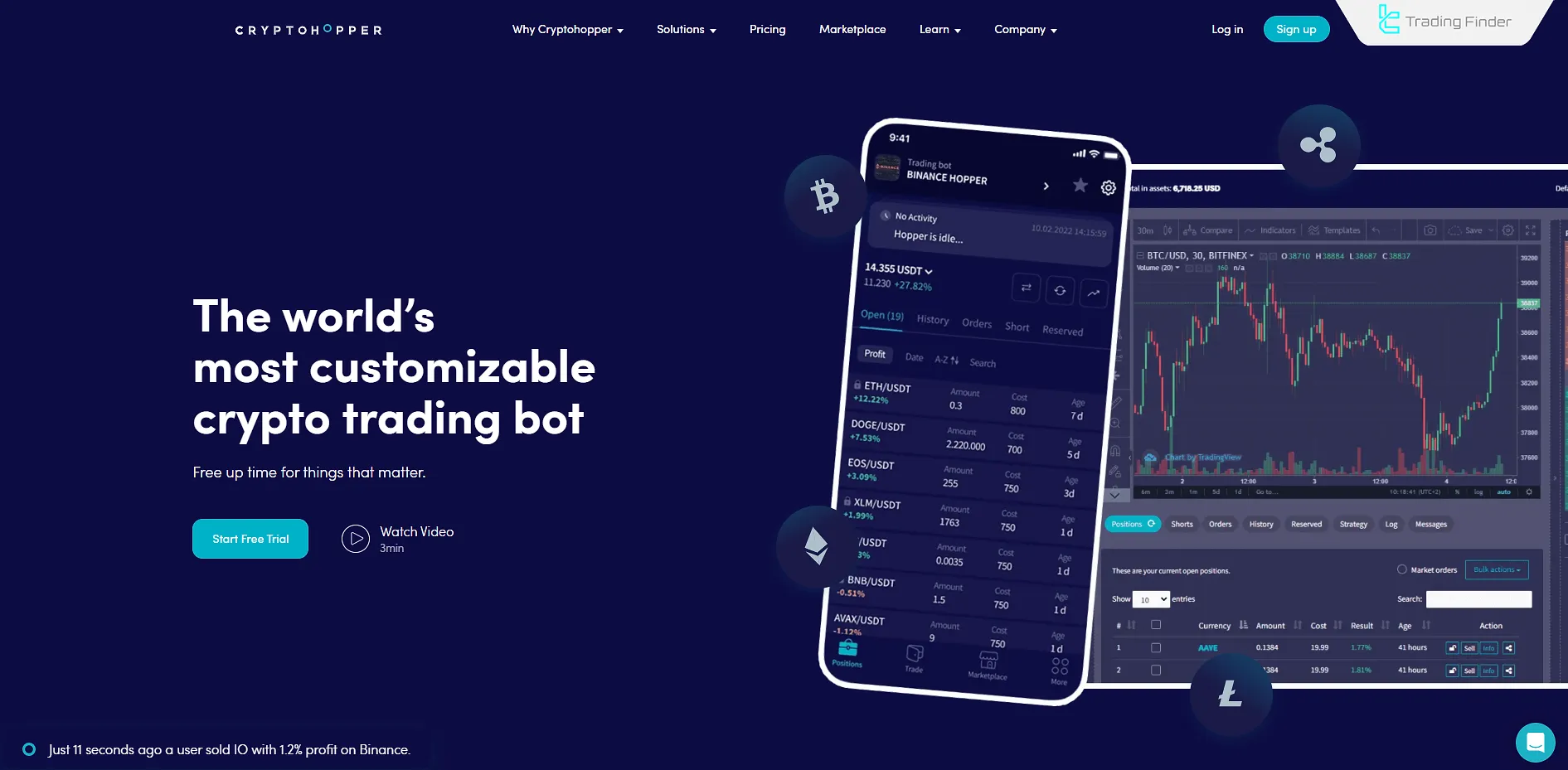

Cryptohopper Bot

One of the key features of the Cryptohopper platform is crypto arbitrage. It offers trailing stops, auto-trading, semi-auto trading, paper trading, and more—supporting various arbitrage strategies.

Its paper trading capability allows users to test strategies risk-free and fine-tune them before going live. It also supports triangular arbitrage (price differences between three assets).

Pionex Bot

The Pionex arbitrage bot is one of the trading bots offered by the Pionex exchange and is available for free.

The cost of using these bots is charged as a trading fee by the Pionex exchange.

Pionex ensures continuous operation of its bots by sourcing liquidity from major exchanges like Binance and Huobi.

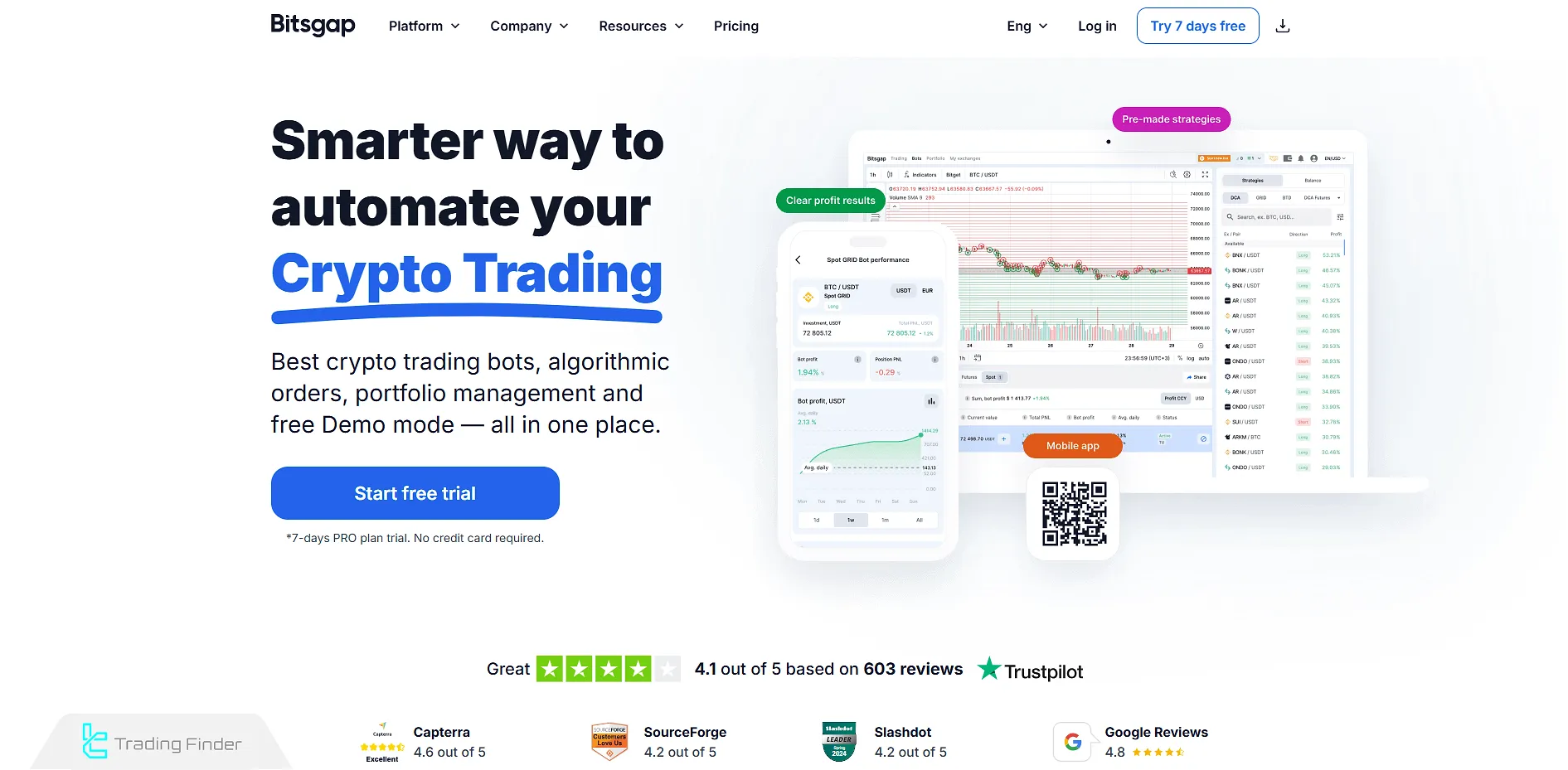

Bitsgap Bot

The Bitsgap arbitrage bot integrates with over 30 global exchanges and supports a wide range of digital assets. It has a beginner-friendly interface.

It offers three plan types: Basic, Advanced, and Pro, each with varying features and prices. Purchases can be made with crypto.

HaasOnline Bot

The HaasOnline platform provides over 100 trading bots, which can operate on major exchanges like Bitfinex.

It supports various arbitrage types, including statistical and triangular. The platform uses a proprietary scripting language called Haas Script, which allows custom bot development.

Plans are divided into Beginner, Simple, and Advanced tiers.

Coinrule Bot

The Coinrule trading bot platform is designed for beginners with a no-code interface. Bots can be created using "If-This-Then-That" logic.

Due to its lack of advanced coding capabilities, it's more suitable for beginners. A demo account is available for risk-free testing (no real money trading).

The platform offers Hobbyist, Trader, and Pro plans.

How to Activate a Cryptocurrency Arbitrage Bot

Activating a crypto arbitrage bot involves several steps like account setup and configuration.

Steps to Activate an Arbitrage Bot:

- Choose the Bot: Select a bot based on your trading strategy;

- Create an Account: Sign up on the bot provider's platform;

- Connect to Exchange: Obtain API keys from your exchange to link the bot;

- Configure the Bot: Define parameters like capital allocation, risk management, and timing;

- Monitor Performance: Supervise the bot to mitigate risks such as exchange limits or technical errors;

- Withdraw Profits: Profits can be withdrawn from the bot’s dashboard.

Pros and Cons of Using Arbitrage Bots

Using crypto arbitrage bots increases the efficiency of digital asset trading; However, a technical malfunction in the bot could also lead to significant losses.

Pros and Cons of Using Crypto Arbitrage Bots:

Advantages | Disadvantages |

Increased profitability | Risk of exchange restrictions |

Reduced human error | Potential for technical malfunctions |

Faster trade execution | Complete dependency on the bot |

Customizable trading strategies | Cost of purchasing and maintaining bots |

Key Tips for Using Arbitrage Bots

Arbitrage bots do not guarantee profits; they merely execute the received commands with precision.

To enhance the performance and profitability of crypto arbitrage trading, it is essential to follow practices such as regular updates, account management, monitoring, and more.

For better results, follow these practices:

- Select the right bot;

- Implement proper risk management;

- Manage capital wisely;

- Update settings to match market changes;

- Use diverse trading strategies.

Conclusion

With the surge in liquidity in the cryptocurrency market, arbitrage opportunities have significantly diminished; Using crypto arbitrage bots, still allows traders to capitalize on the remaining opportunities.

To utilize these bots effectively, one must first select an arbitrage bot that aligns with their trading strategy, considering factors such as bot speed, usage cost, and available features.