Centralized Exchange (CEX) and Decentralized Exchange (DEX) are the two primary types of exchanges in the cryptocurrency market, each having fundamental differences in areas such as management structure, service delivery, and overall operational model.

This foundational contrast forms the core of the ongoing debate in the industry surrounding CEX vs DEX and Centralized vs Decentralized Crypto Exchanges.

Centralized exchanges rely on a central authority to deliver crypto-related services in a structured environment; these exchanges offer a wide range of high-quality services and currently host the majority of active participants in the crypto ecosystem.

Decentralized exchanges, on the other hand, utilize Smart Contract capabilities to provide crypto services in a fully decentralized manner without any central governing body; therefore, they offer significantly higher security and align directly with the core blockchain principle of decentralization.

What Is a Cryptocurrency Exchange?

A cryptocurrency exchange is a platform that provides various blockchain-based services. The primary service of these platforms is buying and selling cryptocurrencies, and they are categorized into two main types:

Centralized (CEX) and decentralized (DEX). This fundamental classification represents the practical foundation of the DEX vs CEX model in modern digital finance.

In the Investopedia cryptocurrency exchange tutorial article, these platforms and the differences between centralized and decentralized exchanges are explained in detail.

What is a Centralized Exchange?

A centralized exchange (Centralized Exchange) is operated by a single organization and management authority and functions as an intermediary enabling cryptocurrency trading.

These exchanges act as the bridge between buyers and sellers in crypto transactions, which contradicts the original decentralization philosophy of blockchain technology.

Advantages and Disadvantages of Centralized Exchanges

Centralized exchanges provide a smooth and user-friendly interface. Additionally, the wide range of services and online customer support offered by these exchanges have attracted a large number of users.

However, using these exchanges involves risks such as hacking threats and the complete access of the exchange operator to user assets.

Advantages and disadvantages of centralized exchange:

Advantages | Disadvantages |

High liquidity | Contradicts the decentralization objective of blockchain |

Simple user interface | Full access of the exchange owner to assets |

Online support | High fees |

Wide range of services | Hacking risk |

What is a Decentralized Exchange?

A decentralized exchange (DEX) is one of the core components of Decentralized Finance (DeFi) and operates via smart contracts.

This type of exchange fully aligns with the decentralized nature of blockchain and is not governed by any central authority.

Advantages and Disadvantages of Decentralized Exchanges

All transactions on decentralized exchanges are executed with the highest possible transparency and without any intermediary involvement.

However, they carry risks such as potential smart contract vulnerabilities, rising network gas fees, and related operational costs.

Advantages and disadvantages of decentralized exchange (DEX):

Advantages | Disadvantages |

High diversity of tradable assets | Complex user interface |

Reduced hacking and cyberattack risk | Possibility of Impermanent Loss |

No identity verification required | Potential smart contract bugs |

No geographic restrictions | No centralized vetting of tradable tokens |

Open-source development | Increased blockchain Gas Fee under certain conditions |

How Does a Decentralized Exchange Operate?

A decentralized exchange operates based on smart contracts, and the entire trading process is conducted without human intermediaries.

Within this framework, users first connect their personal wallets to the platform and interact directly with smart contracts without transferring assets to the exchange account.

Order placement, trade matching, and final settlement all occur on the blockchain network, with full asset control remaining with the user at every stage.

Most decentralized exchanges utilize the Automated Market Maker (AMM) model. In this structure, instead of a traditional order book, liquidity pools exist where users provide liquidity, enabling other users to execute trades.

Asset pricing is determined algorithmically based on the ratio of assets within these pools.

Use Cases of Decentralized Exchanges in the DeFi Ecosystem

Decentralized exchanges are not limited to buying and selling cryptocurrencies; they serve as foundational pillars of the DeFi ecosystem.

Users can earn transaction fee rewards by providing liquidity to pools and increase asset returns through yield farming and staking.

This framework allows users to participate in financial activities without relying on a central authority while maintaining full ownership of their assets, which has positioned DEX platforms as gateways to numerous DeFi services.

Comparison of Centralized and Decentralized Exchanges

The most significant difference between centralized and decentralized exchanges lies in governance and service delivery; in centralized exchanges, operations are overseen by a central authority, whereas decentralized exchanges operate entirely without central management using smart contracts.

On the Crypto Trends YouTube channel, the differences between these two exchange types are explained in video format:

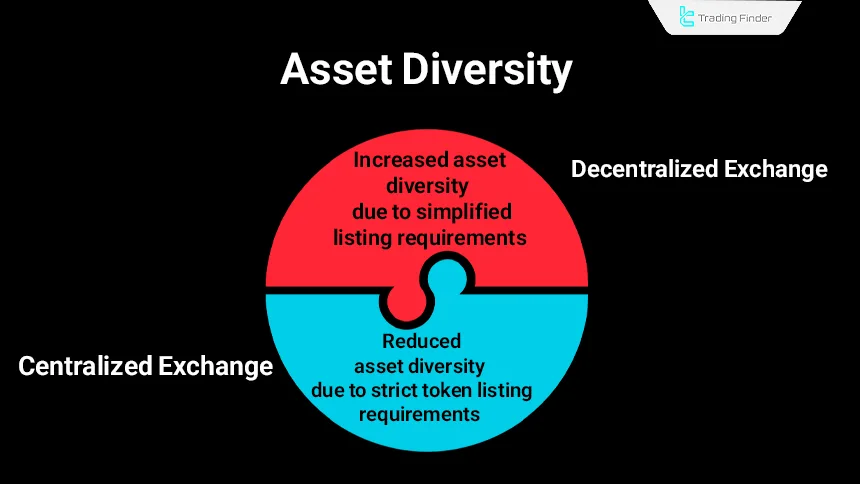

Asset Diversity

Listing assets on centralized exchanges involves complex procedures and policy evaluations; therefore, not all tokens are available for trading on centralized platforms.

Because all operations on decentralized exchanges are executed via smart contracts, transaction validation responsibility rests with users; hence, decentralized exchanges feature much broader asset diversity due to simplified token listing mechanisms.

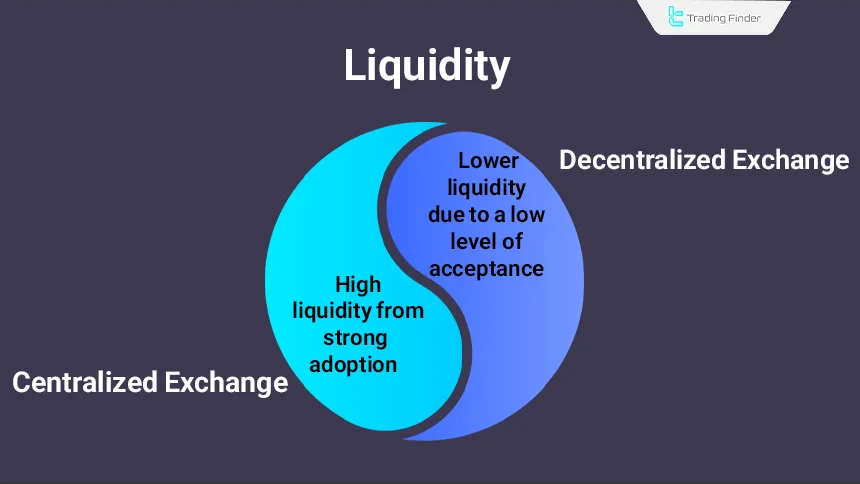

Liquidity

Due to their widespread adoption, centralized exchanges serve more users and maintain higher liquidity compared to decentralized exchanges; partnerships with major liquidity providers further strengthen their liquidity advantage.

High liquidity enhances transaction execution speed and improves overall platform usability.

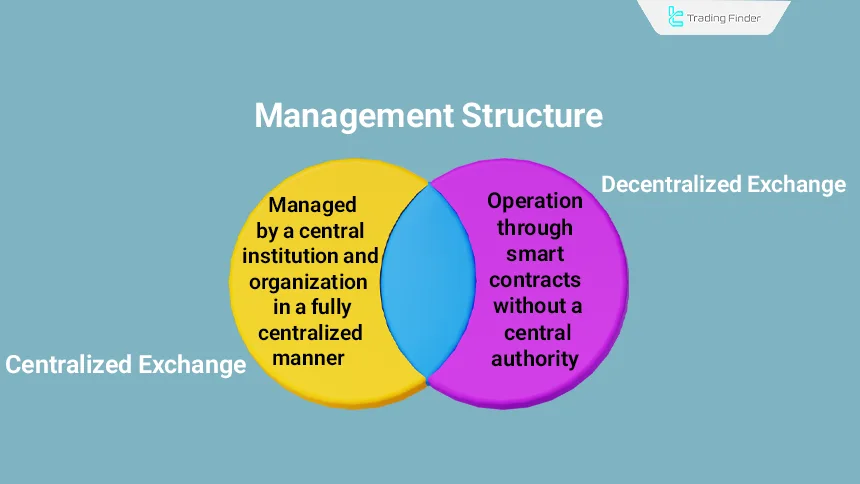

Management Structure

Centralized exchanges are operated by a central authority that has full access to user information and assets; withdrawals require platform approval.

Decentralized exchanges lack a central authority, relying entirely on smart contracts; consequently, all operational responsibility lies with the user, and transaction errors cannot be reversed.

Crypto Asset Ownership Rights

In centralized exchanges, asset ownership remains under the control of the exchange; whereas in decentralized exchanges, full ownership and control of assets remain with the user via smart contract authorization.

Centralized exchanges create custodial wallets disconnected from blockchain, removing private key access from users; decentralized exchanges connect directly to user wallets, preserving full ownership rights.

Customer Support

Centralized exchanges provide 24/7 support via live chat, phone, and email. Decentralized exchanges offer no formal support; users must seek information independently.

Fees

Centralized exchanges charge percentage-based trading fees. Decentralized exchange costs fluctuate based on network congestion, gas fees, and slippage.

Fee variability in DEX platforms makes cost forecasting difficult compared to centralized platforms.

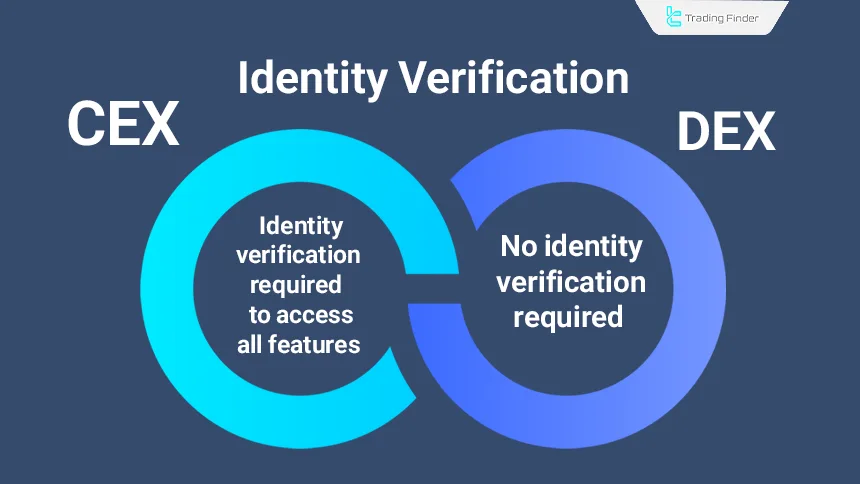

Identity Verification

Centralized exchanges require identity verification at various levels. Decentralized exchanges require no identity verification; wallet connection and smart contract signing suffice.

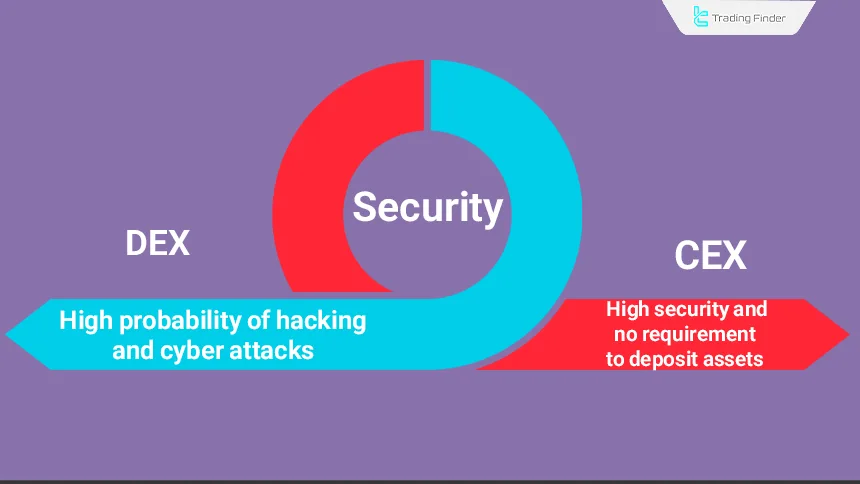

Security

In general, an exchange is not a suitable environment for the long-term holding and storage of assets.

Since the emergence of cryptocurrency exchanges, many centralized exchanges have been subject to cyberattacks and hacking incidents; therefore, the fact that assets are not stored on decentralized exchanges is considered an advantage and contributes significantly to their enhanced security.

The absence of a third party in the operational mechanism of decentralized exchanges is another factor that strengthens the security of this category of cryptocurrency exchanges; operating within a decentralized environment and conducting transactions in a fully peer-to-peer (P2P) manner increases the overall security of trades.

Comprehensive Comparison of Centralized and Decentralized Exchanges Based on Key Performance Indicators

In this section, the core differences between centralized and decentralized exchanges are examined from both technical and trading perspectives in a detailed and structured manner.

The objective of this analysis is to facilitate selecting the most suitable exchange for cryptocurrency trading based on activity type, experience level, and risk management priorities.

This comparison enables users to clearly observe each model’s operational structure and make informed investment decisions aligned with their objectives within the CEX vs DEX framework.

Comparison Metric | Centralized Exchange (CEX) | Decentralized Exchange (DEX) |

Asset Control | Assets are stored within the exchange | Assets remain in the user’s personal wallet |

Management Structure | Operated by a central authority | Operated via smart contracts |

Trade Execution Model | Order book and internal matching engine | Liquidity pools and automated market maker |

Liquidity | High due to user volume and market makers | Variable and dependent on pools |

Transaction Speed | High and processed off-chain | Dependent on blockchain network |

Trading Fees | Includes fixed and maker/taker fees | Includes network and pool fees |

Privacy | Requires identity verification | Generally no identity verification |

Technical Risk | Platform mismanagement and hacking risk | Smart contract vulnerability risk |

Usability Complexity | Suitable for beginners | Requires higher technical knowledge |

Censorship & Restrictions | Subject to geographic limitations | Resistant to censorship |

The Role of Layer-2 Technology in the Evolution of Decentralized Exchanges

One of the primary challenges of decentralized exchanges has been slow transaction speeds and high network fees.

The emergence of Layer-2 solutions such as Optimism and Arbitrum has significantly reduced these limitations and accelerated the adoption of DEX platforms.

By moving a substantial portion of transaction processing off the main blockchain, these technologies reduce costs and elevate user experience to levels competitive with centralized platforms.

Consequently, the future growth of decentralized exchanges is directly linked to continued advancement in Layer-2 scaling technologies within the broader Centralized vs Decentralized Crypto Exchanges landscape.

The Future of Cryptocurrency Exchanges and the Emergence of Hybrid Models

Recent developments indicate that the future of the cryptocurrency exchange industry does not revolve around eliminating either centralized or decentralized models but rather toward integrating both approaches.

Centralized exchanges are expanding non-custodial storage options and enhancing transparency, while decentralized exchanges are improving usability and transaction speed, narrowing the gap with traditional platforms.

Hybrid models seek to combine the speed and liquidity of centralized exchanges with the control and security of decentralized platforms.

These structures allow users to choose between custodial and non-custodial environments while accessing advanced trading tools.

When is CEX the Better Choice and When is DEX?

For new users seeking a simple environment, active customer support, and fast execution, centralized exchanges remain the more practical choice.

Conversely, traders prioritizing full asset control, privacy, early access to new tokens, and participation in DeFi generally favor decentralized exchanges.

In practice, many professional users adopt a hybrid strategy, utilizing both exchange types for specific purposes within their overall trading operations.

The Role of Exchange Selection in Investment Risk Management

Choosing between centralized and decentralized exchanges is not merely a technical decision but directly impacts investment risk management.

Centralized exchanges introduce custodial risk and dependency on a central authority, whereas decentralized exchanges transfer full security responsibility and private key management to the user.

Understanding these distinctions allows traders to align their trading infrastructure with their risk tolerance, investment goals, and technical proficiency while minimizing costly errors in the DEX vs CEX decision process.

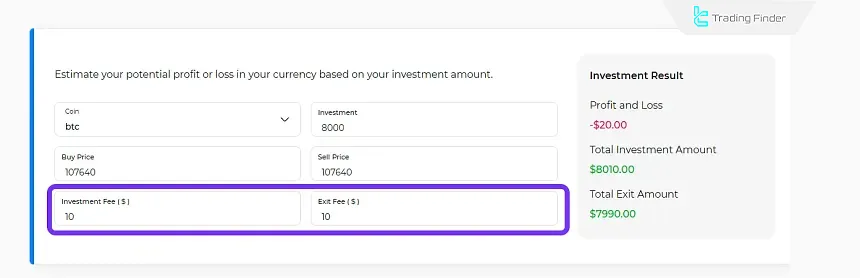

TradingFinder Crypto Profit Calculator

The TradingFinder Crypto Profit Calculator helps users accurately calculate profits or losses from cryptocurrency trades using real market data.

By inputting key parameters such as deposit size, buy price, sell price, buy fee, and sell fee, the tool generates three primary outputs: profit or loss, total deposit value, and final capital amount.

One of the calculator’s major advantages is real-time market price retrieval for the selected asset, significantly improving speed and precision of performance evaluation.

Within the tool, selecting the target coin is the first step, followed by entering initial capital. The buy price and buy fee are then recorded, and the calculator computes the number of coins purchased using the formula:

Next, the current sell price is displayed automatically, with manual adjustment available to enhance realistic analysis. The tool then calculates total profit or loss after deducting fees and outputs the final capital amount following asset liquidation.

The calculator’s application extends beyond single trade evaluation and plays a significant role in performance analysis, risk management, net profit computation of previous trades, scenario comparison, and market entry or exit planning.

This tool is designed for spot trading only and does not calculate Futures trading profit and loss.

Overall, the TradingFinder Crypto Profit Calculator offers a fast, free, and reliable solution for evaluating crypto trading performance and provides users with clear insight into their investment outcomes.

Example of Trade Profit Calculation Using the Crypto Calculator

The image below demonstrates a sample profit calculation. After selecting a coin and entering deposit size, buy price, sell price, and fees, the final trade outcome becomes visible. Outputs include profit or loss amount, total deposit value, and final capital after sale, calculated instantly from the provided inputs.

Conclusion

The differences between centralized and decentralized exchanges are evaluated across multiple critical factors that directly influence how each platform delivers services.

Examining the contrast between centralized and decentralized exchanges across governance, fees, support, and related elements shows that choosing the right platform depends on service needs, trading style, trader profile, and personal preferences.