FinTech companies have rapidly transformed traditional banking, payments, and investment models by leveraging new technologies.

Today, companies like Stripe in paymentprocessing, Robinhood in commission-free trading, and Revolut in neobanking represent some of the top FinTech firms globally.

What is FinTech?

FinTech, short for Financial Technology, refers to the use of technology to create and deliverinnovative financial services.

FinTech companies utilize modern technologies like Artificial Intelligence, Blockchain, Machine Learning, Big Data, and the Internet of Things to simplify and optimize traditional financial processes.

Common FinTech Applications:

- Digital payments

- Online lending

- Investment management

- Digital insurance (InsurTech)

- Open banking

- Cryptocurrencies and blockchain

Introducing 11 Leading FinTech Companies

Here is an overview of 11 globally recognized FinTech firms:

- Robinhood

- Coinbase

- Revolut

- Chime

- Stripe

- Block

- PayPal

- Adyen

- Ant

- Klarna

- Nubank

Robinhood

Robinhood is a US-based financial trading platform that allows users to invest in stocks, ETFs, options, and cryptocurrencieswithout paying commission fees.

Its intuitive mobile app has attracted a wave of new retail investors. While Robinhood doesn't support Forex directly, it offers features such as real-timetrading, IPO access, and educationaltools.

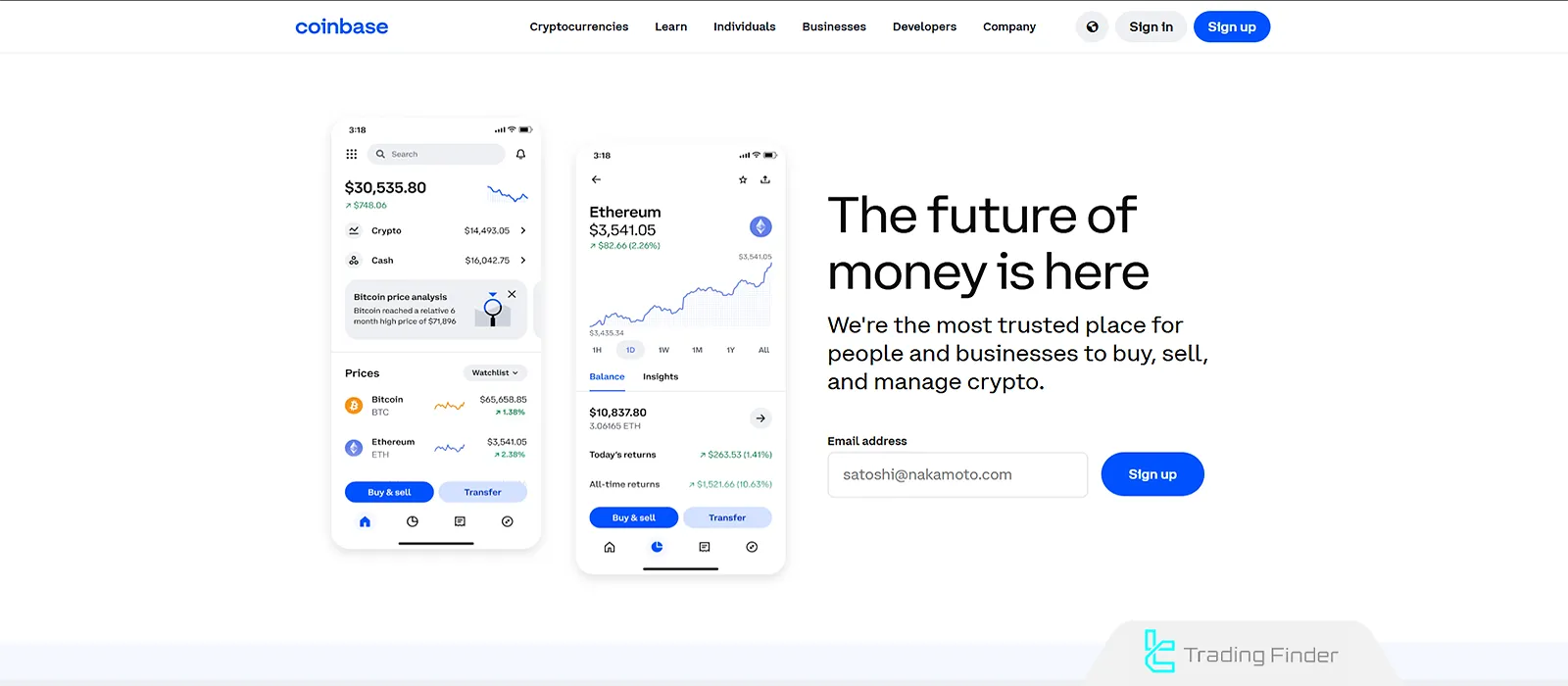

Coinbase

Coinbase exchange, founded in the US, is one of the largest and most reputable cryptocurrency exchanges worldwide.

It enables secure buying, selling, transferring, and holding of cryptocurrencies like Bitcoin and Ethereum. Its user-friendly interface and high-security appeal to both beginners and professional investors.

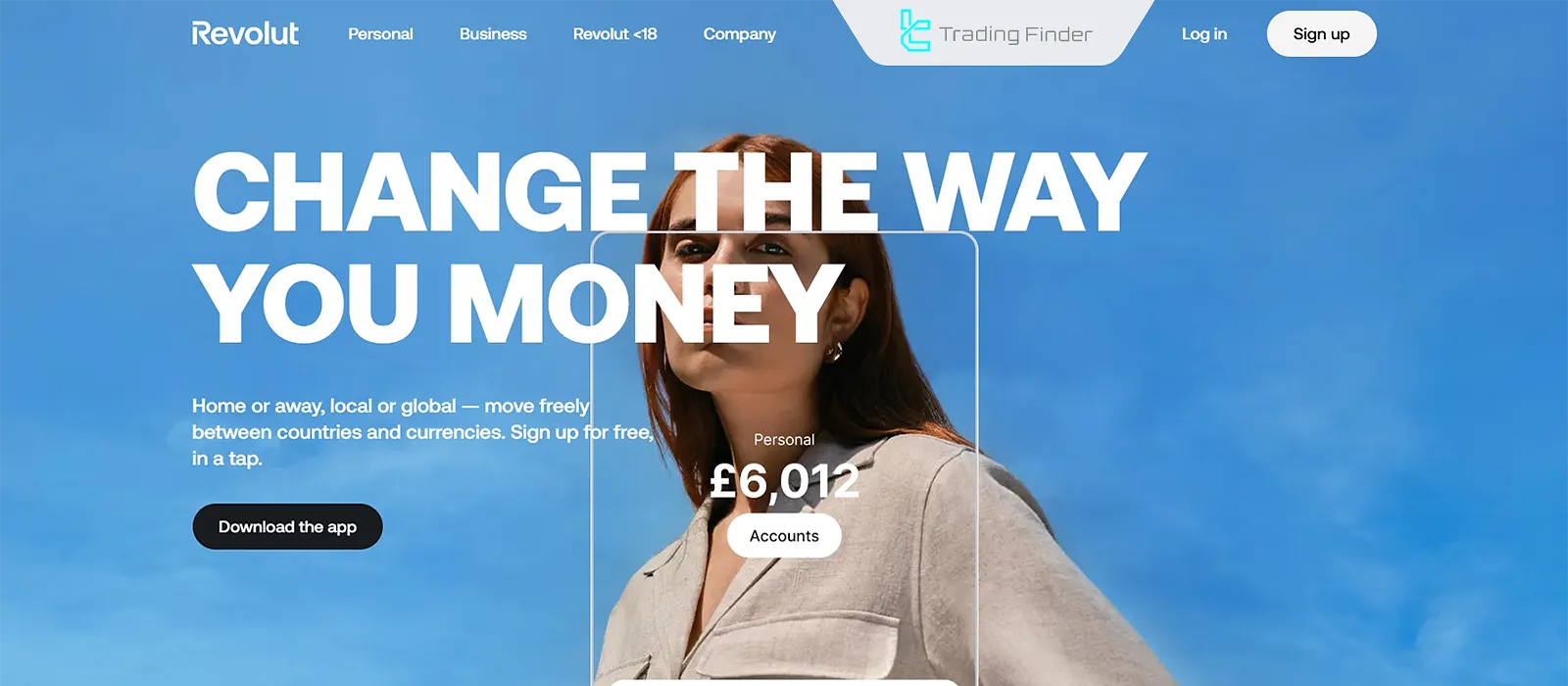

Revolut

Revolut is a UK-based neobank offering daily banking, investing, Forex exchange, crypto trading, and stock trading. The app enables fast currency conversion at competitive rates, travel expense management, and diversified investment options.

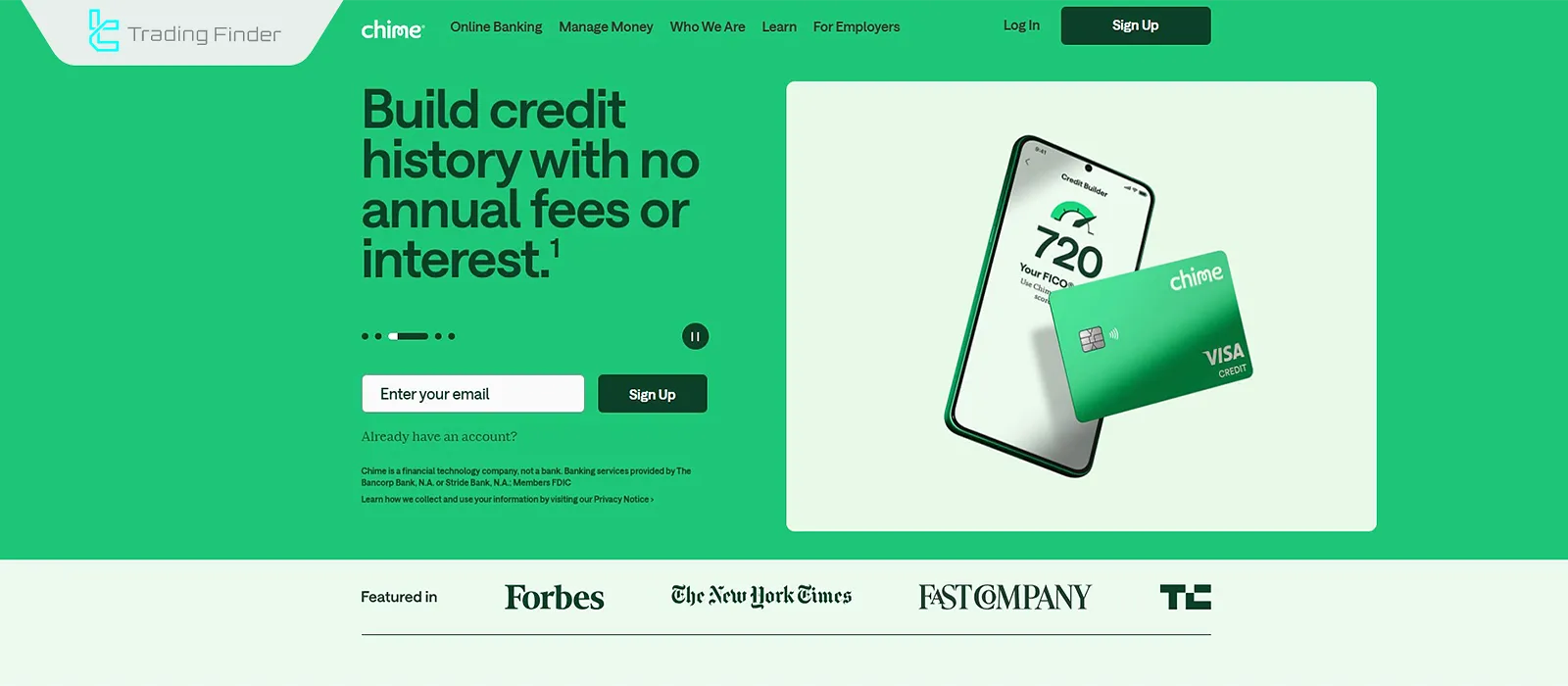

Chime

Chime is a US digital bank designed to eliminate banking fees and simplify financial services.

Although not directly active in stock or crypto trading, Chime offers valuable features like fee-free accounts and easy access to cash, making it useful for financial management.

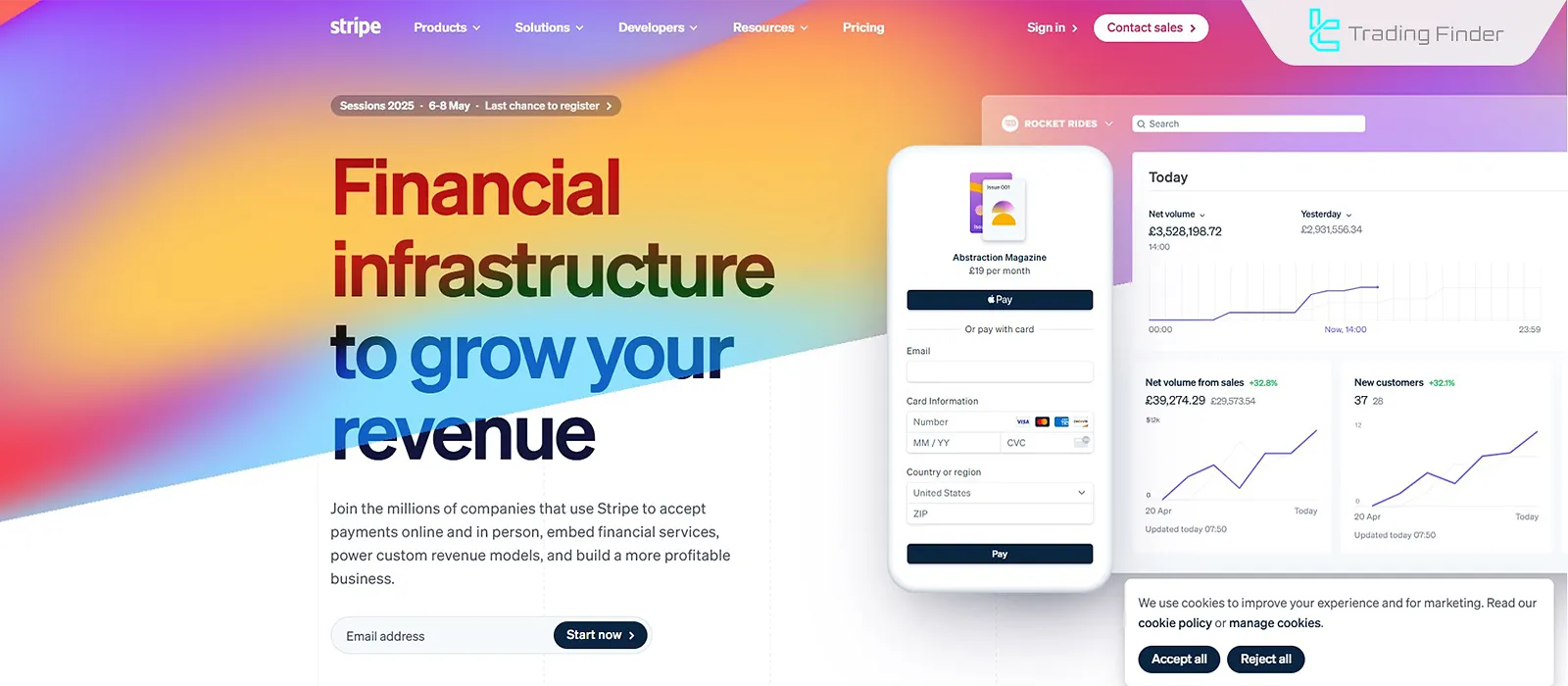

Stripe

Stripe is a leading online payment technology company providing infrastructure for financial transactions to businesses, e-commerce platforms, and apps.

While not directly involved in trading or crypto, it powers many trading platforms and FinTech startups globally.

Block Inc

Block, formerly Square, provides payment solutions for small and medium businesses. It owns the popular Cash App, which allows users to send money, invest in stocks, and tradeBitcoin.

PayPal

PayPal is a pioneer in global digital payments and facilitates millions of online transactions. In recent years, it has added features for buying, selling, and storing cryptocurrencies like Bitcoin and Ethereum.

Adyen

Adyen is a Dutch FinTech company specializing in secure, multi-channel international payments. It serves major brands like Uber, Spotify, and eBay, helping them connect to global markets. While not a trading platform, it provides a secure payment infrastructure.

Ant Group

Ant Group, a subsidiary of Alibaba, manages Alipay, China's largest mobile payment platform. It offers payments, insurance, investment, and credit services. Though access to crypto is limited, Ant Group plays a crucial role in China's financial ecosystem.

Klarna

Klarna is a Swedish FinTech company known for its "Buy Now, Pay Later (BNPL)" services. It allows users to purchase items and pay in interest-free installments—boosting e-commerce and shaping new consumer behaviors.

Nubank

Nubank is Latin America's largest neobank, offering digital banking, credit cards, and financial management tools. It is expanding into crypto trading and has secured a strong market presence in Brazil and neighboring countries.

Conclusion

Each FinTech company focuses on a specific financial need [such as payments, investing, or digital banking] and provides a simplified, accessible solution.

By removing intermediaries, reducing costs, and enhancing user experience, FinTech firms like Robinhood, Coinbase, and PayPal have reshaped financial access for individuals worldwide.