- TradingFinder

- Education

- Cryptocurrency Education

Cryptocurrency Education

Crypto education is crucial for anyone looking to trade in the world of digital assets and decentralized finance. TradingFinder’s team of experts has put together a comprehensive suite of crypto-related educational materials to empower traders from various levels of knowledge and expertise. From basic topics such as smart contracts, blockchain technology, distributed ledger, cryptocurrency exchange, DEFI, digital wallets, etc., to more advanced subjects, including on-chain data, Central Bank Digital Currencies (CBDCs), token distribution, liquid staking, and many more, TradingFinder covers them all. These cryptocurrency educational resources can enhance your skills with up-to-date guides on fundamental and technical analysis secrets of various coins and tokens, including Bitcoin, Ethereum, Solana, Doge, etc. Explore our curated content to gain a comprehensive understanding of the crypto ecosystem and significantly increase your trades win-rate.

What is a Stablecoin? Types, How They Work, and Real-World Examples

Stablecoins link their value to assets such as the dollar or gold and create price stability; this structure makes their use in...

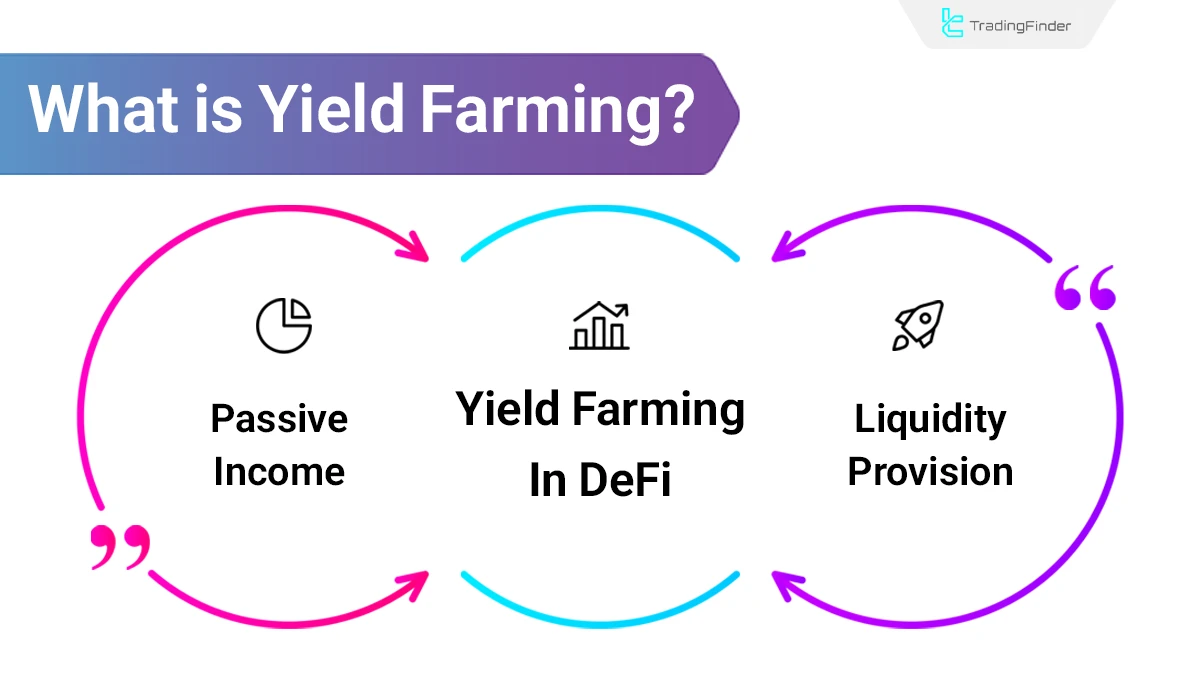

What is Yield Farming in DeFi? How to Earn Passive Income Safely

Crypto yield farming is considered a mechanism based on smart contracts that establishes a direct connection between digital assets...

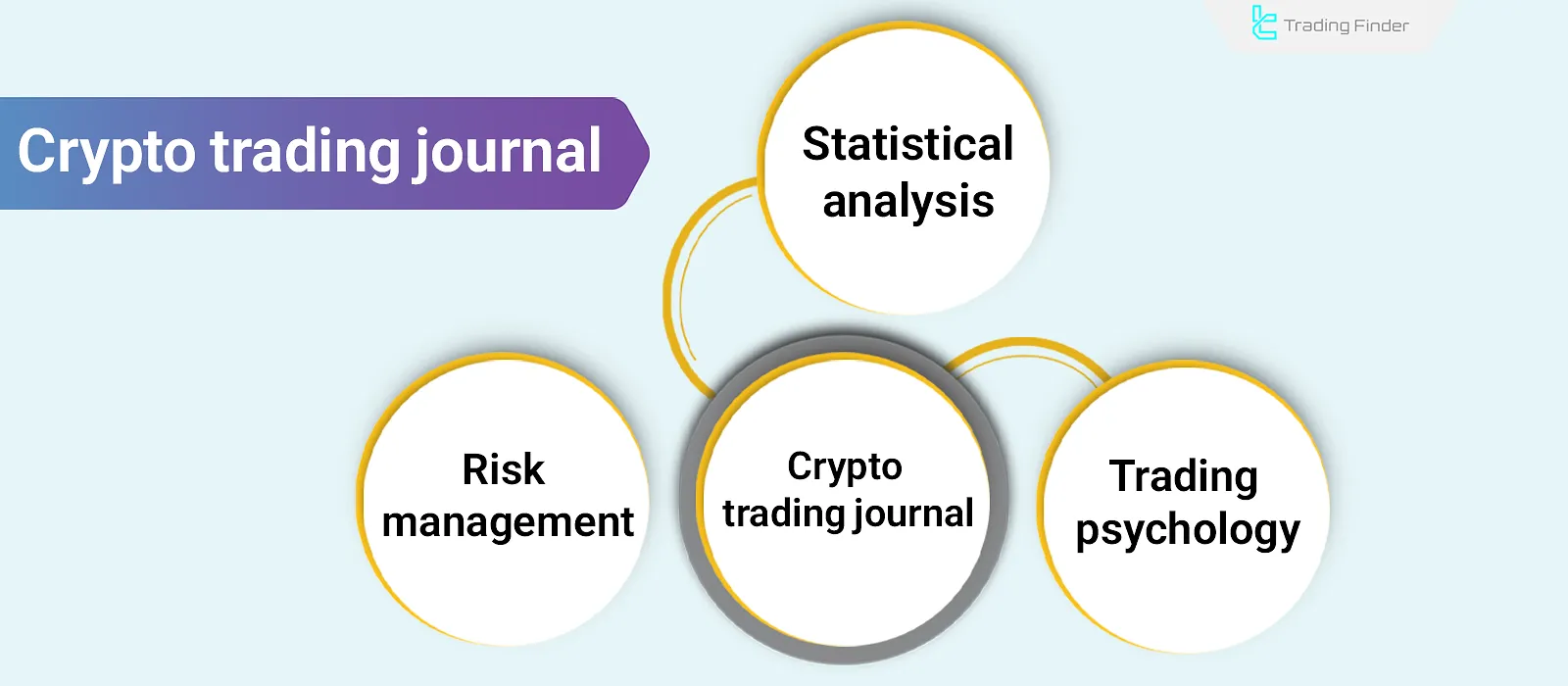

Crypto Trading Journal; Template & Best Tips

The cryptocurrency trading journal is an advanced, analytical tool that, by consistently recording quantitative and qualitative...

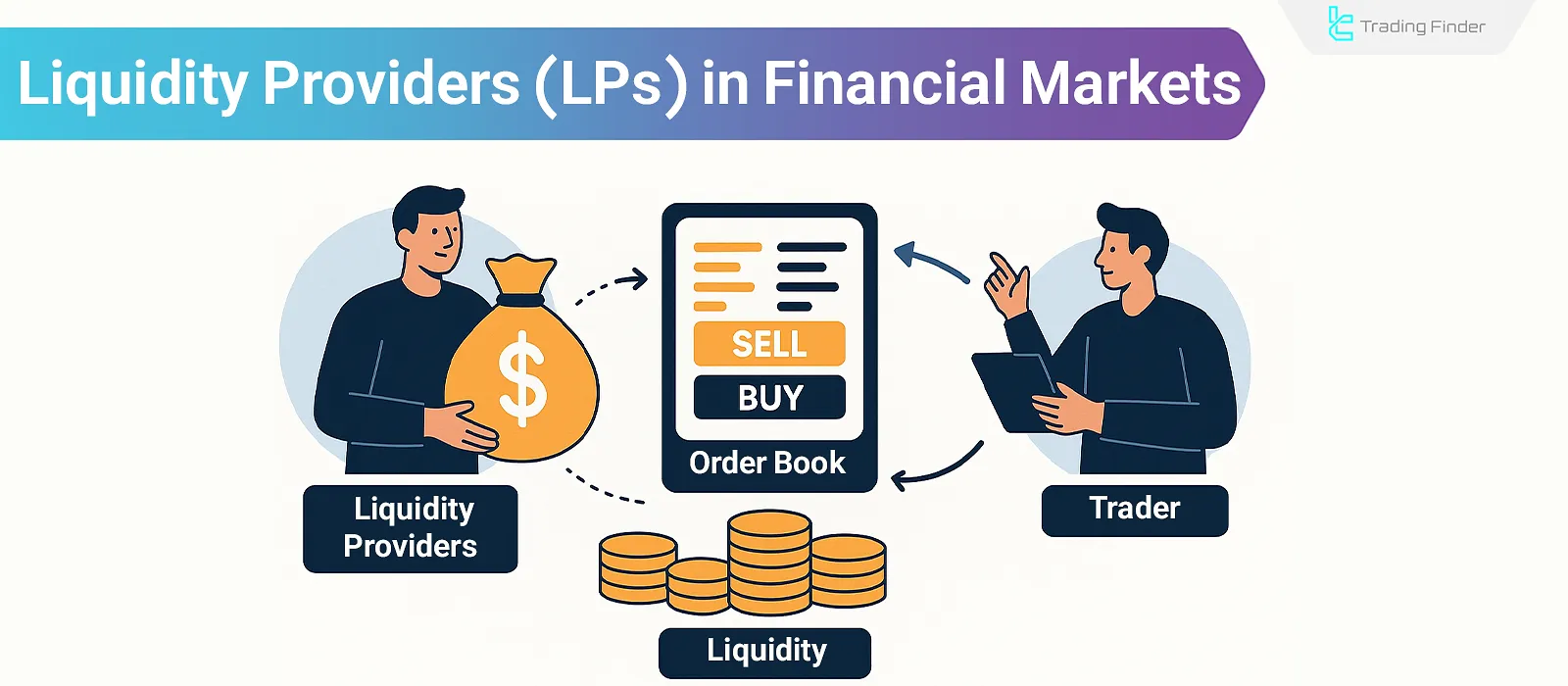

Liquidity Providers: How They Work and Why They Matter in Financial Markets

Liquidity Providers supply the required capital for trading in Forex, cryptocurrency, stock markets, and other markets. Liquidity...

What Is Crypto Wallet? Custodial and Non-Custodial Types

A crypto wallet is a digital wallet within the blockchain space that, through encrypted processes, allows users to store...

Win Rate; How to Calculate Win Rate and Its Importance in Forex

Win Rate in Trading represents the percentage of successful trades out of the total number of trades. By analyzing and...

What is Margin Trading? A Guide to Margin Trading

Margin Trading is a form of leveraged trading that allows traders to operate with capital exceeding their available balance. In...

What is Bitcoin? A New Asset for Peer-to-Peer and Intermediary-Free Transactions

After the 2008 financial crisis and the emergence of weaknesses in traditional and centralized financial systems, a concept...

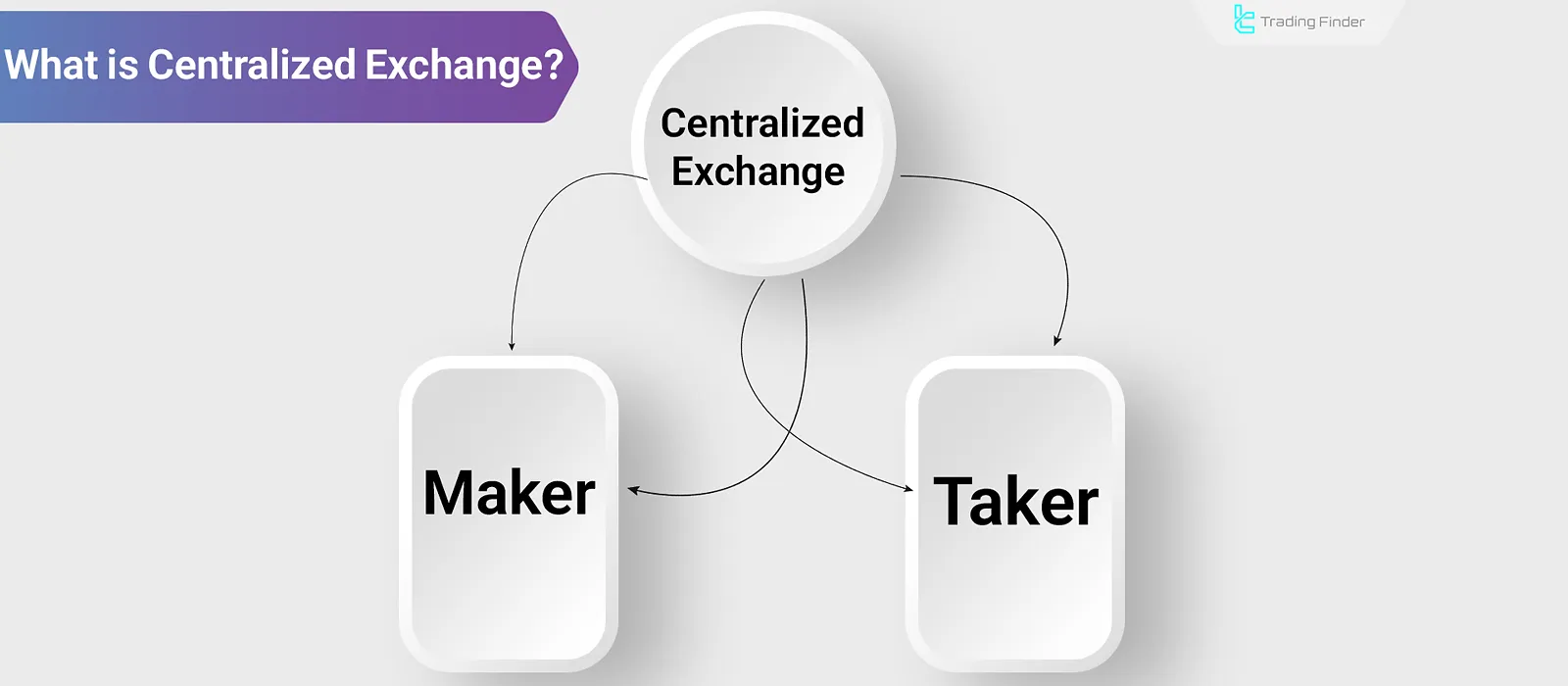

What Is a Centralized Exchange? High Liquidity & Diverse Financial Services

In the cryptocurrency market, exchanges are categorized into two types of centralized (CEX) and decentralized (DEX). Currently,...

What Are Maker and Taker Fees? Difference Between Maker and Taker

When buying and selling cryptocurrencies on atrading platform, you must pay transaction fees. Generally, trading fees on crypto...

What is a Smart Contract? How Does a Smart Contract Work?

Smart contracts are digital agreements recorded on the blockchain. Asmart contract in blockchain is developed using...

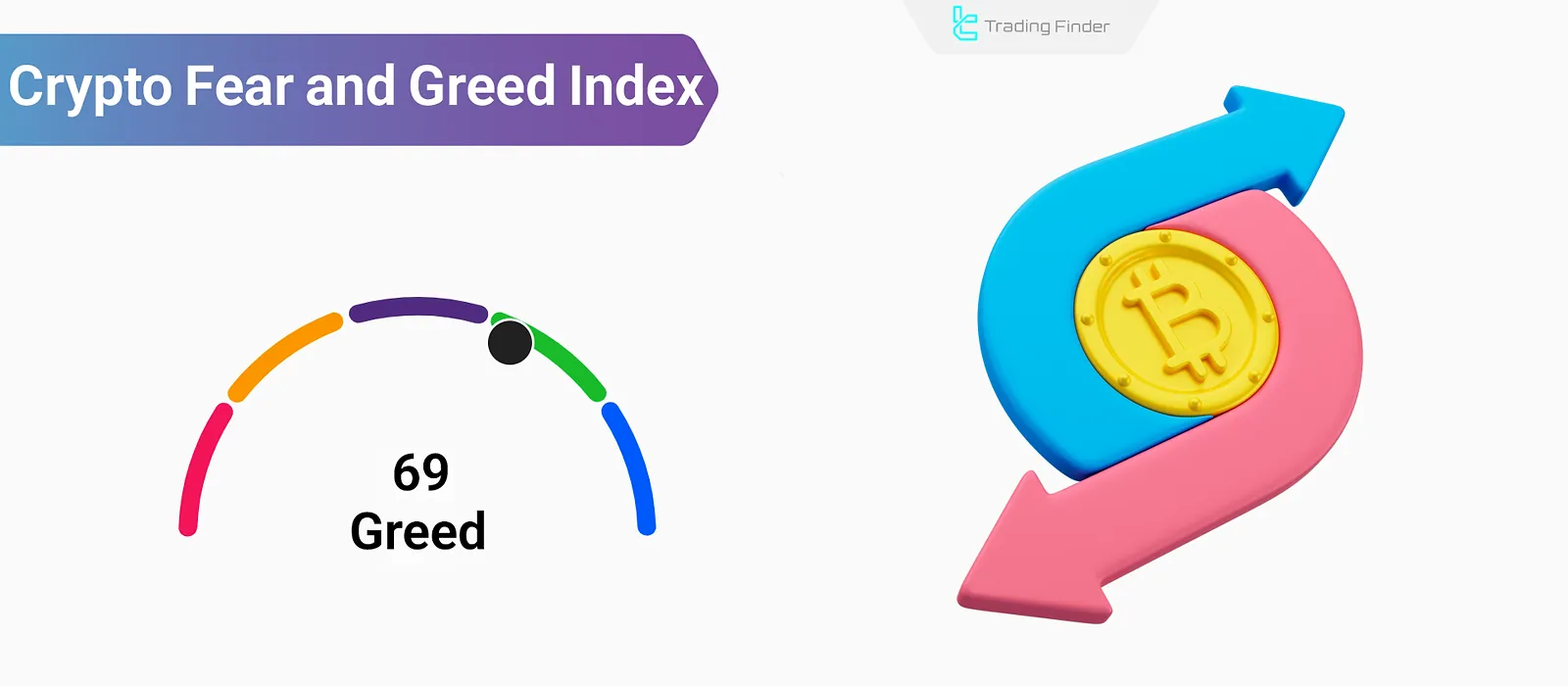

Fear & Greed Index: Market Sentiment Gauge + Component Weights

Price behavior in financial markets is often driven by fluctuations in collective sentiment. Indicators like the Fear &...