In the cryptocurrency market, exchanges are categorized into two types of centralized (CEX) and decentralized (DEX). Currently, centralized exchanges dominate a larger share of the market.

These platforms offer optimal speed and user interface conditions for traders. However, trading on a centralized crypto exchange comes with risks such as hacking and lower privacy compared to decentralized exchanges.

What Is a Centralized Exchange (CEX)?

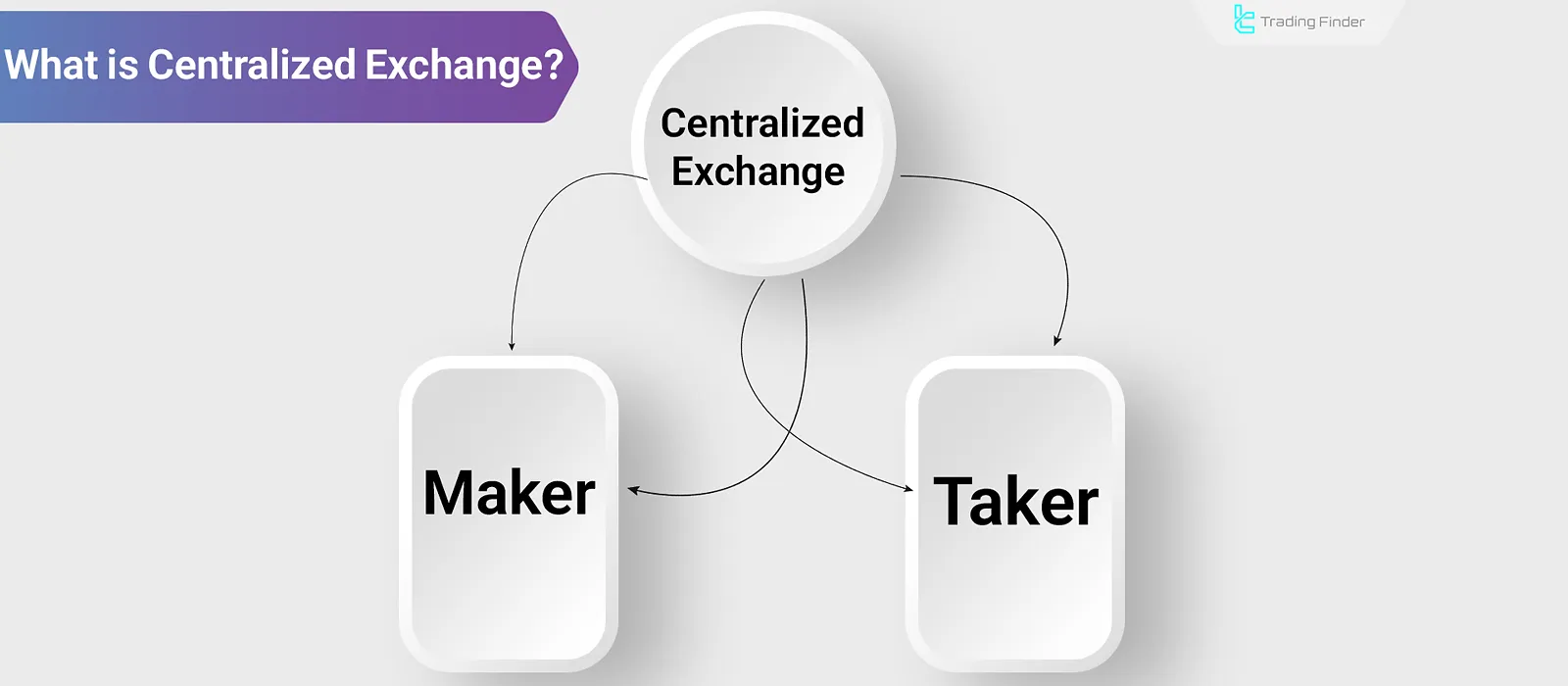

A centralized exchange (CEX) is a platform that acts as an intermediary, enabling the buying and selling of cryptocurrencies. In a centralized exchange, user assets are held in custody, and the platform manages trades.

In the How Centralized Exchanges Work article on Investopedia, the operational mechanism of this type of exchange is explained.

Additionally, identity verification (KYC) is mandatory on most centralized exchanges due to the strict oversight imposed by regulators to prevent security abuses.

Key Features of a Centralized Crypto Exchange

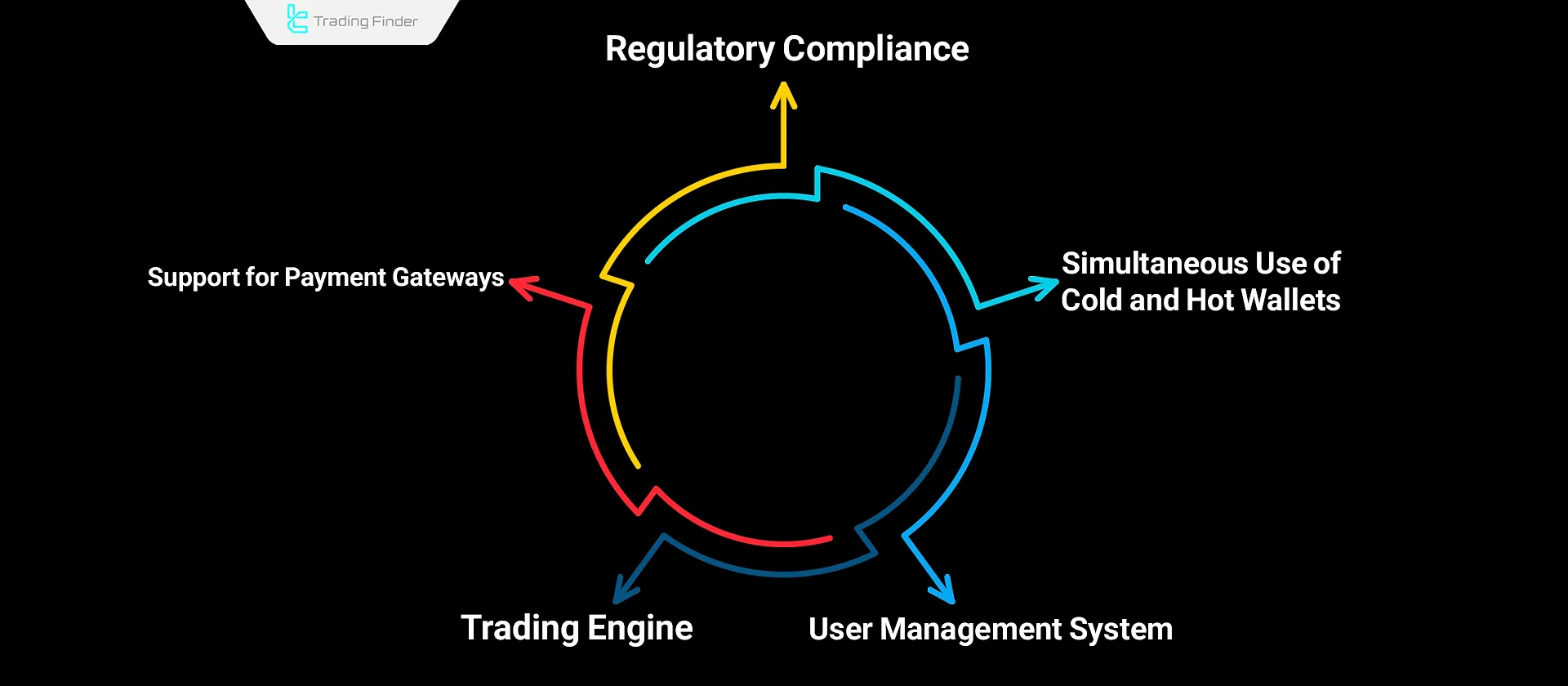

These platforms aim to improve trading speed and asset security through features such as a trading engine and user management system.

Trading Engine

In a centralized exchange (CEX), the trading engine is responsible for executing buy and sellorders. This engine processes trades with minimal delay, calculates the best available price, and completes the transaction.

Alongside this core functionality, the matching engine must also be capable of handling high volumes of orders during volatile market conditions to prevent severe slippage.

In addition, the system architecture is typically designed to ensure stability, speed, and security in trade execution at all times.

User Management System

Thissystem handles processes like registration, identity verification, and security checks.

Features such as two-factorauthentication (2FA), biometric login (e.g., fingerprint recognition), and account recovery options contribute to enhanced asset security for users.

In addition, the user-management infrastructure must be able to dynamically control access levels and quickly detect suspicious behavior.

This ensures a smoother user experience and provides a significantly higher level of protection against potential attacks.

Simultaneous Use of Hot and Cold Wallets

Most centralized crypto exchanges use both hot and cold Creypto wallets to store user assets.

Cold wallets, being offline, offer higher security and are used for storing large amounts of capital. In contrast, hot wallets facilitate quick deposits and withdrawals of cryptocurrency.

Alongside these options, many exchanges also provide fast-settlement systems and international payment capabilities, allowing users from different countries to enter the market without restrictions.

In addition, supporting multiple payment providers increases overall stability and reduces disruptions during the purchase process.

Support for Payment Gateways

Centralized exchanges (CEX) support various payment methods, including bank cards, wire transfers, and online gateways.

These options enable users to purchase cryptocurrencies using fiat currencies such as USD, EUR, GBP, and others.

In line with these requirements, many platforms are obligated to submit periodic transparency and compliance reports to regulatory authorities in order to reduce the risk of misuse.

In addition, the continuous implementation of security and supervisory controls helps increase user trust and ensures that the exchange’s operations remain stable within the framework of international regulations.

Compliance for centralized exchange: Identity Verification and KYC Rules in Centralized Exchanges

The identity-verification process, or KYC, is one of the core requirements for operating on centralized exchanges. The purpose of this step is to comply with Anti-Money Laundering (AML) regulations and ensure the legitimacy of users.

In most CEX platforms, verification is multi-stage and may vary depending on the user’s country of residence, account type, and withdrawal limits. Meeting these requirements enables access to features such as fiat withdrawals or participation in reward programs.

Regulatory Compliance in Operating Jurisdictions

Centralized exchanges (CEX) must operate under the supervision of legal authorities.

Processes such as KYC verification, anti-money laundering (AML) policies, and full transaction monitoring are mandatory to comply with jurisdictional regulations.

Advantages of Centralized Exchanges (CEX)

Due to their centralized structure, centralized crypto exchanges offer advantages such as high liquidity and a user-friendly interface.

High Liquidity

Centralized exchanges benefit from a large user base, enabling them to maintain sufficient capital for high liquidity. This feature allows for quick transactions at stable prices.

As a result, even large orders are executed without causing significant price fluctuations, and traders experience less slippage. In addition, the presence of active market makers in these exchanges helps maintain order book depth at all times and provides users with more trading opportunities.

User-Friendly Interface

Centralized platforms offer intuitive andstraightforward designs. With the help of various educational resources, they make using the platform easier.

In addition to these, centralized exchanges offer services such as mobile applications and integrations with advanced charting tools, including TradingView, which enhance the overall trading experience.

Customer Support

Despite having a simple and accessible interface and educational resources, traders often face questions regarding how to execute trades.

Most centralized exchanges offer 24/7 online support, enabling users to navigate the platform and resolve issues efficiently.

Diverse Financial Services

Over time, centralized exchanges have expanded their services beyond basic crypto buying and selling.

They now offer margin trading, staking, futures contracts, and crypto lending contributing to portfolio diversification.

In addition, offering risk-management tools and innovative financial products helps users execute more advanced strategies. Many exchanges also provide analytical dashboards and real-time data, enabling investors to make more informed and precise decisions.

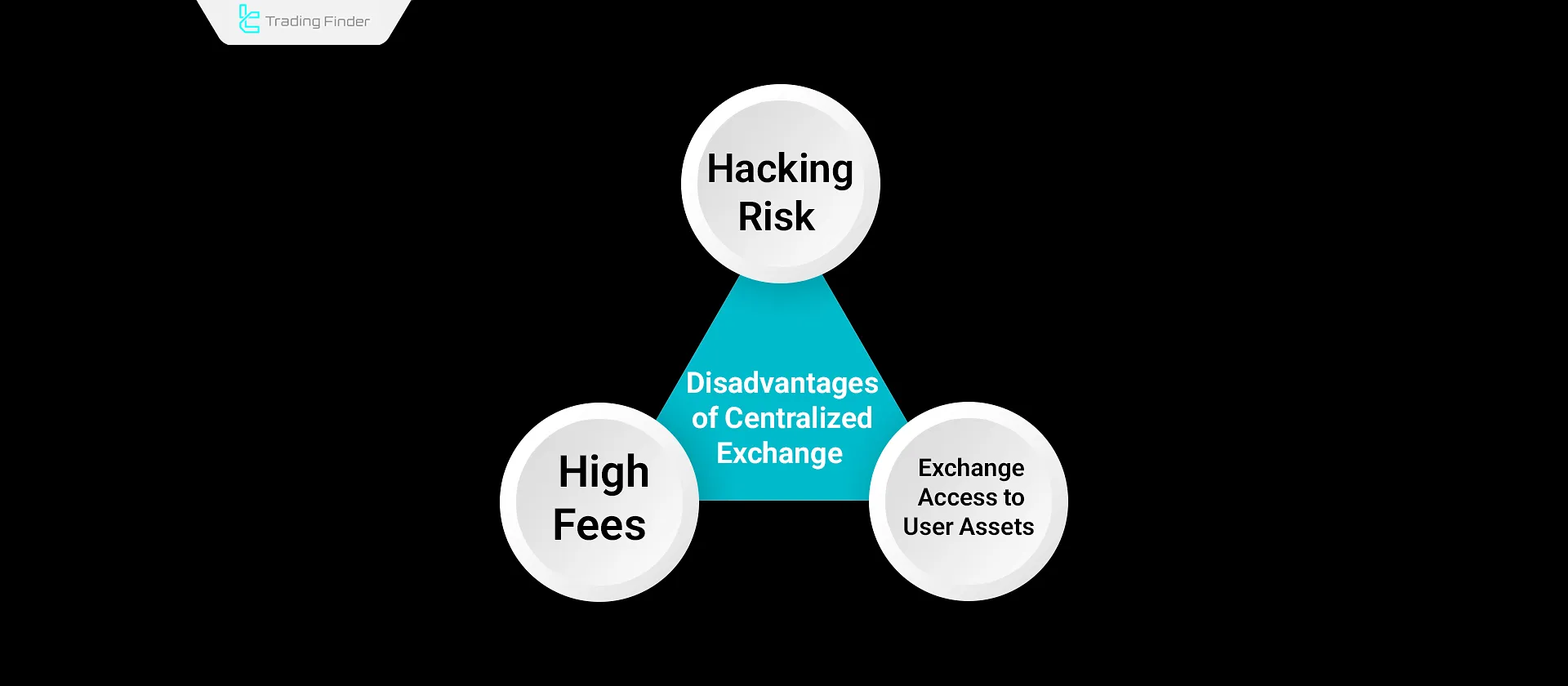

Disadvantages of Centralized Exchanges (CEX)

Centralized exchanges operate contrary to the core philosophy of blockchain, which promotes the decentralization of financial systems. This contradiction introduces certain disadvantages, explained below:

Hacking Risk

There is always a possibility of cyberattacks targeting the technical systems of centralized exchanges. Even well-known platforms are not immune.

For example, the largest cyberattack on centralized exchanges was the Mt. Gox hack, during which $480 million worth of Bitcoin was stolen.

Full Access to User Assets

The operators of centralized exchanges have access to users’ private keys and assets. This access allows them to freeze accounts, transfer funds, or modify user balances under specific circumstances.

High Fees

Most services on a centralized exchange (CEX) involve various fees either direct trading fees or hidden costs deducted from the user’s balance.

These costs may vary depending on market conditions and often increase during periods of high volatility.

How Centralized Crypto Exchanges Work?

A centralized exchange is responsible for matching orders and fulfilling obligations between buyers and sellers.

This process begins with order placement in the order book and concludes with the settlement of funds between the parties.

With a large user base and high trading volume, centralized crypto exchanges provide ample liquidity for executing trades. Orders placed by users fall into two categories:

- Limit Order: A trade executed at a specific price defined by the user;

- Market Order: A trade executed at the current market price, processed immediately.

Another core responsibility of a centralized exchange is to provide proper security for transactions. This is ensured through two-factor authentication (2FA), data encryption, and cold wallet storage of assets.

Example of the Buy and Sell Process in a Centralized Exchange

To better understand how a centralized exchange works, imagine a user intends to purchase a specific amount of Bitcoin using Tether (USDT). After logging into the account, the user selects the BTC/USDT pair in the Spot Market.

In the next step, the user chooses the order type. If they want the trade to be executed quickly, they select a Market Order so the purchase is executed immediately at the best available price.

But if they want to enter the trade only at a specific price, they place a Limit Order so it becomes active once the market reaches that level.

After the order is executed, the purchased Bitcoin appears in the user’s account wallet. If desired, the user may keep it on the same platform or transfer it to their personal wallet.

This entire process usually takes only a few seconds, and the transaction fee is calculated based on the maker and taker fee structure.

This example shows how centralized exchanges combine a matching engine, an internal wallet, and a simple user interface to make the trading process easy for users at any level of experience.

Order types in a centralized exchange

Centralized exchanges offer several types of trading instructions in addition to the Market Order. A Limit Order is executed when the price reaches the level defined by the user.

Order Type | Performance Description | Primary Use | Key Advantage |

Market Order | The trade is executed immediately at the best available price in the order book | Suitable for quick entry or exit from a trade | High speed and instant execution without the need to set a price |

Limit Order | The order is executed only when the market price reaches the level defined by the user | Used when the trader has a specific target price | Full control over entry or exit price |

Stop Order | Activates when the price reaches a specified level and then becomes a market order | For setting stop loss or automatic entry on price breakouts | An effective tool for risk management and preventing large losses |

Stop Limit Order | After activation, it becomes a limit order instead of a market order | For more precise control of stop loss or take profit execution | Combines price control with protection against slippage |

Immediate or Camcel | The order is canceled if not executed immediately upon placement | Suitable for scalpers or high volume trades | Prevents incomplete orders from remaining in the book |

Post Only Order | Is placed only when it is recognized as a maker order | For traders who benefit from maker fee discounts | Reduces fees and supports market liquidity |

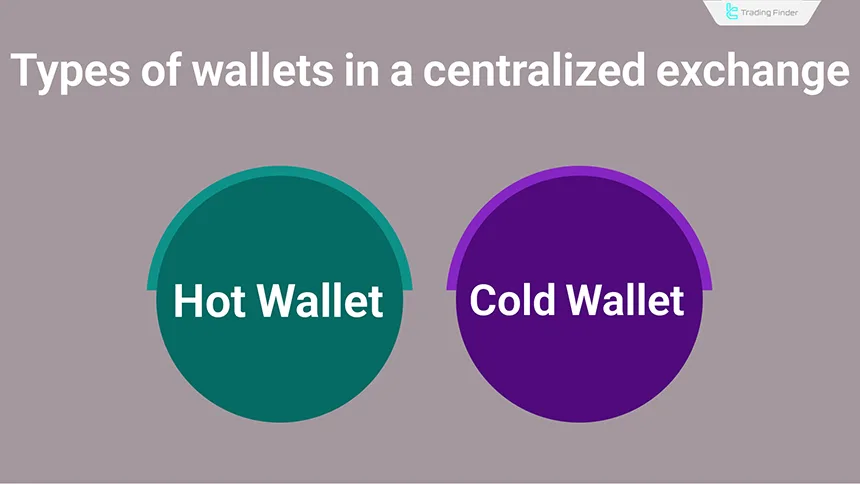

Cold and Hot Wallets in a Centralized Exchange

In centralized exchanges, user assets are stored in two types of wallets:

Hot wallets are connected to the internet and are used for daily transactions, fast withdrawals, and liquidity provision. In contrast, cold wallets are stored offline and offer significantly higher security due to being disconnected from the network.

Most reputable exchanges keep only a small percentage of the total user assets in hot wallets to handle instant withdrawals, while the majority of reserves are protected in cold wallets.

This separation helps the exchange maintain a balance between access speed and storage security, minimizing vulnerability in case of a cyberattack.

Asset security and the concept of Proof of Reserves

Many centralized exchanges publish reports known as Proof of Reserves. These reports show that user assets are fully held and separated from the company’s operational funds. Transparency in releasing this data is one of the key indicators for evaluating an exchange’s credibility.

Reviewing independent audit reports and reserve status can serve as a reliable criterion for choosing a secure exchange.

Trading Models in Centralized Exchanges

Several trading models are available in centralized exchanges. The most common ones are Spot, P2P, and OTC. In the Spot model, orders are directly placed and matched in the order book.

In P2P trading, users exchange directly with each other, and the asset remains in the exchange’s escrow account until the transaction is confirmed. The OTC model is designed for high-volume orders so that buying or selling can be executed without directly affecting the market.

Differences Between Centralized (CEX) and Decentralized (DEX) Exchanges

Unlike centralized exchanges (CEX), a decentralized exchange (DEX) is not governed by a single entity. Instead, all activities on a DEX are managed by smart contracts and conducted on the blockchain.

In the Crypto Trends YouTube channel, the difference between centralized and decentralized exchanges has been explained in a video:

Comparison Between Centralized (CEX) and Decentralized (DEX) Exchanges:

Comparison Criteria | Decentralized Exchange (DEX) | Centralized Exchange (CEX) |

Management & Control | Governed by smart contracts without a single controlling body | Managed by a central company or institution |

Security | Assets held in private wallets; subject to smart contract risks | Assets stored on the exchange; subject to hacking risks |

Liquidity | Limited; suitable for medium-volume trades | High; suitable for large-volume trades |

Speed | Dependent on blockchain transaction speed | Instant order execution |

Privacy | Anonymous; no personal data required | Requires identity verification (KYC) |

How to Choose the Right Centralized Exchange

When selecting a centralized exchange, factors such as security, liquidity, trading volume, fee transparency, support for diverse assets, and the platform’s performance history are important.

It is also advisable to check whether the exchange uses Proof of Reserves, how it treats users from your country, and whether withdrawals function smoothly during critical market conditions.

Guide to Choosing a Centralized Crypto Exchange

To make an informed decision when selecting among centralized exchanges, it is essential to evaluate key factors such as security, fees, asset variety, user interface, and liquidity.

Exchange Security

To assess the security of a centralized exchange, the following factors should be reviewed:

- Activation of two-factor authentication (2FA)

- Storage of user assets in cold wallets

- Encryption of sensitive data

- Compliance with regulations in the jurisdiction of operation

Transaction Costs

In addition to trading fees, most centralized exchanges charge various service-related costs. These may include:

- Spread differences;

- Deposit and withdrawal fees;

- Slippage charges are deducted from the user's account.

Fees and Hidden Costs in CEX

The fee structure in centralized exchanges usually includes Maker and Taker fees. Makers, who provide liquidity, pay lower fees, while Takers, who execute orders instantly, incur higher fees.

In addition, the difference between buy and sell prices (the spread), withdrawal fees, and network costs can affect the overall return of a trade. Carefully reviewing each exchange’s fee table before trading is highly important.

Variety of Cryptocurrencies and Supported Networks

Before registering and starting to trade on a centralized crypto exchange, you should verify the availability of desired cryptocurrencies and the blockchain networks supported for withdrawals.

In some cases, a currency may be available for trading, but no withdrawal network is supported yet meaning it can only be held on the exchange.

Final Checklist for Evaluating a Centralized Exchange

Before choosing or starting to trade on any centralized exchange, it is advisable to review several key criteria. These points help you assess the platform’s security, efficiency, and real credibility before depositing your assets:

- Security and performance history: Check whether the exchange has experienced hacks, withdrawal freezes, or data loss in the past;

- Reserve transparency: Ensure that Proof of Reserves reports are published regularly and publicly;

- Fees and costs: Compare the maker and taker fee table, crypto withdrawal fees, and the buy–sell spread;

- Liquidity and trading volume: Exchanges with higher volume offer faster execution and lower spreads;

- Support and user communication: Evaluate the quality and response speed of the support team in critical situations;

- License credibility and operating jurisdiction: Review official licenses, the registered country, and the regulatory bodies overseeing the exchange.

RV Volume Indicator (Volume RV) in Analyzing Centralized Exchange Trading

In centralized markets, trading volume is one of the primary metrics for assessing trend strength and capital inflow.

The RV Volume Indicator, or Volume RV, is designed as a specialized volume-analysis tool for this purpose. By combining real volume data with a moving-average signal line, this indicator visualizes liquidity-flow changes in a colored histogram, helping traders identify the market’s likely direction.

When the histogram moves above the signal line, buying pressure increases and the market shows a bullish tendency. Conversely, when volume values fall below the signal line, reduced demand and a possible bearish trend appear. These position shifts are often accompanied by visual or audio alerts so traders can react quickly.

Volume RV supports seven commonly used volume-based indicators, including AD, OBV, MFI, FORCE, BWMFI, WRP, and Volumes. Each of these indicators reflects a different perspective on capital flow, and choosing among them depends on the user’s strategy and trading style.

For this reason, the RV Volume Indicator can be used in a multi-purpose manner across Forex, stocks, indices, and cryptocurrencies.

In centralized exchanges (CEX), access to real trading volume is a major advantage compared to decentralized platforms. Therefore, combining Volume RV with tools such as VWAP or Volume Profile provides a more accurate picture of whale liquidity inflows and areas with high order concentration.

Users can customize the indicator settings according to their needs, including the calculation period, type of signal average, or enabling various alerts.

The result is a flexible and intelligent tool that, by simultaneously analyzing volume, price, and momentum, identifies potential entry and exit points and simplifies decision-making in centralized-market trading.

Top Centralized Crypto Exchanges

Many centralized exchanges are currently active in the cryptocurrency market. The following platforms stand out due to their high trading volume and large user base.

Next, several leading centralized exchanges in the world are introduced:

Binance Exchange

Founded in 2017, Binance is one of the older centralized exchanges. It is registered in 18 different jurisdictions worldwide and provides services to over 150 countries.

Binance offers a wide range of services, including spot, futures, and margin trading, supporting over 150 different cryptocurrencies.

Bybit Exchange

Bybit offers 12 distinct user levels, enabling the platform to monitor user activity and enhance overall security closely.

It also offers a diverse suite of services, including crypto loans, an AI trading assistant (TradeGPT), and crypto payment cards.

Coinbase Exchange

Coinbase is one of the few crypto exchanges listed on the NASDAQ stock exchange. It is regulated by central authorities such as the U.S. SEC, FinCEN, and the Central Bank of Ireland.

This American exchange offers features such as staking, copy trading, and 24/7 customer support, and supports trading for more than 11,750 assets.

Upbit Exchange

Upbit is the largest cryptocurrency exchange in South Korea and has earned a trust score of 100 out of 100 on the ScamAdviser website. The platform uses a multi-step identity verification process to enhance security.

Bitget Exchange

Bitget, based in Singapore, boasts over 45 million global users and a significant trading volume. It features a transparent fee structure and supports trading for over 700 cryptocurrencies, offering leverage up to 1:125.

MEXC Exchange

MEXC offers a vast selection of assets with more than 2,800 listed cryptocurrencies. For futures trading, the platform charges zero maker fees.

With its user-friendly interface, MEXC caters to both beginner and professional traders.

Conclusion

Centralized crypto exchanges dominate a significant portion of the cryptocurrency market by offering key features such as high liquidity, fast transactions, security, and user support.

Most centralized exchanges (CEX) now provide a wide range of financial services, including lending platforms, NFT marketplaces, and high-leverage futures trading, which help diversify users’ portfolios.

However, using a centralized exchange also comes with risks, such as hacking threats, asset freezing by platform operators, and hidden transaction fees.

A wise approach is to choose a centralized exchange carefully by evaluating factors such as security, fees, and regulatory compliance, thereby minimizing these risks.