The cryptocurrency trading journal is an advanced, analytical tool that, by consistently recording quantitative and qualitative data for each trade, creates a clear framework for analyzing a trader’s decision-making patterns.

This data-driven structure systematizes the process of evaluating and optimizing trading strategies and steers decisions away from the influence of emotions toward logic and data analysis.

The crypto trading journal acts as the connecting point between trading psychology, risk management, and statistical analysis; a place where personal experience turns into analyzable data and data turns into informed and profitable decisions.

What is a Cryptocurrency Trading Journal?

A cryptocurrency trading journal is a tool that records the details of each trade, including entry and exit price, execution time, profit or loss, and the reasons behind the decision.

This process enables the trader to analyze their performance, identify behavioral patterns and past mistakes, and, by creating discipline and controlling emotions, purposefully optimize their trading strategies.

A cryptocurrency trading journal is not only a notebook for recording trades, but also an analytical and strategic tool for professional capital management and continuous improvement of trader performance.

By accurately recording the quantitative and qualitative data of each trade—including market conditions at entry, position size, the type of trading strategy used, the emotions governing decision-making, and the final outcomes—the trader gains clear insight into their performance.

This enables the identification of the strengths and weaknesses of the trading system through data-driven analysis. Ultimately, the trading journal, by creating a cycle of feedback and optimization, transforms a trader’s path from an emotional trader to a professional, data-driven decision-maker.

Advantages and Disadvantages of a Cryptocurrency Trading Journal

To use a crypto trading journal effectively, traders should be aware of both its advantages and limitations.

The following table provides a detailed analytical overview of the advantages and disadvantages of a cryptocurrency trading journal, based on various analytical criteria:

Advantages | Disadvantages |

Identifying the risk-to-reward ratio, determining optimal position size, preventing high-risk trades | Requires precise and consistent data entry; risk of analytical error if data is inaccurate |

Calculating win rate, identifying profit and loss patterns, optimizing strategy | Time-consuming; requires statistical knowledge and analytical tools |

Controlling emotions, increasing self-awareness, maintaining discipline | Risk of over-obsession or inaccurate recording of emotions |

Evaluating and testing methods, learning from past trades | Complex data interpretation in case of large volumes |

Creating routine and adherence to trading rules | Requires high commitment; difficult for scalpers |

Preventing repetitive mistakes, enabling faster decision-making | Manual logging is time-consuming and tiring |

Using analytical software and dashboards | Some tools can be costly and dependent on digital systems |

Importance of Journaling in Crypto Trading

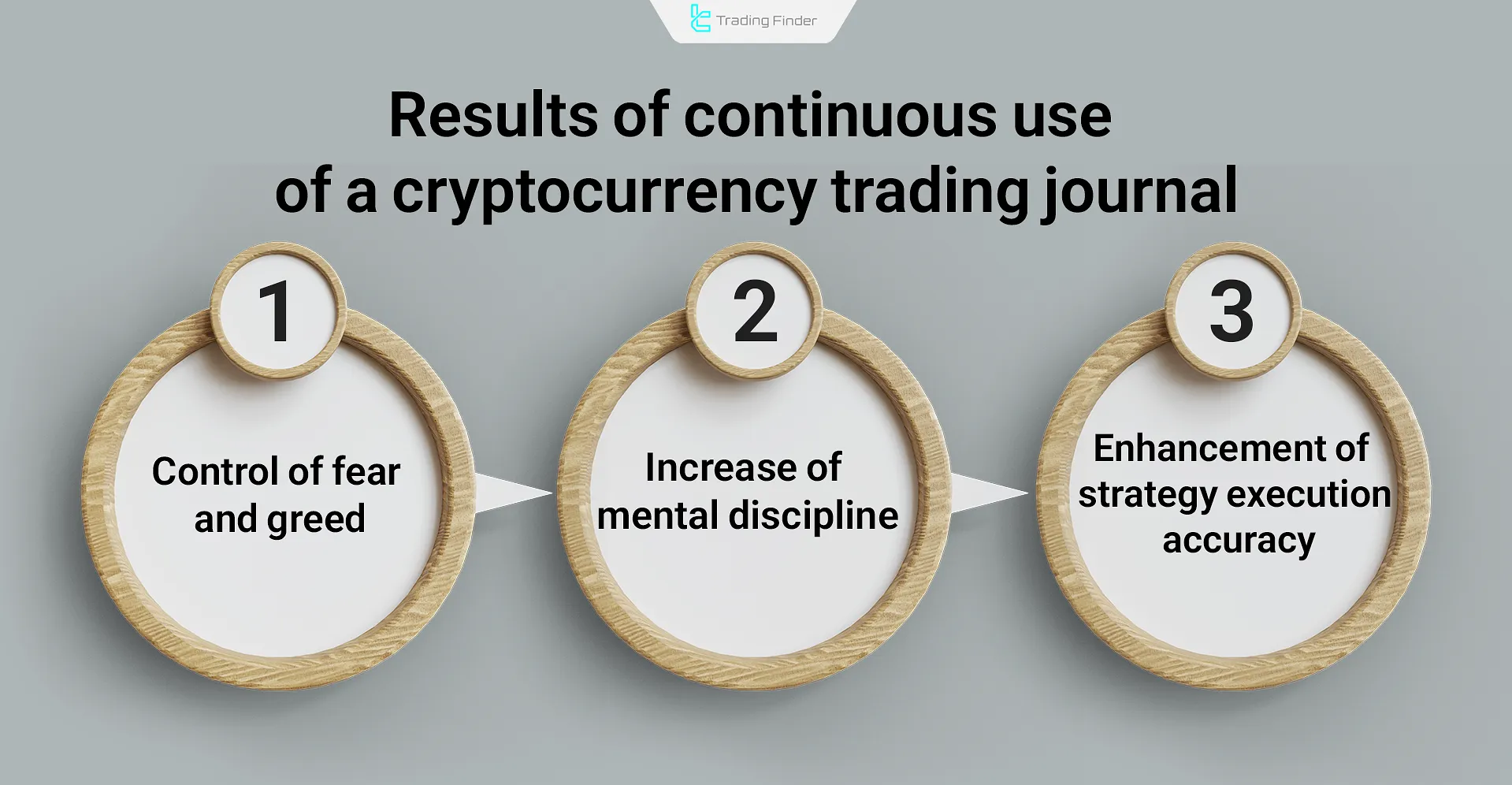

The importance of journaling in trading, especially in cryptocurrency, is extremely high, as it strengthens the process of mental organization, self-awareness, and accurate analysis of trading performance.

A trading journal allows the trader to record their decisions and later review which factors led to profit or loss. This process forms the foundation for strategy improvement, emotional control such as fear and greed, and building a long-term perspective in the volatile crypto market.

In fact, a trading journal acts as a bridge between experience and data, turning every mistake into a lesson and every success into a repeatable pattern.

For a deeper understanding of the importance of journaling for cryptocurrency trading, one can refer to the educational video on the Disciplined Trader YouTube channel.

Importance of Analyzing Trading Journal Data for Strategy Improvement

For many professional traders, merely recording trades in the journal is not enough; the true transformation begins when the stored data is periodically analyzed.

Regularly reviewing trading records enables traders to identify recurring patterns, periods of highest returns, and less effective strategies.

For example, analyzing average returns during bullish and bearish phases of the market reveals which trading style performs better under each condition.

Such a data-driven approach paves the way for redesigning the trading system and improving the structure of individual strategies.

Journaling and its Impact on Emotional Control in Trading

Journaling in cryptocurrency is not just a statistical tool; it is an analytical framework for understanding the hidden layers of emotions within the decision-making process.

Recording mental and emotional states during entry, execution, and exit of a trade allows the trader to identify behavioral patterns such as fear of loss or excessive greed for profit.

Reviewing this emotional data enhances the trader’s self-awareness and prevents impulsive and irrational decisions during the trading process.

Data Recorded in a Crypto Trader’s Journal

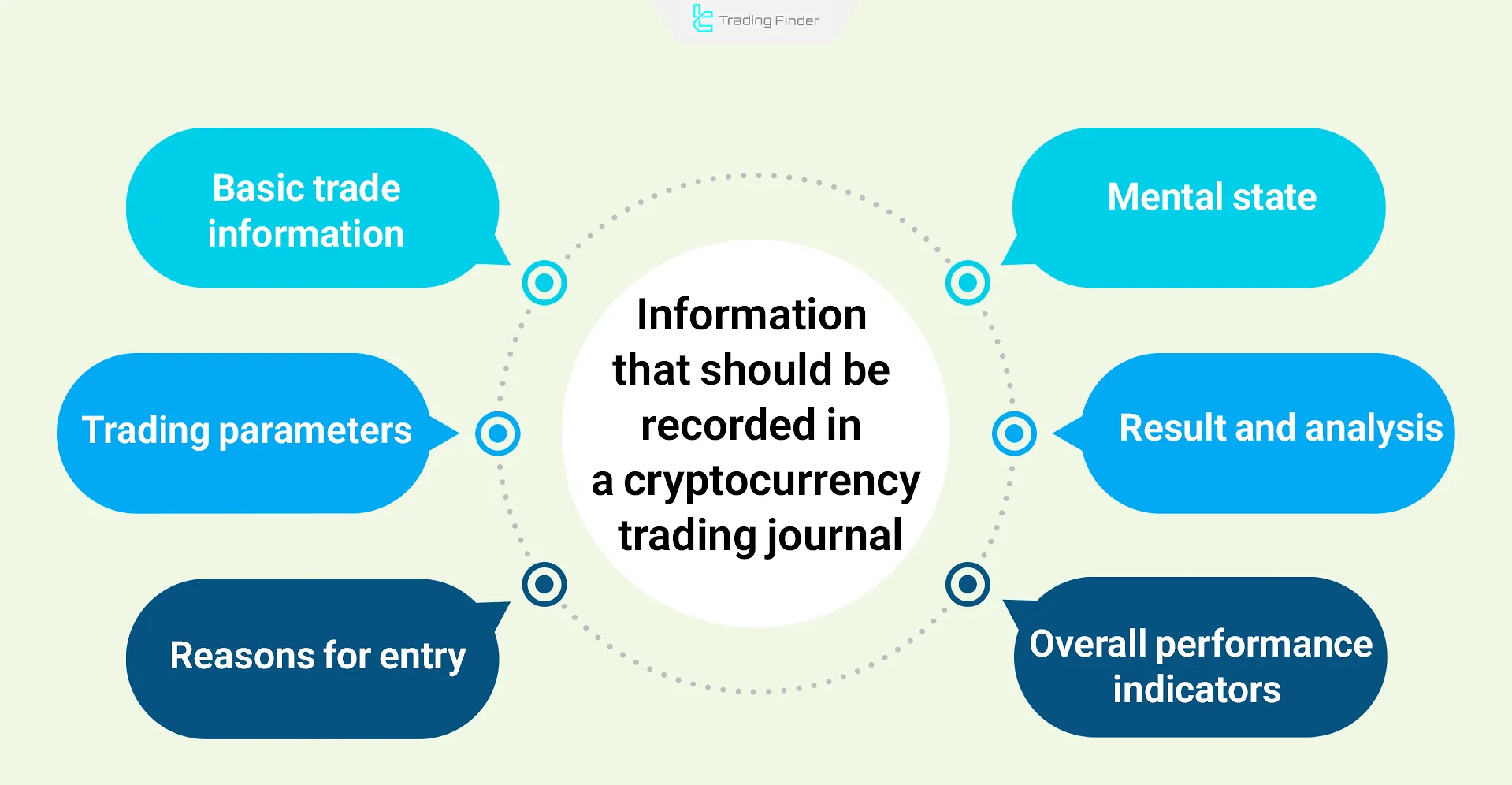

Various types of data are recorded in a cryptocurrency trader’s journal so that the trader can evaluate their trading performance accurately, analytically, and in measurable terms. Below are the most important types of information that should be recorded in such a journal:

- Basic trade information: date and time of entry and exit, trading pair, position type, size, entry and exit price, commission, and profit/loss;

- Trading parameters: stop loss and take profit levels, risk-to-reward ratio, order type, and analysis timeframe;

- Reasons for entry: based on technical analysis, fundamental analysis, or market sentiment, along with an explanation of the decision-making logic;

- Mental state: emotions before, during, and after the trade (confidence, fear, regret, etc.) and mental notes;

- Result and analysis: percentage of profit or loss, decision quality, adherence to stop loss or take profit levels, and notes for improvement;

- Overall performance indicators: success rate, average profit and loss, maximum profit or loss, risk-to-reward ratio, and total portfolio return.

Format of Journaling in Crypto Trading

The format of journaling in cryptocurrency trading is usually designed as a structured table or form so that each trade can be recorded precisely, systematically, and in an analyzable way.

This format can be implemented using tools such as Excel, Google Sheets, Notion, or specialized trading journal software. Below is a standard and professional format for a cryptocurrency trading journal:

Column | Description |

Date and time of trade | Time of entry and exit from the position |

Symbol/pair | For example, BTC/USDT, ETH/USDT, etc. |

Position type | Long (buy) or short (sell) |

Trade volume | Amount of cryptocurrency or percentage of capital entered |

Entry/exit price | Exact open and close prices of the position |

Stop loss/take profit | Defined levels for risk control |

Risk-to-reward ratio | The level of risk compared to potential profit |

Order type | Market, Limit, or Stop |

Reasons for entering the trade | Technical, fundamental, or market sentiment analysis |

Mental and emotional state | Emotions before, during, and after the trade |

Final trade result | Profit or loss in both numerical and percentage form |

Post-trade analysis | Review of decisions, mistakes, or learning points |

Performance rating | Qualitative evaluation of the trade (e.g., from 1 to 5) |

Notes | Free notes or suggestions for future trades |

In the the training for creating a crypto trading journal article on the website blueberrymarkets.com, the parameters of journaling are discussed in more detail, and those interested can also refer to this article.

Professional tips for designing the format of a trading journal:

- Design columns in a way that allows data filtering and statistical analysis later (for example, using formulas and functions in Excel);

- Use color coding for profit and loss with green and red colors to create a clear visual representation of trade results;

- In Notion or Google Sheets versions, sections for monthly performance charts and profit trend analysis can be added to make the evaluation of trading progress simpler and more precise.

Essential Parameters in Trading Journal Writing

In professional cryptocurrency trading journal writing, the goal is not merely to record data; it is to create an analytical framework for optimizing decision-making, evaluating performance, and enhancing trading maturity.

In this process, mastering a set of key parameters plays a fundamental role; parameters that form the core of effective journaling include the following:

- Statistical and professional risk assessment parameters;

- Psychological monitoring and behavioral pattern parameters in trading;

- Strategic and analytical parameters;

- Post-trade analytical parameters and data extraction for improvement;

- Personal growth and sustainable trading mindset management parameters.

Statistical and Professional Risk Assessment Parameters

These parameters are used to measure the accuracy, stability, and risk and capital management efficiency of the trading strategy. They enable the trader to optimize performance using quantitative data and adjust returns according to the risk level.

- Expected Value (EV): the average expected value of each trade based on the probability of winning and the average profit or loss;

- Position Size %: the percentage of total capital allocated to each position to control risk;

- Maximum Drawdown (MDD): the largest drop in capital from peak to trough over a defined period;

- Sharpe Ratio: the ratio of excess return to risk; a measure of strategy efficiency;

- Kelly Criterion: the optimal percentage of capital for sustainable growth without excessive risk;

- Variance/Standard Deviation: the volatility of returns used to evaluate the consistency of trading system performance.

Psychological Monitoring and Behavioral Pattern Parameters in Trading

This section is designed to analyze the influence of emotions, mindset, and cognitive biases on trading decisions. It helps traders maintain psychological stability and mental discipline in volatile market conditions.

- Emotional Trigger: the emotional factor influencing entry or exit (fear, greed, FOMO, revenge trade);

- Confidence Level (0–10): the trader’s mental confidence level when entering a position;

- Discipline Score: the degree of adherence to trading rules and the trading plan (for example, from 1 to 5);

- Post-Trade Reflection: emotional analysis after closing a trade and reviewing its psychological impact;

- Bias Recognition: identifying mental biases such as confirmation bias or overconfidence.

Strategic and analytical parameters

This group focuses on the quality of analytical decision-making and the extent to which the strategy aligns with market structure. It determines which setups, conditions, or signals produce the highest returns with the least risk.

- Setup Type/Strategy Tag: the type of trading setup (Breakout, Reversal, Pullback, Scalping, etc.);

- Market Condition: the state of the market at the time of entry (Trending, Range, Volatile, Low Volume);

- Entry Confirmation Signals: indicators or signals confirming entry, such as RSI, MACD, EMA, or Order Flow;

- Exit Reason: the reason for exiting the trade (stop loss, reverse signal, target price, or emotional decision);

- Trade Duration: the length of time the position was open to assess timeframe efficiency;

- Correlation Impact: the influence of asset correlation on overall portfolio risk.

Post-Trade Analytical Parameters and Improvement Data Extraction

The purpose of this section is to evaluate the real, data-driven results of executed trades.

This evaluation enables the trader to identify the strengths and weaknesses of their trading system and make the necessary adjustments based on historical data.

- Profit Factor (PF): the ratio of total profits to total losses; a PF value higher than 1.5 indicates a profitable strategy;

- Average Holding Time (AHT): the average duration for which positions remain open, used to determine trading style;

- Setup Win Rate: the success rate of each trading setup to compare performance among different strategies;

- Trade Expectancy by Market Phase: analysis of profitability across various market phases such as trending, ranging, or volatile markets;

- Time of Day Effect: analysis of trade results based on execution time (for example, Asian, New York, or London sessions).

Personal Growth and Sustainable Trading Mindset Management Parameters

This category is used to track the development of a trader’s skills, discipline, and personal progress over time. It helps monitor learning paths, corrective goals, and continuous improvement in measurable ways.

- Plan Deviation: the degree of deviation from executing the main strategy and the reasons for straying from the trading plan;

- Learning Notes: documentation of educational insights, mistakes, and key lessons learned from each trade;

- Improvement Goal: a specific corrective goal for future trades (for example, entering only after two confirmations or refining stop-loss placement);

- Account Growth %: percentage change in account balance over daily, weekly, or monthly periods;

- Stress Level Index: the level of mental and emotional stress during drawdown periods or when executing frequent trades.

Platforms for Trading Journal Writing for Cryptocurrency Trading

For accurate performance analysis, emotional control, and strategy improvement in crypto trading, using professional journaling platforms is of great importance.

Tools such as TraderSync, TradeZella, UltraTrader, Edgewonk, and Coin Market Manager are among the best options for automatically logging trades, conducting statistical analysis, and evaluating traders’ behavioral patterns.

Comparison table of the best crypto trading journal platforms:

Features / Platforms | TraderSync | TradeZella | UltraTrader | Edgewonk | Coin Market Manager |

Access type | Web and mobile | Web | Mobile app (iOS/Android) + Web | Desktop software (Windows/Mac) | Web |

Automatic exchange connection | Supports Binance, Coinbase, and major exchanges | Automatic connection via API | Supports Binance and other exchanges | Requires manual entry or CSV file | API connection for spot and futures trades |

Statistical analysis and reports | Very advanced (EV, Win Rate, R/R, Drawdown) | Strong with tagging and dynamic dashboard | Moderate, focused on visual reports | Very strong with mathematical analysis and high customization | Good, focused on futures trading and ROI |

Psychological and behavioral analysis | Emotion notes and emotion control | Dedicated section for trading psychology | Limited but practical | Behavior score and mental focus rating | None |

Backtesting and trade replay | Full playback and trade review | Replay and strategy practice | None | Scenario simulation | None |

Cryptocurrency support | Complete (spot and futures) | Complete (spot/futures) | Limited spot and futures | All markets, including crypto | Focused mainly on futures |

Ease of use (UX/UI) | Very user-friendly and modern | Clean and organized interface, suitable for active traders | Simple and minimal, ideal for mobile | More technical and requires initial learning | Simple and direct, ideal for data-oriented users |

Target user level | Semi-professional to professional | Professional and psychology-focused | Beginner to intermediate | Professional and data-driven | Professional |

Approximate cost (monthly) | 25–50 USD | 35–55 USD | Free version + Pro plan up to 20 USD | About 169 USD annually | Free plan + Pro version up to 30 USD |

Key advantage | Automated, precise, in-depth performance analytics | Focus on behavior and mental analysis | Simple and fast mobile interface | Comprehensive data analysis and risk management | Focus on futures and professional API management |

Main disadvantage | Relatively high cost | No mobile application | Lacks deep analytical tools | Less modern interface | Limited focus on cryptocurrencies and no support for other markets |

Advanced Features of Modern Crypto Trading Journal Platforms

Modern trading journals have evolved beyond traditional formats and have integrated with intelligent technologies.

Platforms such as TraderSync, Coin Market Manager, and Edgewonk enable automatic trade analysis through direct connection to crypto exchanges.

Some advanced versions of these platforms utilize Artificial Intelligence (AI) to detect behavioral mistakes, generate real-time profit and loss reports, and analyze seasonal returns.

The use of these innovative tools significantly accelerates, refines, and optimizes the process of self-evaluation for cryptocurrency traders.

Building a cryptocurrency trading journal

Creating a crypto trading journal can be done using Excel, Google Sheets, Notion, or specialized platforms such as TraderSync.

In the journal, information such as date, symbol, position type, trade volume, entry and exit price, stop loss and take profit, reasons for entry, emotions, and trade result are recorded. Then, performance is analyzed using indicators like Win Rate, R/R, EV, and Profit Factor.

Steps to build a cryptocurrency trading journal:

- Define the purpose and structure of the journal;

- Design the main sections and columns;

- Record results and analyze trading performance;

- Evaluate trading psychology;

- Review and analyze data periodically;

- Pursue continuous improvement and refine the trading plan;

- Use supportive tools or APIs for automation.

Example of Journaling Template in Crypto Trading

The table below shows a sample template for a cryptocurrency trading journal, including three trades with specific parameters for more detailed analysis.

Date | Pair | Position type | Trade volume | Entry price | Stop loss | Take profit | Exit price | Profit/Loss (%) | R/R ratio | Entry reason | Pre-trade emotions | Trade result | Notes and lessons |

30 ⁄ 11 ⁄ 2024 | BTC/USDT | Long | 0.2 BTC | 62,000 | 60,500 | 64,000 | 63,800 | +2.9% | 1:2.5 | Resistance breakout on 4H timeframe with high volume | Confidence and high focus | Take profit triggered | Pre-entry trend confirmation was excellent |

2 ⁄ 12 ⁄ 2024 | ETH/USDT | Short | 3 ETH | 3,400 | 3,480 | 3,250 | 3,470 | -2.1% | 1:1.8 | RSI divergence and strong resistance | Impulsive entry | Stop loss triggered | More patience needed for candle confirmation |

4 ⁄ 12 ⁄ 2024 | SOL/USDT | Long | 50 SOL | 165 | 160 | 175 | 174 | +5.4% | 1:2 | Break of descending channel and 160 support | Proper confidence | Target fully achieved | Perfect timing and precise risk management |

How to Use a Crypto Trading Journal?

Using a crypto trading journal can be summarized in several structured steps:

- Trade recording: immediately log all details of each trade, including date, pair, position type, entry and exit prices, stop loss, and take profit;

- Decision documentation: write down reasons for entry and exit based on technical analysis, fundamental analysis, or behavioral factors;

- Psychological analysis: record the trader’s mental and emotional state before entry, during execution, and after closing the trade;

- Periodic evaluation: regularly assess performance weekly or monthly using metrics such as Win Rate, Risk/Reward, and Expected Value;

- Strategy optimization: identify repeating patterns, analyze results, and correct weaknesses to enhance strategy efficiency and stability;

- Consistency in data recording: consistently log all trades, even minor ones, to preserve statistical accuracy, information consistency, and analytical reliability of the journal.

Expert Advisor for Trade Journal Recording in MetaTrader

The Expert Advisor for trade journal recording in Notion, developed by TradingFinder, provides an intelligent solution for traders who want to automatically and systematically record their trading journal in Notion.

- Download Expert Advisor for MT5 journal recording in Notion for MetaTrader 5

- Download Expert Advisor for MT4 journal recording in Notion for MetaTrader 4

This Expert Advisor extracts key trade information such as Symbol, Volume, StopLoss, TakeProfit, OpenPrice, ClosePrice, and Risk/Reward ratio directly from MetaTrader and stores it in the Notion cloud environment.

Key features of this tool include:

- Automatic connection between MetaTrader and Notion through the WebRequest feature;

- Accurate recording of trade details in a dedicated Notion database;

- Completely free for a limited time;

- Suitable for scalping, swing, and day trading styles in Forex, stocks, and cryptocurrency markets;

- Designed for intermediate to professional traders.

To set up the Expert Advisor for trade journal recording in MetaTrader 5:

- Enable WebRequest: in MetaTrader 5, go to Tools > Options > Expert Advisors, activate the option Allow WebRequest for listed URL, and add the address https://api.notion.com to the allowed list;

- Obtain Parent Page ID: in Notion, after creating a workspace, copy the parent page ID from the end of the URL and enter it in the Expert Advisor settings;

- Retrieve Notion Token: navigate to Connections > Manage Connections, go to Develop or manage integrations, create a new integration, and obtain your personal token;

- Get License Key: to activate the free version, request a license code through TradingFinder support on Telegram or WhatsApp.

After saving the settings and running the Expert Advisor on a chart, the system transfers all open and closed trades to Notion in real-time. The user can also customize fields such as Ticket, Symbol, OrderType, Broker, Account Number, and Comment.

This Expert Advisor eliminates the need for manual data entry, simplifying and improving the accuracy of trading performance analysis.

All trade data is sent to Notion instantly and stored in a structured format, enabling efficient position management, performance evaluation, and strategy development.

Professional Tips for Increasing the Efficiency of a Trading Journal

The maximum effectiveness of a trading journal is achieved when the trader views it not merely as a logbook but as a behavioral and analytical feedback system for evaluating decisions and improving mental mechanisms.

- Review your trading journal at least once a week and examine performance trends on monthly charts;

- Use a color-coding system (green for successful trades, red for unsuccessful ones) to speed up and improve analysis accuracy;

- During each weekly review, write down three notable mistakes or successes to identify recurring thought patterns;

- Store your trading journal in the cloud to ensure access from all devices at any time.

Conclusion

A cryptocurrency trading journal is a specialized and essential tool in the professional crypto trading process that, by precisely recording quantitative and qualitative data, creates a structured system for trading performance analysis and emotional management.

This tool transforms emotional decision-making into a data-driven, measurable process and provides a consistent framework for evaluating crypto trading results.

Through continuous review of trading history, traders gain deep insights into their behavior, decision-making patterns, and actual outcomes.

In fact, the trading journal, by creating mental discipline, directs a trader’s professional growth in the crypto market and, through real data analysis, turns sustainable profitability into a measurable process.