- TradingFinder

- Education

- Forex Education

Forex Education

Forex trading offers opportunities to profit from global currency fluctuations, but success requires solid education and a strategic approach. Forex education encompasses various learning paths, from understanding basic forex concepts to mastering advanced strategies and trading psychology. Trading Finder offers the best Forex educational content for traders with various levels of knowledge and experience. This content covers basic Forex-related topics, including Forex market hours, trading platforms, spreads, commissions, Forex brokers, currency pairs, and general Forex terms such as pips, leverage, and margin. Our team of expert creators doesn’t stop there and also creates content for professional traders. These advanced educational resources cover both fundamental and technical analysis concepts. From Economic calendar, interest rate decisions impacts, economic reports impact including NFP or GDP, Forex regulatory bodies such as SEC, FCA, and ASIC, to technical analysis tools and strategies, including price action trading, various indicators such as RSI, moving average, Bollinger bands, and technical patterns, Trading Finder cover everything a trader needs to know.

RSI and EMA Strategy: A Trend-Confirmed Momentum Setup

In the strategy combining RSI and EMA, the RSI indicator, by displaying overbought and oversold zones, and the EMA indicator, by...

What is a Stablecoin? Types, How They Work, and Real-World Examples

Stablecoins link their value to assets such as the dollar or gold and create price stability; this structure makes their use in...

Moving Average Envelopes; Trading with Envelope Moving Averages

In technical analysis, moving averages are suitable tools for identifying trends, but on their own, they do not offer sufficient...

What is Yield Farming in DeFi? How to Earn Passive Income Safely

Crypto yield farming is considered a mechanism based on smart contracts that establishes a direct connection between digital assets...

Single Candlestick Patterns Explained: Bullish & Bearish (Beginner Guide)

Single candlestick patterns are recognized as basic yet impactful tools in technical analysis, and with the formation of just one...

Classic Rectangle Pattern - Trading Strategy Using the Classic Range Pattern

The classic rectangle pattern represents market indecision and an equal balance between buyers and sellers. As a result, this...

Trading Psychology - How to Develop a Winning Trader Mindset

Trading psychology has a direct connection with a set of specific emotions and behavioral patterns. Emotional behaviors in the...

Footprint Order Flow Indicator Tutorial in NinjaTrader; Bid/Ask Analysis

In short-term trading, seeing the “battle between buyer and seller” inside each candle can make the difference between a precise...

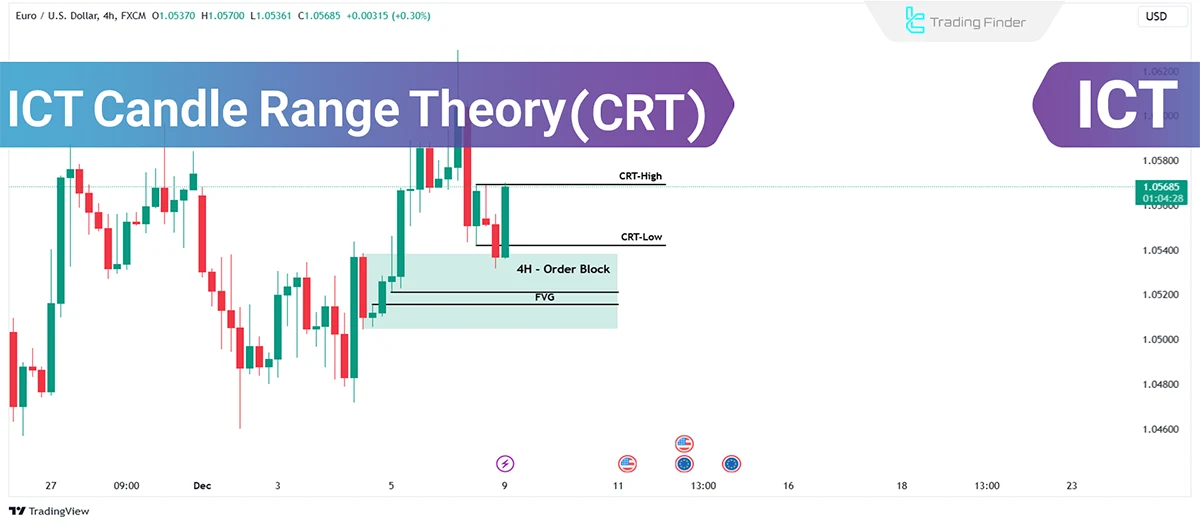

Candle Range Theory (CRT); Price Range Analysis Trading Guide

One of the patterns derived from the ICT methodology is the Candle Range Theory (CRT), which revolves around the concept of...

Fibonacci Retracement; Using Fibonacci Retracement in Trading

In technical analysis, various tools and patterns are used to identify price reversal zones, determine entry and exit points, and...

Binary Options vs Options - Which Market is Better?

Distinguishing between binary options and traditional options is not merely a comparison of two derivative instruments, it is an...

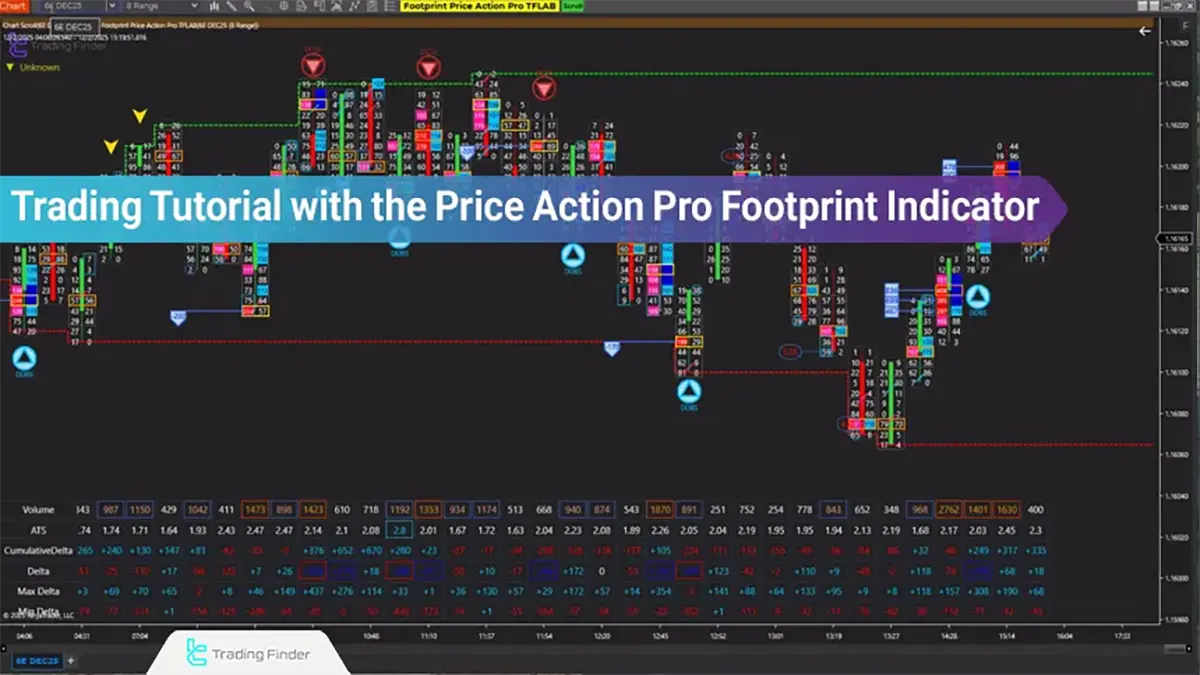

Footprint Price Action Pro Indicator Tutorial in NinjaTrader

The Footprint Price Action Pro indicator is an advanced tool for microstructure market analysis used within the NinjaTrader...