In financial markets such as Forex market, a broker acts as the intermediary between the trader and the market.

To make the right choice among the active brokers in financial markets, one must have a good understanding of the services provided and the way each broker operates.

The best Forex broker should not only have reliable regulation, transparent trading conditions, and fast services, but also provide access to a wide range of trading instruments.

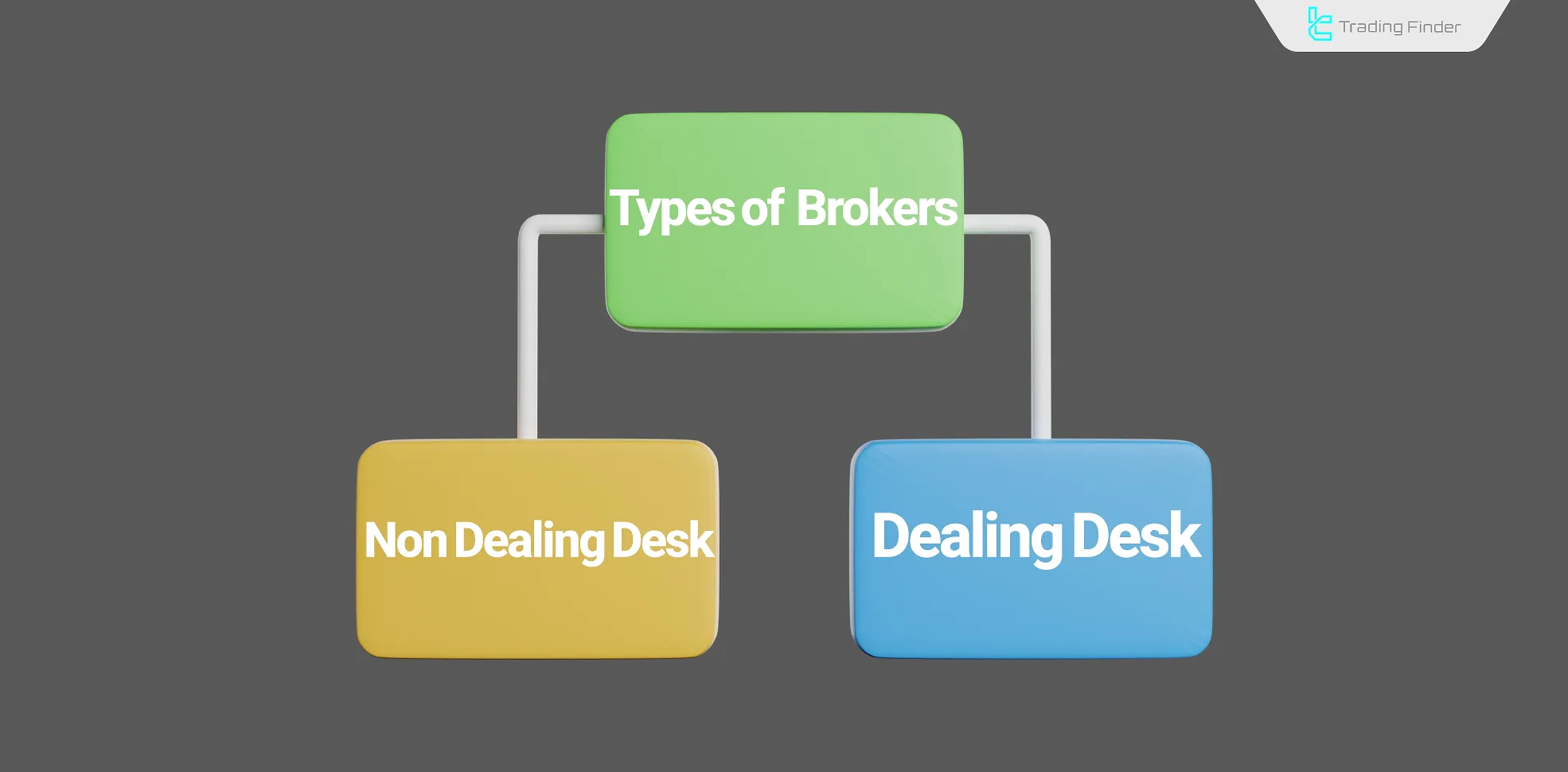

Understanding the types of brokers is an essential part of how to choose best forex broker.

Brokers are categorized into Dealing Desk (DD) and Non-Dealing Desk (NDD) types, with the Non-Dealing Desk category including various trading accounts such as ECN and STP.

Importance of Choosing a Forex Broker

The presence of dozens of active brokerage firms makes the selection process difficult for traders. In such circumstances, having a comprehensive guide for choosing a forex broker becomes highly important.

A wrong choice can lead to unnecessary losses. Therefore, understanding criteria such as commission, spread, and order execution quality forms the foundation of a smart broker selection.

Understanding how to choose a forex broker is crucial because selecting a suitable broker depends heavily on your trading strategy, especially when considering factors like spread and commission costs.

On Jason Graystone’s YouTube channel, a video guide is provided that explains how to choose the right forex broker.

Types of brokers based on execution model

Understanding the execution structure is highly important when it comes to the complete process of choosing a broker. Brokers are divided into two main categories:

- Brokers with a dealing desks or dealing desks forex brokers;

- Brokers without a dealing desk or non-dealing desk forex brokers.

The NDD model includes two main subcategories:

- STP brokers (Straight Through Processing)

- ECN brokers (Electronic Communication Network)

In addition, some brokerage firms combine both models and operate as Hybrid brokers.

Dealing Desk Brokers (DD)

In this type of broker, the trader deals directly with the broker itself. This means the broker buys or sells the trader's requested amount based on the type of order.

Non-Dealing Desk Brokers (NDD)

These brokers act as intermediaries between traders and liquidity providers and are divided into two categories:

- STP Brokers (Straight Through Processing)

- ECN Brokers (Electronic Communication Network)

STP Brokers

When learning how to choose a forex broker, it's important to understand that in STP brokers, liquidity providers are fixed and predefined.

These brokers offer floating spreads and may apply a markup a slight increase in spread for additional broker profit.

However, no commission is charged for executing trades, and they provide high-speed execution with moderate transaction costs.

ECN Brokers

ECN brokers provide a network of market makers (banks, other brokers, large institutions, traders, etc.).

Orders are automatically matched and executed within this network. The broker charges a separate commission for connecting and completing orders.

A critical factor in how to choose best forex broker is understanding that ECN brokers provide the highest transparency in executing trades and typically offer ultra-low spreads.

In the broker selection tutorial article on the AVA Academy website, six important tips for comparing different brokers are introduced.

Comparison Between Dealing Desk and Non Dealing Desk Brokers

The business model, order handling, and connection to the interbank market differ between DD and NDD brokers. The table below presents a comparative overview:

Feature | Dealing Desk (DD) | Non Dealing Desk (NDD) |

Order Execution | By broker (internal) | By liquidity provider |

Conflict of Interest | Yes | No |

Spread Type | Fixed | Floating |

Chance of Requotes | Yes | Very low |

Price Transparency | Lower | Higher |

Suitable For | Beginners | Professionals |

Practical examples of DD and NDD brokers

To better understand the difference between dealing desk vs non dealing desk, a practical example can be mentioned.

During the release of major news such as NFP, DD brokers may execute your market order with a requote or negative slippage because the counterparty of the trade is the broker itself.

In contrast, with NDD brokers, your order is sent directly to liquidity providers and filled at the best available price.

Although in this case you usually pay a fixed commission, the transparency and execution quality are higher. For this reason, scalpers and news traders often prefer forex no dealing desk accounts.

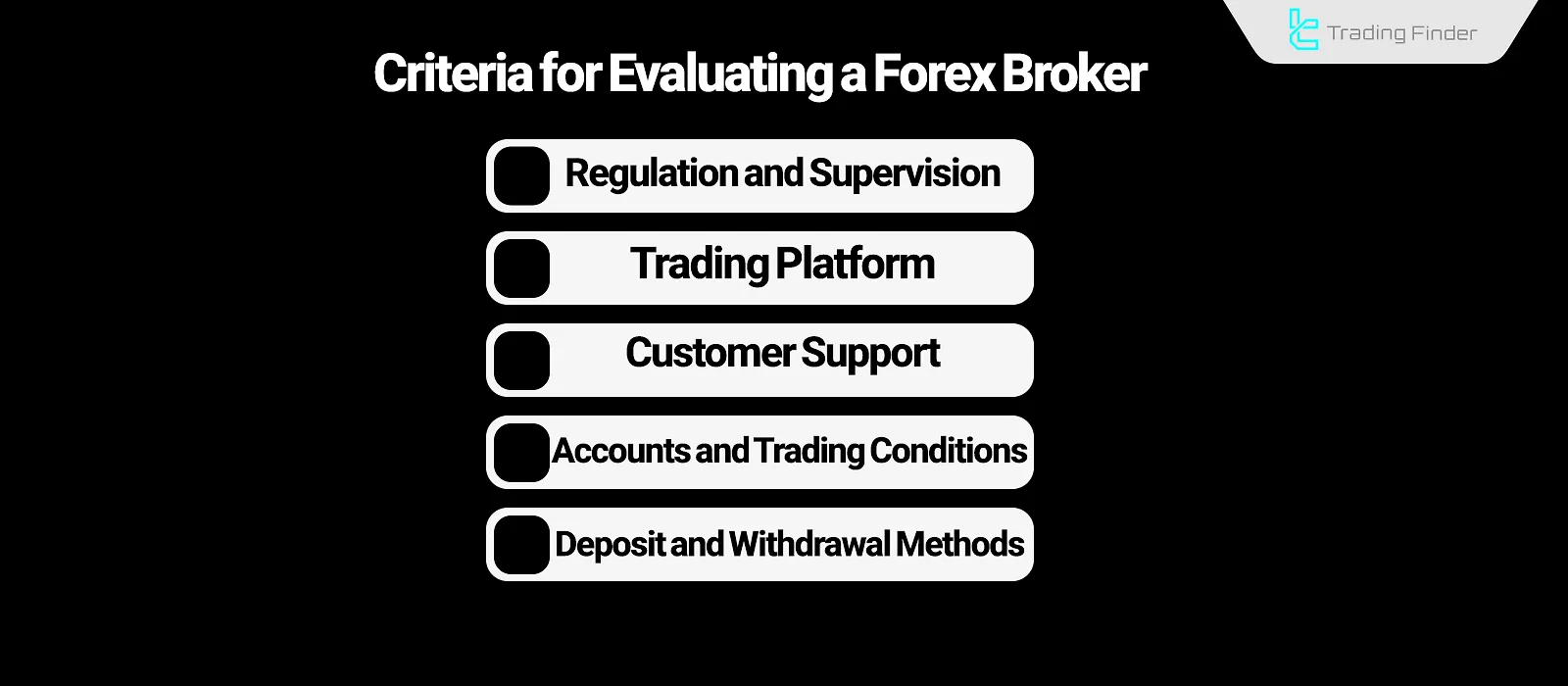

Criteria for Choosing a Forex Broker

After selecting a broker, its services and credibility should be evaluated based on the following factors:

- Regulation and Supervision

- Trading Platform

- Customer Support

- Account Types and Trading Conditions

- Deposit and Withdrawal Methods

Regulation and Supervision

Regulation refers to the supervision of a broker's operations by an international or regional financial authority.

There are three levels of financial regulators with different levels of strictness:

- Tier-1 Regulators: The strictest and most reputable global regulators;

- Tier-2 Regulators: Reputable with less strict oversight compared to Tier-1l;

- Tier-3 or Offshore Regulators: The least strict, often used by brokers serving sanctioned countries like Iran and Lebanon.

Balance protection: fund segregation, compensation schemes, and negative balance protection

Alongside regulation and supervision, it is essential to carefully review the conditions related to client fund protection.

Reputable brokers hold traders’ capital in segregated accounts with trusted banks to reduce the risk of misuse or bankruptcy.

In addition, some regulatory bodies offer compensation schemes such as FSCS or ICF, which reimburse clients up to a certain amount in case of any issue.

Another important aspect is Negative Balance Protection (NBP). During periods of high volatility, an account’s losses may exceed its balance.

Brokers offering NBP reset the account to zero and do not require traders to pay the excess debt. This feature plays a crucial role in risk management within highly volatile markets.

Trading Platform

The trading platform offered by a suitable broker should be stable, fast, and well-known. The most widely used platforms among brokers are MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader.

Additionally, fast trade execution and minimal slippage indicate a high-quality infrastructure.

Order execution quality: indicators and evaluation methods

Regardless of the account type or platform, execution quality is one of the main criteria for selecting a broker.

Execution speed in milliseconds, order fill rate, and the percentage of trades executed without requotes are indicators that should be clearly disclosed.

Moreover, analyzing the average positive and negative slippage can serve as a useful measure of quality.

Brokers that use multiple liquidity providers typically offer faster execution and more stable spreads.

Traders engaged in scalping or news trading should pay special attention to this aspect and base their evaluations on real live-account data rather than demo performance

Customer Support

One important aspect of how to choose a forex broker is access to quick, multilingual, and responsive customer support under various conditions. Ideal support factors include:

- 24/7 availability

- Multiple communication channels (chat, phone, email)

- Multilingual support

Educational resources and market analysis

Many reputable brokers, in addition to trading services, also provide educational and analytical resources.

These include webinars, educational articles, analytical videos, and specialized courses. Having such content helps beginner traders reach a professional level more quickly.

On the other hand, access to reliable data sources such as economic calendars, earnings reports, or market sentiment analysis adds extra value that can play a key role in decision-making.

Brokers offering in-platform analysis or trading signals generally achieve higher user satisfaction.

Account Types and Trading Conditions

A variety of account types (ECN, Micro, Standard, etc.) enables traders to match their accounts to their trading strategies. Important criteria include:

Islamic Account (Swap-Free)

For traders seeking to comply with Sharia principles, many brokers offer swap-free or Islamic accounts, where overnight interest charges are removed.

However, in some cases, a replacement fee such as an admin fee may apply.

It is important to check which instruments are covered by the swap exemption, as some brokers only enable this feature for major currency pairs, while limiting it for crypto or exotic pairs.

In addition, the duration of the Islamic account may sometimes be restricted to prevent arbitrage abuse.

Trading policies (Hedging, Scalping, Algorithms)

Before choosing a broker, you should be aware of its acceptable trading policies. Some brokers impose restrictions on scalping or high-frequency trading, such as minimum holding time for positions or a maximum number of orders per minute.

Regarding hedging, rules may vary; some brokers do not allow opening buy and sell positions simultaneously on the same instrument, or they may apply specific margin rules for hedged positions.

If you plan to use Expert Advisors or algorithmic trading systems, make sure the broker does not restrict their usage. Generally, NDD (ECN/STP) accounts offer greater flexibility for algorithmic strategies, while DD (Dealing Desk) accounts tend to be more sensitive to scalping.

Deposit and Withdrawal Methods

Due to the volatile nature of financial markets, a broker should offer various deposit and withdrawal methods to ensure seamless transactions even during technical issues. Common methods include:

- Bank wire transfers

- Credit cards

- E-wallets like Skrill and Neteller

- Cryptocurrencies

Candle Time Spread Indicator

The Candle Time Spread indicator is one of the key tools for traders who base their trading decisions on candlestick structure and transaction execution costs. This indicator displays two essential live data points on the chart:

- Time remaining until the current candle closes

- Current spread value

Combining this information helps traders gain a clearer view of entry timing and trading costs under real market conditions.

In strategies such as price action or candlestick pattern analysis, the exact closing time of the candle plays a major role in confirming signals. Moreover, monitoring the live spread helps traders avoid entering trades when transaction costs are high.

Especially during critical times such as major economic news releases or the opening of the London and New York trading sessions, these data points can make a significant difference in trade outcomes.

Adjustable features in the Candle Time Spread indicator include changing the clock color and choosing the display corner on the chart.

These options allow users to customize the indicator’s appearance according to their trading style.

This indicator is useful not only in the Forex market but also in cryptocurrencies, stocks, indices, and commodities.

Due to its simple installation and operation, beginner traders can use it easily without technical complexity, while professionals rely on it to better manage volatile conditions and prevent price slippage.

In conclusion, the Candle Time Spread indicator, by combining two key elements time and spread is an effective tool for improving analytical accuracy and risk management.

It helps traders make more confident decisions during high-volatility periods and avoid entering positions with high transaction costs.

- Download Candle Time Spread Indicator for MetaTrader 4

- Download Candle Time Spread Indicator for MetaTrader 5

Hidden costs

In addition to spreads, commissions, and swaps, some brokers charge other fees that are often overlooked.

The inactivity fee is one such charge, deducted from the balance if the account remains inactive for a specified period. Furthermore, when the base currency differs from the deposit currency, a conversion fee may apply.

In the Inactivity Fee tutorial article on the Investopedia website, this concept is explained in full.

Other costs may include withdrawal fees or daily withdrawal limits. In some cases, internal transfers between a client’s own accounts are also subject to fees. Therefore, it is important to thoroughly review the “Schedule of Fees” page before choosing a broker.

Instrument coverage and market depth

One of the key criteria in selecting a broker is the variety of tradable instruments. In addition to major and minor currency pairs, a good broker should offer a diverse range of assets such as precious metals, energy, global indices, and cryptocurrencies.

Another important factor is the presence of multiple liquidity providers (LPs). The greater the number of LPs, the faster the execution and the more stable the spreads.

Moreover, the ability to view market depth (Depth of Market) provides professional traders with better insight into order volume and liquidity levels.

Advanced risk management tools

Beyond standard order types, some brokers offer advanced tools for risk management. One of these is the Guaranteed Stop-Loss, which ensures the order is executed at the specified price even during price gaps, though it involves an additional fee.

Another tool is the precise Trailing Stop, allowing traders to adjust their stop-loss levels dynamically as the price moves in their favor. Some brokers also offer partial close options and conditional orders (OCO), which help optimize capital management.

In the Trailing Stop tutorial article on the Investopedia website, various types of trailing stops in no dealing desk forex are explained.

Final checklist for choosing a broker

To review the key points in broker selection, factors such as reliable regulation, account types including Islamic Account (Swap-Free), and metrics like execution quality should be considered alongside financial aspects such as hidden fees. The following table presents these criteria in a categorized format.

Final checklist table for choosing a broker:

Regulation & Fund Protection | Accounts & Trading Conditions | Execution & Trading Policies | Fees & Transactions | Tools & Additional Services |

Reliable Regulation (Regulation) | Variety of Accounts (Account Types) | Execution Quality (Execution Quality) | Hidden Fees (Hidden Fees) | Risk Management Tools (GSLO, Trailing, OCO) |

Segregated Client Funds (Segregated Accounts) | Islamic Account (Swap-Free) | Trading Policies (Scalping, Hedging, Algo) | Deposit & Withdrawal | Educational & Analytical Resources |

Compensation & Negative Balance Protection (Compensation & NBP) | - | EA & API Support | Options for Iranian Clients | Customer Support Quality |

Transparent KYC/AML | - | Instruments & Liquidity Coverage | Margin Call & Stop Out Levels | - |

Conclusion

Choosing a forex broker should focus on the order execution structure (Dealing Desk or Non-Dealing Desk), spread type (fixed or floating), chance of requotes, price transparency, and interbank market connectivity.

Another key element of how to choose a forex broker is evaluating the broker's credibility by examining regulation levels (Tier-1, Tier-2, Tier-3, or Offshore), account structures (ECN, STP, etc.), commission policies, and trading platforms. All these factors must ultimately align with the trader's personal trading strategy.