The legal status of copy trading varies from one country to another. For instance, in the United States, copy trading is only allowed if regulators like the SEC or CFTC license the service provider.

On the other hand, in some countries, such as Japan, offering copy trading services is strictly illegal and considered a criminal offense.

What Is Copy Trading?

Copy Trading is a trading model within the field of Social Trading. In this method, the investor automatically copies the trades of a professional trader in various markets, such as the Forex market or cryptocurrency, directly into their own personal account.

This process is usually carried out via an API, meaning every trade executed in the signal provider's account is copied and executed in the subscriber’s account.

Is Copy Trading Legal?

Whether or not copy trading is legal, depends on the regulatory status of the platform offering these services.

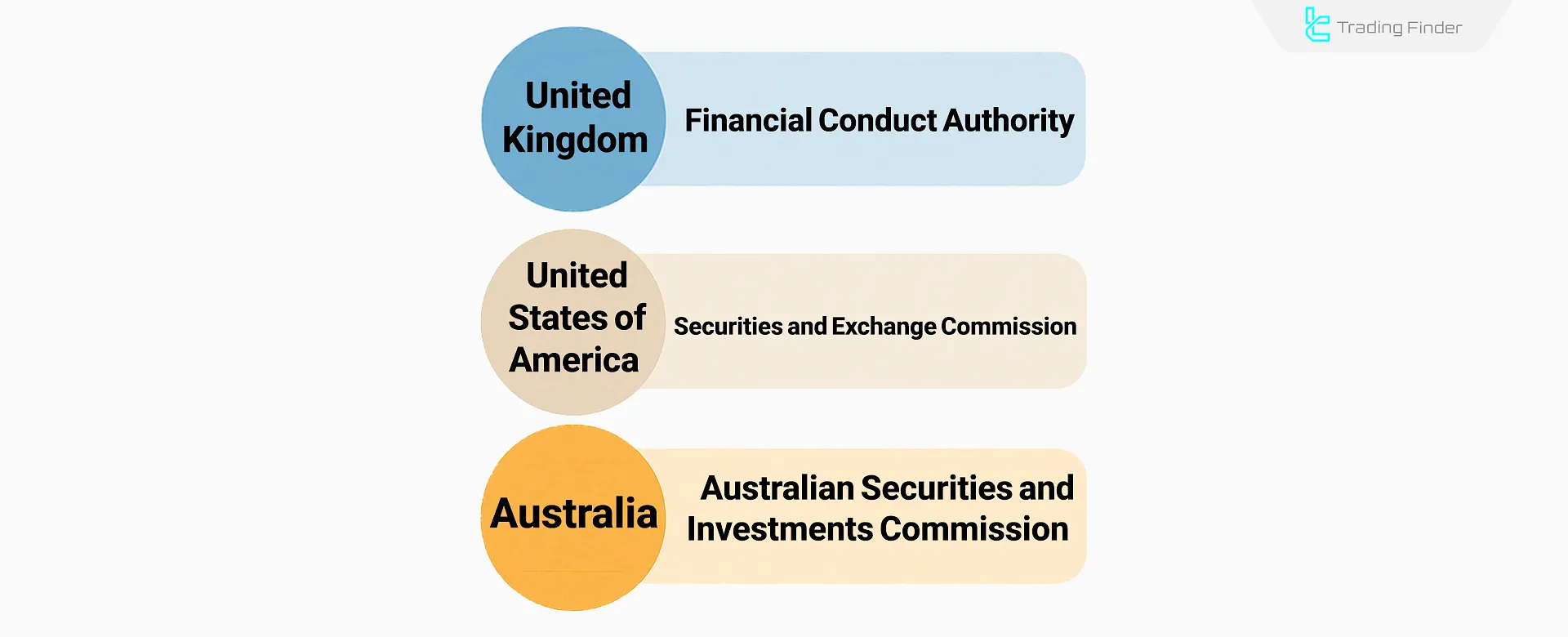

In many countries - such as the UK, Australia, and EU nations - platforms that operate under the supervision of regulators like the FCA, ASIC, or CySEC are permitted to offer copy trading services.

However, offshore platforms may offer these services without regulatory approval. Although they may provide features similar to licensed platforms, there is no guarantee of fund security for users.

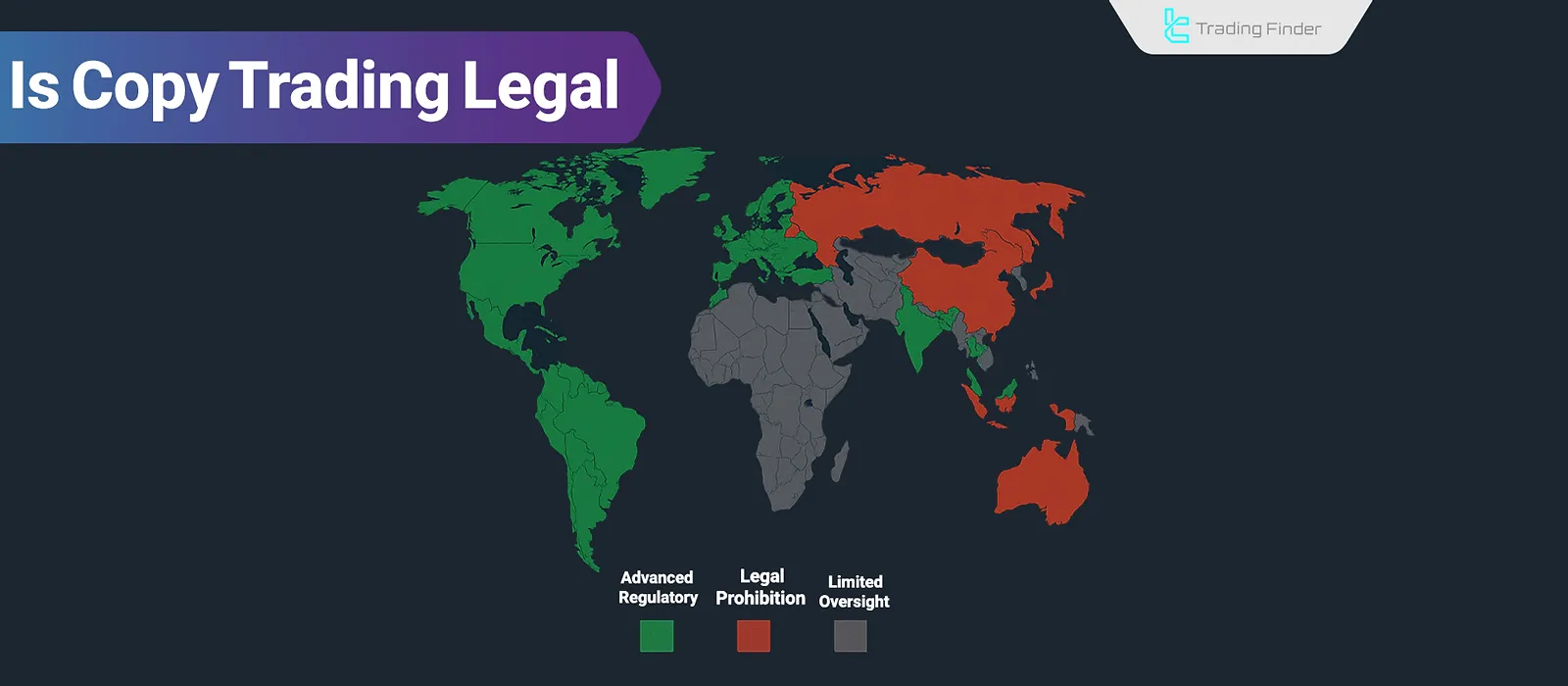

Global Legal Status of Copy Trading

The legal status of copy trading varies across countries. In developed markets like the UK and USA, service providers are directly supervised by recognized institutions such as the FCA.

In countries like Iran or the UAE, copy trading exists in a legal gray area due to the lack of clear legal frameworks.

In others - such as Japan and China - strict limitations have been imposed, leading many platforms to be considered illegal.

Countries With Advanced Regulatory Frameworks

In countries with robust financial regulation, copy trading is legal, only if platforms acquire licenses from official regulators.

For example, in the United States, only firms licensed by the SEC or CFTC are authorized to provide copy trading services.

According to the MiFID directive, copy trading is legally approved within the European Union, and brokers must comply with regulatory obligations. Operating under these rules offers the following benefits:

- Full transparency in trader performance reports

- Mandatory risk disclosures and anti-abuse policies

- Legal complaint mechanisms

- Licensing requirements for service providers

Countries With Weak or Limited Oversight

In many countries like UAE and India, the legal status of copy trading remains unclear.

For instance, in India, no official guidelines or licenses have been issued for copy trading, so users rely solely on foreign platforms. This leads to risks such as lack of support and no legal recourse.

Key risks of copy trading in such jurisdictions include:

- Absence of clear legal definitions for copy trading

- Free operation of unlicensed international platforms

- No transparent user complaint mechanisms

- Lack of active oversight of cross-border financial activities

Countries With Legal Prohibition

Financial laws in some nations - like Japan, China, and South Korea - explicitly ban or restrict copy trading under particular conditions.

For example, copy trading platforms in Japan must have an official investment advisory license from the FSA. Operating without it leads to penalties.

Such regulations present the following challenges:

- Direct or indirect legal bans

- Need for special licenses to operate

- Platform filtering and access restrictions

- Legal action against unlicensed individuals or firms

Dangers of Using Unlicensed Copy Trading Platforms

Using copy trading services from unlicensed platforms involves risks like KYC data abuse, Ponzi schemes, etc.

The main issue is the lack of legal protection. If a platform misuses your data or funds, there’s no legal recourse due to the absence of regulatory oversight.

Conclusion

To answer the question, “Is copy trading legal?” The ultimate answer depends on the user’s country of residence, the platform chosen, and whether that platform is officially licensed.

Copy trading is legal when platforms are regulated by authorities like the FCA, SEC, or ASIC.