- TradingFinder

- Education

- Forex Education

- Elliott Wave Education

Elliott Wave Education

Elliott Wave Theory is an advanced technical Analysis method based on trader psychology and collective market behavior cycles. This theory states that price movements follow repetitive wave structures, categorized into two main types. Impulse waves consist of a five-wave sequence moving in the direction of the dominant trend. Corrective waves are a three-wave structure moving against the primary trend. Key tools in Elliott Wave Analysis include Fibonacci Retracement & Extension, Wave Ratios, Wave Alternation Analysis, and Wave Structure Break Rules. Professional traders apply concepts such as Wave Confluence Zones, Time Cycles, and Key Fibonacci Levels to identify trend reversals and continuation setups. On TradingFinder, a comprehensive training program is available, covering trend forecasting, accurate wave counting, and the combination of Elliott Waves with Price Action and Volume Analysis. This strategy is particularly effective in high-liquidity markets like forex, stocks, and cryptocurrencies, helping traders use wave structures to detect critical price movements.

Elliott Impulse Wave Explained: Terminal vs Trending Impulse Structures

Impulse Wave Elliott (also called Elliott impulse waves) represent the basic structure of price movement in the market and act as...

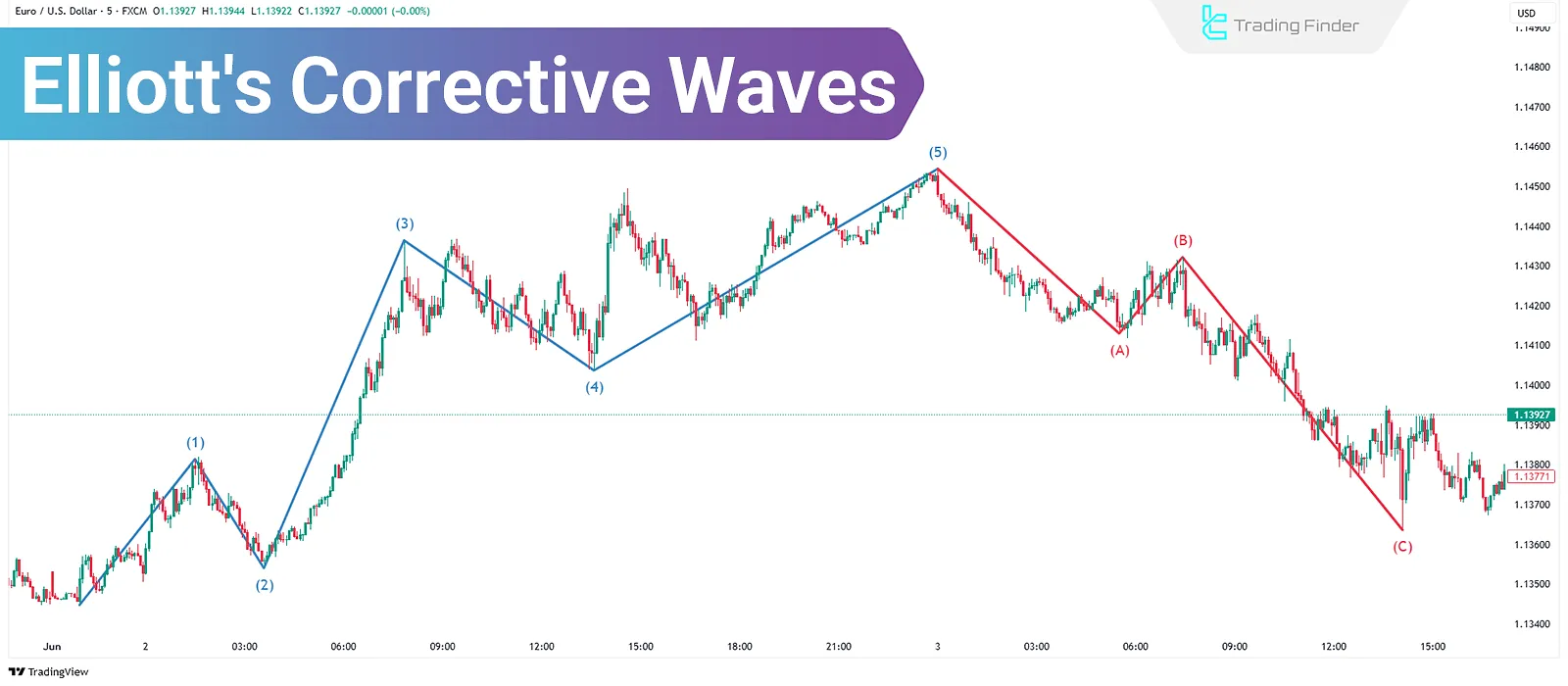

Corrective Waves in Elliott Theory; Training on the Rules of Corrective Waves

Corrective Waves in Elliott Wave Theory are composed of three sub-waves and move against the prevailing trend. Unlike motive...

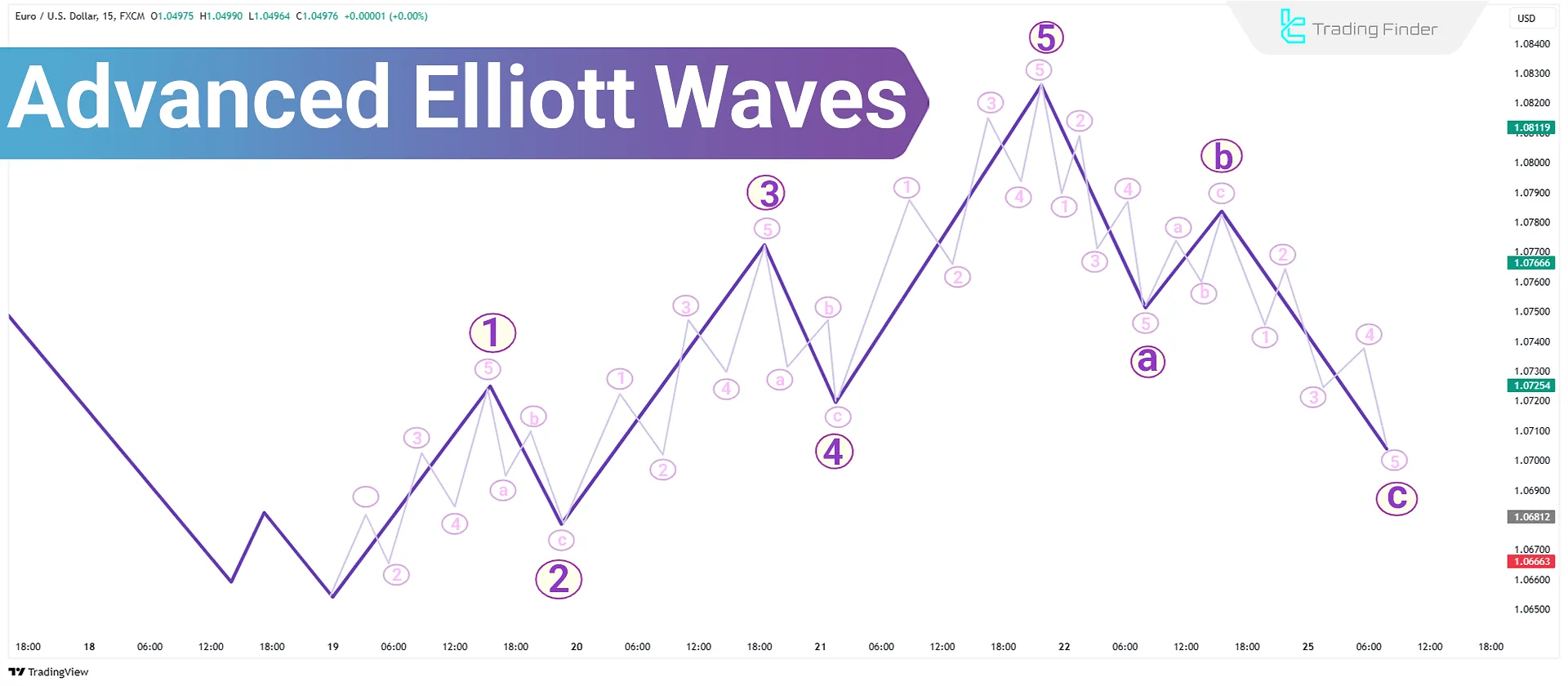

Advanced Elliott Waves Education; Impulse and Corrective Waves

The Elliott Wave Theory in technical analysis is used to describe price movements in financial markets. This concept was developed...