In scalping, any delay in detecting momentum shifts can lead to missed profitable opportunities. The Fast Scalping Indicator for NinjaTrader transforms order flow and micro-market fluctuations into reactive signals within the NinjaTrader 8 environment.

This tool utilizes adaptive models to identify entry and exit zones in short-term timeframes, aiming to enhance precision under volatile conditions.

tIn practice, the Fast Scalping Indicator analyzes the real-time market structure instead of relying on lagging averages, estimating short-term price direction with high speed.

What Is the Fast Scalping AI Indicator?

The Fast Scalping AI Indicator is a reactive tool for short-term market analysis within the NinjaTrader platform. It processes live price and volume data to detect momentum changes and order-flow shifts.

In its internal structure, the indicator uses real-time volume processing to compare each candle’s price behavior pattern with previous data, a functionality that becomes fully accessible after NinjaTrader Signup, allowing traders to identify potential reversal or continuation points with higher accuracy.

The primary purpose of FastScalpingAI is to provide precise entry and exit zone detection in short-term timeframes, especially 1- to 5-minute charts, where quick reactions to order-flow shifts after NinjaTrader Signup can mean the difference between a successful trade and a premature entry.

The indicator also uses "Level 2 Data Indicator" to read market-depth information and liquidity flow.

Compatibility of the Fast Scalping AI Indicator with NinjaTrader

The Fast Scalping AI Indicator is specifically designed for the NinjaTrader Indicator and is fully compatible with its data architecture.

Additionally, to prevent license-related errors, users must enter activation details in the Licensing section so that the indicator can access the core computation engine.

Tutorial video for indicator activation in NinjaTrader from DayTradeToWin YouTube channel:

Installation and Setup Steps for the Fast Scalping AI Indicator

To set up the Fast Scalping AI Indicator in NinjaTrader, add the indicator file to the platform and, after activation, apply it to your chosen chart.

This Fast Scalping AI Indicator, provided by TradingFinder, officially recognized vendor of NinjaTrader, is designed for seamless integration within the NinjaTrader environment.

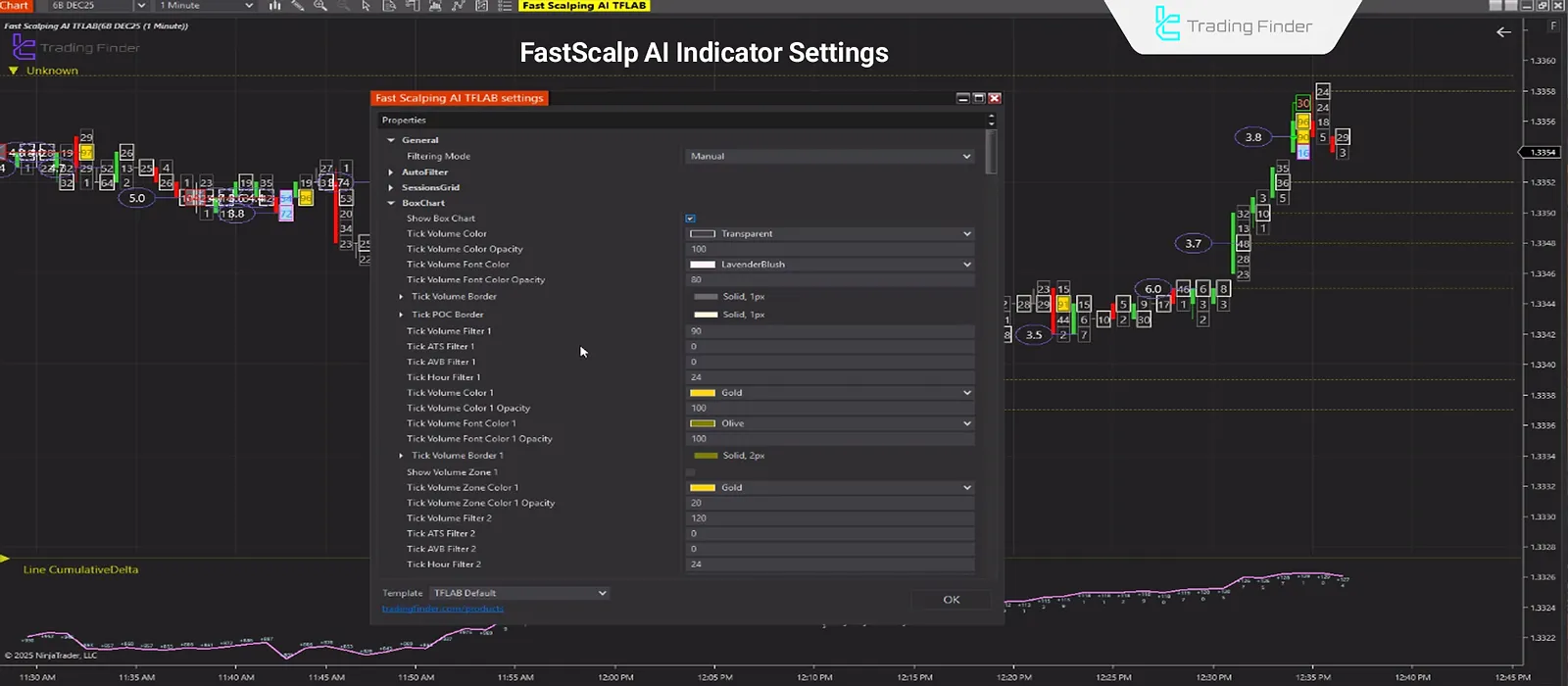

Once installed, the indicator automatically appears in the list of analytical tools, where you can modify settings such as session display, volume levels, and filtering mode according to your trading style.

Proper execution of these steps ensures accurate market-data processing and highly precise signal visualization on the chart.

How to Trade Using the Fast Scalping AI Indicator?

Trading with the Trading Volume Indicator based on quick reactions to shifts in order flow and short-term market momentum.

Effective use of this indicator is not limited to receiving buy or sell signals—it also involves understanding market conditions, filtering out price noise, and setting exit levels according to momentum strength.

Setting the Timeframe for Scalping

In scalping strategies, selecting the right timeframe is one of the key factors affecting signal accuracy and result consistency.

TheTrade Volume Indicator is designed to operate based on "tick data" and short-term momentum shifts; therefore, its performance directly depends on the chart’s timeframe.

On a 1-minute timeframe, the indicator exhibits the highest sensitivity to price changes and generates more frequent signals. This interval suits traders with high focus who operate in high-liquidity environments, such as the New York or London sessions.

Detecting Entry Zones with FastScalpingAI Signals

The Fast Scalping AI Indicator in NinjaTrader identifies entry zones by combining three key factors: short-term momentum, real-time volume shifts, and the direction of order flow.

The indicator displays the volume level numerically, providing insight into the intensity of buying or selling pressure.

A high number indicates buying pressure and the potential start of a bullish wave, while a low number signals increasing selling pressure and a possible short-term pullback or bearish move.

For a valid entry, the signal must coincide with both rising volume and a confirming candle; otherwise, there is a higher risk of premature entry.

Example of Entry

After the price interacts with a "previous volume spike" on the Fast Scalping AI Indicator, traders should wait for the formation of a new, stronger volume surge.

When this new volume appears in the same zone and aligns with a positive price reaction, it can be treated as buy confirmation.

This indicates an inflow of fresh liquidity and the presence of organized buyers, typically leading to a low-risk, short-term bullish move in lower timeframes.

Defining Stop Loss Based on Signal Structure

In the Fast Scalping AI system, stop loss is determined not by a fixed distance or percentage, but according to the signal structure and momentum behavior.

- For long trades, the stop loss is usually placed below the latest reversal zone or confirmation candle—precisely where the indicator shows low volume in an uptrend;

- For short trades, the stop loss is placed above the latest bearish reversal area.

Exit Strategy Based on Momentum Behavior

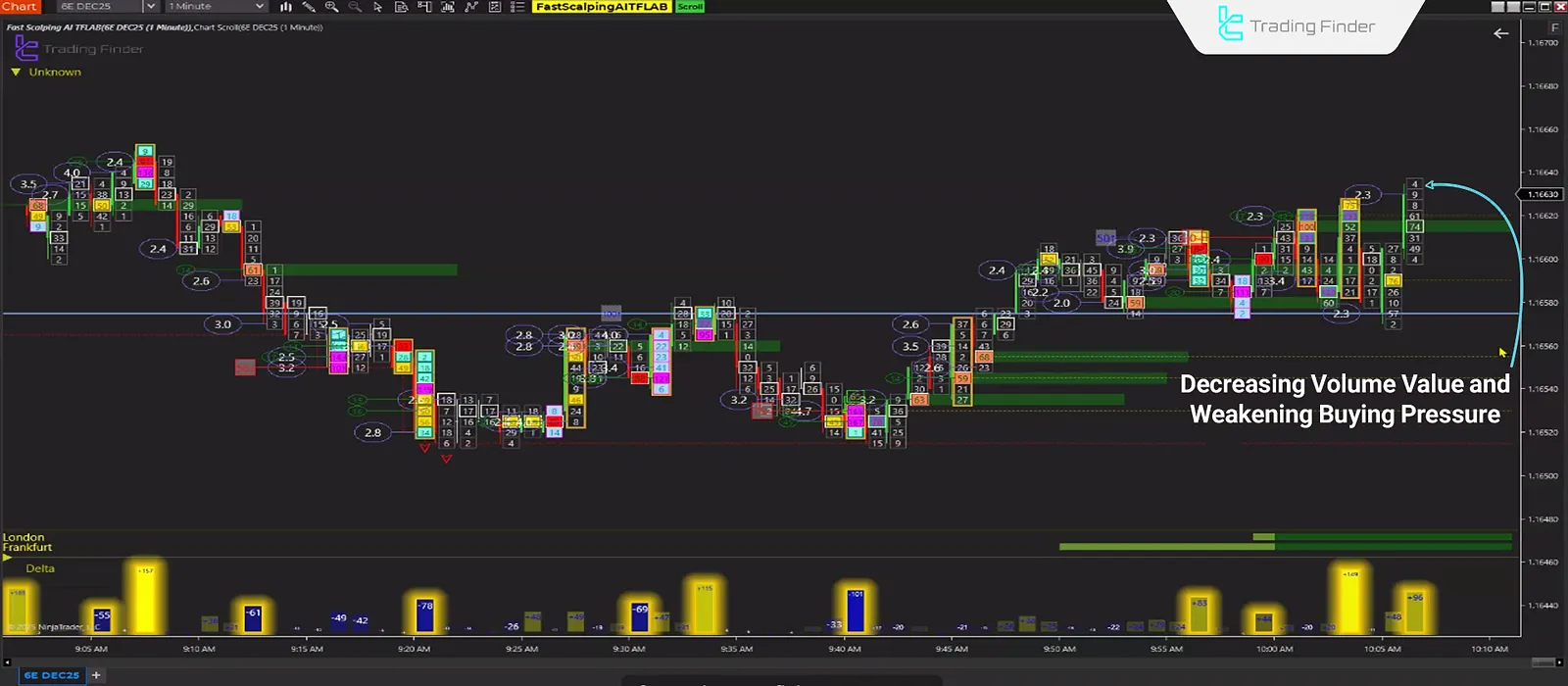

Within the Fast Scalping framework in NinjaTrader, exiting a position should occur simultaneously with a decline in momentum or a drop in the indicator’s value. This usually signals weakening buying or selling pressure and the start of a short corrective phase.

In practice, the best exit timing is when the indicator begins to neutralize its signal and the candles reflect lower volume. Staying in a trade beyond this stage increases the risk of price reversal and loss of profit.

In summary, the exit strategy in this system is based on qualitative momentum shifts, not static numerical levels.

Executing Multiple Positions Simultaneously with Sequential Signals

During strong and continuous market trends, the Fast Scalping AI Indicator often generates multiple consecutive signals in the same direction. This repetition indicates the continuation of order flow and sustained momentum.

In such cases, the trader may apply a Position Scaling approach—entering multiple trades progressively. With each new confirmed signal, the trader can either increase position size or adjust the average entry price.

The main requirement for this method is maintaining a balanced ratio between open risk and total stop distance, ensuring that margin pressure does not increase.

For managing simultaneous positions, it is best to use a "Trailing Stop". Instead of assigning separate stop levels for each position, this method creates a dynamic stop loss based on the latest signal or active momentum zone.

When momentum weakens or the zone color changes, all positions close synchronously.

Counter-Trend Scalping with FastScalpingAI

The counter-trend strategy in this Order Volume Indicator is based on detecting divergence between momentum and price. When the price continues trending but the indicator shows momentum weakening, the likelihood of a short-term correction increases.

In such situations, the Fast Scalping AI Indicator issues a reversal alert by reducing its volume reading.

This type of signal usually appears near price exhaustion levels or areas with declining trade volume.

Counter-trend entries should be taken with smaller position sizes and shorter targets, as the goal is to capture quick corrective moves rather than full reversals.

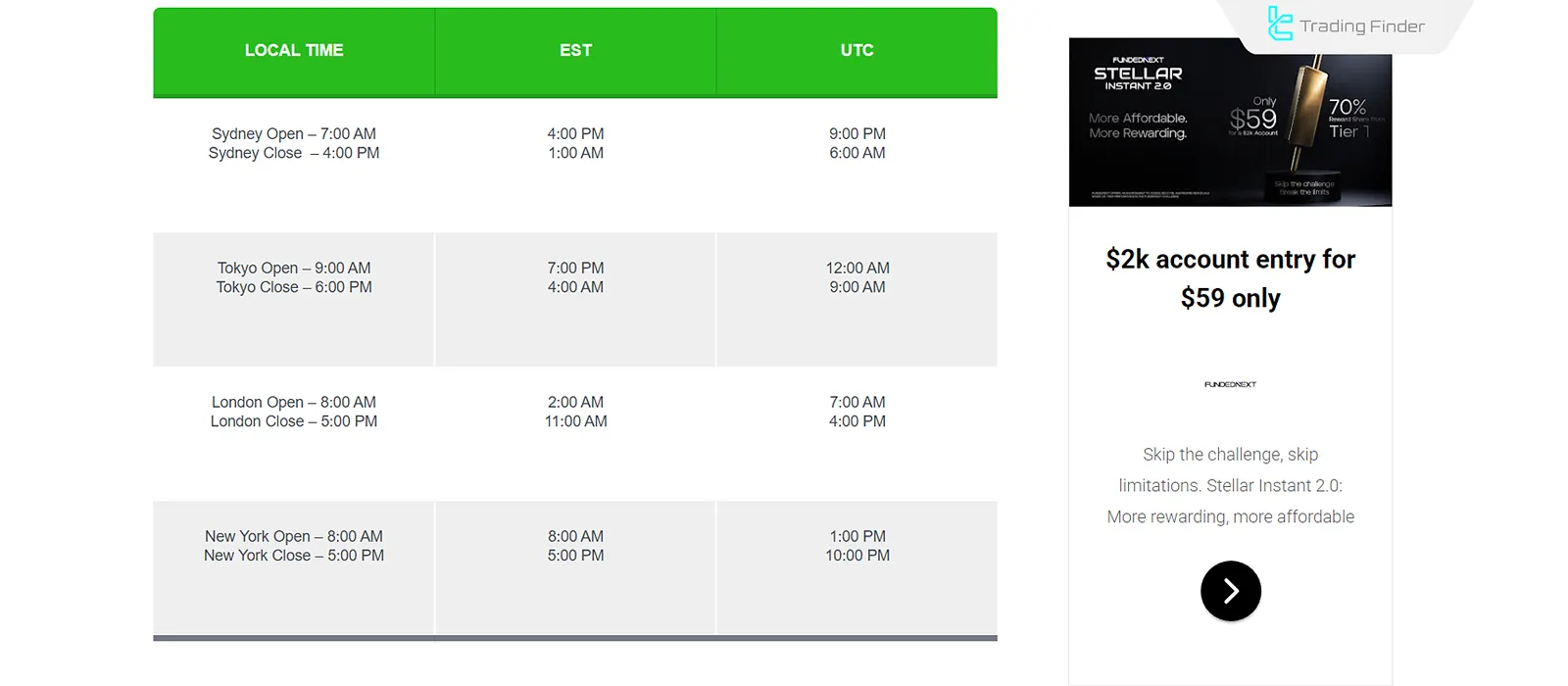

Optimizing Indicator Performance Across Trading Sessions

The behavior of the Fast Scalping AI Indicator is strongly influenced by market volume and volatility during different trading sessions. Since it analyzes real-time order flow and momentum data, adjusting its parameters for each session is crucial for accuracy.

During the London session, where liquidity is high and price movements are fast, the filter sensitivity should be set higher to allow quicker response to volume changes. Education Source for Forex session timing in babypips.com website can be seen in the picture below:

In the New York session, due to overlap with London and increased volatility, higher volume filters are recommended to reduce Level 2 data noise.

In contrast, during the Asian session, where trading volume and speed are lower, reducing sensitivity helps eliminate false signals and ensures more stable indicator output.

Manual, Auto, and AI Modes in the Fast Scalping Indicator

The Fast Scalping AI Indicator operates in three distinct modes, each offering different levels of control and data processing:

- Manual Mode: All parameters such as filters and volume thresholds are manually adjusted by the trader. Ideal for professional users seeking precise control over the indicator’s behavior;

- Auto Mode: The indicator automatically adjusts filters in real time according to market volatility and volume, providing fast reactions to order-flow shifts;

- AI Mode: Analyzes previous data and Level 2 order information to predict potential entry and exit zones.

A summary of each mode’s settings can be found under the “Report” section, beneath the “TradingFinder” logo. From there, users can also export results directly as an Excel Report if needed.

Risk Management in the Fast Scalping AI Indicator

In scalping, risk control is critical due to the high speed of execution and trade frequency. The Fast Scalping AI Indicator enables real-time, data-driven risk management by continuously analyzing momentum and order flow.

Trade volume is determined based on current market volatility and signal strength. When the indicator displays strong buying or selling pressure, position size can be gradually increased; however, in noisy or low-volume conditions, position size must be reduced.

Using an adaptive stop loss and a fixed risk per trade (for example, 0.5%–1% of total capital) helps maintain scalping efficiency while avoiding cumulative small losses.

Advantages and Limitations of the Fast Scalping AI Indicator

The Fast Scalping AI Indicator is one of the most responsive scalping tools available in NinjaTrader 8, generating real-time reactive signals through tick data and momentum analysis.

Its performance varies depending on market conditions and the trader’s experience.

Limitations | Advantages |

High dependency on data quality | Real-Time Order Flow Analysis |

Excessive signals during high volatility | Adaptive Signal Generation |

Ineffective on higher timeframes | High Precision in Reversal Detection |

Requires experience in signal interpretation | Smart Parameter Configuration |

Limited performance in low-volume markets | Full Compatibility with NinjaTrader 8 |

No official support from some brokers | Integration with Other Indicators |

— | Usable in Backtesting and Strategy Optimization |

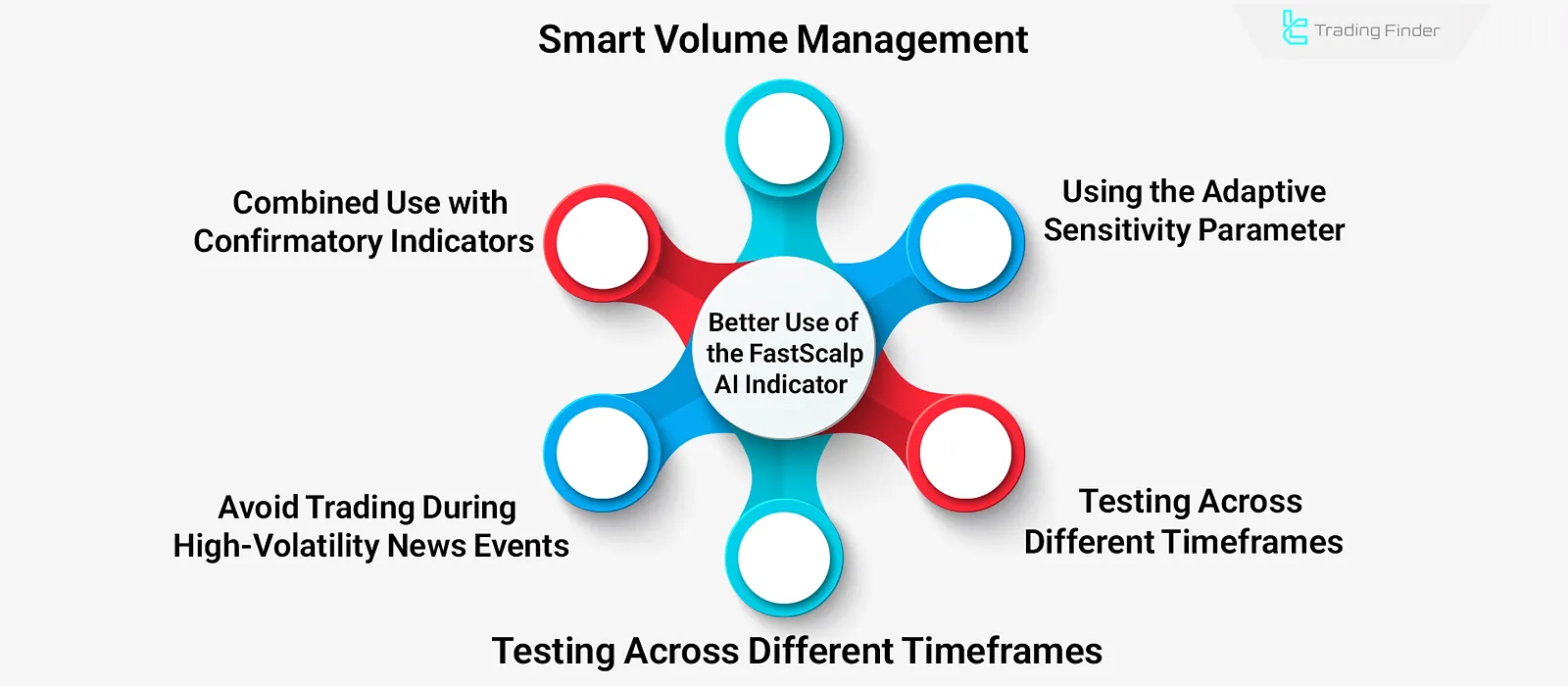

Tips for Optimal Use of the Fast Scalping AI Indicator

The efficiency of the Fast Scalping AI Indicator depends not only on the algorithm’s power and signal accuracy but also on the trader’s setup and usage method.

To achieve consistent and reliable results, parameters must be aligned with actual market conditions, trade volume, and session timing.

Key Professional Guidelines:

- Combine with Confirmatory Indicators: Use complementary tools such as VWAP, EMA, or Volume Profile to confirm trend direction and trading volume;

- Avoid Trading During High-Impact News: During macroeconomic announcements or volatile events, temporarily filter out FastScalpingAI signals, as market noise increases and signals become unstable;

- Analyze Trading Logs: After each session, review signal logs and trade results to optimize Sensitivity and Signal Filter parameters based on real market behavior;

- Test Across Multiple Timeframes: For each instrument (e.g., NASDAQ, EUR/USD), determine its optimal timeframe since indicator reactions differ between fast and slow markets;

- Adjust Filter Sensitivity Dynamically: Increase sensitivity during active sessions and reduce it in calmer markets to avoid false signals;

- Apply Smart Position Sizing: Match trade volume to signal strength and stop-loss distance to maintain a balanced risk-to-reward ratio;

Conclusion

The Fast Scalping AI Indicator is a reactive and high-speed tool for scalping in NinjaTrader, designed to pinpoint accurate entry and exit zones using volume, order flow, and Level 2 data.

Its main advantage lies in its processing speed and near-instant signal visualization—visual adjustments occur almost immediately, while volume calculations refresh with minimal latency.

For optimal performance, filter sensitivity should be adapted to the market session’s liquidity level; during sessions like New York, higher filters typically deliver more accurate results.

Ultimately, Fast Scalping AI performs best when combined with risk management and volume-based market analysis.