- TradingFinder

- Education

- Forex Education

- Financial Glossary

Financial Glossary

Understanding financial terminology enhances trading Analysis, decision-making, and trade execution. Common terms include spread, leverage, liquidity, and pending orders. Terminology varies across trading styles and markets. In price action trading, terms such as pin bar and liquidity grab are frequently used. In ICT trading, concepts like fair value gaps (FVG) and market maker models are essential. In RTM trading, traders use terms like flip levels (FL) and Quasimodo level (QML). On TradingFinder, a specialized financial glossary is available, covering key trading terms across different strategies and markets to help traders apply accurate terminology in their Analysis.

Prop Trading Journal: Steps for Creation and Periodic Trade Review

In prop systems, every trader operates under the scrutiny of data and discipline. The goal, in addition to profit, is the ability...

Trading Journal; Application in Risk Management and Error Identification

A trading journal is a tool for recording Past trade review, analyzing performance, risk, and identifying mistakes. Trade date,...

Trailing Stop – The Use of a Dynamic (Floating) Stop Loss in Different Markets

A Trailing Stop is a type of stop-loss order that adjusts according to the instructions defined by the trader. This...

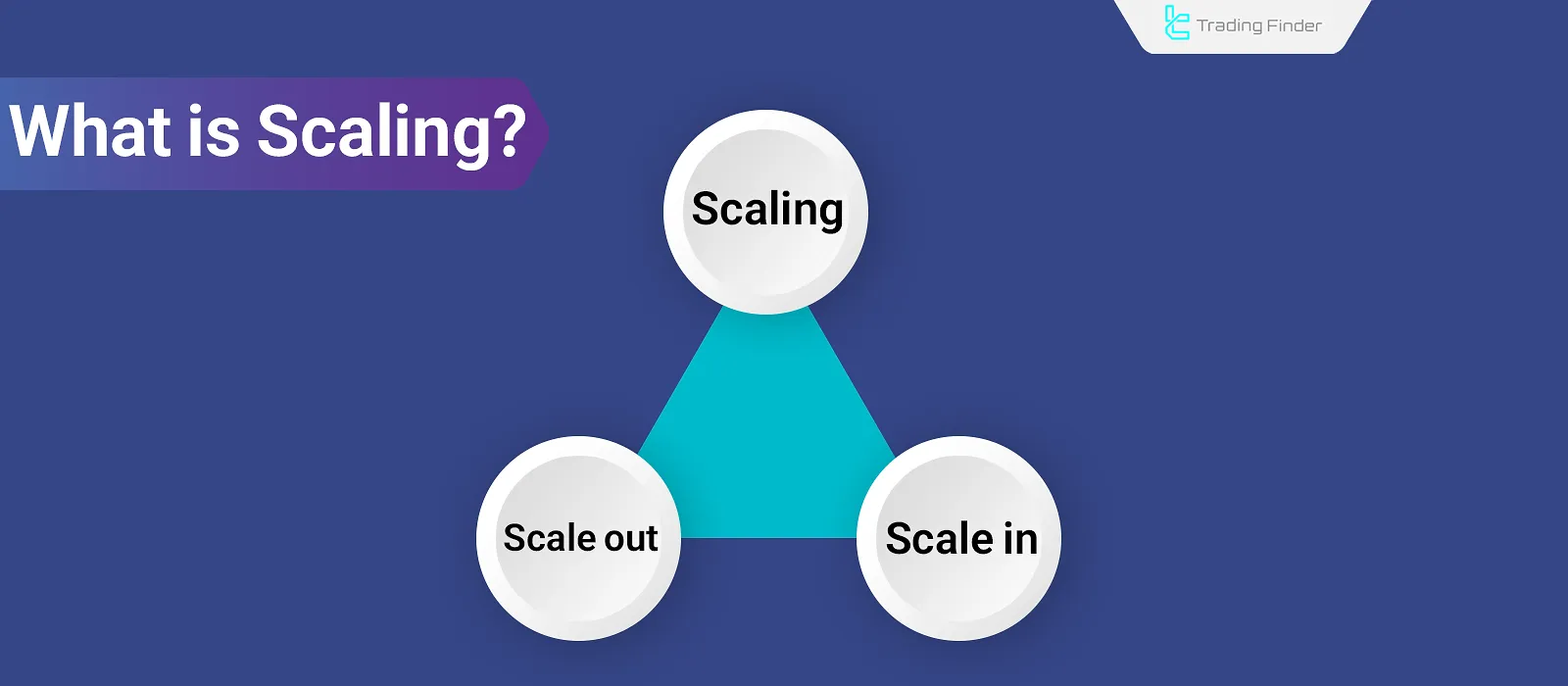

Scaling in Trading: Multi-Stage Entry and Exit with Position Size Adjustments

Scaling in trading refers to the process of increasing or decreasing the position size of a trade based on market conditions and...

What Is Crypto Wallet? Custodial and Non-Custodial Types

A crypto wallet is a digital wallet within the blockchain space that, through encrypted processes, allows users to store...

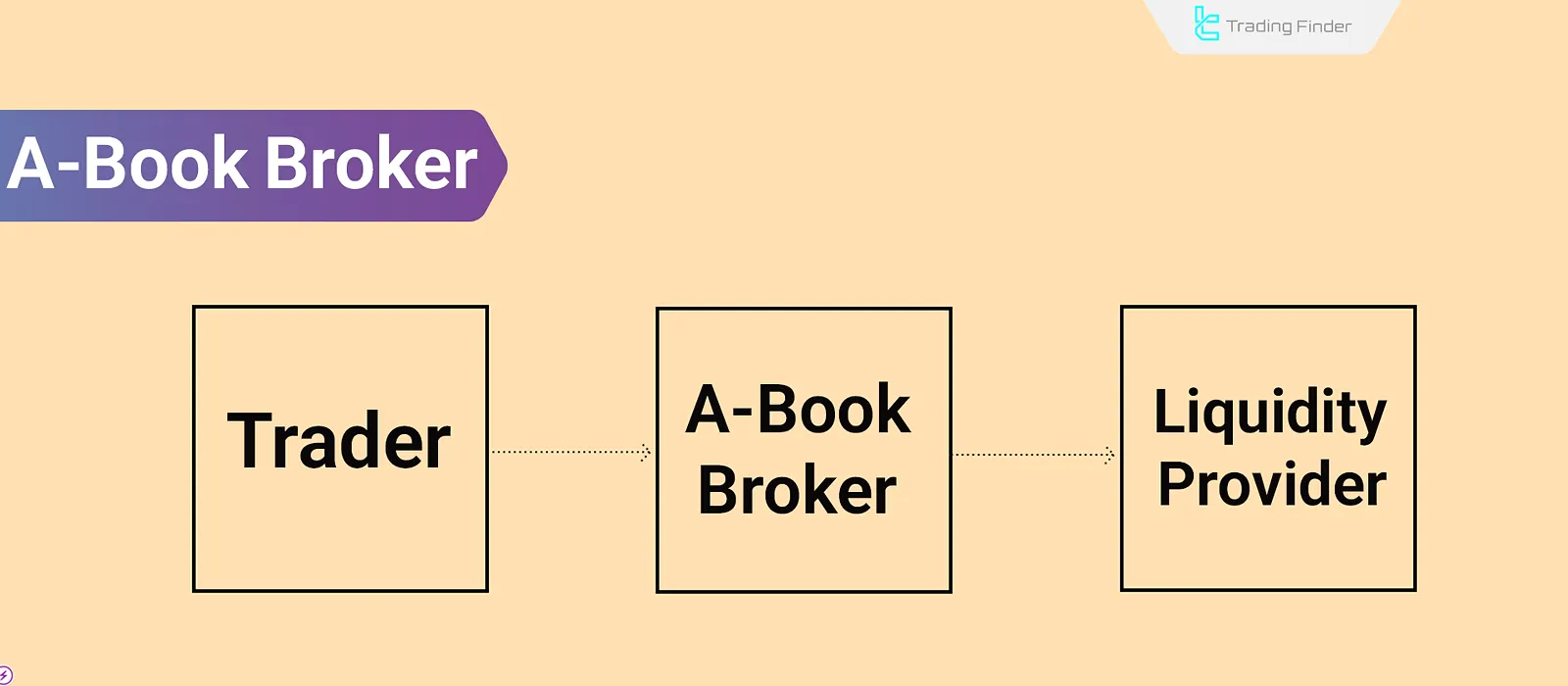

What is an A-Book Broker? Risk Transfer to Liquidity Provider (LP) and Hedging

There are different models for trade execution in the forex market, each with a unique structure and impact on the trading...

What is Margin Trading? A Guide to Margin Trading

Margin Trading is a form of leveraged trading that allows traders to operate with capital exceeding their available balance. In...

What is Bitcoin? A New Asset for Peer-to-Peer and Intermediary-Free Transactions

After the 2008 financial crisis and the emergence of weaknesses in traditional and centralized financial systems, a concept...

What is News Trading? The Most Influential News in the Forex and Crypto Markets

Economic and political news plays a key role in market direction and sentiment. Due to the surge in volume and volatility...

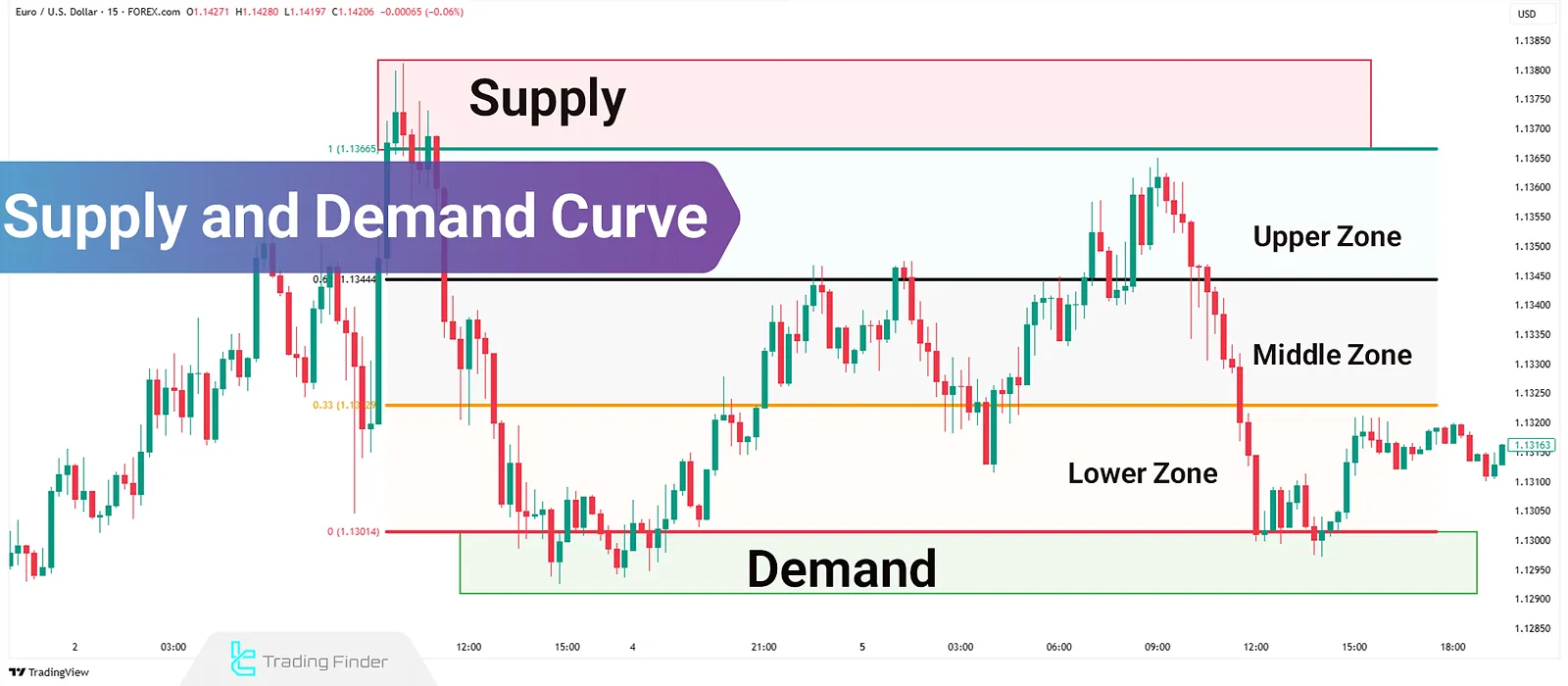

Supply and Demand Curve Training: Trading Setups and Manual/Fibonacci Plotting

When analyzing supply and demand zones in technical analysis, identifying them is not enough; understanding the current price...

What Is Economic Calendar? Applications + Key Events [NFP,CPI,PMI]

The Forex Economic Calendar provides essential economic information related to various forex market assets, including central bank...

ADX Indicator: Average Directional Index for Trend and Range Detection

In technical analysis, identifying the strength of a trend is just as important as recognizing its direction. The ADX Indicator...

![What Is Economic Calendar? Applications + Key Events [NFP,CPI,PMI]](https://cdn.tradingfinder.com/image/478340/03-36-tf-en-forex-economic-calendar-01.webp)