- TradingFinder

- Education

- Forex Education

- Harmonic Patterns Education

Harmonic Patterns Education

Harmonic patterns are an advanced technical Analysis method that uses Fibonacci ratios to identify potential reversal zones (PRZ). These patterns are based on symmetrical price movements within specific wave structures and are applicable in forex, stocks, and cryptocurrency markets. Common harmonic patterns include Gartley, Bat, Butterfly, Shark, and Crab, each with specific Fibonacci ratios. These ratios involve Fibonacci Retracement, Fibonacci Extension, and Fibonacci Projection, which traders use to validate patterns and determine entry and exit points. Combining harmonic patterns with candlestick Analysis, volume data, and liquidity zones enhances prediction accuracy. On TradingFinder, traders can access free specialized training on correctly identifying harmonic structures, integrating them with other technical tools, and applying risk management in PRZ-based trading. This method is especially useful in corrective and ranging markets, helping traders enter at optimal points and set precise stop-loss and take-profit levels.

What is the Deep Crab Pattern? – Guide to Trading the Harmonic Deep Crab Pattern

Harmonic pattern traders use the Deep Crab Pattern to anticipate price reversals. By calculating and identifying points B, A, X,...

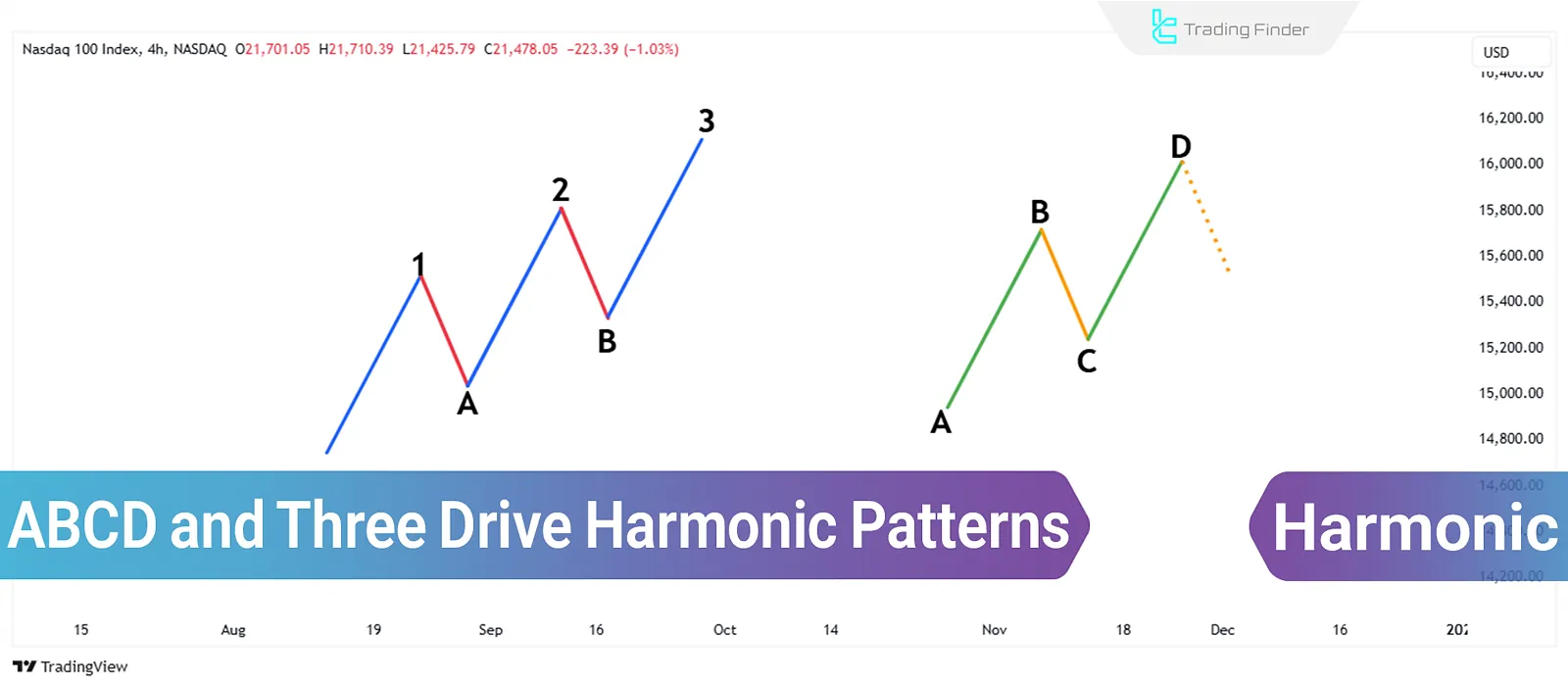

ABCD and Three-Drive; Harmonic Patterns in technical analysis & Fibonacci ratios

Harmonic patterns, based on Fibonacci ratios, are among the tools used in technical analysis. The ABCD pattern and the Three-Drive...

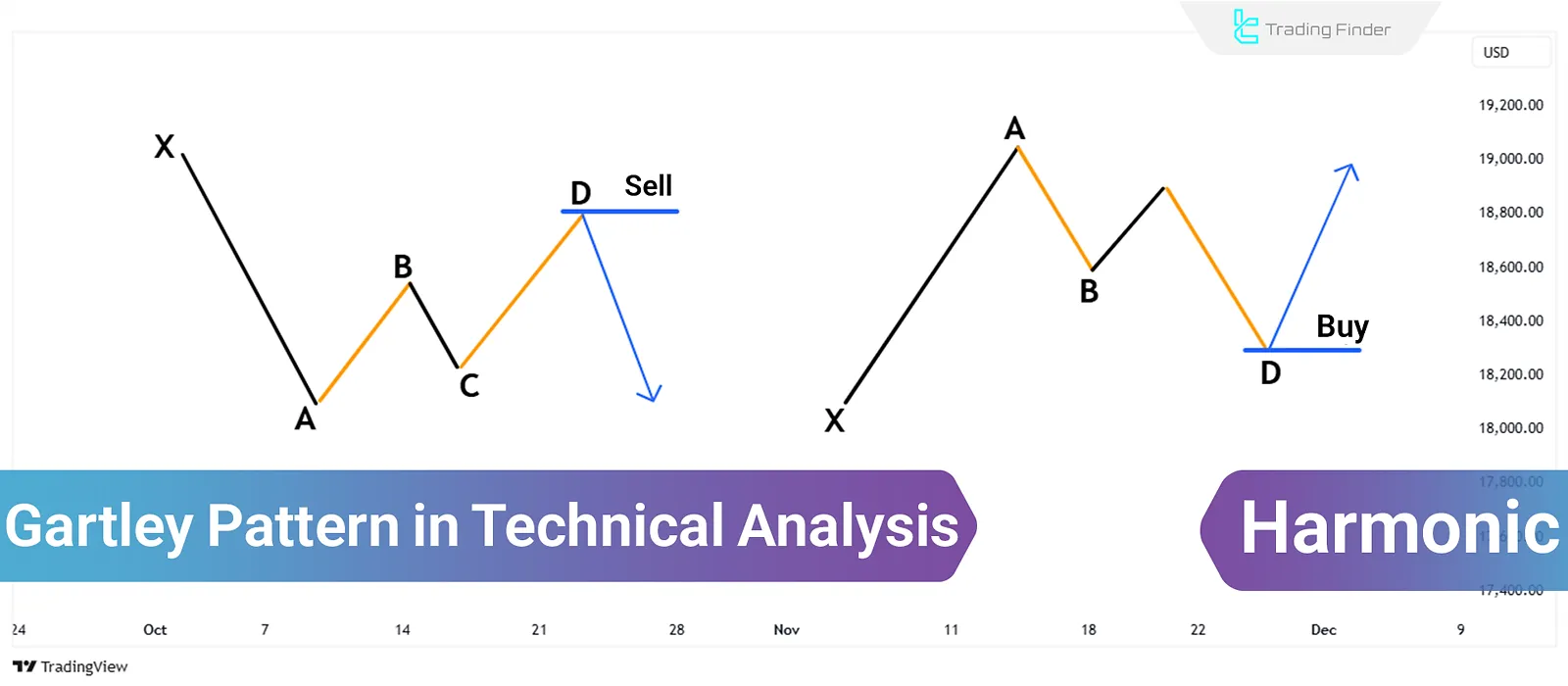

Gartley Harmonic Pattern; Four Price Movements Based on Fibonacci Ratios

The Gartley harmonic pattern in Forex Markets, introduced by Harold “McKinleyGartley”, identifies potential reversal points in...

Harmonic Patterns Training [Complete - 28 Harmonic Patterns]

Harmonic patterns, combining geometric features and Fibonacci ratios, are among the most effective tools for price prediction. Their...

![Harmonic Patterns Training [Complete - 28 Harmonic Patterns]](https://cdn.tradingfinder.com/image/283248/7-51-tr-harmonic-pattern-01.webp)