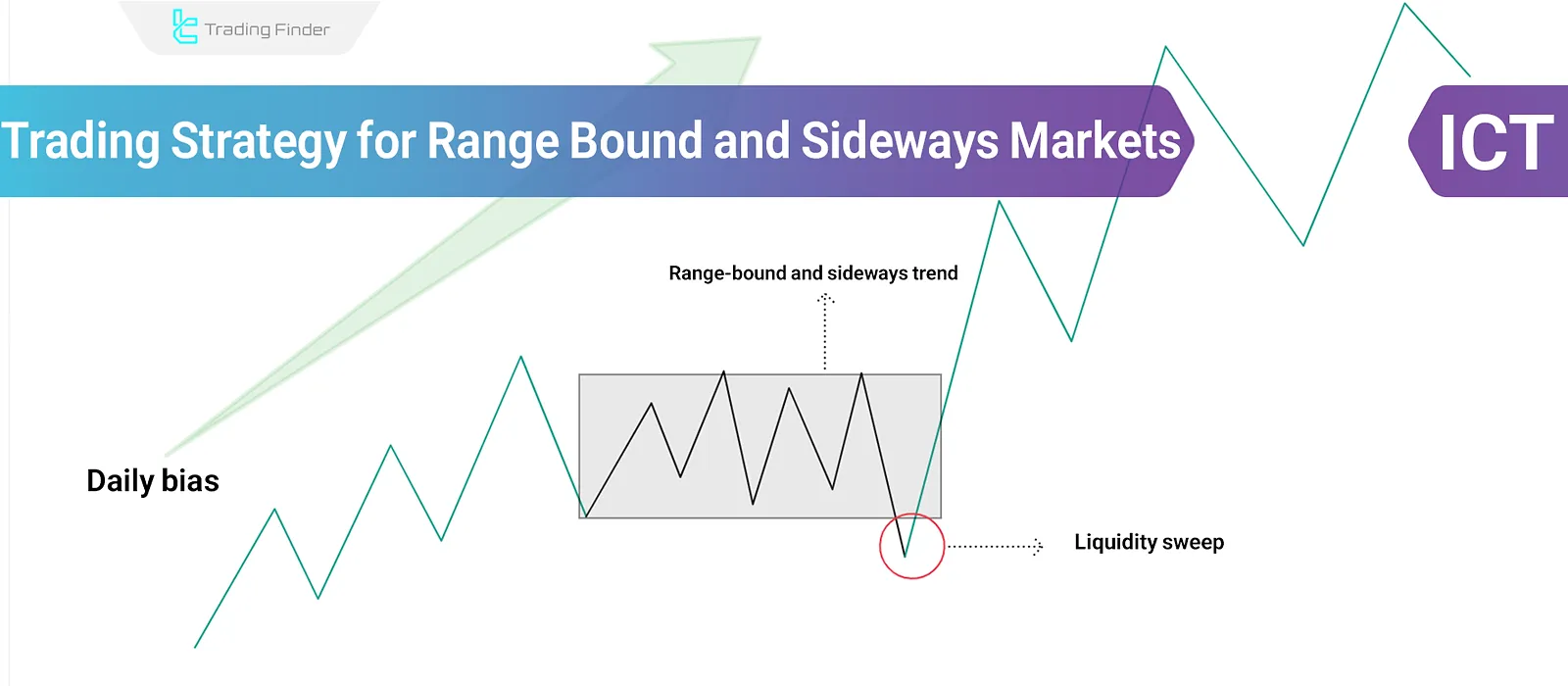

Range markets (also called consolidation zones) are the primary areas where smart money accumulates liquidity. In these zones, price fluctuates within a tight range without a clear trend.

Analyzing such conditions requires mastery of liquidity and an understanding of market-maker tactics. The range trading strategy in ICT style leverages this structure to uncover high-probability trade setups in ranging conditions.

This approach helps traders avoid false breakouts and emotional decisions, aligning their trades with the true market direction.

What Is the ICT Range and Consolidation Strategy?

This strategy is based on analyzing the behavior of banks and financial institutions (i.e., smart money).

Unlike retail traders who buy at support and sell at resistance, smart money seeks to target hidden liquidity behind stop-loss orders placed by retail participants.

Key Steps for the ICT Range Trading Setup

To execute the ICT range trading strategy, follow these six essential steps:

- Determine the daily bias using higher timeframes (daily and 4H);

- Identify the range zone or consolidation area on lower timeframes;

- Locate liquidity pools near support and resistance (where retail stop-losses reside);

- Wait for a liquidity sweep or false breakout;

- Enter the trade against the retail direction;

- Manage the trade and exit at target zones or upon signs of a trend reversal.

Pros and Cons of the ICT Range Strategy

The table below shows the advantages and disadvantages of the range market model (Consolidation) in the ICT style:

Pros | Cons |

Higher success rate by spotting hidden opportunities | Requires experience with sweep patterns |

Liquidity hunting entries aligned with the trend | Some trends may continue without sweeps |

Precise entries with tight stop-loss near range edges | – |

Applicable to all currency pairs and assets (Forex, crypto, stocks) | – |

Psychology of Range Markets & Smart Money Behavior

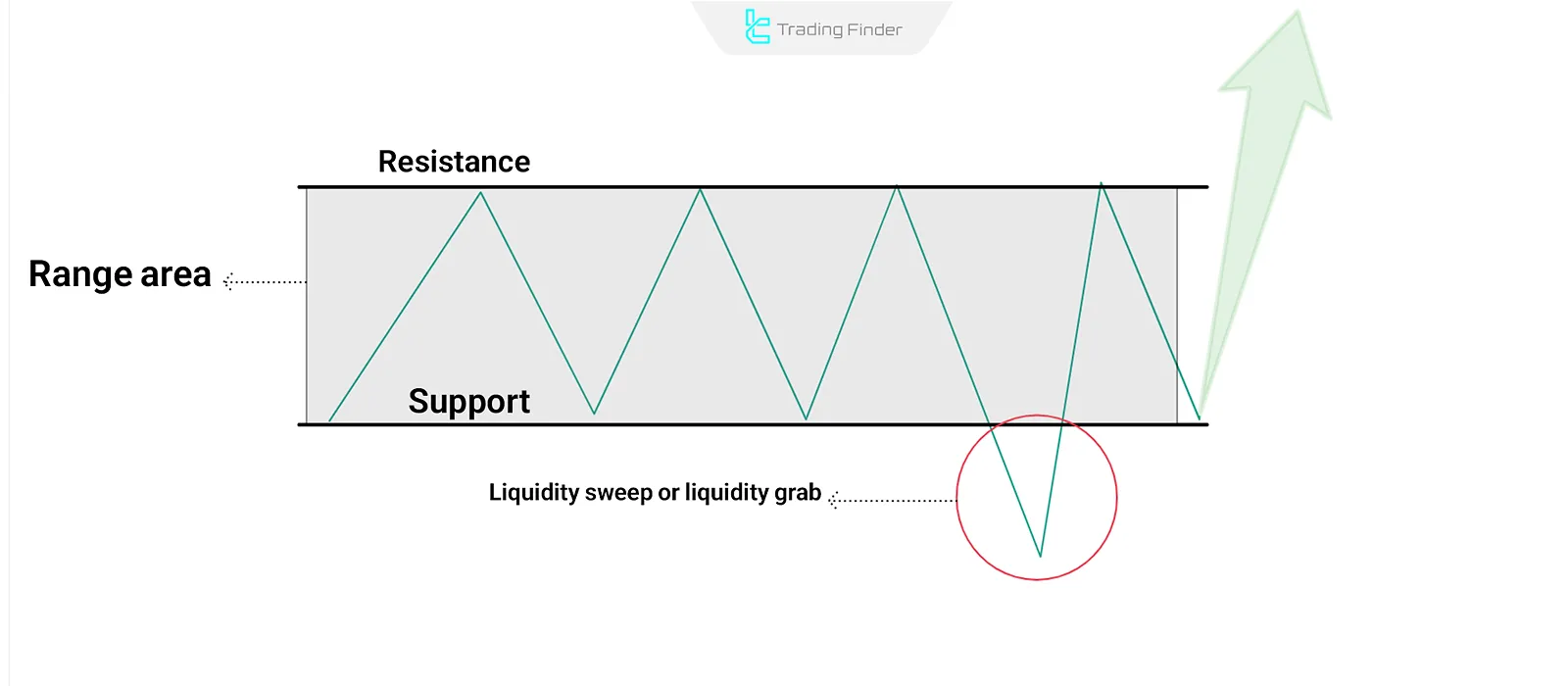

In range markets, price oscillates between support and resistance. Retail traders often buy at support with their stop-losses placed just below and sell at resistance with stops just above. Many of them wait for a breakout, hoping to catch the start of a trend.

In contrast, smart money—large institutional players—target retail stop-losses through false breakouts and quick wicks, absorbing liquidity before initiating the real market move. Recognizing this behavior is the core of the ICT range strategy.

How to Trade Sideways Markets Using the ICT Range Setup

To trade using this strategy, the following points must be observed:

#1 Define the Daily Bias

Identify smart money bias using higher timeframes (daily or 4H). For example:

- If the overall trend is bullish, look for buying opportunities;

- If the market is bearish, focus on short setups.

#2 Identify the Consolidation Zone

On lower timeframes (e.g., 15m, 5m, or 1m), the price often enters a range phase, moving between a clear support and resistance zone. This is where liquidity accumulates, and smart money prepares to strike.

#3 Liquidity Sweep

A liquidity sweep occurs when the price temporarily breaks out of the range to trigger stop-losses, then quickly returns inside the zone. This may appear as a false breakout or a sharp wick.

ICT Range Strategy in a Bullish Trend

According to the EUR/USD chart, the higher timeframe shows a bullish bias, while the lower timeframes indicate consolidation. In such cases, traders anticipate a liquidity sweep below support.

Retail traders view the support break as a bearish signal and start selling, but smart money steps in to buy. This move often appears as a wick or false break, hitting retail stop-losses.

After the sweep, smart money either buys immediately or waits for a market structure shift on lower timeframes (e.g., 15m or 5m).

ICT Range Strategy in a Bearish Trend

When the bias—e.g., in GBP/USD—is bearish on the daily and 4H charts, and the price is ranging, traders anticipate a liquidity sweep above resistance. The goal is to trigger stop-losses of sellers.

This action usually forms a wick or false breakout above the resistance. Retail traders may misinterpret this as a bullish breakout and start buying.

At this point, smart money reverses the move and begins to sell. After the sweep, you can either enter immediately or wait for a market structure shift in lower timeframes.

Conclusion

The ICT range trading setup focuses on analyzing smart money behavior and identifying liquidity clusters near support and resistance. This strategy uses liquidity sweeps to exploit market moves against retail positions.

In consolidation zones, the price fluctuates within a defined range, and smart money uses fakeouts and quick wicks to grab retail stop-losses, initiating the true directional move.

Success with this approach requires proper bias analysis and range identification. The consolidation model in ICT offers low-risk entries and is suitable for Forex, crypto, stocks, and more.