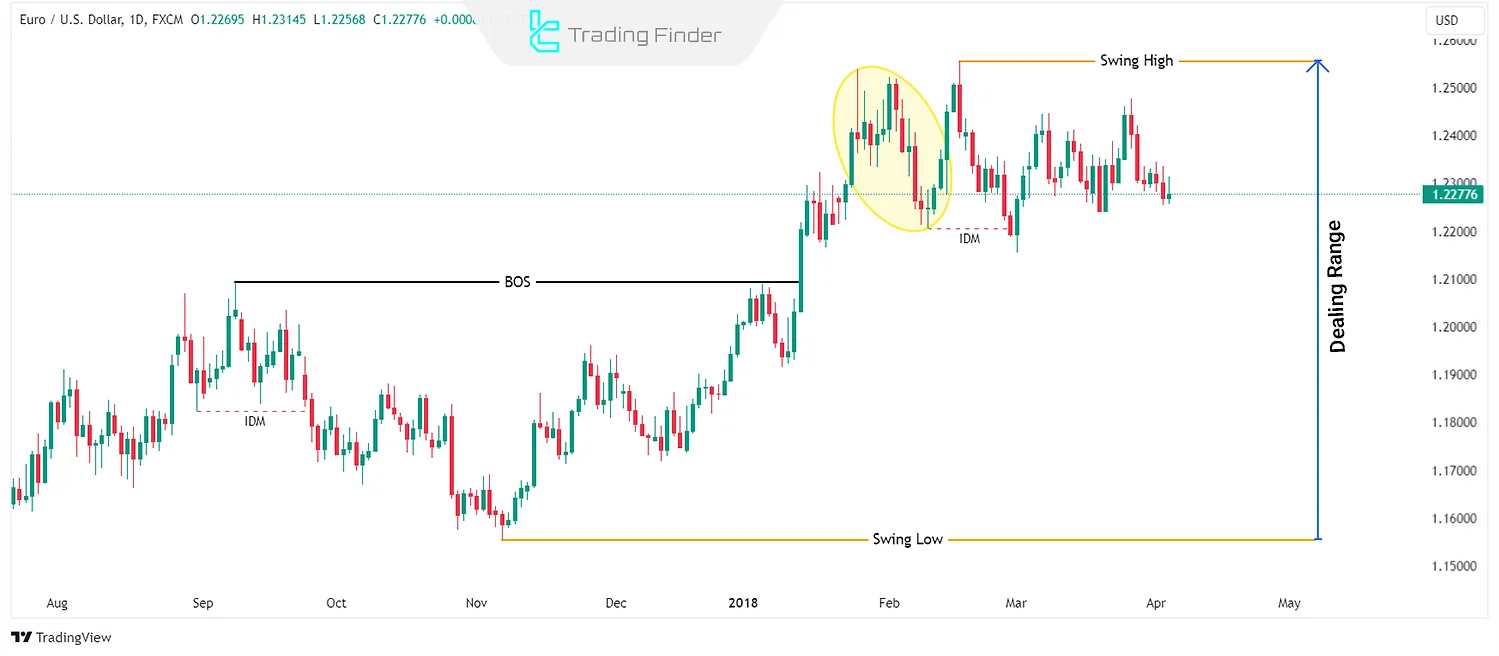

The ICT trading style focuses on market structure and liquidity. Within the market structure, the ICT Dealing Range is a concept where both buy-side liquidity and sell-side liquidity are taken out.

Market makers and smart money operators use the ICT dealing range to manipulate retail traders’ positions and enter the market.

What is the ICT Dealing Range?

The ICT Dealing Range is a price range between the high and low of the most recent swing. Within this range, institutions focus on accumulation and distribution phases since they have enough data to identify liquidity positioning between the high and low.

Institutions and smart money use the ICT dealing range to manipulate retail traders’ positions. They manipulate price movements, hunt liquidity, and create large price shifts.

The market primarily moves between ICT dealing ranges to balance Fair Value Gaps (FVGs) or hunt liquidity by breaking equal highs and equal lows.

Key Elements of the ICT Dealing Range

To better understand the ICT-style dealing range, mastering the following elements is essential:

Market Structure

When drawing market structure, the dominant trend's swing high and swing low are typically identified. This is a key component of the ICT dealing range in the ICT style, as it is defined by selecting the high and low.

Premium/Discount Areas

The ICT dealing range is divided into Premium and Discount areas. ICT Fibonacci levels use the 50% level as the Equilibrium level of the range.

- In an uptrend, the discount area is below the equilibrium level; ICT and institutional traders are more likely to buy in this area.

- In a downtrend, the premium area is above the equilibrium level; ICT and institutional traders are more likely to sell in this area.

Liquidity

Liquidity pools are zones on the chart where large amounts of stop-loss and Take-Profit orders and pending orders accumulate, often forming inside the dealing range. These zones are typically located at:

- Internal Lows

- Internal Highs

- Equal Highs (EQH)

- Equal Lows (EQL)

Identifying the ICT Dealing Range

Marking the high in an uptrend and the low in a downtrend is straightforward. A swing high or swing low is confirmed when price retraces and breaks the first pullback.

The first pullback is often referred to as the Inducement Level. Breaking this level confirms the formation of highs and lows.

Trading the ICT Dealing Range in a Bullish Market

After the formation of a Higher High (HH) or swing high In a bullish market, price often moves within the ICT dealing range. Thus, an ICT trader can identify key levels in the discount area.

Bullish PD arrays in the discount zone of an uptrend provide potential buying opportunities. Order blocks and FVGs are marked in these areas, while premium zones are set as profit targets.

Trading the ICT Dealing Range in a Bearish Market

In a bearish market, after the formation of aLower Low (LL) or swing low, price often moves within the ICT dealing range. Here, an ICT trader can identify key levels in the premium area.

Bearish PD arrays in the premium zone of a downtrend provide potential selling opportunities. Order blocks and FVGs are marked in premium areas, while discount zones are set as profit targets.

Conclusion

The ICT dealing range strategy focuses on market structure, key liquidity levels, and specific price patterns to help traders identify smart money behavior and predict price movements more accurately.

By defining a range between the high and low of the most recent swing, the ICT dealing range strategy identifies critical market areas. It offers the best entry and exit points based on premium and discount levels.