To trade based on ICT style, you must have a checklist to identify entry and exit points in order to find the appropriate strategy.

The most crucial aspect is the entry zone, identified using six different tools such as Fair Value Gap (FVG), Order Block (OB), Optimal Trade Entry (OTE), Premium & Discount zones (PD), Breaker Block (BB), and BOX Setup.

ICT Trade Entry Confirmations

The initial step for successful trading entries is determining the daily bias. After identifying the general market direction, traders use the following checklist to validate entry requirements:

#1 liquidity grab

Initially, a liquidity level (such as previous highs or lows) is identified. This step is complete when the price first breaks through a low and then reverses upward, or conversely, breaks a high and then reverses downward.

This liquidity attack indicates a shift of orders and active participation by major market players, resulting in liquidity collection.

#2 Market Structure Shift (MSS)

Following the liquidity attack, a Market Structure Shift (MSS) [a strong, aggressive move breaking previous highs and lows] or Displacement must be observed. This confirms the new market direction.

#3 Return to Premium or Discount Zones

Next, the position of price within Premium or Discount zones is assessed. If the price is below the 50% midpoint (Discount zone), it offers an opportunity for a long entry.

Conversely, prices above the midpoint (Premium zone) indicate a short-selling opportunity.

#4 Identifying Price Delivery (PD) Arrays

At this stage, various ICT tools such as Fair Value Gaps, Order Blocks, or Breaker Blocks are used to pinpoint optimal entry points.

Each of these tools can individually serve as entry models, though combining them enhances precision and success probability.

Types of Trade Entry Setups in the ICT Method

There are various setups and models in the ICT method that can be used for entering trades.

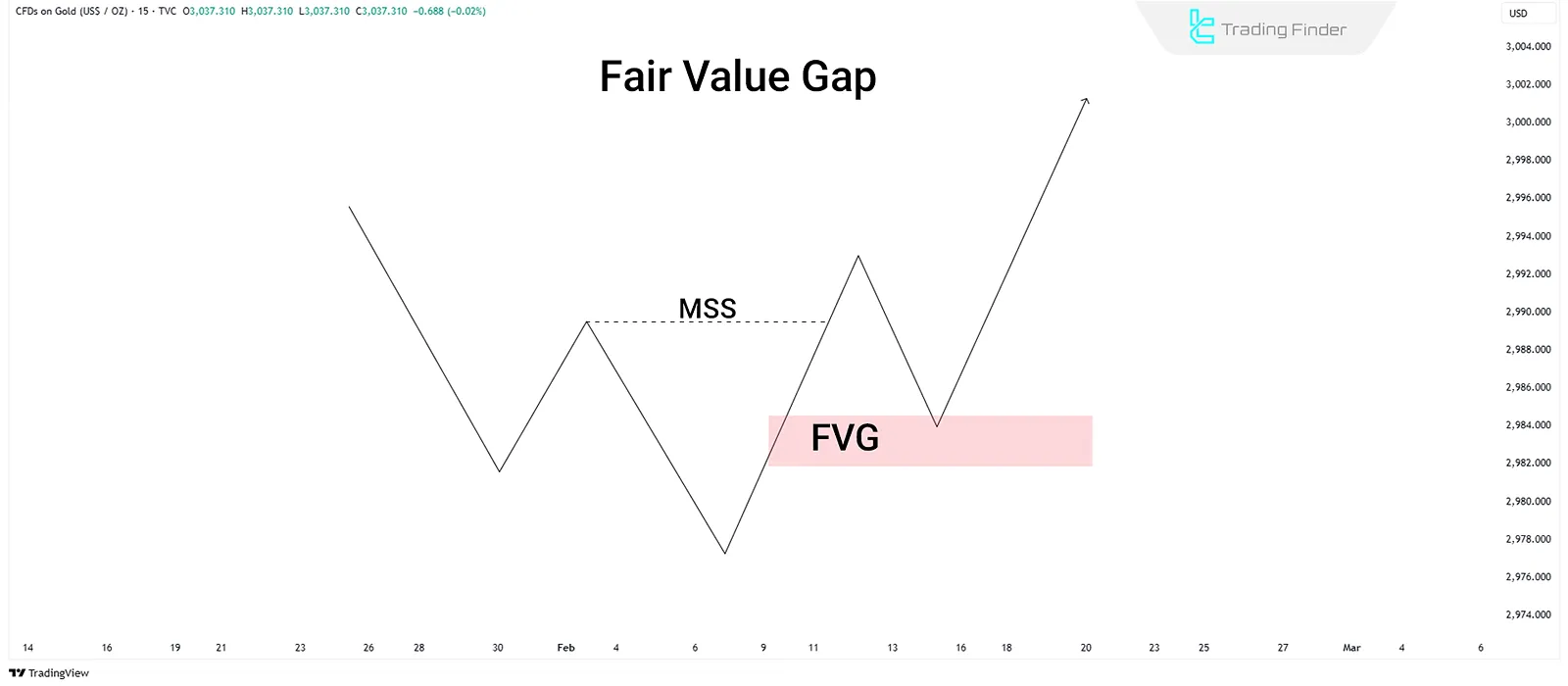

Fair Value Gap (FVG)

After confirming necessary ICT entry conditions, a price return to the Fair Value Gap indicates a potential trading opportunity.

Entry occurs as price first enters the Fair Value Gap (FVG), typically appearing where trade volume decreases, causing imbalanced price movements.

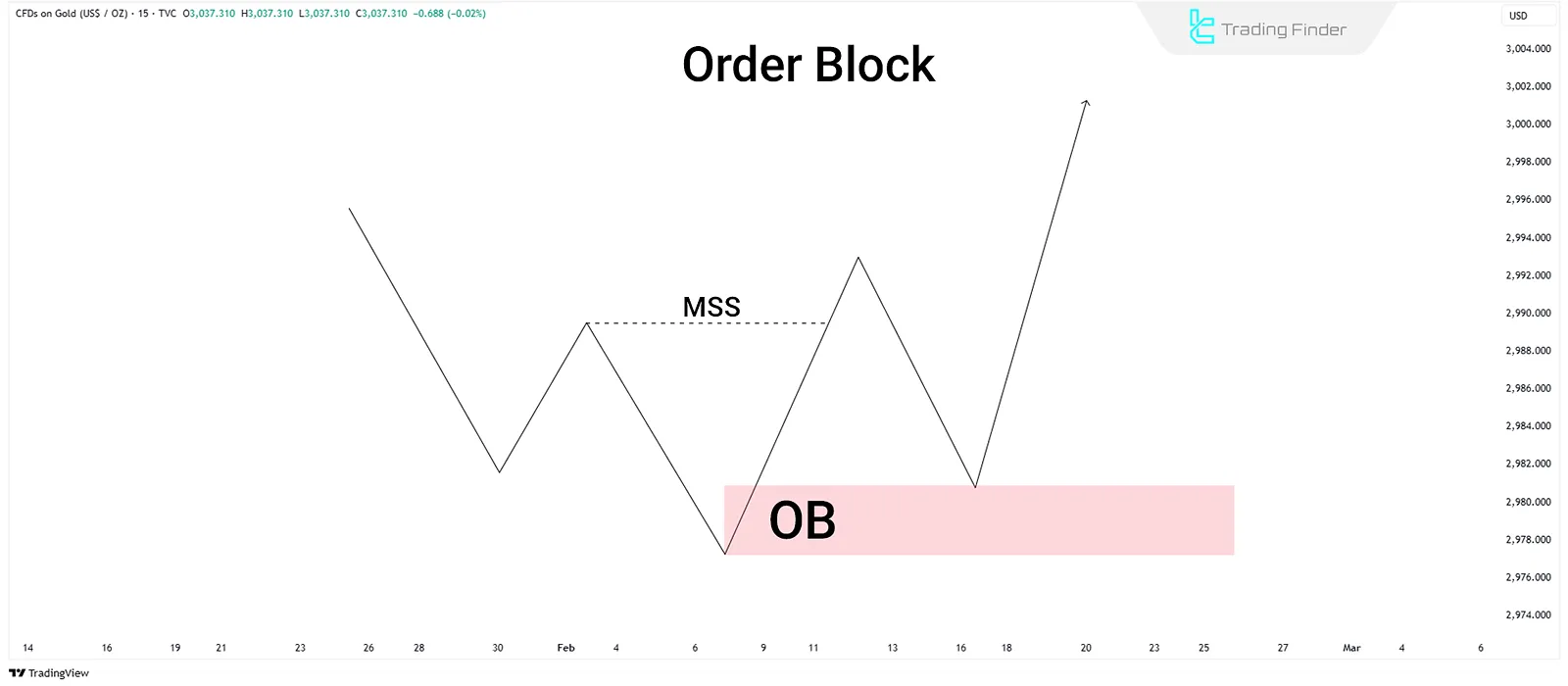

Order Block (OB)

Once essential ICT entry confirmations are established, a return to an Order Block (OB) is considered a key entry point.

OBs form due to large order accumulations before significant market moves, usually created by institutional activity. Entry occurs upon the first touch of the OB.

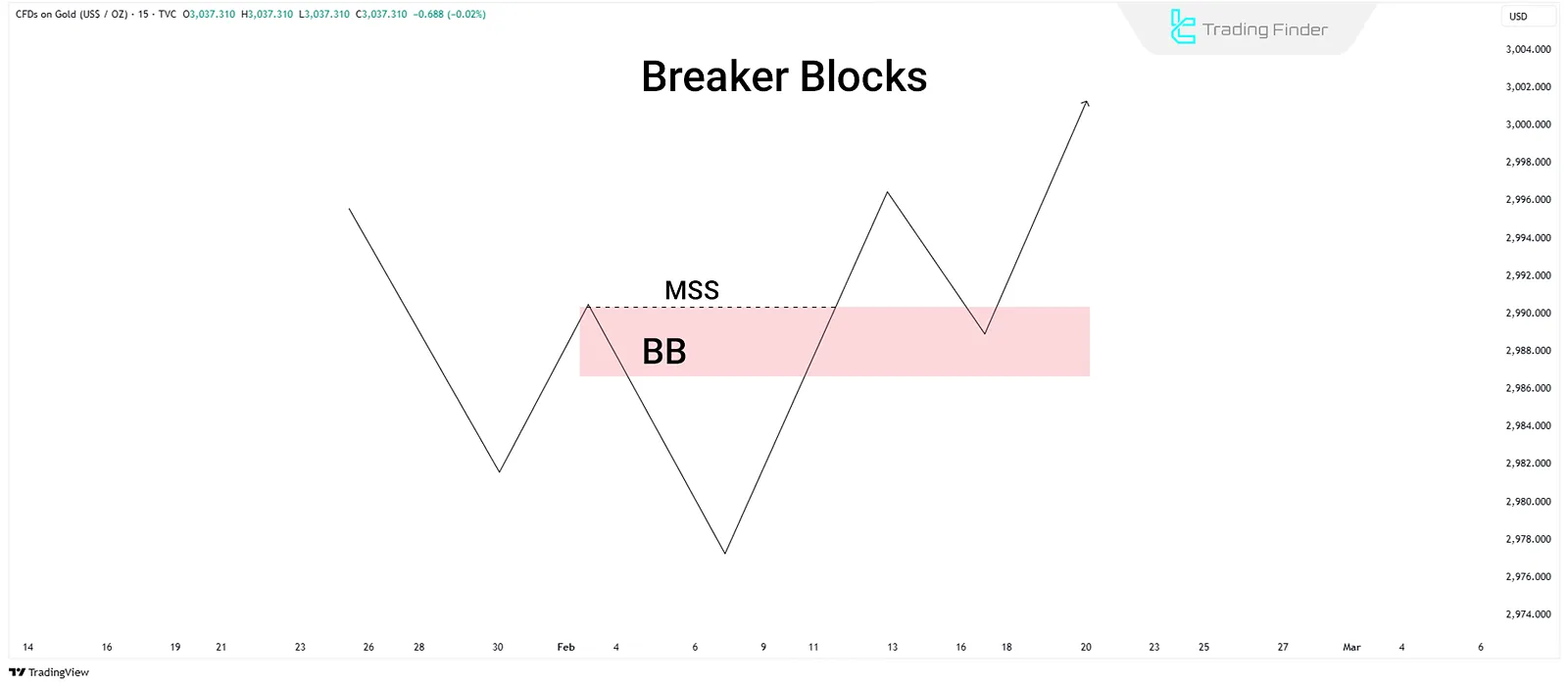

Breaker Block (BB)

Breaker Blocks form when price penetrates support or resistance levels and then returns. After meeting all ICT entry conditions, the return of price to a Breaker Block zone is used as an entry point.

Breaker Blocks typically signify shifts in market structure and occur in zones of significant pre-break.

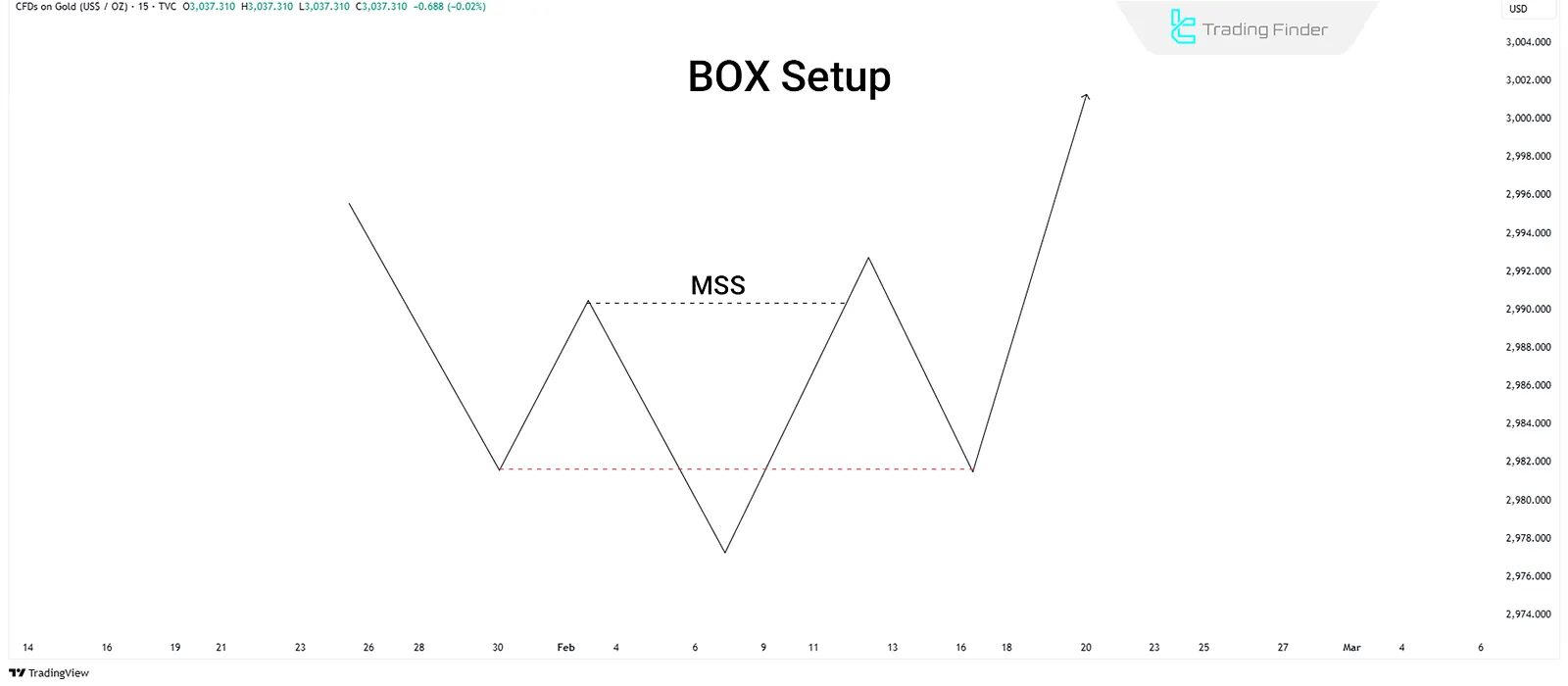

BOX Setup

The accumulation range or BOX Setup is a crucial ICT technique. This setup forms when the price consolidates within a specific range, indicating order accumulation.

Once price breaks and returns to this level, it provides a trading opportunity, highlighting major market players’ actions.

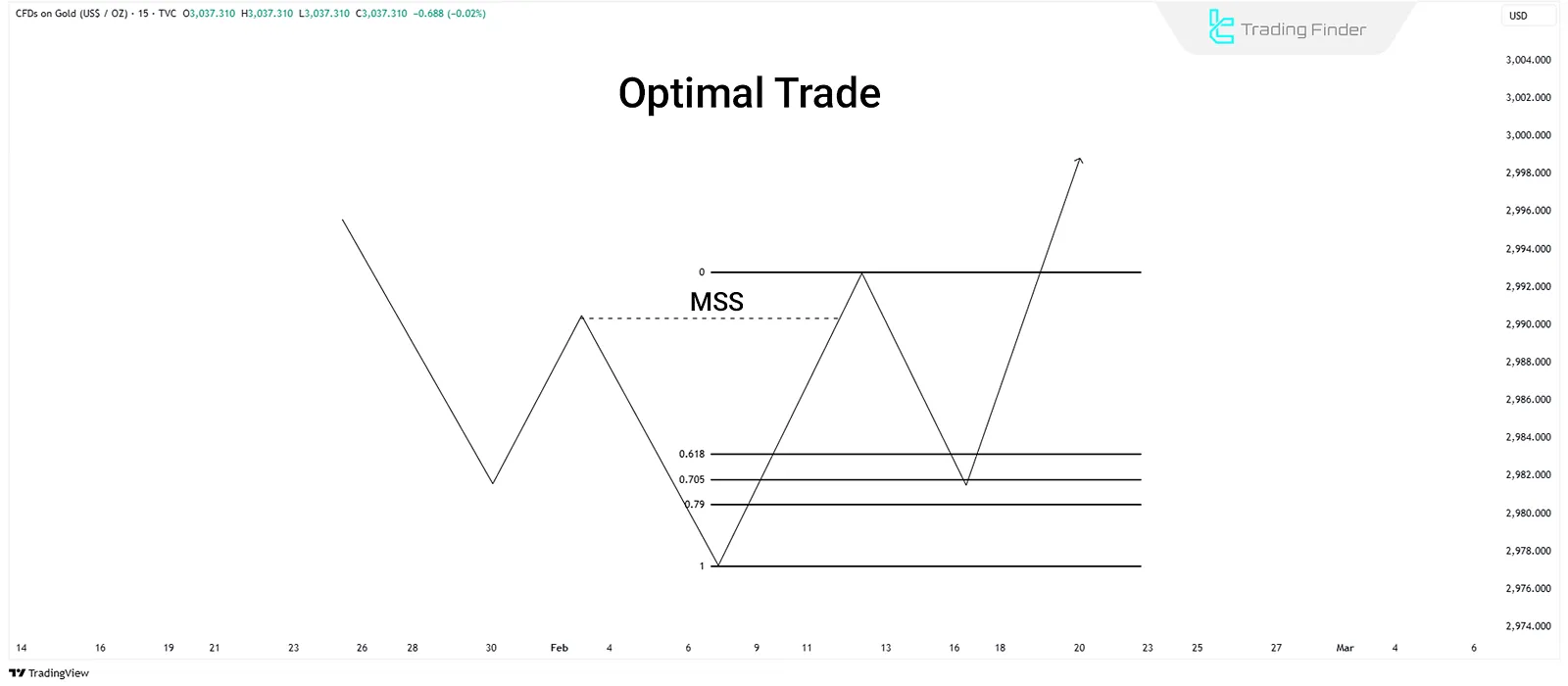

Optimal Trade Entry (OTE Setup)

The OTE method utilizes Fibonacci tools (levels between 0.62 to 0.79) to identify precise entry points.

Following initial confirmations, price returning to this zone provides trade opportunities with high return potential aligned with the primary market trend.

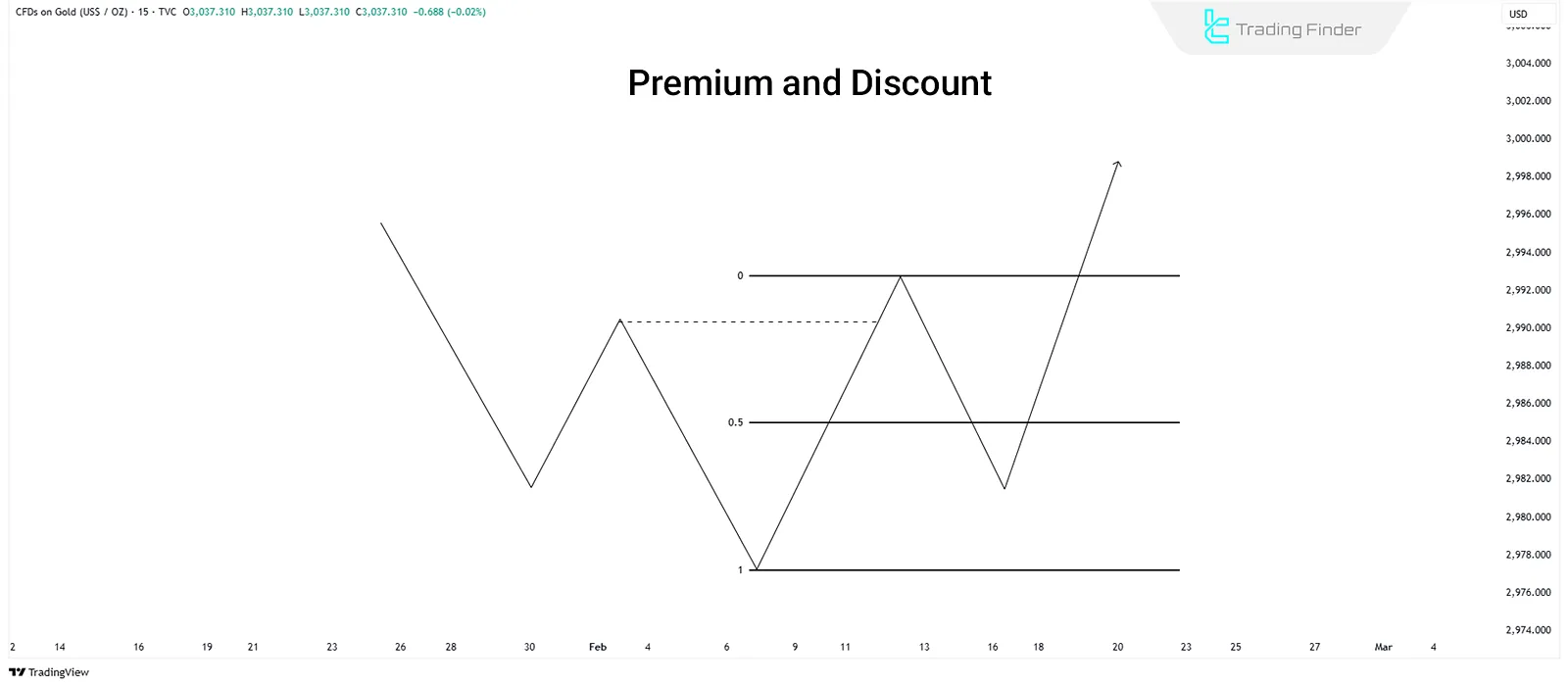

Premium & Discount Analysis

Premium and Discount analysis identifies entry points based on price positioning relative to equilibrium (50%).

Prices below equilibrium (Discount) offer long entry opportunities, while prices above equilibrium (Premium) indicate short-selling opportunities.

Importance of ICT Trade Entry Steps

Adhering to ICT trade entry confirmations provides significant benefits:

- Reducing drawdowns or the duration that trades remain in loss before achieving profitability;

- Increasing trade success rates, significantly affecting overall results;

- Enhancing risk-reward ratios by ensuring precise and optimal entries.

Summary

In the ICT method, precise analysis and entry identification revolve around core concepts like Fair Value Gaps, Order Blocks, Breaker Blocks, BOX setups, Optimal Trade Entries, and Premium & Discount analysis.

Essential steps, including liquidity raids, market structure shifts, and returns to critical zones, create a structured analytical framework for informed decision-making.