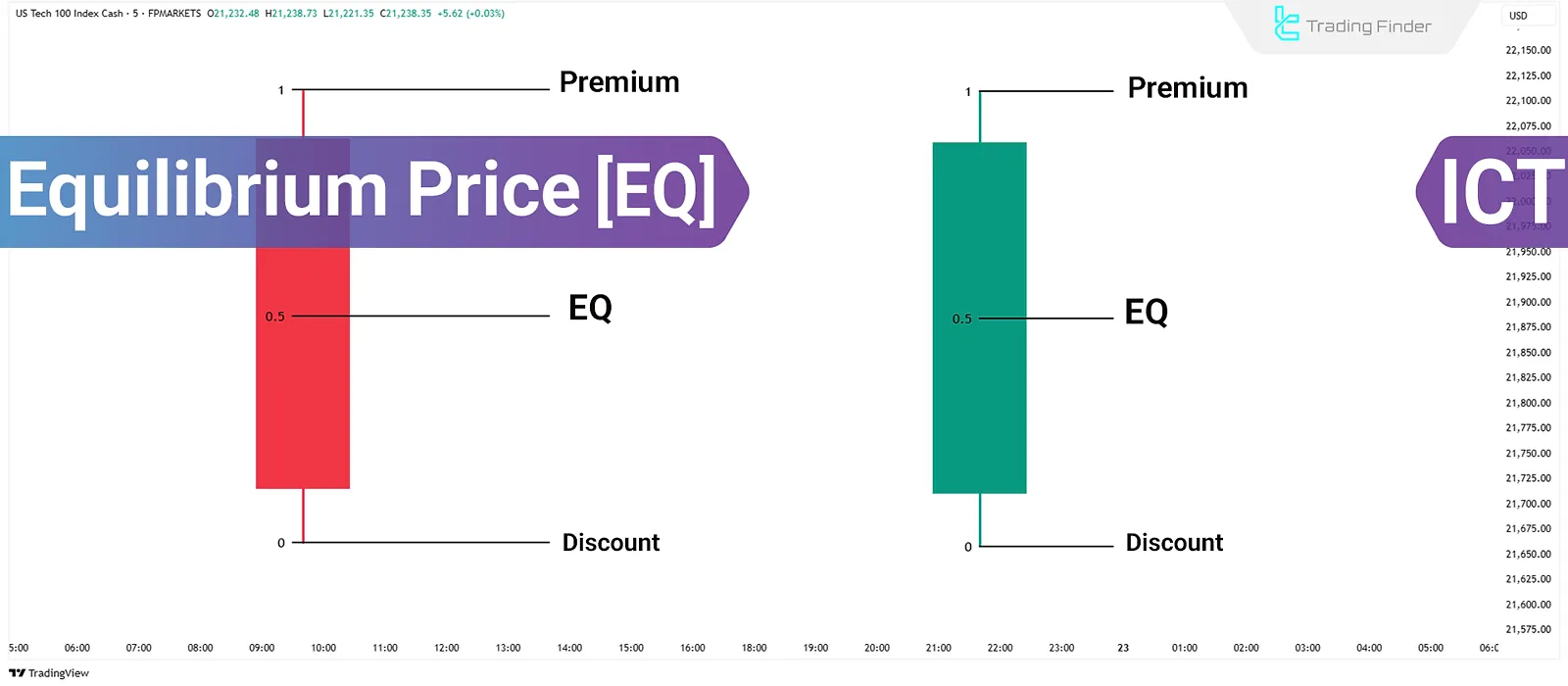

In the ICT methodology, price equilibrium refers to the midpoint between the highest and lowest wick of a candle. This level becomes particularly significant when the market is in an expansion phase rather than a retracement.

In such scenarios, the price typically does not return to premium or discount zones but tends to remain within the active half of the range it began moving from. If the price reacts to this midpoint and holds it, the likelihood of trend continuation increases.

Conversely, a break below the Equilibrium without respecting key price zones can signal a phase shift or structural weakness.

Therefore, monitoring the price equilibrium or EQ on higher timeframes in the ICT style plays a key role in building daily trading scenarios.

What Is Price Equilibrium (EQ)?

EQ, short for Equilibrium, is typically calculated as the 0.5 Fibonacci level of the distance between the wick high and wick low of a candle. This midpoint serves as a reference for assessing the likely direction of price movement in the days that follow.

If the price reacts to this level and holds above it, one can expect the prevailing trend to continue. Conversely, if the price breaks below and confirms below this level, it indicates a potential phase change or trend reversal.

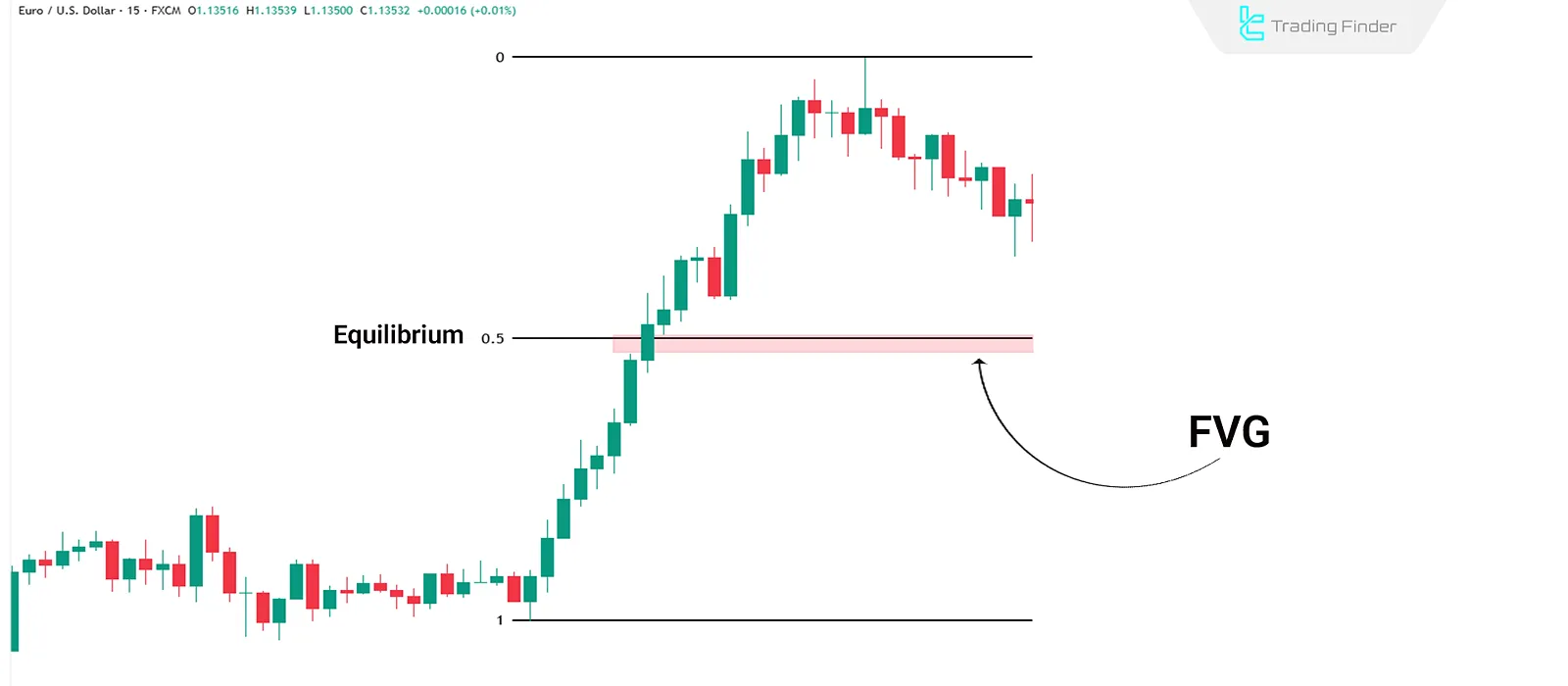

Price equilibrium gains more importance when combined with other ICT elements, such as Fair Value Gaps (FVG) or Order Blocks (OB) located in either half of the range. This combination helps traders identify sensitive price zones for potential entries and exits.

How to Use EQ in Daily Analysis?

Price equilibrium (EQ) serves as a tool to gauge the probable market direction by combining price behavior and key liquidity zones. Daily trading using EQ in ICT style typically involves:

- Analyzing the previous day's candle

- Identifying EQ and PD arrays in the relevant zone

- Confirming a Change in the State of Delivery

Analyzing the Previous Day's Candle

Begin the analysis by measuring the full range of the previous day's candle—from wick high to wick low. The midpoint (0.5 Fibonacci level) is considered the EQ.

The goal here is to observe how the market reacts to this EQ level. If the next day's price holds above EQ or reacts positively, the current trend is likely to continue. A break and close below EQ suggest a potential phase shift or deeper correction.

Identifying EQ and PD Arrays in the Active Zone

Once the EQ of the previous day is established, either the upper or lower half becomes the reference zone, depending on directional bias. In this zone, look for PD Arrays such as:

- Fair Value Gap (FVG)

- Order Block (OB)

- Opposing Candle

- Protected Highs and Lows

The presence of these elements alongside EQ significantly increases the probability of price reacting in the desired direction. For example, for a bullish setup, an FVG or OB in the upper half above EQ would act as a potential support zone.

Confirmation via Change in the State of Delivery

To enter a trade, it's not enough for EQ and PD arrays to be present. There must be a clear shift in price behavior, confirmed by:

- Price closing above a significant bearish candle

- Breaking a key candle in the direction of analysis

- Penetrating and rejecting from an FVG

This change shows the market is exiting accumulation or retracement and resuming the main trend, justifying trade entry.

Examples of Using EQ in ICT Style

The price reaction to EQ often defines the direction for the coming days and forms the basis of trade decisions.

Holding EQ and Trend Continuation

When the price respects and holds the 0.5 Fibonacci level of the previous day's candle (EQ), a continuation of the current trend becomes likely. This is often confirmed by price closing above a Fair Value Gap or Order Block.

With this confirmation, traders can set entries within the half that preserved EQ, placing stop-loss behind the nearest support or resistance.

Breaking EQ and Reversing Direction

If the price breaks EQ and confirms below, it suggests a possible phase change (e.g., from expansion to retracement or from trend to range). This usually coincides with price-anchoring liquidity zones. Traders may shift their bias and look for setups in the opposite direction.

Multi-Timeframe EQ Analysis

Price Equilibrium is a fractal concept usable across all timeframes:

- Daily EQ– to determine overall market direction;

- 4H EQ– for mid-structure evaluation;

- 1H EQ– for precise entry timing.

Traders can apply a single EQ or a confluence of multiple EQs to validate their setups.

Aligning EQ Structures for Higher-Confidence Setups

Setups that align EQ levels from multiple timeframes offer higher reliability. For instance, if the daily EQ is respected and the 4H EQ also reacts in the same area, one can use 1H candles for refined entry.

This multi-timeframe alignment within ICT methodology enhances the accuracy of entry points.

Common Mistakes When Using EQ

Incorrect interpretation or calculation of EQ can result in poor market structure analysis and faulty entries.

Expecting Return to Premium/Discount in Expansion Phase

In the expansion phase, the price typically does not return to premium or discount zones. Assuming full retracement to these zones during expansion is a mistake and can lead to premature or counter-trend entries. Focus should instead be on the active half of the range.

Using Candle Body Instead of Wick for EQ Calculation

In ICT, EQ is measured from the wick high to the wick low, not from the body. Using the candle body leads to incorrect EQ levels and flawed analysis.

Conclusion

Price Equilibrium (EQ) in ICT is a tool for gauging market reactions across various phases—not just a static price level. If the price holds or breaks EQ, the market's direction becomes clearer.

The true effectiveness of EQ emerges when analyzed in combination with liquidity zones and candlestick behavior. Without structural confirmation, EQ alone is not valid. Its value increases when aligned with order flow and lower timeframes.