ICT Kill Zones in Smart Money are key time intervals in financial markets when the highest volatility and trading volume occur. These four intervals (Asia, London, New York Morning, and New York Afternoon) assist traders in identifying optimal market opportunities.

Due to the high liquidity during kill zones, the likelihood of forming strong trends or valid breakouts also increases. For this reason, many trading strategies place special emphasis on these hours.

What is a Kill Zone?

Kill zones are specific times of the day, marked by significant institutional trading activity, resulting in increased volatility and trading volume.

These periods are divided into four primary categories:

- Asia

- London

- New York AM

- New York PM

Educational video on Kill Zones from the TTrades YouTube channel:

Each kill zone aligns with the major forex market sessions (Tokyo, London, and New York) and has unique characteristics.

The table below outlines the exact timing for each kill zone based on three standard time references (EST, UTC).

Kill Zone | New York Time (EST) | UTC Time |

Asia | 08:00 PM - 10:00 PM | 01:00 - 03:00 |

London | 02:00 AM - 05:00 AM | 07:00 - 10:00 |

New York AM | 08:00 AM - 11:00 AM | 13:00 - 16:00 |

New York PM | 01:00 PM - 03:00 PM | 18:00 - 20:00 |

What Is the Difference Between a Kill Zone and a Trading Session?

Many beginner traders make the mistake of assuming that ICT Kill Zones in Forex are the same as trading sessions, while in fact, these two concepts have completely different natures and purposes.

A forex trading session refers to the official time periods of activity in major financial centers such as London, New York, or Tokyo, which usually last for several hours and shape the overall flow of the market.

In contrast, a Kill Zone is only a small and targeted segment within those sessions a limited and high-risk window used for identifying ideal trade entries due to liquidity concentration, stop hunts, and the initiation of major market moves. Table of Differences Between Kill Zone and Trading Session:

Comparison Criteria | Kill Zone | Trading Session |

Definition | Short and targeted time frames within sessions with high liquidity focus | Official time periods of activity in global financial centers |

Duration | Short (usually 1 to 3 hours) | Longer (4 to 9 hours) |

Main Purpose | Stop hunts, trend initiation, high-probability trade entries | Defining the overall range of market activity throughout the day |

Analytical Focus | Liquidity and institutional/bank behavior at specific times | Overall global supply and demand flow |

Main Audience | Price action traders and scalpers | All traders (from scalpers to swing traders) |

Risk and Sensitivity | High; requires precision and experience | Lower; suitable for identifying the overall market structure |

Characteristics of ICT Kill Zones

Each ICT kill zone (Asia, London, New York Morning, and New York Afternoon) has unique features that are outlined below:

Asia Kill Zone

The Asian Kill Zone is one of the four key trading windows in the ICT style, typically active from 8:00 PM to 10:00 PM New York time.

This period marks the beginning of the daily liquidity flow in the forex market; however, due to its overlap with the economic activities of Australia, New Zealand, and Japan, it mostly consists of limited and corrective price movements.

Traders use this window to identify initial range zones so that later in the day, the breakout of these ranges during the London or New York sessions can serve as the basis for entering main trades. Table of Asian Kill Zone Information:

Category | Description |

Characteristics | Low volatility and narrow price ranges – mostly short-term corrective moves with limited opportunities – does not determine the main daily direction |

Suitable Assets | AUD/JPY – NZD/USD – AUD/USD – USD/JPY |

Trading Notes | Focus on short-term corrective movements – use the main trend on higher timeframes – avoid high-volume entries due to low volatility |

London Kill Zone

The London Kill Zone is active from 2:00 AM to 5:00 AM New York time and is considered one of the most important trading windows in the forex market.

The significance of this period lies in its overlap with the opening of European banks and institutions, which inject a large volume of liquidity into the market.

This period is usually accompanied by high volatility and often breaks the price range of the Asian session, setting the main directional bias for the day. Table of London Kill Zone Information:

Category | Description |

Characteristics | High volatility and the beginning of the day’s directional movements – breakout of the Asian session price range – highest activity in GBP/USD and EUR/USD pairs |

Suitable Assets | EUR/USD – GBP/USD – EUR/GBP – USD/CHF – GBP/JPY |

Trading Notes | Pay attention to liquidity accumulation – combine economic news analysis with technical analysis to determine market direction – high probability of forming the main daily trend during this period |

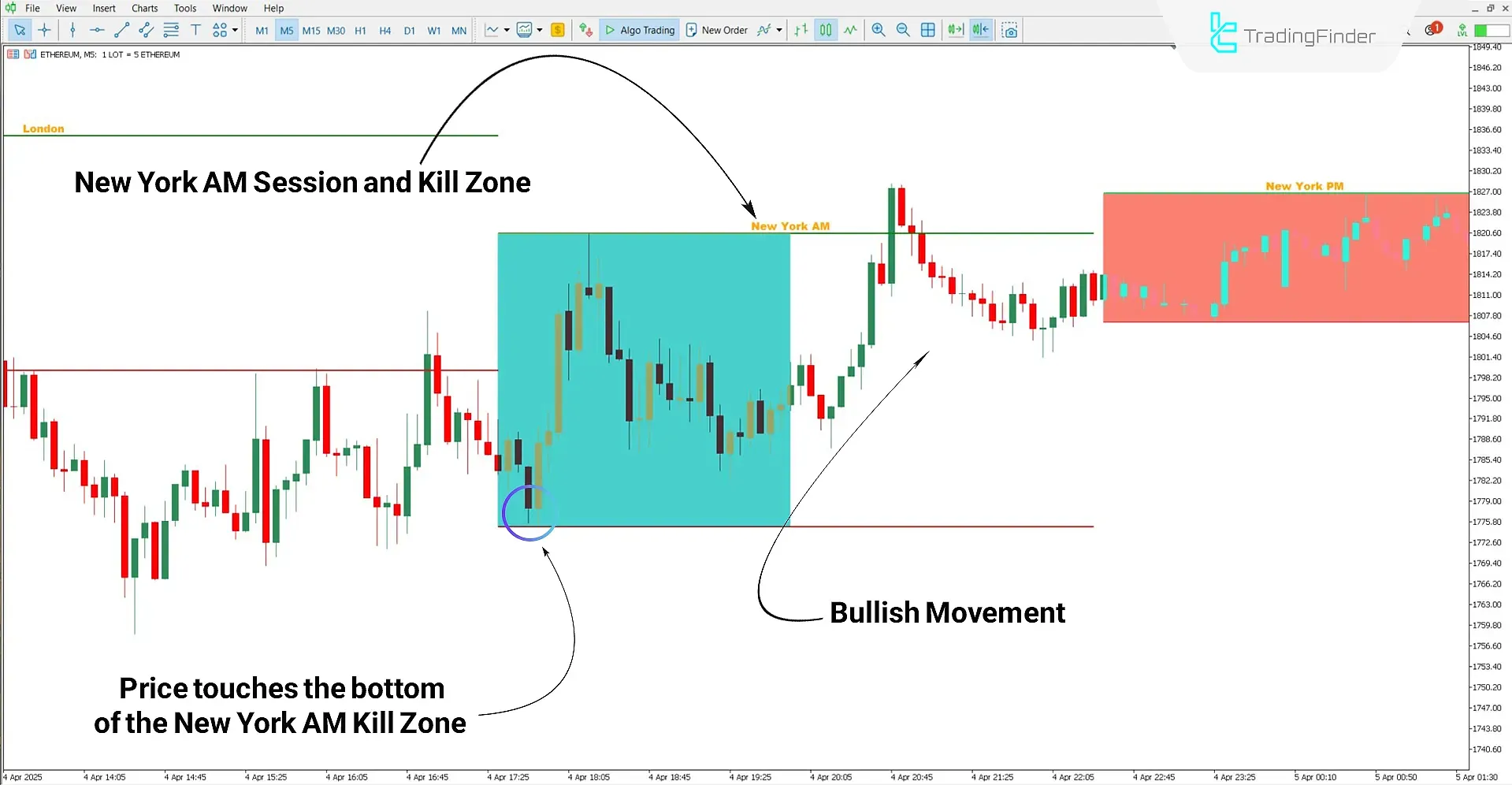

New York AM Kill Zone

The New York Morning Kill Zone is active from 7:00 AM to 10:00 AM New York time and is considered the second most important trading window in the forex market after London.

The significance of this period lies in its overlap with the late hours of the London session, where the highest daily liquidity enters the market and powerful price movements are formed.

This period usually includes either a continuation or a reversal of the London session trend and provides multiple opportunities for traders. Table of New York Morning Kill Zone Information:

Category | Description |

Characteristics | Overlap of the London and New York sessions with high volatility – continuation or reversal of the London trend – very high liquidity offering multiple trading opportunities |

Suitable Assets | USD/CAD, EUR/USD, GBP/USD, XAU/USD |

Trading Notes | Pay attention to levels formed during the London session and price reactions to them – monitor major macroeconomic news – apply strict risk management due to strong volatility |

New York PM Kill Zone

The New York Afternoon Kill Zone is typically active from 1:00 PM to 3:00 PM New York time. This period marks the end of the daily activity in the New York market and coincides with the closing of many major banks and financial institutions

During this time, liquidity decreases, but there are still opportunities for short-term or corrective trades. The market often enters a consolidation phase or continues the morning trends during this window. Table of New York Afternoon Kill Zone Information:

Category | Description |

Characteristics | Suitable for corrective and end-of-day moves – usually includes price consolidation or continuation of morning trends – reduced liquidity but still offers short-term opportunities |

Trading Notes | Pay attention to the day’s movements and morning trends – use for short-term trades with small targets – close open positions to avoid risks before market close |

Example of a Trade Using Kill Zones

In the 15-minute chart of Gold against the U.S. Dollar (XAU/USD), after the start of the London session, the price forms a new high with an upward movement.

When the New York session begins and overlaps with the London session, the price reacts to the same high formed during the London session and starts a downward phase. This area within the Kill Zone can serve as a suitable point for entering short trades.

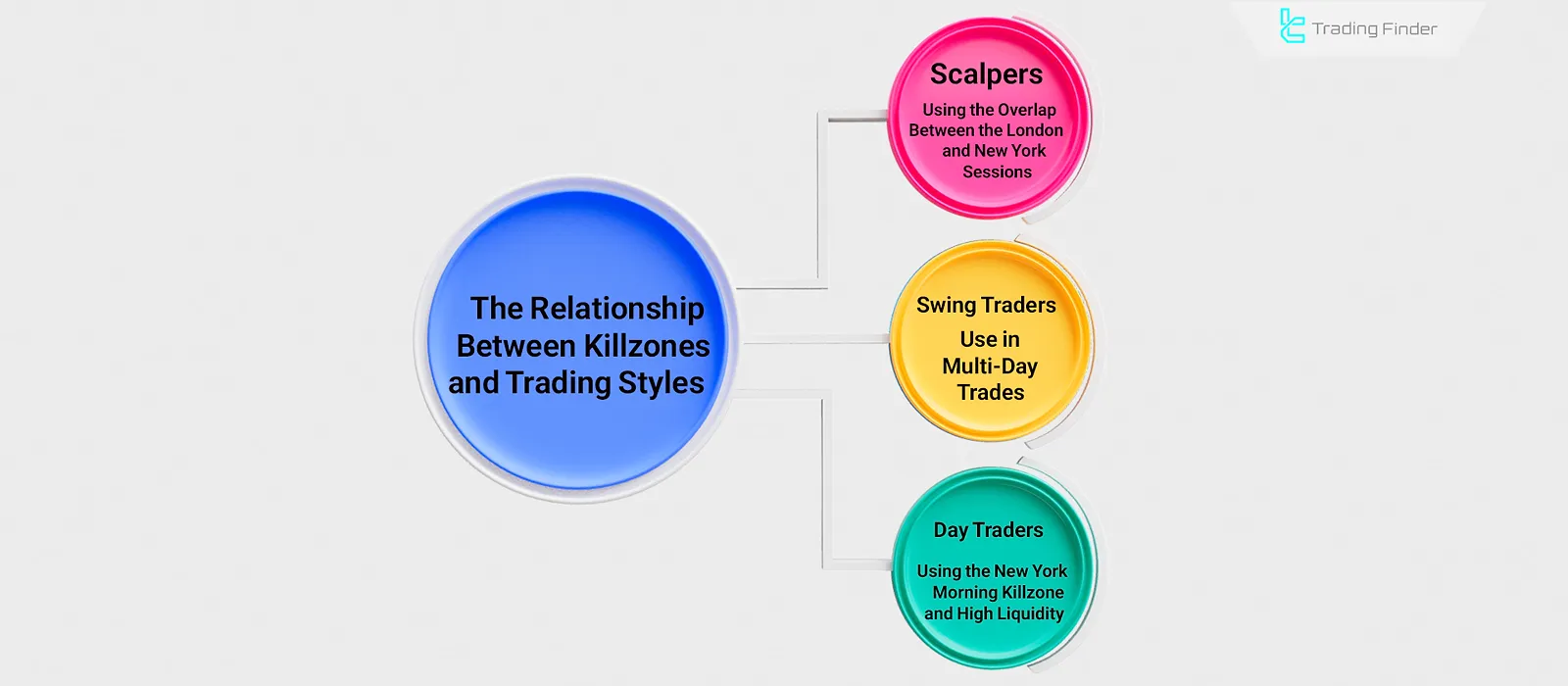

Suitable Kill Zones for Different Types of Traders

Understanding the trader’s type and trading style plays a significant role in how Kill Zones are used in the forex market. Scalpers, swing traders, and day traders each approach these time windows differently, taking advantage of the volatility and liquidity flow in their own unique way.

Table of Suitable Kill Zones for Different Traders:

Trader Type | Suitable Kill Zone | Reason for Use |

Scalpers | London Kill Zone and London–New York Overlap | Rapid volatility and more short-term opportunities |

Swing Traders | Major moves in the London and New York Kill Zones | Utilizing formed trends for multi-day trades |

Day Traders | New York Morning Kill Zone | High liquidity and alignment with major economic news releases |

The image below shows the relationship between Kill Zones and different trading styles:

Trading Kill Zone Indicator

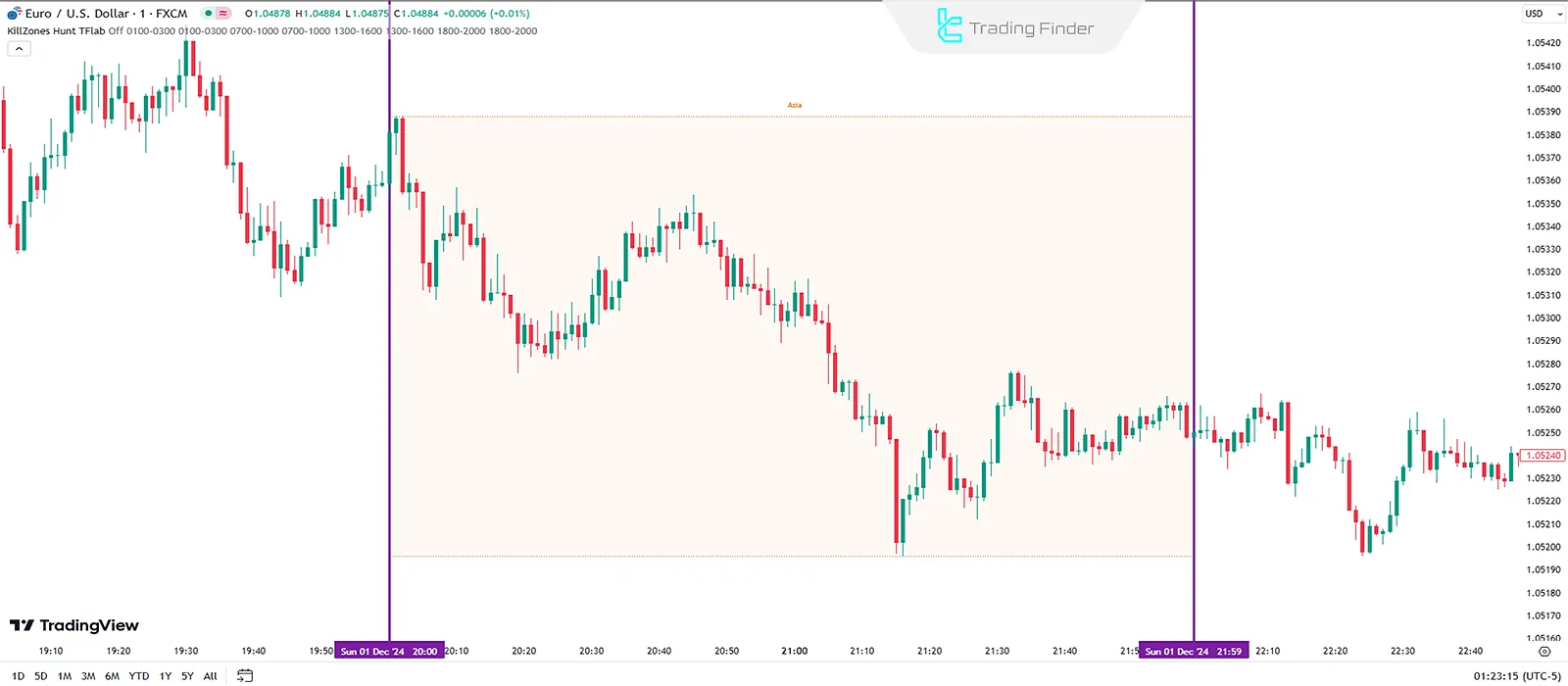

The Killzones Toolkit Indicator is a practical tool designed to display key market time ranges such as the New York Session, London Session, and Asian Session.

This indicator draws colored boxes on the chart that represent high-volatility and high-volume periods (Kill Zones). Traders can use this feature to observe price behavior during key market hours across different markets, including forex, crypto, and stocks.

Kill Zones are typically high-activity areas characterized by increased volume and volatility. By distinguishing trading sessions and displaying them visually, this indicator enables more accurate analysis of upward and downward trends.

For example, in the New York morning chart, a green box appears that acts as a strong support area and initiates an upward trend.

Similarly, on the chart, the blue-colored London session range shows how the price reacts to the Daily High, leading to the beginning of a downward trend.

Video Tutorial for the Kill Zone Box Indicator:

The Killzones Toolkit indicator includes various customizable settings. Users can modify the start time (hour and minute) of each Forex session (Asia, London, New York Morning, and New York Afternoon) and freely choose the color of each range.

The Initialize section allows defining the maximum number of candles to be analyzed. In addition, the PreviousCandle and Text_color options offer further customization for labels and data display.

This indicator can be used across multiple timeframes, from M1 to H4, and is particularly suitable for trading styles such as scalp trading and quick intraday setups. It can also be applied in forex, cryptocurrency, stock, and even forward markets.

Overall, the Killzones Toolkit, available for MT4, MT5, and TradingView, provides a graphical display of trading sessions and key time ranges, serving as an effective tool to improve decision-making in trading. It acts as a valuable complement to both technical and fundamental analysis strategies.

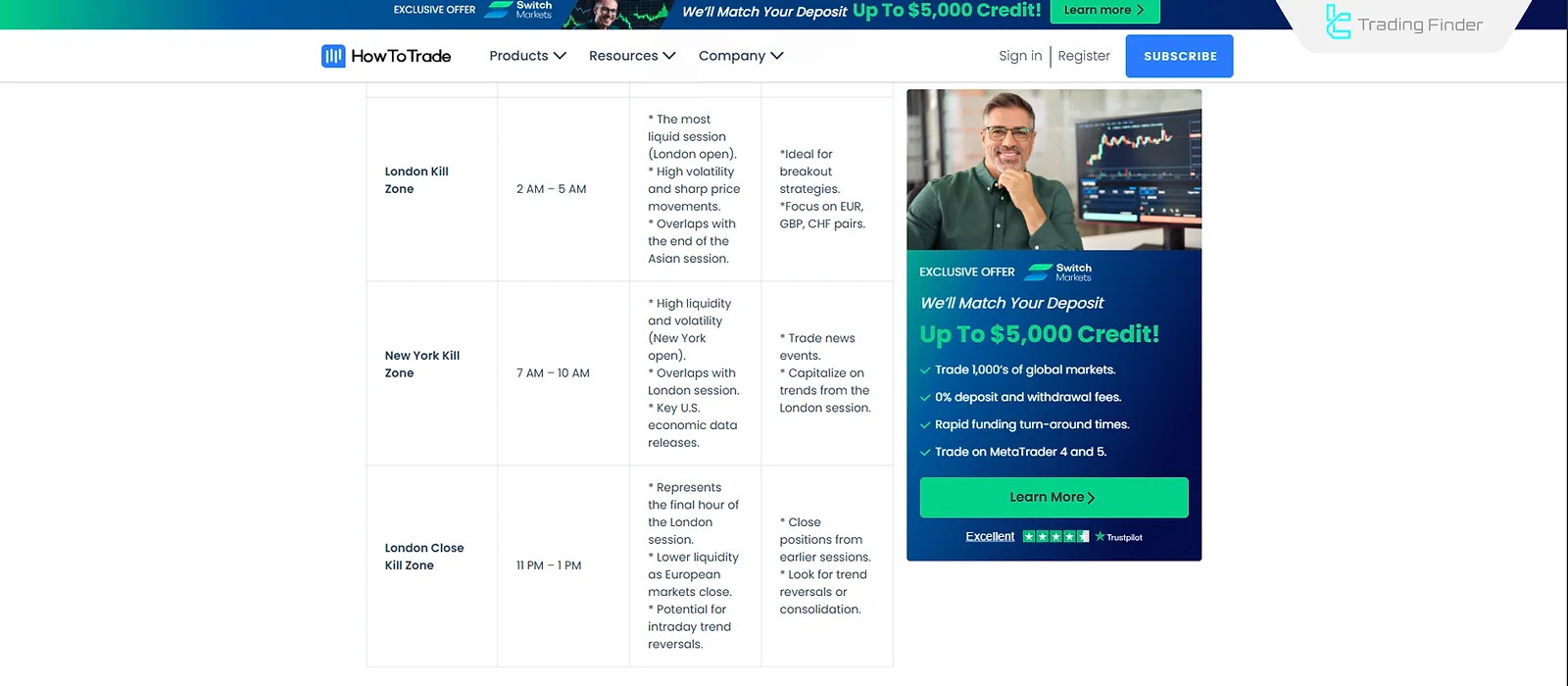

Why Are Kill Zones Important for Traders?

Professional traders use Kill Zones as a tool to understand market behavior. During these periods, stop hunts often occur, leading to the formation of the main daily trends and providing the liquidity needed for the entry of large institutional players.

For this reason, paying attention to Kill Zones can significantly increase the success rate of trades. The image below from the HowToTrade website shows a table of Kill Zone characteristics:

Price movements within Kill Zones are not random; they often follow recognizable patterns such as range breakouts, strong reversals, and reactions to liquidity levels. That’s why strategies like Breakout, Reversal, and Price Action combinations show the highest efficiency for professional traders during these periods.

Strategies Used in Kill Zones:

- Breakout: Many traders use the start of the London session or the London–New York overlap to capture breakouts from Asian range zones;

- Reversal: At the end of Kill Zones, especially London, price reversals often occur, providing opportunities to enter trades against the short-term trend;

- Combination with Price Action: Identifying candlestick patterns or supply and demand Levels during these windows greatly enhances the quality of trading signals.

How Does Daylight Saving Time Affect Kill Zones?

Daylight Saving Time (DST) can shift kill zone timings:

- In countries with DST: The timings adjust to EDT (Eastern Daylight Time), but the structure of the kill zones remains the same;

- In countries without DST: One-hour time difference may occur;

- Recommendation: Always use New York local time as reference.

Risk Management and Common Mistakes in Kill Zone Trading

Although Kill Zones offer attractive opportunities, without proper risk management they can lead to significant losses. Some of the common mistakes in using Kill Zones include:

- Entering a trade merely because it falls within a Kill Zone, without confirmation from price action or ICT setups;

- Ignoring major economic news releases during the London New York overlap;

- Using large position sizes in a market where volatility is extremely Daily high during these periods.

Solution: Always set a logical stop-loss before entering a trade, and only execute when there is strong confirmation.

Conclusion

ICT Kill Zones are powerful tools for traders, enabling them to identify opportunities during periods of high volatility and trading volume. With a clear understanding and intelligent application of these intervals, traders can improve the precision and profitability of their trades.

In addition, trading Kill Zones introduce a broader concept known as ICT Macro Times, which examine higher-level institutional trading frameworks. Using these time windows in combination with appropriate tools such as indicators can make trading strategies and outcomes more optimized.