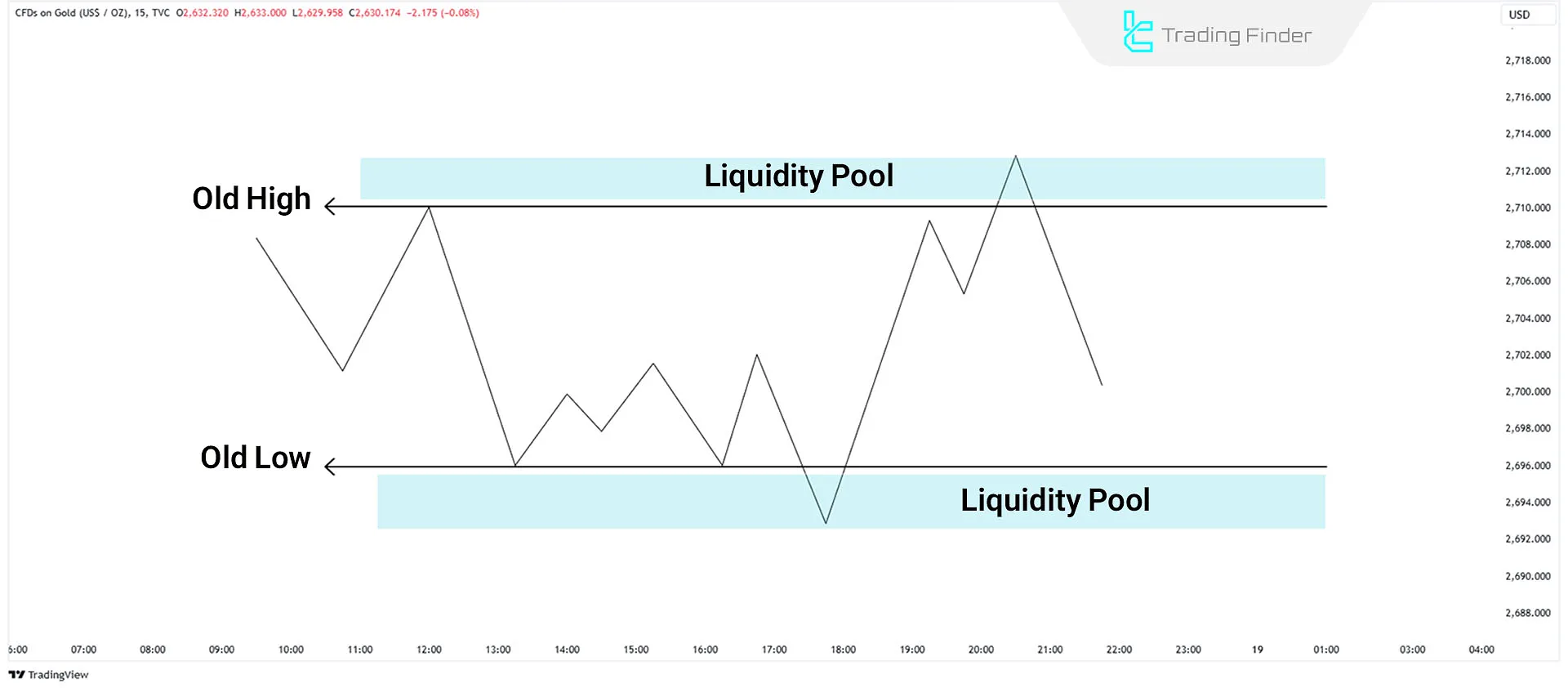

A Liquidity Pool refers to key zones where pending buy orders (Buy Stops) or sell orders (Sell Stops) accumulate. These orders are typically placed above old highs or below old lows.

What is Liquidity?

To understand Liquidity Pools in ICT Style, it’s essential to first grasp the concept of liquidity in Forex. Liquidity refers to buyers and sellers willing to trade at the market price.

In Liquidity Pools, retail traders buy and sell at the market price. However, professional investors Smart Money buy below the market price and sell above it.

What is a Liquidity Pool?

An ICT Liquidity Pool represents areas in the market where numerous buyers and sellers execute trades at these levels. Retail traders usually trade at the market price, while professional traders buy below it and sell above it, waiting for prices to enter premium and discount zones.

Typically, buy orders from potential buyers accumulate above old highs, while old lows hold sell orders from potential sellers. These areas are ICT Liquidity Pools and can be exploited to profit against retail traders’ behavior.

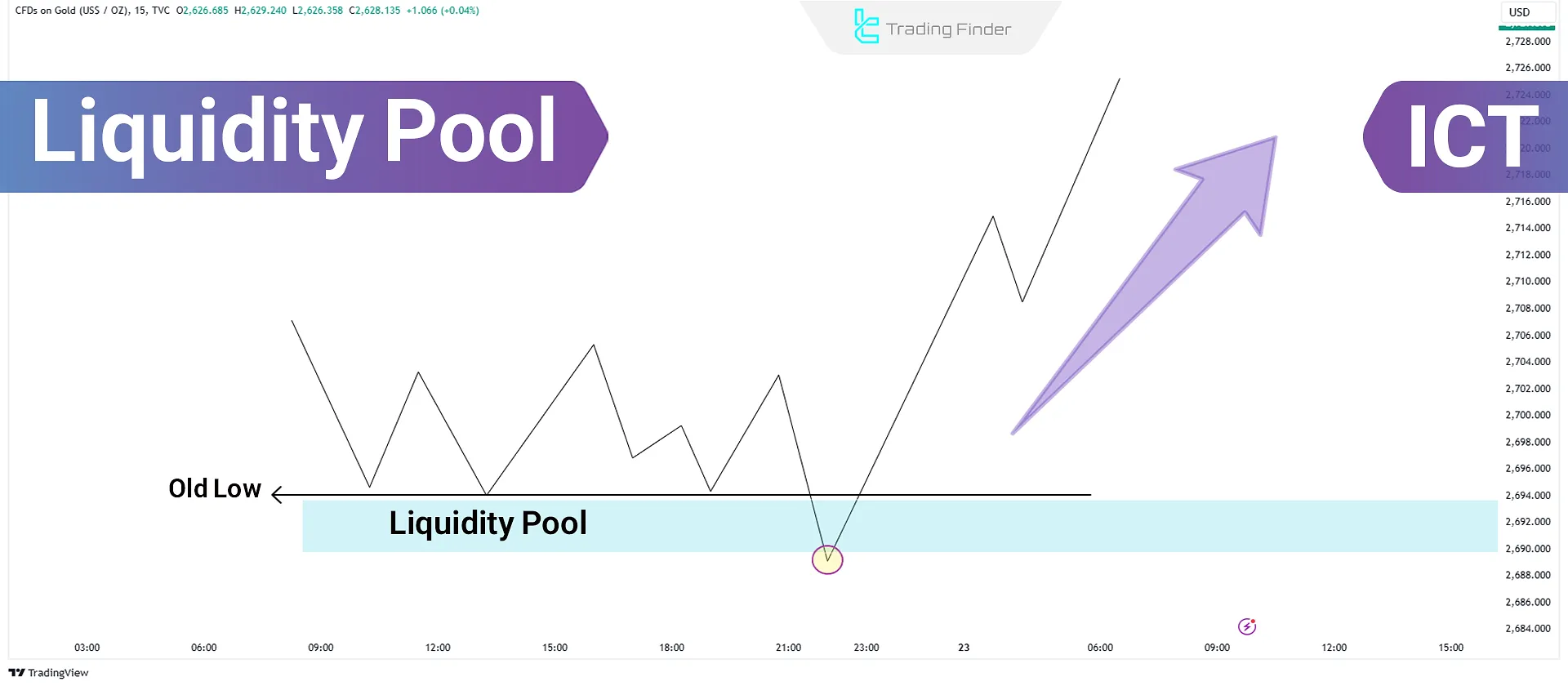

Bullish Liquidity Pool

Bullish Liquidity Pools are areas on a price chart where Smart Money looks to buy. Below old lows, Sell Side Liquidity accumulates as pending sell orders (Sell Stops).

In an uptrend, identify the Discount Zone, and as the price drops below an old low, execute a buy order.

In this scenario, retail traders are selling against your buy orders. Subsequently, the price is likely to rise, targeting Buy Side Liquidity.

Bearish Liquidity Pool

Bearish Liquidity Pools are areas on a price chart where Smart Money looks to sell. Above old highs, Buy Side Liquidity accumulates in the form of pending buy orders (Buy Stops).

In a downtrend, identify the Premium Zone, and as the price rises above an old high, execute a sell order. In this scenario, retail traders are buying against your sell orders. Subsequently, the price is likely to decline, targeting Sell Side Liquidity.

Do ICT Liquidity Pool Trades Require Confirmation?

No, trades based on ICT Liquidity Pools do not require additional confirmation from tools or indicators, as these trades rely on the principles of market liquidity flow.

The main objective of this strategy is to absorb liquidity in specific areas, such as above-old highs or below-old lows.

Is the ICT Liquidity Pool Model Reliable?

Yes. The ICT Liquidity Pool model is designed based on price behavior at liquidity accumulation points, making it a reliable tool for predicting market movements.

Success depends on identifying market behavior and precise entry and exit points.

Conclusion

The ICT Liquidity Pool trading style focuses on liquidity accumulation at old highs and lows.

To succeed, it is essential to understand liquidity behavior, market direction, and risk management through stop-loss settings and position sizing.