To master the liquidity trading strategy, traders must understand the concept of liquidity in Forex, which refers to the volume of pending buy and sell orders, including BSL/SSL, ERL/IRL, and HRLR/LRLR.

In Forex, liquidity is defined as the market's ability to absorb large orders [without drastic price changes].

What is Liquidity in Forex Trading?

Understanding liquidity is crucial in the ICT trading style, as Market Makers primarily drive price movement. Liquidity in Forex can be separated into various parts:

High Liquidity

Assets can be quickly sold and converted to cash.

Liquidity in Forex

Refers to the presence of buyers and sellers ready to trade in the market. If a trader wants to buy an asset, someone must be willing to sell it, and vice versa.

Measuring Liquidity in the Forex Market

In Forex Market, liquidity is determined by the volume of active and pending orders. Higher order volumes indicate higher liquidity.

Role of Market Makers in Liquidity

Market Makers often target order-dense points [such as stop-loss levels] to capture retail traders' liquidity.

Pros and Cons of Master Liquidity Trading Strategy

The table below outlines the advantages and disadvantages of mastering liquidity:

Advantages | Disadvantages |

Ability to anticipate market moves before they occur | Requires advanced understanding of liquidity, market structure, and FVG |

Reduced likelihood of stop-loss hunting | It takes time to learn and understand Market Maker's behavior |

Incorporates practical analysis and risk management | - |

Three-Step Process to Perform Master Liquidity Strategy

To identify liquidity in financial markets, follow these steps:

- Consider highs and lows as key areas, as they are commonly where pending orders accumulate

- Market Makers collect liquidity by targeting one side and then moving to the other

- After identifying liquidity and observing Market Maker behavior, traders can enter positions in Fair Value Gaps (FVG) and place stop-losses above or below previous highs or lows.

Types of Liquidity in Trading

Liquidity, like orders, is divided into two types:

Buy-Side Liquidity

Identifying Buy-Side Liquidity is as Follows:

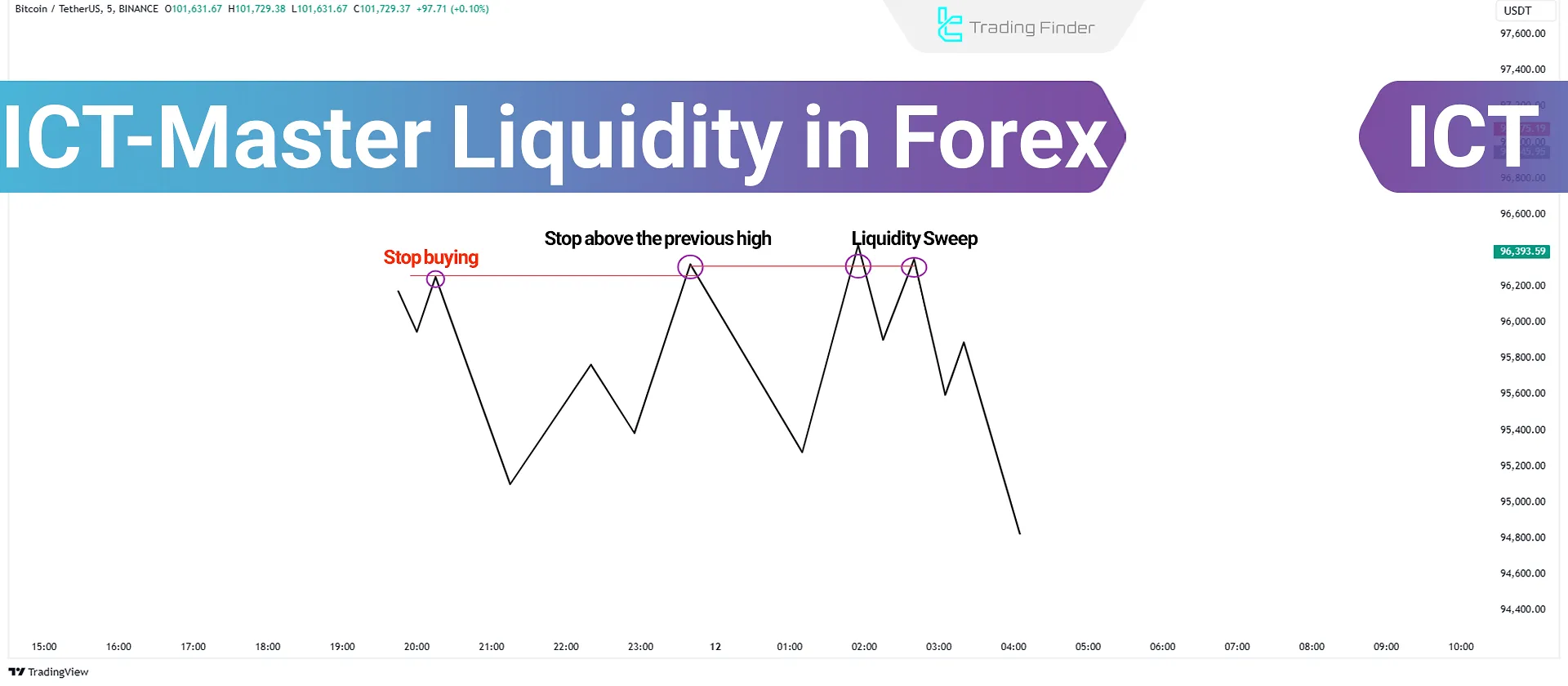

- Refers to pending buy orders (Buy Stops). Traders often place stop-losses above significant highs (e.g., daily or weekly highs) to protect their short positions. These old highs are referred to as Buy-Side Liquidity.

- Market Makers target these highs, activate pending buy orders, and then move the market in the opposite direction to profit. This process is known as the Liquidity Hunt.

Sell-Side Liquidity

To identify the sell-side liquidity, traders must understand essential concepts:

- Refers to pending sell orders (Sell Stops). Traders place stop-losses below significant lows to protect their long positions, making these lows Sell-Side Liquidity

- Market Makers target these lows, activate pending sell orders, and move the market in the opposite direction to profit

Why Understanding Liquidity is Important?

As we checked the concept and types of liquidity in Forex, it's evident that Market Makers aim to hunt liquidity and fulfill their orders. The Market Maker Indicator in TradingView can be used for the TradingFinder team set. The importance of liquidity:

- Market movement

- Liquidity and price movement

- Importance of deep liquidity knowledge

- Mastering liquidity for success in trading

Market Movement

When the market hunts liquidity on one side (activating buy or sell orders), it often moves to hunt liquidity on the opposite side. In other words, the market first targets one set of orders before moving to the next.

Liquidity and Price Movement

Liquidity is the primary driver of price movement. Prices head toward areas with significant buy or sell order volumes.

The importance of Deep liquidity knowledge

Without a clear understanding of liquidity, traders may have their orders targeted by Market Makers.

Success in Trading

To succeed, traders must identify liquidity and align their trades with the broader market flow by understanding Market Maker behavior.

Conclusion

The Master Liquidity in Forex Trading style focuses on identifying liquidity at price highs and lows and Market Maker behavior. This approach helps predict market moves and allows traders to trade considering Market Maker behaviors.

Entering trades in Fair Value Gaps (FVG), managing risks with stop-loss orders, and targeting liquidity points are the core principles of this strategy.