The ICT One Trade Setup For Life is a trading method designed based on market analysis and liquidity identification. This model is suitable for day trading and scalping, as it identifies key liquidity points and market shifts.

Due to the alignment of this structure with liquidity cycles and session-driven algorithms, this method is considered effective for day trading and scalping, especially during high-liquidity periods such as the London Open and New York Kill Zones.

What is the ICT One Trade Setup For Life?

The One Trade Setup For Life is a structured trading model based on key ICT principles such as:

- ICT Daily Bias

- Draw on Liquidity (DOL)

- PM Session Liquidity Raid

- London Session Liquidity Raid

- Opening Range Gaps

- New York Lunch Liquidity Raid

- AM Session Liquidity Raid

The One Trade Setup For Life repeats consistently and is applicable for both scalping and day trading. This ICT Strategy, as a complete model, does not require any additional methods and is considered one of the best ICT setups for traders.

Advantages and Disadvantages of the ICT One Trade Setup for Life Trading Setup

The ICT One Trade Setup for Life offers a powerful, high-precision approach, but its effectiveness depends on the trader’s skill level and analytical ability. The table below outlines the advantages and disadvantages of this ICT-style setup.

Advantages | Disadvantages |

Alignment with daily bias | Requires a deep understanding of market structure |

Using liquidity as price direction guidance | Requires patience for full setup completion |

Entry from FVG after displacement | Sensitivity to news conditions and high volatility |

Confirmation with MSS | Dependence on time-based sessions (Kill Zones) |

Market-structure-based risk management | Risk of creating an illusion of certainty for beginners |

Applicable across all markets | Necessitates precise risk management |

Focus on a single fixed model | Potential for misinterpretation of FVG and MSS |

What is the Draw on Liquidity (DOL)?

In simple terms, liquidity in Forex refers to the availability of buyers and sellers in the market, allowing for smoother trade execution. In trading, liquidity represents areas where buy or sell orders can be quickly executed.

"Draw on Liquidity" (DOL) refers to the liquidity sweep that targets active traders' stop-losses or triggers pending orders (Buy Stop or Sell Stop). DOL is the key factor determining a price movement's direction and primary objective.

The educational video on the TTrades YouTube channel provides more comprehensive, hands-on explanations directly on the price chart and enables a more detailed study of liquidity absorption.

How to Trade the ICT One Trade Setup For Life?

To trade using the model, follow the steps explained by ICT:

- Identify Daily Bias and the Draw on Liquidity (DOL);

- Mark the highest high and lowest low of the selected range (typically the PM session from 1:30 PM to 4:00 PM NY time);

- Wait for a sweep above the high or below the low of the chosen range in the opposite direction of the identified bias;

- Look for an FVG (Fair Value Gap) with Displacement, preferably with a Market Structure Shift (MSS). From this point, target opposite-side liquidity levels or other liquidity areas.

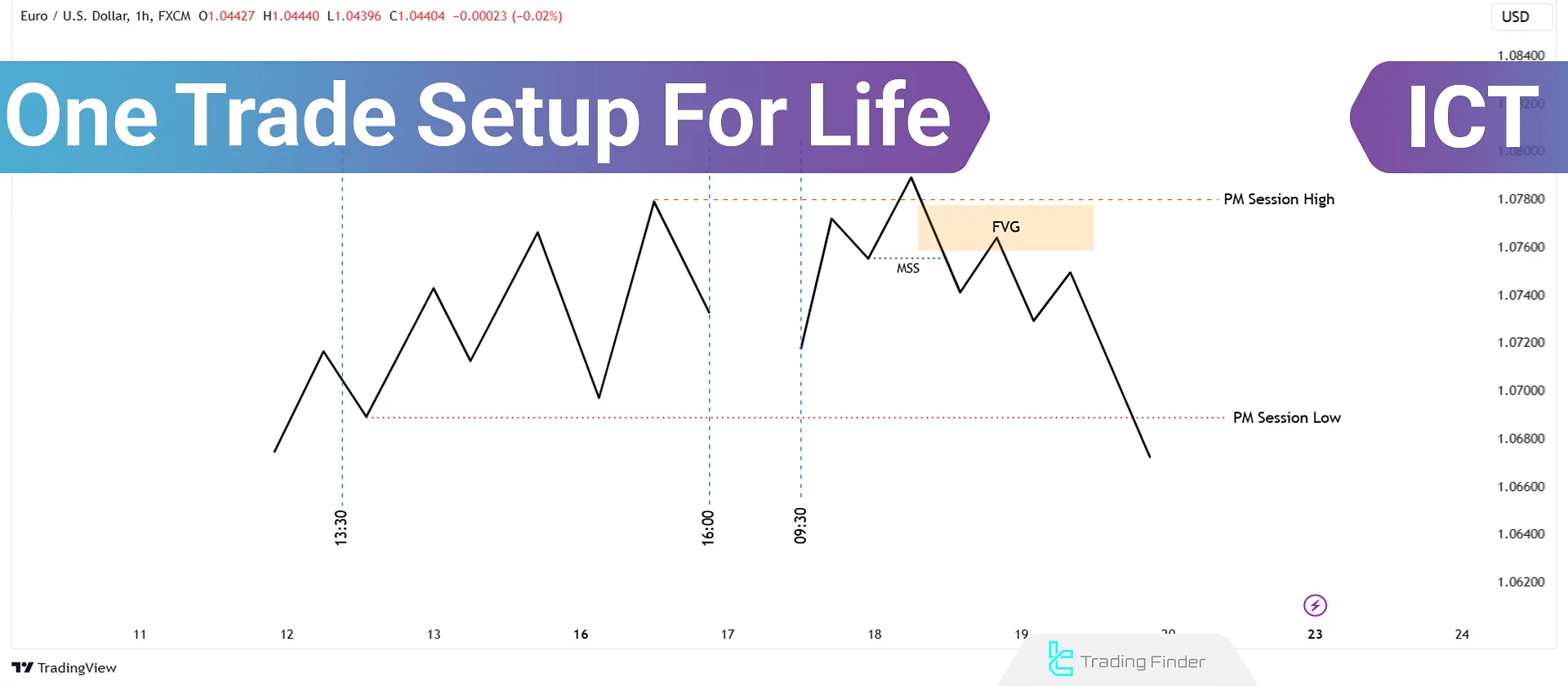

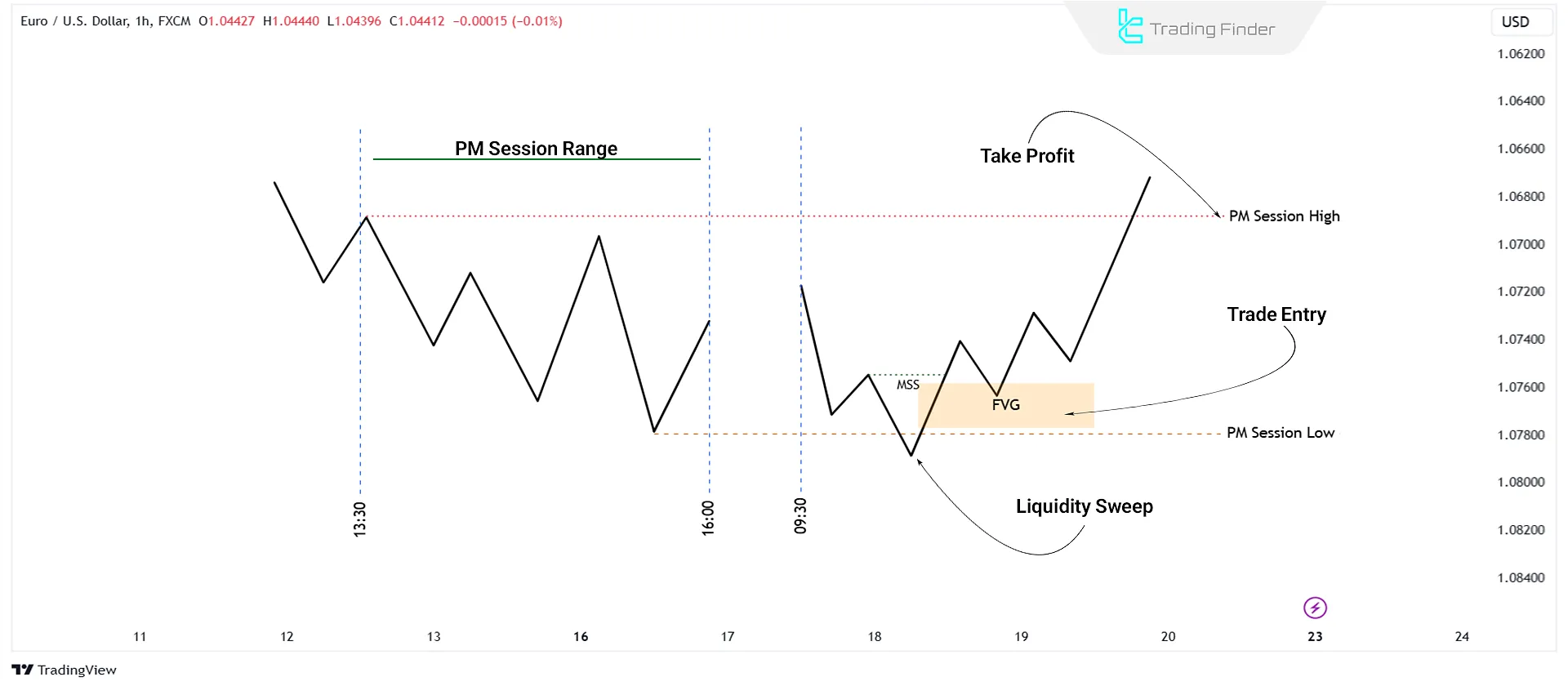

Below is the schematic of the bullish setup for ICT One Trade Setup For Life.

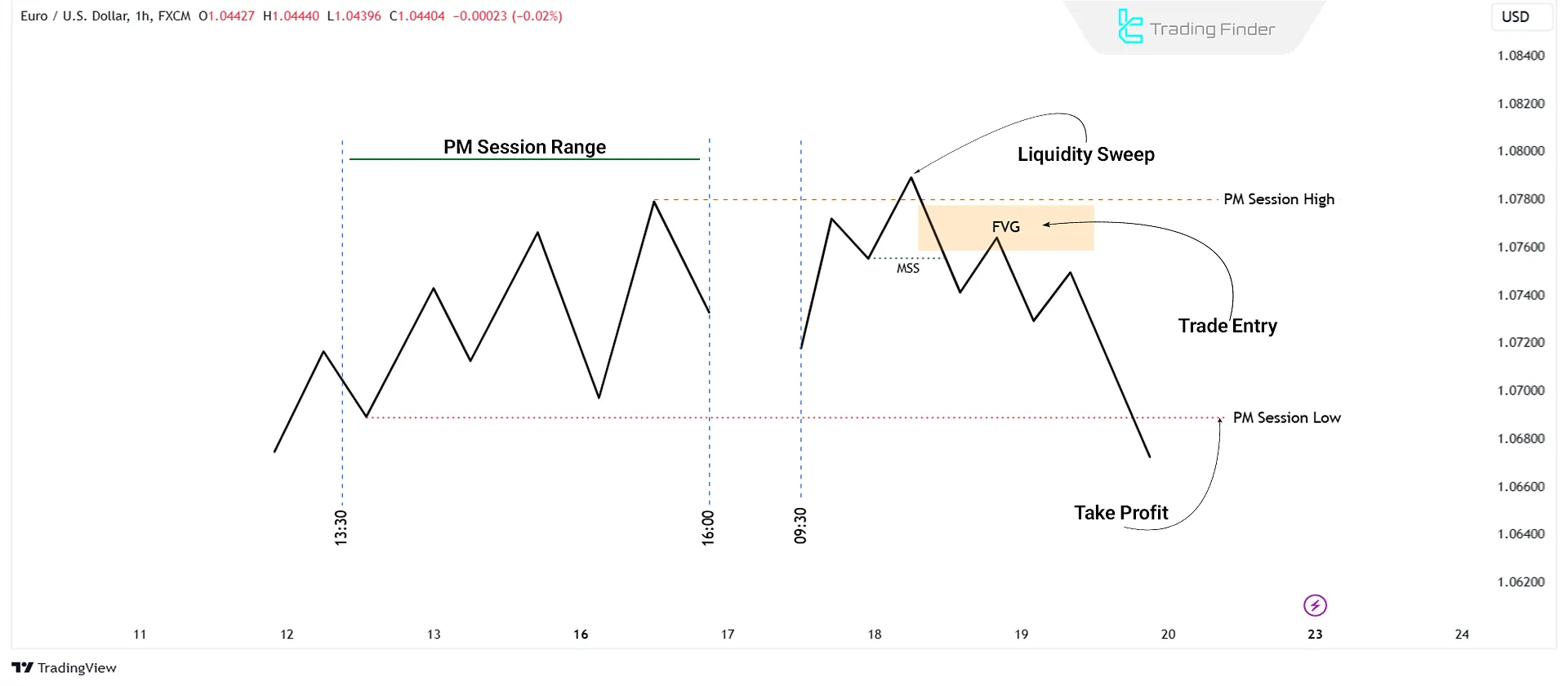

Below is the schematic of the bearish setup for ICT One Trade Setup For Life.

The recommended entry time is between 9:30 AM to 11:00 AM Eastern Time. Setting the trading session time zone to New York local time is essential.

Below are the setup conditions for different session timeframes.

PM Session Ranges

The PM session range reflects the price movement of the previous day. This range covers the timeframe from 1:30 PM to 4:00 PM NY time. To identify liquidity points:

- Mark the session high (Higher High) and low (Lower Low);

- Above the session high lies Buy-Side Liquidity (BSL);

- Below the session low lies Sell-Side Liquidity (SSL).

In a bullish daily bias, the price moves below the PM session low, sweeping SSL and creating an ICT Judas Swing. The price moves above the PM session high in a bearish daily bias, sweeping BSL.

London Session Liquidity Raid

If the PM session range is irrelevant or the price has moved significantly away, the London Session Liquidity Raid is used instead.

The London session range is from 2:00 AM to 5:00 AM NY time, often leading to a major Liquidity Raid before the New York open.

During the New York opening, price is expected to:

- Move below the London session low in a bullish scenario;

- Move above the London session high in a bearish scenario.

Example of a London Session Liquidity Raid on the EUR/USD Chart

In the chart below, price was trading within the candlestick range of the London session. With the opening of the New York session, after attacking the liquidity below the range, price began an upward move targeting the London session high.

Nevertheless, by using market structure shift (MSS) confirmations and the reaction to the order block, it is possible to enter a trade targeting the London session high.

Opening Range Gaps

Opening Range Gaps occur at 8:30 AM for forex and 9:30 AM for indices. In a bearish daily bias, the price moves towards the opening range gap, sweeping liquidity built in the morning and during the New York lunch period.

In the ICT approach, these areas are considered liquidity targets and potential levels for the continuation or acceleration of bearish price movement.

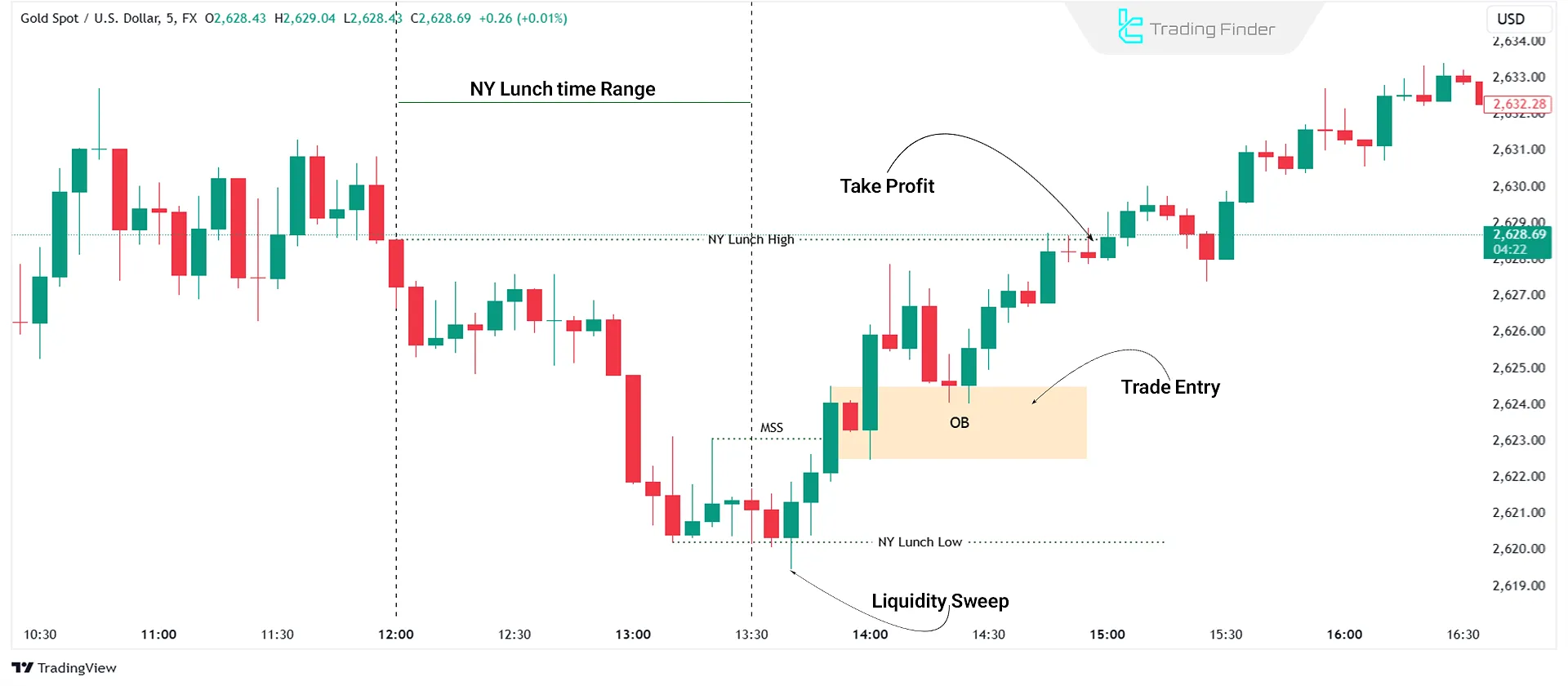

New York Lunch Liquidity Raid

If no liquidity sweeps have occurred earlier, the New York Lunch Range is examined from 12:00 PM to 1:30 PM NY time. Price may:

- Move towards the session high, initiating a bearish move;

- Move towards the session low, initiating a bullish move.

Rooted in ICT’s algorithmic and liquidity-based logic, this behavior often precedes the market’s main move in the final hours of the New York session and is seen by professional traders as a low-risk chance to align with the dominant order flow.

AM Session Liquidity Raid

The final liquidity target is based on the previous day's AM session range (9:30 AM to noon).

- For a bullish setup, the session high is the target;

- For a bearish setup, the session low is the target.

The article on teaching the One Setup for a Lifetime strategy on writofinance.com provides more detailed explanations on how to implement this trading strategy and offers supplementary content for interested readers.

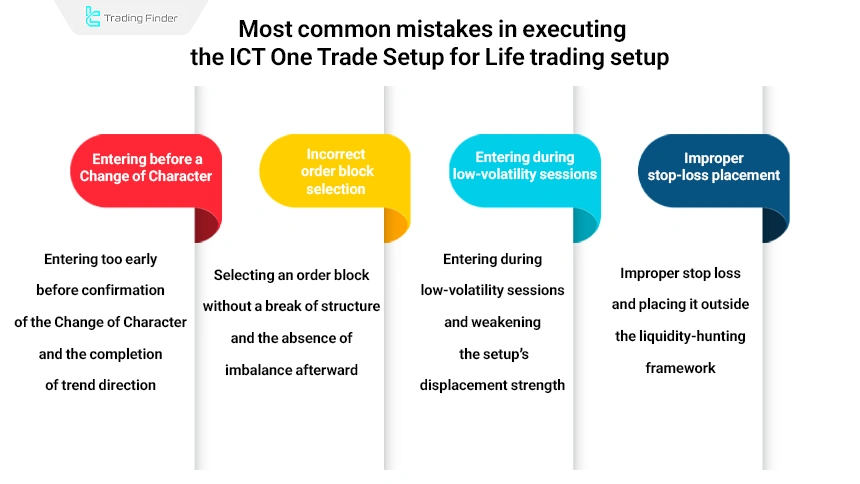

Common trader mistakes in executing the ICT One Trade Setup for Life

More than 70% of traders familiar with the One Trade Setup for Life strategy fall into losing paths due to four specific mistakes and interpret market structure contrary to Smart Money logic. Common errors in executing this setup include the following:

- Entering before a Change of Character: Entering prior to a Change of Character is a fundamental mistake, because a sweep alone does not initiate a trend, and without a Change of Character, the primary market direction is not completed;

- Incorrect order block selection: An order block is valid only when it causes a break of structure in the direction of the scenario and an imbalance forms afterward; otherwise, the entry point deviates from the liquidity flow;

- Entering during low-volatility sessions: This setup is designed for strong displacement. Therefore, entering during sessions such as Asia or the NY Lunch period, which typically have limited volatility, weakens the move and reduces setup quality;

- Improper stop-loss placement: The stop loss should be placed beyond the swept high or low, as the setup is based on liquidity hunting. Placing it too close to the entry increases the risk of premature exit and invalidates the structure.

Trade Manager TF trade management expert advisor in MetaTrader

The Trade Manager TF expert advisor, part of the specialized Trading Finder tools suite, is an advanced trade management system for the MetaTrader platform.

It is designed to precisely control risk, manage position size, and execute intelligent exits, and it can be used to implement ICT trading setups, including the One Trade Setup for Life.

This expert advisor combines two key panels-Trade Manager and Magic Panel-to provide the features a professional trader needs to manage trades in markets such as Forex, indices, stocks, and cryptocurrencies.

This tool enables partial exits, multiple take-profit levels, break-even execution, and the activation of various trailing stop types. Traders can set stop loss based on lot size, equity percentage, or dollar value, gaining full control over entry and exit management.

The Trade Pending section also allows users to manage Buy and Sell pending orders with precise structure.

In both bullish and bearish trends, using this expert advisor guides traders to manage their positions automatically-without constant monitoring-by setting multi-stage stop losses and take-profit levels.

Visual features and a floating panel allow users to easily move the tool across the chart and, if needed, minimize the panels.

The BreakEven & Trailing Stop Setting section is one of the most critical components, where traders can choose the trailing method from among 8 different models, such as ATR Trailing Stop, MA Trailing Stop, and others.

YouTube:

Alongside this, the Magic Panel enables one-click trading, instant activation of break-even or trailing stop, placement of pending orders, and even full position closure (C ALL) or 50% partial closure (C50).

In summary, Trade Manager TF is a professional tool for traders who aim to perform capital management, risk control, and intelligent exits in a fully automated and systematic manner.

Conclusion

The ICT One Trade Setup For Life provides a comprehensive trading framework designed based on a detailed analysis of market movements and liquidity zones. This model helps traders by introducing discipline, predictability, and structure in their trading approach.

Following the setup, traders can confidently execute their strategies and take advantage of repeatable trading opportunities. The result of this structure is increased behavioral discipline, reduced emotional decision-making, and effective utilization of recurring market patterns.