ICT Silver Bullet strategy is a time-based trading approach designed for scalping. Its primary focus is on liquidity and Fair Value Gaps (FVG).

This strategy enables traders to profit from short-term market movements during three specific timeframes (each lasting 60 minutes).

Overview of the Silver Bullet Strategy

The Silver Bullet strategy identifies three optimal times during the day when there is a high likelihood of forming ICT style setups within these specific timeframes.

This strategy occurs three times a day in one-hour intervals:

Session | Time (UTC) | Time (New York) |

London | 07:00 – 08:00 | 03:00 – 04:00 |

New York Morning | 14:00 – 15:00 | 10:00 – 11:00 |

New York Afternoon | 18:00 – 19:00 | 14:00 – 15:00 |

The primary goal of the Silver Bullet is to capture liquidity and leverage FVG opportunities for short-term trades targeting 20-30 pips (for major Forex pairs).

Steps to Implement the Silver Bullet Strategy

To better identify all components of this strategy, it is recommended to proceed step-by-step based on priorities. The steps are as follows:

- Identify Liquidity

- Identify Market Structure Shift (MSS)

- Find the Fair Value Gap (FVG)

- Finally, entering the trade

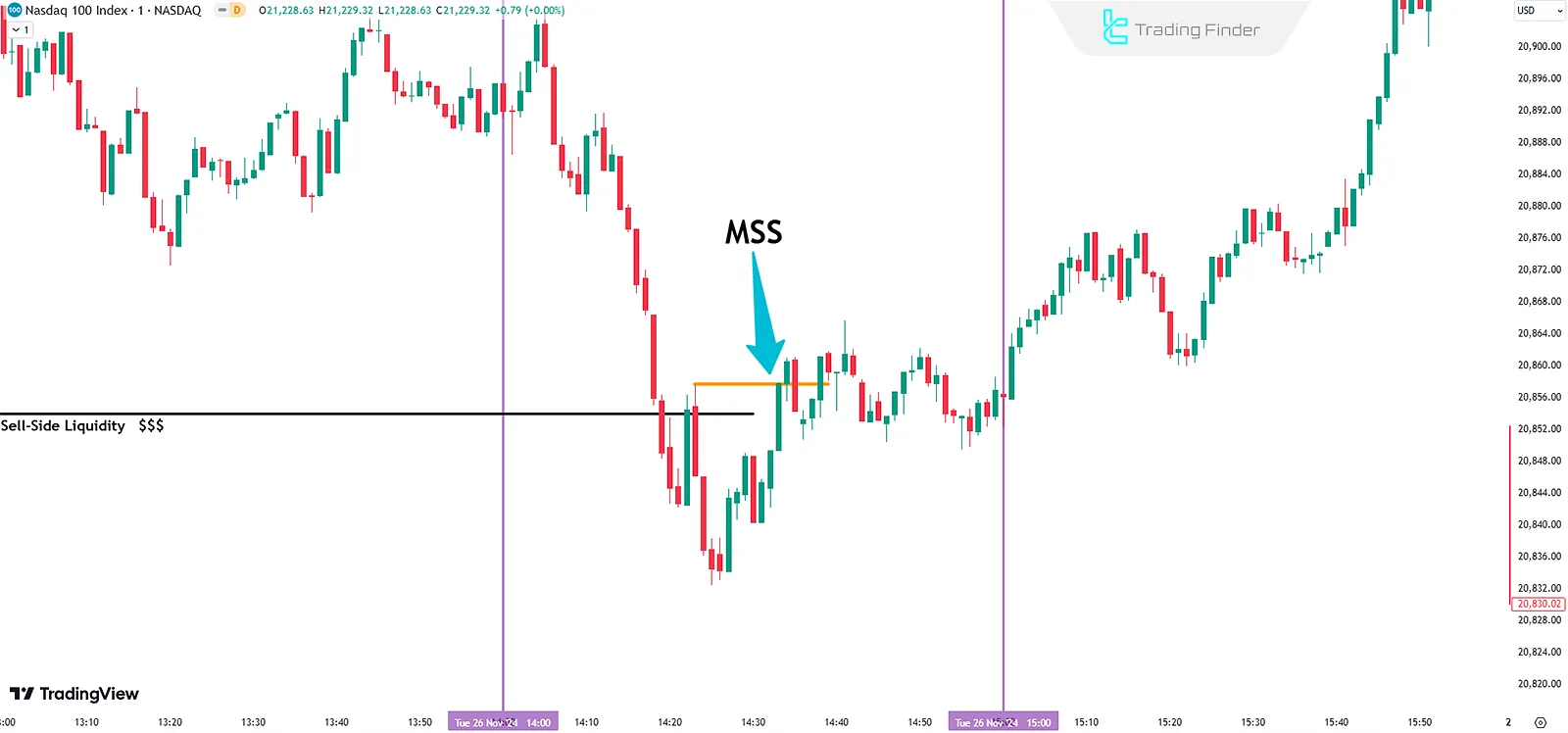

#1 Identifying Liquidity

Before the session begins, identify the nearby Buy and Sell Side Liquidity (BSL & SSL) on the 15-minute timeframe:

- Buy-Side Liquidity: Above the highs

- Sell-Side Liquidity: Below the lows

If the price breaks into one side of liquidity, it may continue to sweep more liquidity in the same direction or shift towards the other side.

#2 Identify Market Structure Shift (MSS)

On lower timeframes (1-minute or 3-minute), observe the Market Structure Shift (MSS) in the direction of liquidity sweep.

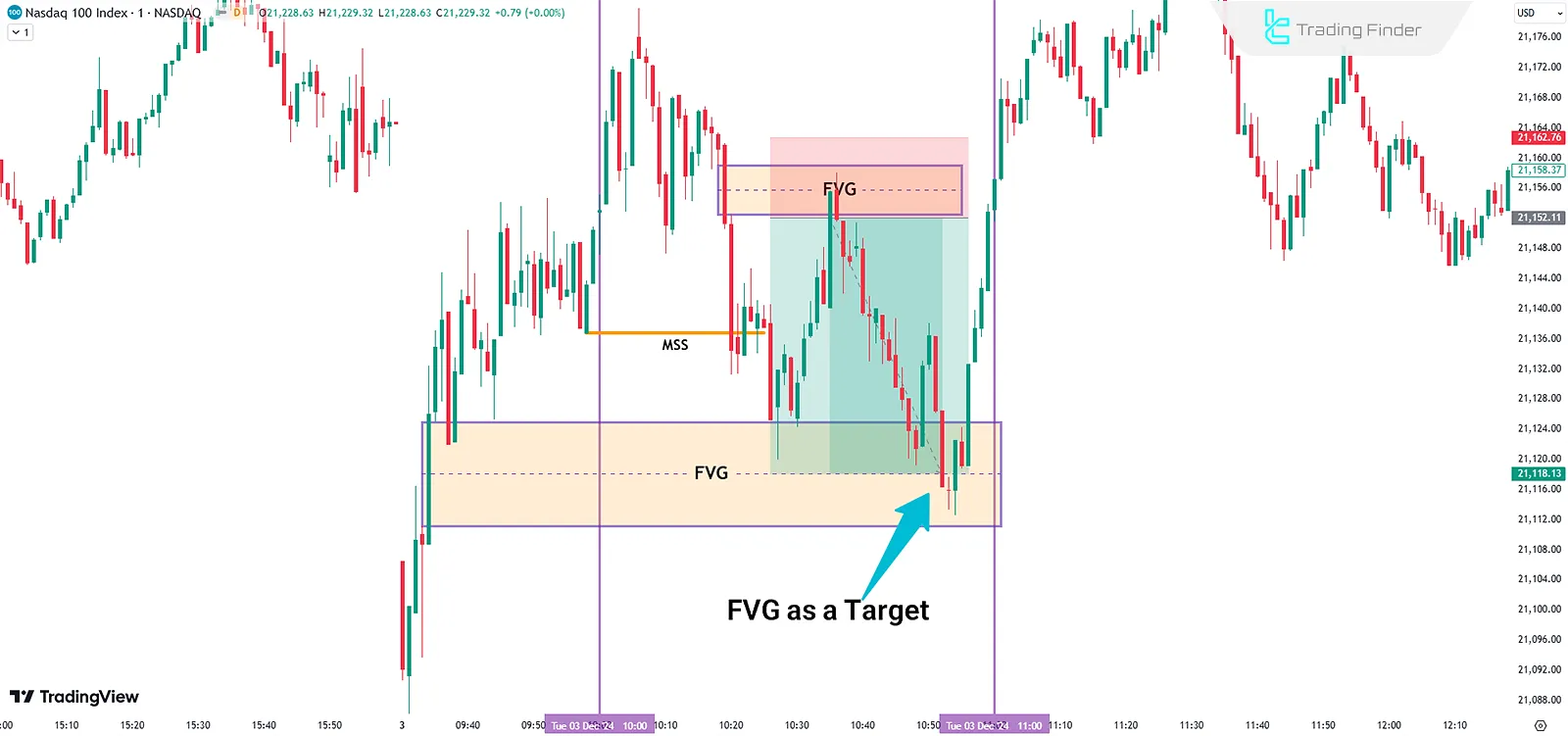

#3 Find the Fair Value Gap (FVG)

After the market structure shift, look for an FVG in the same direction. Use Premium and Discount tools to identify the best FVGs for trading.

#4 Enter the Position

After identifying and marking the Fair Value Gap (FVG), the price gravitating toward the FVG is one of the initial signs for a potential entry.

- Entry: When the price returns to the FVG zone, this retracement can be used as an optimal entry point

- Stop Loss (SL): Place the stop loss above the high (in a bearish setup) or below the low (in a bullish setup) of the candle that formed the FVG

- Take Profit (TP): Liquidity levels on the opposite side of the entry zone or the opposing imbalance area can serve as the target

What is the Suitable Timeframe for the ICT Silver Bullet Strategy?

To use this trading strategy effectively, multi-timeframe analysis is required.

- The primary timeframe for identifying liquidity levels is the 15-minute

- The optimal timeframes for identifying MSS and FVG are 1 or 3-minute

Best Assets for ICT Silver Bullet Strategy

This strategy usually forms on most charts; however, it appears more frequently on indices and metals.

- NASDAQ Index (NQ Futures) and E-mini S&P 500 (ES Futures) yield the highest returns when this strategy is applied

- Major currency pairs and precious metals like EUR/USD,GBP/USD, and XAU/USD are also suitable for trading with this strategy

Best Sessions for ICT Silver Bullet Execution

The New York Morning Session (10:00–11:00 New York time) is the best time to apply the Silver Bullet strategy. Due to high volatility and overlap with the London session, this hour provides the most trading opportunities for this strategy.

Advantages and Disadvantages of the Silver Bullet Strategy

Advantages | Disadvantages |

No need to sit in front of the screen all day | Understanding concepts like liquidity and FVG is crucial for proper execution |

Ideal for scalpers due to its focus on liquidity and short-term moves | Fast movements, especially on lower timeframes, can lead to sudden losses |

Allows for setting clear stop-loss and target levels based on FVG and liquidity | Requires patience to identify accurate signals |

Usable across indices, currency pairs, and precious metals | - |

Key Tips for Success in Executing ICT Silver Bullet

To unlock the full potential of this strategy, factors such as risk management, proper timeframe selection, and more must be taken into account.

- Trade only during specified times (one hour per session)

- Use lower timeframes for entries

- Be patient and wait for patterns to complete

- Apply risk management (1:2 or 1:3)

Note: To simplify the identification of Silver Bullet, you can use the indicator developed by the [TFlab] team:

- TradingView version of Silver Bullet indicator

- MetaTrader 4 version of Silver Bullet indicator

- MetaTrader 5 version of Silver Bullet indicator

Conclusion

The ICT Silver Bullet strategy is a powerful tool for scalpers, focusing on liquidity and FVG during specific timeframes.

During the 6rades by following a few specific rules and practicing proper capital management.0-minute intervals, traders can execute t