TheICT Son's Model – 30-Second Setup is based on Draw On Liquidity (DOL) and Liquidity Sweep concepts.

This ICT-based setup leverages precision in lower timeframes, particularly the 30-second Chart, while focusing on the Fair Value Gap (FVG), so that traders can identify optimal entry and exit points for scalping trades.

What is the ICT Son's Model Trading Strategy?

The ICT Son's Model – 30-Second Setup is designed to capitalize on short-term market fluctuations (scalping trades) and liquidity access in lower timeframes.

This strategy integrates three key concepts:

- Draw On Liquidity (DOL)

- Liquidity Sweep

- Fair Value Gap (FVG)

It allows traders to anticipate price movements more accurately, going beyond traditional analysis by focusing on price interaction with liquidity zones to determine entry and exit points based on market structure and liquidity flow.

How to Use the ICT Son's Model Setup in Trading?

The ICT Son's Model setup is executed in four steps. Follow the guide below:

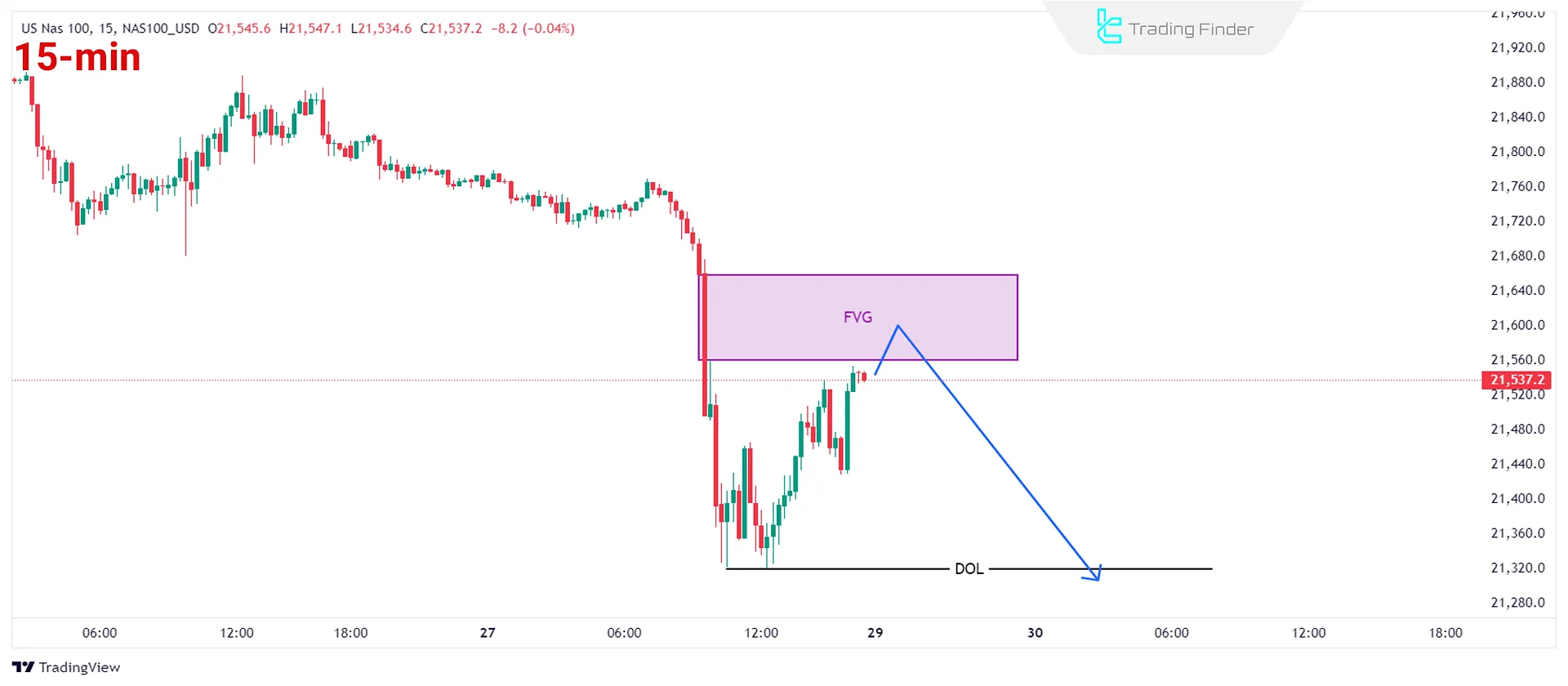

#1 Draw On Liquidity (DOL)

The first step in the ICT Son's Model strategy is identifying Draw-on Liquidity (DOL) in the one-hour or 15-minute timeframe. This step helps determine market direction based on liquidity accumulation.

How to Identify Draw On Liquidity?

- Analyze Swing Highs & Lows: Look for significant swing highs/lows on the Chart.

- Mark Key Levels: Draw horizontal lines at these levels to highlight potential liquidity zones.

- Observe Price Action: Monitorhow price interacts with these levels to assess market sentiment.

#2 Liquidity Sweep

Once liquidity areas are identified, the next step is to detect Liquidity Sweeps on the 5-minute Chart. There are two scenarios:

- Bullish Scenario: If the Draw On Liquidity (DOL) is bullish, wait for a sweep of aswing low followed by a bullish close candle (Up Close Candle) to confirm the bullish reversal.

- Bearish Scenario: If the Draw On Liquidity (DOL) is bearish, wait fora sweep of aswing high followed by a bearish close candle (Down Close Candle) to confirm the bearish reversal.

#3 Thirty-Second Entry Timing

Entry timing is the key strength of the ICT Son's Model – 30-Second Setup. Immediately after confirming the liquidity sweep, switch to the 30-second Chart and identify the Fair Value Gap (FVG).

How to Enter a Trade?

- Identify the Fair Value Gap (FVG): On the 30-second Chart, locate a gap that indicates price imbalance.

- Set Entry Order: Place the entry order within the FVG zone to capitalize on price movement toward draw-on liquidity (DOL).

#4 Risk Management

A trading strategy is incomplete without a solid risk management plan. The ICT Son's Model – 30-Second Setup emphasizes risk control to maximize potential profits.

- Aim for a 1:1 or maximum 1:2 risk-reward ratio.

- Set a 10-12 point stop-loss for NASDAQ and S&P 500

Conclusion

The ICT Son's Model – 30-Second Setup provides a structured framework for leveraging short-term market fluctuations in scalping trades.

This ICT strategy integrates Draw On Liquidity (DOL), Liquidity Sweep, and Fair Value Gap (FVG) while focusing on lower timeframes and precise market structure analysis.