The TGIF (Thank God It's Friday) Setup is an ICT trading pattern that analyzes price movements on Fridays. This setup focuses on price behavior in the final hours of the trading week, helping traders identify potential trading opportunities.

The core logic of this setup is based on price returning to the weekly range after forming the weekly high or low. TGIF, by combining concepts such as liquidity, market structure shift, and Fibonacci levels, enables precise entries with controlled risk at the end of the week.

What is the TGIF Trading Setup?

The TGIF (Thank God It's Friday) trading strategy is a daily algorithmic pattern that appears exclusively on Fridays. In trending markets, the price often returns to the weekly range after forming the weekly high (Highest) or weekly low (Lowest).

The ICT TGIF setup allows traders to identify Friday's price reversal and take advantage of it in their trades.

Tutorial on how to use TGIF from the website Writo Finance:

Advantages and Disadvantages of the TGIF Setup

Analyzing the advantages and disadvantages of the TGIF setup is essential for evaluating the real executability of this pattern.

This setup is highly dependent on timing, weekly structure, and market liquidity behavior, and it delivers optimal performance only under specific conditions. Table of advantages and disadvantages of TGIF:

Advantages of the TGIF Setup | Disadvantages of the TGIF Setup |

Based on repetitive market behavior at the end of the week and liquidity exit | Usable only on Fridays with limited trading opportunities |

Clear timing during the New York session and reduced emotional trading | Strong dependence on the range and direction of the weekly move |

Aligned with key ICT concepts such as MSS, CISD, FVG, and Liquidity | Ineffective in low-volatility or ranging markets |

Clear price targets with predefined Fibonacci levels | High sensitivity to entry and exit timing |

Possibility of achieving a reasonable risk-to-reward when executed correctly | Requires experience and deep understanding of market structure |

Strong time filter and reduction of overtrading | Increased volatility and spread widening during the final hours of the week |

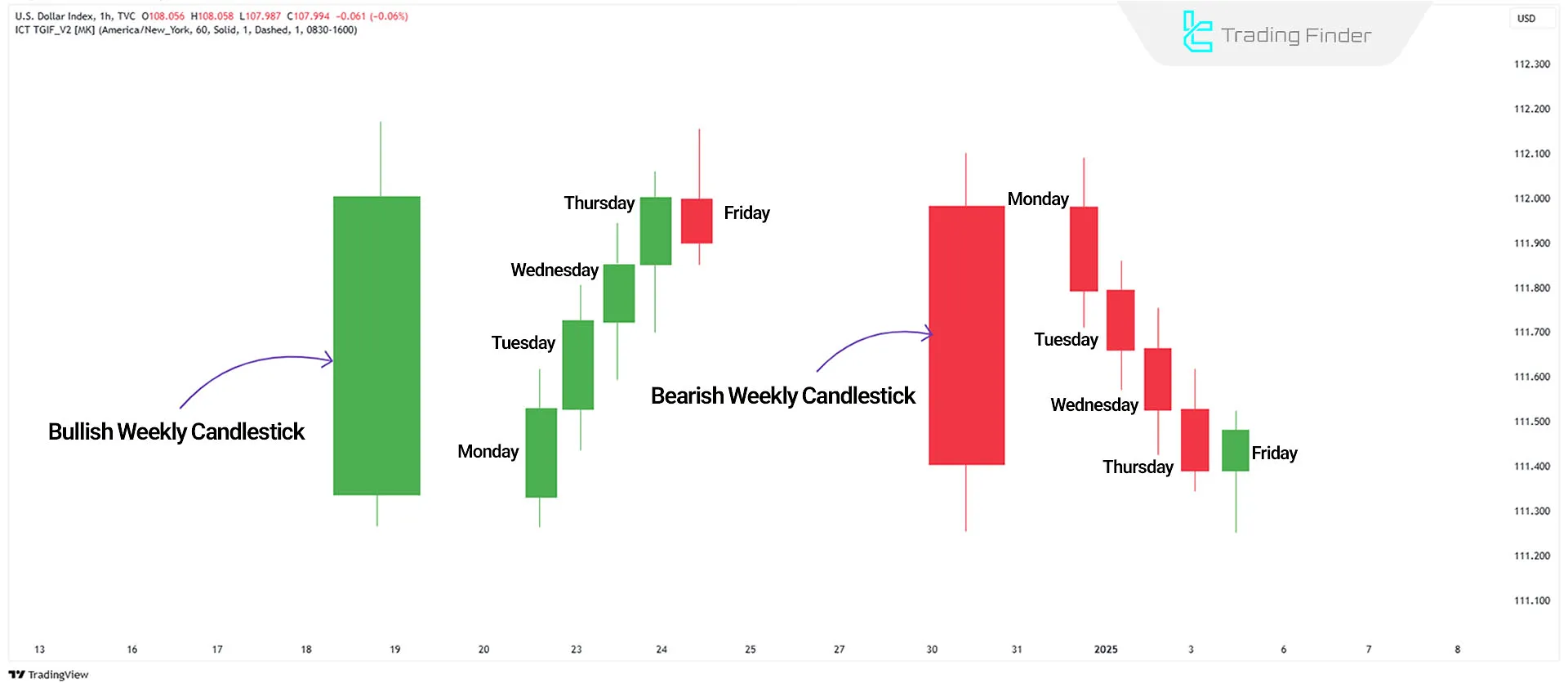

How Does the TGIF Setup Form?

The ICT TGIF Setup is based on repeating price patterns throughout the trading week. This strategy focuses on price returning to the weekly range during the final hours of the week.

Typically, after a week of volatility, the market tends to retrace back to the weekly range, creating favorable trading opportunities.

Steps to Use the ICT TGIF Setup

The steps for executing the TGIF setup are designed based on a specific sequence of price events at the end of the week, and each step plays an independent role in the validity of the trade.

Ignoring this sequence turns the setup from a structured pattern into a random directional decision.

Educational TGIF video from the Solomon King YouTube channel:

Below, the stages of identifying, confirming, and executing TGIF are explained step by step, based on ICT-style price action logic.

Steps for using TGIF:

#1 Identify the Weekly High or Low

On Friday, the market tends to form a weekly high or low. These levels are typically established between morning and afternoon sessions (New York Times).

This move is often accompanied by liquidity collection above previous highs or below previous lows and plays a key role in activating the TGIF setup. Accurate identification of these zones must be based on the higher-timeframe structure.

Additionally, confluence of these areas with key liquidity levels or higher-timeframe Order Blocks can significantly increase the validity of the weekly high or low for executing the TGIF setup.

#2 Wait for a Market Structure Shift (MSS)

After forming the weekly high or low, traders should wait for a Market Structure Shift (MSS) or a Change in State of Delivery (CISD). These events confirm the price reversal towards the weekly range.

This structural shift is usually accompanied by a break of the last internal high or low and the creation of a meaningful price displacement.

At this stage, observing strong displacement along with increased trading volume can confirm that the structural change is real and that the market is ready to enter a new impulsive phase.

#3 Enter the Trade at Optimal Levels

Once the market structure shift is confirmed, traders can enter trades at optimal points, such as Fair Value Gaps (FVGs)or Order Blocks (OBs).

This change is usually accompanied by clear displacement and candle closes in the opposite direction of the previous move, which increases the validity of the setup.

Without observing this structural change, any entry is merely a guess of market direction and does not align with the TGIF logic.

Additionally, confluence of these entry zones with absorbed liquidity at the weekly high or low and confirmation on the lower timeframe (LTF) can reduce entry risk and increase the probability of success of the TGIF setup.

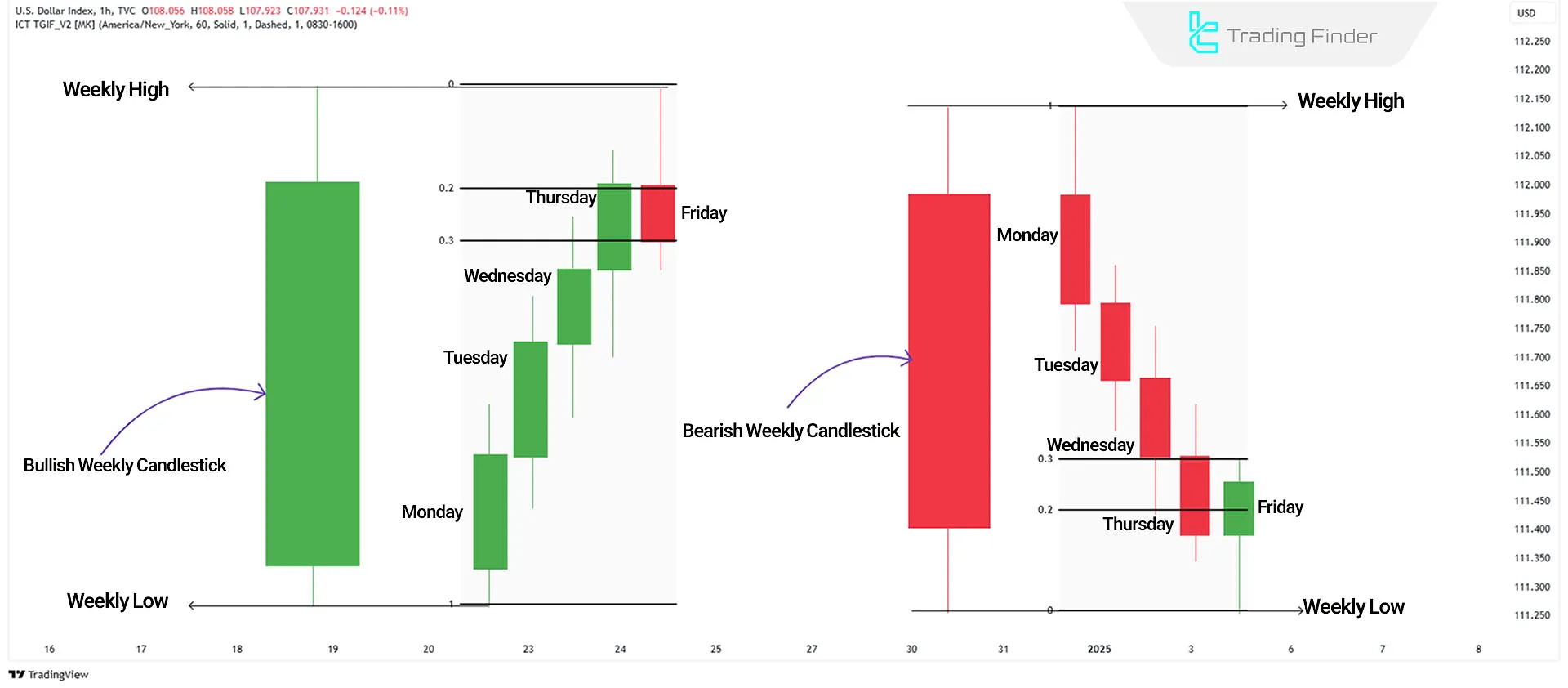

#4 Set Price Targets Using Fibonacci Levels

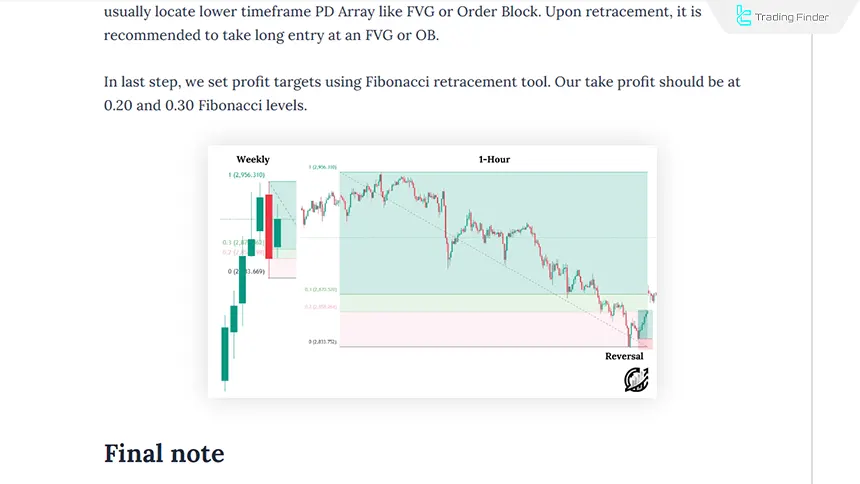

Using the Fibonacci retracement tool, traders can determine price correction targets.

By setting Fibonacci from the weekly low to the weekly high (for a bullish week) or from the weekly high to the weekly low (for a bearish week), the 0.20 and 0.30 levels can be used as profit targets. Fibonacci Settings for the TGIF Setup:

Start | 1 |

End | 0 |

First Profit Target | 0.20 |

Second Profit Target | 0.30 |

The method for setting price targets using the Fibonacci tool is illustrated in the image below:

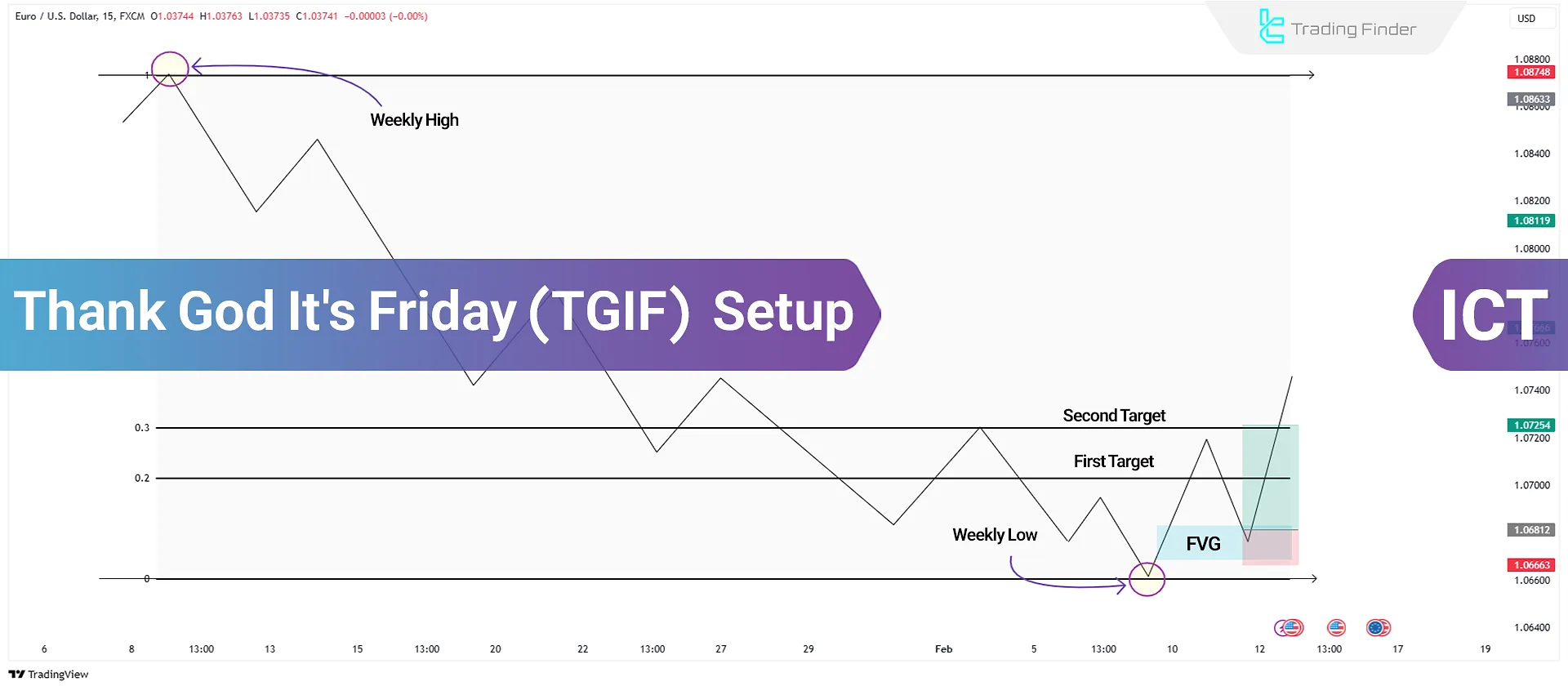

Example of a Trade Using a Bullish TGIF Setup

In the EUR/USD 5-minute chart, the price continues to decline until it reaches a key level in a higher timeframe.

After a Change in the State of Delivery (CISD) and the formation of an Order Block (OB) or Fair Value Gap (FVG), traders can enter buy (long) trades targeting the 0.2 and 0.3 Fibonacci levels.

Example of a Trade Using a Bearish TGIF Setup

In the USD/JPY chart, the price initially moves upward before reversing downward towards a significant level in a higher timeframe.

After identifying a Market Structure Shift (MSS) and forming an Order Block (OB) or Fair Value Gap (FVG), traders can enter sell (short) trades targeting the 0.2 and 0.3 Fibonacci levels.

Common Mistakes in Using TGIF

In executing the TGIF setup, a significant portion of errors relates to how the trade is executed. Ignoring liquidity logic, weekly market conditions, and price structure causes this setup to lose its real performance. Types of common mistakes in using TGIF:

Entering a Trade Before Liquidity Collection (Liquidity Grab)

One of the structural mistakes in executing the TGIF setup is entering a trade too early, before liquidity is cleared. On Fridays, the market usually first collects liquidity above highs or below short-term lows, and then the phase of returning to the weekly range begins.

Entering before this move places the trader directly in the path of a stop hunt. In such conditions, even if the directional analysis is correct, poor entry timing leads to stop-loss activation.

In the TGIF setup, taking liquidity is considered the primary prerequisite for the formation of a valid reversal.

Using the TGIF Setup in Low Volatility or Directionless Weekly Markets

The TGIF setup is inherently designed based on the weekly range and the market’s tendency to return to it. In weeks where the market has a limited range or price movement lacks meaningful displacement, no tradable reversal is formed.

Executing this setup under such conditions causes the 0.20 and 0.30 Fibonacci targets to fail to activate properly, or price to enter a neutral phase before reaching them.

Conditions in which TGIF is applicable include:

- The weekly range has clearly expanded;

- One side of the market holds significant liquidity;

- The weekly move has a one-sided or imbalanced nature.

Setting a Stop Loss that is Not Aligned with the Price Structure

In the TGIF setup, the stop-loss must be set based on the real market structure. Placing the stop-loss inside liquidity zones or too close to the FVG exposes the trader to normal end-of-week volatility.

Proper stop-loss placement in TGIF includes:

- Behind the last valid taken high or low;

- Or behind the Liquidity Grab zone;

- Or above or below a confirmed order block.

Placing the stop-loss too tightly may make the risk-to-reward ratio theoretically attractive, but in real execution it significantly increases the error rate.

Key Considerations for Using the TGIF Setup

The TGIF setup is formed based on liquidity behavior and market structure at the end of the trading week. Correct understanding of the temporal, structural, and behavioral logic of this setup is the main requirement for using it accurately and with low risk in Friday trades.

Following these key points can increase accuracy and reduce errors when using the TGIF Setup:

Pay Attention to Timing

The setup is most effective during the final hours of Friday (between 1:30 PM – 2:00 PM New York Time). During this period, the market often returns to the weekly price range.

During these hours, the closing of weekly positions and the reduced willingness to hold open trades lead to a change in order flow behavior.

This change is often accompanied by increased short-term volatility and the activation of remaining liquidity, which provides a suitable environment for the formation of structural reversals.

Analyze Price Behavior

Observing repetitive price patterns helps identify a return to the weekly average. For instance, if the price reaches a major support or resistance level during the week, it may retrace back to the weekly mean on Friday.

This behavior usually forms after price fails to be accepted at extreme levels and shows weakness in trend continuation. The confluence of this pattern with liquidity collection and a market structure shift significantly increases the validity of the reversal scenario.

Use Technical Confirmations

Applyingother ICT concepts helps confirm price reversals. For example, after a weekly high or low forms in the New York session on Friday, a Market Structure Shift (MSS) and the formation of an FVG in the opposite direction serve as confirmations for a return to the weekly range.

Combining these confirmations with liquidity collection and valid displacement increases the probability of success of the reversal scenario and prevents impulsive entries.

Market Conditions

The TGIF setup works best in markets with high liquidity and significant volatility throughout the week, such as Forex and Stock Indices.

The presence of deep order flow and an expanded weekly range causes the price return to the weekly range to form in a structural and tradable manner.

Automatic Fibonacci Indicator in TGIF

The automatic Fibonacci indicator (Auto Fibo) is an analytical tool based on key Fibonacci ratios such as 23.6%, 38.2%, 50%, 61.8%, and 76.4%, which is used to identify price retracement zones.

These ratios, which are rooted in the Fibonacci sequence, play an important role in the TGIF setup in defining the price retracement range back into the weekly range and are considered the basis for corrective target setting at the end of the week.

Within the TGIF framework, accuracy in determining the weekly high and low is of high importance, because the entire logic of the price retracement is defined based on this range.

The automatic Fibonacci indicator, by algorithmically identifying valid swing highs and lows, removes subjectivity from the Fibonacci drawing process.

This feature helps traders quickly and accurately view retracement levels related to the weekly range on the chart without errors caused by personal interpretation.

Educational videos on using the automatic Fibonacci indicator:

This indicator falls into the category of level-based tools, support and resistance, and reversal indicators, and is suitable for traders who seek to execute structured setups such as TGIF.

Its multi timeframe capability allows simultaneous analysis of weekly structure and precise execution of entries on lower timeframes, which aligns with the multi-dimensional logic of the ICT style.

In a TGIF-aligned scenario, when the market forms a weekly high or low on Friday and enters a retracement phase, the Fibonacci levels plotted by Auto Fibo can act as corrective target zones.

These levels help traders identify logical areas for price continuation back into the weekly range without relying on speculative target setting. From a TGIF trade management perspective, using automatic Fibonacci levels enables structured definition of stop-loss and take-profit levels.

The stop-loss can be placed beyond the weekly extreme or liquidity zones, and price targets can be determined based on retracement levels.

Overall, the automatic Fibonacci indicator increases accuracy in defining weekly ranges and targets, making the execution of the TGIF setup more organized, faster, and more aligned with ICT’s algorithmic logic.

Download links for the automatic Fibonacci indicator:

Conclusion

The TGIF Setup (Thank God It's Friday) in ICT trading style is a powerful strategy for identifying price reversals and entering trades on Fridays. By focusing on weekly highs and lows, traders can capitalize on potential retracements at the end of the trading week.

Using tools like Fibonacci retracements, Fair Value Gaps (FVGs), and Order Blocks (OBs) helps define precise price targets and improve trade execution.

The success of this setup depends on strict adherence to the sequence of events, correct timing, and structure-based risk management. Executing TGIF without liquidity confirmations and structural shifts eliminates its algorithmic nature.