- TradingFinder

- Education

- Forex Education

- ICT (Inner Circle Trader) Education

ICT (Inner Circle Trader) Education

The ICT (Inner Circle Trader) trading style is an advanced approach to price action, focusing on analyzing the behavior of major financial institutions and the role of market makers. In the ICT method, traders aim to identify optimal entry and exit points by analyzing market structure, Break of Structure (BOS), Order Blocks, Liquidity, and Fair Value Gaps (FVG). Trading Finder offers the best ICT-style educational content across four different levels, tailored to the needs of beginner to advanced traders. These courses cover concepts such as the Market Maker Model, Power of Three, and Smart Money Techniques, providing efficient methods for traders.

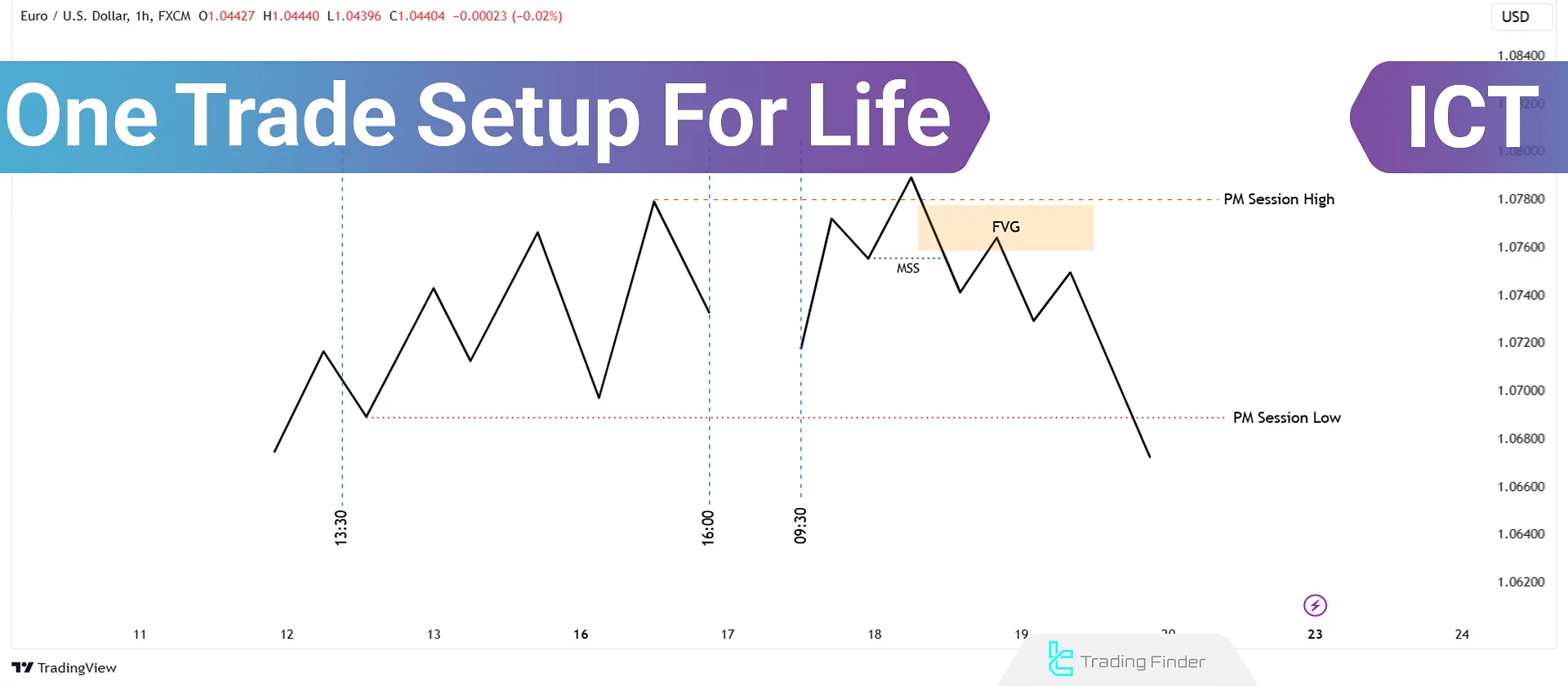

ICT One Trade Setup For Life - High-Probability Trading Strategy

The ICT One Trade Setup For Life is a trading method designed based on market analysis and liquidity identification. This model...

ICT Asian Range Strategy – Master Asian Session High & Low Trading Model

According to the ICT style perspective, the Asian range is a low-volatility zone where the market accumulates liquidity so that in...

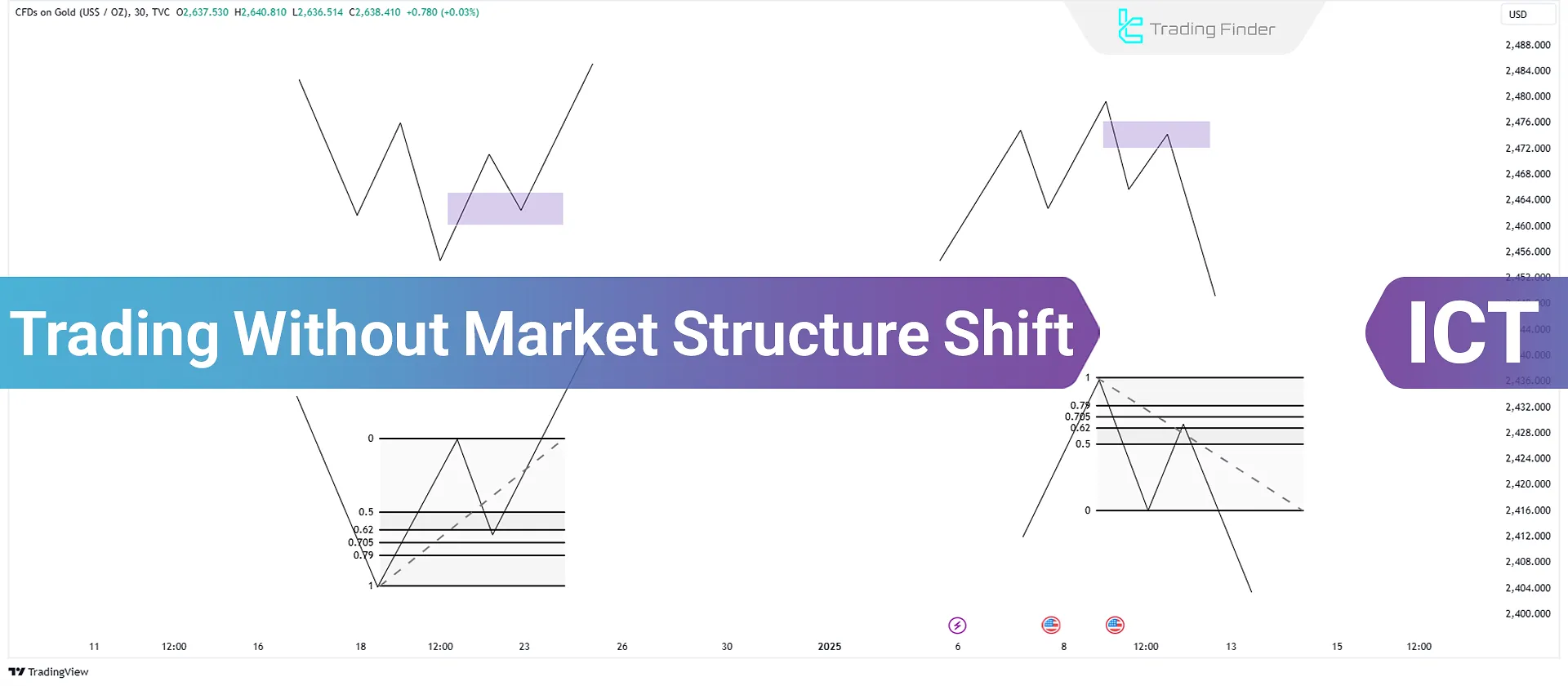

Trading Without Market Structure Shift; Importance of Trading Without MSS & MSB

With "Trading Without Market Structure Shift" strategy in the ICT style, traders can execute trades without waiting for a Market...

No Displacement Model in ICT Trading [Uptrend & Downtrend]

No Displacement in the ICT trading model and Smart Mony refers to a scenario where the price breaks a key level (such as a...

Stop Hunting Training - Triggering Stop Losses of Retail Traders - ICT

Stop hunting is a process in which the market is designed to trigger the stop losses of retail traders, with these movements...

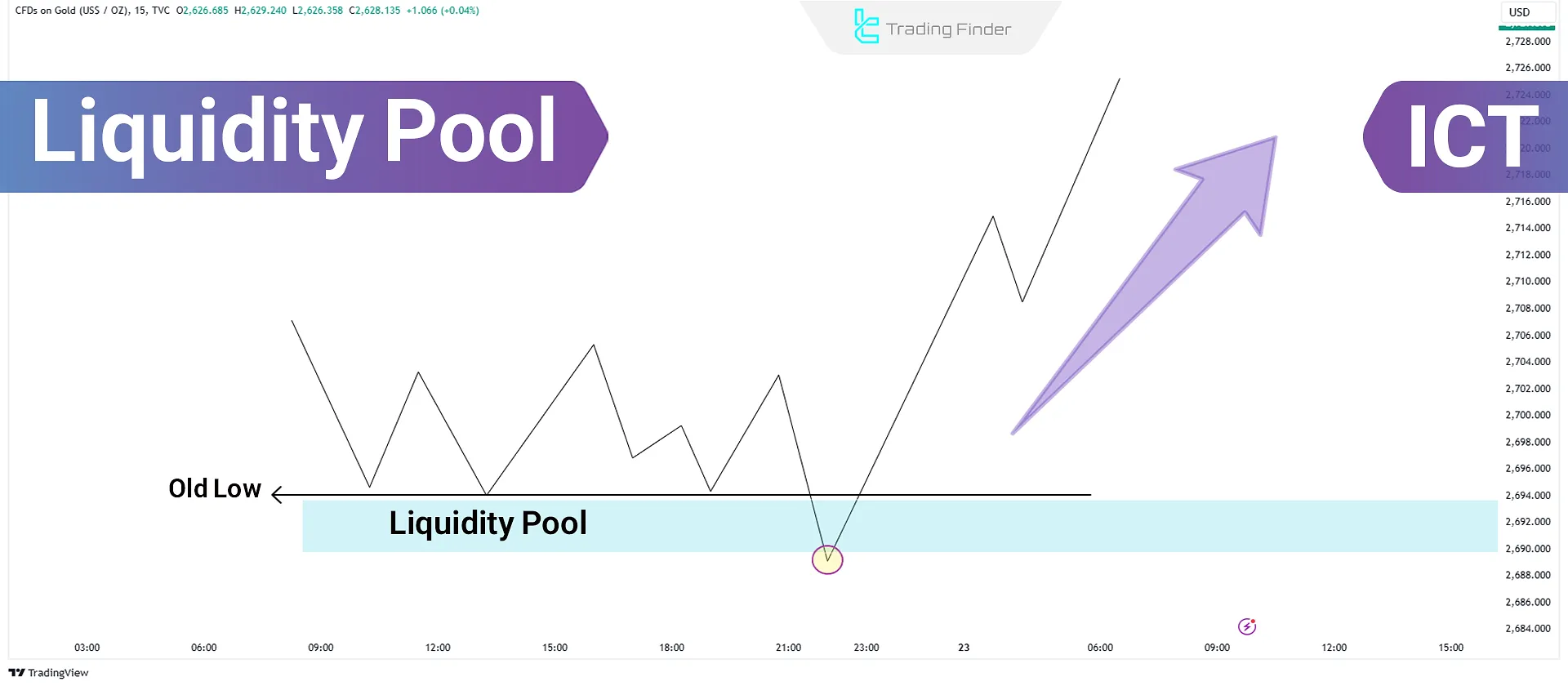

Liquidity Pool Trading Model in ICT Style

A Liquidity Pool refers to key zones where pending buy orders (Buy Stops) or sell orders (Sell Stops) accumulate. These orders...

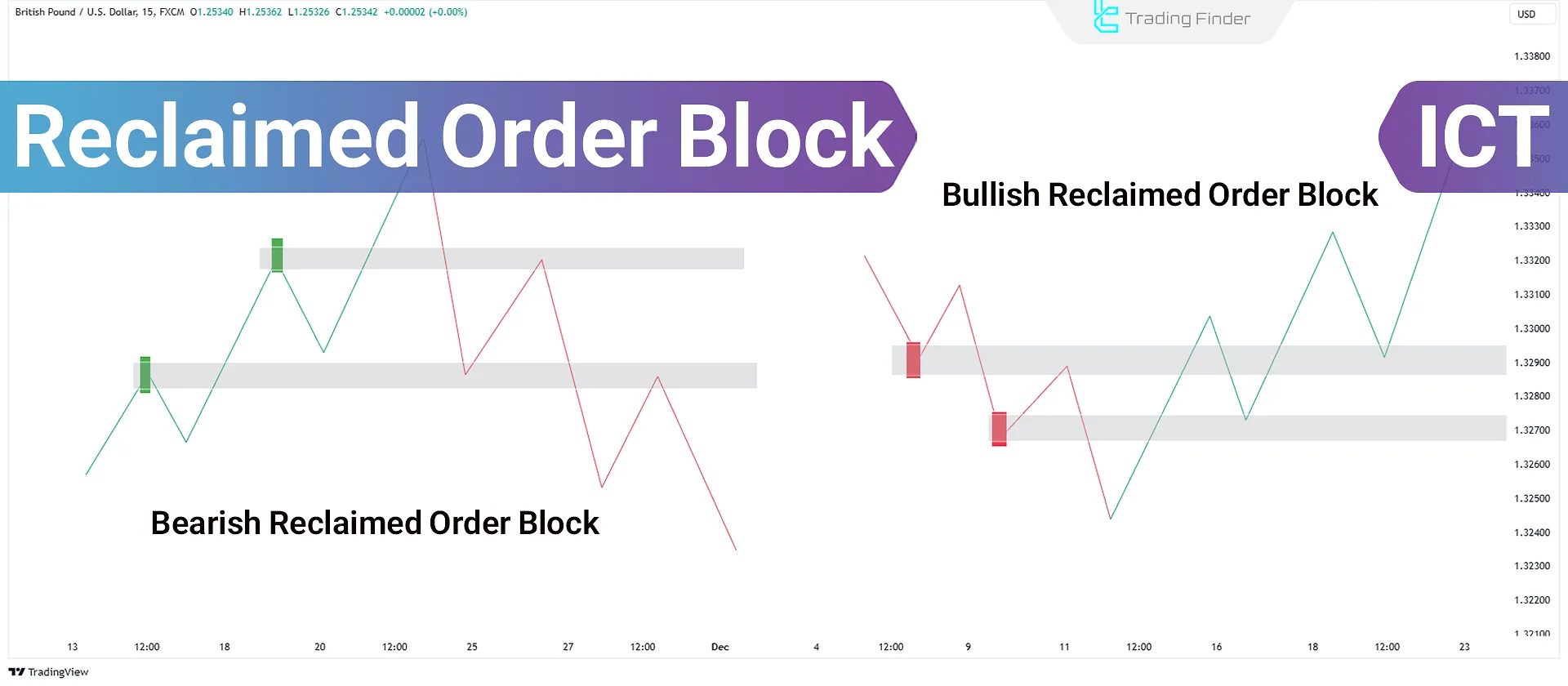

Reclaimed Order Block; Reclaimed Order Block vs Regular Order Block

A Reclaimed Order Block in the ICT trading style initially functions as an Order Block but guides the subsequent price movement...

Learn Seek & Destroy (S&D) Profile in ICT Trading

The Seek & Destroy (S&D) profile is a common daily market behavior in the ICT trading strategy, often observed on days...

Market Structure Trading in Bullish, Bearish, and Ranging Trends - ICT & SMC

Market Structure is a tool for analyzing price behavior and identifying movement trends in Forex Market and cryptocurrency markets....

Forex Liquidity Explained: Definition, Importance & Key Concepts

Liquidity in forex refers to stop loss activation zones triggered by market algorithms and Smart Money. These areas often...

All Time High (ATH) and All Time Low (ATL); Importance of Using Highs and Lows

In forex markets, identifying key price movement levels is one of the most important tools for analyzing asset behavior. Two...

New York Reversal Strategy in ICT Daily Profiles [London & New York AM Sessions]

The New York Reversal Strategy in daily profiles is a core concept in ICT trading style, used by professional traders to identify...

![No Displacement Model in ICT Trading [Uptrend & Downtrend]](https://cdn.tradingfinder.com/image/257229/7-33-en-no-displacement-01.webp)

![New York Reversal Strategy in ICT Daily Profiles [London & New York AM Sessions]](https://cdn.tradingfinder.com/image/241316/7-36-en-ict-daily-profile-new-york-reversal-01.webp)