Inducement or Deception (IMD) refers to conditions where smart money and large market players manipulate the market to lure retail traders in the opposite direction.

The manipulation creates a false impression of price movements, leading traders to enter against the future trend, ultimately resulting in losses.

Inducement refers to areas where liquidity from retail stop-loss orders is hunted. One such area forms after a Break of Structure (BOS), mainly if no price pullback occurs before the break. The targeted area is known as the Liquidity Inducement Zone in such cases.

What is Liquidity Inducement After Break of Structure (BOS)?

A Break of Structure (BOS) occurs when price breaks key levels. Sometimes, after this break, the price continues its movement without a pullback or collecting the initial inducement liquidity.

In such scenarios, if a trader waits for the initial inducement liquidity to be collected, they may miss the trading opportunity. Therefore, it is better to wait for the price to create a new inducement liquidity and then collect it.

After this stage, suitable trading opportunities can be sought. During this process, structural highs and lows are also confirmed.

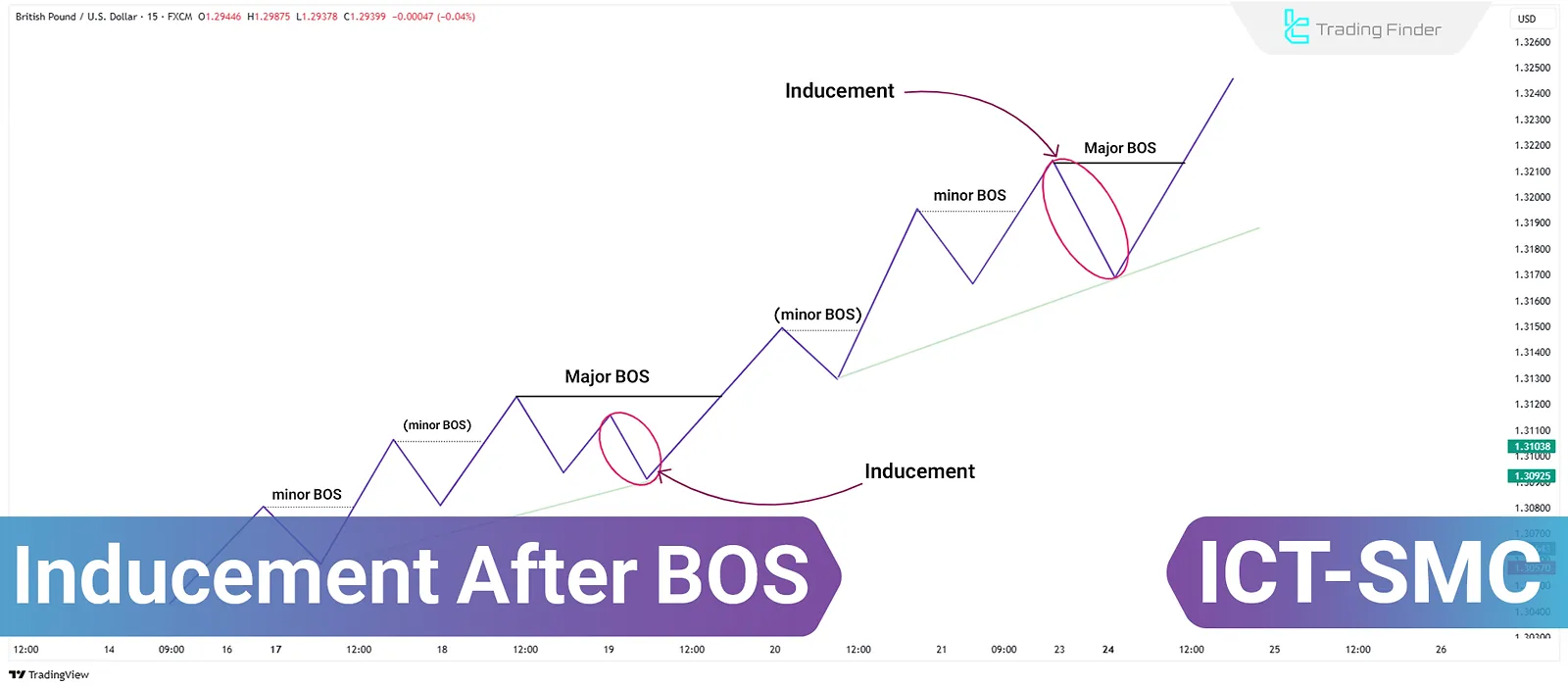

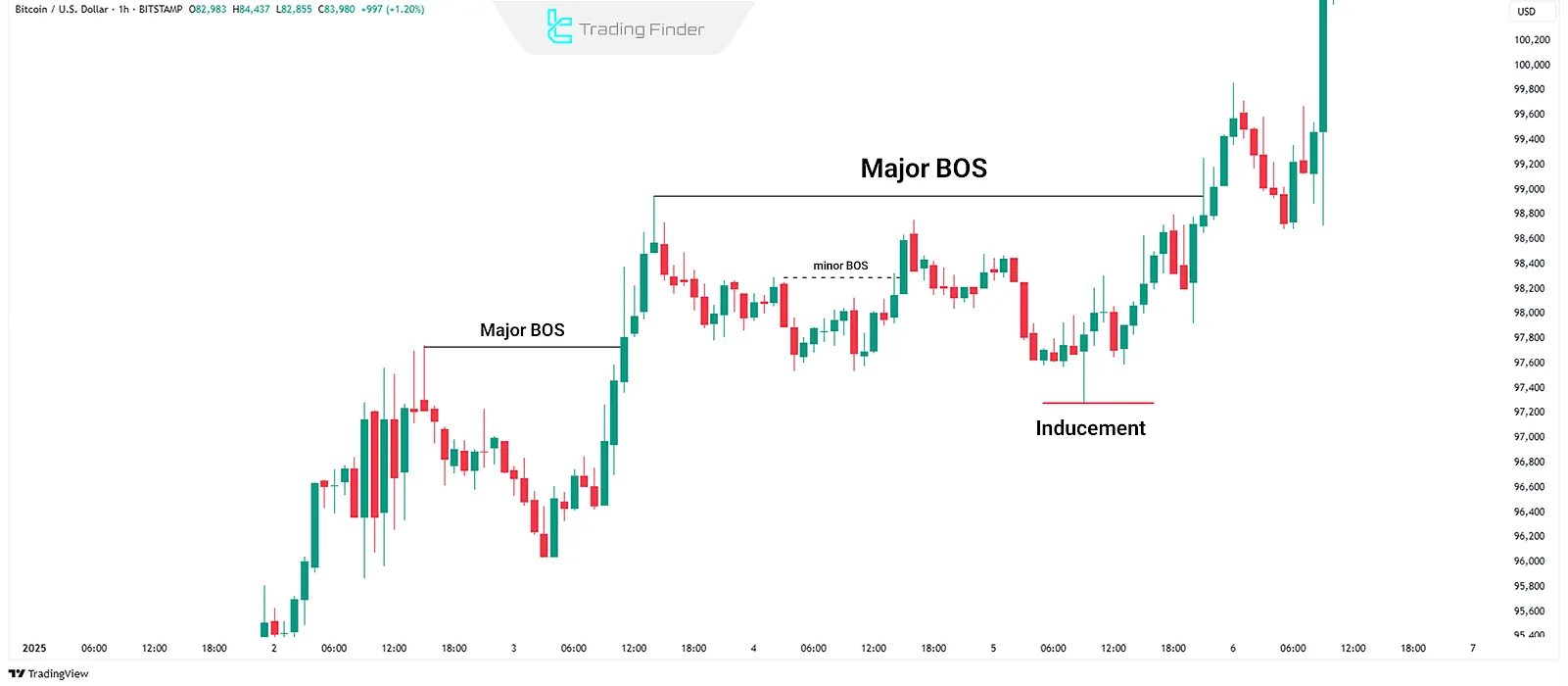

Liquidity Inducement After BOS in a Bullish Market

In a bullish market, new liquidity inducement after a Break of Structure (BOS) refers to an area where the price continues its upward movement without an initial pullback.

To identify liquidity inducement after a Break of Structure (BOS) in a bullish market, follow these steps:

#1 Bullish Market Structure

In a bullish market, the price typically creates higher highs and higher lows. When the price breaks the previous high, it is called a Break of Structure (BOS).

A valid pullback before this break is considered an Inducement Zone.

#2 Price Failing to Collect Inducement in a Bullish Trend

If the price continues its upward movement without collecting the initial inducement liquidity, wait for a Minor Break of Structure (Minor BOS) to identify a new inducement zone.

#3 Identifying Bullish Inducement

- During a minor BOS, the lowest low and highest high in the bullish leg are identified;

- Then, a valid pullback within this bullish leg is found, which will act as the Inducement Level.

Note: The [TFlab] team has developed Inducement indicators for various platforms, including:

#4 Application in Bullish Movements

New inducements can be found at each stage of the price's upward movement, even if the previous inducement liquidity has not been collected.

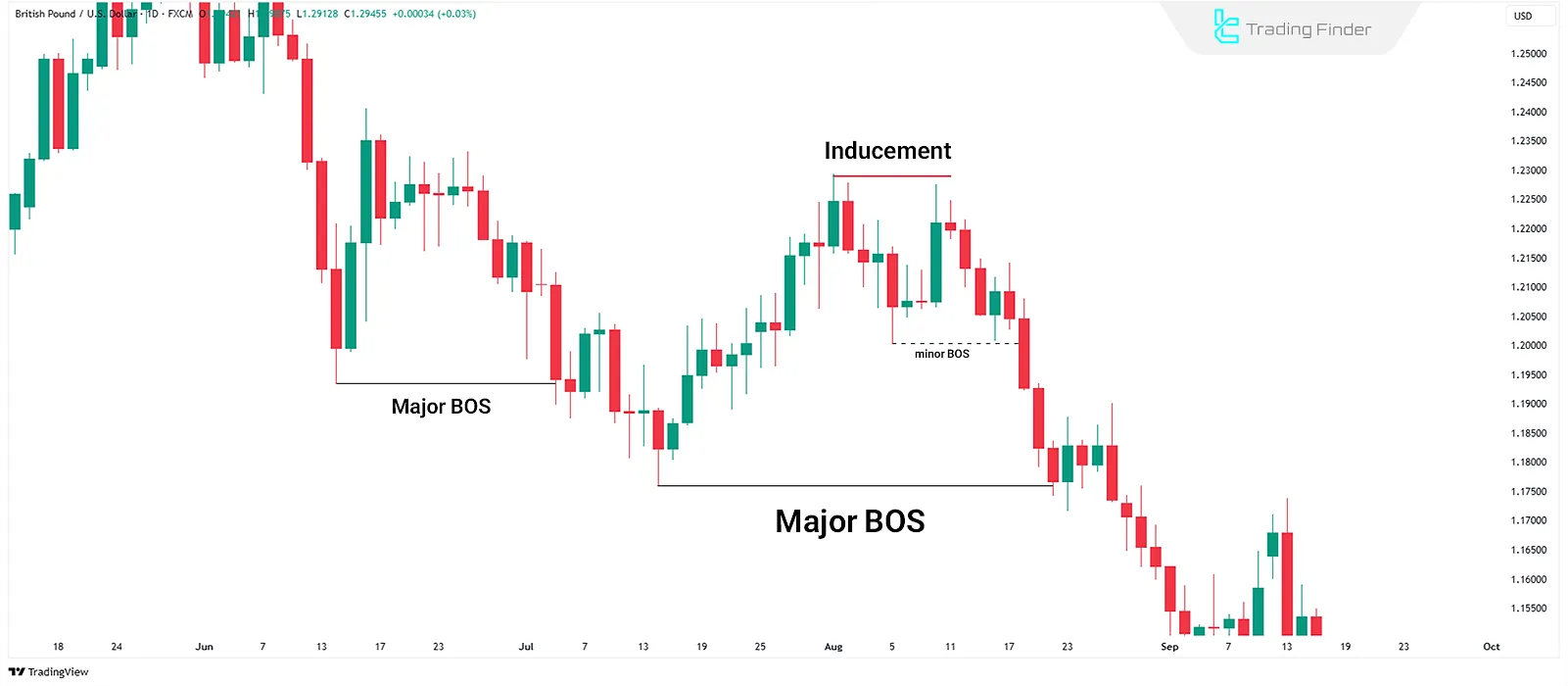

Liquidity Inducement After BOS in a Bearish Market

In a bearish market, new liquidity inducement after a Break of Structure (BOS) refers to an area where the price continues downward without an initial pullback.

To identify liquidity inducement after a Break of Structure (BOS) in a bearish market, follow these steps:

#1 Bearish Market Structure

In a bearish trend, the market typically forms lower highs and lower lows. When the price breaks the previous low, it is called a Break of Structure (BOS). A valid pullback before this break is considered an Inducement Zone.

#2 Price Failing to Collect Inducement in a Bearish Trend

If the price continues downward without collecting the initial inducement liquidity, wait for a Minor Break of Structure (Minor BOS) to identify a new inducement zone.

#3 Identifying Bearish Inducement

- During a minor BOS, the highest high and lowest low in the bearish leg are identified;

- Then, a valid pullback within this bearish leg is found, which will act as the Inducement Level.

#4 Application in Bearish Movements

At each stage of the price's downward movement, new inducements can be found, even if the previous inducement liquidity has not been collected.

Conclusion

Liquidity Inducement after a Break of Structure (BOS) is a key concept in ICT style and Smart Money, used by traders to identify entry and exit points.

Smart Money misleads retail traders to trigger stop orders and create liquidity, ensuring the market follows its main trend. This is reinforced by false breakouts and Judas Swings.