The Martingale strategy in binary options is based on doubling the investment size after each loss so that, on the first winning trade, all previous losses are recovered and the account enters net profit.

This strategy has a simple structure and a fixed-return nature, which significantly increases the risk of applying Martingale. In the event of repeated consecutive losses, the trade size grows rapidly, and only traders with sufficient financial backing can continue this process.

What is Martingale in Binary Options?

The Martingale strategy in binary options is a capital management method that focuses on the principle of doubling the trade size after each loss.

The goal of this approach is to recover all previous losses and achieve net profit on the first winning trade.

Example of Using the Martingale Strategy in Binary Options

For example, if a trader invests $10 and the outcome is a loss, they will enter $20 in the next trade.

If another loss occurs, the trade size increases to $40, and this process continues. As soon as a trade closes with a profit, all previous losses are covered, and the account returns to positive territory.

Educational video on the Martingale method in binary options from the YouTube channel Emma Mindfully Trader:

The difference between applying Martingale in binary options and in other fields lies in the market structure. Binary options have only two outcomes: full win or full loss. With the heightened risk of Martingale in binary options, the likelihood of multiple consecutive losses is high.

Therefore, applying this strategy requires significant financial backing and the ability to withstand the psychological pressure of continuously increasing trade sizes. Comparison Table of Applying Martingale in Binary Options vs. Other Fields:

Comparison Criteria | Martingale in Binary Options | Martingale in Other Fields (Forex, Spot, and Stocks) |

Type of Trade | Binary (Win/Loss) trades with fixed payout (e.g., 70–90%) | Flexible trades (Spot Forex) |

Winning trade return | Limited (less than 100% ROI per trade) | Unlimited depending on price movement |

Loss Risk | Entire trade amount lost in case of failure | Losses limited by oss or margin in Forex/stocks |

Risk Management Capability | Almost limited | Risk managed with position sizing, stop-loss in Martingale, hedging |

Market Nature | More like betting; outcome tied to a single candle or short timeframe | Live market with long-term or technical/fundamental analysis |

Strategy Sustainability | Very low, due to poor risk-to-reward ratio | More sustainable |

Usage Purpose | Typically for “quick recovery of losses” in binary options | Attempt to recover losses or achieve rapid gains (high-risk) |

Steps for Implementing Martingale in Binary Options

Implementing Martingale in binary options requires following specific steps so that the logic of step-by-step increasing trade sizes is properly applied.

Having sufficient capital, choosing the right initial trade size, and adhering to discipline in doubling losing trades are the foundations of this method. Main steps for applying Martingale in binary options:

#1 Determine Initial Capital in Broker Account

To begin, the account balance must be large enough to withstand several consecutive trade size increases. It is usually recommended to keep several multiples of the initial trade size as backup in the account.

#2 Choose the Initial Trade Size

In the Martingale strategy, the initial trade size is crucial, since all subsequent calculations are based on this number.

If a trader risks a large portion of their capital at the start, a streak of consecutive losses will cause trade sizes to grow rapidly and exponentially, soon reaching unsustainable levels. Therefore, it is usually advised to allocate 1–3% of total account balance as the first trade.

#3 Calculate Return and Apply Doubling

After each loss, the size of the next trade is set at exactly double the previous one. If the trade succeeds, the generated profit covers all previous losses, and the balance returns to positive territory. Once a winning trade occurs, the trade size resets back to the initial level.

Suitable Brokers for Applying Martingale in Binary Options

Choosing the right broker plays a crucial role in the success of the Martingale strategy. Since this method requires executing consecutive trades with progressively increasing volumes, the trader must have access to a platform that offers high payouts, fast order execution, and risk management tools.

Three well-known brokers for applying Martingale in binary options:

Quotex Broker (Quotex)

Quotex is a modern platform where payouts on some assets reach up to 100%. It also provides initial deposit bonuses, allowing traders to test part of their capital without direct risk. This feature makes Martingale easier to apply in the early stages.

IQ Option Broker (IQ Option)

IQ Option is recognized as one of the world’s most popular brokers. In addition to a wide variety of assets, it offers multiple analytical tools such as indicators and a dedicated Martingale calculator.

Maximum payouts reach up to 95%, which is sufficient for implementing step-based strategies.

Pocket Option

Pocket Option attracts many Martingale traders due to its attractive bonuses (e.g., 50% bonus for deposits over $50).

Asset payouts reach up to 92%, and supportive tools for trend prediction are available. High-speed trade execution ensures that trade size increases are carried out without delay.

Advantages and Disadvantages of Martingale binary

The Martingale strategy attracts many traders due to its simplicity of application and its strong ability to quickly recover losses. However, while it can create opportunities, it also carries heavy risks. Table of advantages and disadvantages of Martingale in binary options:

Advantages | Disadvantages |

Ability to recover previous losses by doubling trade size | Requires large capital to withstand multiple consecutive losses |

High profitability if a winning trade occurs, bringing account back to net profit | Very high risk in prolonged negative streaks |

Simple to apply without the need for complex calculations | No guarantee of profit due to unpredictable market volatility |

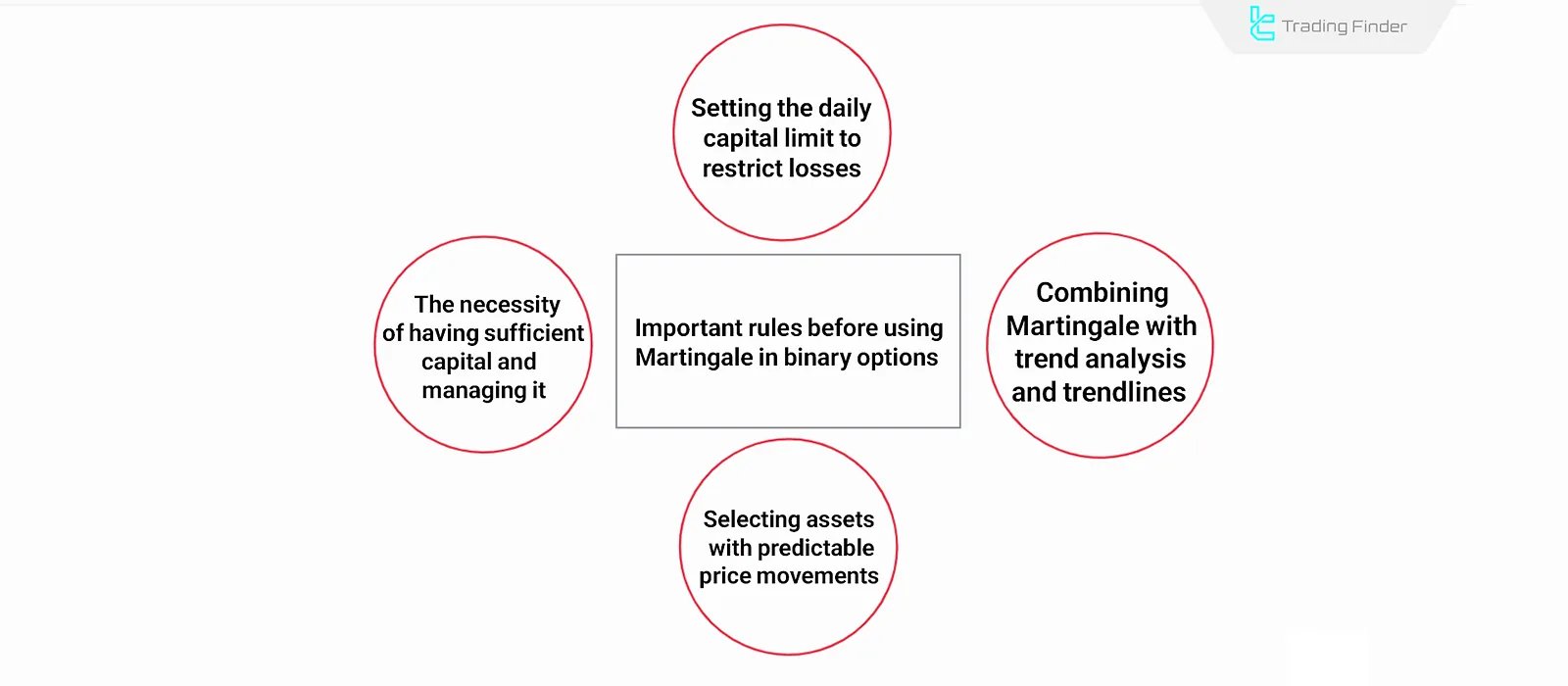

Important Considerations Before Using the Martingale Strategy in Binary Options

Applying the Martingale strategy without paying attention to key points can quickly lead to irrecoverable losses. Before deciding to use this method, the trader must adhere to several essential principles. Rules before using Martingale in binary options.

Having Sufficient Capital and Managing It

This strategy, due to its step-by-step increase in trade size, requires substantial financial backing. Without sufficient capital, a streak of consecutive losses will quickly drain the account. Proper capital management and setting a global stop-loss are essential for long-term sustainability.

Risk-to-Reward Indicator for Capital Management

The Risk-to-Reward Ratio Calculator indicator is a specialized tool for money management and risk in Martingale, which simplifies and makes precise the process of setting take-profit in Martingale and stop-loss levels.

This feature allows traders to calculate the risk-to-reward ratio before entering a trade and visually see entry points, stop-loss, and profit targets on the chart.

The structure of this tool includes a management panel and a movable box on the chart, enabling full control over trading levels. The user can set stop-loss and take-profit either by moving lines directly on the chart or by entering pip values manually.

Additionally, features such as displaying the time remaining until the current candle closes, multi-level take-profit setting, and changing the panel display mode are among its key functions.

Educational video on using the Risk-to-Reward indicator:

YouTube:

One of the most important features of this indicator is its flexibility across different trading styles.

Whether in short-term trades like scalping or in long-term strategies such as swing or day trading, the tool is usable. Moreover, since it supports diverse markets including Forex, stocks, indices, commodities, and cryptocurrencies, traders can benefit from it in any market.

From a capital management perspective, this indicator plays a vital role in reducing human errors. Instead of manual calculations, all values are automatically displayed on the chart, and the trader only needs to adjust inputs according to their trading strategy.

Other features include dark/light mode, quick profit removal of elements, and customizable display of take-profit levels in Martingale (percentage-based or step-based).

Overall, the Risk-to-Reward indicator is a practical tool for traders who seek discipline, precision, and adherence to capital management principles, enabling them to make trading decisions in a more structured manner.

Link to use the Risk-to-Reward indicator:

- Risk-to-Reward indicator in MetaTrader 4

- Risk-to-Reward indicator in MetaTrader 5

- Risk-to-Reward indicator in TradingView

Choosing Assets with Predictable Price Movements

Applying Martingale on assets with extreme volatility or unpredictable behavior multiplies the risk. Selecting financial instruments with clearer trends and defined price patterns increases the chances of success.

Combining Martingale with Trend and Trendline Analysis

Randomly applying Martingale almost always leads to failure. Using technical analysis, identifying trends, and recognizing support and resistance levels allow for more precise entry points and increase the probability of success.

Setting a Daily Capital Limit to Restrict Losses

One of the most important principles is defining the maximum amount that can be risked in a single day. This limit prevents losing the entire account due to several consecutive losses and avoids emotional decision-making during the trading session.

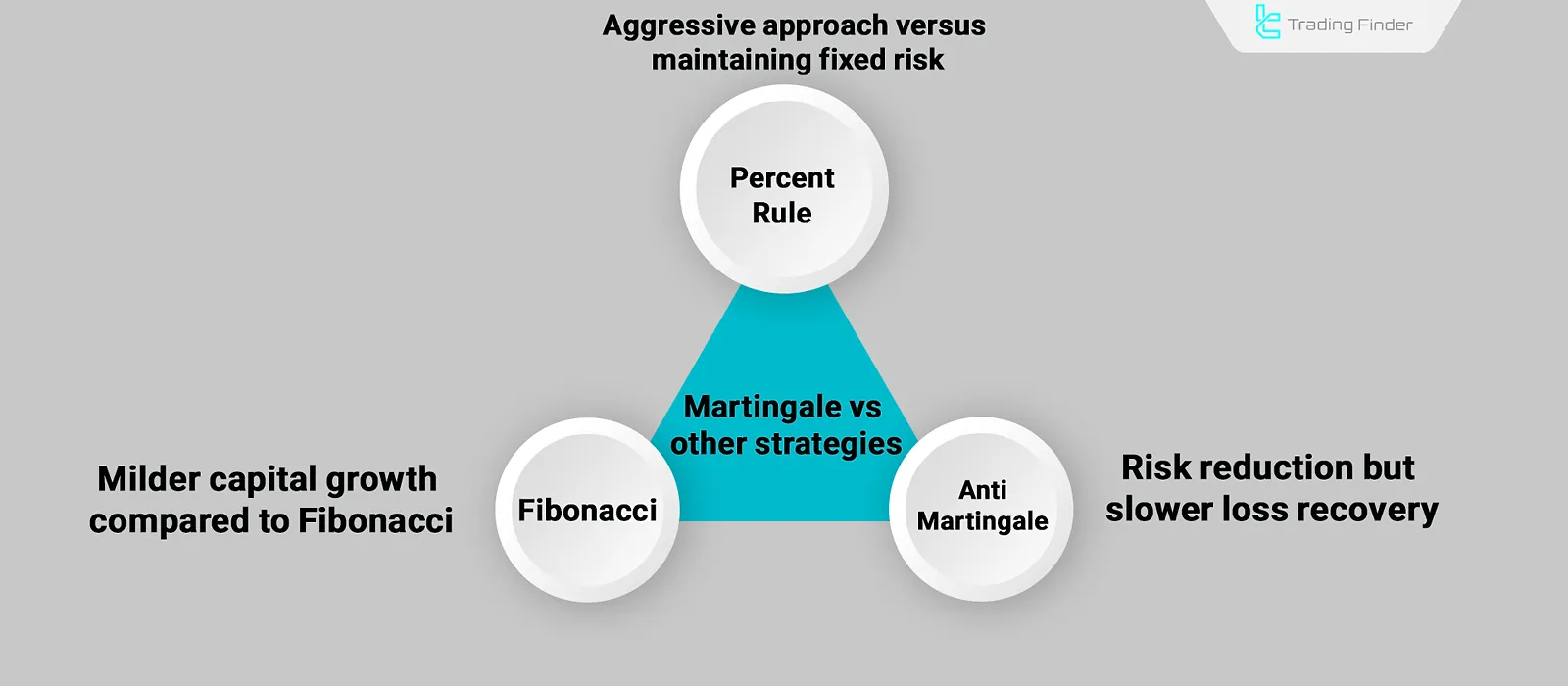

Comparing Martingale with Other Capital Management Strategies in Binary Options

The Martingale strategy is only one of several capital management methods in binary options. To properly understand its advantages and limitations, comparing it with other strategies is essential.

Analyzing differences and similarities with strategies such as the Percent Rule, Fibonacci, and Anti-Martingale reveals that each has different levels of risk, approaches to adjusting trade size, and sustainability.

Difference Between Martingale and the Percent Rule

The Percent Rule is based on keeping risk constant in each trade (usually 1–3% of account balance). This conservative, low-risk method improves long-term survivability. In contrast, Martingale takes an aggressive approach by doubling trade size after each loss, creating far higher risk.

Difference Between Martingale and Fibonacci

In the Fibonacci strategy, trade sizes are adjusted based on the Fibonacci sequence: after a loss, position size increases by moving to the right of the sequence; after a win, it decreases by moving to the left.

This method results in slightly milder growth compared to Martingale; however, it still carries high risk, though the financial and psychological pressure is less intense than Martingale.

Similarities and Differences with Anti-Martingale

Anti-Martingale works exactly opposite to Martingale: trade sizes decrease after a loss and increase after a win. Both strategies involve step-based adjustments, but the main difference lies in the direction of change.

Anti-Martingale reduces overall risk but has a slower pace of loss recovery, while Martingale can recover losses more quickly.

Conclusion

Martingale in binary options is a high-risk capital management method. This strategy, by doubling the trade size after each loss, can recover losses — but it is only feasible with sufficient capital and strict discipline.

Choosing the right broker, setting a logical initial trade size, and defining a daily loss limit are fundamental conditions for success.