- TradingFinder

- Education

- Forex Education

Forex Education

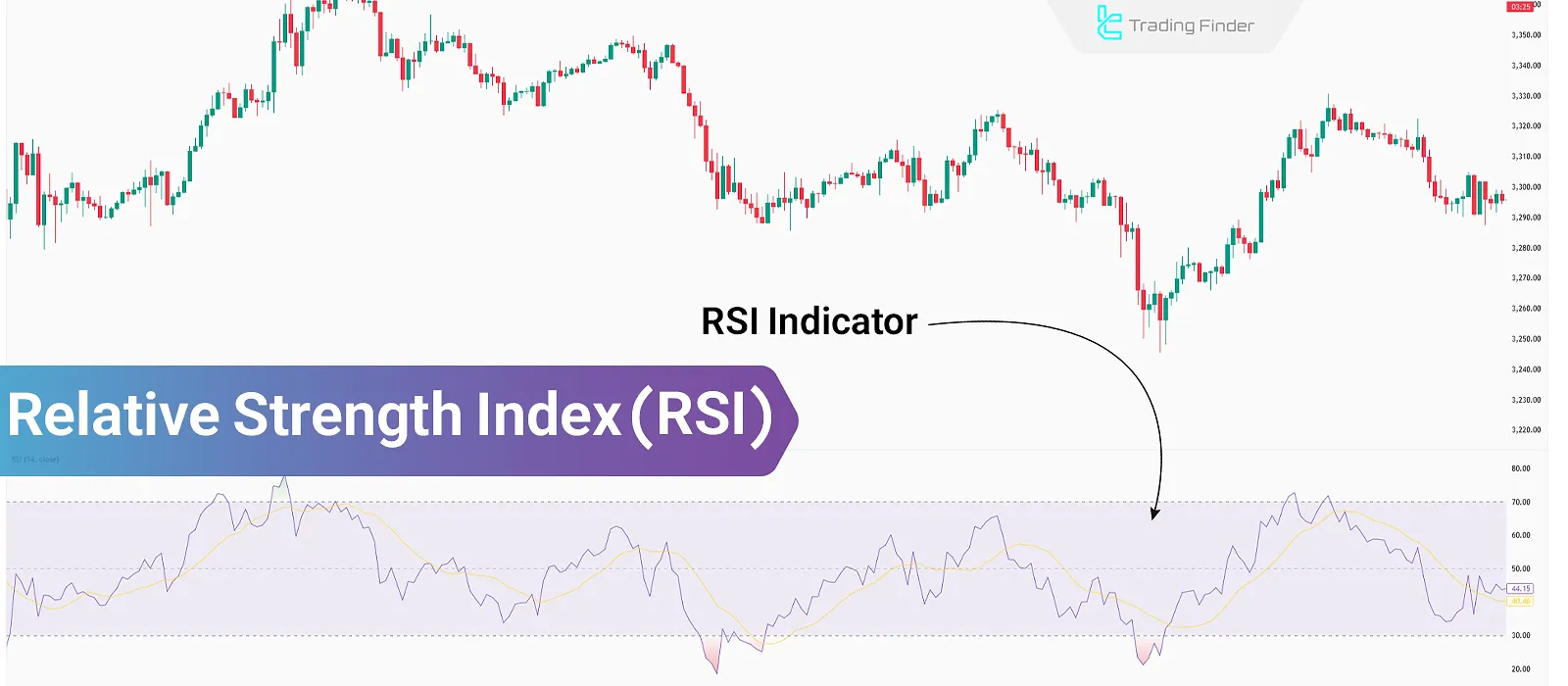

Forex trading offers opportunities to profit from global currency fluctuations, but success requires solid education and a strategic approach. Forex education encompasses various learning paths, from understanding basic forex concepts to mastering advanced strategies and trading psychology. Trading Finder offers the best Forex educational content for traders with various levels of knowledge and experience. This content covers basic Forex-related topics, including Forex market hours, trading platforms, spreads, commissions, Forex brokers, currency pairs, and general Forex terms such as pips, leverage, and margin. Our team of expert creators doesn’t stop there and also creates content for professional traders. These advanced educational resources cover both fundamental and technical analysis concepts. From Economic calendar, interest rate decisions impacts, economic reports impact including NFP or GDP, Forex regulatory bodies such as SEC, FCA, and ASIC, to technical analysis tools and strategies, including price action trading, various indicators such as RSI, moving average, Bollinger bands, and technical patterns, Trading Finder cover everything a trader needs to know.

What Is Demo Account? Differences Between Demo and Real Accounts

Ademo account enables users to test and evaluate trading strategies without risking real capital, providing a safe way to enhance...

What Is the RSI Indicator? Its Applications and How to Trade It Across Different Markets

The Relative Strength Index (RSI) evaluates the strength of a trend by analyzing the open and close prices of candles over...

Williams %R Indicator: Overbought/Oversold Detection, Reversal Signals

Indicators are computational tools based on price and volume data, used for technical analysis and generating trading signals....

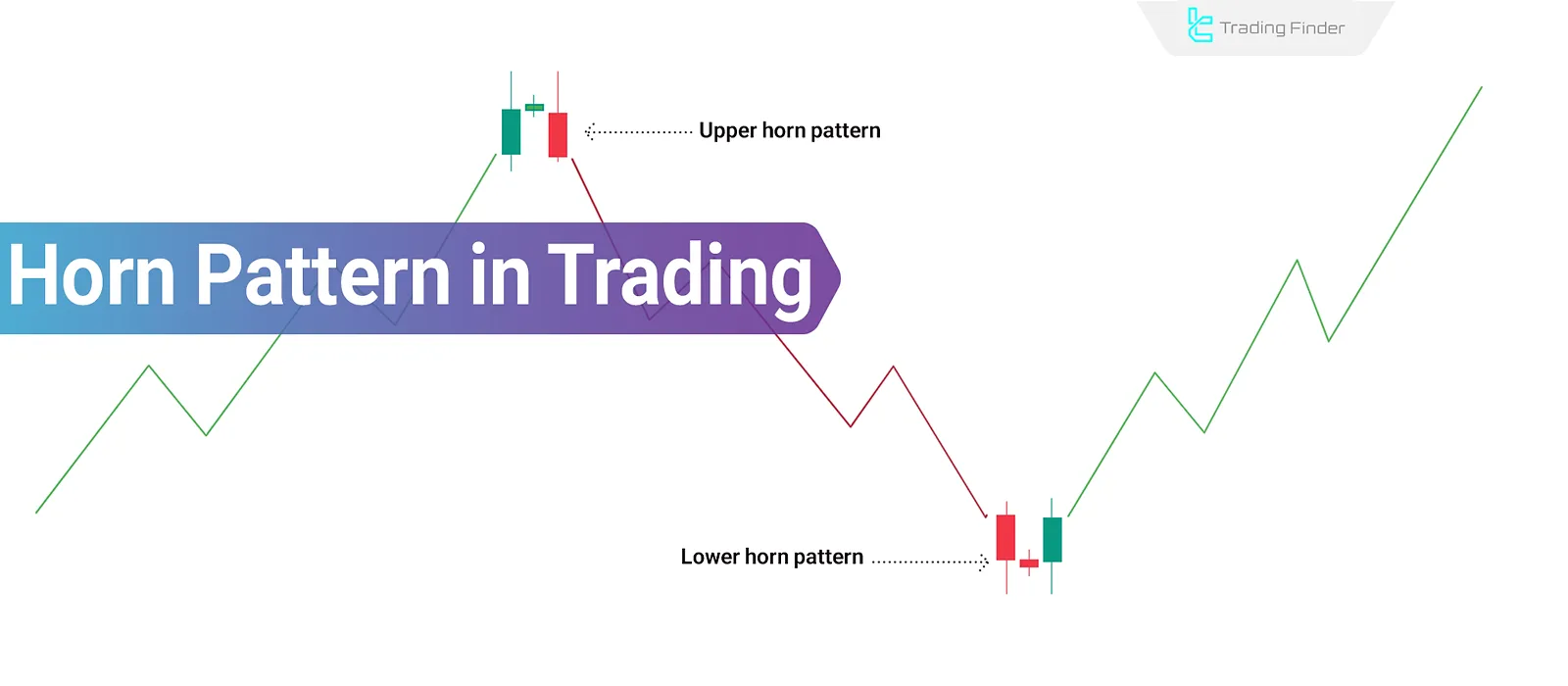

Horn Pattern Trading in Technical Analysis; Horn Top and Bottom

The Horn Pattern in technical analysis is one of the lesser-known reversal patterns that, unlike classical patterns, is based...

What Is Arbitrage? Types of Arbitrages [Triangular, Merger & Spatial]

Arbitrage occurs when the same asset is simultaneously traded at different prices in two separate markets. If this price...

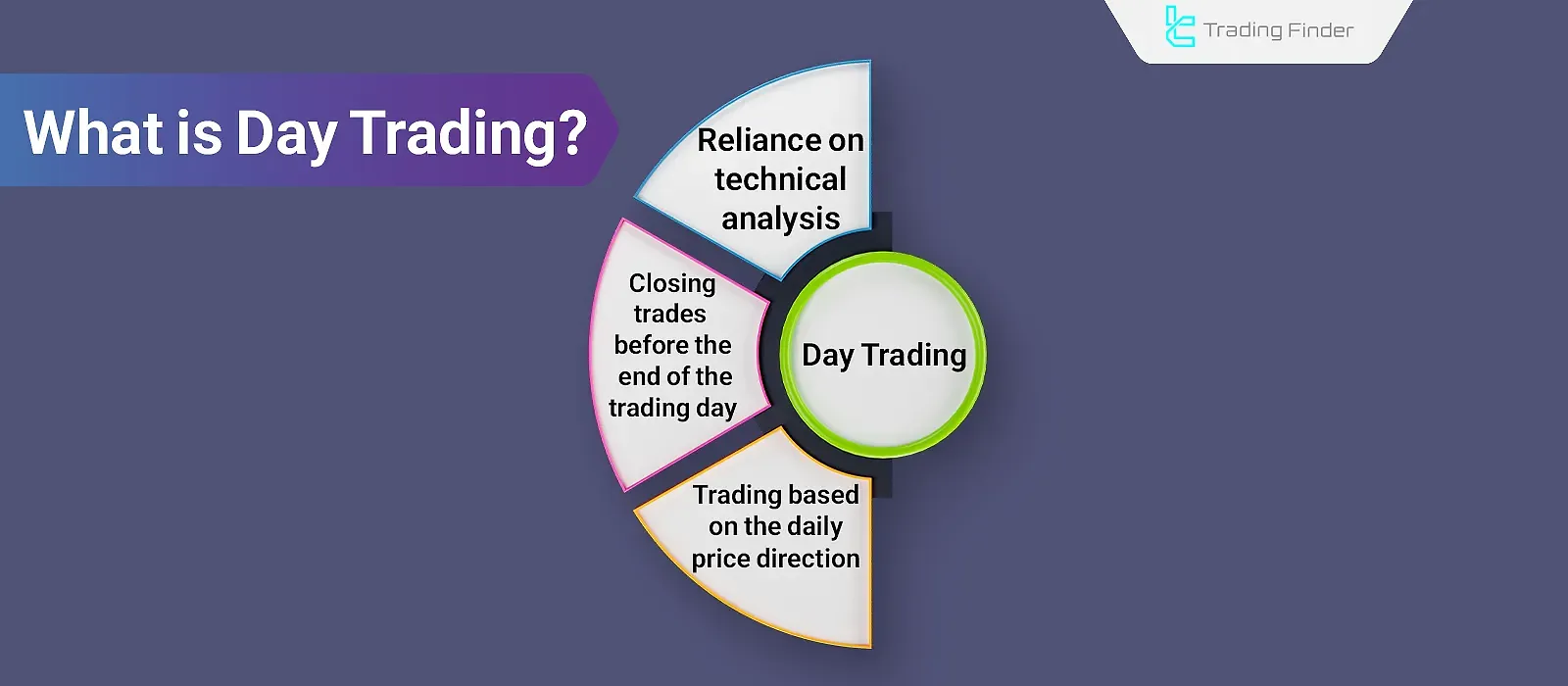

What Is Day Trading? Trade in the Direction of the Trend & Against It

In day trading, traders use technical analysis through various methods, such as ICT style and RTM style (Read The Market), to...

What is Ichimoku? Tenkan-sen, Kijun-sen, Chikou Span, Senkou Span A & B

Ichimoku, as both an indicator and a complete trading system in technical analysis, simultaneously provides information about the...

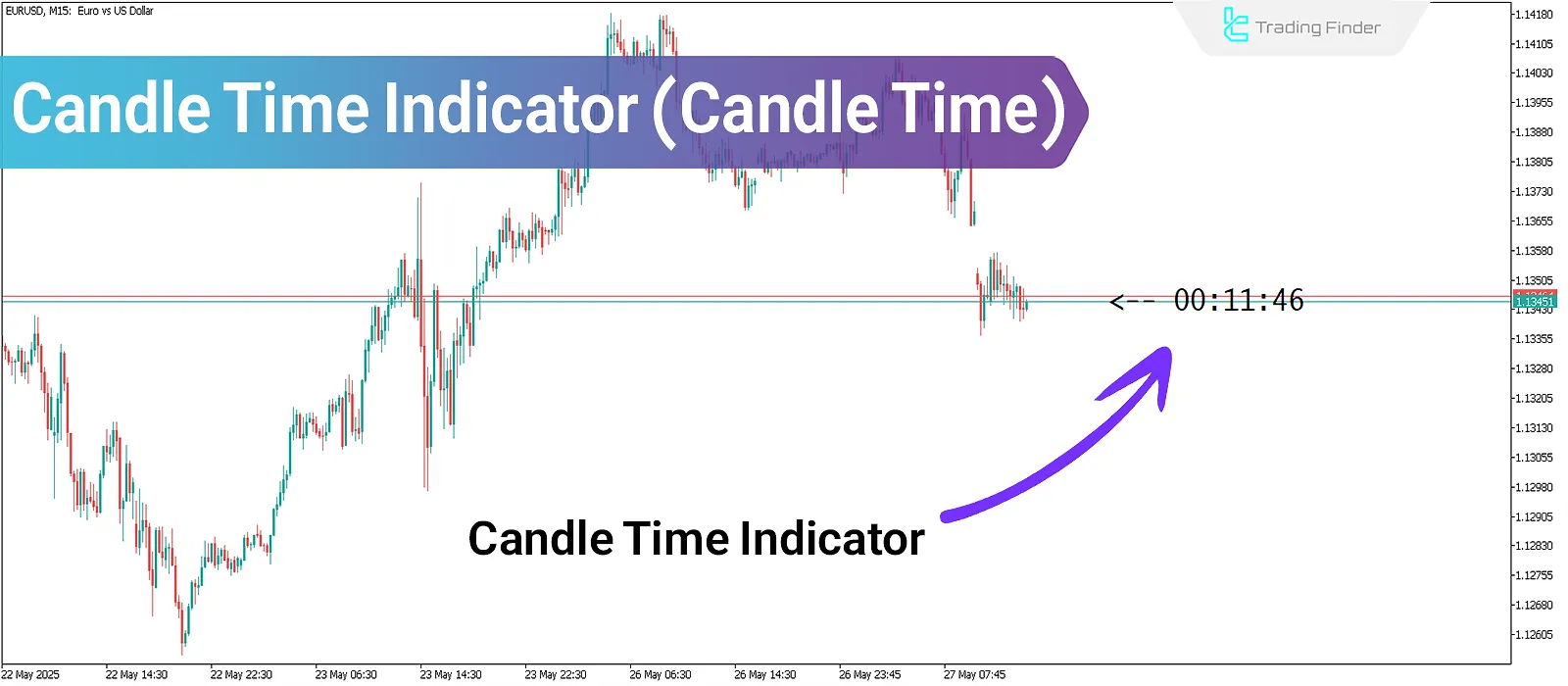

Candle Time Indicator: Free download and installation on MetaTrader

The Candle Time Indicator enhances trading accuracy across various timeframes and strategies, including scalping. With the Candlestick...

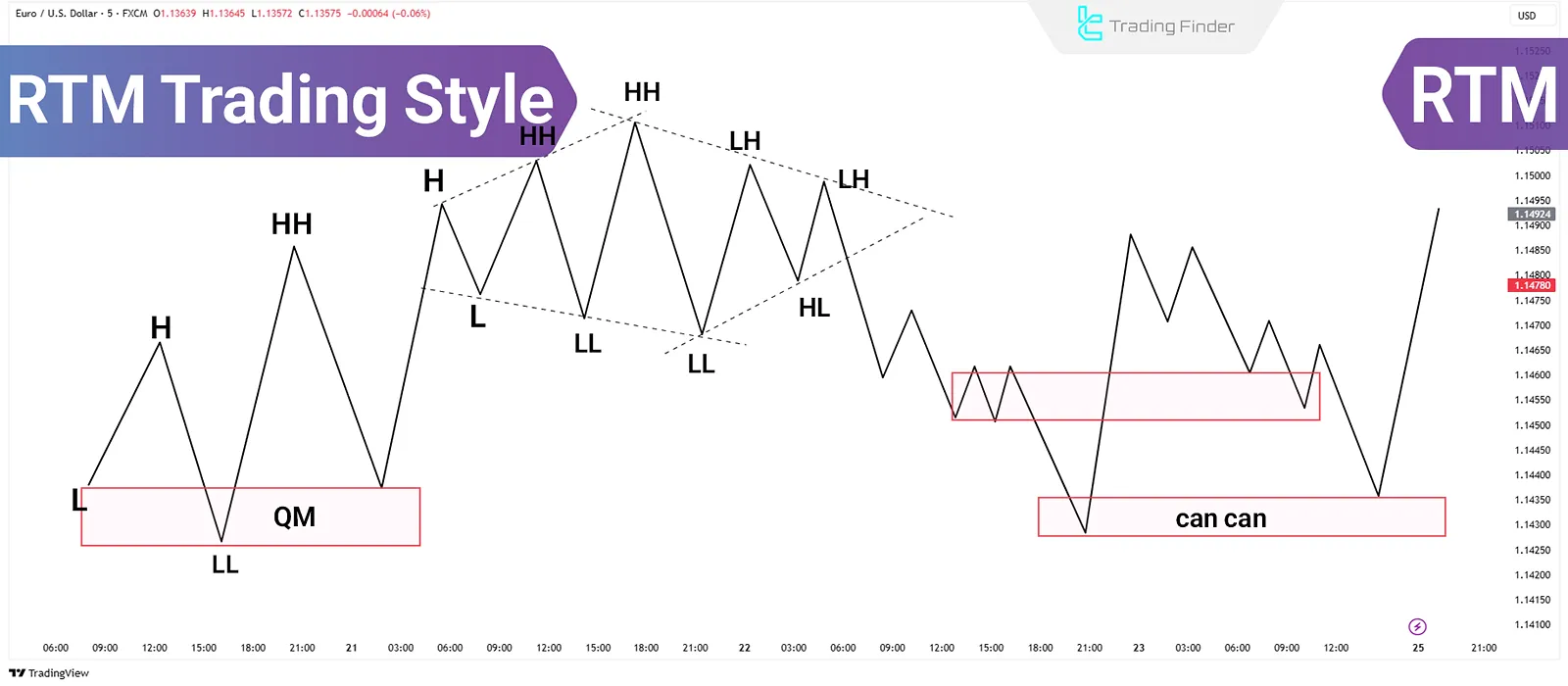

What Is RTM Price Action? Using RBR, DBR, DBD, and RBD Structures in RTM Style

RTM Style, short for "Read The Market" is an analytical method in financial markets that, instead of relying on indicators,...

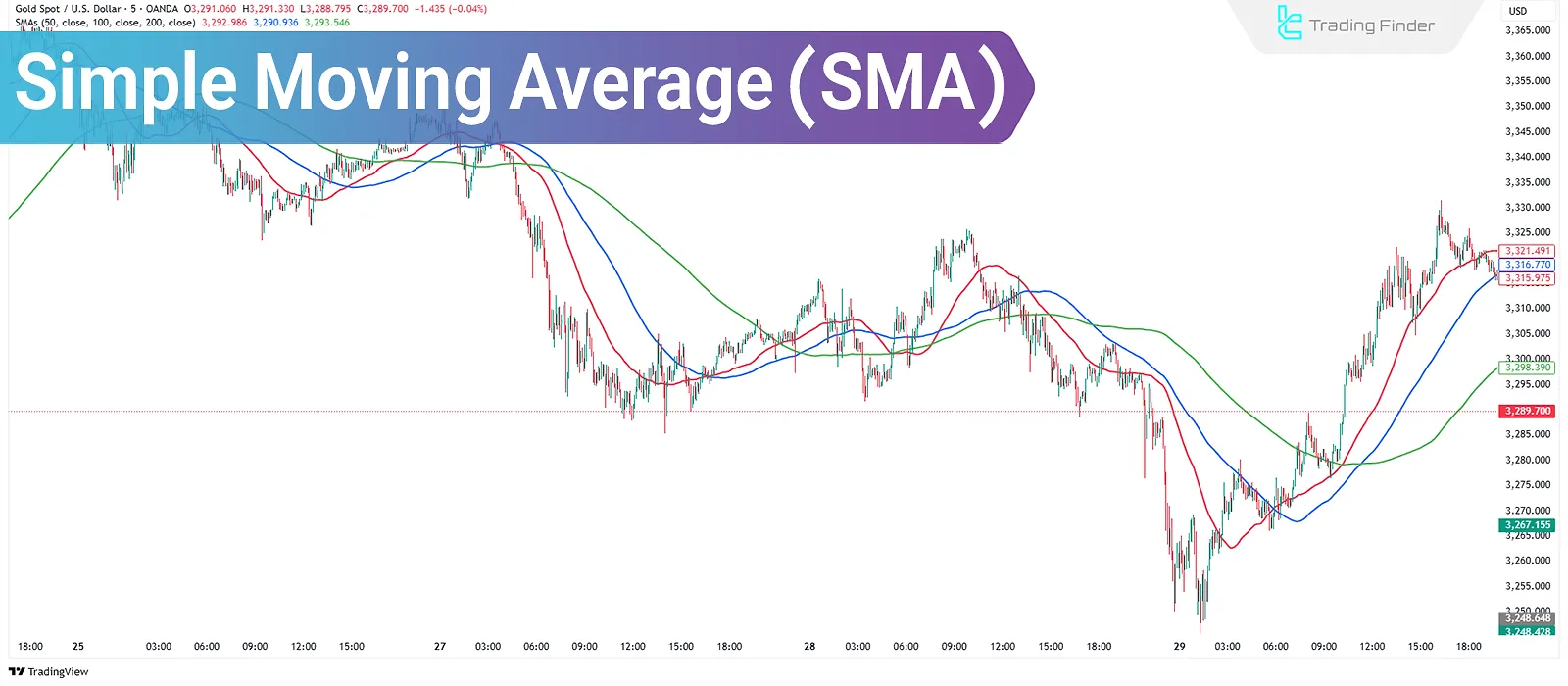

Simple Moving Average (SMA) - How to Calculate

The Simple Moving Average(SMA) is a trend-following indicator in technical analysis that smooths price data and reduces market...

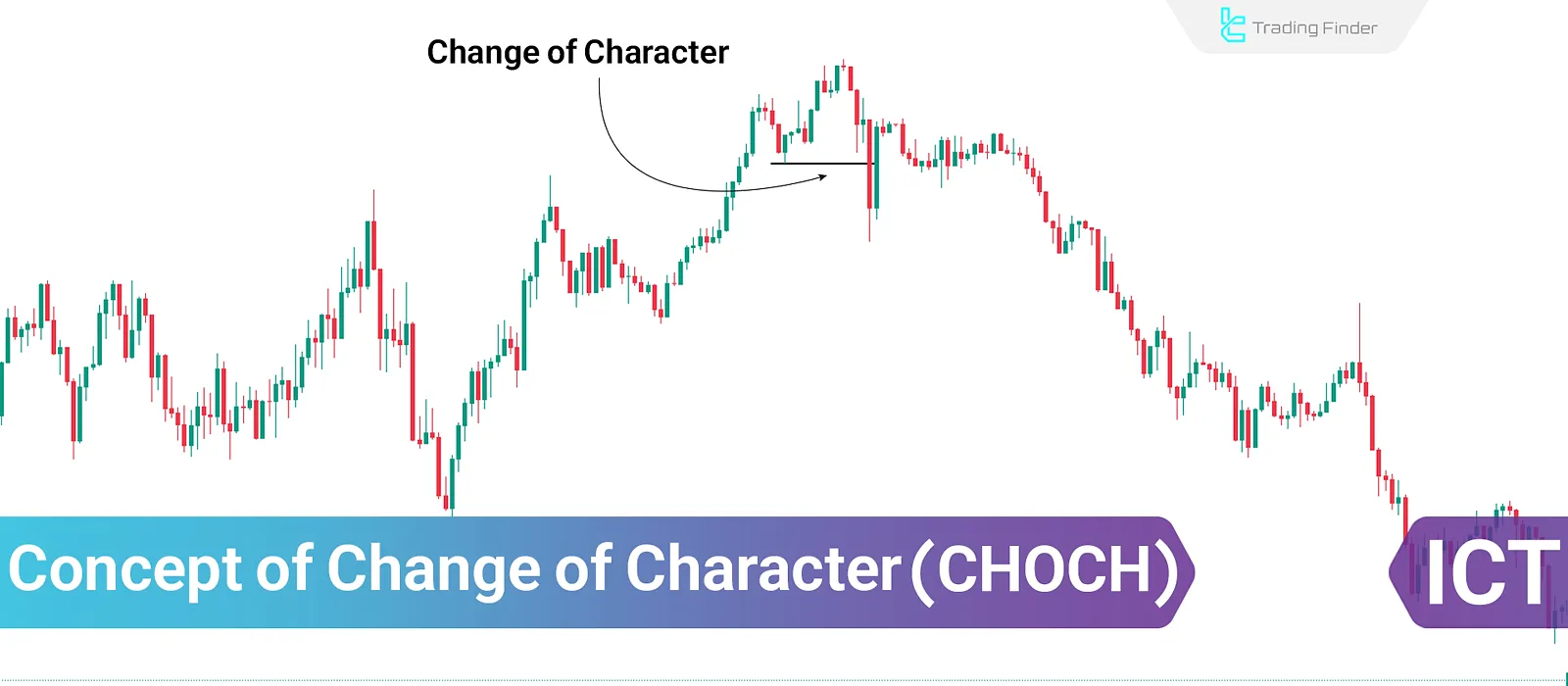

CHOCH in ICT; Best Timeframe to Identify CHOCH in Trading

In the ICT Style, a proper understanding of market structure shifts is highly important, as these changes often mark the...

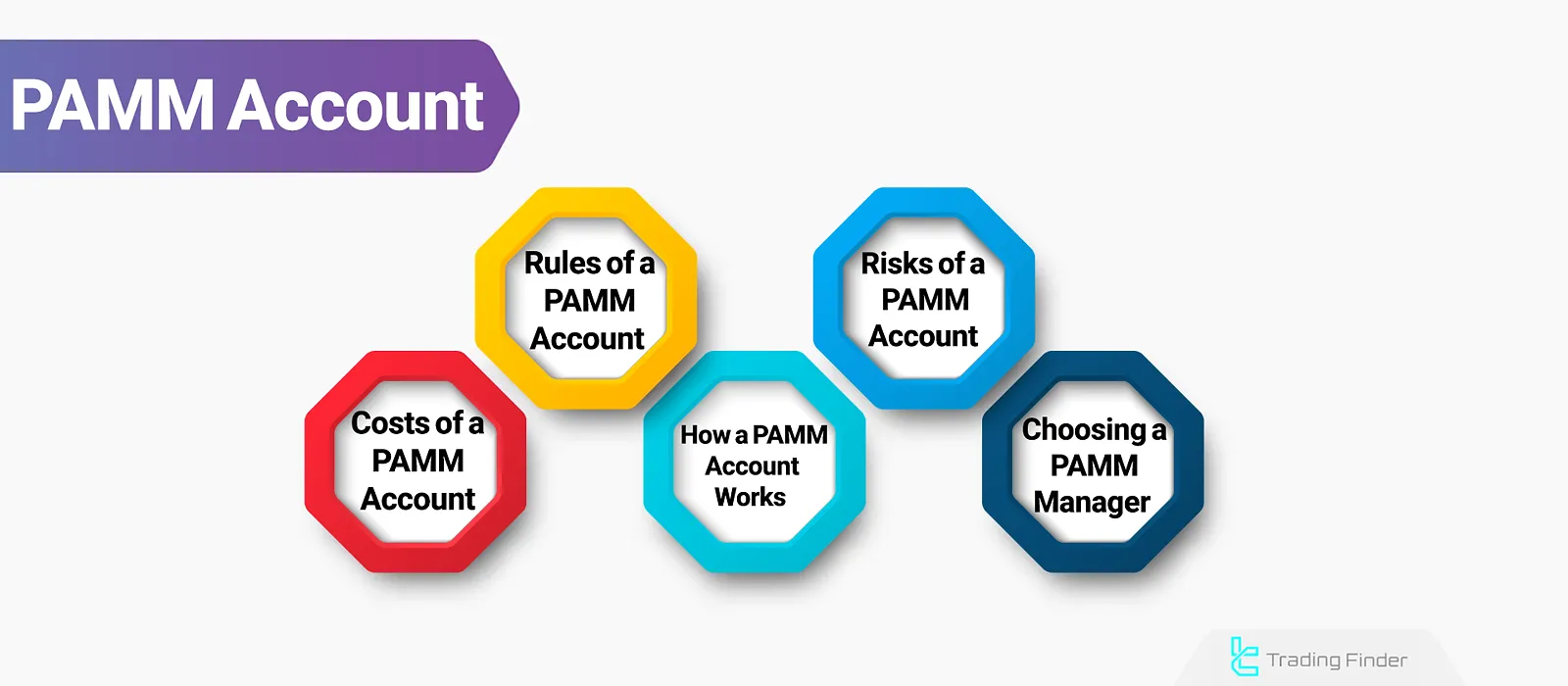

What Is a PAMM Account? Guide to Management and Investment in PAMM Accounts

In the Forex market, many investors prefer to use indirect investment methods due to a lack of sufficient knowledge or time to...

![What Is Arbitrage? Types of Arbitrages [Triangular, Merger & Spatial]](https://cdn.tradingfinder.com/image/431600/03-24-tf-en-what-is-arbitrage-01.webp)