- TradingFinder

- Education

- Forex Education

- Price Action Education

Price Action Education

Price action is one of the most reliable and transparent methods of technical analysis in financial markets, enabling traders to make more precise decisions by focusing solely on the pure price chart without using indicators or trading tools. This method emphasizes the analysis of price patterns, candlestick movements, and the identification of key chart zones, providing traders with an accurate view of market movements through multi-timeframe analysis. In price action, concepts such as pin bars, inside bars, engulfing candles, breakouts, and rejections serve as essential tools for interpreting price movements. Traders can identify optimal entry and exit points by utilizing trendlines and channels, dynamic support and resistance levels, double top and bottom patterns, shadow (wick) analysis, and breakouts. This style also emphasizes trend strength and price retracements, helping traders to trade alongside the dominant market trend and avoid corrective traps.

Reversal vs Pullback in Market Structure – Trend Recognition in HTF

By using the concepts of retracement and pullback in ICT style and Smart Money styles, long-term market trend changes and...

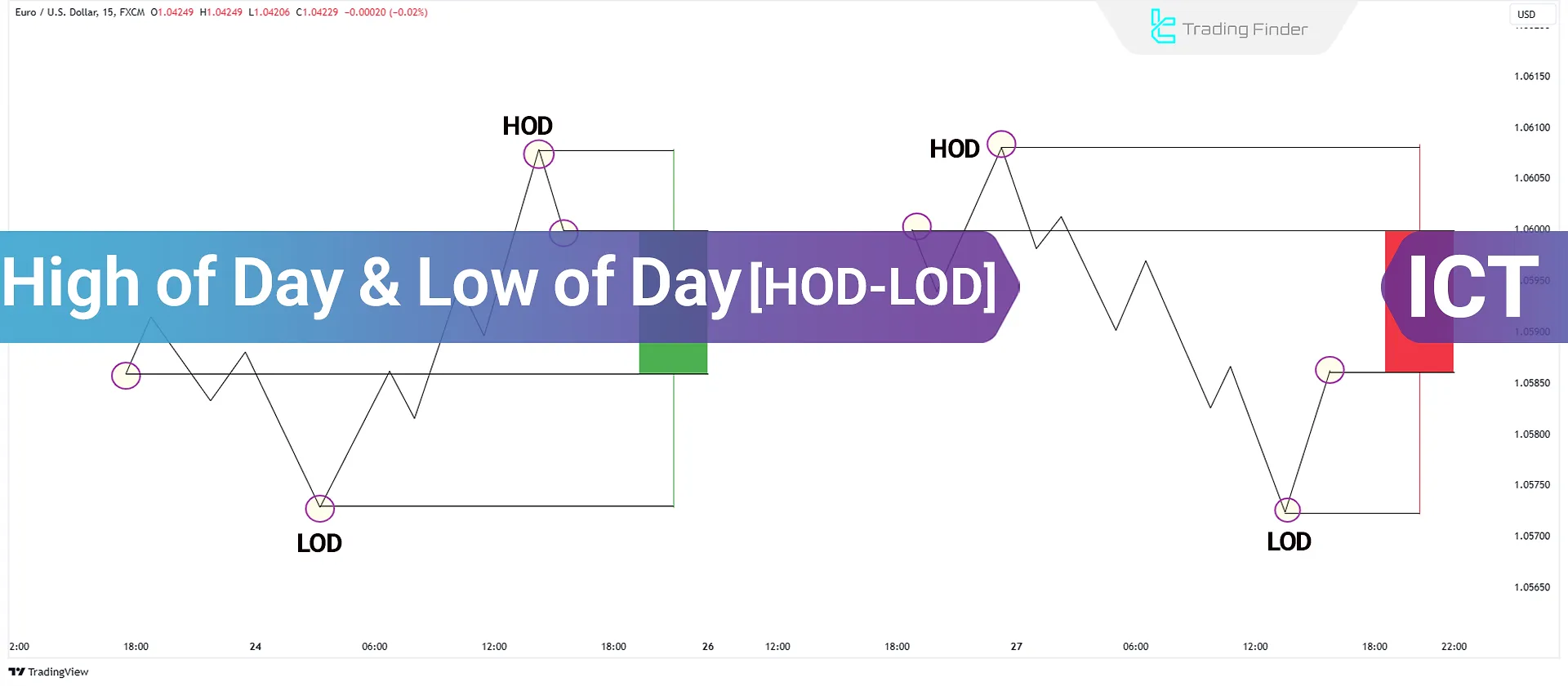

Highest and Lowest Daily Price (High of Day / HOD and Low of Day / LOD)

HOD (High of Day) and LOD (Low of Day) are fundamental concepts in technical analysis and intraday trading. They represent the...

Rally Base Rally (RBR) Pattern: Bullish Continuation Strategy Explained

The Rally Base Rally (RBR) trading strategy is a popular technical analysis method for predicting future asset movements in various...

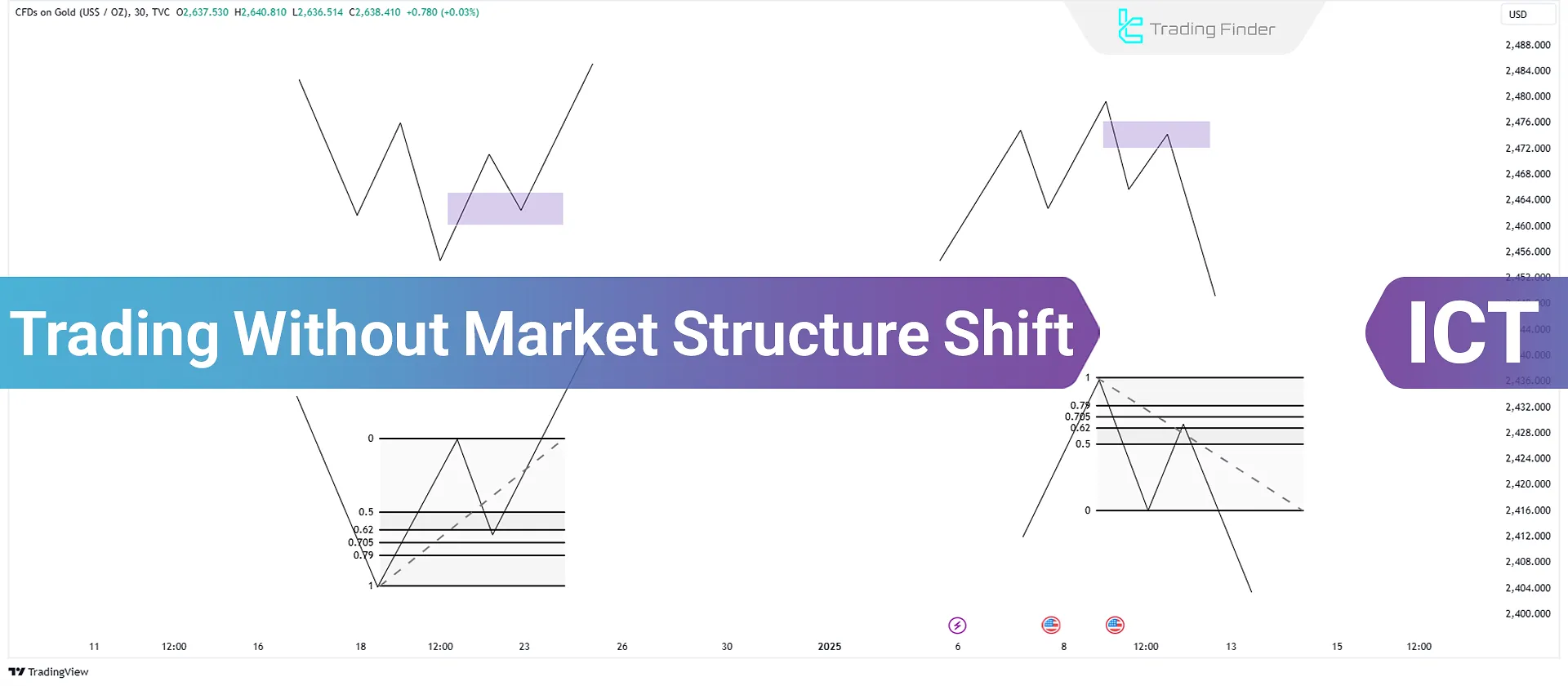

Trading Without Market Structure Shift; Importance of Trading Without MSS & MSB

With "Trading Without Market Structure Shift" strategy in the ICT style, traders can execute trades without waiting for a Market...

Smart Money Concept (SMC): Complete Guide to Liquidity-Based Trading Strategy

The Smart Money Concept (SMC) is an advanced method of market analysis that focuses on market structure, order flow and liquidity...

Market Structure Trading in Bullish, Bearish, and Ranging Trends - ICT & SMC

Market Structure is a tool for analyzing price behavior and identifying movement trends in Forex Market and cryptocurrency markets....

What is the ICT Style? Analysis of ICT Terminology

The ICT trading style is a price action-based methodology developed by Michael J. Huddleston. This strategy focuses on analyzing...

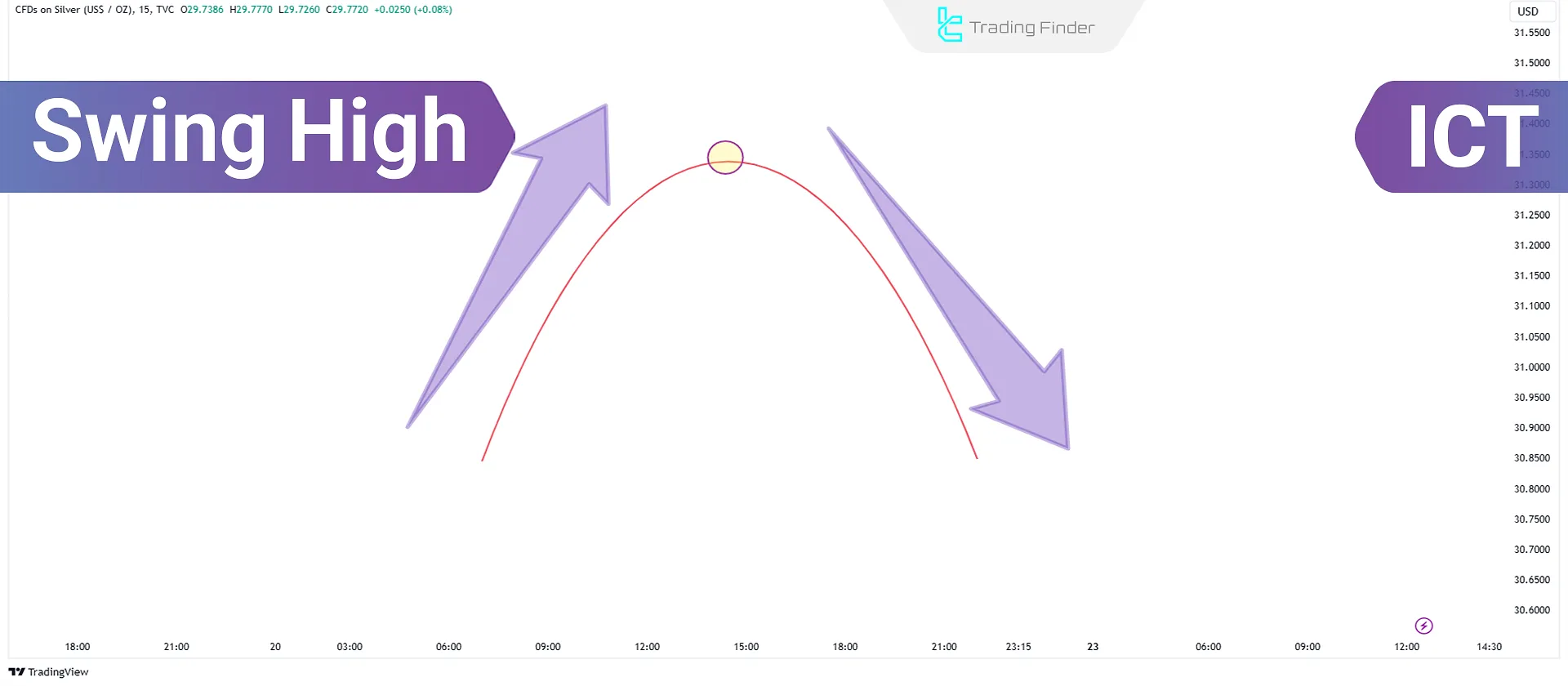

What are Swing Highs? A guide to Identifying Swing Highs or Peaks in ICT

A swing high refers to the highest price level that forms after an upward move and is followed by a downward market movement....

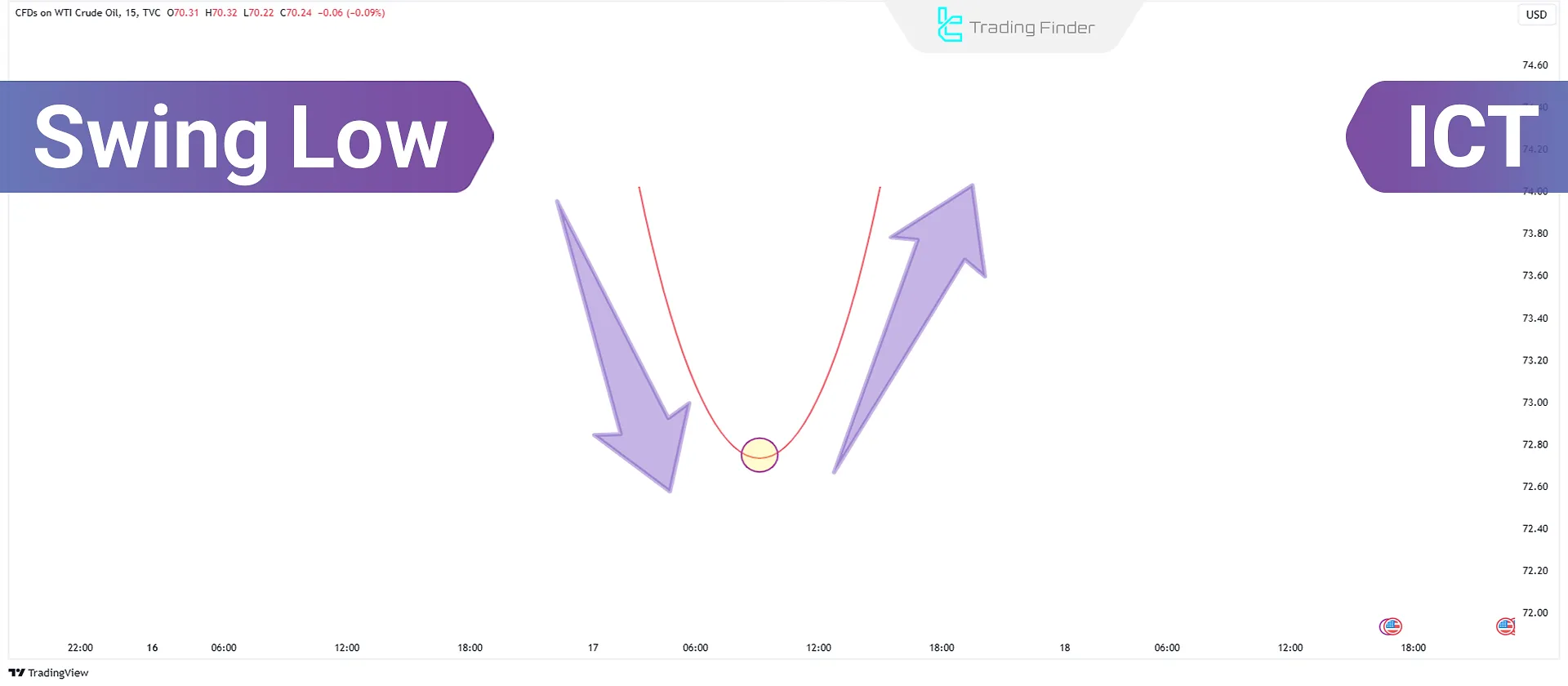

What Is a Swing Low? How to Identify It and Its Application for Identifying

Swing Low is a key point on a price chart where the market reaches its lowest value within a specific timeframe and then moves...

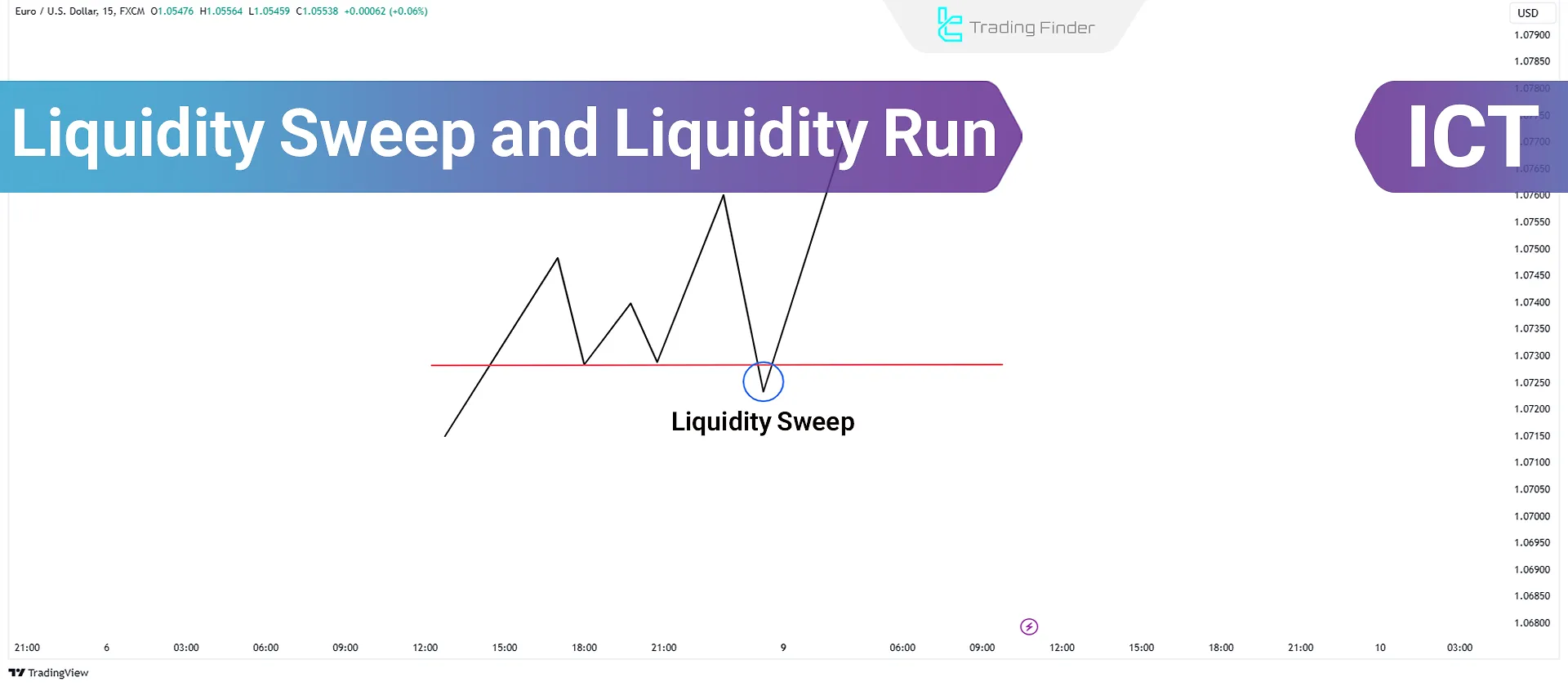

Liquidity Sweep & Liquidity Run; Liquidity Hunting in ICT Style

The liquidity sweep and run strategy in ICT style provides suitableentry and exit points by targeting liquidity at key levels and...

What is Quasimodo (QM) Pattern in RTM Style?

The Quasimodo (QM) pattern is an advanced concept in technical analysis under the RTM (Read the Market) style. It is used to...