Risk Management in binary options means designing a set of rules and methods to control potential losses and protect capital.

In binary options, each trade has two outcomes: either the trader earns a specified profit, or the capital allocated to that position is completely lost; for this reason, risk management in this market is more important than in other financial markets such as the Forex or stock market.

What is Risk Management in Binary Options?

Risk management in options trading refers to a set of principles and approaches aimed at preventing capital destruction and creating the groundwork for sustainable profitability.

A trader who operates without a defined risk-management framework is likely to lose all their capital after a few unsuccessful trades.

In contrast, adherence to risk principles preserves the ability to continue even in the face of consecutive losses; because the trader never risks more than the permitted portion of their capital in a single trade.

Advantages and Disadvantages of Risk Management in Binary Options

Implementing risk management in binary-options trading is not merely a choice but an undeniable necessity.

This approach, on the one hand, prevents rapid capital destruction in loss-making conditions and, on the other, enables the achievement of stable returns.

However, it should be noted that while risk management controls large losses, it cannot completely eliminate systematic risk or strategy error; therefore, the following table merely presents the advantages and disadvantages of risk management in binary-options trading:

Advantages | Disadvantages |

Risk control | Limitation of potential profit |

Preventing capital destruction | Need for high psychological discipline |

Creating order in trading | - |

Difference Between Capital Management and Risk Management

Capital management and risk management are two closely related concepts, but they have different roles and applications. Capital management focuses primarily on how to divide and allocate capital across trades.

This part determines how much of the total account balance should be allocated to a position.

Risk Management | Capital Management |

Controlling losses and preventing irreparable damage in trades | Dividing and allocating total capital among different trades |

Protecting the trading account against large losses and controlling overall risk | Optimizing the use of capital in trades by determining the appropriate position size for each trade |

Responding to adverse market conditions and planning for loss scenarios | Planning capital allocation across different trades based on a percentage of the account |

Stop Loss, Take Profit, Risk-to-Reward ratio | Position size, capital allocation percentage, diversification |

A combination of financial analysis, emotional control, and crisis decision-making | Quantitative and numerical; based on precise percentage calculations of capital |

Long-term account sustainability and prevention of irreparable losses | Gradual capital growth and avoiding over-concentration on a single trade |

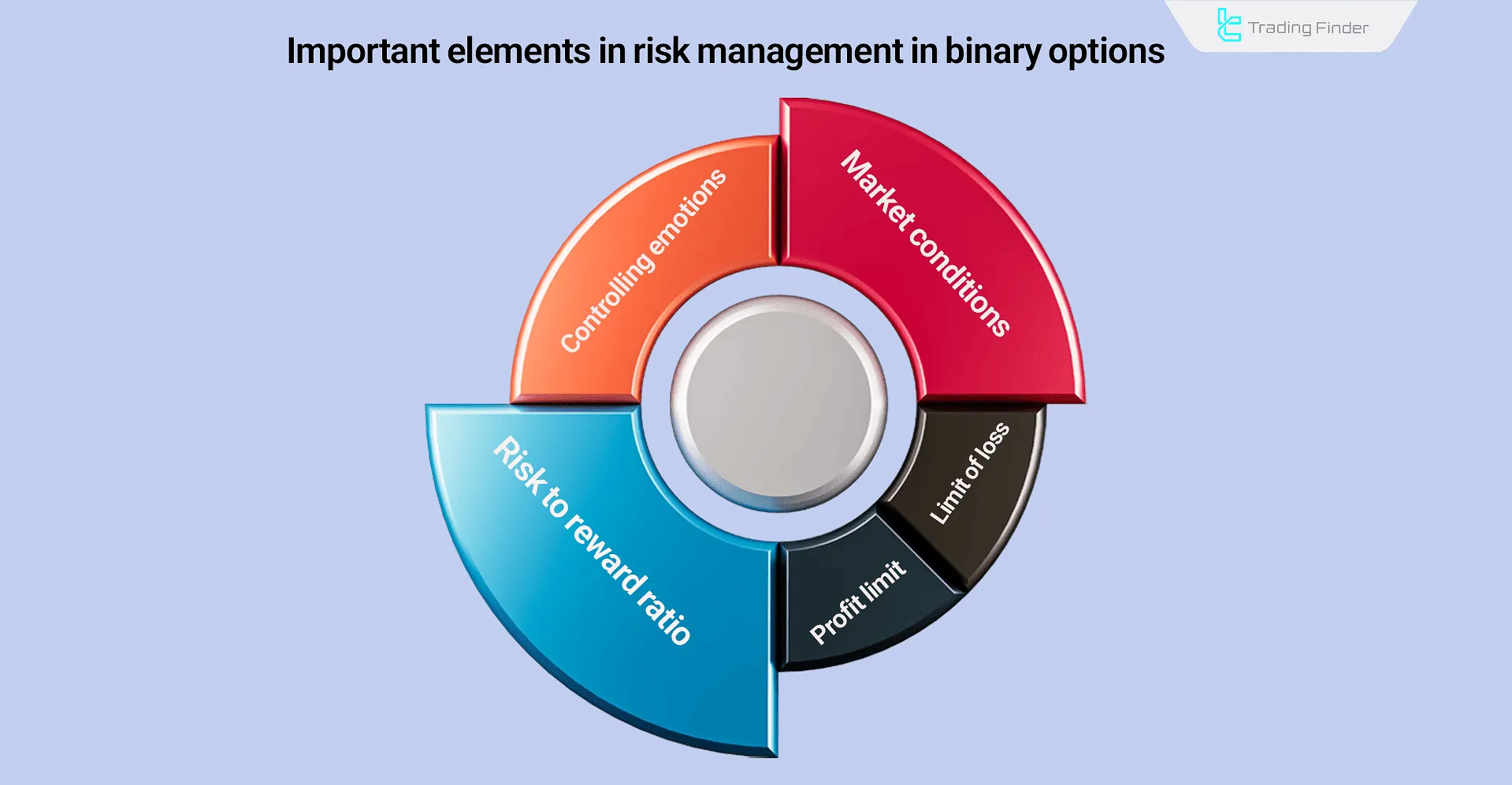

Introducing the Key Elements of Risk Management in Binary Options

Risk management in binary-options trading becomes meaningful when its core elements are precisely defined.

Each of these elements is like a puzzle piece that, together, forms a complete picture of the trading strategy.

Stop Loss in Binary-Options Trading

A Stop Loss is a pre-defined point at which the trader closes the trade once price reaches that level.

Although, unlike Forex, a direct Stop Loss cannot be set in binary options, a similar role in controlling loss can be played by setting the capital amount per trade or using the Early Close feature.

Take Profit in Binary-Options Trading

In binary options, Take Profit is determined as a pre-set payout percentage by the broker; however, the choice of expiration time and contract type such as “Call” or “Put” has a direct impact on realizing it.

In practice, by analyzing volatility and choosing precise timing, a trader can optimize a trade’s potential return.

Risk-to-Reward Ratio in Binary-Options Trading

The Risk-to-Reward ratio is an important metric that shows how much potential return is considered for each unit of risk.

For example, a 1:2 ratio means the trader is willing to risk $10 to gain $20.

Emotional Control in Binary-Options Trading

A large part of failures in trading stems from emotions. Fear, greed, or anger can nullify risk-management rules.

A trader who adheres to their rules will be able to make rational decisions even in volatile market conditions.

Market Assessment in Binary-Options Trading

Before entering any position, examining price volatility, trading volume, and the overall market trend is crucial; because these three factors indicate the strength and sustainability of price movement.

Ignoring them increases the likelihood of entering at exhausted levels or against the trend.

Risk Management Based on Account Size in Binary Options

Total initial capital plays a decisive role in choosing a risk-management strategy.

The larger the account balance, the more flexibility there is in dividing capital. In contrast, small accounts must be managed with greater precision because the margin for error is very limited.

Reviewing Risk Management in Binary Options with $2,000 Capital Example

For accounts with $2,000 capital, using 1% risk is the most logical choice. This means only $20 is allocated per trade.

Even if 10 consecutive trades fail, only $200 equivalent to 10% of total capital is lost, and the account still has the ability to continue. Such a structure allows the trader to preserve capital during periods of consecutive losses;

Reviewing Risk Management in Binary Options with $500 Capital Example

In smaller accounts, the capacity to tolerate consecutive losses is lower. In this case, 2% risk per trade equal to $10 is considered reasonable.

Although the risk percentage is slightly higher, due to limited funds this approach helps the investor maintain control. Otherwise, using larger sizes can lead to rapid account destruction;

Comparing Large and Small Accounts in Binary-Options Risk Management

In large accounts, flexibility in allocating capital among several contracts and using simultaneous strategies such as Hedging or Martingale enables better risk control.

In contrast, small accounts, due to limited capital, must focus on managing position size and choosing precise entry points to avoid heavy losses. Also, in small accounts, using a fixed Risk-to-Reward ratio and avoiding back-to-back trades without analysis is essential.

Therefore, the main difference between the two lies in the capacity to control loss and diversify the risk structure.

Risk management based on account size ensures that no single trade can destroy the account. In fact, whether the capital is $500 or $2,000, what matters is adherence to reasonable risk percentages.

This principle is the most fundamental step for staying in the binary-options market. For more information on how to manage risk in binary options, you can refer to the risk-training article on trendpro.com.

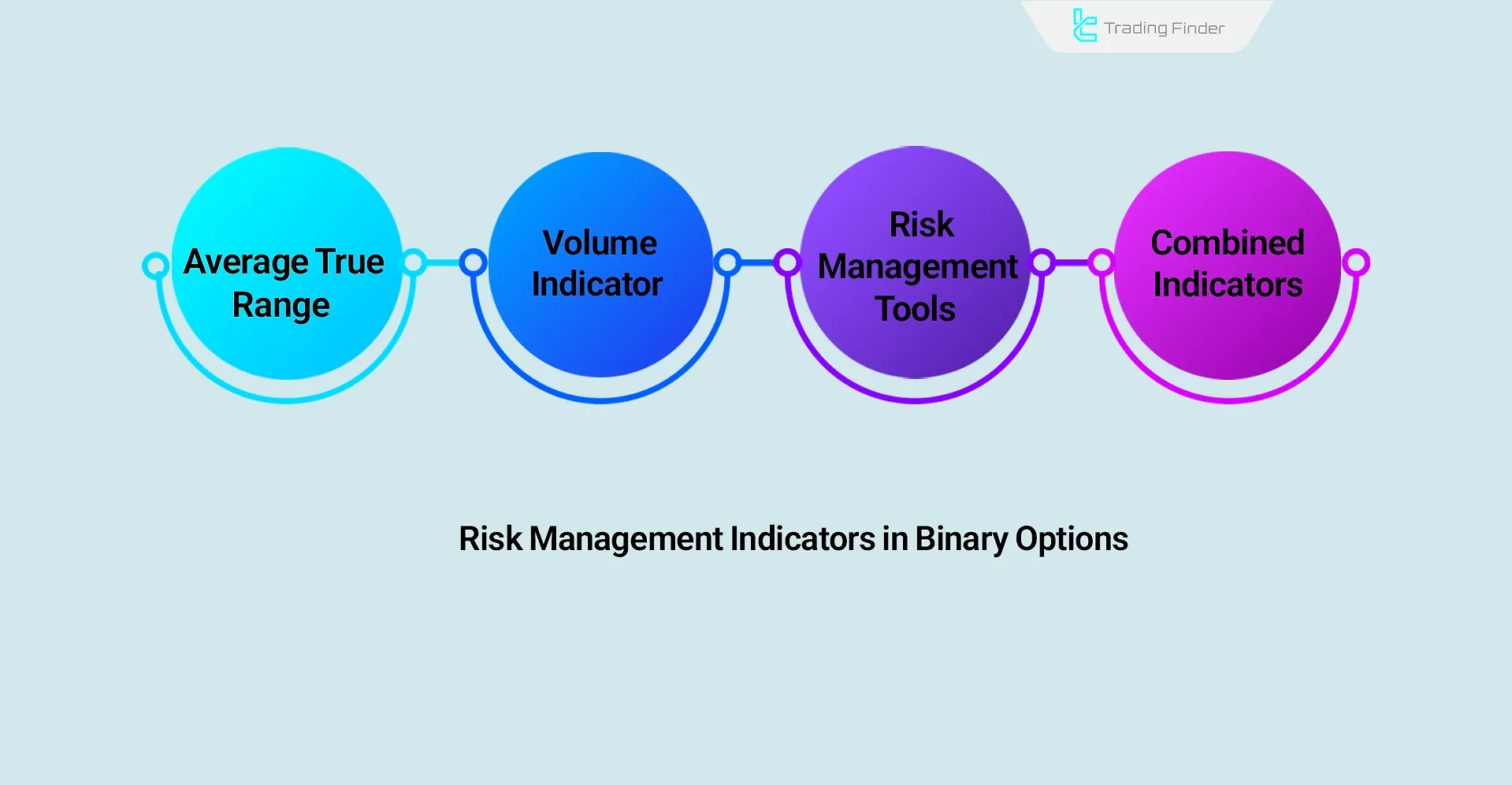

Risk-Management Indicators in Binary Options

To better understand volatility in binary-options trading, specialized indicators can be used:

- Average True Range (ATR): This indicator measures market volatility over a specific period. The higher the ATR, the greater the volatility risk, and the trader should reduce the invested amount;

- Volume Indicator: A tool that shows capital inflows and outflows across candles. High volume in the trend’s direction can strengthen a signal’s validity;

- Computational risk-management tools: such as risk-to-reward calculators that help precisely calculate the profit-to-loss ratio before entering a trade;

- Composite indicators: tools like On-Balance Volume (OBV) or Money Flow Index (MFI) that simultaneously assess volume and price movement and play an important role in identifying high-risk or low-risk situations.

Analyzing volume and using these indicators keeps the trader from entering conditions where the probability of failure is high.

In binary options where each trade’s outcome is definitive reviewing these data is more important than in markets like Forex, because even a small mistake can lead to losing all the capital allocated to a single position.

Introducing a risk-management indicator in binary options

The Risk/Reward Ratio Calculator indicator in MetaTrader is one of the key tools in risk and capital management.

It allows the trader, before entering a trade, to calculate the exact Risk/Reward ratio and simultaneously mark Take Profit (TP) and Stop Loss (SL) levels directly on the chart.

The structure of this indicator includes a management panel and an interactive on-chart box that dynamically displays potential long or short setups.

The user can set TP and SL either by dragging lines on the chart or by entering their values in pips. This indicator is applicable across markets including Forex, cryptocurrencies, stocks, commodities, and binary options.

In the settings, options such as defining SL by pips (SL Pips), separate configuration for long or short trades, quick element removal, and changing how profit targets are displayed (as a percentage or TP1, TP2) are available.

This indicator is especially valuable for scalpers, day traders, and swing traders, because it not only streamlines decision-making but also reduces human error in calculating the Risk/Reward ratio.

Alongside these features, using complementary tools such as TradingFinder’s Pip Calculator or a Fibonacci calculator can increase the accuracy of analysis and risk management.

For this reason, the R/R Ratio Calculator is not merely a simple risk calculator but part of a broader capital-management strategy.

- Download the Risk/Reward Ratio Calculator indicator for MetaTrader 4

- Download the Risk/Reward Ratio Calculator indicator for MetaTrader 5

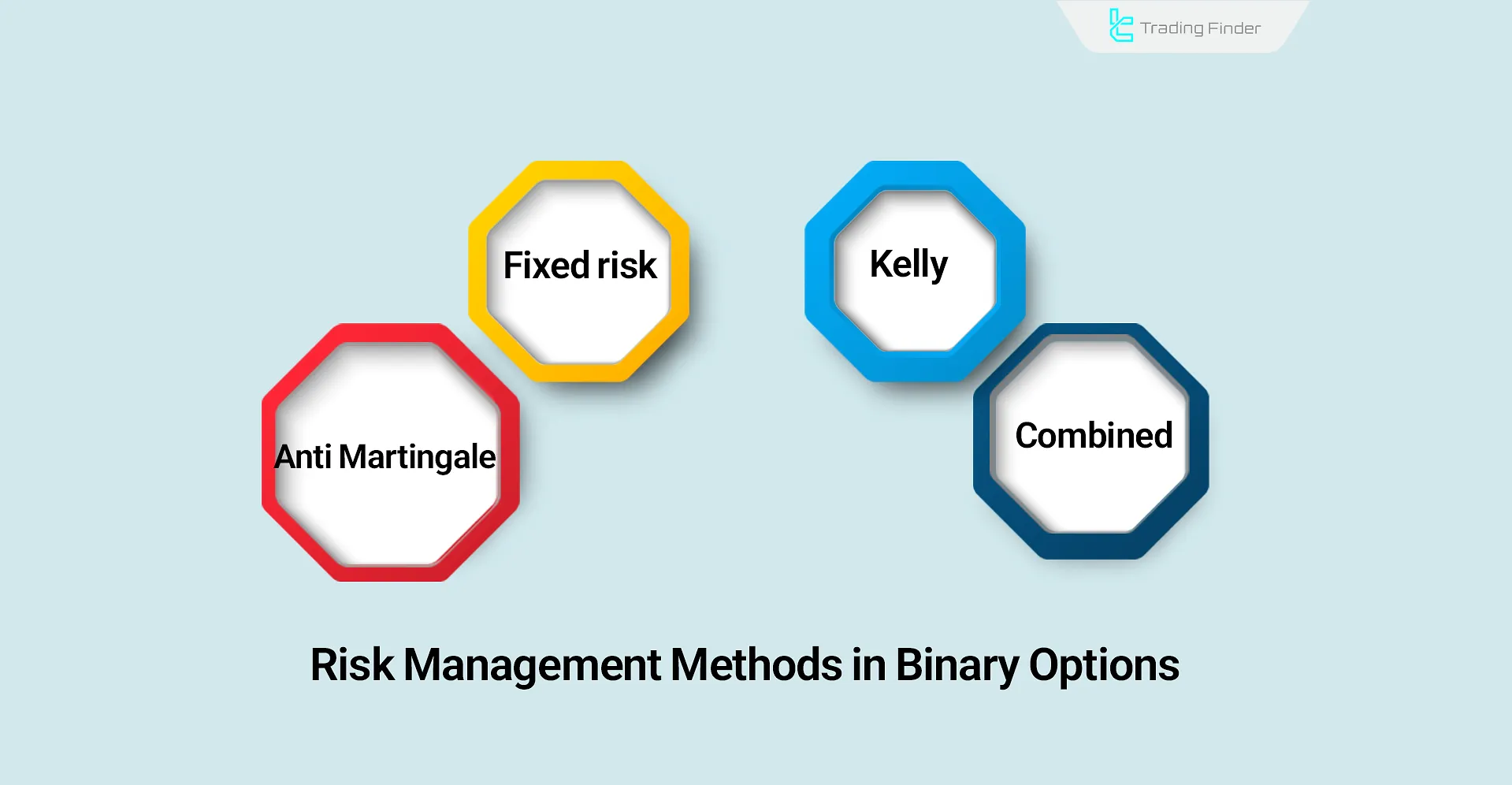

Risk-management methods in binary options

Risk management in binary options is not limited to reducing trade size; it is a set of methods and numerical models, each with different applications and risks. The most important methods are:

Fixed Risk in risk management

In this model, the trader always risks a fixed percentage of their capital per trade. For example, if fixed risk is set at 1%, a $1,000 account always allocates $10 to each trade.

This method offers high stability and prevents irreparable losses.

Anti-Martingale in risk management

In the Anti-Martingale method contrary to Martingale the position size is increased after each winning trade and decreased after each losing trade.

This allows the trader to earn more during winning streaks and suffer less during losing streaks. Proper execution requires high psychological discipline;

Those interested in using the Anti-Martingale method for capital management in binary options can refer to the training video on the “J.D.Hyter” YouTube channel:

Kelly Criterion in risk management

A mathematical formula for calculating position size based on win probability and the profit-to-loss ratio.

For example, if the win probability is 60% and the profit-to-loss ratio is 1:1, the Kelly formula proposes an exact percentage of capital to risk.

This method is more complex, but if implemented correctly, it can optimize account growth.

Combined methods in binary-options risk management

Many professional traders use a combination of methods. For example, most trades may be executed with fixed risk, while Anti-Martingale or Kelly is used in specific conditions. This flexibility makes risk management more aligned with market conditions.

Choosing the right method depends on factors such as capital size, trader experience, risk tolerance, and psychological state.

No single method is ideal for all situations, but adhering to common numerical frameworks prevents account destruction.

Complementary strategies for risk management in binary options

Risk management in binary options trading is not limited to choosing a capital percentage for each trade.

Some advanced tools and features within trading platforms allow greater flexibility and tighter control. The most important strategies are:

Early Close in risk management

Early Close allows the trader to exit the position before expiration. If the position is in loss, Early Close reduces the final loss compared to a full loss.

If the position is in profit, the trader can lock in a smaller profit to avoid the risk of sudden market reversals.

Rollover in risk management

When the trader’s analysis is correct but the market has not yet reached the target, “Rollover” (closing the expiring contract and opening a new contract in the following month) makes it possible to add more time to the position.

This feature typically comes with an additional fee. Used correctly, it can turn losing trades into winning ones, but excessive use increases risk;

Hedging in binary-options trading

In binary options, hedging means opening offsetting positions on the same asset or correlated assets. For example, the trader can open a CALL and a PUT contract simultaneously.

Although this limits potential profit, in highly volatile markets like Forex or crypto it prevents heavy losses.

Doubling Up in risk management

This feature becomes active when the trader is confident that their current position is on the right track. In this case, they can double the trade size to increase profit.

Although this strategy can boost returns, if the market suddenly reverses, the loss also doubles.

Sustainable profit in binary-options risk management

The main goal of implementing risk management in binary options is not only to avoid losses but also to create a foundation for achieving Sustainable Profit over time.

Many beginners seek a few quick trades and instant gains, but a professional trader has a long-term view and knows capital survival is more important than a short-term win.

Sustainable profit in binary options emerges when the investor defines a clear risk framework for every trade.

Using fixed risk of 1% to 3% ensures the account survives even after several losing trades. In contrast, a trader who risks 20% of capital per position can face account destruction after only a few consecutive losses.

Also, a short-term view focuses on instant wins and is usually accompanied by excitement and hasty decisions.

This view can be profitable in some conditions but carries high risk. In contrast, a long-term view focuses on capital stability and account management through both losing and winning periods.

A trader who chooses this approach can gradually grow their account over months or years. To achieve sustainable profit, the trader must balance profit and risk.

This balance is achieved by combining capital management, precise market analysis, and the use of risk-management tools. Ultimately, durability and profitability in binary options are possible only when short-term gains are not prioritized over long-term survival.

Traders’ success with risk management in binary options

All successful binary-options traders share one common feature: strict adherence to Risk Management principles.

Following these principles gives them a rational view of profit and loss and prevents momentary emotions from influencing their trading decisions.

The first achievement of risk management in binary options

The first achievement of risk management in binary options is creating a realistic view of trading.

In this view, each position is only part of a long-term sequence, and winning or losing a single trade does not determine the fate of the entire account.

Such a mindset greatly reduces psychological pressure and keeps the trader away from emotional reactions such as greed or revenge trading.

The second factor for success in binary-options trading

The second factor for success is increasing the likelihood of long-term survival in the market. Without a risk framework, even the best technical strategies and fundamental analysis are useless, because a single high-risk trade can destroy all capital.

But when the trader allocates only a small percentage of capital to each position, their account can continue even through consecutive losses.

The third advantage of successful risk management in binary options

The third advantage of successful Risk management in binary-options trading is creating stability and order in the trading process.

This order helps the trader identify behavioral patterns, correct weaknesses, and develop a personal strategy.

In fact, success in binary options is not the result of one or two big trades but the sum of small yet consistent gains made possible by risk management.

Professional traders focus on account longevity rather than quick profits. This approach is what differentiates them from beginners.

Conclusion

Capital management in binary options is not a side technique but the main pillar of survival and profitability in this market.

The “all-or-nothing” feature of binary contracts means that even minor indiscipline can quickly lead to capital destruction.

Traders who apply capital management and risk management together not only avoid heavy losses but also create the groundwork for consistent, sustainable profit.

Using methods such as Fixed Risk, Anti-Martingale, and Kelly Criterion along with complementary tools like Early Close, Rollover, Hedging, and Doubling Up turns risk management into a complete system.

This system protects the trader against sudden volatility while keeping profitable opportunities alive.

Ultimately, success in binary options results from the combination of knowledge, psychological discipline, and adherence to a risk-management framework.