- TradingFinder

- Education

- Forex Education

- Trading Sessions Education

Trading Sessions Education

Market timing is crucial, as liquidity, volume, and price behavior change throughout the day. Different trading sessions influence market activity. The London session has the highest liquidity in forex, while the overlap between the New York and London sessions is the most volatile. Understanding session-based price behavior helps traders determine optimal trade entry and exit times. On TradingFinder, session-based strategies, liquidity Analysis, and trade optimization techniques are available, allowing traders to identify the best trading windows for higher profitability. This translation fully maintains the original structure, formatting, and emphasis of the source text. Let me know if you need further refinements.

Tokyo Session; Highly Volatile Pairs (EUR/JPY, AUD/JPY, NZD/JPY, GBP/JPY)

The Tokyo session (Tokyo session), as Asia’s trading hub, begins with the activity of the Bank of Japan, financial institutions,...

Fractal & Inversion Strategy in ICT: 1-Hour, 5-Minute, and 1-Minute [Free Guide]

The Fractal model in ICT style is a method for aligning price structure across timeframes and entering reactive market zones. This...

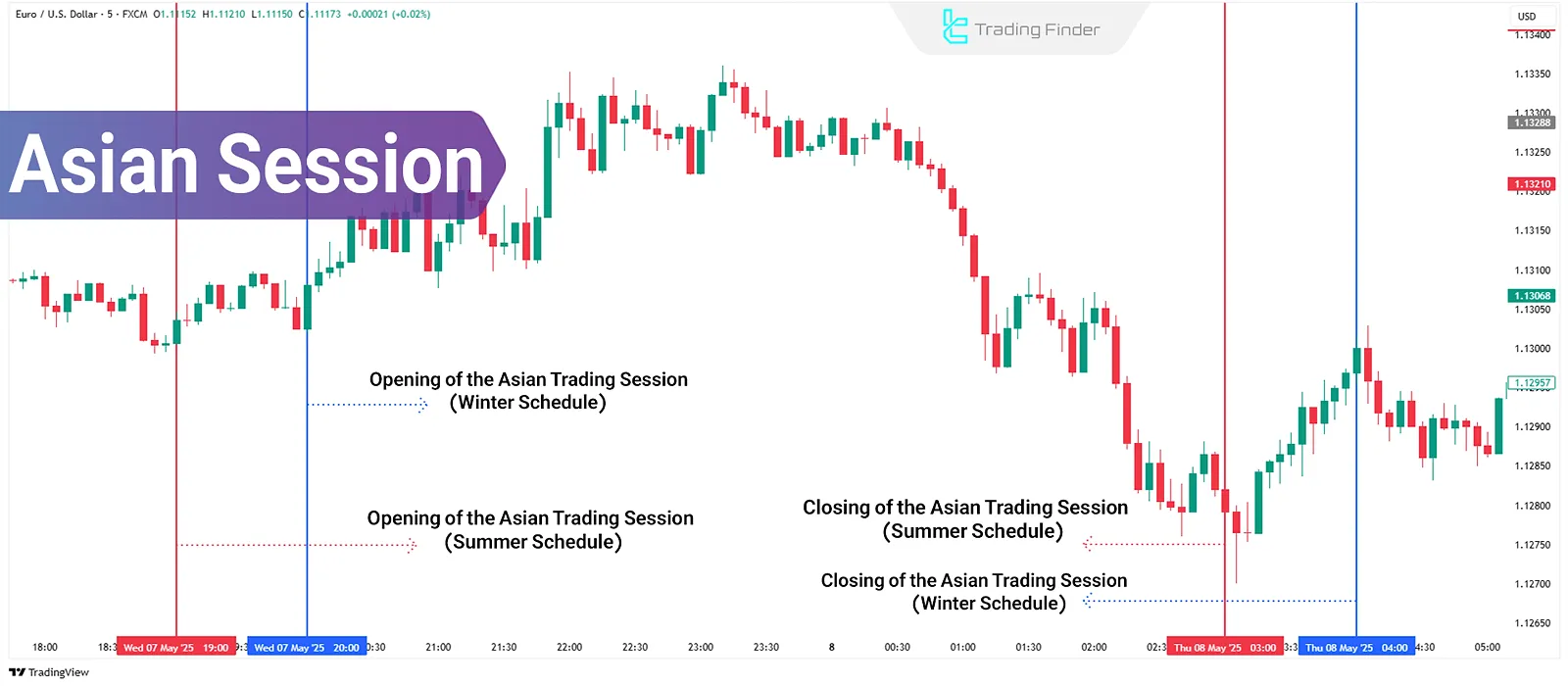

Asian Session Training; The First Active Phase of the Forex Market in 24 Hours

The Asian session sets the initial course of the market with the start of the trading day. Although the volume is lower...

Forex Market Hours: Best Trading Times & Days

The Forex market is a global marketplace for currency trading that operates 24 hours a day, five days a week (Monday to Friday)....

London Trading Session; Exact Timing in GMT Time Zone

Due to the 24-hour nature of the Forex Market, trading is divided into four major sessions: Tokyo, Sydney, London, and New...

New York Trading Session: Peak Volatility in Overlap with London

During the New York session, liquidity spikes and volatility reaches its peak. This session starts at 8:00 AM local New York...

![Fractal & Inversion Strategy in ICT: 1-Hour, 5-Minute, and 1-Minute [Free Guide]](https://cdn.tradingfinder.com/image/444830/7-94-en-fractal-model-in-ict-01.webp)