- TradingFinder

- Education

- Forex Education

- Smart Money Education

Smart Money Education

The Smart Money Concept (SMC) trading style is one of the most advanced methods of price action analysis in financial markets, focusing on identifying smart money behavior and its impact on price manipulation. This style leverages precise market structure analysis, Change of Character (CHoCH), Break of Structure (BOS), identification of Order Blocks, and concepts such as price swings, key zones, and supply and demand levels to help traders detect key changes in market trends and enter trades with greater confidence. Additionally, multi-timeframe analysis enables traders to gain a broader perspective of different market flows and more accurately determine entry and exit points. In the Smart Money Concept (SMC) strategy, traders learn how to exploit liquidity flows driven by large financial institutions and avoid price traps designed for retail traders. This approach focuses on analyzing Liquidity Zones, Imbalances, and Institutional Order Flow, allowing traders to better understand price behavior at various market levels and make more informed decisions. TradingFinder offers the best educational content on the Smart Money Concept (SMC) for traders, from beginner to advanced levels. These courses include comprehensive training on Change of Character, Break of Structure, multi-timeframe analysis, liquidity, and other advanced SMC concepts and techniques. The goal of these trainings is to empower traders to operate professionally in financial markets and achieve favorable outcomes.

Bearish Order Block: Explained the Ultimate ICT Smart Money Trading Guide

One of the foundational concepts in ICT trading is the Bearish Order Block (OB-), which represents the zones where smart money’s...

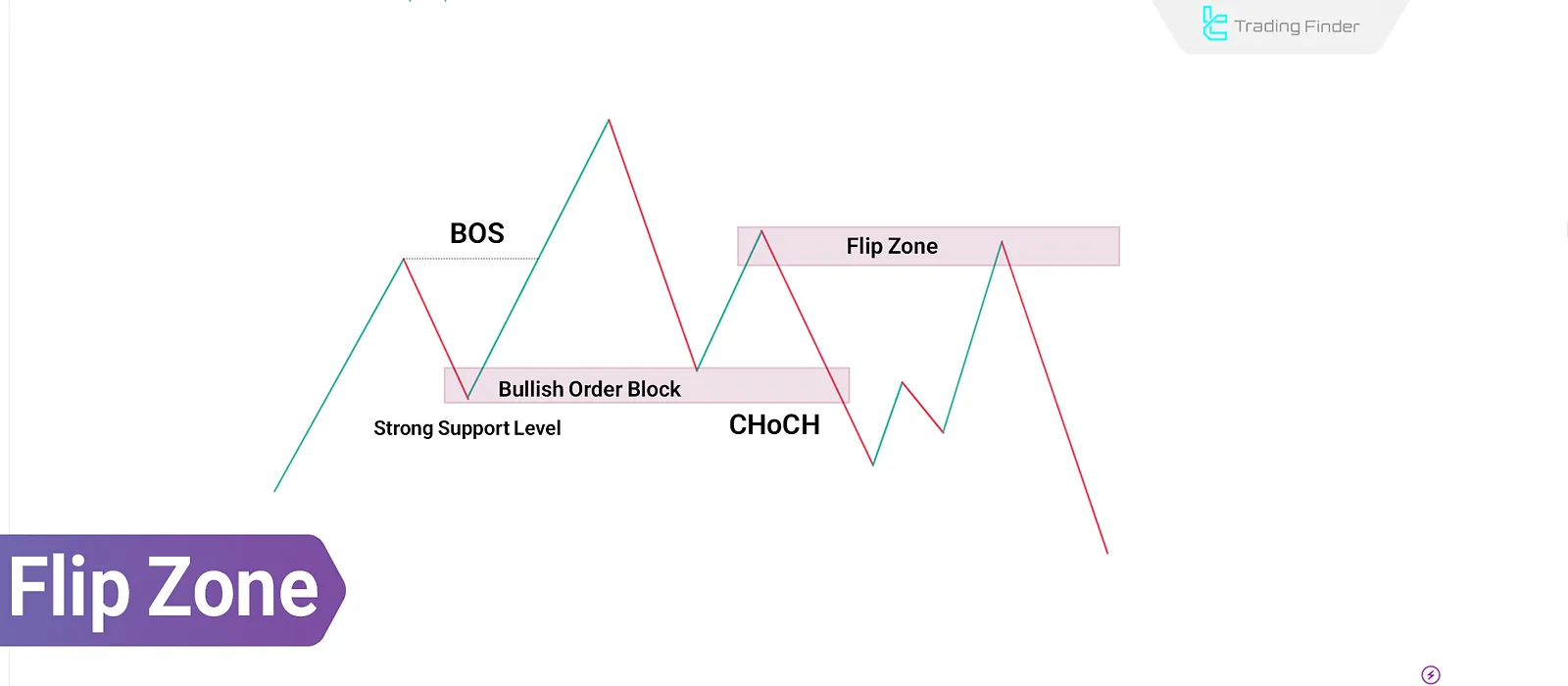

Smart Money Flip Zone & ICT Concept: Using Supply and Demand Levels

In Smart Money analysis and ICT concepts, a Flip Level in ICT is a price level where supply or demand zones are broken and...

Order Block with FVG Confirmation Strategy in ICT [SMC]

When traders miss the initial entry point and aim to enter in the middle of a trend, the ICT approach recommends re-entry...

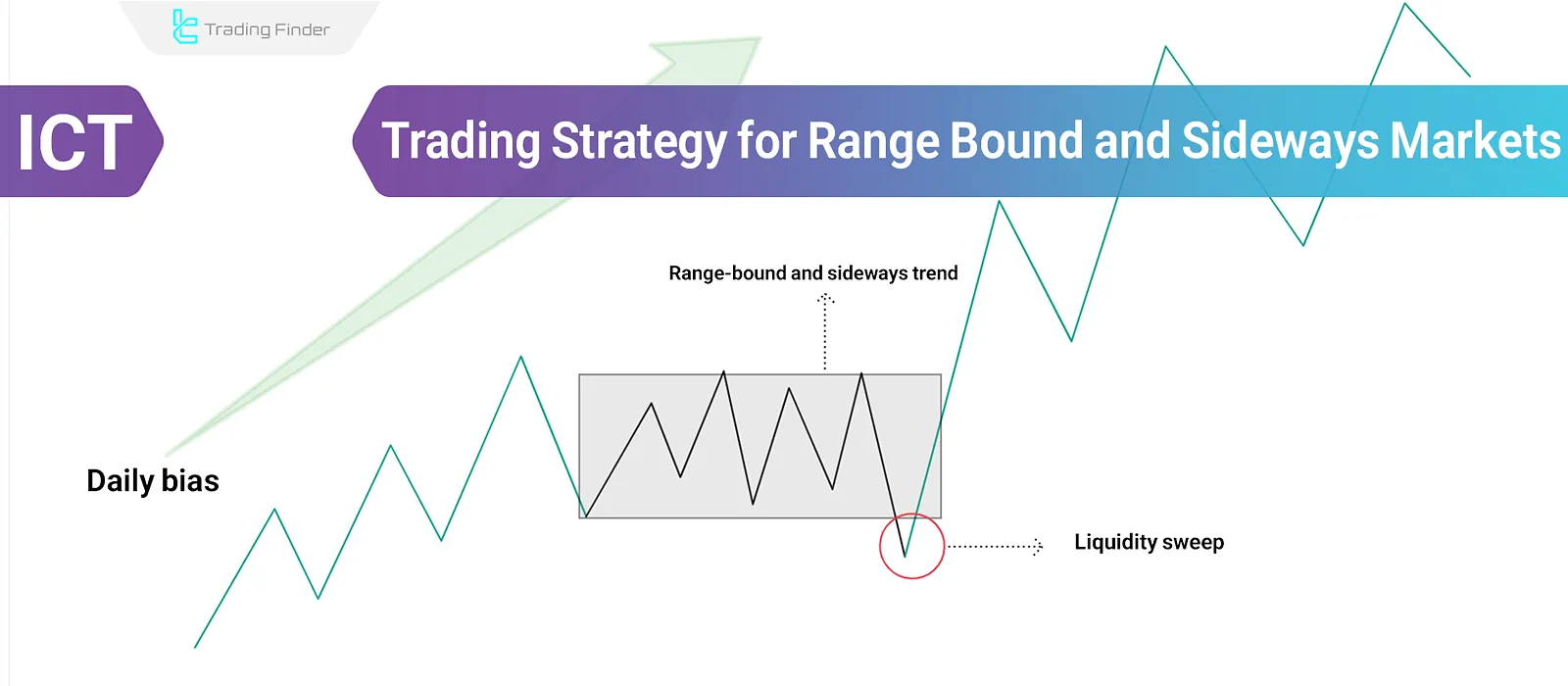

ICT Range and Consolidation Trading Strategy: Identifying Sideways Markets

Range markets (also called consolidation zones) are the primary areas where smart money accumulates liquidity. In these zones, price...

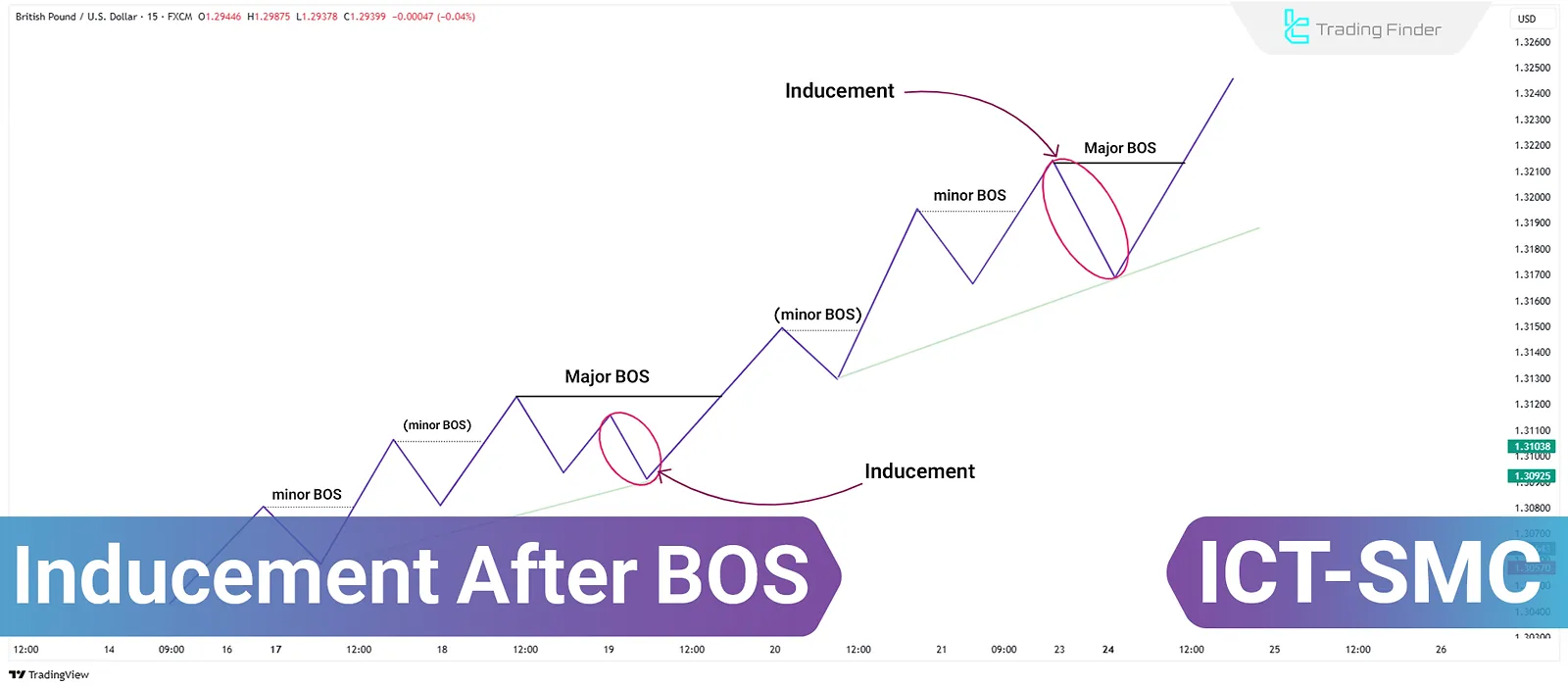

Inducement After Break of Structure (BOS) in ICT and SMC Styles

Inducement or Deception (IMD) refers to conditions where smart money and large market players manipulate the market to lure...

Learn IRL & ERL in ICT; Internal and External Range Liquidity

In the ICT Style, price movement in financial markets like Forex market is shaped solely towards liquidity; In this context,...

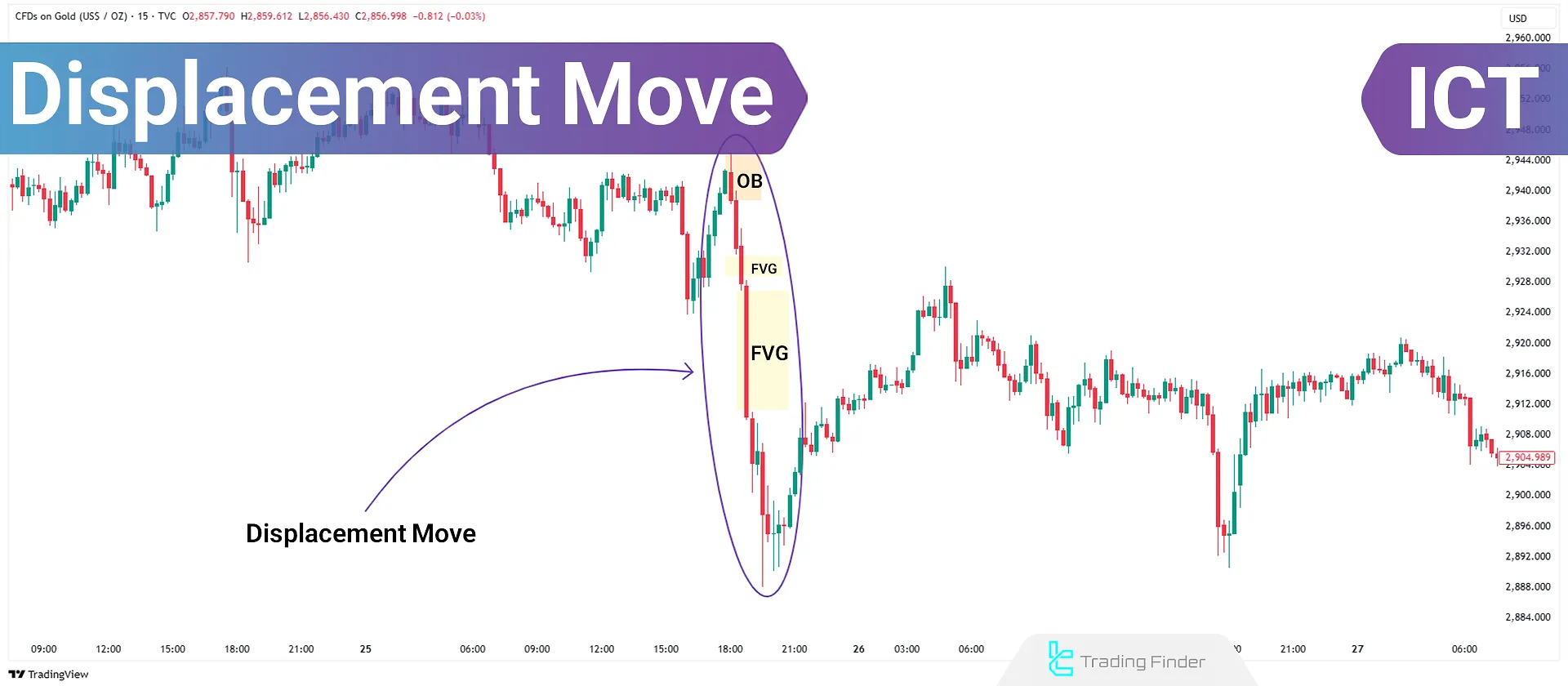

Displacement Move; Strong and Fast ICT Moves with Key Level Breaks

The Displacement Move in the ICT methodology is fundamental in analyzing market structure, identifying the impact of...

Learn ICT Dealing Range Training: Liquidity Accumulation & Distribution

The ICT trading style focuses on market structure and liquidity. Within the market structure, the ICT Dealing...

ICT Average Daily Range [Average Daily Range] - Application in Forex and Crypto

The average daily range is a core volatility metric in price analysis and within the adr ict framework, it refers to the amount...

Highest and Lowest Price of the Previous Month (Previous Monthly High and Low)

In technical analysis and price charts, the Previous Monthly High and Low (PMH & PML) represent the highest and lowest...

Market Structure Shift vs Change in State of Delivery – Combination with IFVG

Traders can use the Market Structure Shift "MSS" to identify medium-term price movements and trend reversals, while Change in...

All Smart Money Concepts (SMC) Abbreviations and Terminologies

Smart Money refers to capital controlled by professional investors, market makers, banks, and financial institutions. Based on this...

![Order Block with FVG Confirmation Strategy in ICT [SMC]](https://cdn.tradingfinder.com/image/402972/06-11-en-trade-continuations-using-order-blocks-1.webp)

![ICT Average Daily Range [Average Daily Range] - Application in Forex and Crypto](https://cdn.tradingfinder.com/image/352367/14-22-ict-average-daily-range-adr-01.webp)