- TradingFinder

- Education

- Forex Education

- Trading Strategies Education

Trading Strategies Education

Every trader needs a trading strategy to succeed in financial markets. This strategy should be based on technical, fundamental, or sentiment analysis. An effective strategy includes clear entry and exit rules, risk management, and emotional control, ensuring disciplined and structured trade execution. Trading strategies vary based on style and timeframe. Day traders often use scalping and breakout trading, whereas long-term traders focus on swing trading and trend following. Advanced methodologies like ICT, RTM, and Smart Money focus on liquidity flow, price manipulations, and structural breaks, allowing traders to pinpoint precise entry and exit points. Building a successful strategy requires continuous testing and optimization. On TradingFinder, traders can access specialized training on creating, testing, and refining trading strategies. Additionally, by combining technical tools, capital management techniques, and past trade performance analysis, traders can optimize their methods for the best possible results.

Fractal & Inversion Strategy in ICT: 1-Hour, 5-Minute, and 1-Minute [Free Guide]

The Fractal model in ICT style is a method for aligning price structure across timeframes and entering reactive market zones. This...

What Is the RTM Diamond Pattern? Trading the Diamond Pattern in the RTM Style

The RTM Diamond Pattern is one of the main patterns in the RTM style that deceives both buyers and sellers. This pattern appears...

What Is Arbitrage? Types of Arbitrages [Triangular, Merger & Spatial]

Arbitrage occurs when the same asset is simultaneously traded at different prices in two separate markets. If this price...

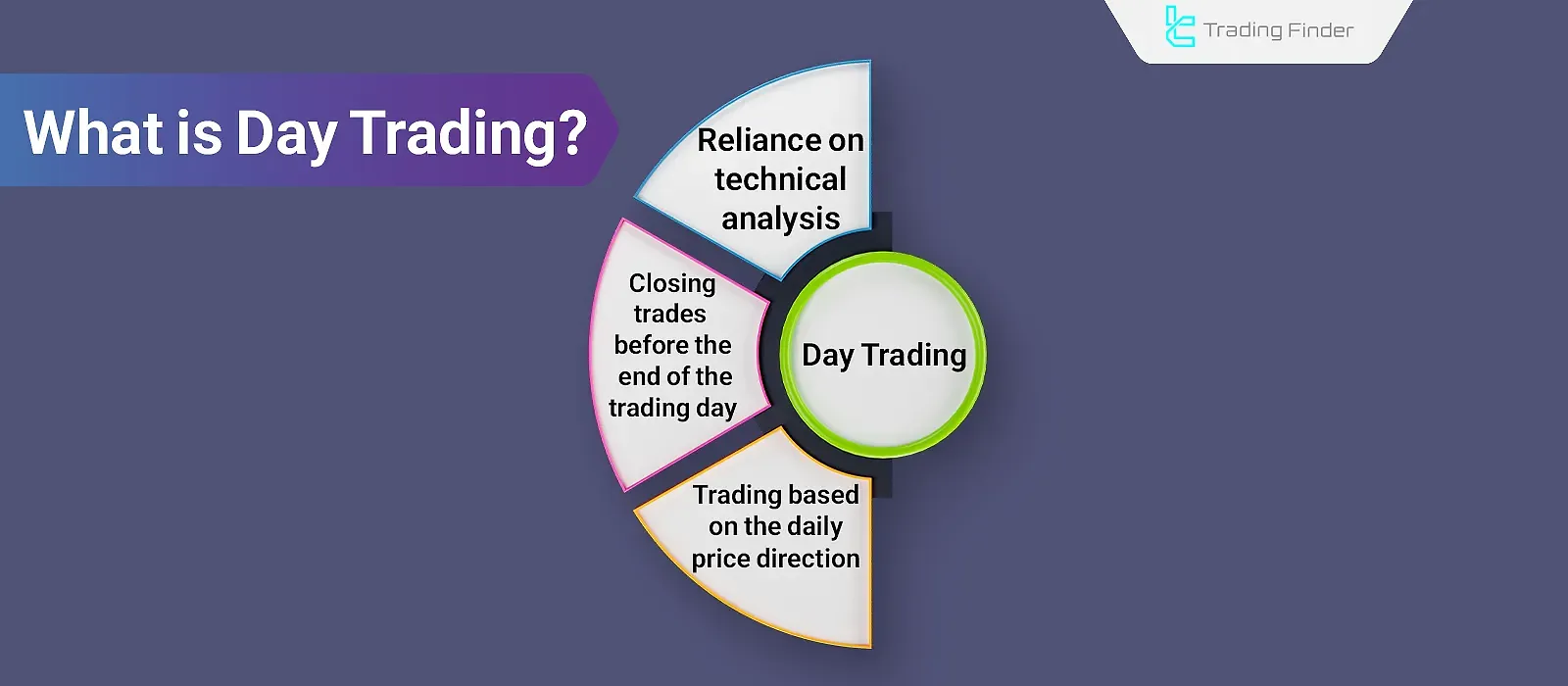

What Is Day Trading? Trade in the Direction of the Trend & Against It

In day trading, traders use technical analysis through various methods, such as ICT style and RTM style (Read The Market), to...

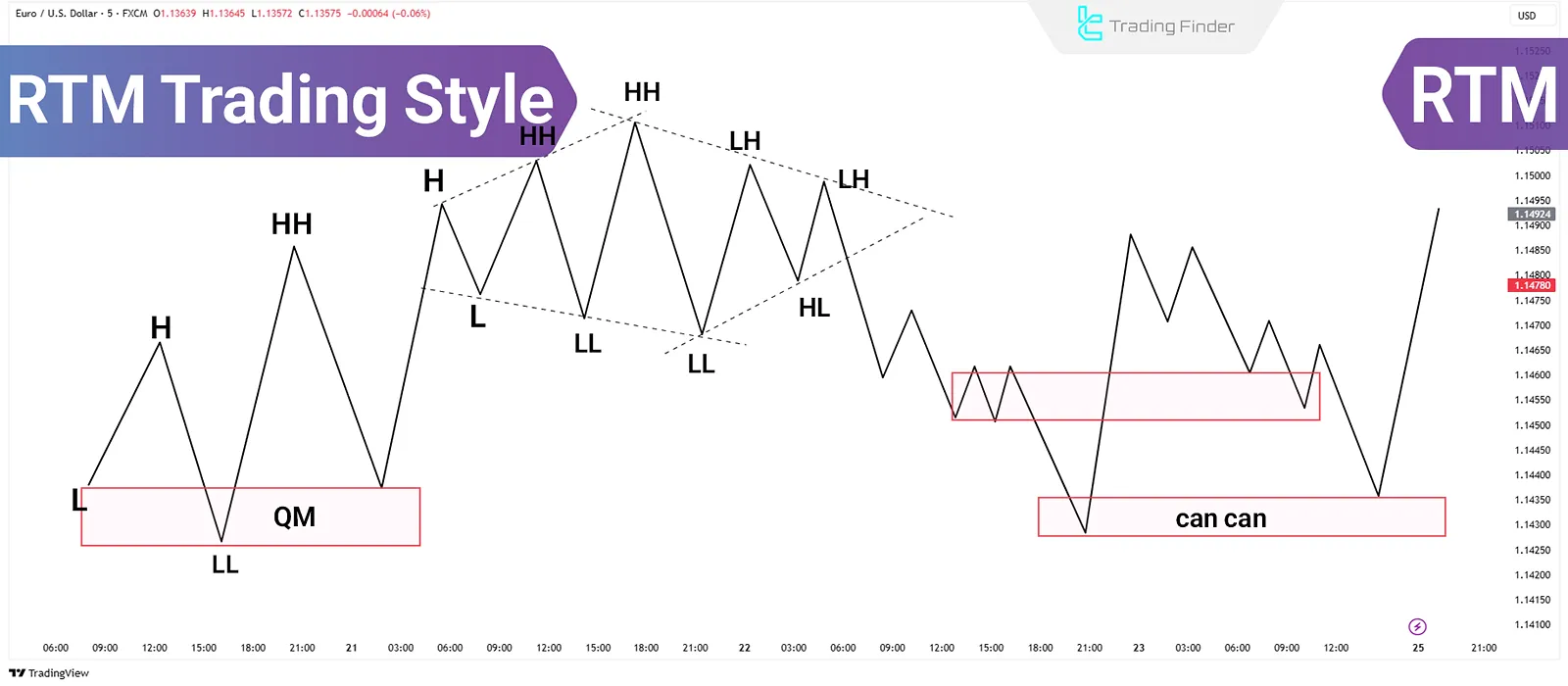

What Is RTM Price Action? Using RBR, DBR, DBD, and RBD Structures in RTM Style

RTM Style, short for "Read The Market" is an analytical method in financial markets that, instead of relying on indicators,...

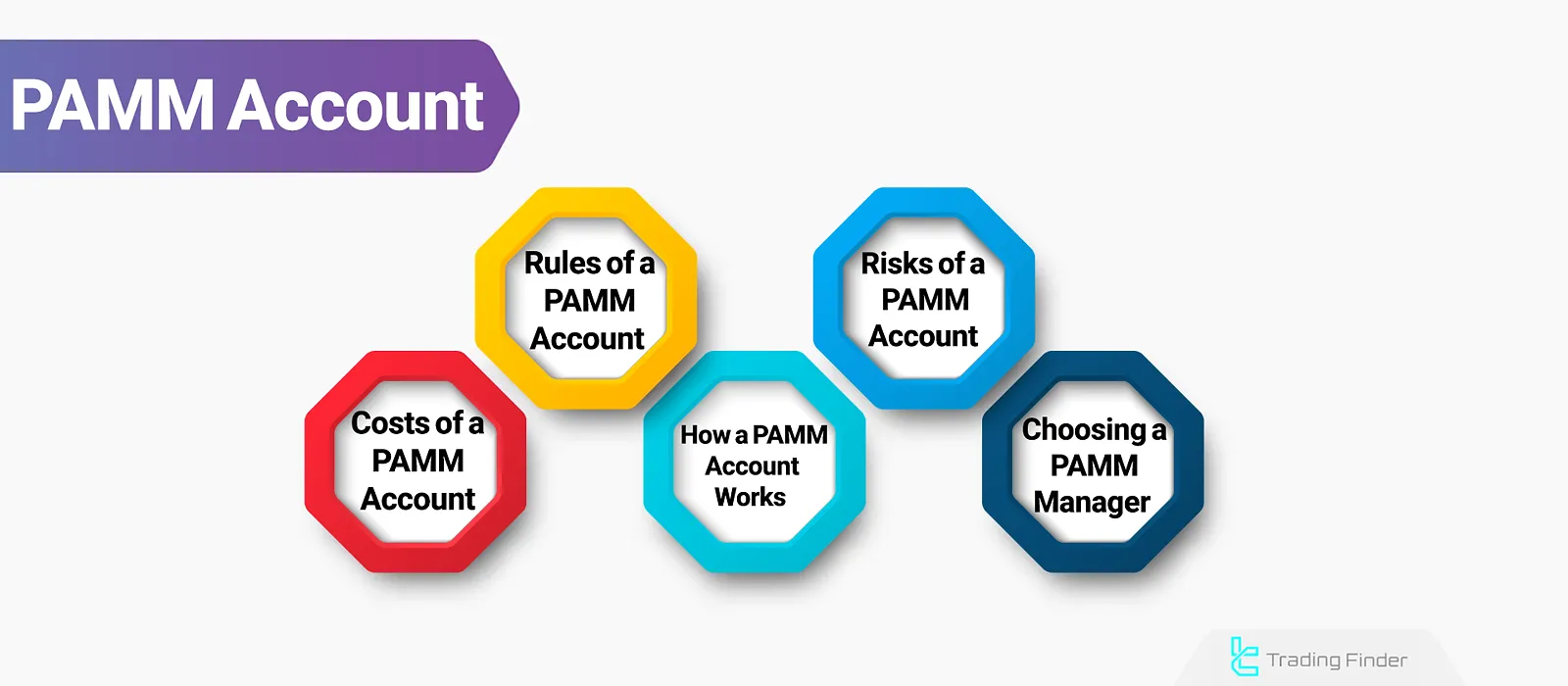

What Is a PAMM Account? Guide to Management and Investment in PAMM Accounts

In the Forex market, many investors prefer to use indirect investment methods due to a lack of sufficient knowledge or time to...

What Is Copy Trading? Review and Introduction to the Best Copy Trading Platforms

Copy Trading is a branch of social trading that allows novice traders and investors to automatically replicate the trades of a...

Order Block with FVG Confirmation Strategy in ICT [SMC]

When traders miss the initial entry point and aim to enter in the middle of a trend, the ICT approach recommends re-entry...

What is Scalping? Best Scalping Trading Strategies

Scalping is a highly fast-paced trading strategy in financial markets where the period between opening and closing trades is only...

Candlestick Patterns in Support and Resistance; Candle Pattern Trading at S/R

Candlestick patterns, as the foundation of Price Action analysis, reflect order behavior at key supply and demand zones. Combining...

Timeframe Selection Guide – Introduction to Best Timeframe in Technical Analysis

Selecting the best time frame for trading strategies depends on various factors such as analytical style and trading approach,...

Bollinger Bands Indicator; Best Settings Based on Timeframe

The Bollinger Bands indicator is a powerful technical analysis tool that uses a simple moving average to evaluate...

![Fractal & Inversion Strategy in ICT: 1-Hour, 5-Minute, and 1-Minute [Free Guide]](https://cdn.tradingfinder.com/image/444830/7-94-en-fractal-model-in-ict-01.webp)

![What Is Arbitrage? Types of Arbitrages [Triangular, Merger & Spatial]](https://cdn.tradingfinder.com/image/431600/03-24-tf-en-what-is-arbitrage-01.webp)

![Order Block with FVG Confirmation Strategy in ICT [SMC]](https://cdn.tradingfinder.com/image/402972/06-11-en-trade-continuations-using-order-blocks-1.webp)