There are different models for trade execution in the forex market, each with a unique structure and impact on the trading process.

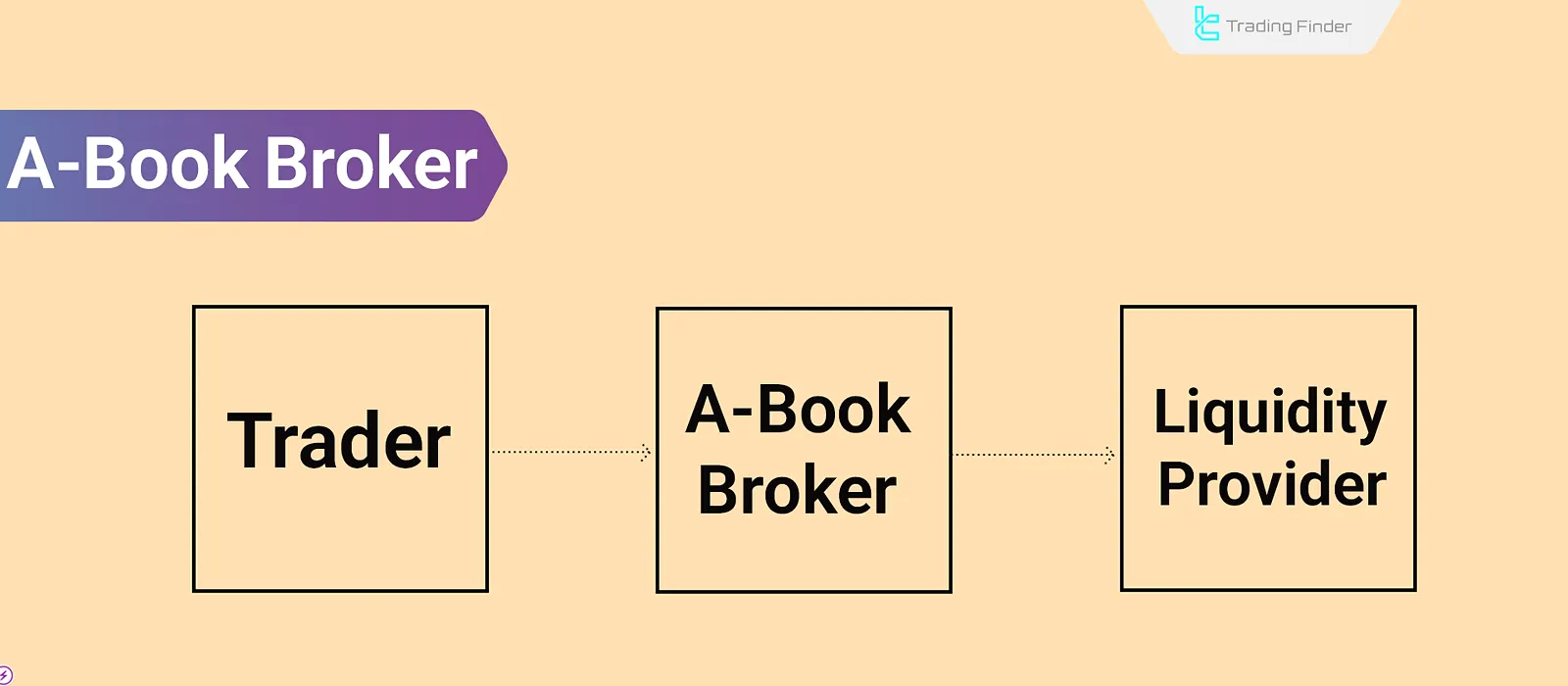

One of the models known for its transparency and reduced conflict of interest is the A-Book model. In an A-Book Broker, the broker hedges the client's order and transfers market risk to a liquidity provider. As a result, the client's profit or loss is irrelevant to the broker's earnings.

What is an A-Book Broker?

In an A-Book Broker, after receiving a client's order, the broker opens an equivalent position with a Liquidity Provider (LP). This way, market risk is removed from the broker's balance sheet and shifted to the LP.

In this structure, the broker merely acts as an intermediary and earns income from spreads or commissions instead of profiting from client losses. In contrast, a B-Book Broker retains the client's position and profits directly if the client loses.

An A-Book Brokerage eliminates the conflict of interest and bases order execution on real interbank market prices.

What does risk transfer or hedging mean in an A-Book Broker?

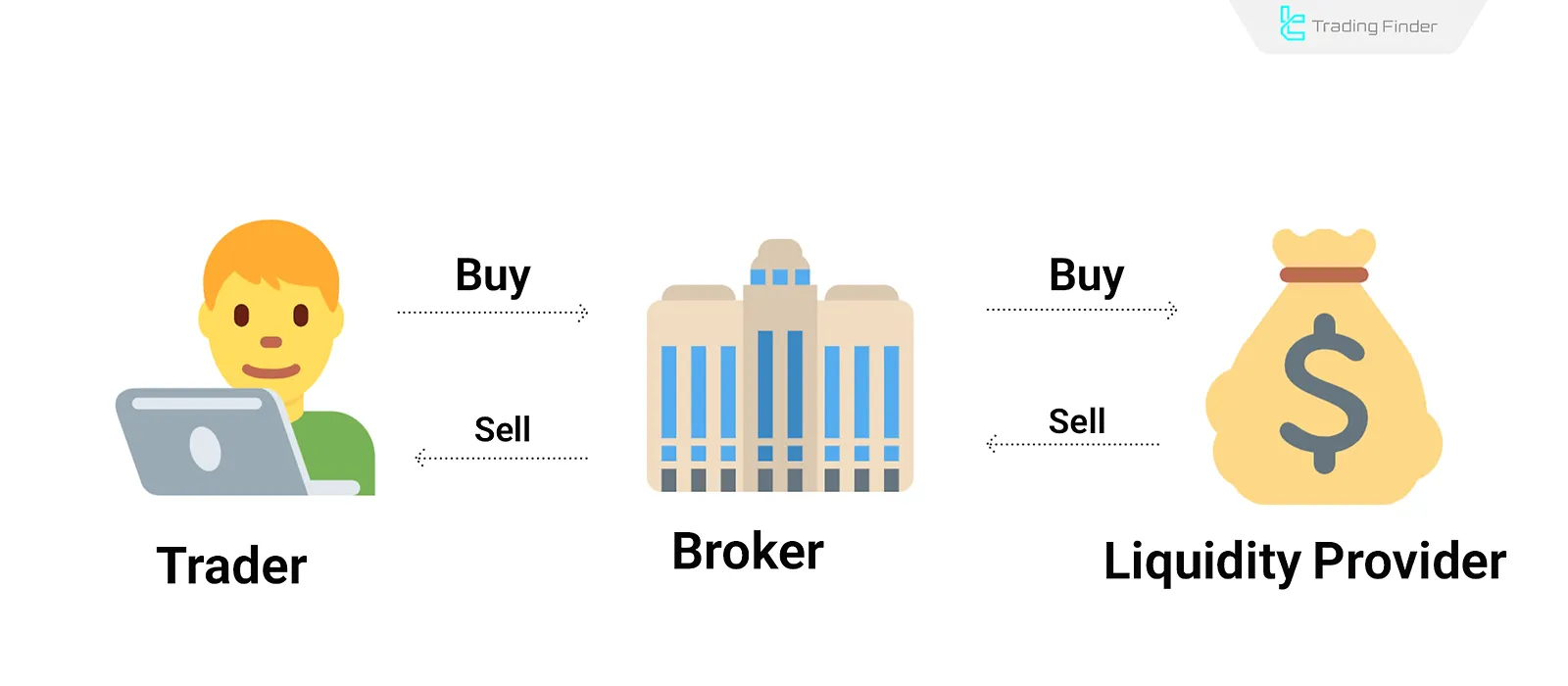

In the A-Book model, to eliminate market risk, the broker opens a reverse position with a reputable counterparty. This process is called Hedging or Risk Transfer.

The counterparty may be a bank, a non-bank market maker, a hedge fund, or an institutional broker that continuously provides tradable quotes. These entities are referred to as Liquidity Providers (LPs).

Liquidity Providers (LPs) offer two-way quotes (bid/ask), enabling immediate hedging of orders. Successful hedging puts the broker in a neutral position against market fluctuations.

How are trades executed in an A-Book Broker?

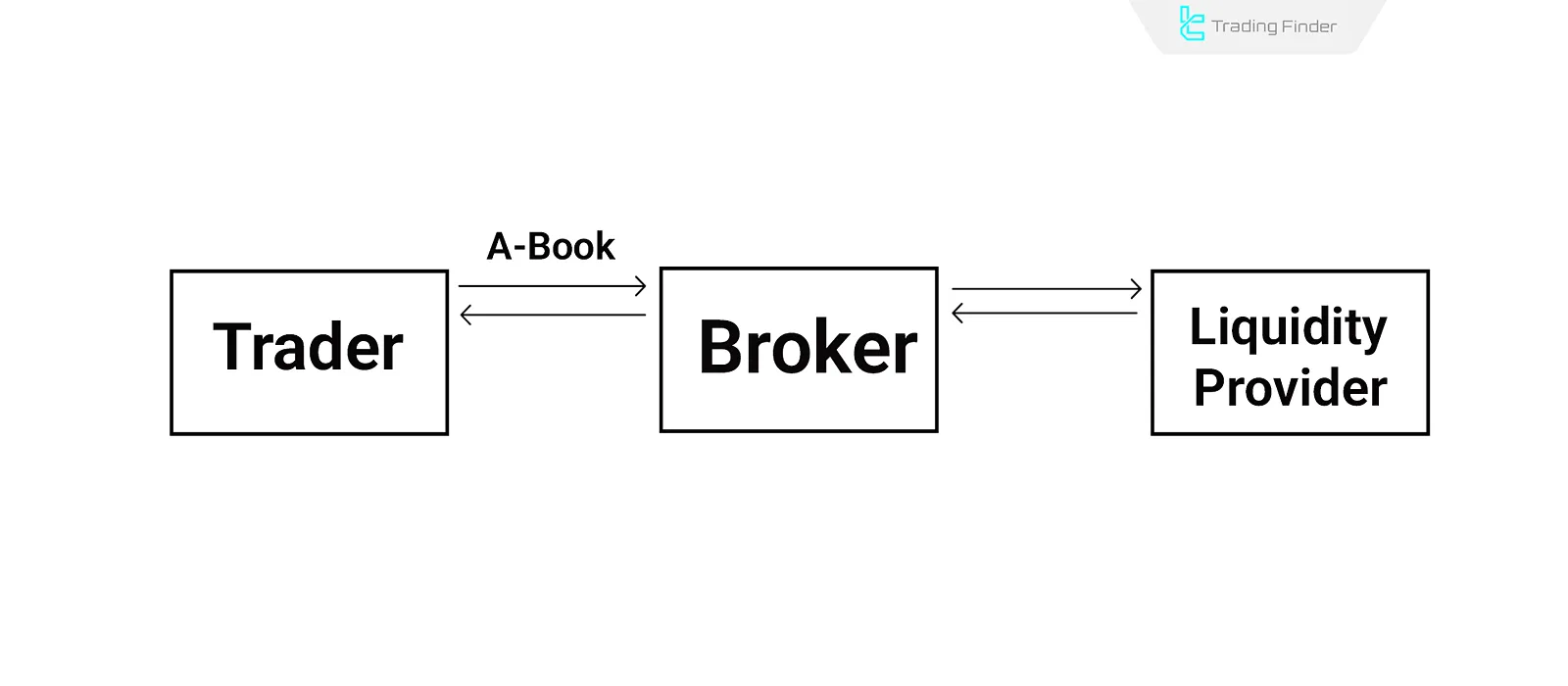

In an A-Book Brokerage, the broker internally logs the client's order and remains the counterparty to the trade. Simultaneously, the broker opens a parallel position with the Liquidity Provider (LP).

This external position is called a "Hedge Position". With this structure, the broker stays in a zero-spread state against market volatility; any profit or loss incurred by the client is offset by the opposite result from the hedge position in the interbank market.

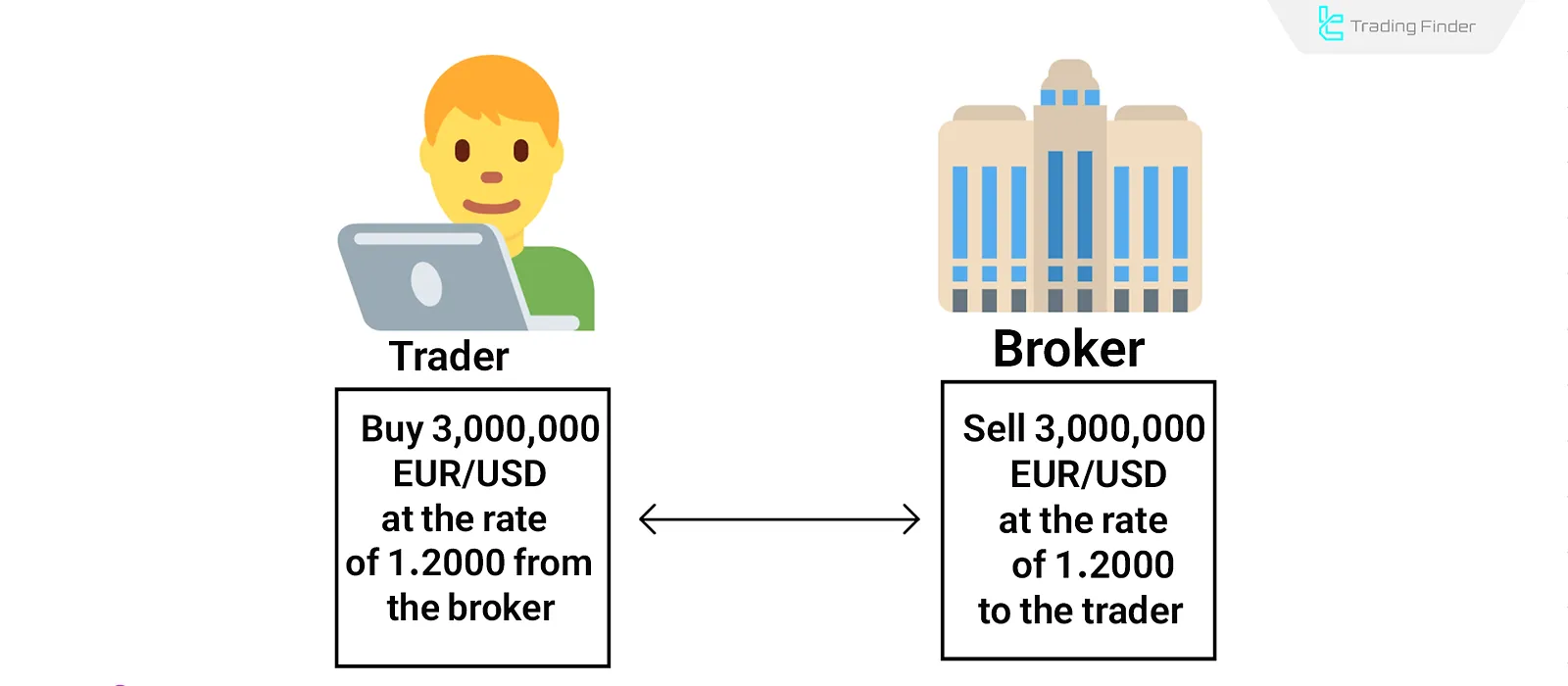

Example EUR/USD Buy Trade by a Trader in an A-Book Broker

Suppose a trader places a buy order of 3 million euros against the US dollar (EUR/USD) at 1.2000.

Following the A-Book structure, the broker simultaneously opens an equivalent buy position with a Liquidity Provider (LP).

As a result:

- The broker holds a short position against the trader;

- Simultaneously, the broker holds a long position with the LP.

Analyzing Two Scenarios: Price Rise or Fall

Once the broker has executed the trader's order under the A-Book model and opened a corresponding position with the LP, market behavior will determine which side profits or loses. The following discusses the impact of price changes under two scenarios.

Price Rise Scenario

If the EUR/USD price rises after execution, the trader profits, and the broker, as the direct counterparty, must pay that profit. However, due to the hedge position with the LP, the broker gains the same profit from the market.

Thus, the profit paid to the trader is neutralized by the profit earned from the LP. Consequently, the broker's net P&L is zero.

Price Fall Scenario

If the price drops, the trader incurs a loss, and the broker gains from it. However, the broker's long position with the LP incurs a matching loss.

Hence, the gain from the trader is offset by the loss with the LP, making the broker's net profit or loss zero.

Who is the Counterparty to the Trader in an A-Book Broker?

In A-Book execution, contrary to popular belief, the trader's order is not directly sent to the Liquidity Provider (LP). The trade still occurs entirely with the broker, who remains the official counterparty.

To eliminate risk, the broker simply opens a matching and parallel position with the LP. This process is not an "order transfer" but rather a "position mirroring".

Advantages and Disadvantages of the A-Book Structure

To fully understand the A-Book model, it's essential to examine both its pros and cons simultaneously. Table of A-Book Broker Pros and Cons:

Disadvantages of A-Book | Advantages of A-Book |

Dependency on liquidity quality | Execution transparency |

Risk of slippage and requotes | No conflict of interest between broker and trader |

Higher structural costs for broker | Compliance with risk management principles |

Potential order rejections at high volumes | Suitable for scalping and precision trading |

Conclusion

The A-Book model is a transparent, risk-hedging mechanism in which the broker opens a corresponding position with a Liquidity Provider after receiving a client's order. In this structure, the client's profit or loss has no bearing on the broker, eliminating any conflict of interest.

The broker remains the official counterparty, and the order is not directly forwarded to the LP; rather, the client's market position is mirrored with the LP.

The main advantages of this model are genuine order execution, transparency, and compatibility with precision trading styles. However, it also presents challenges such as liquidity dependency, slippage, and high operational costs.