One of the most important factors in improving the performance of forex traders is the documentation and analysis of the trading system analysis.

Without recording details, reasons for entry and exit, psychological state, and the result of each trade, it will not be possible to scientifically identify behavioral patterns and weaknesses.

The main function of a forex trading journal is to create a personal data source for each trader; a source through which one can evaluate decision-making processes, measure the trader discipline, and optimize strategies based on real data.

What is a Forex Journal?

A forex journal is an analytical tool used to record the details of each trade in the international currency market.

In addition to listing entries and exits, this journal includes important information such as reasons for entry, technical or fundamental conditions, trade volume, risk management, and the trader’s psychological state at the time of decision-making.

The main purpose of keeping such a journal optimization is to create transparency in the trading process and to provide reliable data for evaluating individual Trade performance analysis.

Video tutorial on how to create a trading journal from Solomon King’s YouTube channel:

Advantages and Disadvantages of a Forex Journal

According to studies conducted among active forex traders, those who regularly use a forex trading journal have been able to reduce their repetitive mistakes by more than 30% within three to six months.

However, due to certain limitations, the forex journal also has some disadvantages. Table of advantages and disadvantages of a forex journal:

Advantages | Disadvantages |

Increased discipline and consistency in trading | Requires time and attention to record details |

Identifying strengths and weaknesses of strategies | Possibility of inconsistency and incomplete data entry |

Controlling emotions and managing trader psychology | Misleading analysis if data is recorded incorrectly |

Improved long-term performance and decision-making | May restrict some traders |

What information should be recorded in a Forex Journal?

A forex journal is effective only when key data from each trade is recorded regularly and accurately. This data serves as the foundation for analyzing personal trading performance and adjusting strategies.

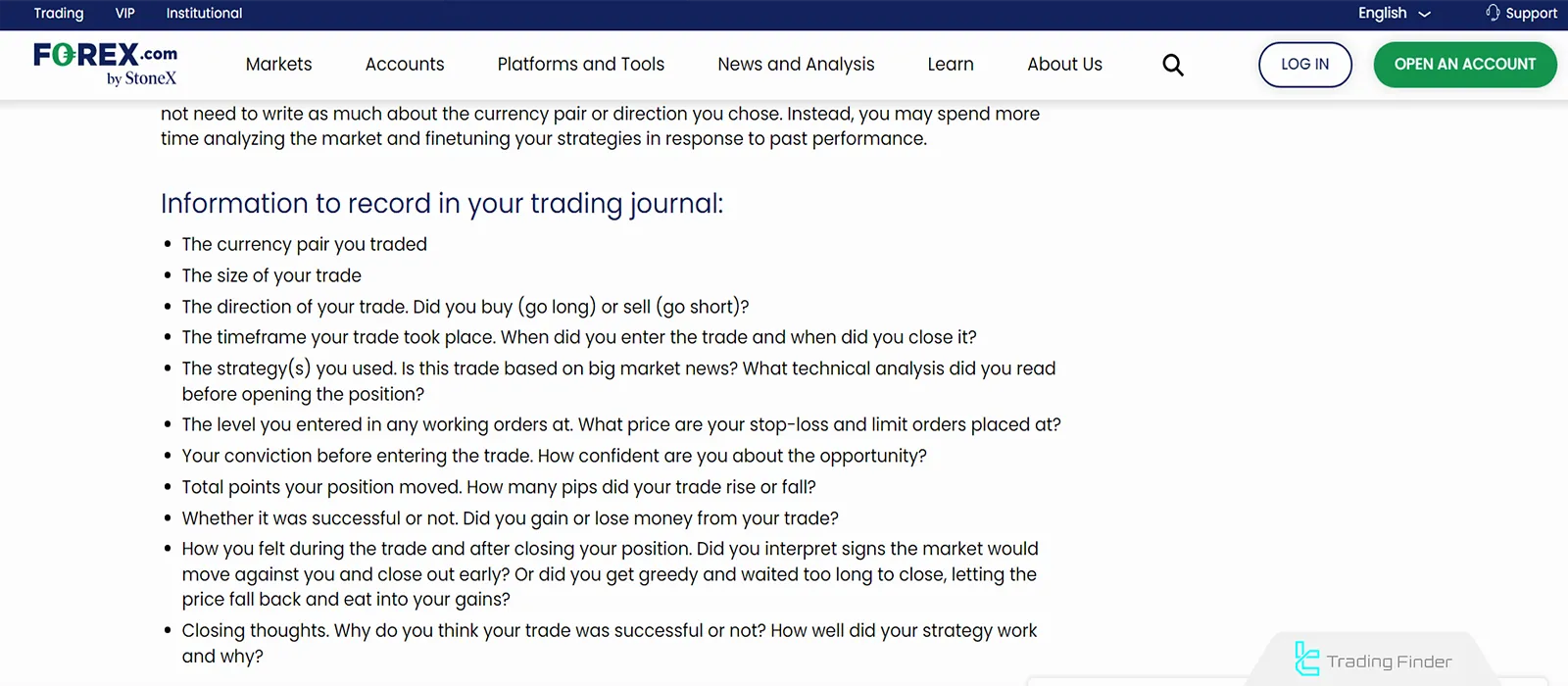

Training on recording key information in a forex journal from FOREX.com:

- Date and time of trade: Identifies the time frames with the highest success or error rates and allows review of market conditions at that moment;

- Currency pair or traded asset: By recording the symbol, one can determine which assets yield the best performance in the personal strategy;

- Trade volume and risk level: These data show how well capital management was applied and whether the position size matched total capital;

- Reasons for entering the trade: Includes explanations related to technical, fundamental, or mixed analysis and helps separate logical decisions from emotional ones;

- Trade result (profit or loss): Recording profits and losses numerically and in percentages enables statistical evaluation of the strategy;

- Trader emotions and thoughts during the trade: This section plays a crucial role in managing personal psychology, as most incorrect decisions stem from excitement or stress.

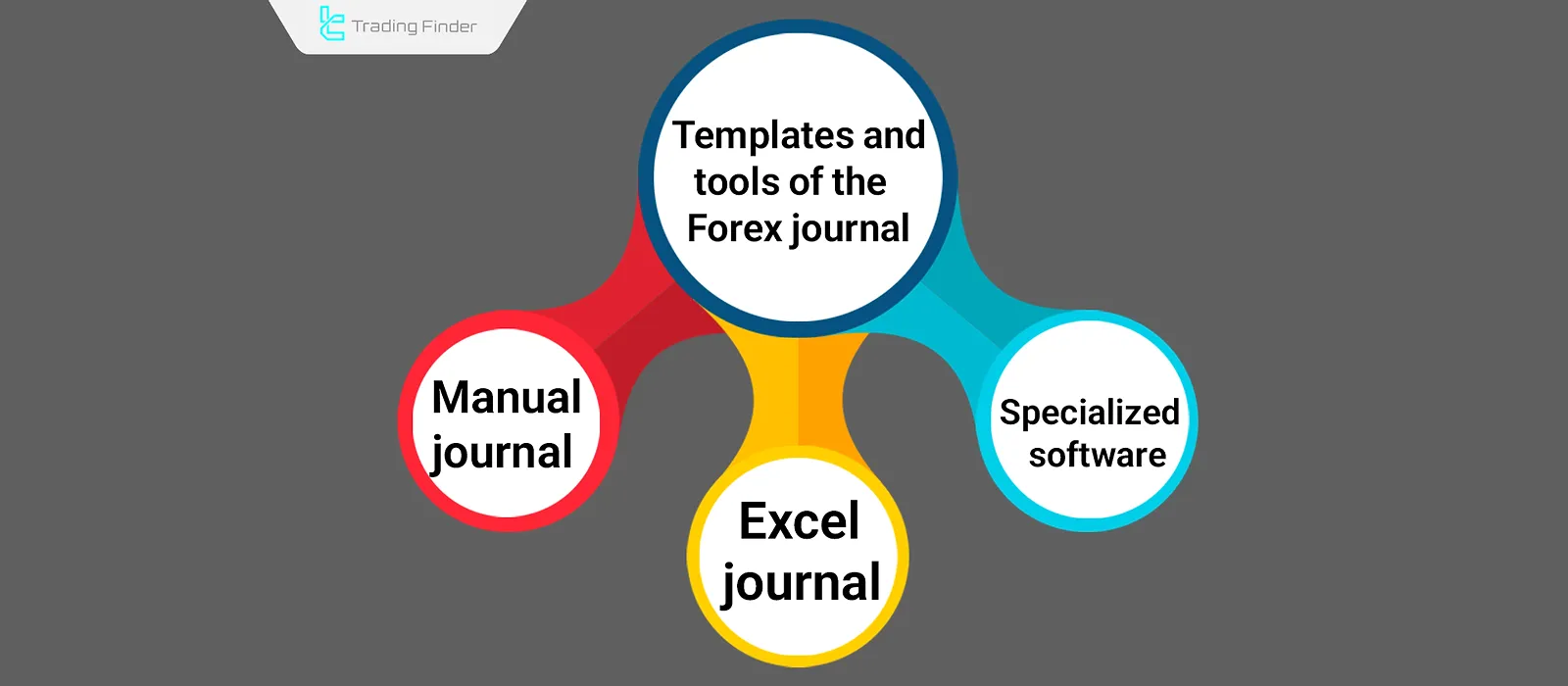

Formats and Tools for a Forex Journal

Recording and analyzing forex trades is effective only when done through the right format and tools.

The choice of journal tool should depend on the trading style, volume, and level of analysis. Types of forex journal formats and tools:

Manual Journal (Notebook or Trading Diary)

A traditional but effective method for traders who focus heavily on details. Manually recording information increases mental accuracy and strengthens personal discipline. However, analyzing data through this method is time-consuming and prone to calculation errors.

Excel or Google Sheets Journal

The most common digital format among professional traders. By setting up columns such as date, symbol, volume, entry and exit points, risk-to-reward ratio, and final result, a precise and analyzable structure can be created.

The advantage of this method lies in its flexibility and the ability to automatically calculate statistical indicators (like Win Rate or Expectancy).

Specialized Forex Journal Software

Platforms such as TraderSync, Edgewonk, and Myfxbook are powerful tools for recording, analyzing, and visualizing trader performance.

These programs directly import trading account data from brokers, calculate statistical ratios, and provide detailed reports on performance, recurring mistakes, and strengths.

Their main advantage is the automation of trade recording and trading psychology analysis. The only limitation is the need for a paid subscription or an API connection to a live account.

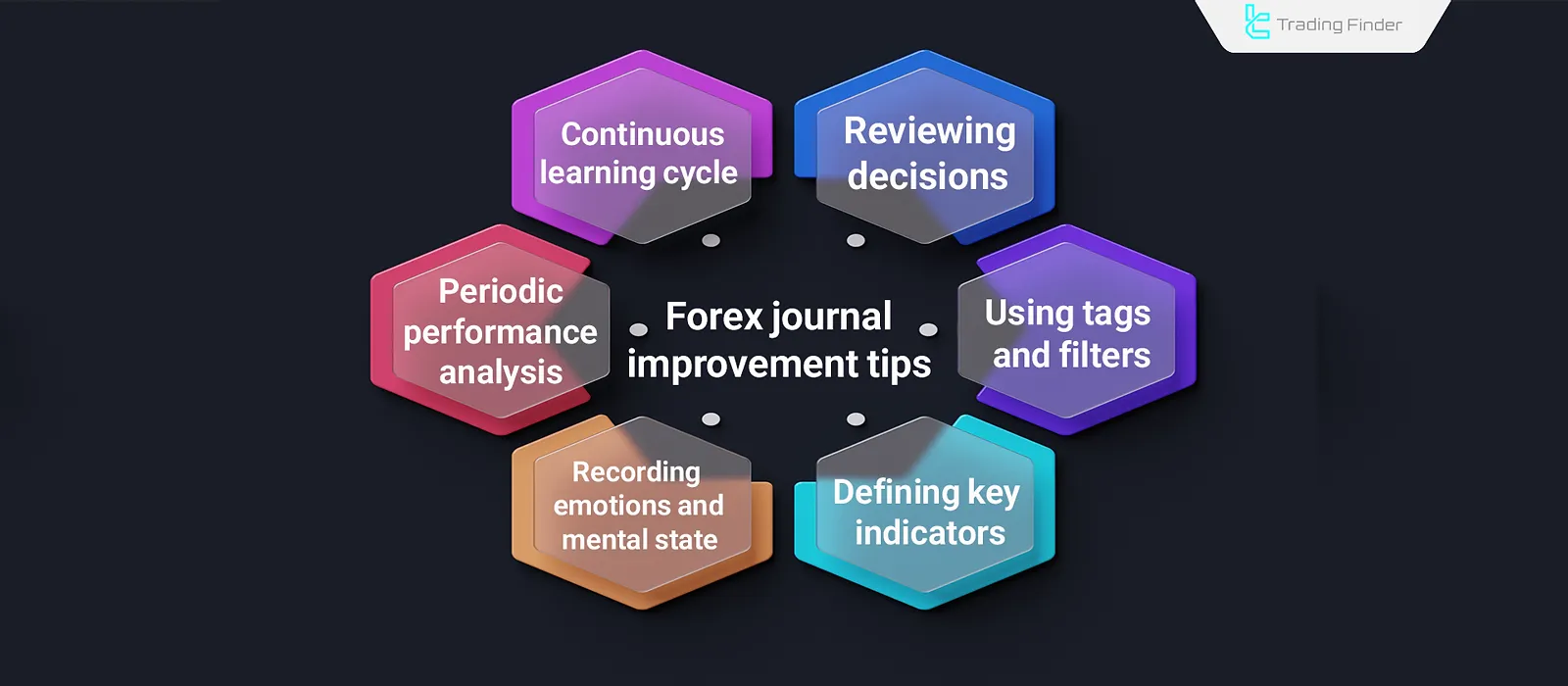

Tips for Improving a Forex Journal for Continuous Growth

Beyond being a record-keeping tool, the forex journal is a system for feedback and personal development.

The goal of optimizing a journal is to turn raw data into a practical method for better decision-making and greater profitability consistency. Important tips for improving a forex journal:

Periodic Performance Review

Review your trading results at least once a week. By examining Win Rate, Risk-to-Reward (R/R) ratio, and account growth percentage, you can identify behavioral patterns. Regular analysis helps expose and fix weaknesses earlier.

Recording Emotions and Mental State Before a Trade

One of the main factors in a trader’s growth is emotional control. For each trade record, note your stress level, confidence, and mental condition. Reviewing this data helps identify when most decision-making errors occur.

Defining Personal Key Performance Indicators (KPIs)

Metrics such as “ratio of disciplined trades to total trades” or “percentage of entries following the plan” are more accurate for assessing progress. The journal should be designed to display these indicators numerically and in a trackable way.

Using Tags and Analytical Filters

By tagging trades based on strategy, timeframe, or market condition, hidden patterns can be revealed. Filtering the data allows traders to understand which market conditions yield the highest returns for their trading style.

Reviewing Non-Systematic Decisions

Review all trades executed outside the strategy separately. These data are crucial for understanding “emotional behaviors”. The goal is to gradually reduce such trades over time.

Creating a Continuous Learning Feedback Loop

Adjusting stop-loss levels, changing timeframes, or removing low-quality setups should lead to clear actions. This feedback cycle is the foundation of real growth in trading and helps make decisions more logical and systematic over time.

Conclusion

A forex journal is not just a record of trades but an analytical tool for engineering trading behavior and improving decision-making.

Traders who regularly document their trades gradually develop deeper insight into their strategy weaknesses, psychological mistakes, and decision-making structure.

An effective journal yields results only when it is treated as a learning system. Regular review data analysis, measurable metrics, and linking results to emotions and mental states transform trading from random actions into a systematic and controllable process.